Face Wash Market Size, Share, Trends and Forecast by Product Form, Skin Type, Size, Price Point, Distribution Channel, End User, and Region, 2025-2033

Face Wash Market Size and Share:

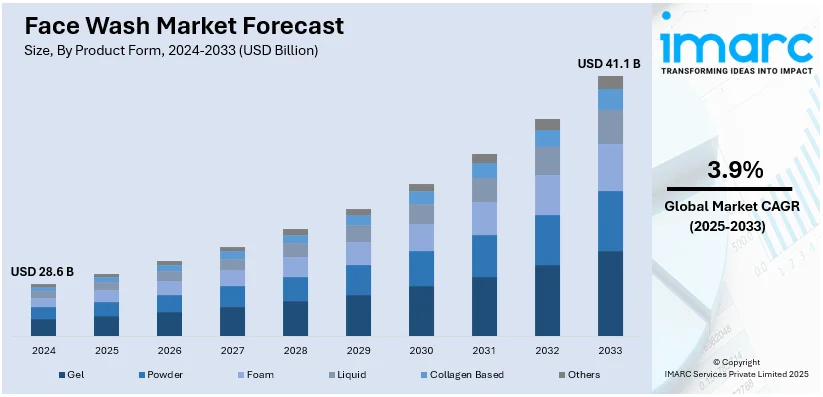

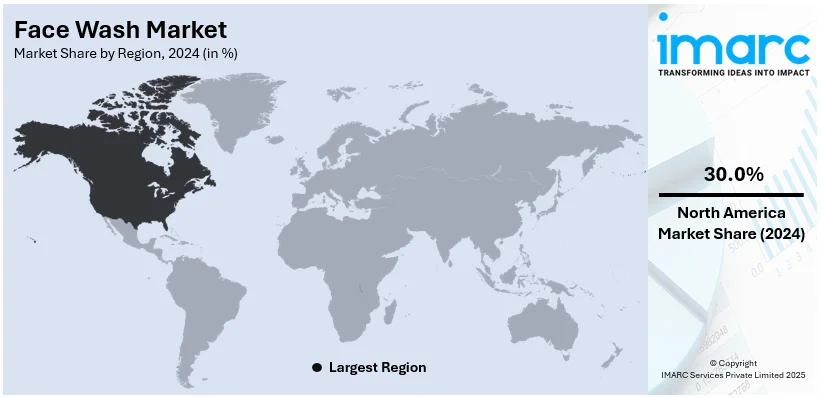

The global face wash market size was valued at USD 28.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 41.1 Billion by 2033, exhibiting a CAGR of 3.9% from 2025-2033. North America currently dominates the market, holding a market share of over 30% in 2024. The face wash market share is increasing due to a rise in skincare and hygiene awareness, significant advancements in technology, ingredient innovations, expansion in e-commerce channels, growth of the middle class in emerging markets, and a rapid shift toward sustainability and eco-friendliness.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 28.6 Billion |

|

Market Forecast in 2033

|

USD 41.1 Billion |

| Market Growth Rate (2025-2033) | 3.9% |

The face wash market growth has increased greatly as many consumers become conscious of taking care of their complexion and the relevance of maintaining good health. As more people start becoming conscious about their skin condition, the face wash market remains high in demand due to skin types, problems, and even lifestyles. There is a rise in demand for deep cleansing and hydrating properties in face wash products, combined with other features like anti-aging, acne, and brightening effects. Natural and organic ingredients mark the evolution of the market, where consumers would want more eco-friendly and skin-friendly products. These products are coming out to be free from harsh chemicals, parabens, and sulfates and are popular among the younger population, who are very keen on sustainability and wellness. Additionally, the rise of online retail and social media influencers has made it easier for consumers to access a wide variety of face wash options and get personalized recommendations. In response to this growing demand, companies are continually innovating, offering diverse formulations and specialized face washes to meet the needs of a broader, more diverse customer base.

