Facility Management Market Size, Share, Trends and Forecast by Solution, Service, Deployment Type, Organization Size, Vertical, and Region, 2025-2033

Facility Management Market Size & Forecast:

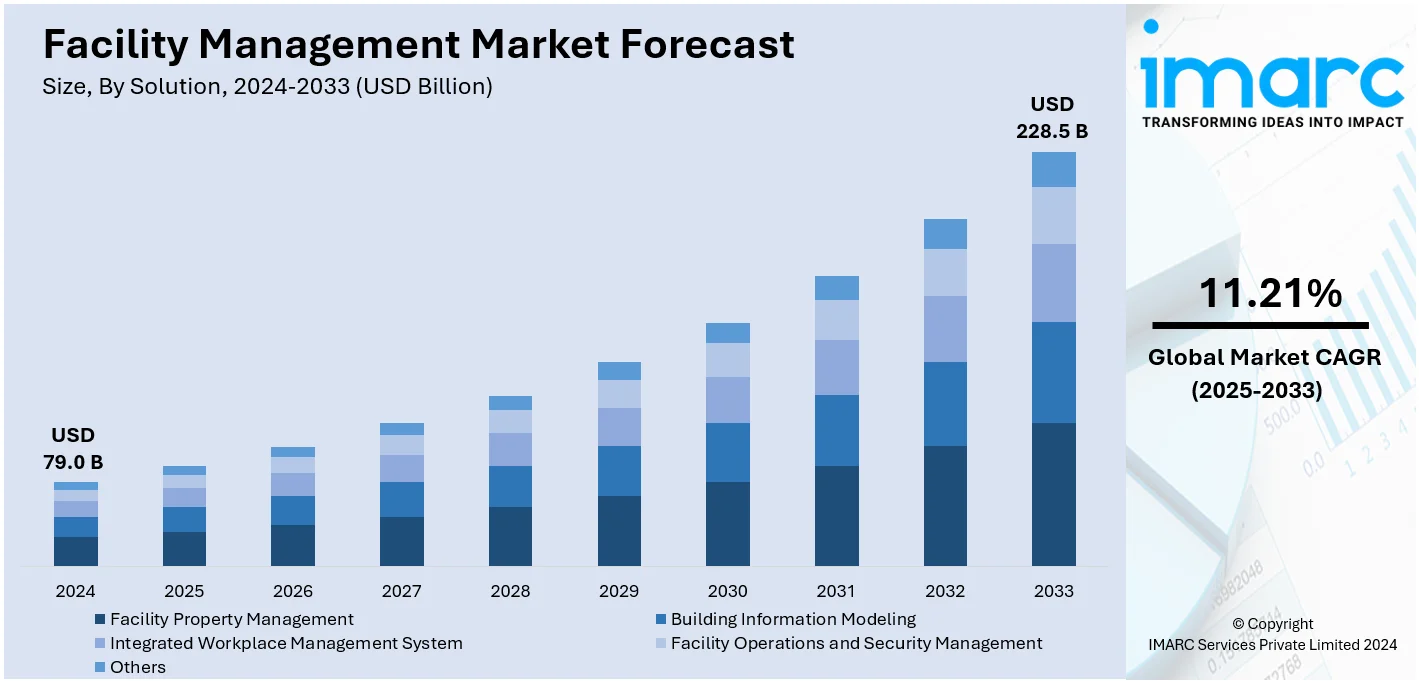

The global facility management market size was valued at USD 79.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 228.5 Billion by 2033, exhibiting a CAGR of 11.21% during 2025-2033. North America currently dominates the market, holding a significant market share of over 32.2% in 2024. The market is growing swiftly, led by smart building uptake, value-added services demand growth, and regulatory compliance. IoT, AI, and automation are redefining operational efficiency and predictive maintenance. Further, ESG compliance and digitalization trends are speeding up the market developments.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 79.0 Billion |

|

Market Forecast in 2033

|

USD 228.5 Billion |

| Market Growth Rate (2025-2033) | 11.21% |

The market is driven by the increasing need for efficient building operations and maintenance to optimize costs and productivity. Rapid urbanization and the growth of complex infrastructure have heightened the demand for integrated facility management solutions. Moreover, continuous technological advancements, including IoT, AI, and automation, are quickly transforming all of the facility management practices, improving efficiency and scalability. For instance, in April 2024, Auberon Technologies, a leader in Software as a Service (SaaS) solutions that enhance facility management, announced the release of its third-generation computer-aided facility management (CAFM) solution, called Optima. Furthermore, the rising focus on sustainability and energy efficiency further fuels the demand for green building management services. Additionally, the trend toward outsourcing non-core business activities to specialized facility management providers enhances market growth. Industries such as healthcare, IT, and BFSI particularly drive demand for comprehensive solutions globally.

