Indian Farming Market Size, Share, Trends and Forecast by Crop Seasonality, Crop Type, Application, Distribution Channel, and Region, 2025-2033

Indian Farming Market Size and Share:

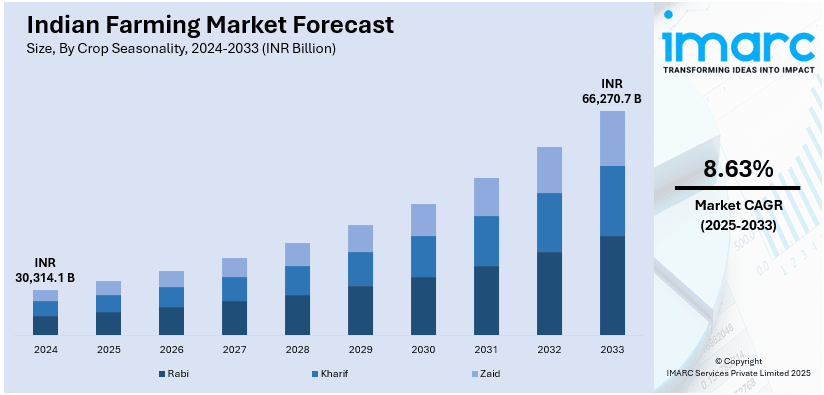

The Indian farming market size was valued at INR 30,314.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach INR 66,270.7 Billion by 2033, exhibiting a CAGR of 8.63% from 2025-2033. North India currently dominates the market, holding a market share of over 35% in 2024. The region dominates the Indian agricultural sector based on its fertile and fruitful lands, vast irrigation facilities, and suitable climate. Its extensive cultivation of staple foods such as wheat and rice further add to its dominance. State support in terms of subsidies, programs, and robust agricultural policies, complemented with well-developed market facilities which helps to develop agricultural productivity, spearheading total agricultural production of Indian farming market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

INR 30,314.1 Billion |

|

Market Forecast in 2033

|

INR 66,270.7 Billion |

| Market Growth Rate (2025-2033) | 8.63% |

The Indian government is also working to develop the agricultural sector with a range of policy measures and support schemes that are useful in increasing farm productivity as well as sustainability. As per the sources, in March 2025, the UP PRAGATI Accelerator and UPCAR added 80,000 hectares to Direct Seeded Rice (DSR) area, on their way towards achieving 100,000 hectares in 2025, saving water and raising farmer incomes. Furthermore, the crop insurance schemes are among the most important measures to reduce the risks posed by volatile weather patterns as well as natural disasters, providing an insurance payout to farmers against their losses. Government assistance also includes subsidizing key agricultural inputs like fertilizers, irrigation equipment, and good quality seeds so that farming becomes cheaper for farmers to increase crop output. Sustainable farm practices, including organic production, water harvesting, and soil protection, are also becoming popular, emphasizing eco-friendly farm culture. Rural infrastructure investments such as enhanced road networks, storages, and market access reinforce supply chains as well as mitigate post-harvest losses. With all these wide-ranging actions, the government takes a very crucial role to make sure of Indian farming market growth, raising farmers' productivity and facilitating their access to a larger market.

To get more information on this market, Request Sample

Technological advancements are transforming the Indian agricultural sector by enhancing its efficiency, productivity, and sustainability. The use of precision agriculture technologies, including drones, sensors, and satellite monitoring systems, enables farmers to make better decisions on irrigation, fertilization, and pest management. For instance, in March 2024, LTIMindtree and Farmers Edge inaugurated the Farmers Edge Innovation Lab (FEIL) in Mumbai. This center combines cutting-edge AgTech with digital technology, with an objective to drive farming efficiency and sustainability using AI, IoT, drones, and data-driven analytics, with a focus on weather, soil, and crop cycles. Moreover, these technologies result in efficient utilization of resources, reducing wastage and increasing yields. Smart irrigation systems, using soil moisture sensors and weather information to control water usage, are assisting farmers in saving water a particularly valuable advantage in areas with drought. Additionally, the embracement of mechanized agriculture, such as automated harvesters and tractors, is decreasing labor expenses while enhancing productivity. The extensive adoption of mobile applications and online platforms gives farmers quick updates on weather, market prices, and advice on crop management by specialists. This tech revolution in Indian agriculture is enhancing more sustainability, overall competitiveness in the agriculture sector, and adding to better food security.

