Explosion Proof Equipment Market Size, Share, Trends and Forecast by Protection Method, Applicable System, Industry Vertical, and Region, 2026-2034

Explosion Proof Equipment Market Size and Share:

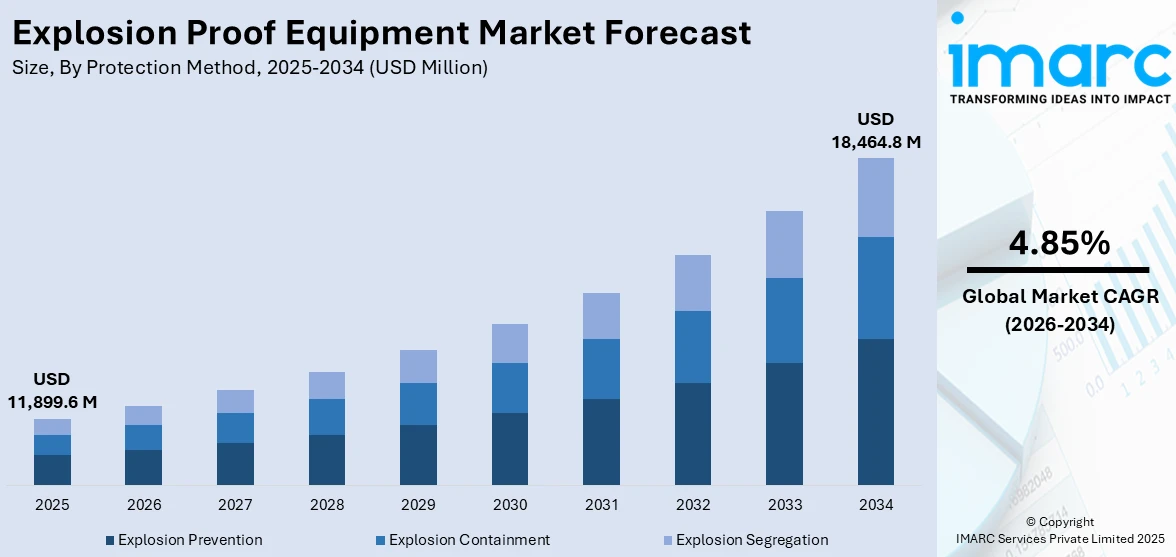

The global explosion proof equipment market size was valued at USD 11,899.6 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 18,464.8 Million by 2034, exhibiting a CAGR of 4.85% from 2026-2034. North America currently dominates the market, holding a market share of over 27.5% in 2025. The market is experiencing steady growth driven by stringent regulations imposed by governing agencies worldwide, the increasing demand for energy, the rising installation of offshore oil production sites, and continual technological advancements in sensing technologies and communication systems in this region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 11,899.6 Million |

|

Market Forecast in 2034

|

USD 18,464.8 Million |

| Market Growth Rate 2026-2034 | 4.85% |

The growth of the global explosion-proof equipment market is boosted by increasing safety regulations within industries like oil and gas, chemicals, and mining operating in hazardous environments. Industrialization and urbanization have increased the demand for equipment that ensures safety during operation and reduces workplace hazards within explosive atmospheres. Ongoing technological advancement in smart monitoring systems and the improved materials enhancing durability and reliability are also providing an impetus to the market growth. Additionally, the increasing automation and adoption of robotics in hazardous industries generates further requirements for explosion-proof parts. Government regulations and international norms are encouraging more and more businesses to invest in certified equipment; this fuels the market in key regions, such as North America and Asia-Pacific.

To get more information on this market Request Sample

The United States is a leading market, holding 80.50% of total shares, due to the strict safety standards placed on industries like oil and gas, chemicals, and mining. Indeed, the Occupational Safety and Health Administration (OSHA) and the National Fire Protection Association (NFPA) set standards that require explosion-proof equipment in hazardous environments. Especially in oil and gas, with such players as ExxonMobil working to increase production by over 1 million barrels of oil per day from the Permian Basin in 2024-an 80% growth over the current level heavy-duty safety gear as explosion-proof is needed in abundance. Also, with the emergence of automation and the Industrial Internet of Things (IIoT), smart explosion-proof devices have been implemented with real-time monitoring that promotes both safety and efficiency in operations. All these factors are responsible for the growth of the explosion-proof equipment market in the U.S.