To get more information on this market, Request Sample

In the United States, the facility management market share is driven by the increasing adoption of advanced technologies such as IoT, AI, and automation to improve operational efficiency. For instance, in December 2024, Digital FM+ SM, a new technology solution designed for facility management owners, investors, and managers to lower risk and give them more control over their asset portfolios, was launched by Lessen, the leading tech-enabled, end-to-end solution for outsourced real estate property services. The growing demand for sustainable building management aligns with energy conservation initiatives and environmental regulations. Rising infrastructure development, including commercial spaces and smart buildings, boosts the need for integrated facility management solutions. Outsourcing trends among large enterprises and government organizations also contribute to market growth. Furthermore, the healthcare, IT, and BFSI sectors drive significant demand for facility management due to their focus on security, compliance, and the need for well-maintained operational environments.

Facility Management Market Trends:

Rising Adoption of Smart Building Solutions

The rising adoption of smart building solutions drives the facility management market. For example, in November 2023, Samsung C&T’s property management system announced that it would integrate with ABB home automation to extend smart connectivity to individual units enabling multi-dwelling residents to benefit from a single-user interface across all Samsung C&T and ABB smart home technologies. Smart buildings are equipped with various advanced technologies, such as sensors, automation systems, and data analytics, enabling intelligent monitoring and control of several building systems and services. These smart solutions come with several benefits, such as enhanced energy efficiency, where a smart building designed in the best possible manner offers between 10% and 30% more energy efficiency compared to other structures in the vicinity, optimum utilization of space, increased security and safety, and scheduled maintenance. Predictive maintenance and automation in smart buildings may decrease maintenance costs by up to 25% and can cut down on downtime by up to 70%, as indicated by industry reports. Facility management professionals leverage these technologies to remotely monitor and manage building operations, identify inefficiencies, and proactively address maintenance issues. Furthermore, integrating smart building solutions with facility management practices allows for real-time data collection and analysis, enabling data-driven decision-making and predictive maintenance strategies. This helps reduce operational costs, enhancing occupant comfort and well-being, and extending the lifespan of building assets. The increasing integration of Internet of Things (IoT) with AI-powered analytics is reshaping predictive maintenance, enabling managers to preempt failures before they occur. The evolution of digital twins in facility operations is also emerging as a major growth catalyst, providing real-time virtual models of physical assets for better decision-making.

Increasing Demand for Value-Added Services

The facility management industry overview shows that the increasing demand for value-added services is playing a crucial role in driving the growth of the market. Traditionally, facility management focused on essential services, such as maintenance, repairs, and operational tasks. However, there is a growing recognition that facility management can provide additional value beyond these core functions. Facilities management companies are in high demand as they offer more than basic upkeep. Value-added services include workplace optimization, space planning, occupancy management, sustainability consulting, energy management, technology integration, data-driven insights, etc. These services help organizations optimize their facilities, improve operational efficiency, enhance employee productivity, and create a better user experience. Additionally, facility management providers that offer advanced technologies and data analytics capabilities enable organizations to make data-driven decisions, identify trends, and proactively address issues. This contributes to better resource allocation, cost savings, and improved performance, which contributes to facility management market business opportunities. Automated systems, for example, can streamline the procure-to-pay (P2P) processes. According to industry reports, this approach minimizes errors and enhances operational visibility, potentially decreasing costs by 50% while increasing revenues by 20%. For instance, in October 2023, care.ai announced incorporating Google Cloud's generative AI and data analytics tools into its Smart Care Facility Platform to improve healthcare facility management and patient care. This would accelerate its move toward predictive and smart care facilities and help, mitigate staffing shortages, reduce administrative burdens, and free up clinicians to spend more quality time with patients in acute and post-acute facilities where care.ai's platform is deployed. The rising emphasis on ESG (Environmental, Social, and Governance) compliance requiring advanced reporting and sustainability strategies offered by facility management providers is providing speedy growth to the overall market.

