Fiber Laser Market Report by Type (Infrared Fiber Laser, Ultraviolet Fiber Laser, Ultrafast Fiber Laser, Visible Fiber Laser), Application (Cutting, Welding, Marking, Fine and Micro Processing, Medical, and Others), and Region 2025-2033

Global Fiber Laser Market:

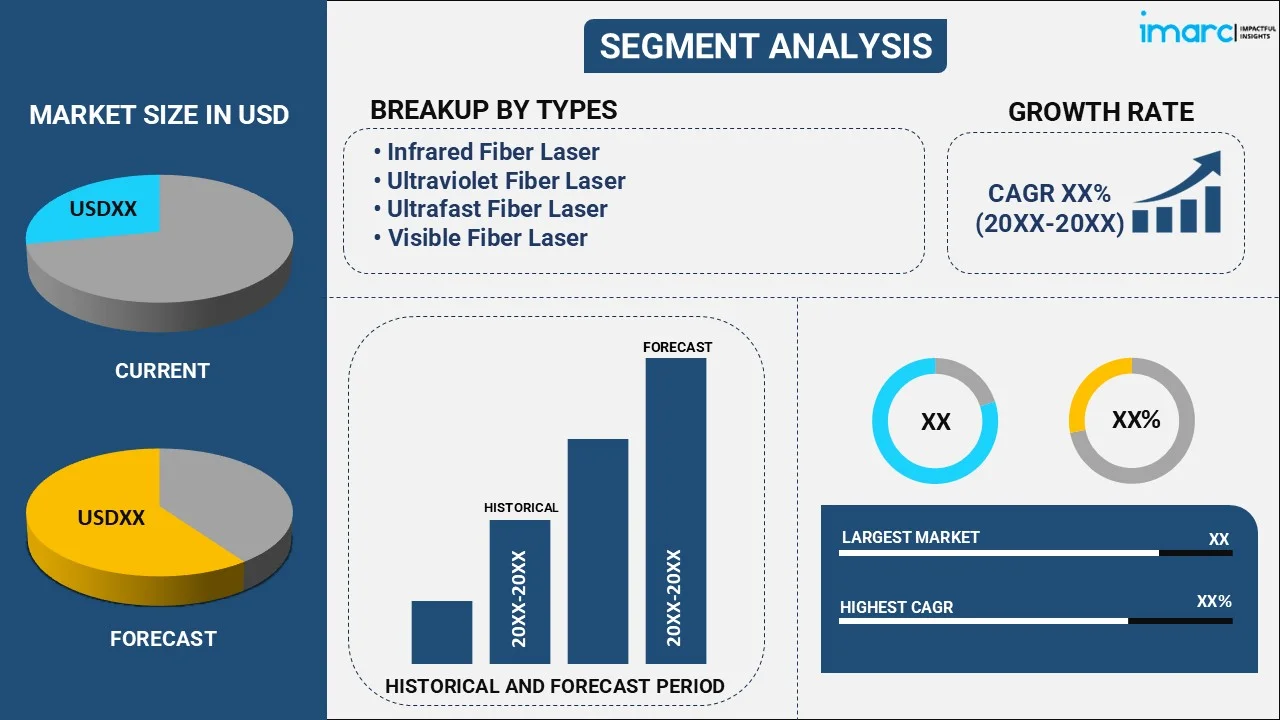

The global fiber laser market size reached USD 3.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.1 Billion by 2033, exhibiting a growth rate (CAGR) of 7.8% during 2025-2033. North America dominates the market in 2024, driven by advanced industrial automation and rising investments in research activities. The fiber laser market growth is primarily driven by the increasing demand for miniaturization of wafers and integrated circuits (ICs), along with the introduction of energy-efficient and automated fiber laser solutions.

Market Size & Forecasts:

- Fiber laser market was valued at USD 3.0 Billion in 2024.

- The market is projected to reach USD 6.1 Billion by 2033, at a CAGR of 7.8% from 2025-2033.

Dominant Segments:

- Type: Ultrafast fiber laser leads the market as they produce high peak power and very brief pulses that allow precision micromachining and no heat damage. It is highly favored because of its capacity to work with sensitive materials in semiconductors, electronics, and medical devices.

- Application: Cutting dominates the market since it requires high power, accuracy, and efficiency. Fiber lasers are widely employed in metal fabrication, automotive, and aerospace industries for accurate, rapid, and clean cutting, significantly reducing production costs and material waste.

- Region: North America is enjoying the leading position in the market, driven by steady expenditure on research and development (R&D) activities, widespread use of laser-based technologies, and advanced industrial automation. North America's sustained market dominance is ensured by the existence of key manufacturing firms and strong demand from the automobile sector.