Explosion Proof Equipment Market Trends:

Regulatory compliance and safety standards

The increasing emphasis on industrial safety and stringent regulatory requirements are the primary drivers for the market. Governments and regulatory bodies all over the world are imposing stringent guidelines to ensure the safety of personnel, assets, and the environment in industries prone to explosive atmospheres. Industries like oil and gas, chemicals, mining, and manufacturing, must abide by these directives. It forces them to invest in explosion-proof equipment to reduce the hazard of accidents and comply with the safety standards. Explosion-proof equipment should be certified with some certifications such as ATEX, IECEx, etc.

Rising industrialization and urbanization

The market demand is also brought about by the increasing industrialization and urbanization process going on globally. Currently, according to the WHO, 55% of the global population is urban, and this is set to increase to 68% in 2050. As these cities and industries expand, infrastructure growth requires more facilities in dangerous conditions. Some industries involved include petrochemical, pharmaceutical, and food processing; their expansions are often located at areas with combustible gases or dust. This expansion leads to a tremendous demand for the equipment that ensures personnel, assets, and infrastructures are protected, hence very helpful in the growth of this market.

Technological advancements and innovation

The advancement in technology plays a significant role in the evolution of this equipment. Innovative materials, sensing technologies, and communication systems increase the efficiency and reliability of explosion-proof solutions. Smart and connected explosion-proof devices with sensors and monitoring capabilities are now trending and offer real-time data on environmental conditions. According to McKinsey, autonomous driving will drive growth in the software and sensors segments. The projection is that software will grow by 9% and sensors by 8%. Additionally, this improves safety and allows for predictive maintenance, reducing downtime and enhancing overall operational efficiency. The continuous innovation in the equipment is attracting industries looking to invest in state-of-the-art solutions to address their safety and operational needs, further propelling the market forward.

Explosion Proof Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global explosion proof equipment market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on protection method, applicable system, industry vertical, and region.

Analysis by Protection Method:

- Explosion Prevention

- Explosion Containment

- Explosion Segregation

Explosion prevention as the largest component in 2025, holding around 45.2% of the market. Explosion prevention remains the largest market segment with a majority share of market share. This method reduces or eliminates the potential source of ignition, such as sparks or open flames that would otherwise cause an explosion to occur. Advanced technologies and safety protocols are used while employing explosion prevention measures as an important proactive measure against hazards in industrial environments. In hazardous industries, the growing adoption of automation increases the demand for explosion prevention systems. Moreover, stringent global safety standards and certifications are also driving the innovation and higher adoption rate of these solutions across sectors.

Analysis by Applicable System:

- Cable Glands

- Junction Boxes and Enclosures

- Lifting and Material Handling System

- Lighting System

- Automation System

- Surveillance and Monitoring System

- Signaling Devices

- Others

Cable glands are essential in protecting electrical connections, providing a secure entry point for cables into electrical enclosures. Junction boxes and enclosures are crucial in breaking up explosion-proof equipment, ensuring that sparks or heat generated within do not pose a risk to the surrounding explosive atmosphere. These structures enhance the safety of electrical components in industrial settings.

Explosion-proof lifting and material handling systems are critical in industries where heavy loads are necessary, as they prevent sparks or overheating during operation. These systems ensure safe and efficient operations in industries like manufacturing, mining, and oil and gas.

Lighting systems are also fundamental in explosion-proof applications, providing illumination in environments with combustible gases or dust. These systems help prevent sparks or heat emissions that could ignite hazardous materials.

Automation systems integrate advanced technologies into industrial processes while ensuring compliance with safety standards. These systems are equipped with components designed to prevent ignition sources, allowing for the automation of critical processes in hazardous environments.

Surveillance and monitoring systems use advanced technologies to monitor and assess potential risks, providing real-time data on conditions within industrial settings. The integration of explosion-proof features ensures the reliability and safety of surveillance and monitoring equipment, contributing to overall workplace safety.

Signaling devices are very important for communication and warning in industrial environments where explosion-proof measures must be ensured. Those include alarm or horn with visual indicator that matches the standards of explosion-proof technologies, granting clear communication in safe conditions in a site where traditional methods of signalization may initiate an explosion.