Growing Regulatory Compliance Requirements

The expanding regulatory compliance requirements across the globe are also creating a positive facility management market outlook. Numerous governments and regulatory bodies have implemented stringent regulations related to safety, security, health, and environmental standards that organizations must adhere to. For example, the CEO of Saudi Arabia’s Real Estate General Authority announced in October 2023, during his address to the Middle East Facility Management Association Confex 2023 in Riyadh, that the country would unveil its first facility management regulation in the first quarter of 2024. He positioned this move as part of Saudi Arabia’s attempts to increase the facility management industry’s trustworthiness and investment allure while benefiting the housing sector. Complying with these regulations necessitates the expertise of facility management professionals who can ensure that facilities meet the required parameters, including building safety, emergency preparedness, workplace ergonomics, waste management, energy efficiency, environmental sustainability, etc. Facility management professionals are essential in implementing and developing procedures, policies, and practices that align with legal needs. They conduct regular inspections, audits, and risk assessments to identify potential compliance gaps and implement corrective measures. As the regulatory landscape continues evolving and becoming more stringent, organizations increasingly rely on facility management services to ensure compliance and mitigate legal and financial risks. Additionally, the accelerated digitalization of compliance workflows using cloud-based platforms is among the fastest growing drivers, empowering facility managers to meet regulatory mandates more efficiently.

Facility Management Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global facility management market report, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on solution, service, deployment type, organization size, and vertical.

Analysis by Solution:

- Facility Property Management

- Building Information Modeling

- Integrated Workplace Management System

- Facility Operations and Security Management

- Others

Facility property management is the largest segment owing to its significant contribution to market growth. Managing and overseeing real estate properties, such as stores, residential complexes, commercial buildings, and industrial facilities, is a part of facility property management. The market segment is being stimulated by the growing demand for these services. Property owners and investors understand the benefits of hiring specialist experts with knowledge of leasing, tenant management, maintenance, rent collection, and property appraisal to handle property management tasks. Facility property management companies provide a wide range of services to optimize occupancy rates, increase property value, and guarantee the seamless running of buildings. They assist property owners in raising rental income, improving tenant satisfaction, and reducing risks. Moreover, the elevating need for efficient property management becomes crucial as the real estate market expands and becomes more competitive. For example, Aldar Properties, International Holding Company and Adnec Group merged their jointly-owned property and facilities management businesses in 2023 to create the Middle East’s largest property and facilities management company.

Analysis by Service:

- Deployment and Integration

- Consulting and Training

- Support and Maintenance

- Auditing and Quality Assessment

- Others

The deployment and integration segment is experiencing massive growth in the facility management market. This segment emphasizes integrating and implementing facility management solutions, such as hardware, software, and technology infrastructure. As organizations recognize the importance of technology in optimizing facility management operations, there is a growing demand for deployment and integration services. Facility management providers assist in selecting, customizing, and implementing software platforms, sensor networks, IoT devices, and other technological solutions. As per the facility management market forecast, this segment growth is driven by various factors, such as the increasing adoption of smart building solutions, the need for data-driven decision-making, and the integration of facility management with other business functions. In line with this, numerous companies are investing in smart building solutions. For instance, in March 2024, Siemens, along with its property technology subsidiary Enlighted, has entered into a strategic collaboration with Zumtobel Group, a leading provider of lighting solutions. This partnership aims to drive the global adoption of smart building technologies, including advanced IoT-enabled intelligent lighting systems, to enhance building operations worldwide.

The segment guarantees interoperability, seamless connectivity, and efficient use of technology to enhance operational efficiency and provide real-time insights. By enabling organizations to leverage advanced technologies, the deployment and integration segment contributes significantly to the facility management market growth rate, facilitating the transformation of traditional facilities into intelligent and optimized environments.

