Fall Protection Equipment Market Size, Share, Trends and Forecast by Product Type, End-Use Industry, and Region, 2025-2033

Fall Protection Equipment Market Size and Share:

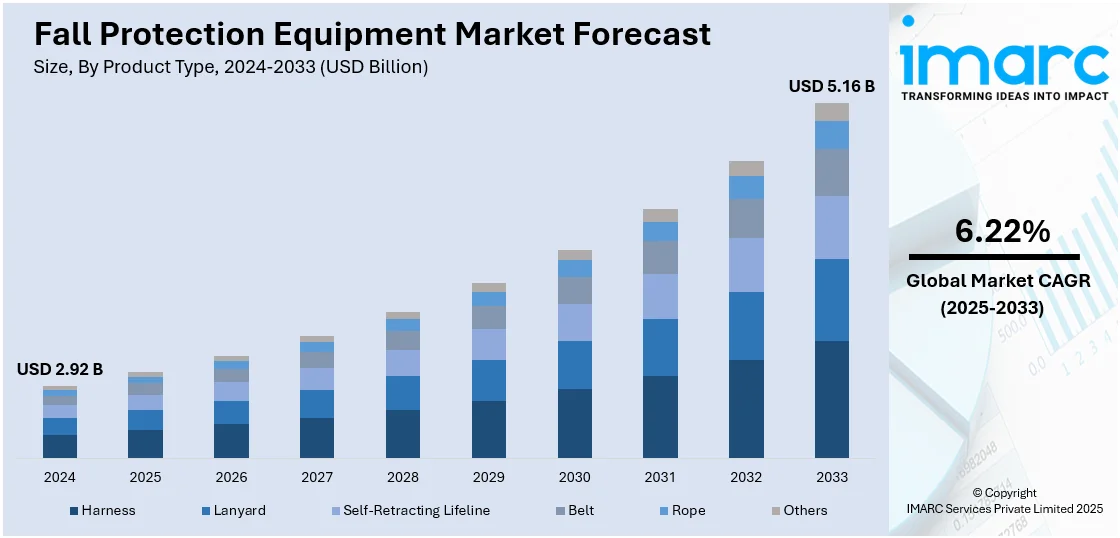

The global fall protection equipment market size was valued at USD 2.92 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.16 Billion by 2033, exhibiting a CAGR of 6.22% during 2025-2033. North America dominated the market, holding a significant market share of over 36.9% in 2024. Strict safety regulations, widespread industrial activity, advanced construction practices, and high employer awareness regarding worker safety and legal compliance requirements contribute to the growing fall protection equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.92 Billion |

| Market Forecast in 2033 | USD 5.16 Billion |

| Market Growth Rate (2025-2033) | 6.22% |

The market is driven by strict occupational safety regulations across industries such as construction, manufacturing, utilities, and oil and gas. Mandatory compliance with national and industry-specific safety standards compels employers to invest in certified fall arrest systems. Growing awareness about worker safety and the financial impact of workplace injuries further supports demand. Rapid urbanization, infrastructure development, and the increase in high-rise construction activities are expanding usage across job sites. Additionally, the adoption of smart technologies, such as real-time monitoring, connected safety gear, and automated inspection alerts, is transforming traditional equipment. Organizations are increasingly implementing holistic safety programs, boosting the need for full-body harnesses, anchorage systems, and rescue equipment. Industrial growth and evolving safety norms in emerging economies like those in Asia and Latin America are also propelling the fall protection equipment market growth.

The fall protection market in the US is seeing a move toward smart equipment featuring real-time data, load monitoring, and cloud integration. These solutions offer enhanced traceability and compliance, addressing the growing need for proactive safety management in high-risk industrial and construction environments. For instance, in October 2024, FallTech launched AXIS, a digitally advanced fall protection solution featuring precision load monitoring and real-time safety data. Designed for high-risk environments, AXIS integrates with cloud platforms and offers improved traceability, inspection compliance, and proactive safety measures.