The United States emerged as a key regional market for face wash, driven by increasing consumer awareness about skin health and hygiene. With a growing focus on self-care and wellness, U.S. consumers are investing more in facial cleansing products that promote clear, healthy skin. Face washes for specific skin types, like oily, dry, or sensitive, are in great demand, along with those addressing common concerns like acne, aging, and pigmentation. In the U.S., there is also a growing trend toward natural and organic skincare products. Consumers are increasingly buying face washes that are plant-based, chemical-free, paraben-free, and sulfate-free in keeping with an overall trend for sustainability and clean beauty. There is also increased influence from social media and beauty influencers who advise specific products to their large following. Hence, brands have been innovating continually and now provide a range of face washes to match the ever-changing requirements of American consumers.

Face Wash Market Trends:

Increasing awareness about skincare and hygiene

The main factor influencing face wash market trends is the rising awareness about consumers across the world about skincare and hygiene. A survey showed that 82% women and 62% men follow a daily skincare routine. There has been a massive shift in consumer behavior, especially over the last few years, toward self-care and the need to keep skin healthy. Changes in this culture are being driven by several factors that include increased disposable incomes, exposure to beauty and skincare influencers on social media platforms, and the yearning to look better than before. Consumers today realize that proper facial cleansing is a must to dislodge dirt, pollutants, and makeup residues from the pores and resultant skin problems. Face-wash products now form an intrinsic part of various daily skincare programs. This elevated awareness has fostered an enormous requirement for a wide-ranging face wash assortment that caters to the different needs and skin concerns of the customers.

Technological improvements and active ingredient developments

Growth in the global face wash demand has been fueled further by technological advancement along with ingredient development activities. The more modern consumers' demand for cleansing products and additional skincare functions has obliged manufacturers to undertake research and development processes to develop innovative face washes that utilize front-line technologies along with new ingredients in their formulations. However, one of the most notable changes is the push toward natural ingredients and organic use. A survey conducted by Prodge and reported in Mancunian Matters in July 2021 revealed that 34% of consumers preferred buying natural and organic skincare products. Consumers are now more conscious of the ingredients they apply to their skin and prefer products that are free from harsh chemicals and artificial additives. This has led manufacturers to launch face washes containing aloe vera, tea tree oil, chamomile, and other plant extracts that are used for soothing and nourishing the skin.

E-Commerce channel expansion

The global face wash market has experienced an enormous expansion of e-commerce channels, which have been a major driver of sales and a broader consumer base. With the proliferation of online shopping platforms and the convenience they offer, consumers now have easy access to a diverse range of face wash products from the comfort of their homes. E-commerce platforms provide an ideal avenue for both established brands and emerging players to showcase their products and engage with consumers directly. In 2024, the global e-commerce market size was USD 26.8 Trillion. In general, most online retailers provide full descriptions of the product, consumer reviews, and educational content, which informs most consumers of informed purchasing decisions. The availability of subscription services and options to buy in bulk further drives the demand for face washing through online channels.

Increasing middle-class population in emerging markets

The growth of the middle-class population in emerging markets, especially in regions such as Asia-Pacific, Latin America, and the Middle East, is benefiting the global face wash market. Reports indicate that India's middle class is the fastest-growing segment, rising at 6.3% a year and growing by 338 Million from 1995 to 2021. At present, it constitutes 31% of the population and is expected to grow to 38% by 2031 and 60% by 2047. Generally, the expansion of the middle class is tied to growth in urbanization, rising incomes, and improvements in living standards, which fuel increased consumer spending on personal care and beauty products. These countries are India and China, with their emergent middle class being an important consumer segment for face washes. This is due to most people who are currently shifting from rural to urban locations and have income levels above average care about personal grooming and skincare. This shift in consumer behavior has resulted in an increased demand for various face wash products that cater to different skin types and concerns.

