Fermented Foods Market Size, Share, Trends and Forecast by Food Type, Ingredient Type, Fermentation Process, Distribution Channel, and Region, 2026-2034

Fermented Foods Market Overview :

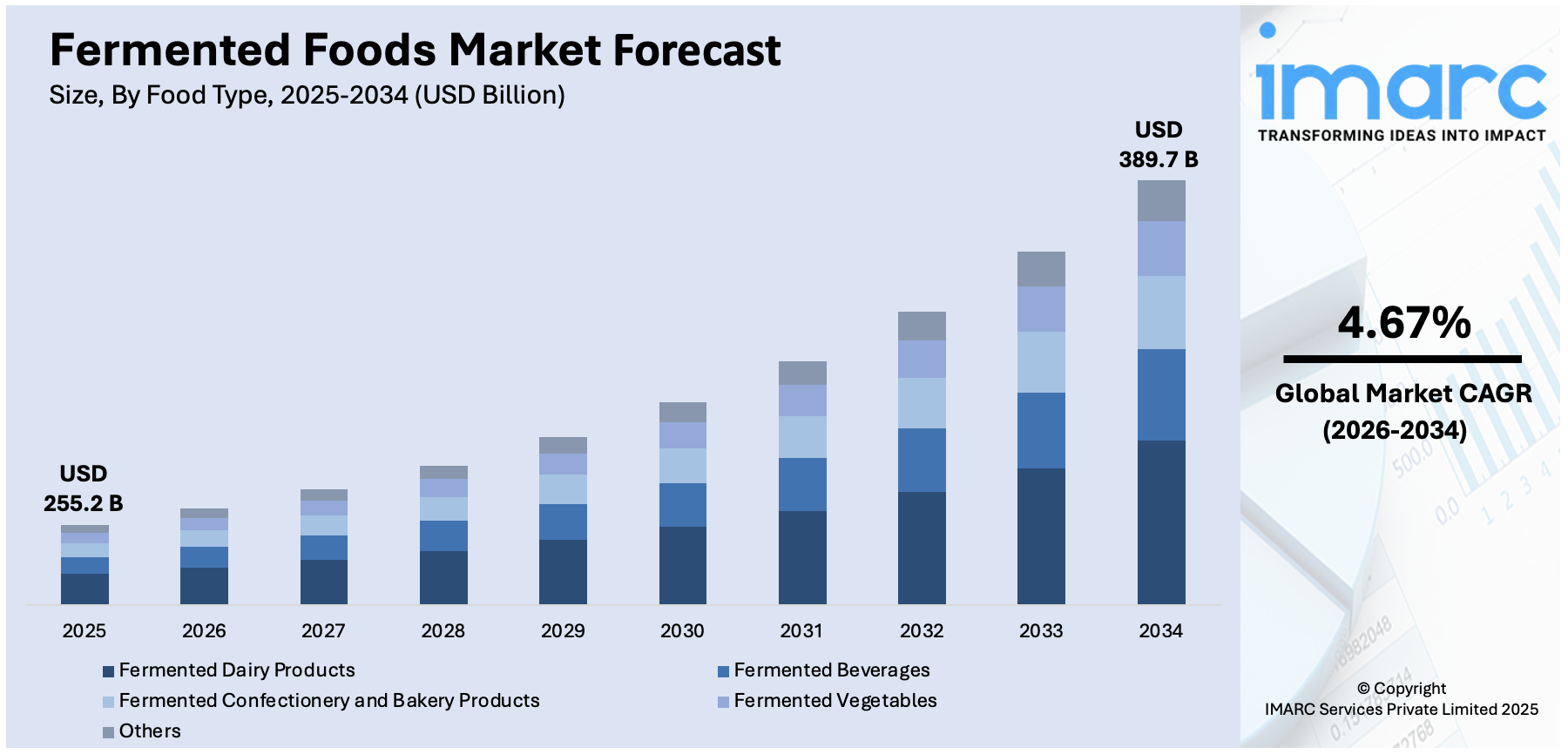

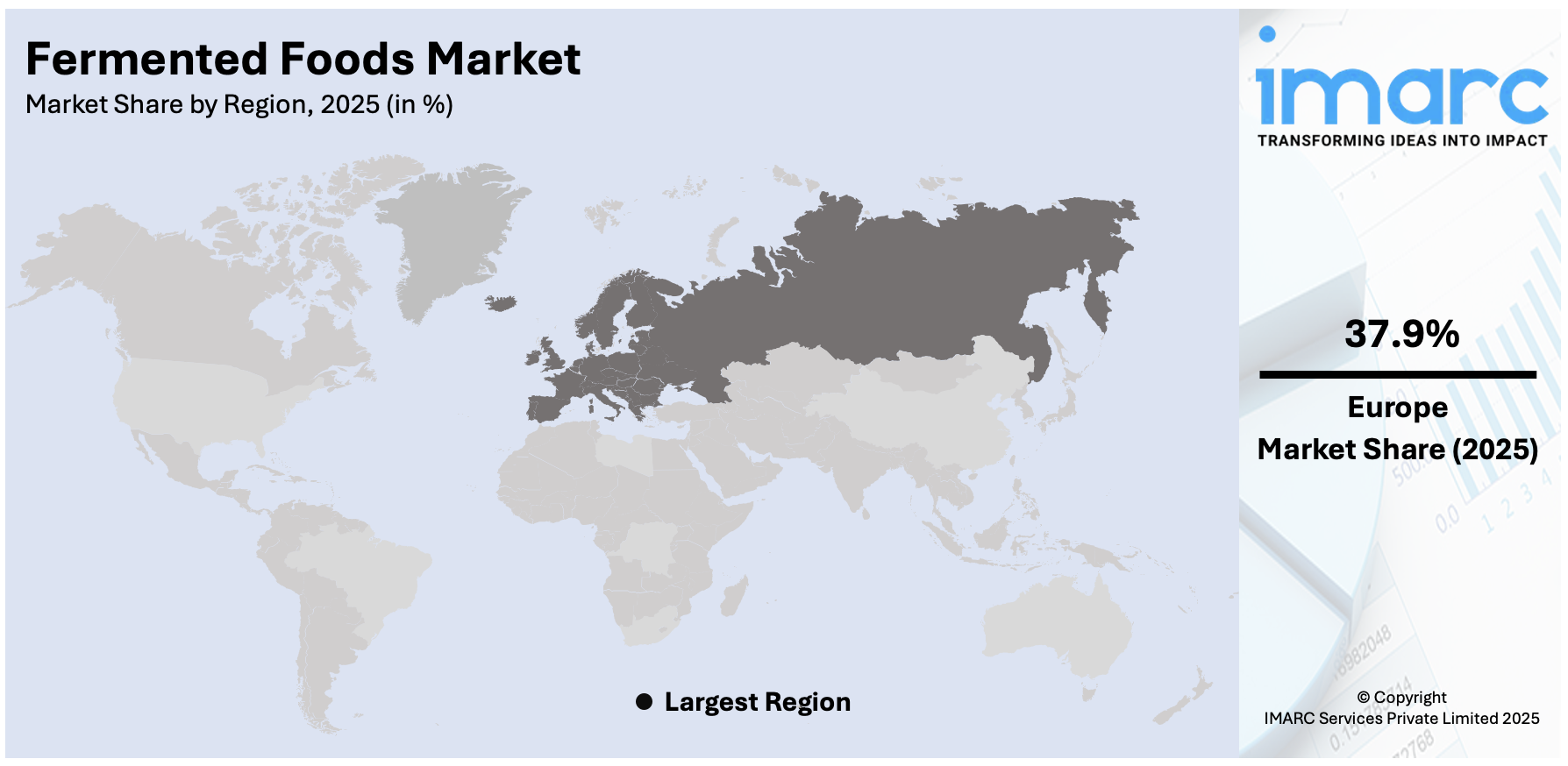

The global fermented foods market size was valued at USD 255.2 Billion in 2025. The market is projected to reach USD 389.7 Billion by 2034, exhibiting a CAGR of 4.67% from 2026-2034. Europe currently dominates the market, holding a market share of over 37.9% in 2025. The market is driven by accelerating consumer demand for probiotic-rich, naturally preserved foods. Traditional dairy-based foods continue to be in favor, as plant-based and innovative beverages tap into new consumers. Demand is underpinned by increasing awareness of digestive health, clean-label attitudes, and artisanal flavors. Retail and foodservice channels are increasing variety and quality, positioning fermented foods as a regular choice for health-focused consumers, ultimately leading to a more robust fermented foods market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 255.2 Billion |