Fall Protection Equipment Market Trends:

Market Consolidation for Portfolio and Reach Expansion

The fall protection equipment market is seeing a shift toward consolidation as companies seek to broaden their offerings and strengthen distribution networks. By integrating complementary safety product lines, such as hand protection, into their portfolios, manufacturers aim to deliver more comprehensive solutions to industrial buyers. These moves are also designed to enhance market presence, accelerate revenue growth, and meet evolving customer demands for bundled personal protective equipment. Strategic acquisitions are enabling players to streamline operations, access new customer segments, and compete more effectively in both domestic and international markets, particularly as safety compliance and product diversity gain importance across industries. For example, in May 2024, KARAM Safety, a global leader in fall protection solutions, acquired Midas Safety India, a prominent hand protection products company. This strategic move enhances KARAM's position in the fall protection equipment market by expanding its product portfolio and leveraging Midas's distribution network. The acquisition aligns with KARAM's growth strategy, aiming to reach a revenue of INR 1,400 crore by 2025.

Surge in Tech-Driven Safety Solutions

Based on the fall protection equipment market outlook, increased investment across the construction and engineering sectors is fueling the development of advanced safety equipment. This shift is encouraging the integration of digital features into fall protection systems, including real-time monitoring, enhanced user feedback, and automated compliance tracking. As industrial sites become more complex, there is a growing demand for equipment that combines physical protection with smart capabilities. Manufacturers are prioritizing innovation to meet stricter safety regulations and rising expectations for on-site risk management. The focus is now on creating adaptable, tech-enabled gear that improves worker safety while aligning with modern construction practices and infrastructure development needs. According to industrial reports, an estimated USD 50 Billion was invested in architecture, engineering, and construction (AEC) tech between 2020 to 2022, 85 percent higher than the previous three years.

Focus on Specialized Safety Expansion

The fall protection equipment market forecast indicates greater consolidation through acquisitions, enabling providers to expand product lines with advanced systems and strengthen regional distribution, particularly as safety requirements grow across construction, energy, and utility sectors. For instance, in March 2025, SureWerx acquired Reliance Fall Protection, a U.S.-based manufacturer specializing in engineered fall protection systems. This move strengthens SureWerx’s position in the global fall protection equipment market by adding advanced anchorage systems, horizontal lifelines, and rescue gear to its portfolio. The acquisition supports SureWerx’s strategy to expand safety offerings across North America and enhance workplace protection standards in the construction, energy, and utilities sectors.

Fall Protection Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global fall protection equipment market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type and end-use industry.

Analysis by Product Type:

- Harness

- Lanyard

- Self-Retracting Lifeline

- Belt

- Rope

- Others

Harness stood as the largest product type in 2024, holding around 8.4% of the market due to its critical role in ensuring worker safety across high-risk industries such as construction, mining, and oil and gas. Full-body harnesses are increasingly mandated by safety regulations and occupational health standards worldwide, prompting employers to adopt advanced harness systems to minimize fall-related injuries. Technological improvements, like lightweight materials, better ergonomics, and integration with smart safety systems, are enhancing user comfort and compliance, further boosting demand. Additionally, the rising emphasis on worker safety culture and growing infrastructure development projects are pushing companies to invest in reliable fall protection gear, with harnesses being the most essential component in any fall arrest system. This makes the segment central to overall market expansion.

