Fertility Test Market Size, Share, Trends, and Forecast by Product, Mode of Purchase, Application, End User, and Region, 2025-2033

Fertility Test Market Size and Share:

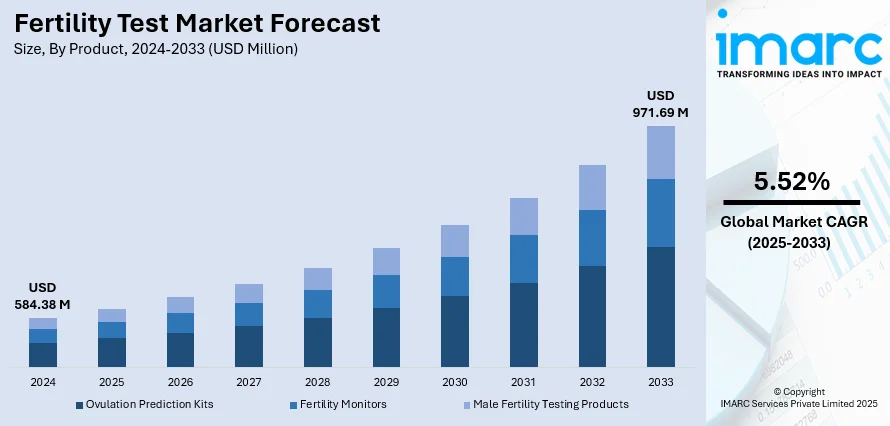

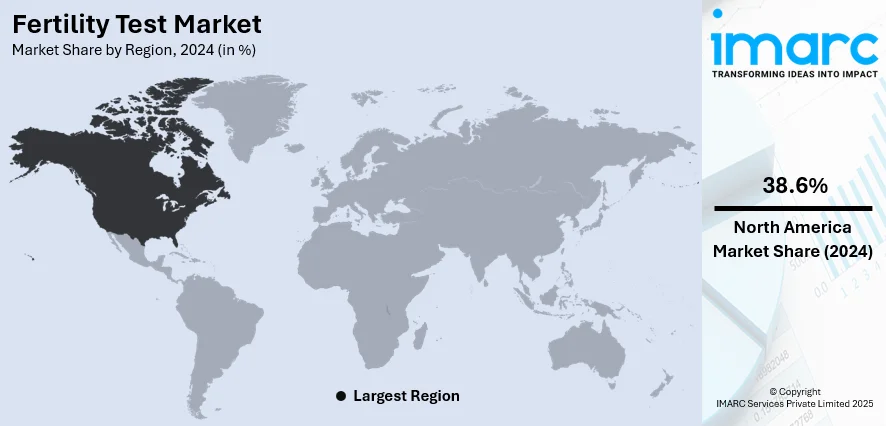

The global fertility test market size was valued at USD 584.38 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 971.69 Million by 2033, exhibiting a CAGR of 5.52% during 2025-2033. North America currently dominates the market, holding a significant market share of 38.6% in 2024. The market is expanding as awareness about reproductive health rises and demand for early diagnosis and home-based testing grows. Technological advancements in ovulation prediction kits, digital devices, and mobile-connected solutions are enhancing accuracy and convenience. Increasing emphasis on family planning and accessible healthcare services continues to drive adoption, strengthening the fertility test market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 584.38 Million |

| Market Forecast in 2033 | USD 971.69 Million |

| Market Growth Rate (2025-2033) | 5.52% |

The market is driven by multiple factors that reflect changing lifestyle patterns, medical needs, and technological progress. Rising infertility rates due to obesity, stress, sedentary lifestyles, and dietary changes have increased demand for reliable fertility testing solutions. The high prevalence of polycystic ovary syndrome (PCOS), which affects an estimated 6–13% of reproductive-aged women globally, further contributes to market growth. Growing public awareness about reproductive health and the benefits of early fertility testing has encouraged adoption, particularly of home-based and over-the-counter kits. Technological advancements, including AI-powered sperm analysis, digital fertility monitors, and connected mobile applications, are enhancing accuracy and convenience. Moreover, increasing investments in research and development (R&D) by key players are fostering innovative product launches and accessibility.