Key Players:

- The leading companies in fiber laser market include ABB Ltd., Amonics Limited, Apollo Instruments Inc., Coherent Inc., Cy-laser S.r.l., IPG Photonics Corporation, MKS Instruments Inc., Omron Corporation, NKT Photonics A/S, Toptica Photonics, Trumpf GmbH Co. KG, etc.

Key Drivers of Market Growth:

- Rising Adoption of Renewable Energy: Increasing usage of renewable energy is creating the need for fiber lasers in manufacturing solar panels, batteries, and wind turbine components. Their high precision and low waste capabilities support the efficient production of clean energy systems.

- Increasing Vehicle Production: Rising manufacturing of vehicles is driving the demand for fiber lasers, as they offer precision cutting, welding, and marking for various automotive components. Their efficiency and speed make them ideal for mass production.

- Growing Transition to Industry 4.0: The shift towards Industry 4.0 is encouraging smart production, where fiber lasers are favored for their automation compatibility, precision, and integration with robotic systems. These lasers enhance manufacturing speed, reduce waste, and support digital workflows.

- Technological Advancements: Innovations in technology improve fiber laser performance, including beam quality, efficiency, and adaptability across industries. As capabilities are expanding and system costs are reduced, industries are adopting fiber lasers to enhance production quality and meet evolving technical demands.

- Rising Aerospace Applications: Fiber lasers are used in the aerospace industry for precise cutting and welding of lightweight materials like titanium and composites. Their ability to meet high tolerance standards and process sensitive components without distortion makes them vital for aircraft manufacturing, contributing to safer and more efficient production of advanced aerospace systems.

Future Outlook:

- Strong Growth Outlook: The fiber laser market is expected to see sustained expansion, driven by increasing demand for precision manufacturing, energy efficiency, and automation across industries like automotive and aerospace. Continued innovations in laser technology and the adoption of Industry 4.0 practices are further supporting a positive market trajectory.

- Market Evolution: The sector is anticipated to shift from niche industrial use to widespread adoption across diverse sectors. Early focus on metal cutting and welding has expanded to include medical, defense, and semiconductor applications. Technological advancements have enhanced performance, reliability, and cost-efficiency, solidifying fiber lasers as an industry standard.

The market is witnessing strong growth due to increasing demand for high-precision tools in electronics manufacturing, where fiber lasers are used for micromachining, etching, and marking delicate components with accuracy. Additionally, the growing utilization of fiber lasers in the metal fabrication industry to offer superior cutting speed, energy efficiency, and low maintenance compared to traditional systems is positively influencing the market. The rising adoption of fiber lasers in the healthcare sector, particularly for medical device manufacturing and surgical procedures, is also significant in fueling the market growth. Moreover, increasing investments in infrastructure and construction projects are catalyzing the demand for advanced cutting tools for metals and composite materials. Furthermore, the growing awareness about environmental benefits, such as reduced waste, cleaner operations, and energy-optimized performance, is making fiber lasers a preferred option across sectors. Apart from this, continued innovations in laser source technology, improved beam quality, and multi-axis integration are enhancing application scope.

To get more information on this market, Request Sample

Global Fiber Laser Market Trends:

Increasing vehicle production

Rising vehicle production is positively influencing the market. As per ACEA’s reports, in 2024, worldwide car sales reached 74.6 Million units, representing a growth of 2.5% from 2023. Fiber lasers offer high accuracy, faster processing times, and reduced operational costs, making them ideal for mass production lines in automotive assembly. Their application in battery welding for electric vehicles (EVs), cutting lightweight metals, and marking parts with traceable identity documents (IDs) ensures quality and compliance. As the demand for EVs is increasing, manufacturers continue to rely on fiber lasers for efficiency and innovation. Rising dependence on advanced manufacturing techniques is also supporting fiber laser adoption. The automotive sector’s continuous growth in emerging economies, driven by rising urbanization activities and high disposable incomes, is contributing to the increased deployment of fiber lasers across global production facilities.

Rising shift towards Industry 4.0

Increasing shift towards Industry 4.0 is transforming the manufacturing industry with increased automation, connectivity, and intelligent systems, thereby catalyzing the demand for fiber lasers. As factories are evolving into smart production hubs, fiber lasers are becoming essential tools for precise, automated processes like cutting, engraving, welding, and marking. These lasers easily integrate with robotic arms, supporting real-time data feedback and minimal human intervention. Their efficiency, flexibility, and ability to handle complex tasks in high-speed environments align with Industry 4.0 objectives of productivity and cost-effectiveness. Additionally, fiber lasers’ long operational life and low maintenance requirements make them suitable for continuous automated production. According to the IMARC Group, the global Industry 4.0 market size was valued at USD 164.7 Billion in 2024.