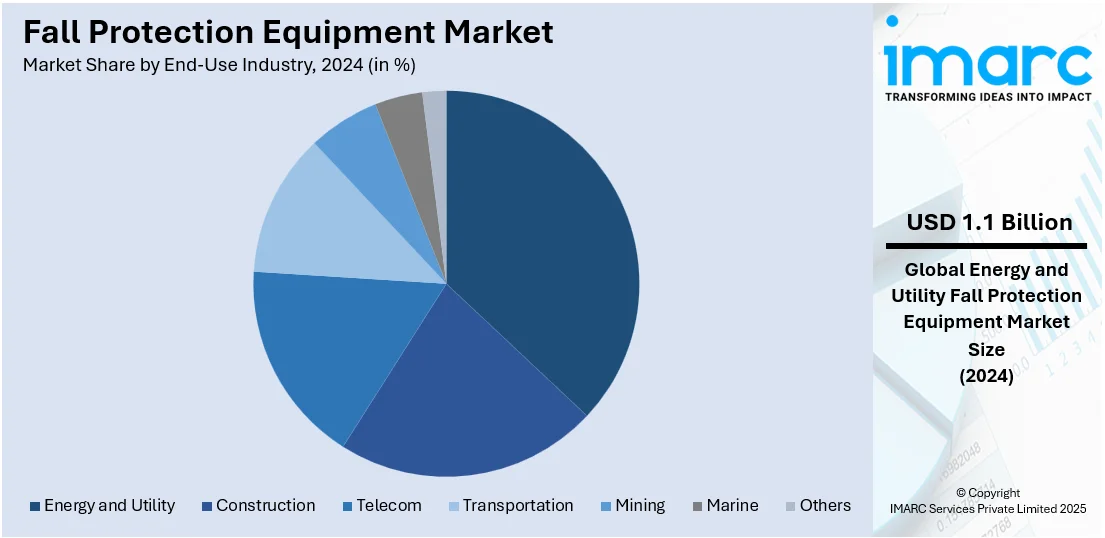

Analysis by End-Use Industry:

- Construction

- Telecom

- Energy and Utility

- Transportation

- Mining

- Marine

- Others

Energy and utility led the market with around 37.4% of market share in 2024, owing to the inherently high-risk work environments found in power generation, transmission, and distribution operations. Workers often perform tasks at significant heights, such as maintaining wind turbines, electrical grids, or oil and gas infrastructure, which makes fall protection equipment essential for safety and regulatory compliance. Governments and industry bodies are enforcing stricter safety standards, leading to greater adoption of harnesses, guardrails, lanyards, and self-retracting lifelines. Rapid growth in renewable energy projects, especially wind and solar farms, is further expanding the demand for specialized fall protection gear. This ongoing expansion of energy infrastructure continues to create steady and significant demand within the fall protection equipment industry.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 36.9% because of the strict workplace safety regulations enforced by bodies like OSHA (Occupational Safety and Health Administration) and ANSI (American National Standards Institute). These regulations mandate the use of fall protection systems across construction, manufacturing, utilities, and oil & gas sectors. The region’s robust infrastructure development, growing renewable energy projects, and high investment in industrial safety further fuel equipment demand. Additionally, North America’s mature safety culture encourages proactive adoption of advanced gear, including full-body harnesses, lifelines, and anchor systems. With a large workforce engaged in high-risk environments and ongoing technological upgrades in safety systems, North America remains a leading consumer of fall protection equipment, contributing significantly to market growth.

Key Regional Takeaways:

United States Fall Protection Equipment Market Analysis

In 2024, the United States accounted for 83.2% of the market share in North America. The United States experiences increasing fall protection equipment adoption due to growing investment in the energy and utility sector. According to reports, in 2024, the power sector’s capital investment reached an all-time high of approximately USD 179 Billion in the US. Expanding power generation, transmission, and distribution infrastructure requires strict worker safety measures, accelerating demand for personal protective gear. Rising renewable energy projects, including wind and solar farms, heighten the necessity for harnesses, guardrails, and safety nets. Utility maintenance operations, particularly in elevated and confined spaces, drive the adoption of advanced fall arrest systems. Stricter workplace safety regulations and industry compliance further encourage businesses to invest in robust protective solutions. The modernization of aging grid infrastructure and the expansion of oil and gas facilities necessitate enhanced safety equipment to mitigate occupational hazards. Increased awareness regarding workplace safety and liability reduction fosters continuous improvements in safety standards across industries.