To get more information on this market, Request Sample

The fertility test market growth in the United States is driven by rising infertility rates linked to lifestyle factors such as stress, obesity, sedentary habits, and delayed parenthood. A growing prevalence of polycystic ovary syndrome (PCOS), one of the leading causes of infertility among women, further fuels demand for reliable testing solutions. Increasing awareness of reproductive health and greater acceptance of home-based, over-the-counter fertility kits have made testing more accessible and convenient. Technological advancements, including AI-enabled sperm analysis, digital ovulation kits, and fertility tracking apps, are improving accuracy and user experience. Strong healthcare infrastructure, coupled with high healthcare expenditure and active research and development (R&D) investments by leading companies, also supports innovation and adoption, strengthening the market growth in the country. For instance, in December 2023, reproductive technology startup Orchid introduced an advanced genetic testing solution aimed at supporting prospective parents across the US. The company unveiled the first commercially available whole genome sequencing report for embryos, specifically developed for couples undergoing in vitro fertilization to address infertility or potential hereditary risks.

Fertility Test Market Trends:

Rising Prevalence of PCOS and Infertility Rates

The growing prevalence of diseases such as polycystic ovary syndrome (PCOS), caused by the overproduction of estrogen by the ovaries, is a major factor driving the fertility test market. According to the World Health Organization (WHO), PCOS affects an estimated 6–13% of reproductive-aged women, making it one of the most common endocrine disorders among women. Alongside this, infertility rates are rising globally due to lifestyle changes, stress, obesity, and poor dietary patterns. The National Library of Medicine reports that 8%–12% of reproductive-aged couples worldwide experience difficulties conceiving, making infertility a significant public health concern and increasing the demand for early, accurate fertility testing solutions.

Growing Awareness and Technological Advancements

The increasing awareness among the masses about the benefits of fertility testing is boosting the fertility test market trends. Individuals are more proactive about reproductive health, creating greater demand for ovulation kits, pregnancy tests, and fertility monitors. At the same time, the introduction of technologically advanced products is positively influencing adoption. Companies are launching devices with digital interfaces, mobile connectivity, and centralized fertility tracking to improve user experience. The growing demand for easy-to-use monitors with high accuracy further strengthens this trend. These innovations not only make fertility testing more accessible but also enhance reliability, thereby encouraging more consumers to integrate such products into their family planning journeys. For instance, in August 2023, Trajan Scientific and Medical supplied its CE-IVD registered Mitra® devices to Fertilly, a German startup that introduced Europe’s first at-home fertility testing kits. These kits, which use VAMS® technology for dried blood microsampling, are medically certified and now accessible to consumers across Europe.

Investments, AI Integration, and Healthcare Growth

The extensive investment by key players in research and development (R&D) is providing new opportunities in the fertility test market. Companies are innovating pregnancy and ovulation kits designed to centralize fertility-related data and provide comprehensive insights. In addition, the integration of artificial intelligence (AI) in sperm analysis is emerging as a transformative factor, improving accuracy and efficiency in fertility evaluations. For instance, in August 2025, researchers from the Li Ka Shing Faculty of Medicine at the University of Hong Kong (HKUMed) developed a groundbreaking artificial intelligence model capable of detecting human sperm with fertilization potential. The system demonstrated exceptional performance, reaching an accuracy level exceeding 96 percent. Alongside these technological advances, the rapid growth of the global healthcare industry is creating supportive infrastructure and wider product accessibility. Together, these elements are not only driving market expansion but also opening lucrative opportunities for investors seeking to leverage innovation and meet the increasing global demand for fertility testing solutions.

Fertility Test Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global fertility test market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, mode of purchase, application, and end user.

Analysis by Product:

- Ovulation Prediction Kits

- Fertility Monitors

- Male Fertility Testing Products

Ovulation prediction kits stand as the largest product in 2024, holding 43.8% of the market due to their widespread accessibility, ease of use, and high accuracy in detecting fertile windows. These kits provide quick results at home, empowering women to track ovulation without clinical intervention, which makes them highly convenient and cost-effective. Rising infertility issues and conditions like polycystic ovary syndrome (PCOS) have further increased reliance on such tools for effective family planning. Growing awareness about reproductive health, coupled with the availability of both digital and traditional test formats, has expanded their adoption globally. Additionally, frequent product innovations with advanced features, including smartphone connectivity and improved sensitivity, continue to strengthen their dominance in the fertility test market.