|

Market Forecast in 2034

|

USD 389.7 Billion |

| Market Growth Rate 2026-2034 | 4.67% |

The global fermented foods market is experiencing significant growth due to the rapid expansion of functional food consumption worldwide. Consumers are highly seeking products that deliver added health benefits beyond basic nutrition, with fermented foods gaining attention for their positive effects on digestive health, immunity, and nutrient absorption. The increasing incidence of lifestyle disorders has prompted people to include probiotic-packed and nutrition-rich foods, including fermented dairy, plant-based yogurt, kimchi, and sauerkraut, in their daily diets. Urbanization and globalization of cuisines have also increased consumer knowledge and acceptability of various types of fermented foods. Greater retail presence and consumption of these foods, aided by specific awareness campaigns on gut health, are driving market growth. For instance, in August 2025, Fermented Food Holdings added Bubbies and Wildbrine's five new SKUs in U.S. Whole Foods Market, solidifying leadership in the fermented foods category, which is expanding. Furthermore, this ongoing interest in healthy and functional foods, assisted by developments in production technologies, is likely to drive the demand for fermented food products in various regions in the years ahead.

To get more information on this market Request Sample

In the United States, the market for fermented foods is propelled by growing consumers' interest in gut-health-focused diets, which represented 86.60% of the market share in 2024. As per the sources, in March 2025, Vivici introduced Vivitein™ BLG, precision-fermented, animal-free dairy protein, in U.S. active nutrition, to deliver next-generation high-quality protein products with sustainability advantages and enhanced functionality. Moreover, growing awareness of the importance of gut microbiota for overall health has prompted the use of fermented products high in probiotics and bioactive compounds. Health-aware consumers are incorporating foods like kefir, miso, kombucha, and cultured veggies into their daily lives to nurture digestion, immunity, and metabolic well-being. The movement is also driven by the increasing number of nutrition experts prescribing fermented foods as part of preventive care measures. The demand for functional beverages and plant-based beverages has also spurred innovation in the category, bringing fermented products more within the reach of consumers through retail stores, farmers' markets, and direct-to-consumer channels. As consumers become highly concerned with wellness and diet balance, demand for fermented foods in America is also expected to grow over the next few years.

Fermented Foods Market Trends:

Increased Consumer Health Consciousness

Growing consumer health awareness is becoming one of the most significant fermented foods market trends, driving global consumption. Fermented foods, which are high in probiotics, omega-3 fatty acids, and beneficial enzymes, are highly prized for promoting digestive health, immunity, and overall wellness. In the United States, 50% of consumers make a conscious effort to eat healthily, and 62% see healthfulness as an important influence in food and beverage buying. This amplified sensitivity is in keeping with the general movement toward functional foods that do more than provide ordinary nutrition. Foods like yogurt, kefir, kimchi, and sauerkraut are in high demand because they contain all-natural ingredients and are seen as having medicinal uses. Additionally, increased realization about gut microbiome health has promoted daily intake of probiotic options. As this wellness focus intensifies, health-conscious eating habits are expected to continue their growth, driving long-term expansion and innovation in the global fermented foods market.

Demand for Natural, Organic, and Clean-Label Foods

Consumer demand for natural, organic, and clean-label foods is heavily driving demand for fermented foods. These foods frequently contain bio-preservatives and are processed little, reflecting current diet expectations. The Research Institute of Organic Agriculture (FiBL) states that worldwide sales of organic food and beverage products totaled almost €135 billion in 2022, illustrating high demand for chemical-free and sustainable products. Fermented foods answer these demands by presenting a healthy profile without synthetic additives, thus pleasing health-oriented and eco-conscious consumers. Moreover, the link between fermented foods and traditional or artisanal preparation processes contributes to authenticity and confidence in their market value. Clean label further promotes honest ingredient sourcing, strongly appealing to purchasers who look for traceable supply chains. As this preference heightens, naturally produced, organically certified fermented food markets will grow significantly in the following years.