Indian Farming Market Trends:

Urbanization and Its Effect on Agricultural Demand

Increased urbanization in India is causing a major reduction in arable land, as development and population boost pressure on rural and agricultural lands. NITI Aayog states that more than 40% of India's population will reside in urban areas by 2030. This shift in population is speeding up the demand for food, posing new challenges to food production systems. Consequently, the agricultural sector is experiencing strong growth opportunities, fueled by the pressing requirement to boost output in a declining cultivable space. To fulfill these requirements, farmers and stakeholders in the industry are adopting novel farming techniques and technologies. Furthermore, corporate collaboration with farmers is gaining momentum, offering farmers enhanced access to markets, resources, and income security. These collaborations are improving supply chains and securing a more consistent production process, aiding overall growth of the agriculture sector in the face of pressures from urbanization.

Increasing Demand for Organic Products

The heightening health awareness of Indian customers is driving a wave of demand for organic food products. Organic products are seen to be safer and greener, simply due to the fact that they are grown without the application of artificial pesticides or fertilizers. This accelerating trend is encouraging farmers all over India to shift towards organic farming techniques. These practices not only satisfy consumer taste but also foster long-term soil health and diversity. Growing popularity of organic food is supporting an upbeat Indian farming market outlook, particularly in urban and semi-urban areas where there is greater awareness about health and sustainability. In addition, retailers and food companies are adding more organics to their portfolios, enhancing demand and exposure further. Organic farming is also being encouraged by government regulations and certifications, which work towards controlling standards and generating consumer confidence. Thus, organic farming is turning out to be a profitable and feasible sector within India's larger agriculture industry.

Government Support and Food Processing Growth

The Indian government is aggressively supporting agricultural growth through policy, budgetary, and infrastructure augmentation. The Department of Agriculture and Farmers' Welfare has been allocated a budget of ₹1,22,528.77 crore for FY 2024–25, highlighting its importance. These allocations are being made towards improving irrigation, mechanization, and rural connectivity. Credit support for farm produce marketing and transportation is also promoting export expansion. At the same time, India's food processing industry is expanding at a tremendous pace, with estimated output growing to US$ 535 billion in 2025–26. Backward linkages with the agricultural industry are being created with this expansion, leading to rising demand for raw farm inputs. Improved processing infrastructure combined with favorable government schemes is boosting productivity, farmers' revenues, and overall market competitiveness. Efforts such as cold chain development and digital agri-markets are bridging gaps in logistics and distribution, bringing India's agricultural system in line with modern supply chain and export standards.

Indian Farming Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Indian farming market, along with forecast at the country and regional levels from 2025-2033. The market has been categorized based on crop seasonality, crop type, application, and distribution channel.

Analysis by Crop Seasonality:

- Rabi

- Kharif

- Zaid

In 2024, Kharif crops hold the highest position in the Indian farming market forecast and account for half of the agricultural production at 50% share. They are planted right at the commencement of the monsoon season. Kharif crops like rice, maize, and pulses thrive well under intensive rain and desirable climatic conditions in areas of consistent irrigation provision. The key position of the monsoon in Indian agriculture continues to propel the predominance of Kharif cultivation, particularly in states where there is extensive rain-fed cultivation. The seasonal timing coincides with peak demand seasons and facilitates large-scale procurement and exports. The government's minimum support price (MSP) schemes and input subsidies for seeds and fertilizers also spur Kharif crop cultivation. Also, the extensive mechanization and availability of hybrid seed varieties have primarily increased yield efficiency, supporting the dominance of the Kharif season in the market. The high reliance on monsoon rains, along with enhanced agricultural practices, guarantees this season is crucial to the Indian agricultural landscape.