Growing adoption of renewable energy

Rising emphasis on renewable energy sources is offering a favorable market outlook. As per the PIB, India's overall renewable energy installed capacity jumped by an impressive 24.2 GW (13.5%) within a single year, reaching 203.18 GW in October 2024, an increase from 178.98 GW in October 2023. Fiber lasers play a critical role in manufacturing components for solar panels, battery packs, and wind turbines, offering high precision and clean cuts that reduce material waste. In solar energy, fiber lasers are used for scribing, drilling, and cutting photovoltaic cells, enhancing production efficiency and panel reliability. In battery production, they enable fine welding and sealing operations, especially important for lithium-ion batteries. Additionally, as renewable infrastructure is expanding, the need for high-performance, automated fabrication tools is increasing, positioning fiber lasers as a preferred solution. Their accuracy and adaptability support the scaling up of renewable energy systems.

Key Growth Drivers of Fiber Laser Market:

Technological advancements

Technological advancements are enabling lasers to become more powerful, efficient, and compact. Innovations in beam quality, pulse duration, and output power have broadened the application scope of fiber lasers across industries like automotive, aerospace, electronics, and healthcare. Modern fiber lasers offer enhanced energy optimization, lower heat generation, and faster processing speeds, which increase productivity and decrease operational costs. Developments in ultrafast lasers and tunable wavelengths are allowing precise micromachining and delicate tasks, such as medical device fabrication and semiconductor processing. Additionally, smarter interfaces, improved cooling systems, and integration with digital manufacturing systems contribute to ease of use and flexibility. These technological improvements make fiber lasers more attractive to industries seeking higher quality, reduced downtime, and scalability. As R&D investments continue, fiber lasers are expected to evolve further, supporting new applications and broadening market opportunities.

Rising applications in aerospace industry

The aerospace sector’s increasing reliance on advanced materials and high-precision manufacturing is driving the demand for fiber lasers. These lasers are crucial in cutting, welding, and marking lightweight materials like titanium and aluminum used in aircraft structures. Fiber lasers deliver the accuracy and consistency required for producing complex aerospace parts, where even minor defects can compromise safety. Their utilization in engine components, turbine blades, and structural panels supports high-quality manufacturing with minimal material waste. As aerospace companies are focusing on fuel efficiency, weight reduction, and smart maintenance, fiber lasers offer reliable, non-contact solutions. Their ability to work with composites and sensitive materials without causing distortion makes them ideal for the sector.

Increasing utilization in healthcare industry

The healthcare industry is adopting fiber lasers due to their precision, versatility, and safety in medical applications. Fiber lasers are used in manufacturing surgical instruments, implants, and medical devices, where high accuracy is essential. Their ability to perform micro-cutting, drilling, and welding of delicate materials without thermal damage ensures superior product quality and patient safety. In medical imaging and diagnostics, fiber lasers provide reliable light sources for high-resolution scanning equipment. Additionally, fiber lasers are employed in dermatology, ophthalmology, and dentistry for non-invasive procedures because of their controlled energy delivery and minimal recovery times. Their compact size and ease of integration into robotic surgical tools also enhance the capabilities of modern medical systems.

Fiber Laser Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type and application.

Breakup by Type:

- Infrared Fiber Laser

- Ultraviolet Fiber Laser

- Ultrafast Fiber Laser

- Visible Fiber Laser

Ultrafast fiber laser currently exhibits a clear dominance in the market

The report has provided a detailed breakup and analysis of the market based on the type. This includes infrared fiber laser, ultraviolet fiber laser, ultrafast fiber laser, and visible fiber laser. According to the report, ultrafast fiber laser accounted for the largest market share.

Ultrafast fiber lasers find extensive applications, owing to their ability to produce high peak power pulses with minimal thermal damage to surrounding materials. This, in turn, is propelling the fiber laser market revenue in this segmentation. SLTL Group introduced ultra laser marking systems that can be efficiently utilized for marking medical devices which is challenging for medical device manufacturers.

Breakup by Application:

- Cutting

- Welding

- Marking

- Fine and Micro Processing

- Medical

- Others

Cutting holds the largest market share

The report has provided a detailed breakup and analysis of the market based on the application. This includes cutting, welding, marking, fine and micro processing, medical, and others. According to the report, cutting accounted for the largest market share.

