Fertilizer Additives Market Size, Share, Trends and Forecast by Function, Form, Application, and Region, 2025-2033

Fertilizer Additives Market Size and Trends:

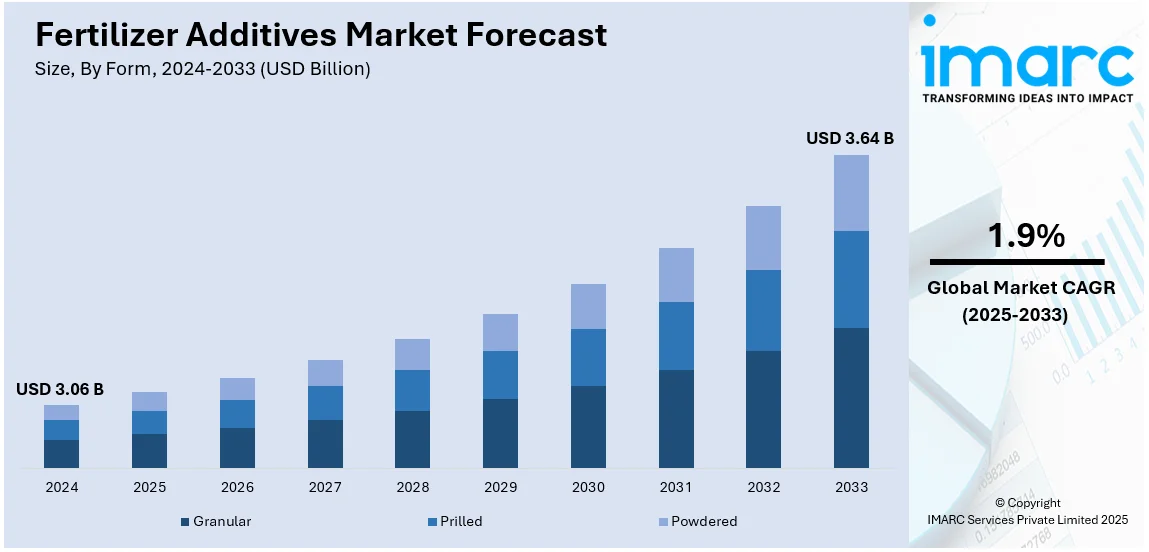

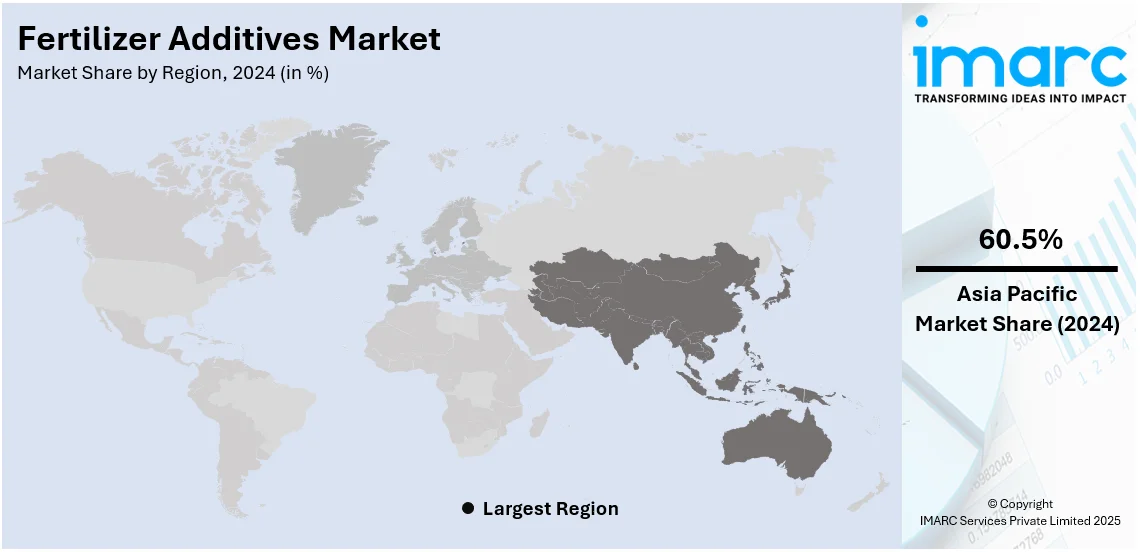

The global fertilizer additives market size was valued at USD 3.06 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.64 Billion by 2033, exhibiting a CAGR of 1.9% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 60.5% in 2024. The increasing awareness among individuals towards soil deterioration caused by conventional agricultural practices is primarily augmenting the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.06 Billion |

|

Market Forecast in 2033

|

USD 3.64 Billion |

| Market Growth Rate 2025-2033 | 1.9% |

The fertilizer additives market is driven by increasing demand for high-efficiency fertilizers to enhance global agricultural productivity. Growing awareness of sustainable farming practices is augmenting the adoption of additives that improve nutrient availability while reducing environmental impact. The rise of advanced irrigation systems and precision agriculture is further amplifying the need for customized additives. Government initiatives promoting efficient agricultural inputs are also playing a crucial role in market expansion. For instance, India’s Union government launched 109 high-yielding, climate-resilient crop varieties and allocated ₹1.52 lakh crore for agriculture in 2024-25, supporting research and development (R&D) to create innovative additives for climate resilience and improved crop yields.

The United States fertilizer additives market is driven by the demand for efficient agricultural inputs to enhance crop yields and address soil health challenges. The rise of large-scale farming and advanced technologies such as precision agriculture is increasing the need for high-performance additives. Government programs as well as private investments promoting sustainability and awareness regarding the economic benefits of reducing fertilizer waste drive adoption of additives that improve stability