eVTOL Aircraft Market Size, Share, Trends and Forecast by Lift Technology, Mode of Operation, Maximum Take Off Weight (MTOW), Range, Propulsion Type, Application, and Region, 2025-2033

eVTOL Aircraft Market Size and Share:

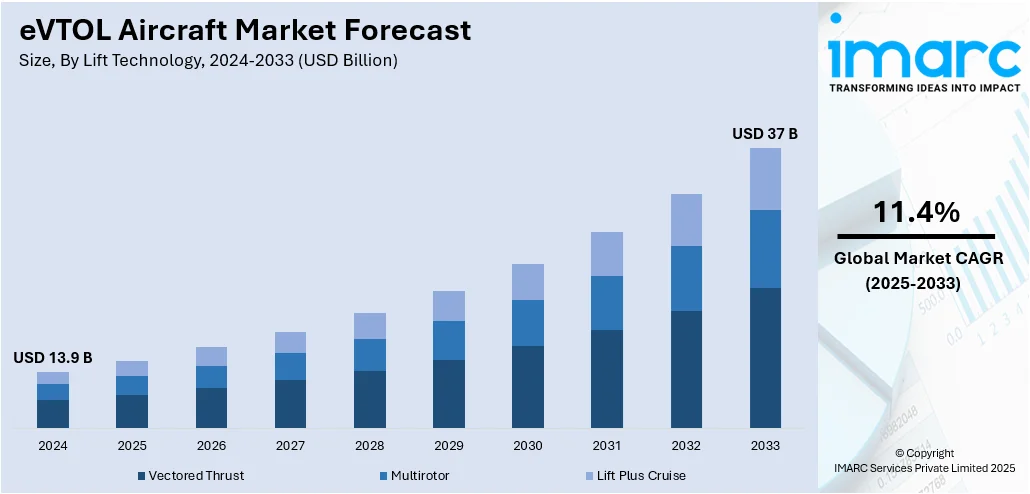

The global eVTOL aircraft market size was valued at USD 13.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 37 Billion by 2033, exhibiting a CAGR of 11.4% from 2025-2033. North America currently dominates the market, holding a market share of 37.5% in 2024. The growing demand for lighter and more aerodynamic designs, along with the development of advanced materials, rising demand for transportation that bypass ground-level traffic, and increasing preference for eco-friendly transportation alternatives to reduce carbon dioxide emissions are some of the major factors propelling the eVTOL aircraft market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13.9 Billion |

| Market Forecast in 2033 | USD 37 Billion |

| Market Growth Rate 2025-2033 | 11.4% |

The rapid urbanization of major cities has intensified road congestion, increasing the need for efficient, time-saving transport solutions. eVTOL aircraft address this by enabling point-to-point air travel within urban environments, drastically reducing travel times. Supported by smart city initiatives and infrastructure investments, eVTOLs are positioned as key players in future urban mobility ecosystems. Their low-noise profiles and small takeoff footprints make them suitable for city operations. This growing demand for Urban Air Mobility (UAM) is a critical driver, attracting strong interest from governments, ride-sharing companies, and aerospace manufacturers.

To get more information on this market, Request Sample

The development of high-energy-density batteries and efficient electric propulsion systems has been pivotal in making eVTOL aircraft commercially viable. Improvements in lithium-ion and next-generation battery technologies have extended flight range, reduced charging times, and improved overall aircraft performance. These advancements enable manufacturers to design lightweight, cost-effective aircraft with lower operational expenses than traditional helicopters. Additionally, electric propulsion systems offer reduced noise levels and zero in-flight emissions, aligning with global sustainability goals. As battery technology continues to evolve, it significantly drives the eVTOL aircraft market growth by enhancing practicality, scalability, and regulatory acceptance.

eVTOL Aircraft Market Trends:

Rising demand for transportation that bypass ground-level traffic

Urban congestion and traffic gridlock are becoming a pervasive issue in many metropolitan areas worldwide. The INRIX 2024 Global Traffic Scorecard revealed that traffic congestion in the U.S. costed over USD 74 Billion in 2024, averaging USD 771 per driver. In the UK, delays costed USD 5.17 Billion in London and USD 10.34 Billion nationwide, highlighting the urgent need for cities to improve traffic management. In addition, the rising demand for transportation that bypasses ground-level traffic is bolstering the growth of the market. Apart from this, eVTOL aircraft can take off and land vertically, which means they can utilize existing infrastructure, such as helipads and vertiports, while also accessing more confined urban spaces. Moreover, it assists in reducing travel times and making commuting more efficient and enjoyable, which is offering a positive market outlook. In line with this, the rising adoption of eVTOLs to address the need for congestion relief and enhanced urban mobility is supporting the eVTOL aircraft market demand.

Growing preference for eco-friendly transportation alternatives

The rising preference for eco-friendly transportation alternatives is propelling the growth of the market. In line with this, there is an increase in concerns over climate change and air pollution among the masses across the globe. According to WHO data, nearly the entire global population (99%) breathes air that surpasses the organization’s guideline limits and contains elevated levels of pollutants. Besides this, these aircraft are powered by electricity that produces zero emissions during flight while aligning with sustainability goals. In addition, they have a lower noise profile as compared to conventional helicopters. Governing agencies worldwide are encouraging the adoption of cleaner and greener transportation modes, which is offering a positive market outlook. Furthermore, advancements in battery technology are extending the range and efficiency of these aircraft, which makes them even more environmentally attractive.

Increasing demand for lighter and more aerodynamic designs

Rapid technological advancements in these aircraft, such as electric propulsion, battery energy density, and autonomous flight systems, assist in providing a more viable transportation solution is a key eVTOL aircraft market trend. As such, in November 2024, GE Aerospace demonstrated a 1-megawatt hybrid electric propulsion system under a USD 5.1 Million U.S. Army contract, advancing tech for future air and ground military vehicles. Electric propulsion systems offer high efficiency and have low maintenance requirements as compared to traditional internal combustion engines. Moreover, the rising development of advanced materials to offer lighter and more aerodynamic eVTOL designs is bolstering the growth of the market. Simultaneously, autonomous flight technology is enhancing the safety and operational capabilities of aircraft, which is contributing to the growth of the market. As a result, these technological advancements assist in the manufacturing of reliable and cost-effective aircraft.

eVTOL Aircraft Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global eVTOL Aircraft market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on lift technology, mode of operation, maximum take off weight (MTOW), range, propulsion type, and application.

Analysis by Lift Technology:

- Vectored Thrust

- Multirotor

- Lift Plus Cruise

Multirotor eVTOL aircraft represent the majority of market share due to their simplicity, cost-effectiveness, and suitability for urban operations. These aircraft use multiple rotors for vertical lift, eliminating the need for complex tilt or fixed-wing mechanisms, which reduces manufacturing and maintenance costs. Their compact design and enhanced maneuverability make them ideal for congested urban environments where space for takeoff and landing is limited. Additionally, multirotors typically have shorter development timelines and are easier to scale for applications like air taxis, cargo delivery, and emergency services. Their inherent stability and redundancy in rotor systems also increase safety, a key factor for regulatory approval and public acceptance, driving their dominance in the eVTOL market.

Analysis by Mode of Operation:

- Piloted

- Autonomous

- Semi-Autonomous

Based on the eVTOL aircraft market forecast, semi-autonomous dominate the market demand with a share of 38.9% due to their ability to balance automation benefits with human oversight. These systems leverage advanced autopilot and navigation technologies for tasks like route optimization, altitude control, and obstacle avoidance while still requiring a pilot for critical decision-making. This hybrid approach increases operational safety, regulatory compliance, and passenger trust, making them more acceptable for near-term urban air mobility deployment. Semi-autonomous operations also reduce pilot workload, enabling more efficient training and operations compared to fully manual aircraft. As the industry transitions toward full autonomy, semi-autonomous eVTOLs serve as a practical bridge, supporting scalable commercial operations while meeting current aviation standards and easing regulatory adoption.

