Febrile Neutropenia Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035

Market Overview:

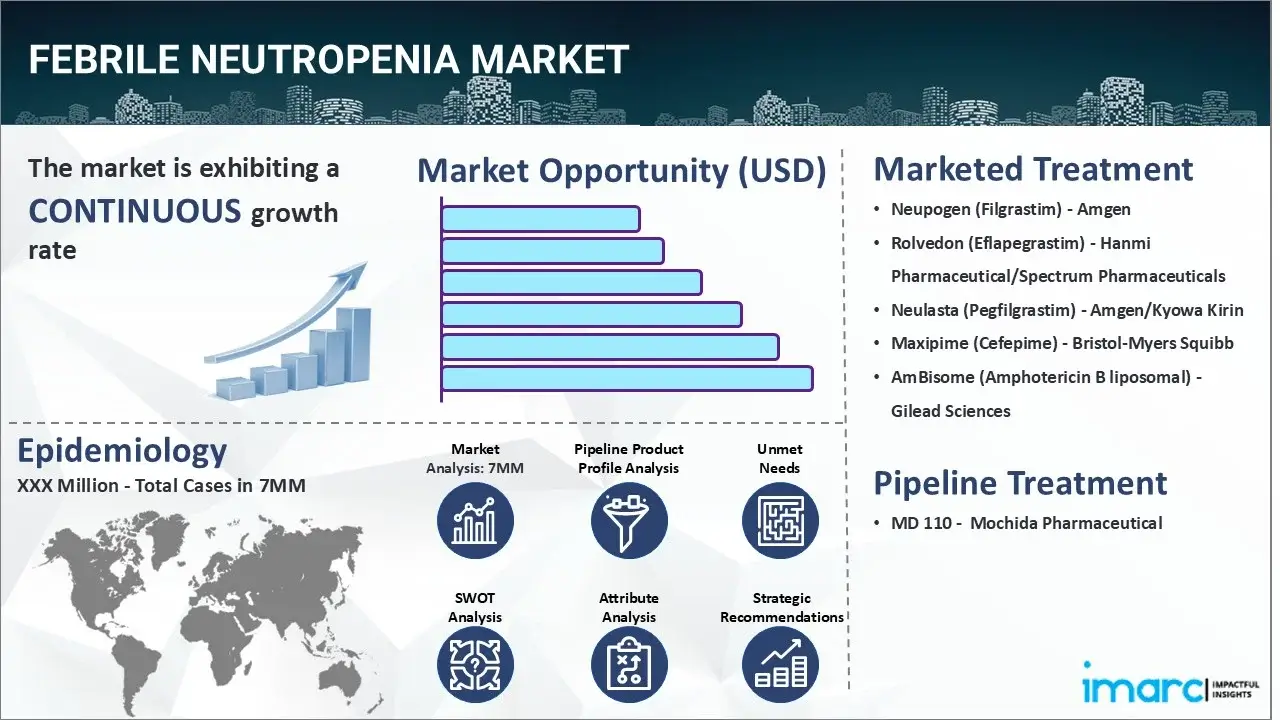

The febrile neutropenia market reached a value of USD 10.9 Billion across the top 7 markets (US, EU4, UK, and Japan) in 2024. Looking forward, IMARC Group expects the top 7 major markets to reach USD 17.0 Billion by 2035, exhibiting a growth rate (CAGR) of 3.98% during 2025-2035.

|

Report Attribute

|

Key Statistics

|

|---|---|

| Base Year |

2024

|

| Forecast Years | 2025-2035 |

| Historical Years |

2019-2024

|

|

Market Size in 2024

|

USD 10.9 Billion |

|

Market Forecast in 2035

|

USD 17.0 Billion |

|

Market Growth Rate (2025-2035)

|

3.98% |

The febrile neutropenia market has been comprehensively analyzed in IMARC's new report titled "Febrile Neutropenia Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035". Febrile neutropenia is a medical condition characterized by the presence of a fever (body temperature above 38.3°C or 101°F) in a patient with low neutrophil counts. This disease can affect the body's ability to fight infections, increasing the likelihood of health complications, such as severe sepsis and septic shock. The common indications of the ailment include unexplained fever, general weakness, tiredness, episodes of chills and sweating, increased heart rate, sore throat, difficulty swallowing, painful mouth sores, coughing, shortness of breath, chest and abdominal pain, nausea, vomiting, diarrhea, etc. The diagnosis of febrile neutropenia is mainly based on the patient's symptoms, medical history, and physical examination findings. Blood cultures and a complete blood count test are also utilized to detect the presence of bacteria or fungi in the bloodstream and identify other abnormalities. The healthcare provider may further perform numerous imaging studies, such as a chest X-ray, a computed tomography (CT) scan, an ultrasound, etc., to identify the source of infection and rule out other possible causes of indications among patients.