Innovation and Growth in Vegan and Functional Fermented Products

The increasing use of plant-based diets presents new market opportunities for vegan fermented foods. Foods such as tempeh, a vegetable protein substitute, have nutritional profiles equivalent to meat, appealing to flexitarians as well as vegans. The World Animal Foundation estimates that 1–2% of the world's population, which equates to about 88 million people, adhere to a vegan diet, further boosting demand. In addition to plant-based technologies, functional fermented drinks like probiotic milk beverages and kombucha tea are building market share on their perceived benefits to the digestive system and immune system. At the same time, governments around the globe are instituting safety measures to provide control of quality and maintain the functional integrity of fermented foods. Improved fermentation technology is further allowing manufacturers to create offerings with better taste, longer shelf life, and nutritional upgrade. These technologies are likely to be the key factors defining the competitive dynamics of the global market for fermented foods in the years to come.

Fermented Foods Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global fermented foods market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on food type, ingredient type, fermentation process, and distribution channel.

Analysis by Food Type:

- Fermented Dairy Products

- Fermented Beverages

- Fermented Confectionery and Bakery Products

- Fermented Vegetables

- Others

Fermented dairy products, including yogurt, kefir, and buttermilk, remain a staple in global diets due to their probiotic benefits, nutrient density, and versatile applications. Growing consumer focus on gut health and functional foods is driving demand, supported by both traditional and innovative fermentation methods across diverse regional markets.

Fermented drinks, including kombucha, kefir beverages, and classic brews, are becoming popular due to their probiotic content, detoxifying effects, and distinct flavors. Heightened health awareness, along with diversification and premiumization, is fueling their popularity among consumers in search of functional hydration and natural substitutes for sugar-rich drinks.

Fermented bakery and confectionery items, such as sourdough bread, fermented chocolates, and traditional pastries, are valued for their unique flavor, enhanced digestibility, and craft heritage. Growing need for clean-label products and historical methods of preparation is driving market growth, as fermentation is equal to authenticity, quality, and improved sensory experience.

Fermented vegetables like kimchi, sauerkraut, and pickles are experiencing high demand due to their probiotic benefits, extended shelf life, and variety of flavor profiles. Consumers are embracing them for gut health, while international food trends are incorporating these foods as part of the normal dining pattern, breaking from conventional cuisines to mainstream eating habits.

The "others" segment includes fermented soy foods, condiments, and plant-based innovations like miso, tempeh, and fermented hot sauces. Vegetarian and vegan-oriented, these products provide health benefits as well as cultural authenticity. Increased product innovation and availability in stores are driving wider global acceptance and steady market growth.

Analysis by Ingredient Type:

- Amino Acids

- Organic Acid

- Vitamins

- Industrial Enzymes

- Others

Amino acids hold a prominent place in the world fermentation industry because of their widespread uses in food, pharmaceuticals, and nutraceuticals. Manufactured through microbial fermentation, they provide higher purity, quality consistency, and environmentally friendly sources compared to traditional extraction methods. Of the most commercially relevant are lysine, glutamic acid, and tryptophan, used for purposes from flavor enhancement to critical supplementation in human and animal nutrition. The increase in protein-fortified diets, combined with the mounting demand for specialty clinical nutrition, has fueled demand. Advances in strain engineering, precision fermentation, and process optimization enhanced yield efficiency and lowered production costs, enabling more widespread adoption across industries. Amino acids are also of prime importance in sports nutrition, weight management products, and metabolic disorder therapeutic treatment. The pairing of health-aware consumer demand, the widening scope of functional food segments, and replicable industrial manufacturing solidifies amino acids as a core growth segment within the global fermentation industry.

Analysis by Fermentation Process:

- Batch Fermentation

- Continuous Fermentation

- Aerobic Fermentation

- Anaerobic Fermentation

Batch fermentation continues to be a prevalent process in the fermentation industry, appreciated for its convenience, scalability, and capacity to yield high-quality products across food, beverage, pharmaceutical, and industrial applications. This technique entails the growth of microorganisms in a closed system with a constant volume of nutrients, which allows exact control over the growth conditions, product formation, and risk of contamination. It is especially ideal for antibiotic, enzyme, amino acid, and fermented food production where process consistency and product purity are paramount. Batch fermentation provides operational flexibility in the sense that adjustments between production batches can be made to fit different products and formulas. Even though it takes downtime for preparation and cleaning, its versatility and dependability make it very appropriate for large-scale production as well as specialty product design. Advances in technology, including automated surveillance and optimized reactor design, have made it even more efficient and cost-effective, further marking its significance. As production demand increases for various, high-quality fermented products, batch fermentation remains an essential tool for addressing global production demands.