Analysis by Maximum Take-off Weight (MTOW):

- <250 Kg

- 250-500 Kg

- 500-1500 Kg

- >1500 Kg

<250 Kg is the leading segment with a market share of 28.9% due to its regulatory advantages, cost efficiency, and operational flexibility. Aircraft under this weight often fall into less stringent certification categories, allowing faster approvals and reduced compliance costs, which accelerates time-to-market. These lightweight eVTOLs are widely used for cargo delivery, surveillance, medical supplies transport, and pilot training, making them attractive to both startups and established operators. Their lower energy consumption and simplified designs also reduce operational costs while enhancing safety. Moreover, their smaller size and minimal infrastructure needs make them ideal for early urban air mobility deployments, particularly in densely populated cities where space and regulatory barriers are significant.

Analysis by Range:

- 0-200 Km

- 200-500 Km

200-500 km account for the majority of shares of 58.0% owing to its ability to serve regional and intercity transport needs, bridging the gap between short-range urban flights and long-haul aviation. eVTOLs in this range are ideal for commuter routes, regional air taxi services, cargo logistics, and emergency operations, making them highly versatile. This range also aligns with the growing demand for suburban-to-urban and city-to-city connections, where ground travel is time-consuming. Advancements in battery technology and lightweight materials have enabled greater energy efficiency, supporting longer flights without compromising payload capacity. As infrastructure for regional air mobility expands, the 200–500 km range emerges as the most commercially viable segment for scalable eVTOL operations.

Analysis by Propulsion Type:

- Battery-Electric

- Hybrid-Electric

- Hydrogen-Electric

Battery-Electric represents the largest market share driven by their zero in-flight emissions, lower operational costs, and regulatory favorability. They rely on advanced lithium-ion and next-generation batteries, which provide improved energy density, faster charging, and extended flight ranges, making them suitable for urban and regional mobility. Their simpler propulsion systems reduce maintenance needs compared to hybrid or combustion alternatives, further lowering costs for operators. Additionally, their quiet operation supports compliance with stringent urban noise regulations, a critical factor for city-based air taxi services. Growing investment in charging infrastructure and government incentives for clean aviation further bolster battery-electric eVTOL adoption and market leadership.

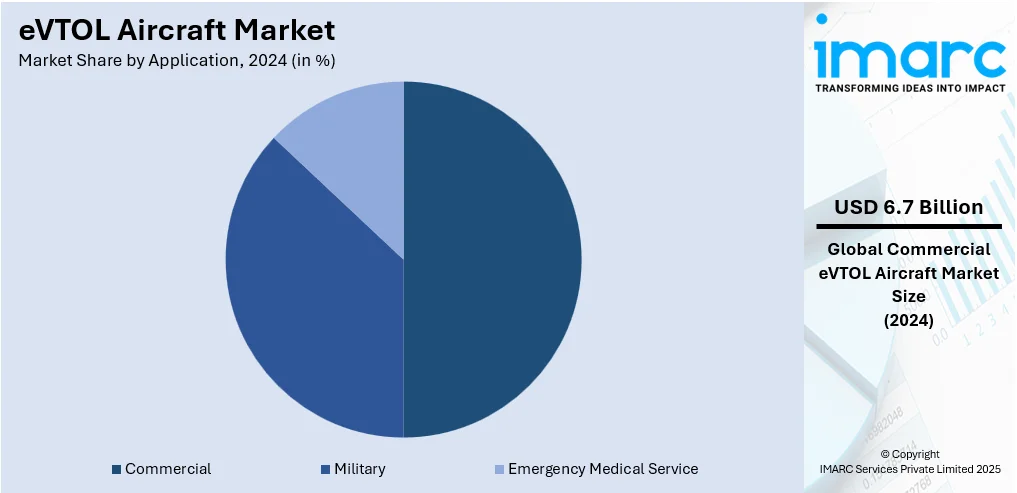

Analysis by Application:

- Commercial

- Air Taxi

- Delivery Drones

- Military

- Cargo Transport

- Combat Mission

- Emergency Medical Service

- Air Ambulance

- Medical Cargo Transport

Commercial account for the majority of shares of 48.5% due to the rising demand for air taxi services, cargo transport, tourism, and corporate travel. Urban Air Mobility initiatives are driving adoption, as eVTOLs offer cost-effective, time-saving alternatives to congested ground transport for short- and mid-range trips. Companies like Joby Aviation, Archer, and Lilium are prioritizing commercial applications, supported by significant venture capital funding and strategic airline partnerships. Additionally, the scalability of commercial eVTOL operations—enabled by vertiport infrastructure development and evolving regulatory frameworks—makes this segment the most viable for near-term revenue generation, solidifying the eVTOL aircraft market outlook.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America is the leading region with a market share of 37.5% driven by strong technological innovation, regulatory support, and heavy investments. The U.S., in particular, leads with companies like Joby Aviation, Archer Aviation, and Beta Technologies advancing toward FAA certification and commercial launch. The region benefits from a robust aerospace ecosystem, early adoption of Urban Air Mobility (UAM) initiatives, and substantial funding from both private investors and government agencies. Additionally, infrastructure development, such as vertiports in cities like Los Angeles, Dallas, and Miami, supports large-scale deployment. Favorable policies, strategic airline partnerships, and growing demand for air taxi and cargo services further strengthen North America’s leadership in the global eVTOL market.

Key Regional Takeaways:

United States eVTOL Aircraft Market Analysis

The United States eVTOL aircraft market is primarily driven by continual advancements in battery energy density, which are extending aircraft range and payload capacity. In accordance with this, increasing public and private investments, accelerating innovation, infrastructure development, and certification processes, are impelling the market. The rise of public-private partnerships is further propelling the market growth by supporting urban air mobility trials and integration initiatives. For instance, in October 2024, Toyota invested USD 500 Million in Joby Aviation to support certification and production of its S4 electric air taxi. Joby’s eVTOL progress is driven by strong public-private partnerships, including a USD 131 Million U.S. Air Force contract. Similarly, increasing national efforts to reduce fossil fuel dependency and augmenting interest in zero-emission aviation technologies are fostering market expansion. The ongoing development of digital air traffic management systems, which ensures safer operations in low-altitude urban airspace, is also strengthening market demand. As such, in May 2025, the U.S.’s Federal Aviation Administration unveiled the plan to modernize its air traffic control system over a three-to-four-year period, including the replacement of 618 radars, the installation of anti-collision tarmac technology at 200 airports, construction of six new air traffic control centers, and expansion of its ADS-B network of real-time aircraft traffic information. Apart from this, robust domestic aerospace manufacturing capabilities and growing consumer demand for premium, time-saving transport solutions are further expanding market scope.

Europe eVTOL Aircraft Market Analysis

The eVTOL aircraft market in Europe is experiencing growth due to strong regulatory backing from the European Union Aviation Safety Agency (EASA), which is actively defining certification pathways for new air mobility. In line with this, the ongoing inclusion of eVTOL development in the European Green Deal, which increases investments aligned with net-zero transport goals, is supporting market demand. Furthermore, growing demand for efficient intercity and urban mobility is encouraging higher product adoption, particularly in densely populated regions. A 2024 EIT Urban Mobility report estimated that USD 1.76 Trillion is needed by 2050 to meet EU’s transport decarbonization goals. The expansion of public-private partnerships, including government-supported pilot programs and demonstrations, is accelerating operational readiness. Additionally, Europe’s advanced aerospace manufacturing ecosystem, centered in countries like France and Germany, is contributing technological expertise and scalable production capabilities. Moreover, favorable smart city initiatives and airspace digitization efforts are promoting infrastructure development tailored to the deployment of urban air mobility. As such, the ARIS strategy, presented in June 2025, planned an investment of USD 77.47 Billion between 2028 and 2034 in Europe’s aviation sector, focusing on next-generation aircraft, efficient air traffic management, and pioneering innovations to enhance competitiveness and sustainability.

