Fin Fish Market Size, Share, Trends and Forecast by Fish Type, Environment, Distribution Channel, and Region, 2025-2033

Fin Fish Market Size and Share:

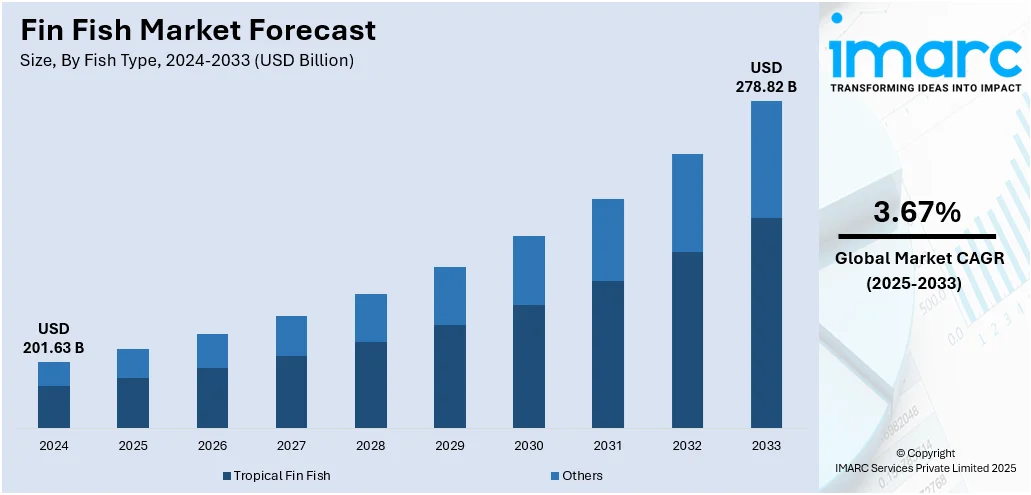

The global fin fish market size was valued at USD 201.63 Billion in 2024. The market is projected to reach USD 278.82 Billion by 2033, exhibiting a CAGR of 3.67% from 2025-2033. Asia Pacific currently dominates the market, registering significant growth driven by rising health awareness, growing demand for low-fat and protein-rich food, and the increasing popularity of ready-to-cook seafood. Aquaculture technology innovations, better harvesting methods, and increased availability through supermarket channels and online media are making products more accessible to consumers. Changing dietary trends towards natural and sustainable sources of protein also continue to drive market momentum. All these factors together are likely to fuel long-term growth in demand and support the propelling fin fish market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 201.63 Billion |

|

Market Forecast in 2033

|

USD 278.82 Billion |

| Market Growth Rate 2025-2033 | 3.67% |

The global fin fish market is being driven by changing food attitudes that increasingly turn towards convenient, natural protein supplies. As per the sources, in July 2025, Stronger America Through Seafood (SATS) issued a national campaign calling on U.S. policymakers to support offshore finfish aquaculture, citing stagnating growth because of missing federal legislation and regulatory certainty. Moreover, fin fish are now universally adopted in conventional and fusion cooking, providing a culinary link between healthy living diets and great taste. Such increased popularity is the result of a wider worldwide trend toward nutrient-rich food items that are versatile in preparation like grilled, steamed, baked, or eaten raw in foods like sushi or ceviche. As global travel, culinary media, and cultural exchange bring consumers into contact with new foods, fin fish are coming into focus for the way they can be used and their palatability. Moreover, worldwide culinary trends are focused on freshness, clean labels, and less processing, qualities cosely linked with fish-based food products. With increased households and foodservice operators looking for natural, wholesome ingredients that align with contemporary wellness trends, fin fish are highly becoming part of global dietary habits, driving constant demand throughout emerging economies and mature markets.

To get more information on this market, Request Sample

The United States fin fish market outlook is led by the escalating demand for convenient and healthy food products like ready-to-eat (RTE) seafood. In line with increasingly busy daily lifestyles, food consumers are looking for food options that are consistent with their hectic schedule while maintaining diet objectives. Fin fish provides a convenient solution, easily incorporated in dishes requiring little preparation but high nutritional content. From pre-marinated fillets to frozen portioned packs, the consumer-friendly options available are impacting buying patterns on retail shelves. The growing trend towards home-cooked meals with restaurant-quality ingredients has also raised demand for fish that quickly cooks and pairs well with different cuisines. This trend is noticeable not just in home kitchens but also in quick service and health-conscious restaurants. With wellness trends further defining national eating habits, fin fish sits at the center of protein-driven, convenient meal preparation across age groups. For instance, in April 2025, Finless Foods revealed plans to introduce lab-grown tuna and mahi-mahi in the U.S. by 2025, an important step forward for sustainable seafood and transforming future fin fish market dynamics.

