Facade Market Report by Product Type (Ventilated, Non-Ventilated, and Others), Material (Glass, Metal, Plastic and Fiber, Stones, and Others), End Use (Commercial, Residential, Industrial), and Region 2026-2034

Market Overview:

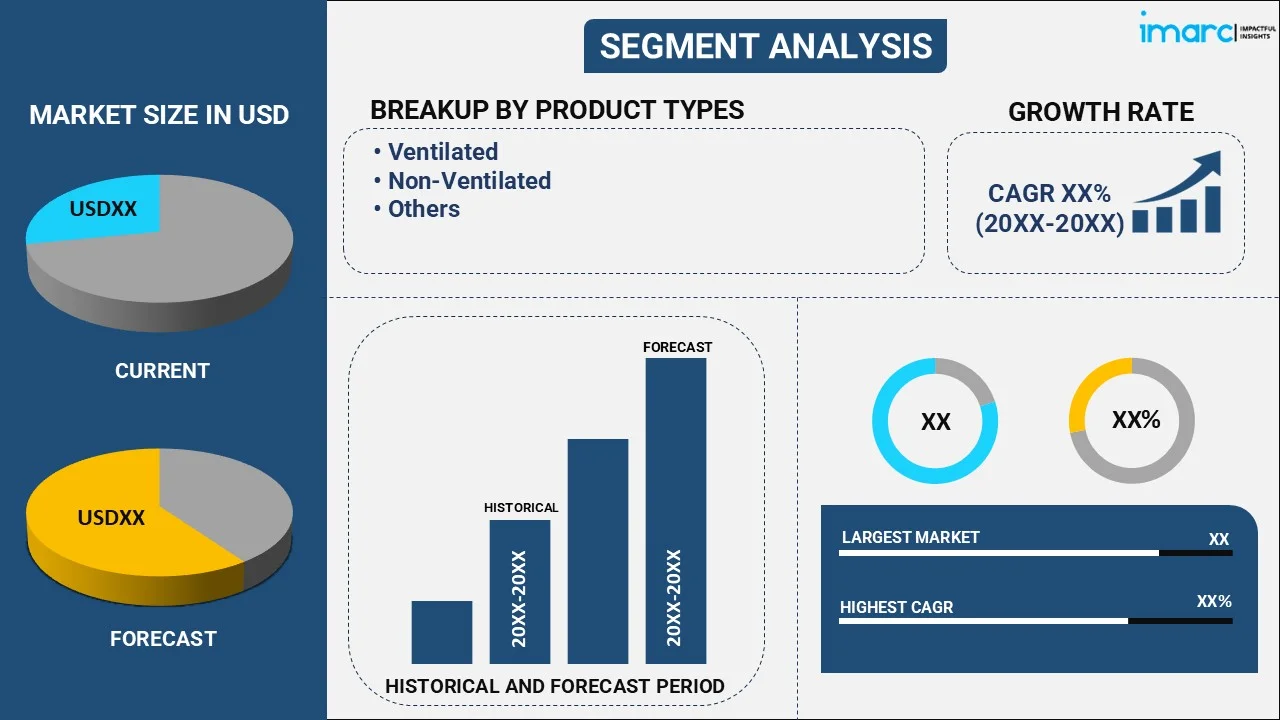

The global facade market size reached USD 311.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 549.7 Billion by 2034, exhibiting a growth rate (CAGR) of 6.32% during 2026-2034. Rapid urbanization and infrastructural development, the rising focus on sustainability and energy efficiency, stringent regulatory framework, ongoing product innovation, and technological advancements are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 311.4 Billion |

| Market Forecast in 2034 | USD 549.7 Billion |

| Market Growth Rate 2026-2034 | 6.32% |

A facade refers to the exterior face of a building, particularly the front view designed with aesthetic appeal in mind. It serves as the structure's primary display surface, the one that instantly shapes the first impression for observers. Facades often incorporate elements such as windows, doors, and decorative features that enhance their visual allure and serve functional roles. They embody the architectural style of the building, narrating its historical period, function, and cultural context. A well-designed facade harmonizes aesthetics with sustainability considerations, often encompassing innovative materials and techniques for improved energy efficiency.

To get more information on this market Request Sample

The global facade market is mainly driven by increasing urbanization and infrastructural developments worldwide. Besides this, the shifting trend toward sustainable construction is compelling manufacturers to innovate and offer environmentally friendly facade solutions, including energy-saving glass and recyclable materials, creating a favorable outlook for market growth. Moreover, regulatory bodies across the globe are implementing stringent norms pertaining to energy consumption, necessitating the use of energy-efficient facades in both residential and commercial buildings. Additionally, significant advancements in technology have paved the way for the integration of smart features and digital technologies within facades, such as photovoltaic and smart glass, propelling the market forward. Concurrently, the growing need for routine maintenance and renovation of aging infrastructure is acting as another significant growth-inducing factor. Furthermore, consumer preference for aesthetically appealing structures, spurred by improved standards of living and growing awareness of architectural trends, is presenting remunerative growth opportunities for the market.

