Finished Vehicles Logistics Market Report by Activity (Transport (Rail, Road, Air, Sea), Warehouse, Value-added Services), Vehicle Type (Passenger Vehicle, Commercial Vehicle, Hybrid Electric Vehicle, Battery Electric Vehicle), Distribution Channel (OEMS (Original Equipment Manufacturers), Aftermarket), and Region 2025-2033

Finished Vehicles Logistics Market Size:

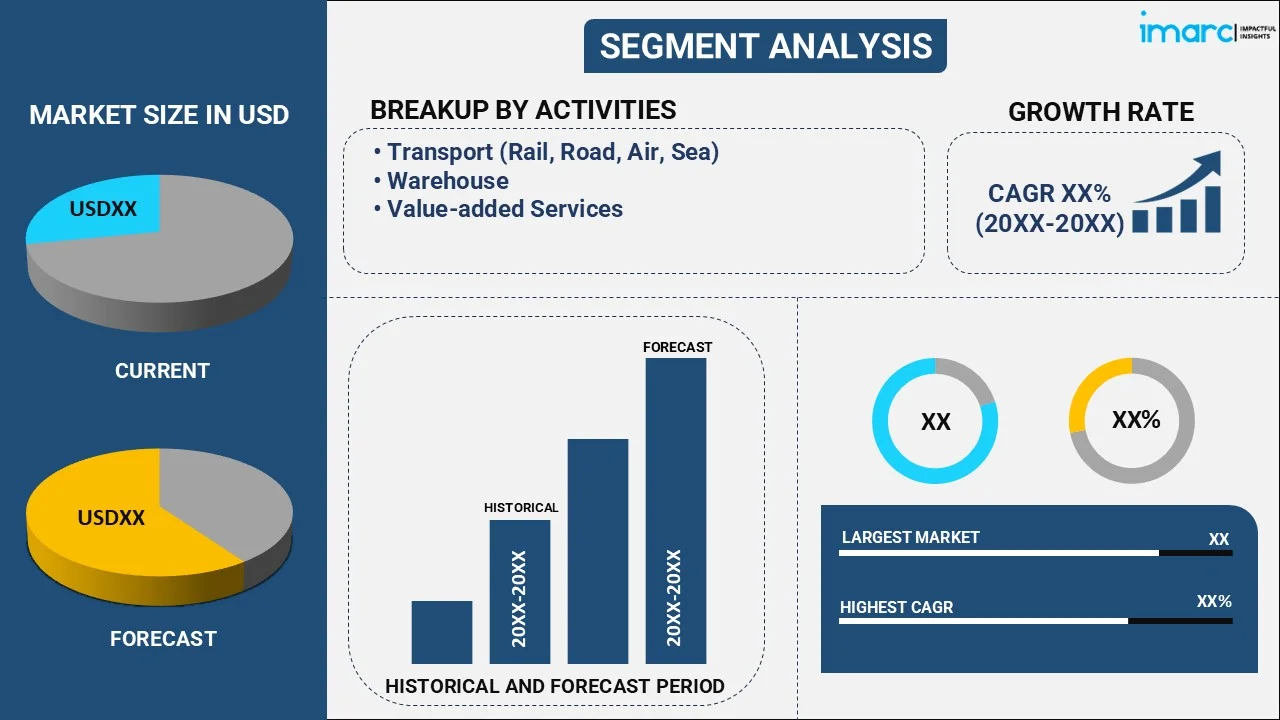

The global finished vehicles logistics market size reached USD 150.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 218.8 Billion by 2033, exhibiting a growth rate (CAGR) of 4.26% during 2025-2033. At present, Asia Pacific leads the market accredited to its substantial automotive production base, increasing vehicle demand, developing infrastructure, and growing investments in logistics technology. The rising global demand for efficient vehicle distribution, growing awareness of carbon footprint reduction and stringent regulations on carbon emissions are further propelling the market growth.

Market Size & Forecasts:

- Finished vehicles logistics market was valued at USD 150.1 Billion in 2024.

- The market is projected to reach USD 218.8 Billion by 2033, at a CAGR of 4.26% from 2025-2033.

Dominant Segments:

- Activity: Transport (rail, road, air, sea) hold the biggest market share because it enables efficient, timely delivery of finished vehicles. It provides flexibility across routes, supports large volumes, reduces costs, and adapts to different shipment sizes. This ensures reliable distribution worldwide, meeting industry demands effectively.

- Vehicle Type: Commercial vehicle accounts for the largest market share owing to its increasing demand in the logistics, construction, and transportation sectors. Its regular application for transporting goods, resilience, and capacity to manage heavy weights render it vital, fostering ongoing production and widespread finished vehicle logistics services worldwide.

- Distribution Channel: Original equipment manufacturers (OEMs) represent the largest segment as they have direct control over vehicle manufacturing and distribution. OEMs guarantee quality, prompt deliveries, and effective logistics coordination, minimizing expenses and risks while upholding robust relationships with dealers and customers, which strengthens their leading position in the market.