Asia Pacific eVTOL Aircraft Market Analysis

The Asia Pacific market is predominantly propelled by rapid urbanization, which increases demand for innovative urban air mobility solutions to ease ground traffic congestion. In addition to this, growing government investments in smart city projects are fostering the integration of eVTOL infrastructure with existing transport networks. The expansion of commercial drone applications is accelerating technological advancements, further supporting market growth. Accordingly, JSW Ventures invested USD 1.8 Million in Aereo to accelerate the expansion of its commercial drone solutions in the mining, infrastructure, and land record management segments. Moreover, growing environmental concerns are prompting the adoption of zero-emission aerial vehicles to reduce urban pollution, thereby expanding the market reach. The various strategic collaborations between regional aerospace companies and global technology leaders are facilitating knowledge sharing and speeding up product development. Besides this, rising disposable incomes and the emergence of affluent urban populations in key metropolitan areas are expanding the customer base for premium air taxi services, thus stimulating market appeal.

Latin America eVTOL Aircraft Market Analysis

In Latin America, the market is growing due to the pressing need to alleviate traffic congestion in densely populated urban hubs such as São Paulo and Mexico City. In 2024, drivers in Mexico City lost an average of 97 hours to traffic congestion, marking a 1% increase in time lost compared to the previous year, according to the Global Traffic Scorecard. Similarly, growing environmental concerns are prompting authorities to invest in electric aviation to support carbon-neutral transport goals, enhancing market accessibility. Furthermore, government support through aviation innovation zones and regulatory sandbox initiatives is accelerating the development of pilot programs. Furthermore, expanding tourism in remote and ecologically sensitive areas, which drives demand for low-impact, air-based connectivity alternatives, is creating lucrative market opportunities.

Middle East and Africa eVTOL Aircraft Market Analysis

The eVTOL market in the Middle East and Africa is significantly influenced by strategic government initiatives such as the UAE’s Smart Mobility Strategy and Saudi Arabia’s Vision 2030. Furthermore, rising investment in aerial infrastructure, including vertiports and control systems, is supporting commercial deployment. For instance, in April 2025, Ondas secured a USD 3.2 Million order to expand its Optimus autonomous drone network in the UAE, supporting public safety and emergency response. Similarly, increased demand for rapid connectivity in underserved regions is bolstering eVTOL applications in the market. Moreover, robust public-private collaborations are driving innovation in urban air mobility across key cities, providing an impetus to the market.

Competitive Landscape:

Key players are investing in research and development (R&D) activities to enhance the technology and performance of their aircraft. This includes improving battery technology, propulsion systems, aerodynamics, and autonomous flight capabilities. In addition, they are building and testing prototypes of the aircraft to validate their designs and performance. Apart from this, major manufacturers are conducting extensive flight testing and simulations to ensure safety and reliability. In line with this, companies are working closely with aviation authorities to develop and certify their aircraft, creating a pathway for safe and legal operations. Furthermore, some companies are investing in the development of infrastructure required for the operations of aircraft, such as the construction of vertiports, charging stations, and ground support equipment.

The report provides a comprehensive analysis of the competitive landscape in the eVTOL Aircraft market with detailed profiles of all major companies, including:

- Airbus SE

- Archer Aviation Inc.

- Beta Technologies

- Guangzhou EHang Intelligent Technology Co. Ltd

- Lift Aircraft Inc.

