Europe Weight Management Market Size, Share, Trends and Forecast by Diet, Equipment, Service, and Country, 2025-2033

Europe Weight Management Market Size and Share:

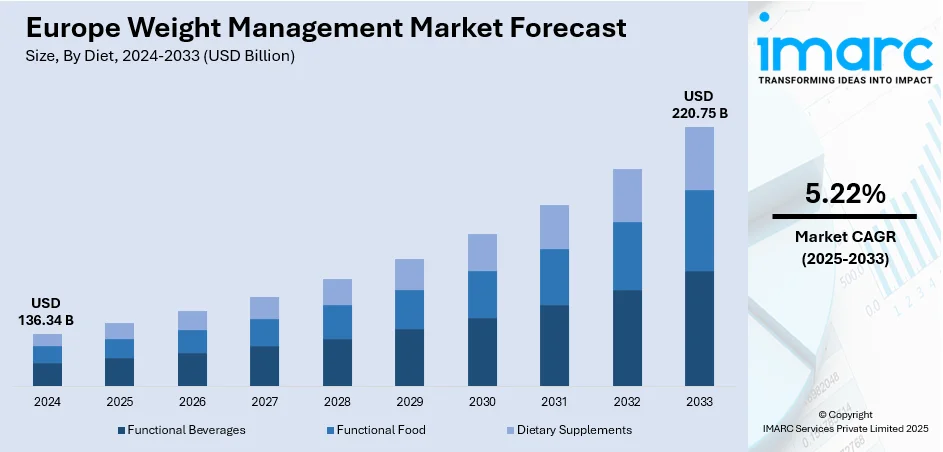

The Europe weight management market size was valued at USD 136.34 Billion in 2024. Looking forward, the market is expected to reach USD 220.75 Billion by 2033, exhibiting a CAGR of 5.22% during 2025-2033. Italy currently dominates the market, holding a significant market share in 2024. The market is fueled by growing obesity rates, health consciousness, and rising demand for personalized fitness and nutrition programs. Urban lifestyle, busy lifestyle, and physical inactivity have resulted in heightened demand for easy health solutions like meal replacements, dietary supplements, and online fitness programs. Government initiatives encouraging healthier lifestyles and corporate wellness programs are also fueling market growth. Technological advancements, such as wearable fitness trackers and mobile health platforms, also contribute significantly, while growing disposable income and changing consumer behavior further aid growth in Europe weight management market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 136.34 Billion |

|

Market Forecast in 2033

|

USD 220.75 Billion |

| Market Growth Rate 2025-2033 | 5.22% |

The increasing prevalence of lifestyle-related health issues and the growing tendency toward preventive healthcare are two major factors propelling the European weight management market. Throughout the region, there is an evident increase in health issues associated with sedentary lifestyles, consumption of processed food, and stress at work, most especially among urban dwellers. The UK, France, and Germany are experiencing increased sensitization around such conditions as cardiovascular disease, diabetes, and joint-related issues resulting from obesity. Increased sensitivity has spurred consumers towards taking proactive action in their weight and general welfare. In contrast to other areas, Europe boasts a robust public health system that enables education campaigns and initiatives for physical activity and healthy diets. Consequently, more people are integrating fitness regimens, healthy nutrition, and wellness-oriented lifestyles into their lives. With a blending of healthcare support systems, available health education, and culturally established wellness practices, the Europe weight management market outlook is poised for ongoing development of the industry.

To get more information on this market, Request Sample

Cultural attitudes within Europe towards health, food, and innovation are central to driving the weight management market forward. Europeans have traditionally sought quality nutrition, tending to prioritize fresh, seasonal, and local ingredients. This cultural context slots perfectly with contemporary weight management solutions focused on whole foods, plant-based eating, and sustainable options. Other nations such as Italy and Spain include healthy food in their society, and Nordic countries emphasize active living and outdoor fitness. This cultural acceptance of wellness acts as a foundation for the implementation of structured weight management services and programs. Additionally, Europe's receptiveness to technological innovation favors the development of advanced solutions such as smart wearables, AI-facilitated fitness apps, and tailored meal planning services. The use of these digital solutions to daily life has increased the accessibility and customization of weight management. This blend of cultural relevance with contemporary tools and services is further defining the future of the European weight management market as unique as well as rapidly changing.