Analysis by Deployment Type:

- On-Premises

- Cloud

On-premises leads the market with around 56.9% of market share in 2024. The on-premises segment is witnessing substantial growth in the market because it comprises deploying facility management solutions within the organization's physical infrastructure rather than depending on cloud-based or off-site hosting. Various organizations prefer complete control and ownership over their facility management systems and data, facilitated by on-premises solutions, which is impacting the growth in this segment. Start-ups are catalyzing this segment by trying to bring cloud-like functionalities to private data centers. For example, US-based company Oxide, which raised US$ 44 Million in October 2023, offers data storage solutions that entail a combination of hardware and software that behave like a pool of cloud resources despite being inside a data center.

Additionally, diverse industries with stringent data privacy and security regulations may opt for on-premises deployments to maintain compliance. Furthermore, the segment caters to corporations with unreliable or limited internet connectivity as it does not rely heavily on network availability. It provides real-time access to data and offers higher data processing speeds, which is critical for time-sensitive facility management operations.

Analysis by Organization Size:

- Large Enterprises

- Small and Medium Size Enterprises

Large enterprises encompass organizations with significant scale and complex facility management needs across multiple locations or extensive portfolios. They usually have a wide range of complex facility management needs, such as overseeing several properties, making the best use of available space, making sure regulations are followed, and putting energy-saving measures into action. These companies therefore look for all-inclusive facility management services to deal with these issues. Furthermore, large enterprises can afford to spend money on cutting-edge facility management tools and technology, such as data analytics platforms, IoT devices, and smart building systems. They can use these technologies to improve the overall performance of their facilities, lower expenses, and increase operational efficiency. Additionally, large enterprises have long-term contracts or partnerships with facility management service providers, ensuring consistent service demand and contributing to the segment's growth.

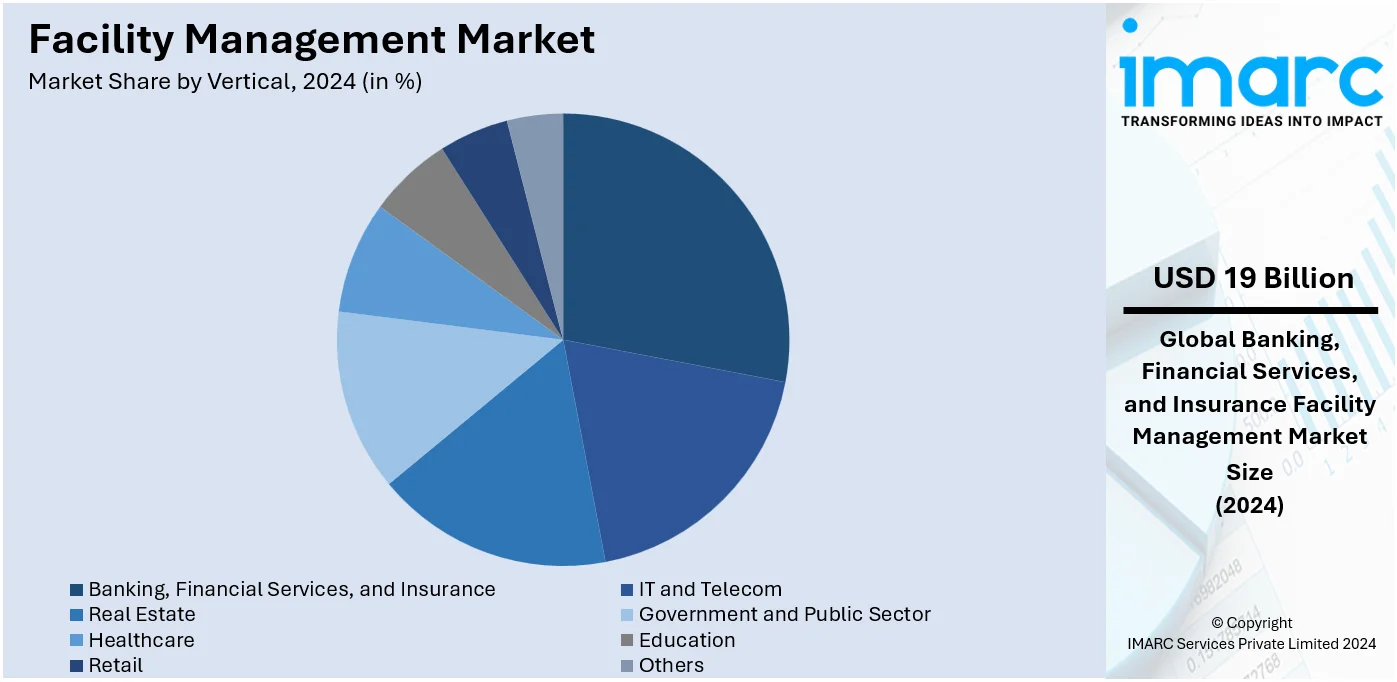

Analysis by Vertical:

- Banking, Financial Services, and Insurance

- IT and Telecom

- Real Estate

- Government and Public Sector

- Healthcare

- Education

- Retail

- Others

Banking, financial services, and insurance leads the market with around 23.8% of market share in 2024. The banking, financial services, and insurance (BFSI) segment encompasses banks, financial institutions, insurance companies, and related organizations. BFSI organizations operate in highly regulated environments with stringent compliance requirements, particularly regarding security and data privacy. Facility management services help ensure adherence to these regulations, such as physical security measures and disaster recovery planning. Furthermore, the BFSI industry relies heavily on technology infrastructure and data centers for its operations. Facility management is crucial in managing these facilities, ensuring their availability, security, and optimal performance. Moreover, the BFSI sector often has large and geographically dispersed facility portfolios, including branches, offices, and data centers. This has also led to outsourcing efforts. For example, in February 2024, US-based business process management (BPM) company, Fusion CX, announced the opening of a 500-seat outsourcing facility in Navi Mumbai, which will focus on BFSI clients. Effective facility management services assist in consolidating operations, optimizing space utilization, and standardizing processes across locations.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 32.2%. North America is experiencing the highest growth in the facility management market owing to several key factors. The region has a mature and developed commercial infrastructure with many large enterprises, institutions, and organizations. These entities have extensive facility management needs and often outsource these services to specialized providers, driving the market growth. Moreover, there is a strong emphasis on regulatory compliance and sustainability in North America. Stricter regulations related to safety, security, energy efficiency, and environmental standards necessitate the expertise of facility management professionals. Organizations in the region rely on facility management services to ensure compliance and meet sustainability goals, further contributing to market growth. There are also high levels of merger and acquisition (M&A) activity. For instance, in April 2023, Chicago-based Blue Skyre IBE was strategically acquired by Lessen, a tech-enabled end-to-end solution for outsourced real estate property service providers. Rapid technological advancements and the adoption of smart building solutions are also prevalent in North America. Additionally, the region leads in implementing advanced technologies such as IoT, artificial intelligence, and data analytics in facility management. The integration of these technologies enhances operational efficiency, reduces costs, and promotes sustainability, driving the facility management market demand.

Key Regional Takeaways:

United States Facility Management Market Analysis

In 2024, the United States accounted for the market share of over 84.90%. The healthcare industry in the United States is emerging as a significant force propelling the growth of the facility management (FM) market. This is largely attributed to the rising patient population and increasing investments in healthcare by both public and private sectors. Data from the Centers for Medicare & Medicaid Services predicts that national healthcare spending will grow at an average annual rate of 5.5% between 2018 and 2027, ultimately reaching nearly USD 6 trillion. This substantial growth has led to the expansion of various care facilities, such as hospitals, clinics, and nursing homes, further fueling the demand for efficient facility management services.

The outsourcing of FM services within healthcare has become a common practice, with hospitals, third-party professionals, and long-term care facilities increasingly relying on specialized service providers. Companies like Medxcel, one of the largest and most respected healthcare facility service providers in the U.S., have demonstrated the growing market potential. Over the past four years, Medxcel has saved its clients USD 80 Million on facility management costs, highlighting the cost-saving benefits and operational efficiency that outsourcing brings to the healthcare sector. This trend underscores the significant role that healthcare is playing in driving the expansion of the U.S. facility management market.

Europe Facility Management Market Analysis

Europe remains a mature and sophisticated outsourced market for facility management (FM) services, driven by increasing demand for operational efficiency and the outsourcing of non-core functions. Over the past decade, many FM providers have focused on expanding their presence in Europe to capitalize on this demand, particularly in sectors like education, healthcare, and data processing.