Facade Market Trends/Drivers:

Urbanization and infrastructural development

As urbanization accelerates across the globe, there is an escalating need for new construction projects, including a vast array of structures, ranging from residential complexes and commercial spaces to industrial facilities and public infrastructure such as hospitals, schools, and government buildings. This is fueling the demand for high-quality, aesthetically pleasing, and robust facades. These are crucial for enhancing the visual appeal of buildings and creating distinct architectural identities and providing essential protection against environmental elements such as wind, rain, and heat. Moreover, widespread product adoption for improving a building's energy efficiency, helping regulate indoor temperature, and contributing to overall sustainability is aiding in market expansion.

Increasing focus on sustainability and energy efficiency

The rising environmental awareness and the constant push for sustainability is positively impacting the construction industry, in turn, impelling the construction of structures that are both functional and environmentally responsible. Across the globe, governments are establishing stricter regulations to limit the carbon emissions associated with buildings, recognizing the significant role the construction sector plays in overall global emissions. The result of these changes has influenced the demand for energy-efficient facades that can moderate interior temperatures, thereby reducing the dependency on artificial heating and cooling systems. In addition to this, the surging demand for facades featuring thermally active building systems or those made from bio-based materials, which further help minimize a building's carbon footprint, is strengthening the market growth.

Significant technological advancements

Ongoing technological innovation in the construction industry has resulted in the emergence of smart facades equipped with an array of advanced features such as self-cleaning surfaces that reduce maintenance needs, dynamic glass capable of adjusting its transparency according to light intensity, and facades integrating digital technologies for interactive and responsive purposes. This is creating a favorable outlook for market growth. In addition to this, the integration of photovoltaic cells into facades, allowing buildings to generate their solar energy, is presenting remunerative growth opportunities for the market. Furthermore, the integration of Internet of Things (IoT) devices and sensors into facades enabling real-time monitoring and control of various facade functions, improving energy efficiency and user comfort, is contributing to the market growth.

Facade Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on product type, material, and end use.

Breakup by Product Type:

To get detailed segment analysis of this market Request Sample

- Ventilated

- Non-Ventilated

- Others

Ventilated facades dominate the market

The report has provided a detailed breakup and analysis of the market based on the product type. This includes ventilated, non-ventilated and others. According to the report, ventilated facades represented the largest segment.

The demand for ventilated facades is primarily propelled by their unique features that enhance building functionality and aesthetics. The ventilation gap present in such facades aids in controlling the interior microclimate, thus providing a healthier, more comfortable environment for occupants. This ability to regulate heat and moisture reduces reliance on HVAC systems, thereby promoting energy efficiency. Moreover, ventilated facades act as an effective sound barrier, enhancing the acoustic comfort inside the building. They also offer increased fire resistance, making them a safer choice for high-rise constructions. Additionally, these facades are designed to facilitate easy installation and replacement of individual components, which significantly reduces maintenance and repair costs over time. Furthermore, the surging demand for customized aesthetic solutions and the availability of ventilated facades due to the wide variety of materials, textures, and colors is positively impacting the market growth.

Breakup by Material:

- Glass

- Metal

- Plastic and Fiber

- Stones

- Others

A detailed breakup and analysis of the market based on the material has also been provided in the report. This includes glass, metal, plastic and fiber, stones and others.

In the glass segment, the market is witnessing a surge due to the increasing demand for energy-efficient solutions and aesthetic appeal. Glass facades are predominantly used in commercial buildings and high-rise structures, offering benefits like natural lighting and thermal insulation.

The metal facade segment is also growing steadily, primarily driven by its durability and low maintenance requirements. Aluminum and steel are commonly used metals, favored for their ability to withstand extreme weather conditions and for their recyclability.

Plastic and fiber segments are gaining traction for their lightweight properties and cost-effectiveness. These materials are often used in residential and low-rise commercial buildings, offering a balance between durability and design flexibility.

The stone facade market is relatively stable, often chosen for its natural appearance and long-lasting durability. Stone materials like granite and marble are commonly used in luxury residential buildings and historical renovations, providing a timeless aesthetic.

Other materials like wood and composite are also part of the market but occupy a smaller share. These are typically chosen for specific aesthetic or functional needs and are less common in large commercial projects.

Breakup by End Use:

- Commercial

- Residential

- Industrial

Commercial represents the leading end use segment

The report has provided a detailed breakup and analysis of the market based on the end use. This includes commercial, residential and industrial. According to the report, commercial represented the largest segment.

The increasing focus on brand image and visual identity represents one of the key trends influencing the market of facades in the commercial segment. Companies are realizing the potential of facades to make a strong architectural statement that aligns with their brand and sets them apart from the competition. This includes unique design elements that reflect the corporate identity, as well as a commitment to environmental sustainability through the use of eco-friendly facade materials. In addition to this, commercial buildings often have extensive requirements for heating, cooling, and lighting. Facades that incorporate smart technologies can optimize these functions, resulting in substantial long-term cost savings. Moreover, the rising emphasis on creating a healthier and more productive work environment to improve employee well-being and productivity is aiding in market expansion.