Europe Weight Management Market Trends:

Increasing Health-Consciousness of European Consumers

Throughout Europe, there has been a drastic change in consumer attitude, with people putting more emphasis on health and wellness. This increased consciousness is largely prompted by better access to information on health, extensive campaigns encouraging healthy living, as well as a trend in self-care at the cultural level. Several Europeans are embracing healthier lifestyles, altering their way of eating, and seeking holistic methods of weight control. Plant-based foods, low-calorie foods, and sugar-free foods are steadily becoming mainstream consumption. It is no longer only about weight reduction but about sustained well-being, mental well-being, and preventive medicine. For instance, a 2025 study by the European Association for the Study of Obesity (EASO) reported that following a diet of time-restricted eating (TRE) for three months can be a viable method for maintaining long-term weight loss for overweight or obese individuals. Such cultural transformation is found to be very robust in nations such as Germany, the Netherlands, and Scandinavia, where health literacy and sustainability awareness travel together. Consequently, the Europe weight management market demand for products and services that comply with these values is observed, ranging from intelligent fitness devices to clean-label supplements and tailored nutrition plans.

Corporate Wellness Initiatives Driving Market Growth

A developing trend in the European weight management market is incorporating wellness programs into corporate settings. Companies throughout the region are increasingly identifying the connection between staff well-being and performance, and so are investing in on-site fitness centers, health workshops, and discounted gym memberships. The UK, France, and Sweden are at the forefront of this movement, where employers provide fitness benefits and tailored coaching through employee benefits packages. These corporate wellness programs boost workforce morale and also as effective measures for cutting down long-term healthcare expenses. The presence of gyms and fitness centers in office buildings has provided an efficient solution for hectic professionals to take care of their health objectives without halting their timetables. For instance, in March 2025, Wellhub revealed plans for the acquisition of Urban Sports Club in an effort to provide overall wellness solutions Europe’s corporate sector. This evolution is considerably driving the weight management services demand, such as diet counseling, personal training, and mobile fitness apps customized for working adults. The increased convergence between wellness and work life is proving to be a significant driver in transforming the Europe weight management market trends.

Technology and Innovation Driving Personalized Solutions

The uptake of newer technologies and data solutions is another primary trend shaping the weight management market in Europe. Customers are increasingly looking for personalized experiences that address their unique health requirements, genetic makeup, and lifestyle choices. This has created the demand for AI-driven nutrition apps, genetically based diet plans, and intelligent fitness trackers that offer real-time feedback and goal setting. European startups as well as established businesses are investing in technology-driven wellness platforms that deliver customized programs for weight loss, fitness training, and mental health. Moreover, the convergence of telehealth services and virtual coaching has facilitated greater access to expert advice in urban and rural areas of Europe. Finland and Denmark are specifically renowned for using digital platforms to advance population health. These technologies enhance participation and facilitate long-term weight management adherence, thus making the European market a pioneer in the convergence of technology and health-oriented solutions.

Europe Weight Management Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe weight management market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on diet, equipment, and service.

Analysis by Diet:

- Functional Beverages

- Functional Food

- Dietary Supplements

Functional beverages stand as the largest component in 2024. Functional beverages have become the top constituent segment according to the Europe weight management market forecast owing to growing consumer interest in convenient and health-focused solutions. They are designed with supplemented ingredients like vitamins, minerals, proteins, fiber, and natural extracts, which enhance metabolism, boost energy levels, and induce satiety. Europeans are now adopting functional drinks in their daily lifestyles as meal substitutes, pre-workout energizers, or health snacks in line with the region's increasing emphasis on fitness and preventive health. The demand for green tea-flavored beverages, protein drinks, detox drinks, and probiotic waters is growing exceedingly fast in nations such as Germany, the UK, and France. Clean-label and low-sugar versions are especially attractive to consumers looking for health and wellness who want transparency and quality in what they eat. Additionally, ready-to-drink convenience aligns perfectly with busy lifestyles. With innovation ongoing in taste, packaging, and functionality, functional drinks are cementing their grip on Europe's weight management market.

