Fecal Incontinence Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035

Market Overview:

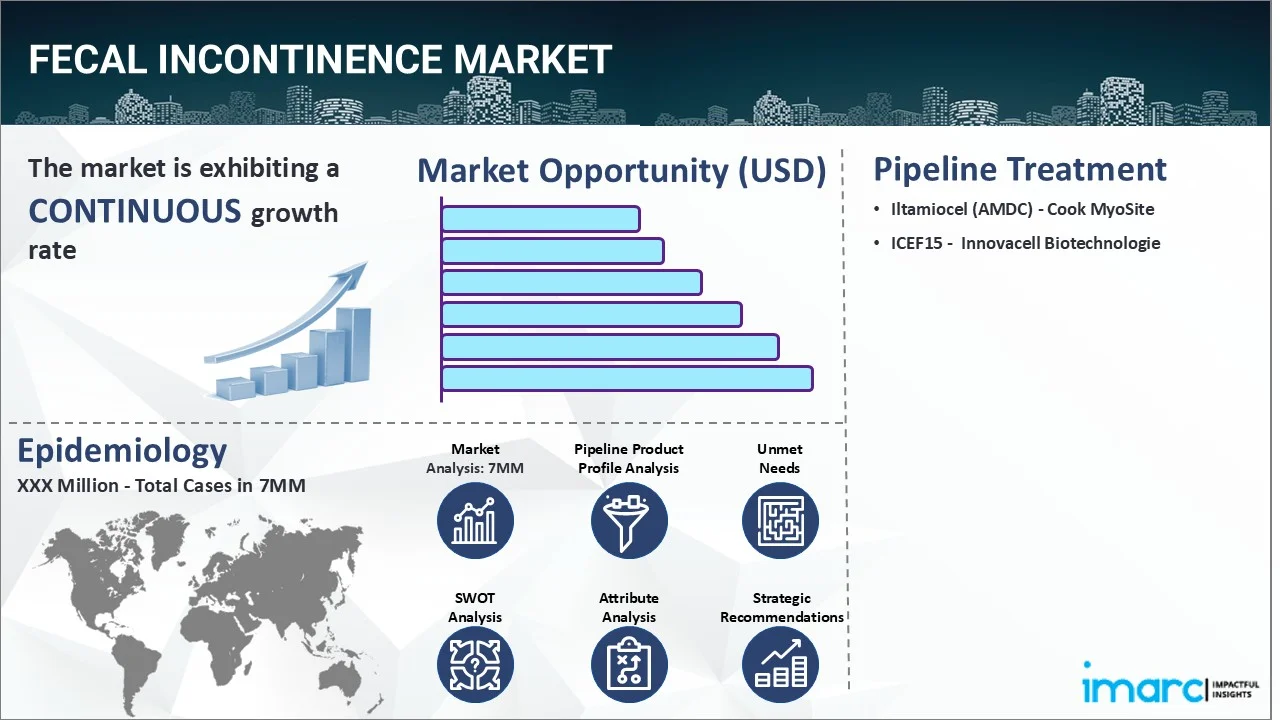

The fecal incontinence market reached a value of USD 2.2 Billion across the top 7 markets (US, EU4, UK, and Japan) in 2024. Looking forward, IMARC Group expects the top 7 major markets to reach USD 3.3 Billion by 2035, exhibiting a growth rate (CAGR) of 3.93% during 2025-2035.

|

Report Attribute

|

Key Statistics

|

|---|---|

| Base Year |

2024

|

| Forecast Years | 2025-2035 |

| Historical Years |

2019-2024

|

|

Market Size in 2024

|

USD 2.2 Billion

|

|

Market Forecast in 2035

|

USD 3.3 Billion

|

|

Market Growth Rate 2025-2035

|

3.93% |

The fecal incontinence market has been comprehensively analyzed in IMARC's new report titled "Fecal Incontinence Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035". Fecal incontinence is a medical disorder that causes an involuntary passage of feces (stool) from the rectum due to an inability to control bowel movements. It can range in severity from occasional stool leakage to a complete loss of intestinal motility. The symptom of the ailment usually varies depending on the underlying cause of the condition. They may include the involuntary passage of stool, inability to control gas, frequent urge to defecate, staining of underwear, etc. This illness can have a significant impact on a patient's emotional well-being, leading to embarrassment, anxiety, and a compromised quality of life. The diagnosis of fecal incontinence involves a comprehensive evaluation of medical history, clinical features, and a physical examination. A healthcare professional can also perform a digital rectal examination to check for any abnormalities, such as muscle weakness or damage to the anal areas. Furthermore, several imaging studies, like anorectal ultrasound and magnetic resonance imaging (MRI), may be utilized to rule out other conditions that could cause the underlying indications in patients.