Analysis by Crop Type:

- Cereals

- Fruits & Vegetables

- Plantation Crops

- Spices

- Pulses

- Others

Fruits and vegetables were the most dominant crop category in India's agriculture industry in 2024, with a market share of 28%. This increase is being promoted by rising domestic off-take driven by growing health consciousness and consumption diversification among Indian consumers. The fruits include bananas, mangoes, and citrus, and vegetables like potatoes, onions, and tomatoes, which are grown in different agro-climatic regions, allowing them to be produced throughout the year. The transition towards horticulture is also aided by government policies such as the Mission for Integrated Development of Horticulture (MIDH), which induces improved infrastructure, post-harvest handling, and cold chain facilities. Farmers are finding these high-value crops more attractive with shorter rotation periods and greater returns. Urbanization and the growth of organized retail are also driving demand for fresh produce. Besides, technological improvements, such as precision irrigation and greenhouse cultivation, are leading to improved yields and quality, cementing the leading role of fruits and vegetables in the agricultural economy.

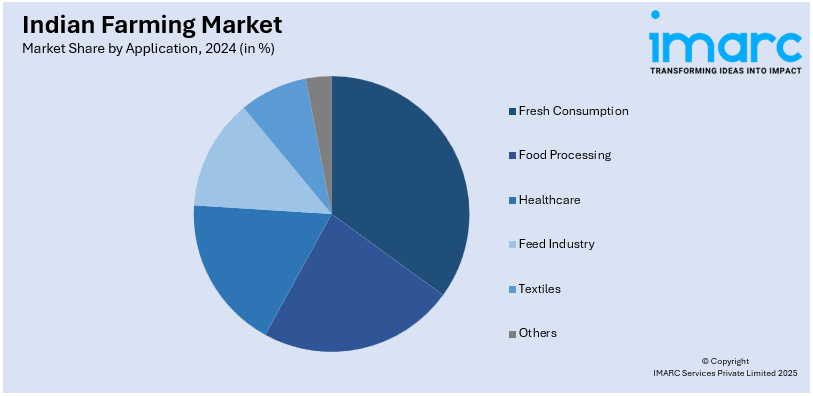

Analysis by Application:

- Fresh Consumption

- Food Processing

- Healthcare

- Feed Industry

- Textiles

- Others

In 2024, fresh consumption led the Indian agriculture market application segment with an overwhelming 60% share. The robust penchant for fresh fruit, vegetables, and cereals is a direct result of legacy consumption habits as well as India's increasingly health-conscious and conscious consumer who spends more on such items. Indian consumers are biased toward cooking meal at home because of their mass, so naturally, demand stays high for all fresh produce with high levels across urban and semi-urban. Rising disposable income and consciousness regarding food safety and hygiene have also increased demand for fresh-sourced products. This is supported by enhanced rural and urban connectivity, facilitating quicker transportation of perishables. Farmers and traders are also using local mandis, community markets, and mobile retailing formats to supply directly to consumers. In addition, efforts to minimize food loss by optimizing storage and distribution processes are improving the productivity of fresh consumption supply chains, cementing this application's dominance in the marketplace.

Analysis by Distribution Channel:

- Self Consumption

- Traditional Retail

- Business to Business

- Modern Retail

- Online

Traditional retail held 50% share of India's agricultural distribution in 2024 and remained the largest channel for farm produce sales. It comprises local mandis, kirana stores, roadside vendors, and periodic markets, which continue to be easily accessible to both rural and urban consumers. Their entrenched presence across the country allows them to achieve extensive coverage and convenience, especially where modern retail and e-commerce have weak reach. Traditional channels provide affordability, personal relationships, and trust—factors that still appeal to Indian consumers. For farmers on the supply side, these channels are preferred due to their ease, lower barriers to entry, and cash-upfront payment terms. Moreover, the informal structure of these networks enables flexible pricing and quicker product turnover, particularly for perishable products. Though digital platforms and organized retail are expanding, the deep-rooted cultural and logistical support of traditional retail guarantees its continued dominance. Investments in enhancing mandi infrastructure and connecting farmers directly to consumers are also strengthening this channel's position.