Fin Fish Market Trends:

Increasing Health Awareness and Protein-Rich Diet Demand

The world's food and beverage (F&B) market is growing very strongly, closely impacting the demand for fin fish across culinary categories. Fin fish are widely utilized in a variety of dishes, such as sandwiches, pasta, and rice dishes, as well as in traditional foods like salt herring and salmon roe. One of the key drivers behind this demand is growing health awareness among consumers and their desire for protein foods. As asserted by the Development Aid Organisation, about 3.3 billion human beings worldwide rely on aquatic foods for more than 20% of their animal protein consumption, highlighting the irreplaceable nutritional value of fin fish in the world's diets. The push for healthier diets is compelling consumers to eat more fish as lean sources of vital nutrients, including omega-3 fatty acids and quality proteins. This trend is likely to continue defining consumption habits on both developed and emerging markets.

Technological Innovations in Fishing and Aquafarming Practices

Technological innovations in fishing gear as well as aquafarming practices are one of the fin fish market trends fueling the expansion. Innovations in automated feeding systems, sophisticated sonar for detecting fish, and eco-friendly fish farming options are lessening the intricacies with conventional fishing techniques. These developments not only maximize productivity but also facilitate sustainable fishing of fish stocks, which is ever more essential in the face of heightened ecological concerns. The combination of precision aquaculture and artificial intelligence-enabled monitoring solutions is improving fish health, minimizing waste in feeding, and decreasing labor expense. As technological advancements intensify, they are allowing commercial fisheries and fish farmers to respond to the growing worldwide demand for seafood more effectively. These innovations help to enhance yields and ensure steady supply chains, particularly in regions where conventional fishing is hard work and dependent on natural limitations. Overall, technologically empowered aquafarming is acting as a key enabler of sustained long-term market expansion.

Convenience Food Trends and Workforce Dynamics Expansion

The accelerating desire for convenient meal solutions, especially among the working classes, is driving ready-to-eat (RTE) seafood product demand such as salmon, tuna, Maine sardines, and mackerel. With increasingly busy lifestyles worldwide, consumers are opting more and more for healthy food products that can be easily prepared. The World Bank estimates the world's labor force to be 3.7 billion in 2024, which reflects a growing number of people with less time for preparing meals. This population shift is propelling the demand for pre-packaged seafood that is both healthy and convenient. The growing trends of seafood-based cuisine and increased disposable income are also spurring consumers to spend on premium RTE fish products. Government programs supporting fish farming and seafood supply chains are further supporting fin fish market growth. Collectively, these trends are part of a larger shift in consumer diet, where convenient but nutrient-packed food options such as fin fish are intensely becoming part of the regular diet.

Fin Fish Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global fin fish market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on fish type, environment, and distribution channel.

Analysis by Fish Type:

- Tropical Fin Fish

- Pompano

- Snappers

- Groupers

- Salmon

- Milkfish

- Tuna

- Tilapia

- Catfish

- Seabass

- Others

Tropical finfish represent one of the leading categories in the global market, attributed to their year-round availability and high culinary value. Characterized by a mild flavor, tender texture, and exceptional versatility in preparation, these species are widely favored across a broad spectrum of cuisines, from traditional to contemporary. They are widely used when grilled, fried, steamed, or baked and can be served in household kitchens as well as foodservice institutions. Primarily cultivated in warm-water aquaculture systems, tropical finfish benefit from optimal farming conditions that support efficient production and ensure a stable, year-round supply. Their increased popularity is also attribuable to mounting consumer demand for light, protein-filled seafood that is simple to prepare and integrate into regular meals. As diets worldwide trend toward healthier, sustainable food sources, tropical fin fish remain increasingly popular in retail and packaged meal forms. They are versatile and nutritious enough to remain a steady choice among diverse demographic and geographic consumer groups.