Fiber lasers are extensively utilized for numerous cutting processes, including tube cutting, flat sheet cutting, 3D cutting, etc., as they provide optimal accuracy and speed. These lasers are widely adopted for cutting stainless steel and non-ferrous metals, thereby augmenting the market growth in this segmentation.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest fiber laser market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

The increasing number of fiber laser suppliers in North America who provide fiber laser solutions to aerospace manufacturers is primarily driving the regional market. For example, Coherent, Inc. offers fiber laser solutions to various medical device manufacturers, semiconductor manufacturers, and e-mobility companies. Besides this, numerous other factors, including high beam quality and lower cost of ownership, are impelling companies in industries to shift from CO2 laser systems to fiber laser cutting systems in North America.

Leading Key Players in the Fiber Laser Industry:

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- ABB Ltd.

- Amonics Limited

- Apollo Instruments Inc.

- Coherent Inc.

- Cy-laser S.r.l.

- IPG Photonics Corporation

- MKS Instruments Inc.

- Omron Corporation

- NKT Photonics A/S

- Toptica Photonics

- Trumpf GmbH Co. KG.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Global Fiber Laser Market News:

- May 2025: Acclaro Medical, an innovative medical technology firm, announced the successful conclusion of its Series B funding round. It was intended to address unmet aesthetic demands through the firm’s groundbreaking 2910 nm fiber laser technology and other innovative solutions. Acclaro Medical's UltraClear fiber laser was acclaimed by top aesthetic experts as a significant advancement in skin health, targeting various skin layers to aid in reversing aging signs and the effects of gravity.

- April 2025: Scientists at the Fraunhofer Institute for Applied Optics and Precision Engineering (IOF) created a thulium fiber laser that could produce 1.91 kW, almost twice the average output. The team from Jena, headed by Till Walbaum, employed ‘spectral beam combining’, a method used to enhance the output power of systems emitting light at wavelengths ranging from 2030 to 2050 nm. These wavelengths were anticipated to be particularly effective for upcoming free-space optical satellite links, benefiting from reduced atmospheric attenuation and improved eye safety.

- January 2025: IPG Photonics Corporation was set to present new and innovative fiber laser solutions at Photonics West in San Francisco, US. The 1,200 square foot exhibit would showcase a variety of laser sources and technologies aimed at enhancing performance in applications, such as cutting, micro-machining, and quantum computing. IPG would highlight its newly launched YLS-RI fiber laser system, designed with an enhanced internal structure to optimize performance and facilitate integration.

- October 2024: Coherent Corp. introduced the EDGE FLTM high-power fiber laser series, designed specifically for cutting tasks in the machine tool sector. Available in power variations from 1.5 kW to 20 kW, the EDGE FL series reshaped the balance between affordability and efficiency.

- August 2024: BWT presented the world’s first 200kW ultra-high-power industrial fiber laser in Tianjin, China. The solution enhanced the four key features of high power, high brightness, high assimilation, and extended fiber delivery cable through advancements in CTC chip integration, ultra-high-power beam combining, and output technology. This was intended to greatly improve the effectiveness of handling ultra-thick metal plates, offering greater backing for the evolution and advancement of conventional manufacturing.

- August 2024: IPG Photonics Japan, a supplier of advanced fiber laser technology, expanded its Chubu facility, established in Japan. The Chubu Technical Center featured 14 lab rooms for customer use, providing customers with greater chances to utilize its fiber laser products and assess their performance prior to making a purchase. The company aimed to broaden its operations into the medical and food industries.

Fiber Laser Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Type, Application, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., Amonics Limited, Apollo Instruments Inc., Coherent Inc., Cy-laser S.r.l., IPG Photonics Corporation, MKS Instruments Inc., Omron Corporation, NKT Photonics A/S, Toptica Photonics and Trumpf GmbH Co. KG |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the fiber laser market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global fiber laser market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the fiber laser industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global fiber laser market was valued at USD 3.0 Billion in 2024.

We expect the global fiber laser market to exhibit a CAGR of 7.8% during 2025-2033.

The rising demand for fiber lasers, as they offer superior stability, higher precision, and resistance to environmental disturbances, owing to their sealed optical path, is primarily driving the global fiber laser market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous manufacturing units for fiber lasers.

Based on the type, the global fiber laser market has been segregated into infrared fiber laser, ultraviolet fiber laser, ultrafast fiber laser, and visible fiber laser. Among these, ultrafast fiber laser currently exhibits a clear dominance in the market.

Based on the application, the global fiber laser market can be bifurcated into cutting, welding, marking, fine and micro processing, medical, and others. Currently, cutting holds the largest market share.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global fiber laser market include ABB Ltd., Amonics Limited, Apollo Instruments Inc., Coherent Inc., Cy-laser S.r.l., IPG Photonics Corporation, MKS Instruments Inc., Omron Corporation, NKT Photonics A/S, Toptica Photonics, and Trumpf GmbH Co. KG.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)