and efficiency. On December 13, 2023, Chipotle’s Cultivate Next fund invested in Greenfield Robotics and Nitricity. Greenfield, based in Kansas, develops robots to reduce herbicide use and support regenerative farming, while Nitricity, an American agtech startup revolutionizing nitrogen fertilizer production, creates low-emission fertilizers using artificial lightning. These investments align with the need for sustainable agriculture while minimizing environmental impacts.

Fertilizer Additives Market Trends:

Advanced Nutrient Management Technologies

According to an industrial report, the global fertilizer market was valued at USD 197 Billion in 2022 rising by 2.5% to USD 202 Billion in 2023. The inflating need for optimizing the use of fertilizers is augmenting the adoption of novel technologies to ensure that plants receive the necessary nutrients at the right time and in the right amounts. For example, in June 2024, DPH Biologicals introduced EnvelixTM Prime, a patented biological nutrient enhancer specifically designed to uniformly cover bulk dry fertilizer, thereby delivering a robust biological consortium in a single application. Additionally, it contains naturally occurring beneficial bacterial and fungal microorganisms to maximize and accelerate fertility release by using a carrier to adhere microorganisms to the fertilizer prill. This trend is driven by the need to increase agricultural productivity while minimizing environmental impact. For instance, in June 2024, a fertilizer maker, Paradeep Phosphates (PPL), unveiled nano urea and DAP products. The nano urea is a revolution in the agriculture sector, as it has the potential to reduce storage space while improving crop yield. Apart from this, advanced technologies also contribute to sustainable farming practices, which will continue to fuel the market over the forecasted period. In May 2024, FRST (Fertilizer Recommendation Support Tool) project partners announced the release of a web-based tool that provides unbiased and science-based interpretations of soil test phosphorus and potassium values for crop fertilization.

