Europe Vegan Cosmetics Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Europe Vegan Cosmetics Market Overview:

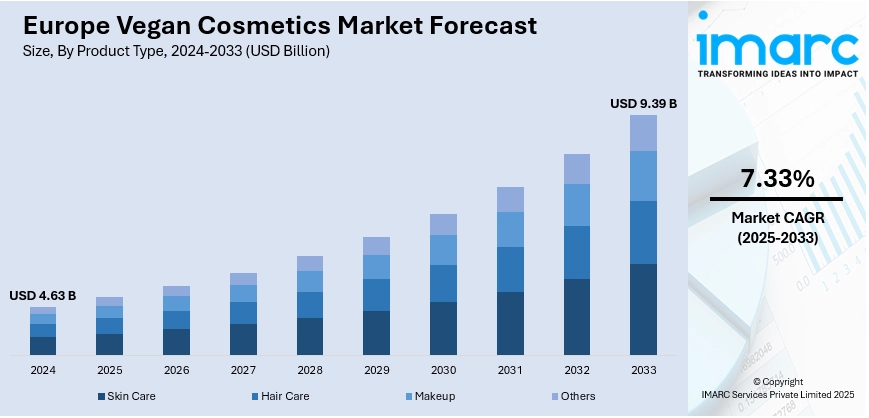

The Europe vegan cosmetics market size reached USD 4.63 Billion in 2024. Looking forward, the market is expected to reach USD 9.39 Billion by 2033, exhibiting a growth rate (CAGR) of 7.33% during 2025-2033. The market is driven by increased ethical consciousness, with consumers increasingly appreciating cruelty‑free, plant‑based, and clean beauty products. Strong regulatory frameworks that ban animal testing and promote transparent vegan certifications also lay a solid ground for consumer trust. Digital-first startups and established beauty houses alike are further responding with transparency, traceability, and locally inspired formulations, thereby increasing the Europe vegan cosmetics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.63 Billion |

| Market Forecast in 2033 | USD 9.39 Billion |

| Market Growth Rate 2025-2033 | 7.33% |

Europe Vegan Cosmetics Market Trends:

Consumer Ethics & Regulatory Climate

Europe's vegan beauty market is rooted in high ethical awareness, with consumers increasingly making purchases based on values such as cruelty-free manufacturing, clean ingredients, and environmental responsibility. European consumers, particularly throughout Western and Northern Europe, value certifications including vegan symbols, organic stamps, and cruelty‑free marks. Regulatory environments within the continent have traditionally prohibited animal testing, establishing a secure climate for brands dedicated to vegan principles. Germany, France, and the Netherlands are among the countries where there are high levels of consumer expectations on transparency and ingredient disclosure. These conditions prompt both heritage beauty houses and indie brands to promote their vegan credentials and ethical sourcing. This movement toward responsible consumption is not trend oriented but a hallmark of the regional beauty culture which also contributes to the Europe vegan cosmetics market growth.

To get more information on this market, Request Sample

Innovation Fueled by Biodiversity and Local Sourcing

Europe's innovation in vegan beauty is influenced by its rich botanical heritage - from Alpine botanicals and Mediterranean herbs to Nordic berries and Scandinavian seaweed. European companies are employing locally sourced ingredients such as lavender from Provence, sea buckthorn from the Baltic, and Nordic birch extract to make unique formulas with strong geographic identities. This makes it possible for brands to blend performance with authenticity and sustainability. Co-creation with local farmers and small cooperatives provides fair trade and fosters protection of biodiversity. Transparency in supply chains is also promoted through such relationships, validating the vegan and ethical positioning of products. Through this natural wealth, European vegan beauty brands differentiate themselves with efficacy-providing formulations that respect environmental heritage and regional authenticity.

Retail Landscape and Digital Influence

The European market for vegan beauty contains prestige and new niches alike: conventional department stores and beauty chain stores carry vegan products alongside international brands, while independent labels and clean beauty shops thrive in city hubs such as Paris, Berlin, Stockholm, and Amsterdam. E-commerce plays a strong role, with digitally native vegan companies leveraging experiential online, ingredient-based storytelling, and stories around sustainability to engage with European consumers. Social media bloggers and environmentally‑minded bloggers are instrumental in raising the profile of vegan beauty trends. Pop-up green beauty shops and vegan beauty festivals in key European capitals further enhance recognition. These trends drive the growth of multi-channel approaches combining bricks‑and‑mortar retail and digital‑first branding, extending the reach and impact of vegan cosmetics throughout Europe.

Europe Vegan Cosmetics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on product type, and distribution channel.

Product Type Insights:

- Skin Care

- Hair Care

- Makeup

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes skin care, hair care, makeup, and others.

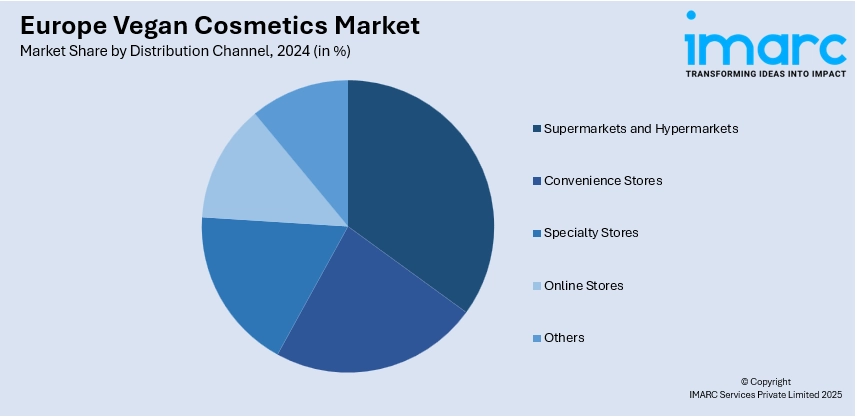

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others.

Regional Insights:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Germany, France, United Kingdom, Italy, Spain, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Europe Vegan Cosmetics Market News:

- In June 2025, the European Commission declared its goal to finish its "Save Cruelty Free Cosmetics" plan by the beginning of 2026, opening the door for a phased transition to non-animal testing in chemical safety assessments. In order to integrate New Approach Methodologies (NAMs) into 15 legislative domains that still rely on animal testing, including but not limited to the REACH Regulation, the roadmap will provide well-organized procedures and detailed recommendations. While implementation will begin immediately following the roadmap's release, it will take years to make progress on complex testing endpoints, pending the development and validation of alternative strategies. Where science and legal frameworks permit, the Commission also aims to incorporate NAMs more thoroughly into the ongoing REACH amendment process.

Europe Vegan Cosmetics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Skin Care, Hair Care, Makeup, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Europe vegan cosmetics market performed so far and how will it perform in the coming years?

- What is the breakup of the Europe vegan cosmetics market on the basis of product type?

- What is the breakup of the Europe vegan cosmetics market on the basis of distribution channel?

- What is the breakup of the Europe vegan cosmetics market on the basis of region?

- What are the various stages in the value chain of the Europe vegan cosmetics market?

- What are the key driving factors and challenges in the Europe vegan cosmetics market?

- What is the structure of the Europe vegan cosmetics market and who are the key players?

- What is the degree of competition in the Europe vegan cosmetics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe vegan cosmetics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Europe vegan cosmetics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe vegan cosmetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)