Analysis by Mode of Purchase:

- OTC-based

- Prescription-based

OTC-based leads the market with 68.7% of market share in 2024 because they offer affordability, convenience, and immediate accessibility without requiring medical prescriptions. Consumers increasingly prefer at-home solutions for privacy and ease, especially when tracking ovulation or confirming pregnancy. The availability of a wide range of products, from ovulation prediction kits to digital fertility monitors, in pharmacies, supermarkets, and online platforms further enhances their reach. Growing awareness about reproductive health, coupled with lifestyle-driven fertility challenges, has accelerated their adoption worldwide. Moreover, frequent advancements in accuracy, user-friendly designs, and smartphone connectivity make OTC products more reliable. These factors, combined with rising demand for self-care solutions, solidify OTC-based tests as the leading category in the market.

Analysis by Application:

- Female Fertility Testing

- Male Fertility Testing

Female fertility testing leads the market with 83.7% of market share in 2024, as infertility concerns are more commonly addressed in women, with conditions such as polycystic ovary syndrome (PCOS), endometriosis, and hormonal imbalances significantly affecting reproductive health. A wide variety of female-focused fertility products, including ovulation prediction kits, digital monitors, and home-based hormone tests, make access easier and more affordable. Increasing awareness about reproductive health, combined with the rise in infertility rates caused by stress, obesity, and lifestyle changes, has further fueled demand. Continuous innovations and growing acceptance of self-testing strengthen the dominance of female fertility testing in the fertility test market outlook.

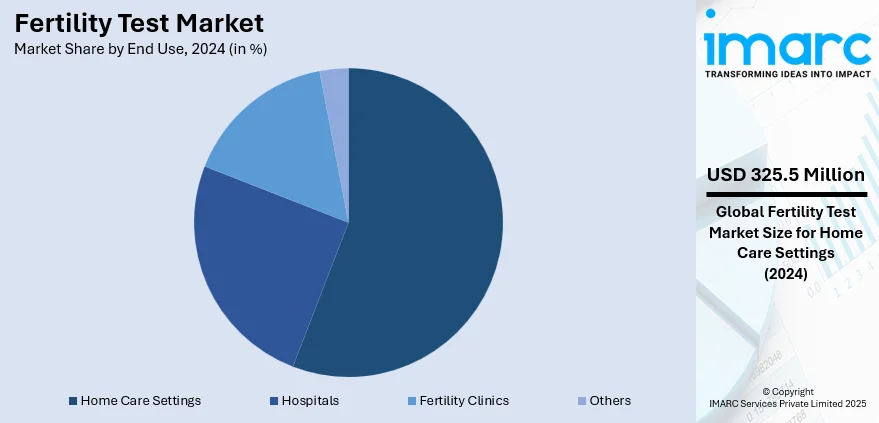

Analysis by End User:

- Hospitals

- Home Care Settings

- Fertility Clinics

- Others

Home care settings lead the market with 55.7% of market share in 2024 due to rising consumer preference for privacy, convenience, and cost-effectiveness. Many individuals and couples opt for at-home fertility tests to avoid frequent clinic visits and to monitor reproductive health discreetly. The availability of accurate and easy-to-use ovulation kits, pregnancy tests, and digital fertility monitors enhances adoption. Growing awareness of reproductive health, coupled with lifestyle-driven infertility challenges, has increased demand for home-based solutions. Additionally, e-commerce platforms and pharmacies provide widespread accessibility to these products, making them highly convenient. According to the fertility test market forecast, technological advancements, such as app-connected devices and AI-enabled monitoring, further improve accuracy and user experience. These factors collectively reinforce the dominance of home care settings in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 38.6%. The fertility test market demand in North America is driven by rising infertility rates linked to lifestyle changes, stress, obesity, and delayed family planning. A growing prevalence of conditions like polycystic ovary syndrome (PCOS) and hormonal disorders also contributes to the demand for advanced fertility solutions. Strong awareness of reproductive health, supported by educational campaigns and healthcare initiatives, encourages early diagnosis and testing. The region benefits from widespread availability of over-the-counter fertility products through pharmacies and online platforms, making them easily accessible. Moreover, technological advancements, including digital ovulation kits, connected fertility monitors, and AI-based sperm analysis, enhance accuracy and adoption. Significant investments in healthcare infrastructure and the strong presence of key market players further accelerate market growth in North America.