A notable example is the October 2023 acquisition of Accuro, a UK-based company specializing in FM services for education and healthcare, by OCS. This move allows Accuro to scale its operations and improve service delivery by integrating with OCS’s broader offerings.

Germany, with 522 data centers in 2023, represents a key market for FM, driven by its 93.1% internet literacy rate. This growth in digital infrastructure, alongside emerging technologies like Big Data and 5G, fuels demand for efficient FM services across sectors like technology and telecommunications, further accelerating market growth. These factors highlight the continued expansion of the FM market in Europe.

Asia Pacific Facility Management Market Analysis

The facility management market share in Asia Pacific is likely to increase over the next six years due to rapid expansion in retail, commercial, and residential sectors. Economic liberalization and a favorable investment environment have opened up wide opportunities for private sector growth across industries like banking, airlines, pharmaceuticals, and information technology, thus attracting major multinational corporations to the region. The investment thus attracted has fueled infrastructure development and increased demand for facility management services.

In particular, the technology sector has been a significant driver of investments in construction and building stock expansion across Asia. Changes in consumer lifestyles have also accelerated the growth of organized retail developments, further increasing the need for professional facility management services. In India, for example, private equity investments in the real estate sector stood at INR 3.3 billion (USD 38.9 Million) between January and July 2022, as policies like 100% FDI for township and settlement development projects have provided a much-needed boost to the sector. Similarly, the facility management market in Asia is emerging as a critical growth driver due to the increasing demand for commercial office spaces across the region, as the economic growth and urbanization in the region remain dynamic. These developments point to the importance of facility management services for the developing infrastructure and expanding economy of Asia-Pacific.

Latin America Facility Management Market Analysis

The Latin America facility management market is ready for rapid growth, propelled by an increasing commercial and infrastructural development across major countries, including Brazil and Mexico. Brazil has emerged as the leading country for technological and demographic developments and has attracted various international investors through government support and an excellent business climate. Global companies' movement into Brazil also highlight strategic relevance.

Increasingly, the development of data infrastructure such as the expected proliferation of 5G technology is key to it. GSMA predicts that Brazil will lead Latin America in 5G connections, which will account for 20% of all mobile connections by 2025. The country also has an aging population, where 6.7% of Brazilians were over the age of 64 in 2022, and is expected to grow significantly, increasing demand for healthcare services and related facility management. These trends reflect the increasing role of facility management in supporting the region's changing infrastructure and service needs.

Middle East and Africa Facility Management Market Analysis

The Middle East and Africa facility management market is experiencing robust growth, driven by the expansion of residential, commercial, industrial, and public infrastructure sectors. In particular, Qatar and Saudi Arabia are emerging as key contributors to this growth, fueled by substantial investments in infrastructure and public development projects.

In Qatar, infrastructure projects have been allocated QAR 74 Billion (USD 20.33 Billion), accounting for approximately 36% of the government’s focus areas, according to the Ministry of Finance. This investment is aimed at ensuring the timely completion of major projects, especially those related to hosting the FIFA World Cup in 2022. Beyond infrastructure, Qatar is prioritizing emerging sectors like education and healthcare, with nearly QAR 20 Billion (USD 5.49 Billion) allocated to healthcare projects and programs and QAR 17.8 Billion (USD 4.89 Billion) directed toward educational initiatives.

Similarly, Saudi Arabia’s focus on large-scale urban development, industrial growth, and economic diversification under its Vision 2030 initiative is propelling demand for advanced facility management solutions. These strategic investments across sectors highlight the critical role of facility management services in maintaining and enhancing infrastructure, positioning the Middle East and Africa as a dynamic and evolving market for innovative and efficient facility management practices.

Competitive Landscape:

The facility management market is highly competitive, featuring a mix of global and regional players. Leading companies dominate with comprehensive service portfolios and innovative solutions. The industry is marked by strategic partnerships, mergers, and acquisitions aimed at expanding service capabilities and geographic reach. Furthermore, increasing technological integration, such as IoT and AI-driven tools, intensifies competition, as providers focus on enhancing operational efficiency and client experience. Regional firms maintain a competitive edge through localized services and cost advantages. Overall, the market’s competitive landscape is shaped by evolving client demands and a shift toward sustainable practices. For instance, in July 2024, Hunt Companies, based in El Paso, Texas, introduced Hunt Campus Solutions, a new division focused on revolutionizing facility management in higher education. This initiative builds on the expertise of CGL, a Hunt Companies affiliate that has been collaborating with universities since 2010, further enhancing its established portfolio in the sector.