Shift toward sustainable and eco-friendly products

Sustainability and environmental consciousness are becoming significant drivers in the global face wash market. With increasing consciousness of personal care products on the environment, the demand for green and environmental face wash has increased. According to a report published in 2024, the size of the global beauty and personal care products market reached USD 529.5 Billion. Traditionally, most face wash products contained chemicals and microplastics that raised more concern about their environmental footprint. However, with awareness about these matters, consumers are more actively looking for alternatives that do not harm the environment. Companies are reformulating their products by removing environmentally degrading ingredients and packaging materials. Eco-friendly face washes nowadays come in recyclable or biodegradable packages and contain natural ingredients that are ethically sourced and produced. Companies are also following cruelty-free and vegan certification to align with consumer values.

Face Wash Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global face wash market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product form, skin type, size, price point, distribution channel, and end user.

Analysis by Product Form:

- Gel

- Powder

- Foam

- Liquid

- Collagen Based

- Others

The gel form leads the market with a share of 42.2% due to its easy flow and fresh feel. As such, a lot of the user population uses this as a day-to-day routine product. The gel format effectively removes dirt, oil, and impurities from the skin without over-drying, which appeals to consumers looking for a gentle yet effective cleansing solution. The form is extremely popular among users with oily or combination skin since the gel formula offers deep cleansing properties while keeping the skin in balance. Gel face washes are also favored for their ability to provide a smooth, non-greasy finish, which makes them suitable for use in both the morning and evening skincare routines. Additionally, advancements in gel formulations, which incorporate ingredients like aloe vera and glycerin for hydration, have expanded their appeal to a wider audience, including those with sensitive or dry skin. The widespread consumer preference for gels, combined with their versatility, results in the gel form leading the face wash market in terms of volume and revenue.

Analysis by Skin Type:

- Dry Skin

- Oily Skin

- Acne-Prone

- Normal Skin

- Sensitive Skin

- Others

Normal skin is the largest segment in the market, characterized by a balanced level of moisture and oil, making it the most common and versatile skin type. Normal skin is less dry and oily, so its owners do not face inappropriate moisture and lipid levels that either bother the skin with a persisting irritation or breakouts and give an excuse to use a wide variety of face washes. Products for normal skin are usually mild and gentle cleansers and are meant for everyday use. This segment leads the market as it caters to a large and diverse consumer group, with normal skin individuals seeking products that maintain their skin's health without additional complexity. Additionally, many face wash brands formulate their products with ingredients that appeal to normal skin types, ensuring that consumers can easily find solutions that fit their skincare needs. This is the leading category in the market for face wash due to the widespread nature of normal skin and the simplicity with which one cares about it.

Analysis by Size:

- 50 ML

- 50ML-200ML

- 200ML-400ML

- Others

The 50 ML segment accounted for a significant proportion of the world face wash market. These smaller-sized products have their popularity due to many reasons. One of them is that it's very convenient in terms of being taken on the go, especially when traveling, so it's quite beneficial for the active lifestyle user, and then secondly, due to their small size, these are appreciated by consumers who like to try different formulations without committing to a larger bottle. This segment is where travel-sized as well as sample-sized units commonly are found, leading new consumers to a variety of brands and lines. The face wash product 50ML-200ML meets value-conscious consumers who still want the convenience of the product and products in this size range are ubiquitous. Standard-sized bottles, offering enough product for regular use without being too bulky, fall under this category. Consumers tend to prefer 50ML-200ML face washes as they are both affordable and long-lasting. Such products usually last a long time, making them suitable for daily skincare routines. Many consumers in this group prefer to stay with a favorite product and buy it in more volume so that they will never run out. The 200ML-400ML segment is preferred by consumers preferring to buy more in advance or have one product last longer. These larger bottles are usually sold as value-for-money products for those who have already set up their skincare regimens and are brand or formulation-loyal. The consumers in this category appreciate the convenience of buying less often and reducing packaging waste. Many also view this size range as an economical choice since the cost per unit volume is often lower than in smaller sizes.