Key Regional Takeaways:

United States Fertility Test Market Analysis

In 2024, the United States accounted for 88.50% of the fertility test market in North America. The fertility test market in the United States is witnessing significant growth driven by increasing awareness of reproductive health among individuals across various age groups. Advancements in digital health technologies are enabling the integration of at-home fertility tracking tools with smartphone applications, which enhances user engagement and convenience. The Centers for Disease Control and Prevention (CDC) reports that around 19% of married women aged 15 to 49 without previous births face difficulties conceiving after one year of attempts, while approximately 26% in the same group encounter challenges with becoming pregnant or sustaining a pregnancy to term. This high prevalence of fertility challenges is pushing demand for accurate and accessible fertility monitoring solutions. The expanding availability of personalized testing options tailored to specific hormonal cycles further strengthens consumer preference. Additionally, insurance coverage for diagnostic services and the proliferation of health education platforms are helping normalize fertility discussions. The widespread adoption of e-commerce and direct-to-consumer testing kits is transforming distribution, while innovation in biomarker detection and predictive analytics enhances test reliability. As fertility awareness becomes an integral aspect of health-conscious living, the US market is poised for sustained expansion.

Europe Fertility Test Market Analysis

The fertility test market in Europe is expanding due to increasing public engagement with preventive health and diagnostic technologies. A growing inclination toward natural family planning methods is driving the use of ovulation and hormone tracking kits as non-invasive alternatives. According to the European Parliamentary Forum on Sexual and Reproductive Rights, 1 in 6 couples in Europe face infertility, equating to approximately 25 million individuals requiring diagnosis and treatment. This significant number of affected individuals is fostering broader acceptance of fertility monitoring tools. Societal shifts, such as an increase in same-sex couples and single-parent families pursuing fertility pathways, are enhancing demand. The integration of fertility assessments into wellness routines, like hormonal balance and menstrual tracking, is expanding the scope of use. Furthermore, strong institutional support for reproductive education in schools and clinics promotes early fertility awareness. Accessibility to over-the-counter test kits, along with normalized fertility discussions via digital media, is creating a more informed consumer base.

Asia Pacific Fertility Test Market Analysis

The Asia Pacific fertility test market is benefiting from demographic transitions marked by urbanization and evolving family planning preferences. The United Nations Population Fund (UNFPA) estimates that infertility affects approximately 27.5 million Indian couples, reflecting a pressing need for accessible fertility assessment tools across the region. Rising disposable income is enabling increased spending on personal wellness, including reproductive diagnostics. A significant surge in mobile health adoption supports fertility tracking apps that integrate with home test kits, particularly among younger populations. Shifting social attitudes toward delayed childbearing and smaller families are encouraging the use of fertility tests for proactive planning. Additionally, growing female workforce participation across the region is reinforcing structured health management. Cultural openness to discussing reproductive health, especially in urban centers, is improving visibility and acceptance. Strategic partnerships between diagnostic providers and retail pharmacies are enhancing availability, even in semi-urban regions.

Latin America Fertility Test Market Analysis

In Latin America, the fertility test market is experiencing growth fueled by rising awareness of reproductive health and a shift toward self-monitoring tools. According to FOLHA DE S.PAULO, Brazil’s fertility rate has reached the replacement level of 2.1 children per woman, marking a demographic shift toward smaller families. This change is influencing personal reproductive planning and boosting interest in fertility tracking solutions. Urbanization and growing digital access are driving consumer exploration of non-clinical fertility testing options. Health-focused social media content is playing a crucial role in educating younger generations about fertility cycles. Dual-income households are promoting lifestyle management, fertility tracking, and home diagnostic tools due to improved access, online retail channels, and cultural trends favoring holistic health solutions.

Middle East and Africa Fertility Test Market Analysis

The fertility test market in the Middle East and Africa is gradually expanding, supported by the region’s evolving health and technology landscape. Also, growing women in workforce is helping in driving demand for female-oriented health solutions, including fertility tracking tools. Saudi Vision 2030 reports that as of Q3 2024, the female labor participation rate in Saudi Arabia reached 36%, with women increasingly contributing to biotech and healthcare sectors. Rising smartphone usage and internet access are also enabling the use of fertility-related mobile applications and information platforms. There is growing interest in personalized wellness routines that integrate fertility self-assessment into broader health monitoring. Awareness campaigns and educational initiatives are reducing stigma and encouraging proactive testing, while at-home fertility kits are expanding access in underserved areas, predicting steady growth in adoption.