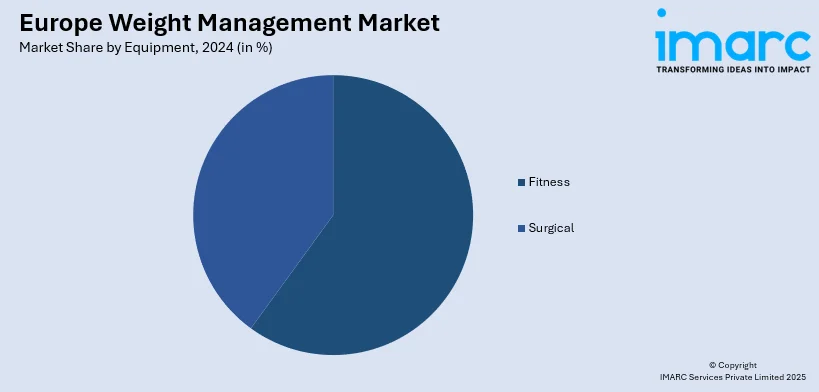

Analysis by Equipment:

- Fitness

- Surgical

Fitness leads the market share in 2024. Fitness equipment is the top category in the Europe weight management market, driven by the region's growing focus on active living and fitness. People are making purchases of home-based and gym equipment like treadmills, stationary cycles, resistance bands, and intelligent fitness machines to aid weight control objectives. This growth is fueled by the increased demand for home-based workouts, hybrid fitness models, and customized training programs. The UK, Germany, and the Netherlands are experiencing a rise in demand for compact, high-tech fitness equipment for both beginners and advanced users. The popularity of corporate wellness programs as well as the integration of fitness centers in office buildings also contribute to the growth of equipment sales. Further, intelligent fitness solutions, combined with tracking programs, virtual coaching, and performance analysis, boost user motivation and interest. With fitness becoming a part of daily life among all age groups, the fitness equipment segment continues to be at the forefront of Europe's weight management sector.

Analysis by Service:

- Health Clubs

- Consultation Services

- Online Weight Loss Services

Health clubs lead the market share in 2024. The Europe weight management market's leading service segment is now health clubs, propelled by increasing consumer demand for organized fitness programs and professional wellness guidance. These clubs provide an array of services such as personal training, group exercise classes, nutritional guidance, and wellness coaching for various fitness levels and purposes. In Germany, the UK, and Sweden, memberships of health clubs continue to grow as people look for guided, peer-based settings in which to control their weight successfully. Most clubs today incorporate new technologies such as fitness tracking, mobile app connection, and personalized training plans to improve member experience and participation. The addition of wellness features like saunas, physiotherapy, and stress management classes is also attractive to Europe's health-balanced populace. Further, the growth of high-end and boutique gym studios throughout urban centers is an indicator of shifting demand towards high-end, customized experiences. Consequently, health clubs continue to be at the heart of the region's weight management system.

Analysis by Country:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

In 2024, Italy accounted for the largest market share. The Italian region leads as the prominent regional segment, as per the Europe weight management market analysis, with a high cultural priority placed on wellness, lifestyle balance, and healthy nutrition. Although the typical Mediterranean diet continues to be a pillar of Italian eating habits, contemporary consumers are increasingly adopting disciplined weight management programs, training regimens, and specialist foodstuffs. Cities like Milan, Rome, and Turin are experiencing a swift growth in health clubs, wellness centers, and natural food stores as a reflection of the entire country's shift toward preventive medicine and physical fitness. Clean-label supplements, functional beverages, and customized nutrition services are also in huge demand in the Italian market. Physical exercise and healthy lifestyles are encouraged by government programs, further propelling the growth of the market. Furthermore, Italy's fashion-oriented populace is also responsible for driving the demand for weight management solutions, associating personal looks with general well-being. With both traditional dietary beliefs and contemporary health interests, Italy still dominates the Europe weight management market.