Analysis by Environment:

- Freshwater

- Marine Water

- Brackish Water

Marine water led the fin fish market environment segment in 2024 and held 54.5% of the world's share, mainly as a result of the prevalence and variety of species obtained from seas and oceans. Fin fish from marine sources are extremely prized for their high nutrient value, firm texture, and specific taste profiles, which suit both connoisseur and normal meal options. This category comprises widely available species of mackerel, tuna, and snapper available in a readily accessible range of fresh, frozen, and processed forms. Developments in sustainable seafood fishing techniques and deep-sea aquaculture are also supporting development through securing regular supplies while handling environmental issues. Marine water fin fish remain satisfying consumer demand for variety and superior quality, particularly in areas where ocean access facilitates strong harvesting and export capacity. Their incorporation into local and global cuisine further assures their wide presence, ensuring marine habitats to be integral contributors towards global fin fish resources.

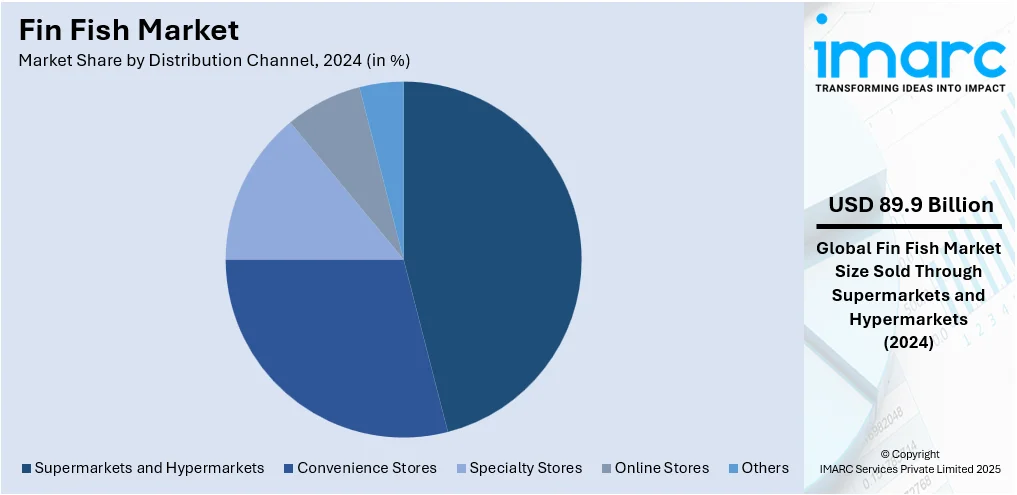

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

Supermarkets and hypermarkets dominated all distribution channels in the fin fish sector in 2024, holding a 44.6% market share, with the support of being able to provide varied product offerings and easy shopping experiences. These big-box retail stores make fresh, frozen, and value-added fin fish products available to consumers, appealing to diverse tastes and cooking requirements. Consumers enjoy the guarantee of quality, consistent availability, and competitive prices that boost the attractiveness of fish purchases at these stores. Besides, in-store promotion, point-of-sale marketing, and wider seafood departments result in higher visibility and product turnover. With nutritional awareness increasingly shaping meal purchases, supermarkets and hypermarkets are the destination of choice for health-aware consumers seeking to increase fish consumption. The coupling of traceable supply, eco-labels, and pre-packaging in these channels also enhances shopper trust, making them critical to sustaining stable market demand in both urban and suburban segments.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific became the leading regional fin fish market in 2024, driven by strong domestic consumption, high aquaculture yields, and cultural importance of fish in daily diets. The nations of the region, both coastal and island countries, have been built on the historical trend of including fin fish in their foods, from street food to ceremonial dishes. The presence of warm water conditions for cultivation favors large-scale farming of tropical and marine varieties to serve both national requirements and overseas export needs. In addition, the region is aided by extensive fish farm infrastructure, state encouragement for sustainable culture, and robust retail distribution chains. Urbanization and increasing per capita incomes are also affecting consumer patterns, as there is a growing demand for processed, packaged, and ready-cook fish products. With foodservice outlets, modern grocery chains, and wet markets continuing to grow, Asia-Pacific continues to lead both production and consumption trends, reinforcing its dominance of the global fin fish market.

Key Regional Takeaways:

North America Fin fish Market Analysis

The market for North America fin fish is growing steadily, fueled by increasing consumer demand for nutritious, high-protein food and greater focus on balanced diets. Fin fish are becoming more prominent in meal preparation throughout homes and foodservice units because they are nutritious, versatile, and simple to prepare. More fresh, frozen, and ready-to-cook fish products are being added to consumers' diets, aided by growing seafood offerings in retail supermarkets and greater availability of a variety of fish species. Demand for clean-label and minimally processed seafood is also driving shopping behavior, with consumers favoring those products that reinforce wellness-oriented lifestyles. Regional aquaculture operations and eco-friendly fishing practices are also contributing to steady supply for local consumption. The inclusion of traceability, quality certifications, and sustainable sourcing practices further enhances consumer confidence. With changing culinary cultures and growing awareness of the benefits of seafood, North America is a foremost region in global fin fish market analysis.