Analysis by Price Point:

- Premium

- Medium

- Economy

The premium category of face wash caters to the high-end and luxurious consumer who is looking to experience the luxury of skincare. The products here are premium packed, with the most advanced formulation and, most of the time, exotic or rare ingredients. Premium face washes are targeted to give maximum cleansing and add-on benefits to the skin in terms of anti-aging, hydration, or specific solutions to skin concerns. The medium segment of the face wash market targets a broader consumer base, including those who seek effective skincare without the premium price tag. Products in this segment typically offer a balance between quality and affordability. They may contain a mix of natural and synthetic ingredients, providing essential cleansing and often addressing common skincare concerns such as acne, oiliness, or dryness. Medium-priced face washes are readily available and accommodate various skin types and issues. The economy face wash segment appeals to budget-conscious customers who want only the cheapest face washes, regardless of other considerations. Such products are affordable and only provide basic cleaning without additional skincare benefits or foreign ingredients. They usually come in simple packaging and straightforward formulations. Economy-priced face washes are popular with price-sensitive customers, including students, budget-constrained families, and residents in areas of low disposable incomes. Such products will offer a simple, practical solution for everyday cleaning without extras. The women's segment constitutes the majority share of the global face wash market.

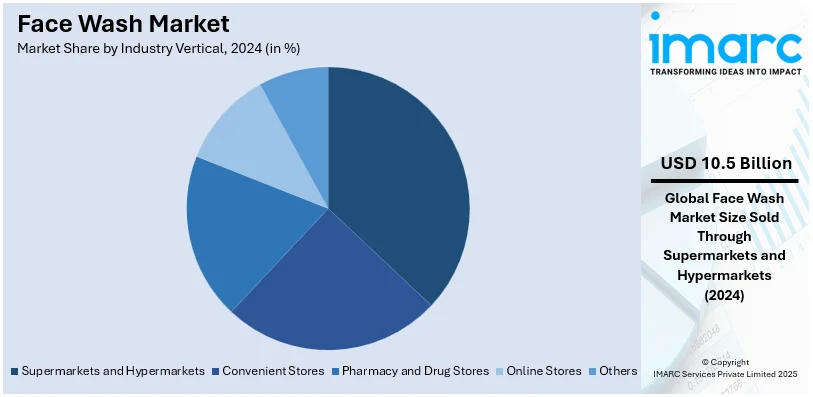

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenient Stores

- Pharmacy and Drug Stores

- Online Stores

- Others

Supermarkets and hypermarkets hold the leading position of the market with a share of 36.7%. The high street chains remain the biggest retail point for face wash products, mainly due to their appeal to a broad section of customers and the wide range of skincare products available at relatively cheap prices. Supermarkets and hypermarkets are one-stop shopping destinations where consumers can easily access a diverse range of face wash brands catering to different skin types and preferences. The presence of physical stores in high-traffic locations makes them convenient for consumers looking for immediate product availability. Moreover, the layout of these stores allows for easy product comparison, promotions, and bundle deals that appeal to shoppers seeking value for money. The retailer's strong supply chain and retail partnerships also contribute to the availability of a consistent supply and a high selection of products in supermarkets and hypermarkets. As convenience and accessibility continue to be key drivers for consumers, supermarkets, and hypermarkets are expected to continue as the biggest channel through which distribution occurs in the face wash market, leaving the majority share of sales volume.

Analysis by End User:

- Men

- Women

- Others

The women's segment represents a substantial portion of the global face wash market. This category is characterized by a wide range of preferences and needs, hence a wide variety of face wash products specifically for women. Women's face wash products are often focused on solving various skincare issues, such as acne, dryness, oiliness, and signs of aging. These formulations may contain ingredients such as hyaluronic acid, retinol, and antioxidants to target specific skin issues and promote a healthy complexion. The packaging and marketing of these products often highlight fragrances, textures, and visual appeal to match women's preferences. The men's segment of the global face wash market has been growing rapidly over the past few years. Traditionally, men were less demanding and less likely to go through elaborate processes associated with skincare routines. However, this trend is changing due to increased awareness by men that proper facial cleansing and maintenance are essential. Men's face wash products are formulated to address the unique characteristics of male skin, which tends to be thicker and oilier than women's skin. These products often feature ingredients such as salicylic acid and menthol to provide deep cleansing and a refreshing sensation after use. Packaging and marketing for men's face washes typically emphasize simplicity and functionality.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America is the largest market for face wash with a share of 30% due to an established skincare and personal care culture that is in the United States and Canada. Skincare and personal care practices are of the highest importance as people prioritize appearances, self-care, and a general sense of well-being. There has been growth due to awareness concerning the necessity of skincare routines. This growth is primarily fueled by the broad penetration of sophisticated face wash formulations catering to diverse skin types and issues, including acne, aging, and dryness. Consumers are also gaining a better understanding of what goes into their skincare products and thus opt for gentle yet effective cleansers that best match their individual needs. Beauty influencers and social media platforms have become a great source of influencing consumer preferences. Reviews, tutorials, and endorsements of products have been found to drive purchasing decisions. The wide availability of face washes, including foaming cleansers and micellar waters, further supports this market expansion. E-commerce has also gained popularity in North America, allowing consumers to shop online and obtain global skincare brands, thereby increasing the reach and availability of face wash products.

The European market is growing, driven by diversity along with greater importance to skin care. Countries in the European Union, such as the UK, France, and Germany, face a high demand for face wash products. Such factors as urbanization, increasing disposable incomes, and a focus on personal grooming drive the demand for face wash products. This is mainly due to most European consumers considering premium and natural skincare products of high value. Hence, organic and eco-friendly face washes have thrived. The region also observes an increasing demand for anti-aging and specialty face wash formulations. The European face wash market remains competitive and dynamic with the growth of online beauty retailers and a culture of skin care education.

The Asia-Pacific is a significant region of growth for the face wash market, particularly in countries such as China, India, South Korea, and Japan. Rapid urbanization, a rising middle-class population, and changing lifestyles have fueled the demand for face wash products. In these markets, skincare is deeply ingrained in cultural norms, making face wash a daily essential. The market is marked by a wide range of products catering to various skin types and concerns, from acne-prone to whitening and brightening face washes. Innovative formulations with ingredients that traditionally include rice and herbs, etc., are thus promising to be in high demand.

Latin America is emerging as a new market for face wash products with an ever-increasing consumer base coupled with rising disposable incomes. Brazil, Mexico, and Argentina are leading this country-specific growth of Latin America. Face wash products, therefore, have been gaining popularity as the residents of Latin America increasingly become conscious of their appearance and skincare routines. The increased exposure to international beauty trends and social media is contributing factors. There is also an increased demand for the product as people are seeking face wash that comes in various types of formulations and is made available according to individual needs. In the face wash market, local manufacturers provide a product line of natural ingredients while international brands rely on reputation and innovation.

The Middle East and Africa are experiencing a growing face wash market influenced by the elements of increasing urbanization and paying more attention to personal grooming. Countries like South Africa demonstrate a growing demand for high-quality face wash products with increased concerns over skincare products. Consumers in this region like to find products that may solve common concerns, such as hydration in arid environments. It would also see demand for specialty face washes tailored to skin types, such as oilier or more sensitive. Local brands need to compete with global ones to thrive in these markets. They must comply with regional preferences and offer products that fit the given culture. E-commerce platforms are gaining momentum, and this is making it easier for consumers in these regions to access a variety of face wash options.

Key Regional Takeaways:

United States Face Wash Market Analysis

The United States accounts for 87.80% of the face wash market share in North America driven by increasing awareness about skin care and personal hygiene among consumers, resulting in an increasing demand for specialized facial cleansing products. A survey revealed that 75% of women and 60% of men reported using skincare products regularly, indicating a widespread adoption of skincare routines across genders. This growing consumer focus is additionally accelerated by this shift toward more natural and organic ingredients. Consumer demand has progressively increased for products having no chemicals inside, especially when it comes to parabens and sulfates. More common skin issues, especially acne and dryness, now push consumers toward investing in proper, dermatologist-recommended solutions. Social media and beauty influencers play a significant role in educating the public about the benefits of face washes, hence encouraging the adoption of these products. Demand for premium and specialty facial cleansers is growing as consumers are willing to pay a premium for added skincare benefits like anti-aging and hydrating properties. Additionally, gender-neutral products are becoming more popular, with both men and women actively seeking face washes that address their specific skin concerns. The increasing focus on eco-friendly packaging solutions also contributes to market growth, as environmentally conscious consumers prefer products that align with their values.