Competitive Landscape:

Major players in the Europe weight management market are increasingly adopting strategic moves to enhance their market presence and address changing consumer needs. Top players are heavily investing in research and development to launch innovative, science-based products like low-calorie meal replacements, plant-based protein supplements, and functional beverages that can support weight control. Numerous brands are also upgrading their digital presence in the form of customized wellness apps and online coaching websites, which help users monitor progress, get tailored diet plans, and access nutritionists remotely. Strategic collaborations with gyms, corporate spaces, and healthcare organizations are assisting these companies in reaching new segments of consumers, particularly working professionals. In addition, a few players are emphasizing clean-label, organic, and sustainable product lines to target environmentally aware consumers in Europe. Marketing is becoming locally relevant, with multilingual communications and locally tuned product ranges. Mergers and acquisitions are also being undertaken to build portfolios and expand geographies. For example, firms are buying boutique health brands and technology startups to drive competitiveness in customized nutrition and wellness technology. Together, these initiatives by major players are enhancing innovation and accessibility but also catalyzing the Europe weight management market growth.

The report provides a comprehensive analysis of the competitive landscape in the Europe weight management market with detailed profiles of all major companies.

Latest News and Developments:

- August 2025: Leanova introduced its flagship weight loss supplement in the United Kingdom, a once-daily plant-based product designed to promote metabolic health, hunger control, and long-term weight loss. Supported by clinical studies, rich in functional vitamins and nutrients, and completely made in Europe under GMP-compliant settings, Leanova is designed for health-conscious individuals who prioritize natural ingredients, transparency, and long-term benefits.

- July 2025: Novo Nordisk announced that it had applied to the European Medicines Agency (EMA) to authorize a new, increased dosage of Wegovy, its medication for treating obesity. This represents an important turning point in the company's mission to offer a wide range of creative, individual-centered solutions to assist obese individuals in their quest for weight management and improved health.

- June 2025: Hims & Hers Health, Inc., revealed plans for the acquisition of ZAVA, a digital health platform offering various wellness services, including weight-management solutions. This acquisition will significantly increase Hims & Hers' presence in the UK, along with formally launching the business into France, Ireland, and Germany.

- February 2025: Biocon announced the official launch of its obesity and diabetes management drug, Liraglutide, in the United Kingdom. Following approval from the UK's Medicines and Healthcare Products Regulatory Agency (MHRA) earlier in 2025, the company is now implementing this deployment.

- February 2025: Liva Healthcare, a digital health platform that also offers weight management services, announced the successful acquisition of Discover Momenta, as well as its subsidiary Momenta Newcastle. This acquisition is a key component of Liva's expansion plan as it becomes a significant global supplier of therapeutic lifestyle treatments.

Europe Weight Management Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Diets Covered | Functional Beverages, Functional Food, Dietary Supplements |

| Equipments Covered | Fitness, Surgical |

| Services Covered | Health Clubs, Consultation Services, Online Weight Loss Services |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe weight management market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe weight management market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the weight management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The weight management market in Europe was valued at USD 136.34 Billion in 2024.

The Europe weight management market is projected to exhibit a (CAGR) of 5.22% during 2025-2033, reaching a value of USD 220.75 Billion by 2033.

The Europe weight management market is driven by increasing health awareness, rising obesity-related concerns, and the growing demand for personalized fitness and nutrition solutions. Cultural focus on wellness, government health initiatives, and the adoption of digital health technologies further support market growth across the region, encouraging preventive healthcare and active lifestyles.

Italy accounts for the largest share in Europe weight management market, driven by a strong cultural emphasis on healthy living, the popularity of the Mediterranean diet, and increasing demand for personalized wellness solutions. Urbanization, rising health consciousness, and growth in fitness centers and functional food consumption further contribute to the country’s expanding weight management industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)