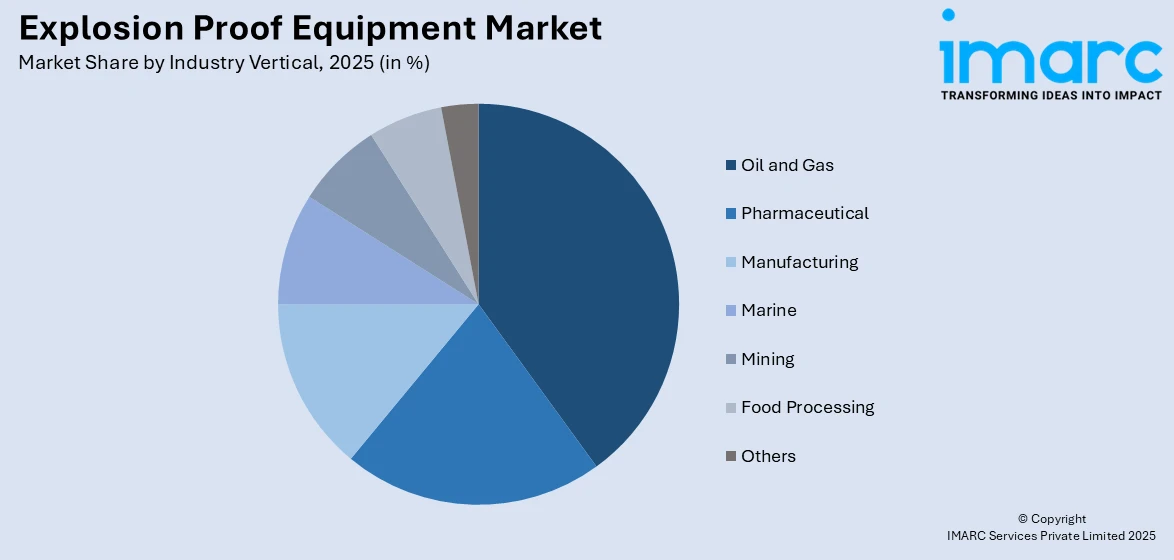

Analysis by Industry Vertical:

Access the comprehensive market breakdown Request Sample

- Oil and Gas

- Pharmaceutical

- Manufacturing

- Marine

- Mining

- Food Processing

- Others

Oil and gas leads the market with around 29.3% of the market share in 2025. The oil and gas industry stands as the primary and leading segment in the breakup by industry vertical. With oil and gas operations being inherently hazardous, explosion-proof equipment becomes necessary for ensuring the safety of personnel and assets. From exploration and extraction to refining and processing, the implementation of explosion-proof solutions is integral to mitigating the risks associated with flammable substances, making this industry a cornerstone for the demand and application of such safety measures. The increasing exploration work and investments in offshore ventures are further fueling the demand for explosion-proof equipment in this business. Furthermore, technological innovation, such as IoT monitoring systems, is enhancing the safety measures, which would further strengthen the industry's dependence on these technologies.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest market share of over 27.5%. Leading the market, North America commands the largest share of the market. This region's dominance is attributed to its highly developed industrial landscape, stringent safety regulations, and a proactive approach towards adopting advanced technologies for workplace safety. Industries such as oil and gas, manufacturing, and pharmaceuticals in North America heavily rely on explosion-proof solutions, driving sustained demand and market leadership. The presence of major industry players and continuous investments in research and development further bolster the region's position. Additionally, government initiatives promoting workplace safety and compliance with global standards strengthen the adoption of explosion-proof equipment in North America.

Key Regional Takeaways:

United States Explosion Proof Equipment Market Analysis

The explosion-proof equipment market in the United States is experiencing significant growth, driven by stringent safety regulations and a thriving industrial sector. Regulatory bodies such as the Occupational Safety and Health Administration (OSHA) and the National Fire Protection Association (NFPA) mandate the adoption of explosion-proof solutions in high-risk industries, including oil and gas, chemicals, and mining, to ensure safety in hazardous environments. U.S. According to National Institute for Occupational Safety and Health (NIOSH), from 2006 to 2011, mine explosions accounted for nearly one-quarter of mining-related deaths. According to U.S. Energy Information Administration, the U.S. achieved substantial growth in energy production in 2022, with oil production reaching 12.1 Million barrels per day (b/d) and natural gas gross withdrawals climbing to 121.1 Million cubic feet per day (Bcf/d). This surge in production underscores the increasing need for advanced explosion-proof equipment to safeguard operations and personnel in volatile environments. Furthermore, advancements in technology, coupled with a heightened focus on preventive maintenance and proactive safety measures, are further bolstering demand. The market is also supported by the increasing automation of industrial processes and the ongoing expansion of the energy and petrochemical sectors.