Regional Analysis:

- North India

- South India

- East India

- West India

North India dominated the regional agricultural market in 2024, accounting for 35% share of the region's agricultural production. This is due to the fertile Indo-Gangetic plains in the region, which provide room for high-yielding crops such as wheat, rice, sugarcane, and vegetables. Multiple cropping cycles are made possible by extensive irrigation systems from rivers such as the Ganges and canal networks, and crop reliability is guaranteed despite changes in rainfall. Punjab, Haryana, and Uttar Pradesh are some states that have derived advantages from mechanized agriculture, intensive use of inputs, and well-developed procurement networks under minimum support prices. Strong rural infrastructure, proximity to agricultural research institutions, and improved access to credit facilities also exist in North India, augmenting productivity. With additional assistance from the government through subsidies, training, and technology transfer, the agricultural scene has improved even further. Furthermore, their proximity to consumption centers and food processing units improves market access and logistics effectiveness. All these place North India at the forefront of regional contributors to India's agrarian economy.

Competitive Landscape:

The Indian agricultural market has a competitive environment with high modernization, technological implementation, and strategic partnerships. The value chain players are making investments in new agriculture methods, precision farming, and sustainable methods to increase productivity and address the amplified demand for food and organic goods. Farmers, agritech companies, and food processing units are entering into collaborations that promote innovation and optimize supply chain efficiency. Digital platforms are also taking their share by providing real-time information, market exposure, and financial services to farmers, adding to competitiveness. In addition, growth in integrated farming systems and contract farming models has resulted in structured and scalable operations across crop categories. Regional specialization and diversified portfolios of crops are helping market participants effectively address seasonal and geographical demand. With governmental assistance and an accelerated emphasis on exports, the market is set to grow further, boosted by efficiency, quality improvement, and increasing domestic and foreign consumption.

The report provides a comprehensive analysis of the competitive landscape in the Indian farming market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Bayer initiated its first issuance of carbon credits in India through the Bayer Rice Carbon Program, involving thousands of rice farmers across 11 states. By adopting regenerative practices like direct seeded rice (DSR) and alternate wetting and drying (AWD), these farmers had significantly reduced methane emissions and water usage.

- January 2025: Super Crop Safe Ltd. launched Super Gold WP+, a new bio-fertilizer designed to reduce chemical fertilizer use and boost yields. Developed by its biotech division, the product featured a mycorrhiza inoculant blend.

- November 2024: Crystal Crop Protection acquired Bengaluru-based I&B Seeds to expand its presence in India's vegetable and flower-seed segment. The acquisition, funded through internal accruals, was expected to enhance Crystal's seed portfolio by about 30%, contributing significantly to its INR 400 crore seed business.

- November 2024: Diageo India launched a regenerative agriculture program in Telangana, partnering with the Centre for Sustainable Agriculture. The initiative involved over 220 farmers across 15 villages and 500 hectares. It aimed to cut carbon and water use in rice farming, reduce Scope 3 emissions, and promote sustainable practices like AWD and direct seeding.

- September 2024: Bayer launched its ForwardFarm initiative in India, spanning 18 hectares, to promote sustainable agriculture for smallholder farmers. The initiative shows practices like direct seeded rice, carbon farming, IoT integration, and drone technology. It aims to improve productivity, reduce environmental impact, and support regenerative agriculture through collaborations and tailored innovations.

Indian Farming Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Metric Tons, Billion INR |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Crop Seasonalites Covered | Rabi, Kharif, Zaid |

| Crop Types Covered | Cereals, Vegetables, Fruits, Plantation Crops, Spices, Pulses, Others |

| Applications Covered | Fresh Consumption, Food Processing, Healthcare, Feed Industry, Textiles, Others |

| Distribution Channels Covered | Self-Consumption, Traditional Retail, Business to Business, Modern Retail, Online |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indian farming market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Indian farming market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indian farming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Indian farming market was valued at INR 30,314.1 Billion in 2024.

The Indian farming market is projected to exhibit a CAGR of 8.63% during 2025-2033, reaching a value of INR 66,270.7 Billion by 2033.

Major drivers of the Indian agricultural market are high urbanization, escalating food demand, enhanced health consciousness, government subsidies, technological innovation, and growth in food processing. Moreover, developing organic farming and corporate-farmer alliances are improving productivity and market access along the agricultural value chain.

North India currently dominates the Indian farming market, accounting for a share of 35%. The region is the powerhouse of the Indian agricultural sector due to fertile land, favorable climate, widespread irrigation facilities, and high levels of agricultural productivity. Government assistance, widespread cultivation of major crops, such as wheat and rice, and good market linkages also help in keeping the region at the top in Indian agriculture.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)