Competitive Landscape:

The fertility test market is highly competitive, with global and regional players focusing on innovation, product expansion, and technological integration. Key companies emphasize developing advanced ovulation prediction kits, digital fertility monitors, and app-connected devices to meet rising consumer demand for accuracy and convenience. Strategic partnerships, mergers, and acquisitions are common as players aim to expand distribution networks and strengthen global presence. Investments in research and development (R&D) focus on enhancing usability, integrating artificial intelligence in sperm analysis, and centralizing fertility data. Additionally, the growing shift toward home-based and over-the-counter testing drives competition in affordability and accessibility. Companies leveraging e-commerce platforms and digital marketing strategies are gaining a stronger foothold in the rapidly evolving market.

The report provides a comprehensive analysis of the competitive landscape in the global fertility test market with detailed profiles of all major companies, including:

- AdvaCare Pharma

- Babystart

- Church & Dwight Co., Inc.

- ExSeed Health

- Fairhaven Health

- LetsGetChecked

- Medical Electronic Systems

- Mira Fertility

- Modern Fertility

- Proov

- Quest Consumer Inc

Latest News and Developments:

- August 2025: Maven Clinic launched a Cycle Tracker and enhanced male fertility tools, giving members earlier insights into fertility. The app combined personalized tracking with expert guidance, while discreet at-home semen kits enabled men to test privately. These innovations reduced barriers, improved accessibility, and supported families in conceiving naturally and cost-effectively.

- February 2025: Sonora Quest Laboratories introduced an at-home male fertility test in Arizona, offering results within 30 minutes on five key sperm quality factors. Costing $99, the kit arrived by mail and included app-based results, personalized recommendations, and physician-sharing options, providing men convenient access to fertility insights without a doctor’s order.

- August 2025: Nova IVF Fertility announced the integration of Artificial Intelligence (AI) into its IVF labs to bring in greater precision and trust to embryo selection, an extremely crucial element of fertility treatment. Vita Embryo, an artificial intelligence-powered tool for embryo evaluation, is set to be adopted by the fertility chain across 120 clinics spanning 65 cities. This implementation aims to enhance precision in embryo selection and improve outcomes in assisted reproductive treatments.

- April 2025: The Wyatt Foundation and Conceive Fertility Foundation launched a grant program offering $15,000 each to five individuals for IVF treatment. Announced during National Infertility Awareness Week, the program aimed to reduce financial barriers and was supported by CooperSurgical, which contributed an extra $1,000 per recipient for genetic testing.

- March 2025: UniHealth launched an advanced IVF and fertility clinic at UMC Victoria Hospital in Uganda. Equipped with state-of-the-art reproductive technology, the initiative addressed the country’s infertility crisis and reversed outbound medical tourism by enabling access to high-quality treatment locally. It is also committed to specialised training and expanding regional healthcare capacity.

Fertility Test Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Ovulation Prediction Kits, Fertility Monitors, Male Fertility Testing Products |

| Mode of Purchases Covered | OTC-based, Prescription-based |

| Applications Covered | Female Fertility Testing, Male Fertility Testing |

| End Users Covered | Hospitals, Home Care Settings, Fertility Clinics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AdvaCare Pharma, Babystart, Church & Dwight Co., Inc., ExSeed Health, Fairhaven Health, LetsGetChecked, Medical Electronic Systems, Mira Fertility, Modern Fertility, Proov, Quest Consumer Inc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the fertility test market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global fertility test market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the fertility test industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fertility test market was valued at USD 584.38 Million in 2024.

The fertility test market is projected to exhibit a CAGR of 5.52% during 2025-2033, reaching a value of USD 971.69 Million by 2033.

The fertility test market is driven by rising infertility rates linked to lifestyle changes, obesity, and stress, along with increasing cases of polycystic ovary syndrome (PCOS). Growing awareness about reproductive health, demand for home-based testing kits, and advancements in digital and AI-powered fertility monitoring further boost market growth.

North America currently dominates the fertility test market due to rising infertility rates, growing prevalence of PCOS, advanced healthcare infrastructure, strong adoption of digital and home-based fertility kits, and increasing awareness of reproductive health supported by continuous technological innovations.

Some of the major players in the fertility test market include AdvaCare Pharma, Babystart, Church & Dwight Co., Inc., ExSeed Health, Fairhaven Health, LetsGetChecked, Medical Electronic Systems, Mira Fertility, Modern Fertility, Proov, Quest Consumer Inc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)