The report provides a comprehensive analysis of the competitive landscape in the facility management market with detailed profiles of all major companies, including:

- Accruent

- AHI Facility Services

- Archibus

- CBRE

- Cushman & Wakefield

- Emeric Facility Services

- International Business Machines Corporation

- ISS A/S

- Jones Lang LaSalle IP, Inc.

- SAP SE

- SMI Facility Services

- Sodexo

- Trimble Inc.

Latest News and Developments:

- April 2024: SmartCheck, the SaaS-based facility management solutions provider, raised undisclosed debt financing from Incred Capital. Lakhani Financial Services facilitated the funding round. The investment will enable SmartCheck to grow faster and innovate in the fast-emerging facility management space.

- February 2024: CBRE Group Inc. announced a deal to acquire J&J Worldwide Services, a company focused on engineering services, base support operations, and facilities maintenance for the U.S. federal government. The acquisition is being made from private equity firm Arlington Capital Partners.

- October 2023: Facilities services provider OCS acquired Accuro, a UK-based company which provides business-critical facilities management solutions, with special expertise in education and healthcare sectors.

- July 2023: Johnson Controls said it had plans to strengthen its OpenBlue digital buildings capabilities by merging with FM:Systems - a leader in workplace management software. The acquisition augmented the OpenBlue digital buildings SaaS software suite with its advanced cloud-based workplace management functionalities.

- March 2023: Alternative asset investment firm HIG Capital, which also has several facility management-related subsidiaries, acquired Synecore and Meesons Future. HIG combined these with its previous acquisition of CPS and Classic Lifts to create the Andwis Group, a new enterprise of technical service providers.

- March 2023: Planon Group announced the acquisition of control.IT Unternehmensberatung GmbH, a software company specializing in real estate (RE) asset and portfolio management in the DACH region, along with its SaaS products bison.box and CollaborationApp. This acquisition further includes control IT subsidiaries easol GmbH and Synapplix GmbH.

Facility Management Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered | Facility Property Management, Building Information Modeling, Integrated Workplace Management System, Facility Operations and Security Management, Others |

| Services Covered | Deployment and Integration, Consulting and Training, Support and Maintenance, Auditing and Quality Assessment, Others |

| Deployment Types Covered | On-Premises, Cloud |

| Organization Sizes Covered | Large Enterprises, Small and Medium Size Enterprises |

| Verticals Covered | Banking, Financial Services, and Insurance, IT and Telecom, Real Estate, Government and Public Sector, Healthcare, Education, Retail, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Accruent, AHI Facility Services, Archibus, CBRE, Cushman & Wakefield, Emeric Facility Services, International Business Machines Corporation, ISS A/S, Jones Lang LaSalle IP, Inc., SAP SE, SMI Facility Services, Sodexo, Trimble Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the facility management market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global facility management market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the facility management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The facility management market refers to the global industry that provides professional services to support the functionality, safety, and efficiency of built environments—including office buildings, hospitals, shopping centers, educational institutions, industrial parks, and residential complexes.

The facility management market was valued at USD 79.0 Billion in 2024.

The facility management market is projected to exhibit a CAGR of 11.21% during 2025-2033, reaching a value of USD 228.5 Billion by 2033.

The facility management market is driven by increased demand for efficient building operations, cost reduction, ongoing technological advancements (e.g., IoT and automation), and the growing need for sustainability. Additionally, rising urbanization, the complexity of modern infrastructure, and the shift toward outsourcing services further fuel market growth.

North America currently dominates the market, accounting for a share of around 32.2%. The dominance is driven by increasing demand for outsourcing non-core services, growing focus on sustainability and energy efficiency, technological advancements in automation, and rising need for cost-effective operations management.

Some of the major players in the facility management market include Accruent, AHI Facility Services, Archibus, CBRE, Cushman & Wakefield, Emeric Facility Services, International Business Machines Corporation, ISS A/S, Jones Lang LaSalle IP, Inc., SAP SE, SMI Facility Services, Sodexo, Trimble Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)