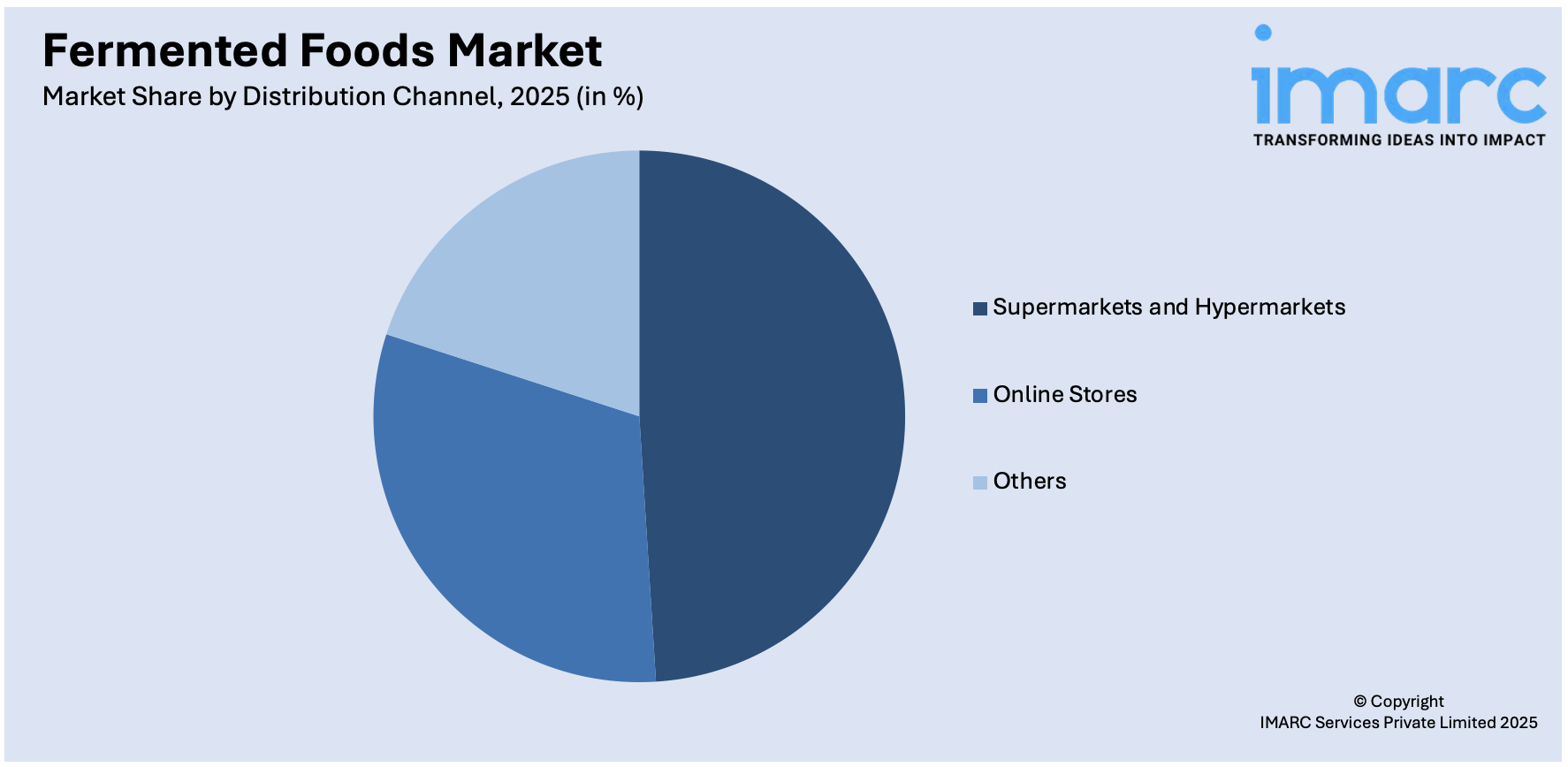

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Online Stores

- Others

The channel representing supermarkets and hypermarkets accounted for 48.4% share in 2025 of the fermented foods market outlook, indicating its supremacy as the main retail format for product availability and diversity. These big-box retail stores present consumers with the convenience of buying a wide variety of fermented foods—spanning dairy-derived yogurts to plant-based kimchi—under one roof. Increased shelf space for refrigerated and health-oriented product departments in supermarkets has made fermented foods more visible and available to more consumers. Promotions, in-store tastings, and health-focused product placement have also fueled trial and repeat use. Additionally, supermarkets offer competitive prices and frequent discounts to the mainstream consumer, which makes fermented foods more accessible to them. The addition of private-label fermented food products has also boosted consumer confidence and loyalty. As the practice of health-conscious buying becomes stronger, supermarkets and hypermarkets continue to be the consumers' first choice for both conventional and novel fermented foods, continuing their leadership in the global market.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Others

According to fermented foods market analysis, Europe had 37.9% market share in 2025 of the global fermented foods industry, driven by traditional culinary practices and high consumer preference for probiotic-rich diets. Germany, France, and Italy are among countries that traditionally have had consumption of fermented staples such as sauerkraut, kefir, yogurt, and long-aged cheeses, creating stable demand. The consumer culture in Europe prioritizes quality, origin, and authenticity, so artisanal and region-specific fermented food and beverage products are extremely sought after. Besides, the region has experienced a growth in consumption of functional foods, promoted by increased consciousness of gut health and immunity. Regulation encouragement of health claims, in addition to EU-wide standards for labeling and food safety, has reinforced consumer confidence in fermented products. Retail and specialty store networks in Europe offer extended access to traditional and innovative products, ranging from craft kombucha to plant-based cheese alternatives. This intersection of cultural heritage, health consciousness, and product innovation makes Europe a growth center for the international fermented foods industry.

Key Regional Takeaways:

North America Fermented Foods Market Analysis