Europe Explosion Proof Equipment Market Analysis

The explosion-proof equipment market in Europe is propelled by strict safety standards, industrial advancements, and increasing demand from high-risk sectors such as chemicals, petrochemicals, and mining. Regulatory frameworks like the ATEX (Atmosphères Explosibles) directive set stringent requirements for explosion-proof solutions, driving widespread adoption across industries. Additionally, Europe’s transition toward renewable energy sources, which accounted for an estimated 24.1% of the European Union’s final energy use in 2023, is further stimulating market demand. The renewable energy sector, particularly in wind and bioenergy facilities, often involves hazardous environments where explosion-proof equipment is essential for operational safety. Moreover, the region’s growing focus on industrial automation and digitalization has spurred the adoption of smart and efficient explosion-proof technologies. Investments in infrastructure development, deep-water oil exploration, and worker safety initiatives also contribute significantly to the market's growth across Europe.

Asia Pacific Explosion Proof Equipment Market Analysis

The explosion-proof equipment market in Asia-Pacific is driven by rapid industrialization, expanding infrastructure, and growing safety awareness. Key industries such as oil and gas, chemicals, mining, and manufacturing are fueling demand for these solutions. In India, the power sector is set to invest INR 42 Trillion (~USD 500 Million) over the next decade, focusing on renewable energy projects, battery storage, and transmission networks, creating substantial growth opportunities for explosion-proof technologies. Policy reforms and improved asset quality further support this momentum. Additionally, countries like China and India are witnessing increased investments in energy and industrial sectors, bolstering the adoption of safety-compliant equipment. Rising construction activity and infrastructure development across the region also amplify the need for explosion-proof solutions, ensuring safety in hazardous environments.

Latin America Explosion Proof Equipment Market Analysis

The explosion-proof equipment market in Latin America is primarily driven by the oil and gas sector, especially in Brazil and Mexico. In November 2023, Brazil achieved a record oil and natural gas production of 4.698 Million barrels of oil equivalent per day (MMboe/d), surpassing the previous record of 4.666 MMboe/d set in September. This growing production underscores the increasing need for advanced safety equipment in hazardous environments. Additionally, the region's expanding mining sector and rising investments in infrastructure projects are fueling demand for explosion-proof solutions. Enhanced safety regulations and the adoption of modern technologies further contribute to market growth across Latin America.

Middle East and Africa Explosion Proof Equipment Market Analysis

The explosion-proof equipment market in the Middle East and Africa is strongly influenced by the dominant oil and gas sector, which necessitates advanced safety solutions for hazardous environments. Organization of the Petroleum Exporting Countries (OPEC) refinery capacity has shown steady growth, reaching 14 Million barrels per day in 2023, with Saudi Arabia leading at 3.3 Million barrels per calendar day. This expansion drives significant demand for explosion-proof equipment to ensure operational safety in refineries and related facilities. Additionally, the region's increasing number of oil refineries, chemical plants, and investments in industrial infrastructure contribute to market growth. The mining sector's expansion in Africa further supports the adoption of explosion-proof technologies.

Competitive Landscape:

The global explosion-proof equipment market is highly competitive, featuring a mix of established players and emerging companies. Key participants dominate due to their extensive product portfolios, strong distribution networks, and innovation capabilities. These companies invest significantly in research and development to introduce advanced technologies, such as IoT-enabled and smart explosion-proof systems, which enhance safety and operational efficiency. Regional players also contribute to the market by catering to localized demands and offering cost-effective solutions. Strategic collaborations, mergers, and acquisitions are common, enabling firms to expand their market share and geographical presence. With rising regulatory requirements and increasing industrialization in Asia-Pacific and the Middle East, companies are focusing on these regions for growth opportunities, intensifying competition further. The landscape is shaped by continuous technological advancements and the need for adherence to global safety standards, driving innovation across the sector.

The report provides a comprehensive analysis of the competitive landscape in the explosion proof equipment market with detailed profiles of all major companies, including:

- ABB Ltd

- AdaletEnclosures

- BARTEC Top Holding GmbH

- Eaton

- Emerson Electric Co.