United States Fin Fish Market Analysis

The fin fish market in the United States is witnessing robust growth, fueled by shifting dietary preferences toward high-protein, low-fat foods. Rising consumer inclination toward clean-label and organic protein sources is significantly boosting demand across retail and food service sectors. According to the Physicians Committee for Responsible Medicine, 46% of U.S. adults plan to start a new diet as one of their resolutions in 2025, reinforcing a growing trend toward healthier food choices, including seafood. The popularity of gourmet cuisines that include smoked, grilled, or cured fish is also contributing to market expansion. Moreover, a growing number of culinary schools and food innovation programs are emphasizing seafood preparation, further influencing consumption patterns. The adoption of advanced cold storage and packaging solutions is enabling extended shelf life and wider distribution, supporting market penetration in inland regions. Innovations in value-added products, such as pre-seasoned or marinated cuts, are appealing to time-conscious consumers. Additionally, online grocery platforms are increasingly featuring fresh and frozen fin fish options, expanding accessibility. Collaborations between food distributors and aquaculture producers are also streamlining supply chains, ensuring year-round availability.

Europe Fin Fish Market Analysis

The Europe fin fish market is growing steadily, driven by the rising adoption of sustainable aquaculture practices aligned with regional environmental policies. Increasing consumer demand for traceable and responsibly sourced seafood is encouraging the implementation of eco-certification and digital tracking systems. The integration of seafood into quick-serve meals and gourmet offerings is supporting its popularity across a broad demographic, including younger consumers seeking convenience without compromising quality. In the European Union, nearly 80% of processed fish and seafood consumed through foodservice is accounted for by five countries: Germany, Spain, France, Italy, and Sweden. Culinary tourism and food culture exchange within the region are broadening exposure to diverse fin fish preparations. Continued investment in breeding techniques and fish welfare is improving yield efficiency, further strengthening supply. The expansion of seafood counters in hypermarkets and educational campaigns on nutritional benefits are positively influencing purchasing behavior.

Asia Pacific Fin Fish Market Analysis

In the Asia Pacific region, the fin fish market is expanding due to increasing urbanization and rising disposable incomes, which are altering dietary habits. Consumers are gravitating toward protein-rich and nutrient-dense food options, driving demand for fin fish in daily meals. According to IBEF, India’s seafood exports in H1 FY25 surpassed USD 6.93 Billion, signaling a strong regional supply and robust trade network. The popularity of ready-to-cook seafood dishes, supported by developments in food processing, is bolstering retail sales. Expansion of modern retail infrastructure in emerging economies is improving consumer access to fresh and frozen fin fish. Government-backed nutrition awareness programs are promoting the health benefits of seafood consumption. Furthermore, foodservice outlets and cloud kitchens are increasingly featuring fin fish in diversified menus, supporting out-of-home consumption. Regional trade agreements strengthen intra-regional supply chains, ensuring consistent availability. These drivers are collectively accelerating the growth of the fin fish market in the Asia Pacific

Latin America Fin Fish Market Analysis

The Latin American fin fish market is experiencing notable growth, fueled by increasing consumer interest in high-protein, affordable food sources. Shifts in lifestyle and eating habits are leading to greater integration of fin fish into everyday diets, particularly among younger demographics. According to Agrostat (Brazilian Agribusiness Foreign Trade Statistics), Brazil exported over 12,000 Tons of fish to approximately 90 countries in the first quarter of 2024, generating USD193 Million in revenue, underscoring the region's growing export capacity. Expansion in frozen food sections of supermarkets and a rising preference for convenient meal solutions are supporting domestic demand. Culinary media and digital food platforms drive awareness and experimentation with seafood-based recipes. Additionally, coastal and inland aquaculture development is enhancing regional production capabilities, contributing to better supply consistency across markets.