The North America fermented foods market growth is witnessing significant growth due to changing consumer tastes in favor of health-oriented and functional foods. Fermented foods are becoming more desirable for their inherent probiotic value, perceived gut health benefits, and role in overall health. Legacy classes like yogurt, kefir, and sauerkraut remain firm favorites, but newer products like kombucha, plant-based fermented competitors, and handcrafted pickled vegetables are picking up speed. Heightening demand for clean-label, minimally processed foods has further boosted the attractiveness of fermentation, as the process is linked to natural preservation and true flavors. Foodservice providers and retailers are increasing offerings to meet this rising interest, with a specific focus on premium quality and variety. Cultural trends, combined with enhanced consumer knowledge about gut health, are driving consumption patterns throughout the region, supporting the role of fermented foods as a core feature of contemporary North American diets.

United States Fermented Foods Market Analysis

The United States fermented foods market is primarily driven by growing health consciousness among consumers, which is boosting interest in foods that support gut wellness and immune function. This is leading individuals to increasingly seek out traditional fermented items such as yoghurt, kombucha, kimchi, sauerkraut, miso, and kefir. This trend is complemented by a broader wellness mindset favoring clean-label, minimally processed foods with live cultures. The growing demand for plant-based and vegan alternatives is also supporting market growth as consumers seek nutritious, dairy-free, and environmentally friendly food options. For instance, according to the World Animal Foundation, approximately 4% of the population of the United States follows vegan diets. Moreover, sales of plant-based food in the U.S. grew by 6.6% in 2022. Fermented plant-based products, such as non-dairy yoghurts, tempeh, and cultured nut cheeses, are also gaining popularity among health-conscious and environmentally aware shoppers. Additionally, culinary curiosity and adventurous eating habits are boosting demand for ethnic and artisanal fermented products that offer bold flavors and cultural authenticity. Retailers and foodservice outlets are responding by stocking more premium and innovative offerings, including probiotic shots, craft fermented beverages, and exotic jarred ferments. Food manufacturers are also investing in new product lines and convenient packaging to appeal to busy consumers seeking functional foods.