- Lilium GmbH

- Moog Inc.

- Piasecki Aircraft Corporation

- Pipistrel d.o.o Ajdovšcina

- Vertical Aerospace Group Ltd.

- Volocopter GmbH

- Wisk Aero LLC

- Xti Aircraft Company

Latest News and Developments:

- July 2025: AIR launched a 32,000 sq. ft. production facility in central Israel to meet rising demand for its eVTOL aircraft. The site supports simultaneous assembly of six aircrafts and will accelerate deliveries of its uncrewed cargo and piloted two-seater eVTOLs, with a larger U.S. facility planned next.

- June 2025: Archer Aviation expanded its eVTOL Launch Edition program to Indonesia through a USD 250 Million deal with IKN for up to 50 Midnight aircraft. The partnership targets air-taxi services in Jakarta and Ibu Kota Nusantara.

- May 2025: Vertical Aerospace and Honeywell expanded their partnership to accelerate VX4 eVTOL certification and production. Honeywell will supply flight control and management systems, including new inceptors. The agreement, valued at up to USD 1 Billion over a decade, supports Vertical’s 2028 certification and 2030 delivery goals for 150 aircraft.

- February 2025: Sarla Aviation unveiled its seven-seater electric VTOL aircraft at the Invest Karnataka Summit. The flying taxi can travel 160 km per charge. Pilot testing in Bengaluru will begin soon, with commercial operations planned by early 2029, starting from the airport to hotels, IT hubs, and hospitals.

- February 2025: Volocopter partnered with Jet Systems to launch eVTOL services in France, starting in Paris. The collaboration will deploy two VoloCity aircraft after EASA certification and expand nationwide. Volocopter provides technology and training, while Jet Systems handles operations, leveraging existing routes and infrastructure for sustainable urban air mobility.

eVTOL Aircraft Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Lift Technologies Covered | Vectored Thrust, Multirotor, Lift Plus Cruise |

| Mode of Operations Covered | Piloted, Autonomous, Semi-Autonomous |

| Maximum Take Off-Weights (MTOW) Covered | <250 Kg, 250-500 Kg, 500-1500 Kg, >1500 Kg |

| Ranges Covered | 0-200 Km, 200-500 Km |

| Propulsion Types Covered | Battery-Electric, Hybrid-Electric, Hydrogen-Electric |

| Applications Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Airbus SE, Archer Aviation Inc., Beta Technologies, Guangzhou EHang Intelligent Technology Co. Ltd, Lift Aircraft Inc., Lilium GmbH, Moog Inc., Piasecki Aircraft Corporation, Pipistrel d.o.o Ajdovšcina, Vertical Aerospace Group Ltd., Volocopter GmbH, Wisk Aero LLC, Xti Aircraft Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the eVTOL aircraft market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global eVTOL aircraft market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the eVTOL aircraft industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The eVTOL aircraft market was valued at USD 13.9 Billion in 2024.

The eVTOL aircraft market is projected to exhibit a CAGR of 11.4% during 2025-2033, reaching a value of USD 37 Billion by 2033.

Key factors driving the eVTOL aircraft market include growing demand for Urban Air Mobility, advancements in battery and electric propulsion technologies, regulatory support for sustainable aviation, and increased investments from aerospace companies and venture capital. Additionally, reduced noise, lower operating costs, and the need for faster urban and regional transport boost adoption.

Multirotor eVTOL aircraft dominate the market due to their cost-effectiveness, simplicity, and suitability for urban operations. Their compact, stable design, shorter development timelines, and safety-enhancing rotor redundancy make them ideal for air taxis, cargo delivery, and emergency services.

Semi-autonomous eVTOLs dominate with 38.9% share by combining automation for navigation and flight control with human oversight for critical decisions. This balance enhances safety, regulatory compliance, and passenger confidence, while reducing pilot workload. It serves as a practical bridge toward fully autonomous operations, accelerating market adoption and scalability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)