Europe Face Wash Market Analysis

The European face wash market is dominated by the growth in consumer care and wellness with rising demand for skincare products, which promote the health and protection of the skin. Skin issues are a big driver in the market, as revealed by the EADV's Burden of Skin Diseases study, showing that acne afflicts 5.4% of adults in 27 European countries. This condition, meaning cysts, spots, and oily skin on the face, back, and chest, means that most patients end up with scars, making consumers find facials with sufficient cleaning of spots. In addition, growing awareness about the negative impact of pollution and environmental stressors has increased the demand for deep cleansing and protective face washes. Consumers increasingly prefer products containing natural, organic, and chemical-free ingredients as the region highly emphasizes clean and sustainable beauty. The male grooming segment is also growing, and men are highly investing in their skincare products catering to their requirements. Further support for growth has been rendered by e-commerce platforms through easily accessing several face washes. Apart from this, sustainability is now also a crucial priority, boosting demand for eco-friendly packaging and refilling services since eco-conscious customers give preference to those brands that complement their values.

Asia Pacific Face Wash Market Analysis

The face wash market in the Asia-Pacific (APAC) region is driven by rising urbanization, changing lifestyles, and increasing disposable incomes, particularly in emerging markets such as China and India. The increasing incidence of sensitive skin is a critical factor driving demand for skincare products. A survey conducted in 2021 indicated that about 19% of APAC consumers reported sensitive skin concerns, largely due to stressful lifestyles, pollution, and misuse of products. This has sparked the demand for face washes that offer gentle yet effective cleansing, addressing skin sensitivities while protecting against environmental factors. There is also an increased awareness about skincare routines and the K-beauty phenomenon, which has seen a growing interest in face washes that can offer deep cleansing, hydration, and anti-aging benefits. Natural and herbal ingredients are gaining popularity, with consumers looking for products that work well and have a gentle impact on the skin.

Latin America Face Wash Market Analysis

The face wash market in Latin America is expanding due to growing consumer interest in personal care and skin care products, especially among the middle class. Urbanization in the region is at about 80%, much higher than most other regions, which has resulted in increased demand for personal care products in urban areas. With more awareness about skincare routines and increased access to global beauty trends, consumers are searching for face washes that have been created to specifically address specific problems, such as acne and pigmentation. The demand for natural and organic products is gaining popularity, mirroring the shift toward cleaner beauty.

Middle East and Africa Face Wash Market Analysis

It has been observed that the face wash market in the Middle East and Africa is developing significantly due to a growing interest among men and women in skincare and grooming. World Bank statistics reflect that the Middle East and North Africa (MENA) region is already 64% urbanized, further increasing the need for skincare products in urban settings. This area has a significant demand for face washes. Higher disposable incomes and changing lifestyles of people in such regions make them increasingly conscious about their care and hygiene. In harsh climate conditions, with the scorching heat and dry air, it increases the necessity for face washes that moisturize and protect.

Competitive Landscape:

Market players in the face wash industry are actively expanding their product lines to cater to the diverse needs of consumers. A major trend is the shift toward natural and organic formulations, with brands focusing on eco-friendly ingredients free from harmful chemicals. Companies are also investing in personalized skincare solutions, creating products targeted to specific skin concerns, such as acne, aging, and dryness. In addition, the new digital wave of e-commerce has increased online sales, and brands are using social media platforms and leveraging influencers to engage consumers. Most players work with dermatologists or run clinical studies to authenticate products in the eyes of their target audiences. Innovation, especially in clean and sustainable beauty, continues to be high on the agenda for the market leaders, as these are expected to result in increasing consumer loyalty and maintaining the edge in the highly competitive market. These efforts are creating a positive face wash market outlook.