- Region: Asia Pacific dominates the market accredited to its large automotive manufacturing base, growing vehicle demand, expanding infrastructure, and rising investments in logistics technology. Rapid urbanization and increasing exports also contribute to the region’s leading position in finished vehicle logistics.

Key Players:

- The leading companies in finished vehicles logistics market include CargoTel Inc., CEVA Logistics (CMA CGM), DHL (Deutsche Post AG), DSV A/S, Hellmann Worldwide Logistics SE & Co. KG, Kuehne + Nagel International AG, Omsan Logistics, and Pound Gates.

Key Drivers of Market Growth:

- Digital Transformation: Digital transformation is revolutionizing finished vehicles logistics by enhancing client involvement and operational effectiveness via real-time tracking, digital platforms, and advanced data analytics. This is enabling better shipment visibility, optimized routes, improved resource allocation, and reduced operational costs.

- Demand for Resilient Logistics Networks: Increasing supply chain complexity, driven by trade uncertainties, EV integration, and capacity constraints, is encouraging automakers to adopt flexible, technology-driven logistics strategies. This shift recognizes logistics as a strategic asset, boosting demand for advanced, customized solutions and accelerating growth in the finished vehicle logistics market.

- Rise of Flexible Ownership: Adaptable vehicle ownership approaches require quicker, continuous logistics assistance featuring improved fleet oversight, regular vehicle relocation, and centralized administration. This change is encouraging finished vehicle logistics providers to implement flexible, technology-driven solutions that support ongoing service during a vehicle's lifecycle.

- Increasing Vehicle Production: The swift expansion of the automotive industry in emerging markets is driving the need for sophisticated logistics to handle intricate, growing supply chains. Increasing vehicle output, varied models, and customized features necessitate specialized, efficient logistics solutions for finished vehicles to accommodate greater quantities and stricter delivery schedules.

- Sustainability Driving Logistics Innovation: Strict environmental regulations and heightened ecological consciousness are pushing the finished vehicle logistics industry towards sustainable methods. Businesses are embracing route optimization, alternative fuel vehicles, and low-emission transport techniques to ensure compliance, appeal to environmentally aware individuals, and achieve competitive edge.

- Growing EV Adoption: The swift uptake of EVs is fueling expansion in finished vehicle logistics, necessitating specialized handling, charging facilities, and customized transport options. Rising EV production heightens the need for creative, dependable logistics solutions that tackle specific safety and operational hurdles in electric vehicle delivery.

Future Outlook:

- Strong Growth Outlook: The finished vehicles logistics market is expected to grow steadily due to rising global vehicle production, increasing demand for efficient transport solutions, and technological advancements. Expansion in emerging markets and focus on sustainability further support long-term growth across various transportation and distribution channels.

- Market Evolution: The finished vehicles logistics market is evolving with advancements in digital technologies, automation, and real-time tracking systems. Increasing focus on sustainability, multimodal transport integration, and customized logistics solutions is reshaping operations, enhancing efficiency, and meeting the changing demands of automakers and global supply chains.

The growing automobile manufacturing, particularly in developing countries, is catalyzing the demand for effective logistics strategies. With the increase in vehicle production, manufacturers need dependable systems for delivering completed units to dealerships or clients, resulting in a greater need for specialized logistics providers across road, rail, sea, and air networks. In addition to this, emerging technologies like global positioning systems (GPS) tracking, Internet of Things (IoT), artificial intelligence (AI), and blockchain are revolutionizing logistics processes. These advancements enhance route optimization, live tracking, and data precision, leading to lower delivery times and expenses. As a result, logistics providers can deliver services that are more efficient, transparent, and customer-centric, enhancing their appeal to OEMs. Besides this, the increasing transition towards electric cars is transforming vehicle manufacturing and logistics requirements. EVs necessitate tailored handling, storage, and transport systems, encouraging logistics firms to adjust rapidly. This shift presents novel market possibilities for suppliers capable of addressing the distinct challenges of EV logistics, accelerating market expansion.

To get more information on this market, Request Sample

Finished Vehicles Logistics Market Trends:

Increase in Digital Transformation

Digital transformation in the finished vehicles logistics sector is fundamentally changing how businesses engage with clients and oversee their operations. For example, DHL Group plans to invest more than €2 billion in digital transformation efforts from 2021 to 2025, focusing on improvements in customer and employee experiences as well as operational excellence. Utilizing sophisticated digital solutions, companies can enhance client interaction through accessible online platforms and mobile apps, allowing for effortless shipment tracking, modifications to delivery schedules, and direct contact with service providers. Real-time tracking systems provide accurate information on vehicle position and condition, greatly lowering ambiguity and improving logistical planning. Furthermore, advanced data analytics and management systems facilitate improved route optimization and resource allocation, consequently enhancing operations and realizing cost savings.