To get more information on this market, Request Sample

The increasing cases of injuries or trauma that affect the muscles or nerves in the rectum and anus, leading to loss of bowel control, are primarily driving the fecal incontinence market. In addition to this, the rising prevalence of chronic diarrhea, which can strain and weaken anal sphincter muscles over time, compromising their ability to hold stool within the rectum, is creating a positive outlook for the market. Moreover, the widespread adoption of anti-diarrheal medications, since they work by slowing down the gut movement to control loose stools, is further bolstering the market growth. Apart from this, the escalating utilization of biofeedback therapy, on account of its numerous advantages, such as strengthening pelvic floor muscles, enhancing awareness and control over physiological processes, and empowering the self-management aspect of patients, is acting as another significant growth-inducing factor. Additionally, the emerging popularity of sacral nerve stimulation techniques, which involve the implantation of a device to stimulate the sacral nerves to modulate communication between the brain, spinal cord, and pelvic floor muscles, thereby reducing the disease symptoms, is expected to drive the fecal incontinence market during the forecast period.

IMARC Group's new report provides an exhaustive analysis of the fecal incontinence market in the United States, EU4 (Germany, Spain, Italy, and France), United Kingdom, and Japan. This includes treatment practices, in-market, and pipeline drugs, share of individual therapies, market performance across the seven major markets, market performance of key companies and their drugs, etc. The report also provides the current and future patient pool across the seven major markets. According to the report, the United States has the largest patient pool for fecal incontinence and also represents the largest market for its treatment. Furthermore, the current treatment practice/algorithm, market drivers, challenges, opportunities, reimbursement scenario, unmet medical needs, etc., have also been provided in the report. This report is a must-read for manufacturers, investors, business strategists, researchers, consultants, and all those who have any kind of stake or are planning to foray into the fecal incontinence market in any manner.

Key Highlights:

- Fecal incontinence affects approximately 10% of adults (over the age of 20).

- Women are more prone to fecal incontinence than men.

- According to estimates from the National Institutes of Health, one in every three persons might experience fecal incontinence during their lifetime.

- The prevalence of fecal incontinence rises with age, affecting 9.3% of those 60 years of age and older compared to 4.9% of younger persons.

- At 3-6 months following vaginal or cesarean delivery, 13-25% of women develop fecal incontinence.

Drugs:

Iltamiocel is under clinical development by Cook MyoSite for the treatment of fecal incontinence in adults. The therapeutic candidate is administered through an intramuscular route. It is an autologous muscle-derived cell (AMDC) therapy that possesses an excellent myogenic ability and can repair both skeletal and cardiac muscle.

ICEF15 is a personalized cell-based product concept based on proliferating autologous myoblasts obtained from a biopsy of the patient's muscle. The patient's proliferating muscle cells are re-injected into the external anal sphincter muscle using Innovacell's patented injection technology, restoring the muscle's full functionality.

Time Period of the Study

- Base Year: 2024

- Historical Period: 2019-2024

- Market Forecast: 2025-2035

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

Analysis Covered Across Each Country

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the fecal incontinence market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the fecal incontinence market

- Reimbursement scenario in the market

- In-market and pipeline drugs

Competitive Landscape:

This report also provides a detailed analysis of the current fecal incontinence marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

Late-Stage Pipeline Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

| Drugs | Company Name |

|---|---|

| Iltamiocel (AMDC) | Cook MyoSite |

| ICEF15 | Innovacell Biotechnologie |

*Kindly note that the drugs in the above table only represent a partial list of marketed/pipeline drugs, and the complete list has been provided in the report.

Key Questions Answered in this Report:

Market Insights

- How has the fecal incontinence market performed so far and how will it perform in the coming years?

- What are the markets shares of various therapeutic segments in 2024 and how are they expected to perform till 2035?

- What was the country-wise size of the fecal incontinence across the seven major markets in 2024 and what will it look like in 2035?

- What is the growth rate of the fecal incontinence across the seven major markets and what will be the expected growth over the next ten years?

- What are the key unmet needs in the market?

Epidemiology Insights

- What is the number of prevalent cases (2019-2035) of fecal incontinence across the seven major markets?

- What is the number of prevalent cases (2019-2035) of fecal incontinence by age across the seven major markets?

- What is the number of prevalent cases (2019-2035) of fecal incontinence by gender across the seven major markets?

- What is the number of prevalent cases (2019-2035) of fecal incontinence by type across the seven major markets?

- How many patients are diagnosed (2019-2035) with fecal incontinence across the seven major markets?

- What is the size of the fecal incontinence patient pool (2019-2024) across the seven major markets?

- What would be the forecasted patient pool (2025-2035) across the seven major markets?

- What are the key factors driving the epidemiological trend fecal incontinence of?

- What will be the growth rate of patients across the seven major markets?

Fecal Incontinence: Current Treatment Scenario, Marketed Drugs and Emerging Therapies

- What are the current marketed drugs and what are their market performance?

- What are the key pipeline drugs and how are they expected to perform in the coming years?

- How safe are the current marketed drugs and what are their efficacies?

- How safe are the late-stage pipeline drugs and what are their efficacies?

- What are the current treatment guidelines for fecal incontinence drugs across the seven major markets?

- Who are the key companies in the market and what are their market shares?

- What are the key mergers and acquisitions, licensing activities, collaborations, etc. related to the fecal incontinence market?

- What are the key regulatory events related to the fecal incontinence market?

- What is the structure of clinical trial landscape by status related to the fecal incontinence market?

- What is the structure of clinical trial landscape by phase related to the fecal incontinence market?

- What is the structure of clinical trial landscape by route of administration related to the fecal incontinence market?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization

.webp)

.webp)