- Honeywell International Inc.

- Johnson Controls

- Marechal Electric

- MIRETTI Group

- Pepperl+Fuchs Group

- R. STAHL AG

- Rockwell Automation

- Warom Technology Incorporated Company

Latest News and Developments:

- November 2024: Konecranes launched its latest innovation, the EX C-series electric chain hoist, designed for use in Zone 1/2/21 hazardous environments. This product is part of Konecranes’ comprehensive line of explosion-proof equipment and is available for industries in the EMEA and APAC regions. The hoist is particularly suited for operations in sectors such as oil refineries, chemical plants, and gas facilities, where explosive atmospheres are a concern.

- October 2024: WEG, a company operating in electric motors, automation, and drives, launched its latest innovation, the W51Xdb explosion-proof motor, at the Abu Dhabi International Petroleum Exhibition and Conference (ADIPEC) 2024. The event held from November 4-7 at the Abu Dhabi National Exhibition Centre (ADNEC), where visitors explored the new motor.

- August 2024: ABB introduced the DP200 Crush+ severe-duty motor, engineered for demanding applications in mining, quarrying, and aggregates. The motor is based on the proven SD200 platform and is designed to operate reliably in harsh conditions. It also offers high starting and breakdown torque, flexibility, and modularity and its rugged construction is ideal for use in explosion-proof environments, optimizing performance, efficiency, and total cost of ownership.

- March 2024: HMi Elements, a UK-based provider of PC workstations for oil rigs, has partnered with Cobic-Ex, a Dutch expert in explosion-proof equipment, to extend its reach in the global market. The collaboration will utilize Cobic-Ex’s extensive network across Europe, the UAE, KSA, USA, Nigeria, and South Africa, to promote HMi Elements’ products, which are specifically designed for hazardous environments in the oil and gas sector. HMi Elements' products are known for their reliability and high performance in Zone 1 and Zone 2 areas.

- January 2024: Eaton showcased its explosion-proof technologies at CES 2024 in Las Vegas, focusing on electrification, decarbonization, and sustainability. The company’s innovations aim to support industries in hazardous environments, such as oil and gas, by providing safe and reliable power solutions. Zari Venhaus, Vice President of Corporate Marketing Communications, emphasized the importance of Eaton’s work in driving the transition to cleaner, safer energy systems for a more resilient future.

Explosion Proof Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Protection Methods Covered | Explosion Prevention, Explosion Containment, Explosion Segregation |

| Applicable Systems Covered | Cable Glands, Junction Boxes and Enclosures, Lifting and Material Handling System, Lighting System, Automation System, Surveillance and Monitoring System, Signaling Devices, Others |

| Industry Verticals Covered | Oil and Gas, Pharmaceutical, Manufacturing, Marine, Mining, Food Processing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd, AdaletEnclosures, BARTEC Top Holding GmbH, Eaton, Emerson Electric Co., Honeywell International Inc., Johnson Controls, Marechal Electric, MIRETTI Group, Pepperl+Fuchs Group, R. STAHL AG, Rockwell Automation, Warom Technology Incorporated Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the explosion proof equipment market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global explosion proof equipment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the explosion proof equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Explosion-proof equipment refers to specialized devices designed to operate safely in hazardous environments where flammable gases, vapors, or dust are present. These solutions prevent ignition sources, ensuring safety and minimizing risks of explosions in industries like oil and gas, chemicals, and mining.

The explosion proof equipment market was valued at USD 11,899.6 Million in 2025.

IMARC estimates the global explosion proof equipment market to exhibit a CAGR of 4.85% during 2026-2034.

Key drivers include stringent safety regulations, increasing industrialization, rising demand for energy, growing use of automation and robotics, and technological advancements in sensing and monitoring systems.

In 2025, explosion prevention represented the largest segment by protection method, driven by its ability to eliminate ignition sources in hazardous environments.

The oil and gas industry is the leading segment by industry vertical, driven by its high safety requirements in volatile operations.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global explosion proof equipment market include ABB Ltd, AdaletEnclosures, BARTEC Top Holding GmbH, Eaton, Emerson Electric Co., Honeywell International Inc., Johnson Controls, Marechal Electric, MIRETTI Group, Pepperl+Fuchs Group, R. STAHL AG, Rockwell Automation, Warom Technology Incorporated Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)