Asia Pacific Fermented Foods Market Analysis

The Asia Pacific fermented foods market is expanding due to a resurgence of cultural pride and culinary nostalgia, as younger generations rediscover time-honored regional staples such as kimchi, dosa batter, natto, and pickled vegetables. At the same time, urban consumers are increasingly gravitating toward modernized formats, such as bottled kombucha, coconut kefir, and fermented fruit beverages, that blend tradition with convenience. Health-conscious shoppers are also drawn to fermented products for their probiotic benefits, digestive support, and flavor diversity. Meanwhile, rising disposable incomes and food innovations are encouraging the trial of premium and imported ferments. Additionally, expanding e‑commerce and social media influences are fueling a wave of DIY fermentation kits and influencer‑led tutorials, making home fermentation more accessible across the region. For instance, the e-commerce sector in India is projected to reach USD 345 Billion by FY 2030, recording a significant increase in comparison to FY 2024 at USD 125 Billion, as per the India Brand Equity Foundation (IBEF).

Europe Fermented Foods Market Analysis

The growth of the Europe fermented foods market is largely propelled by a sophisticated consumer base that blends culinary heritage with modern health awareness. Consumers are increasingly drawn to artisanal and traditional ferments such as kefir, pickles, and regional cheeses, which celebrate local ingredients and age‑old recipes. Parallel to this, there is a growing interest in functional foods that support gut microbiome balance, energy, and overall wellness, leading shoppers to embrace probiotic and fermented beverage formats. Sustainability is also significantly influencing consumer preferences as fermentation is increasingly being seen as a climate-friendly preservation method, reducing waste and extending the shelf life of seasonal produce. The rising popularity of plant-based and vegan diets is further fueling demand for fermented alternatives, such as dairy-free yoghurts and vegan kimchi. For instance, 5% of the population of Austria follows vegan diets, as per a 2021 survey. Additionally, in 2024, the French market for five categories of plant-based foods reached €537 Million, recording a growth of 8.8% in comparison to 2023 and 20.5% in comparison to 2022, according to the Good Food Institute (GFI) Europe. Other than this, retailers and online platforms are broadening distribution, making premium and exotic fermented options more accessible across urban and rural areas.

Latin America Fermented Foods Market Analysis

The Latin America fermented foods market is significantly influenced by increasing consumer interest in healthy and minimally processed foods that align with clean-label preferences. For instance, Brazil is the fifth most significant market globally for healthy foods, growing at an annual rate of 20% in comparison to the global average of 8%. Consumers are becoming more mindful of ingredient transparency, prompting a shift toward fermented products with simple, recognizable components. Rising awareness about digestive health and immune support is also driving demand for probiotic-rich items, such as kombucha, kefir, and fermented dairy products. Moreover, the influence of global food trends is inspiring local adaptation of international ferments, blending them with native ingredients to suit regional palates.

Middle East and Africa Fermented Foods Market Analysis

The Middle East and Africa fermented foods market is experiencing robust growth due to a dynamic mixture of regional heritage and modern demands. Consumers are increasingly embracing age‑old traditional ferments, such as laban, labneh, injera, and pickled vegetables, often rediscovered through cultural revival campaigns and a sense of local pride. Entrepreneurs are also introducing innovative twists, such as spiced kombucha and artisanal kefir, blending local flavors to cater to evolving modern palates. Moreover, the expansion of modern retail and online grocery platforms is increasing access to premium fermented products across both urban centers and secondary cities. According to a report by the IMARC Group, the online grocery market in the Middle East reached USD 50.0 Billion in 2024 and is projected to grow at a CAGR of 23.23% from 2025-2033. Other than this, cooking shows and nutrition influencers are raising awareness about home fermentation as a sustainable practice, further facilitating industry expansion.

Competitive Landscape:

The competitive dynamics of the fermented foods industry are defined by the diversified portfolios of international and regional manufacturers emphasizing product differentiation, innovation, and building out distribution channels to consolidate their market position. Firms are investing more in research to develop new variants of products with greater nutritional value, different taste, and extended shelf life, keeping pace with the growing consumer demand for health-focused and functional foods. Furthermore, sustainable raw material sourcing and the use of sophisticated fermentation processes are emerging as strategic imperatives. The fermented foods market forecast shows consistent growth driven by growing consumer knowledge of the health effects of probiotics and naturally preserved foods. Marketing trends are also moving towards emphasizing clean labels, transparency, and authenticity in a bid to attract health-conscious consumers. In addition, partnerships with retailers and extension to e-commerce platforms are facilitating wider access, further bolstering the industry's growth trend in both developed economies and emerging economies.

The report provides a comprehensive analysis of the competitive landscape in the fermented foods market with detailed profiles of all major companies, including:

- Ajinomoto Co. Inc.