Popularity of Precision Agriculture

The emerging trend of using precision agriculture practices, which involves the use of data-driven approaches, is acting as a significant growth-inducing factor. As per recent industrial news, by 2024, precision agriculture solutions are expected to increase crop yields by up to 20% while reducing water usage by 30%. For instance, in June 2024, LG CNS, one of the information technology service providers, launched an AI-driven platform that analyzes meteorological data and soil to optimize fertilizer usage and irrigation schedules while also predicting pest outbreaks as well as recommending pesticides. Moreover, the widespread adoption of sensors and IoT devices is also contributing to the fertilizer additives market growth. For example, in January 2024, the Council of Scientific and Industrial Research (CSIR) introduced a mission to develop region-specific smart agro-technologies for paddy in South India. The project envisages the use of the Internet of Things (IoT) based sensors to generate a real-time precision database across different agro-climatic conditions of the country. Apart from this, smart fertilizers, such as those offered by Yara International, use advanced technology to ensure that nutrients are delivered precisely when and where plants need them. Furthermore, in April 2024, Nitricity Inc. launched the field trial of climate-smart nitrogen fertilizer on almond trees with Olam Food Ingredients in California’s Central Valley.

Demand for Biological Additives

The global population is growing at an unprecedented rate and hundreds of millions of people are moving into urban areas. This mass urbanization inadvertently results in waste production, habitat destruction and pollution. The global population rate is growing around 0.87% per year in 2024, up from 0.88% in 2023. Apart from this, the rising consumer environmental consciousness is escalating the demand for microbial and biological additives in fertilizers as an effective way to enhance crop health and productivity naturally. For instance, in March 2024, Nachurs Alpine Solutions (NAS) introduced a new biostimulant product line called NACHURS Enduro-Shield to protect genetic yield potential in a variety of crops. Moreover, products, including Rhizobium bacteria and Mycorrhizal fungi, are prime examples of biological additives that form symbiotic relationships with plants to ensure the facilitation of better nutrient absorption. Similarly, in March 2024, Kraton Corporation, one of the sustainable producers of high-value biobased products and specialty polymers, developed SYLVASOLV, a biobased fertilizer coating to meet the unique functional needs of the agriculture industry. Besides this, the elevating need for organic and sustainable farming practices is also strengthening the market. In January 2024, Zuari Farmhub Ltd (ZFHL) unveiled its nano fertilizer additives, Nano Shakti Nano DAP and Nano Shakti Nano Urea, that are produced by using green biotechnology.

Fertilizer Additives Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global fertilizer additives market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on function, form, application, and region.

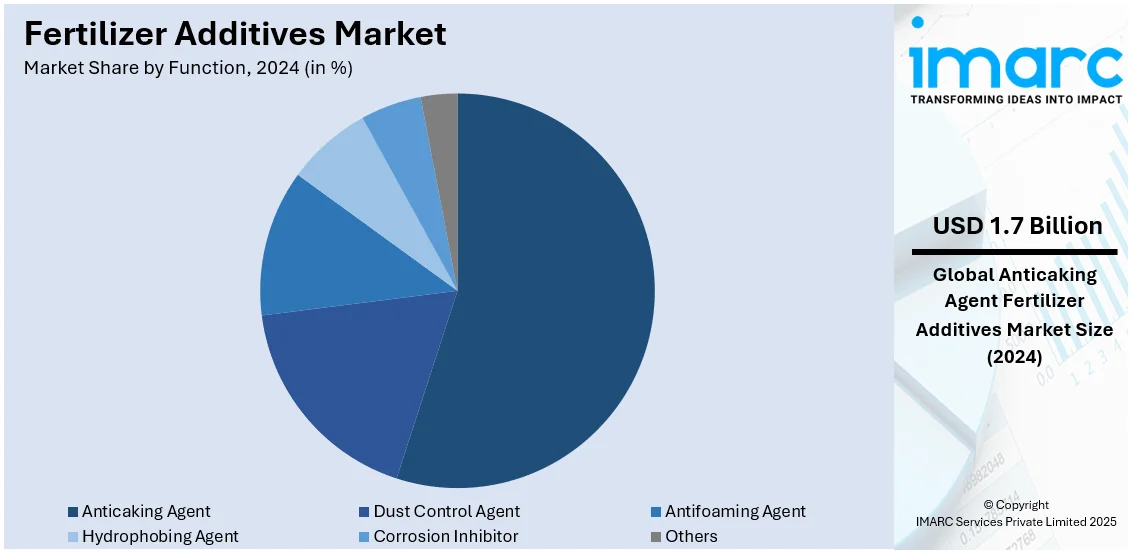

Analysis by Function:

- Dust Control Agent

- Anticaking Agent

- Antifoaming Agent

- Hydrophobing Agent

- Corrosion Inhibitor

- Others

Anticaking agents leads the market with around 54.6% of market share in 2024. Anticaking agents dominate the fertilizer additives market due to their crucial role in maintaining product quality during storage and transportation. These agents prevent clumping by reducing moisture absorption and ensuring fertilizers remain free-flowing and easy to apply. Their effectiveness in enhancing shelf life and improving the efficiency of fertilizer application drives their widespread adoption. Additionally, the growing demand for high-quality fertilizers in agriculture, coupled with increased focus on reducing waste and operational costs, further solidifies the dominance of anticaking agents in the market.

Analysis by Form:

- Granular

- Prilled

- Powdered

Granular additives lead the market. Granular additives are widely used due to their ease of handling, uniform distribution, and controlled release properties. For example, Mosaic's MicroEssentials offer a granular form that combines essential nutrients and additives for improved crop performance. Innovations like these sustainable farming practices by minimizing nutrient leaching and runoff. Granular additives further improve soil structure by ensuring consistent nutrient availability, which promotes healthier root systems and boosts plant resilience. Their long shelf life and compatibility with various crop types make them a preferred choice for farmers globally. Additionally, granular forms are well-suited for mechanized application methods, reducing labor costs and increasing efficiency in large-scale farming.

Analysis by Application:

- Urea

- Monoammonium Phosphate

- Triple Super Phosphate

- Diammonium Phosphate

- Ammonium Nitrate

- Others

Urea leads the market. Urea, a widely used nitrogen fertilizer, frequently includes urease inhibitors to decrease nitrogen loss from volatilization. An example is AGROTAIN by Koch Agronomic Services, a popular addition for urea. Additives like these improve nitrogen retention in the soil and support higher crop yields by ensuring a steady nutrient supply. As a widely used fertilizer, urea benefits from additives that enhance its performance, including anti-caking agents, dust suppressants, and slow-release coatings. Along with volatilization, these additives actively address common challenges associated with urea, such as clumping, and nutrient loss, ensuring more efficient nutrient delivery to crops.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 60.5%. Asia-Pacific remains the leading region in the fertilizer additives market as a result of its substantial agricultural industry and heavy dependence on farming to sustain increasing population in countries including India and China. The use of innovative farming techniques in the area, such as precision agriculture and better irrigation systems, increases the need for high-quality additives. Government efforts to encourage sustainable farming practices and provide subsidies for fertilizer usage also strengthen the market. Moreover, the dominance of Asia-Pacific as the top market for fertilizer additives on a global scale is reinforced by the extensive fertilizer production and export operations in the region that necessitate additives for ensuring product quality while in storage and transit.

Key Regional Takeaways:

United States Fertilizer Additives Market Analysis

In 2024, United States accounted for 72.5% of the total North America fertilizer additives market. Increased agriculture demand and stringent regulations for sustainable farming increase the demand for U.S. fertilizer additives. According to USDA, agriculture, food, and related industries contributed approximately USD 1.530 Trillion to the U.S. GDP in 2023, accounting for a 5.6% share, of which America's farms contributed about 0.7% at USD 203.5 Billion. Adoption of additives such as anti-caking agents and dust suppressants ensures that environmental standards are met, including the US Environmental Protection Agency's Clean Water Act. Companies such as Nutrien and Mosaic are leading in innovation to introduce biodegradable and environmentally friendly additives that meet both regulatory needs and consumer demands. Advancements in precision agriculture have enabled a bigger market for liquid fertilizers that are integrated with additives, further driving market growth.