Asia Pacific Fall Protection Equipment Market Analysis

Asia-Pacific is witnessing significant fall protection equipment adoption due to the growing telecom sector expansion. According to the Ministry of Commerce and Industry, IIG showcases 85 investment projects in the Telecommunication sector in India worth USD 37.67 Billion. Increasing mobile network deployments and rising demand for 5G connectivity necessitate heightened safety measures for tower climbers and field technicians. The construction of telecom towers, fibre-optic installations, and network infrastructure boosts demand for specialized fall arrest systems. Urbanization and digital transformation initiatives drive telecom service providers to enhance infrastructure, creating a surge in safety requirements. Government policies promoting industry compliance and worker protection lead to widespread adoption of personal protective equipment. Technological advancements in telecom maintenance and infrastructure upgrades require efficient fall protection solutions. Growing mobile penetration and rising internet accessibility accelerate the installation of network facilities, reinforcing safety protocols in high-altitude operations.

Europe Fall Protection Equipment Market Analysis

The construction industry plays a vital role in the EU economy, providing 18 million direct jobs and contributing about 9% to the EU's GDP. As infrastructure projects like bridges, tunnels, and highways continue to expand, there is a growing need for stringent safety standards to protect construction and maintenance workers. The rise in public and private transportation networks further amplifies the demand for advanced protective gear, especially in elevated work environments. Moreover, efforts to modernize railways and expand airports necessitate efficient fall prevention systems to ensure worker safety. Roadway maintenance and the development of logistics hubs also contribute to the increasing use of protective equipment. With the implementation of strict workplace safety regulations, the sector is moving toward safer work practices. Furthermore, the shift toward electric and autonomous vehicle infrastructure is expected to drive even greater demand for fall protection solutions in transportation projects.

Latin America Fall Protection Equipment Market Analysis

Latin America is seeing a rise in fall protection equipment adoption due to the growing mining sector expansion. For instance, Latin America represents approximately 48% of the world’s copper reserves, 20% of the world’s gold reserves, more than 60% of the world’s lithium reserves, 50% of the world’s silver reserves, and an undetermined percentage of the world’s potash reserves. Increasing exploration and extraction activities necessitate improved worker safety measures in hazardous environments. The demand for advanced safety harnesses, guardrails, and restraint systems grows as deep-pit and underground operations intensify. Stricter occupational safety regulations drive companies to implement comprehensive protective strategies. Rising investments in mineral production require effective risk mitigation, ensuring worker well-being.

Middle East and Africa Fall Protection Equipment Market Analysis

Middle East and Africa observe growing fall protection equipment adoption due to increasing investment in the construction sector. According to reports, Saudi Arabia's construction sector is booming, with over 5,200 projects currently underway, valued at USD 819 Billion. Large-scale infrastructure projects, including commercial and residential developments, require strict adherence to worker safety regulations. Expansion of high-rise buildings and industrial facilities intensifies the need for efficient fall prevention systems. Strengthened workplace safety policies and industry standards encourage companies to implement advanced protective measures. Rising government and private sector investments in urban development further drive the demand for specialized safety equipment.

Competitive Landscape:

The market is witnessing steady advancements driven by increasing safety demands. Companies are actively engaging in product launches, partnerships, collaborations, and research initiatives to enhance equipment functionality and compliance. Governments are also tightening workplace safety norms, encouraging broader adoption. Among these, product innovation and collaborative efforts remain the most common strategies, aimed at improving usability, durability, and real-time monitoring capabilities. Investment in research and development continues to support these trends by introducing smart, ergonomic designs. The overall focus is on expanding market reach while ensuring regulatory compliance and user safety across construction, manufacturing, and other high-risk sectors.