Breakup by Region:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance in the market, accounting for the largest facade market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

The demand for facades in North America is being driven by strict energy regulations and green building codes in the region. Besides this, favorable government policies such as tax incentives and rebates are also encouraging the adoption of these solutions. Moreover, the robust economic growth in North America is supporting significant commercial and residential development, which in turn, is propelling the demand for facades. In addition to this, the region's aging infrastructure necessitates extensive renovation and retrofitting activities, which is contributing to market growth. In addition to this, societal awareness regarding environmental issues and a desire for visually appealing architecture are shaping consumer preferences, prompting developers to focus on sustainable, aesthetically pleasing facades. North America is also home to many technology companies, leading to a higher uptake of smart facades with integrated features.

Competitive Landscape:

The competitive landscape of the market is highly fragmented and competitive, marked by the presence of numerous players ranging from large multinational corporations to small and medium-sized enterprises. These companies compete based on factors such as product quality, innovation, pricing, and the ability to provide comprehensive solutions and services. The market leaders typically have strong brand recognition, extensive product portfolios, and a wide geographical presence. Innovation is a key differentiator in this market, with companies continually investing in R&D to develop advanced and sustainable facade materials and solutions. Technological advancements, including the incorporation of smart technologies into facades, are frequently being introduced to meet evolving consumer demands.

The market research report has provided a comprehensive analysis of the competitive landscape in the global market. Detailed profiles of all major companies have also been provided. Some of the key players in the global market include:

- Compagnie de Saint-Gobain S.A

- Enclos Corp. (CH Holdings USA Inc.)

- EOS Framing Limited

- FunderMax GmbH

- Harmon Inc. (Apogee Enterprises Inc.)

- Kawneer Company Inc. (Arconic Corporation)

- Permasteelisa S.p.A. (Lixil Group Corporation)

- Rockwool International A/S

- Walters & Wolf Glass Company

- YKK AP Inc. (YKK Corporation)

Recent Developments:

- In July 2021, Rockwool North America started commercial production of stone wool insulation products at its new manufacturing facility in West Virginia. The facility, which covers 460,000 square feet, utilizes advanced melting and emissions abatement technologies.

- In September 2022, Saint-Gobain partnered with Megasol, a leader in building-integrated photovoltaics (BIPVs), acquiring a minority stake in Megasol's BIPV unit in Deitingen, Switzerland. This partnership will expand Saint-Gobain's sustainable façade solutions and position it as a leading provider for BIPV facade solutions in Europe.

- In January 2023, Enclos acquired PFEIFER Structures America, expanding its offerings to include custom tensile membrane structures, structural glass systems, and kinetic structures.

Facade Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Ventilated, Non-Ventilated, Others |

| Materials Covered | Glass, Metal, Plastic and Fiber, Stones, Others |

| End Uses Covered | Commercial, Residential, Industrial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Compagnie de Saint-Gobain S.A, Enclos Corp. (CH Holdings USA Inc.), EOS Framing Limited, FunderMax GmbH, Harmon Inc. (Apogee Enterprises Inc.), Kawneer Company Inc. (Arconic Corporation), Permasteelisa S.p.A. (Lixil Group Corporation), Rockwool International A/S, Walters & Wolf Glass Company, YKK AP Inc. (YKK Corporation), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the facade market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global facade market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the facade industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

According to the estimates by IMARC Group, the global facade market is expected to witness a CAGR of 6.32% during 2026-2034.

The increasing levels of urbanization coupled with the growing consumer inclination towards aesthetically appealing building designs represent some of the key drivers for the global facade market.

Several architectural companies are emphasizing on the development of modern, eco-friendly facade designs for overcoming limitations pertaining to excess heat control and soundproofing, thereby representing one of the key trends in the global facade market.

Sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in temporary halt of numerous construction activities, thereby limiting the demand for facades.

On the basis of the product type, the market has been bifurcated into ventilated, non-ventilated, and others. Currently, ventilated product holds the majority of the total market share.

On the basis of the end-use, the market has been segmented into commercial, residential, and industrial. At present, commercial exhibits a clear dominance in the market.

Region-wise, the market has been classified into North America, Europe, Asia Pacific, Middle East and Africa, and Latin America, where North America dominates the global market.

The key companies in the global facade market are Compagnie de Saint-Gobain S.A, Enclos Corp. (CH Holdings USA Inc.), EOS Framing Limited, FunderMax GmbH, Harmon Inc. (Apogee Enterprises Inc.), Kawneer Company Inc. (Arconic Corporation), Permasteelisa S.p.A. (Lixil Group Corporation), Rockwool International A/S, Walters & Wolf Glass Company and YKK AP Inc. (YKK Corporation).

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)