Europe Fertilizer Additives Market Analysis

Europe's fertilizer additives market is driven by sustainable agriculture and stringent EU legislation. The European Green Deal plan set a target to reduce the use of chemical fertilizers by 20% by 2030, promoting bio-based additives. Major markets in Germany, France, and the Netherlands form a large part of Europe's fertilizer consumption. Anti-caking agents are the most sizable component of the market, as a large majority of fertilizers sold in the region are granular. Companies such as BASF and Yara are developing advanced products that are in line with the EU's sustainability goals. The region is also intent on organic farming, which increased 15% from 2020 to 2023, an aspect that supports the use of organic-compatible additives.

Asia Pacific Fertilizer Additives Market Analysis

Asia Pacific is the world's largest region in the fertilizer additives market, accounting for significant regional demand in 2023 among India and China. Growth is due to higher demand for food coupled with government subsidies on fertilizers. According to an industrial report, India witnessed a remarkable rise in both production and sales of key fertilisers, propelling the total production to an impressive 45.2 million tons during FY23-24. In addition to this, the adoption of advanced additives in China is escalating with China's "Zero Growth of Fertilizer Use" policy that reduces chemical fertilizer use, while increasing crop productivity. Anti-foaming agents and corrosion inhibitors are now gaining recognition in liquid fertilizer formulations. Companies such as Haifa Chemicals and Clariant also extended their operations to cater to regional demand.

Latin America Fertilizer Additives Market Analysis

The fertilizer additives market in Latin America is increasing due to increased agricultural exports and attempts to improve soil productivity. According to an industry report, Brazil is the biggest soybean exporter worldwide, and in 2023, it used more than 35 million metric tons of fertilizers where additives play an important role in preventing caking and enhancing nutrient delivery. Increasing awareness regarding sustainable agriculture, and government initiatives such as the soil health initiatives from Embrapa, would prove beneficial for the adoption of eco-friendly additives. The market for micronutrient-enriched fertilizers in Mexico is growing, augmented by additive technologies that enhance the bioavailability of micronutrients. Significant contributors to this growth are local players such as Fertinal and international giants such as FMC Corporation.

Middle East and Africa Fertilizer Additives Market Analysis

In the Middle East and Africa, fertilizer additives are crucial to overcoming challenges such as water scarcity and low soil fertility. According to an industrial report, Saudi Arabia and Qatar accounted for a share of 45% and 27% in GCC fertilizer production volume market in 2019. Saudi Arabia’s Vision 2030 emphasizes sustainable agriculture, driving demand for high-performance fertilizers with additives. Developments such as the African Fertilizer Financing Mechanism (AFFM) are now embracing improved fertilizers with additives to increase yields in Africa. Companies, including SABIC and OCP Group, invest in research and development (R&D) activities to develop additives specific to a region, thereby solving not only climate challenges but nutrient deficiencies as well.

Competitive Landscape:

The fertilizer additives market features a competitive landscape with key players focusing on innovation and strategic collaborations to maintain their market positions. Major companies invest in research and development (R&D) to create advanced, eco-friendly additives that enhance fertilizer efficiency and sustainability. The market also sees competition from regional players offering cost-effective solutions tailored to local agricultural needs. Regulatory compliance, sustainability goals, and expanding global agricultural practices drive innovation and market dynamics. Strategic mergers, acquisitions, and partnerships further strengthen the presence of prominent companies while addressing the growing demand for high-performance fertilizer additives worldwide.

The report provides a comprehensive analysis of the competitive landscape in the fertilizer additives market with detailed profiles of all major companies, including:

- Amit Trading Ltd

- ArrMaz (Arkema S.A.)