Middle East and Africa Fin Fish Market Analysis

The Middle East and Africa fin fish market is expanding due to evolving dietary patterns and increasing demand for diverse protein sources. Rapid urban development and growing middle-class populations are contributing to higher seafood consumption, particularly in metropolitan areas. A recent report states that Saudi Arabia aims to boost its domestic aquaculture production from 280,000 Tons in 2024 to 530,000 Tons annually by 2030, a goal that is expected to significantly strengthen the regional supply chain. The popularity of health-oriented diets is encouraging the inclusion of fin fish in both traditional and modern cuisines. Expansion in organized retail formats and specialty seafood stores is enhancing consumer access to varied offerings. Additionally, culinary events and food expos are promoting seafood as a versatile and nutritious food option, further accelerating market interest across the region.

Competitive Landscape:

The competitive environment of the fin fish market is changing at a rapid pace, shaped by changing consumer tastes, technology, and sustainability demands. While demand for premium, convenient seafood keeps increasing, leading players are modifying their operations to be in harmony with new trends in health-focused consumption and eco-friendliness. The fin fish market forecast predicts steady growth, and due to this, companies are making investments in new aquaculture methods, digital monitoring systems, and traceable supply chains to ensure efficiency and transparency. Competition ranges from integrated aquaculture operations, local fish farms, and processing facilities, each with product differentiation based on innovation, like marinated fillets and ready-to-cook products. Strategic partnerships with supermarkets, hypermarkets, and e-commerce retailers are growing distribution channels to provide easier access to consumers. In addition, sustainability labels and certifications are being used to appeal to environment-conscious consumers. As the market develops, investment in value-added products and technology will be key to securing positions and addressing future market needs.

The report provides a comprehensive analysis of the competitive landscape in the fin fish market with detailed profiles of all major companies, including:

- Bakkafrost

- Blue Ridge Aquaculture, Inc.

- Cermaq Group AS

- Huon Aqua

- Lerøy

- Mowi

- Nissui

- SalMar ASA

- Stehr Group

- Tassal Seafood

- Thai Union Group PCL

Latest News and Developments:

- June 2025: The Mediterranean Marine Finfish Aquaculture Demonstration Centre was launched in Crete, providing state-of-the-art training and research facilities. It gave direct experience to observers from six countries, encouraged environmentally friendly practices, and deepened regional cooperation, facilitating inclusive growth and innovation in fish farming in the Mediterranean and Black Sea regions.

- April 2025: Phibro Animal Health gained FDA approval for PAQFLOR®, a 50% florfenicol premix antibiotic for freshwater-reared salmonids, catfish, and finfish. The product treated diseases such as furunculosis, columnar, and enteric septicemia, providing aquaculture producers with an economical, broad-spectrum health management tool to improve fish survival and sustainability results.

- July 2025: The Centre promulgated new guidelines for the regulation of the activities of hatcheries and farms in the cultivation of indigenous shrimp and marine finfish. This follows after the Department of Fisheries issued notice to the 'Hatcheries and Farms for Seed Production and Culture of Indigenous Shrimp in Marine and Brackishwater Guidelines, 2025' on June 26. The guidelines are meant to ensure sustainability, safety, and appropriate management of hatcheries and farms involved in indigenous shrimp culture, enhancing the regulatory environment of the industry.

Fin Fish Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fish Types Covered |

|

| Environments Covered | Freshwater, Marine Water, Brackish Water |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bakkafrost, Blue Ridge Aquaculture, Inc., Cermaq Group AS, Huon Aqua, Lerøy, Mowi, Nissui, SalMar ASA, Stehr Group, Tassal Seafood, Thai Union Group PCL, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the fin fish market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global fin fish market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the fin fish industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fin fish market was valued at USD 201.63 Billion in 2024.

The fin fish market is projected to exhibit a CAGR of 3.67% during 2025-2033, reaching a value of USD 278.82 Billion by 2033.

The market for fin fish is being fueled by growing health consciousness, demand for high-protein and low-fat products, and increasing popularity of ready-to-eat (RTE) seafood. Technological progress in aquaculture, extensive shelf space in supermarkets, and changes towards healthy consumption patterns are also driving both developed and emerging markets for fin fish.

Asia Pacific currently dominates the market, due to high fish consumption per capita, robust aquaculture production, and widespread cultural inclusion of seafood in daily meals. The region also enjoys good coastal conditions, government-supported fish farming programs, and increasing exports, thus forming a central location in the international fin fish business.

Some of the major players in the fin fish market include Bakkafrost, Blue Ridge Aquaculture, Inc., Cermaq Group AS, Huon Aqua, Lerøy, Mowi, Nissui, SalMar ASA, Stehr Group, Tassal Seafood, Thai Union Group PCL, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)