- Angel Yeast Co. Ltd.

- Archer Daniels Midland Company

- Cargill Incorporated.

- Chr. Hansen Holding A/S

- Conagra Brands Inc.

- Danone

- Dohler GmbH

- General Mills Inc.

- Kerry Group PLC

- KeVita Inc (PepsiCo Inc.)

- Koninklijke DSM N.V.

- Lallemand Inc.

- Mars Incorporated

- Meiji Holdings Co. Ltd.

- Mondelez International

- Nestlé S.A.

- Royal FrieslandCampina N.V.

Latest News and Developments:

- July 2025: Lifeway Foods, Inc., a distributor of fermented probiotic products in the United States, reported a significant accomplishment of exceeding USD 5.5 Million in gross sales for the week ending July 13, 2025. This represents a growth of 66% in comparison to the previous year.

- July 2025: Yumame Foods established a partnership with Le Patron for the development of plant-based food products using innovative fermentation technologies. With this collaboration, the two businesses intend to actively support the shift to a plant-based food system that is prepared for the future.

- June 2025: Corbion officially joined the Ferment4Health Project in order to further explore the benefits of fermented foods for intestinal health. This public-private research project intends to investigate how postbiotics and fermented foods can enhance intestinal health and lessen long-term low-grade inflammation.

- June 2025: Cleveland Kitchen introduced new fermented food products in an effort to significantly expand its product range. The new launch includes Pickle Bites, Hot Honey Jalapeños, and a new range of Everything Sauces.

- April 2025: Moolec Science announced plans to merge with three businesses, the precision fermentation company Nutrecon, Argentina-based Bioceres Group, and Gentle Tech, a manufacturer of farming equipment, in a Business Corporation Agreement. With this transaction, Moolec will serve as the controlling entity of these firms and issue up to 87 Million additional shares and 5 Million warrants to its stakeholders. The transaction is expected to be completed by Q2 2025.

Fermented Foods Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Food Types Covered | Fermented Dairy Products, Fermented Beverages, Fermented Confectionery and Bakery Products, Fermented Vegetables, Others |

| Ingredient Types Covered | Amino Acids, Organic Acid, Vitamins, Industrial Enzymes, Others |

| Fermentation Processes Covered | Batch Fermentation, Continuous Fermentation, Aerobic Fermentation, Anaerobic Fermentation |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Online Stores, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Turkey, Saudi Arabia |

| Companies Covered | Ajinomoto Co. Inc., Angel Yeast Co. Ltd., Archer Daniels Midland Company, Cargill Incorporated., Chr. Hansen Holding A/S, Conagra Brands Inc., Danone, Dohler GmbH, General Mills Inc., Kerry Group plc, KeVita Inc (PepsiCo Inc.), Koninklijke DSM N.V., Lallemand Inc., Mars Incorporated, Meiji Holdings Co. Ltd., Mondelez International, Nestlé S.A. and Royal FrieslandCampina N.V. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the fermented foods market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global fermented foods market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the fermented foods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fermented foods market was valued at USD 255.2 Billion in 2025.

The fermented foods market is projected to exhibit a CAGR of 4.67% during 2026-2034, reaching a value of USD 389.7 Billion by 2034.

The market is registering robust growth because of heightening awareness of digestive health, probiotic benefits, and demand for natural, minimally processed foods. Consumer adoption of functional diets, along with product innovation in taste, texture, and nutrient profile, is further fueling consumer interest and underpinning the favorable fermented foods market outlook globally.

Europe currently dominates the fermented foods market, accounting for a share of 37.9%. It is because of the cultural historical practice of fermented foods, health-consciousness, and the desire to pay a premium for probiotic foods. The region enjoys the diversity of products available and ongoing innovations, further solidifying its position at the top of the global market.

Some of the major players in the fermented foods market include Ajinomoto Co. Inc., Angel Yeast Co. Ltd., Archer Daniels Midland Company, Cargill Incorporated., Chr. Hansen Holding A/S, Conagra Brands Inc., Danone, Dohler GmbH, General Mills Inc., Kerry Group plc, KeVita Inc (PepsiCo Inc.), Koninklijke DSM N.V., Lallemand Inc., Mars Incorporated, Meiji Holdings Co. Ltd., Mondelez International, Nestlé S.A., Royal FrieslandCampina N.V., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)