- BASF SE

- Clariant AG

- Corteva Inc.

- Dorf-Ketal Chemicals India Private Limited

- Holland Novochem B.V.

- Hubei Forbon Technology Co Ltd

- KAO Corporation

- Michelman Inc.

- Solvay S.A.

- Tolsa SA

Latest News and Developments:

- September 2024: Innovar Ag, a U.S. company developing chemical fertilizer additives, announced that they have established a representative office in Tokyo, to gather information of the Japanese market and to build relationships with Japanese companies.

- August 2024: The Fertilizer Institute (TFI) certified three biostimulants—Timac Agro USA's Duo Maxx, Valent BioSciences' Transit 500, and Biodyne's Environoc 401—under its Certified Biostimulant Program. Certifications last six years; labels will indicate compliance with industry guidelines, aiding growers, and retailers in making reliable choices.

- June 2024: DPH Biologicals launched EnvelixTM Prime, a patented biological nutrient enhancer designed to cover bulk dry fertilizer uniformly.

- March 2024: Kraton Corporation, one of the sustainable producers of high-value biobased products and specialty polymers, introduced SYLVASOLV, a biobased fertilizer coating, to meet the unique functional needs of the agriculture industry.

- January 2024: Zuari Farmhub Ltd (ZFHL) unveiled its nano fertilizer additives, Nano Shakti Nano DAP and Nano Shakti Nano Urea, that are produced by using green biotechnology.

Fertilizer Additives Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Functions Covered | Dust Control Agent, Anticaking Agent, Antifoaming Agent, Hydrophobing Agent, Corrosion Inhibitor, Others |

| Forms Covered | Granular, Prilled, Powdered |

| Applications Covered | Urea, Monoammonium Phosphate, Triple Super Phosphate, Diammonium Phosphate, Ammonium Nitrate, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amit Trading Ltd, ArrMaz (Arkema S.A.), BASF SE, Clariant AG, Corteva Inc., Dorf-Ketal Chemicals India Private Limited, Holland Novochem B.V., Hubei Forbon Technology Co Ltd, KAO Corporation, Michelman Inc., Solvay S.A., Tolsa SA, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the fertilizer additives market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global fertilizer additives market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the fertilizer additives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Fertilizer additives are substances incorporated into fertilizers to enhance their efficiency, stability, and performance. These additives prevent issues such as caking, improve nutrient delivery, and extend the shelf life of fertilizers. They also ensure even application and minimize nutrient loss. By optimizing fertilizer quality and functionality, additives play a crucial role in modern agriculture, supporting higher crop yields, sustainable farming practices, and cost-effective solutions to meet global food production demands.

The fertilizer additives market was valued at USD 3.06 Billion in 2024.

IMARC estimates the global fertilizer additives market to exhibit a CAGR of 1.9% during 2025-2033.

The key factors that drive the market are the rising demand for high-efficiency fertilizers to enhance crop yields, growing awareness of sustainable farming practices, advanced irrigation and precision agriculture technologies, government initiatives promoting eco-friendly inputs, and innovations in biological and region-specific additives improving soil health and productivity.

In 2024, anticaking agents represented the largest segment by function, driven by their role in maintaining fertilizer quality during storage and transport.

Granular additives lead the market by form attributed to their ease of handling, uniform distribution, and controlled nutrient release properties.

Urea is the leading segment by application, driven by its widespread use and incorporation of urease inhibitors to reduce nitrogen loss.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global fertilizer additives market include Amit Trading Ltd, ArrMaz (Arkema S.A.), BASF SE, Clariant AG, Corteva Inc., Dorf-Ketal Chemicals India Private Limited, Holland Novochem B.V., Hubei Forbon Technology Co Ltd, KAO Corporation, Michelman Inc., Solvay S.A., and Tolsa SA, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)