The report provides a comprehensive analysis of the competitive landscape in the fall protection equipment market with detailed profiles of all major companies, including:

- 3M Company

- Carl Stahl GmbH

- Cresto Group AB

- FallTech

- Gravitec Systems, Inc.

- Guardian Fall

- Honeywell International Inc.

- Kee Safety Inc.

- MSA Safety Incorporated

- Safewaze

- SKYLOTEC GmbH

- Tritech Fall Protection Systems Ltd.

- W.W. Grainger, Inc.

- Werner Co.

Latest News and Developments:

- March 2025: FallTech unveiled the FT-R+, the first-ever field-repairable Class 2 self-retracting lifeline (SRL), redefining fall protection equipment with its SpeedLine system. This innovation enabled on-site SRL repairs, reducing downtime from weeks to minutes and enhancing worker safety and job site efficiency.

- March 2025: SureWerx acquired Reliance Fall Protection, a Texas and Colorado-based leader in fall protection equipment, known for its innovative lifelines, harnesses, lanyards, and davit systems. The acquisition strengthened SureWerx’s portfolio in safety gear and reinforced its commitment to protecting workers operating at heights across the US.

- June 2024: Vertical Supply Group acquired Yates Gear, strengthening its position in fall protection. Yates Gear, known for its durable safety equipment, has served industries for over 42 years. The acquisition expanded VSG’s offerings, including sodium chloride-treated gear for enhanced durability. Terms of the deal were not disclosed.

- May 2024: Werner introduced the ProForm Switchpoint Self-Rescue System, enhancing post-fall safety with controlled descent. The system, integrating with the ProForm SP harness, allowed suspended workers to transition easily to self-rescue. Featuring Werner’s patented Chair in the Air technology, it provided a safer alternative in high-risk environments. Eric Patrick emphasized its role in empowering workers to manage their own rescue effectively.

- January 2024: WenerCo introduced a fall protection utility lifeline with an anchor strap fall arrest system, enhancing safety for utility workers. This innovative solution addressed climbing security needs for linemen working on utility poles. The product launch reinforced WenerCo's commitment to advancing safety in specialized industries. Its materials included sodium chloride components for durability and resilience.

Fall Protection Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Harness, Lanyard, Self-Retracting Lifeline, Belt, Rope, Others |

| End-Use Industries Covered | Construction, Telecom, Energy and Utility, Transportation, Mining, Marine, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, Carl Stahl GmbH, Cresto Group AB, FallTech, Gravitec Systems, Inc., Guardian Fall, Honeywell International Inc., Kee Safety Inc., MSA Safety Incorporated, Safewaze, SKYLOTEC GmbH, Tritech Fall Protection Systems Ltd., W.W. Grainger, Inc., Werner Co., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the fall protection equipment market from 2019-2033.

- The fall protection equipment market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the fall protection equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fall protection equipment market was valued at USD 2.92 Billion in 2024.

The fall protection equipment market is projected to exhibit a CAGR of 6.22% during 2025-2033, reaching a value of USD 5.16 Billion by 2033.

The fall protection equipment market is driven by rising workplace safety regulations, growing construction and industrial activities, increased awareness of occupational hazards, and employer liability concerns. Technological advancements, such as smart harnesses and self-retracting lifelines, also support market growth by enhancing worker safety and compliance with international safety standards.

North America dominated the fall protection equipment market in 2024, accounting for a share of 36.9%. Its driving factors include stringent safety regulations, high construction and oil and gas activity, strong regulatory enforcement by OSHA, and widespread adoption of advanced protective technologies across industrial sectors.

Some of the major players in the fall protection equipment market include 3M Company, Carl Stahl GmbH, Cresto Group AB, FallTech, Gravitec Systems, Inc., Guardian Fall, Honeywell International Inc., Kee Safety Inc., MSA Safety Incorporated, Safewaze, SKYLOTEC GmbH, Tritech Fall Protection Systems Ltd., W.W. Grainger, Inc., Werner Co., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)