To get more information on this market, Request Sample

The increasing utilization of chemotherapy or radiation therapy, which can suppress the bone marrow's ability to produce new blood cells, is primarily driving the febrile neutropenia market. In addition to this, the rising incidences of various associated risk factors, including nutritional deficiencies, kidney diseases, usage of certain medications, like corticosteroids, that can affect immune function, etc., are also bolstering the market growth. Furthermore, the inflating adoption of broad-spectrum antibiotics to control the infection while providing coverage against a wide array of other potential pathogens is creating a positive outlook for the market. Besides this, the escalating application of colony-stimulating factors, such as filgrastim and pegfilgrastim, to treat the underlying symptoms of the ailment is also propelling the market growth. These medications work by stimulating the production of white blood cells, specifically neutrophils, to accelerate the recovery of the immune system. Additionally, the emerging popularity of intravenous antifungal therapy for treating the condition in patients who are unresponsive to other conventional antibiotic regimens is expected to drive the febrile neutropenia market in the coming years.

IMARC Group's new report provides an exhaustive analysis of the febrile neutropenia market in the United States, EU4 (Germany, Spain, Italy, and France), United Kingdom, and Japan. This includes treatment practices, in-market, and pipeline drugs, share of individual therapies, market performance across the seven major markets, market performance of key companies and their drugs, etc. The report also provides the current and future patient pool across the seven major markets. According to the report the United States has the largest patient pool for febrile neutropenia and also represents the largest market for its treatment. Furthermore, the current treatment practice/algorithm, market drivers, challenges, opportunities, reimbursement scenario and unmet medical needs, etc. have also been provided in the report. This report is a must-read for manufacturers, investors, business strategists, researchers, consultants, and all those who have any kind of stake or are planning to foray into the febrile neutropenia market in any manner.

Time Period of the Study

- Base Year: 2024

- Historical Period: 2019-2024

- Market Forecast: 2025-2035

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

Analysis Covered Across Each Country

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the febrile neutropenia market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the febrile neutropenia market

- Reimbursement scenario in the market

- In-market and pipeline drugs

Competitive Landscape:

This report also provides a detailed analysis of the current febrile neutropenia marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

Late-Stage Pipeline Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

| Drugs | Company Name |

|---|---|

| Neupogen (Filgrastim) | Amgen |

| Rolvedon (Eflapegrastim) | Hanmi Pharmaceutical/Spectrum Pharmaceuticals |

| Neulasta (Pegfilgrastim) | Amgen/Kyowa Kirin |

| Maxipime (Cefepime) | Bristol-Myers Squibb |

| AmBisome (Amphotericin B liposomal) | Gilead Sciences |

| MD 110 | Mochida Pharmaceutical |

*Kindly note that the drugs in the above table only represent a partial list of marketed/pipeline drugs, and the complete list has been provided in the report.

Key Questions Answered in this Report:

Market Insights

- How has the febrile neutropenia market performed so far and how will it perform in the coming years?

- What are the markets shares of various therapeutic segments in 2024 and how are they expected to perform till 2035?

- What was the country-wise size of the febrile neutropenia across the seven major markets in 2024 and what will it look like in 2035?

- What is the growth rate of the febrile neutropenia across the seven major markets and what will be the expected growth over the next ten years?

- What are the key unmet needs in the market?

Epidemiology Insights

- What is the number of incident cases (2019-2035) of febrile neutropenia across the seven major markets?

- What is the number of incident cases (2019-2035) of febrile neutropenia by age across the seven major markets?

- What is the number of incident cases (2019-2035) of febrile neutropenia by gender across the seven major markets?

- What is the number of incident cases (2019-2035) of febrile neutropenia by type across the seven major markets?

- How many patients are diagnosed (2019-2035) with febrile neutropenia across the seven major markets?

- What is the size of the febrile neutropenia patient pool (2019-2024) across the seven major markets?

- What would be the forecasted patient pool (2025-2035) across the seven major markets?

- What are the key factors driving the epidemiological trend febrile neutropenia of?

- What will be the growth rate of patients across the seven major markets?

Febrile Neutropenia: Current Treatment Scenario, Marketed Drugs and Emerging Therapies

- What are the current marketed drugs and what are their market performance?

- What are the key pipeline drugs and how are they expected to perform in the coming years?

- How safe are the current marketed drugs and what are their efficacies?

- How safe are the late-stage pipeline drugs and what are their efficacies?

- What are the current treatment guidelines for febrile neutropenia drugs across the seven major markets?

- Who are the key companies in the market and what are their market shares?

- What are the key mergers and acquisitions, licensing activities, collaborations, etc. related to the febrile neutropenia market?

- What are the key regulatory events related to the febrile neutropenia market?

- What is the structure of clinical trial landscape by status related to the febrile neutropenia market?

- What is the structure of clinical trial landscape by phase related to the febrile neutropenia market?

- What is the structure of clinical trial landscape by route of administration related to the febrile neutropenia market?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization

.webp)

.webp)