The report provides a comprehensive analysis of the competitive landscape in the face wash market with detailed profiles of all major companies, including:

- Bioderma Laboratories

- Burt's Bees Inc. (The Clorox Company)

- Cocokind

- Emami Limited

- Godrej Consumers Product Limited

- Henkel AG & Co. KGaA

- Himalaya Wellness Company

- Johnson & Johnson

- Juice Beauty Inc.

- L'Oréal S.A.

- Shiseido Co. Ltd.

- The Procter & Gamble Company

- Unilever plc

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- September 2024: Dusky India has recently introduced two new Ayurvedic face washes. The Delay Aging Face Wash contains Gotu Kola, and it targets early signs of aging that increase collagen production and skin elasticity. It has no harmful chemicals and is perfect for all types of skin. The Tea Tree Face Wash targets oily and acne-prone skin with the power of tea tree leaves and aloe vera that removes excess oil and impurities.

- March 2024: RSH Global's Joy Personal Care has appointed Shah Rukh Khan as the brand ambassador for its face wash category. The actor joins Sanya Malhotra in a commercial that went on air during IPL 2024. The brand, with Joy as the sponsor of Kolkata Knight Riders, has highlighted the importance of equality between the genders and women's empowerment.

- February 2024: Hyphen, a skincare brand by Pep Technologies and actor Kriti Sanon, recently launched a new range of cleansers. Among them are moisturizing creamy cleanser and oil control exfoliating cleanser. According to Kriti Sanon, one needs the right cleanser for maintaining the skin's natural oils. The products are available on the brand's website and major e-commerce platforms Nykaa, Amazon, and Flipkart.

- January 2024: VLCC launched a serum-infused face wash with eight variants across the country for India's first such range powered by Salicylic Acid, Vitamin C, and Hyaluronic Acid. It consists of Acne Defence for oily skin, Bright Glow for all kinds of skin types, and Hydra Nourish for dry skin. Being tested dermatologically, paraben-free, and easy and effective to give a perfect face wash within a short time with versatile care.

Face Wash Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Forms Covered | Gel, Powder, Foam, Liquid, Collagen Based, Others |

| Skin Types Covered | Dry Skin, Oily Skin, Acne-Prone, Normal Skin, Sensitive Skin, Others |

| Sizes Covered | 50 ML, 50 ML–200 ML, 200 ML–400 ML, Others |

| Price Points Covered | Premium, Medium, Economy |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenient Stores, Pharmacy and Drug Stores, Online Stores, Others |

| End Users Covered | Men, Women, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bioderma Laboratories, Burt's Bees Inc. (The Clorox Company), Cocokind, Emami Limited, Godrej Consumers Product Limited, Henkel AG & Co. KGaA, Himalaya Wellness Company, Johnson & Johnson, Juice Beauty Inc., L'Oréal S.A., Shiseido Co. Ltd., The Procter & Gamble Company, Unilever plc. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the face wash market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global face wash market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the face wash industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The face wash market was valued at USD 28.6 Billion in 2024.

The face wash market is estimated to exhibit a CAGR of 3.9% during 2025-2033.

The face wash market share is increasing due to a rise in skincare and hygiene awareness, significant advancements in technology, ingredient innovations, expansion in e-commerce channels, growth of the middle class in emerging markets, and a rapid shift toward sustainability and eco-friendliness.

North America currently dominates the market due to an established skincare and personal care culture that is in the United States and Canada.

Some of the major players in the face wash market include Bioderma Laboratories, Burt's Bees Inc. (The Clorox Company), Cocokind, Emami Limited, Godrej Consumers Product Limited, Henkel AG & Co. KGaA, Himalaya Wellness Company, Johnson & Johnson, Juice Beauty Inc., L'Oréal S.A., Shiseido Co. Ltd., The Procter & Gamble Company, Unilever plc. etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)