Rising Demand for Agile and Resilient Logistics Networks

The growing intricacy of the automotive supply chain, shaped by trade unpredictability, EV incorporation, and capacity limits, is encouraging automakers to implement more flexible and robust finished vehicle logistics strategies. In May 2025, the Finished Vehicle Logistics North America conference highlighted how key companies such as Volkswagen, GM, and Nissan are revolutionizing their logistics through the adoption of modular networks, EV-ready lanes, and data-informed quality control to enhance efficiency and flexibility. This change signifies a strategic acknowledgment of logistics as an essential business facilitator rather than just an operational function. As a result, car manufacturers are committing significant resources to cutting-edge technologies and adaptable frameworks to cope with disruptions and changing market needs. These advancements are driving a heightened need for sophisticated, tailored logistics services, thus speeding up the expansion of the finished vehicle logistics sector globally.

Expansion of Vehicle Leasing, Rental, and Subscription Models

The emergence of adaptable vehicle ownership options like leasing, short-term rentals, and vehicle subscriptions is introducing new aspects to finished vehicle logistics. These models need quick and regular vehicle turnover, examination, relocation, and distribution, frequently over wide geographic regions. Logistics companies need to adjust to quicker delivery timelines and the demand for improved fleet oversight and condition tracking. In contrast to conventional single-instance vehicle delivery from the manufacturer to the dealer, these models require ongoing logistics assistance throughout the life of a vehicle. Moreover, business-to-business (B2B) fleet managers and mobility service providers frequently need centralized logistics management for significant numbers of vehicles across various sites. This change elevates the significance of fleet pooling, reverse logistics, and vehicle refurbishment logistics. The evolving trends in vehicle usage are reshaping demand in the finished vehicle logistics sector, encouraging providers to transition from conventional transport services to more versatile, technology-driven vehicle movement solutions designed for ongoing client and fleet requirements.

Finished Vehicles Logistics Market Growth Driver:

Growing Vehicle Production in Emerging Markets

The swift expansion of the worldwide automotive sector, especially in developing markets, is influencing the finished vehicle logistics industry. As vehicle manufacturing increases, the demand for sophisticated logistics systems also rises to effectively transfer completed vehicles from production facilities to showrooms. This trend is particularly apparent in regions, such as Asia-Pacific, Latin America, and Africa, where increasing incomes, urban growth, and a desire for personal transportation are driving automotive growth. Producers are reacting by establishing new manufacturing sites nearer to these markets, forming complex supply networks that demand tailored logistics strategies. Moreover, the growing range of vehicle types and personalized features contributes to the logistical challenges. The Society of Indian Automobile Manufacturers (SIAM) reports that India manufactured 2.84 crore vehicles in FY 2023–24, an increase from 2.59 crore in FY 2022–23. This increase emphasizes the necessity for effective finished vehicle logistics systems that can handle greater capacities and stricter delivery schedules.

Focus on Sustainability and Efficiency

Strict environmental regulations and growing awareness about the ecological effects of logistics are accelerating the transition towards sustainable practices in the finished vehicle logistics sector. Globally, governing bodies are implementing stricter emissions regulations, encouraging logistics companies to reduce their carbon footprint through route optimization, the use of electric or alternative fuel vehicles, and a greater reliance on lower-emission transportation options such as rail and maritime. These actions assist businesses in meeting regulatory requirements while attracting environmentally-aware OEMs and clients. For example, in 2024, the EPA implemented tougher multi-pollutant emissions regulations for light- and medium-duty vehicles beginning with model year 2027, with the goal of decreasing pollution and greenhouse gases through 2032. This regulatory drive enhances public health while encouraging logistics companies to innovate and invest in more sustainable solutions. As the automotive industry undergoes a green shift, logistics companies that align with sustainability objectives are acquiring a vital competitive advantage, fostering growth and modernization in the finished vehicle logistics market.

Shit Towards Electric Logistics Solutions

The rapid global transition towards EVs is a major contributor to the expansion of the finished vehicle logistics market. EVs need careful management because of their delicate batteries and the necessity for safe charging systems while in transit and storage, leading logistics companies to invest in specialized fleets like EV haulers and create advanced transportation and storage options designed for EV needs. With automakers boosting EV output and expanding their product lines, there is a significant rise in the need for efficient, dependable, and tailored logistics services. The International Energy Agency (IEA) stated that in United States, EVs sales reached 1.6 million units in 2024, with a market share surpassing 10%, highlighting the swift acceptance of electric cars. This growing demand is encouraging logistics providers to embrace innovative technologies and operational approaches, driving progress that improves the ability of the finished vehicle logistics market to support the burgeoning global electrified vehicle industry.

Finished Vehicles Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on activity, vehicle type, and distribution channel.

Breakup by Activity:

- Transport (Rail, Road, Air, Sea)

- Warehouse

- Value-added Services

Transport accounts for the majority of the finished vehicles logistics market share

The report has provided a detailed breakup and analysis of the market based on the activity. This includes transport (rail, road, air, sea), warehouse and value-added services. According to the report, transport (rail, road, air, sea) represented the largest segment.

Transportation, encompassing rail, road, air, and sea, represents the backbone of the Finished Vehicles Logistics Market, accounting for the majority of its market share. Road transport, due to its flexibility and reach, is particularly pivotal in delivering vehicles directly to dealerships or end consumers. In 2022, more than three-quarters (78.6 %) of EU road freight transport in tonne-kilometers was carried by heavy goods vehicles with a maximum permissible laden weight of over 30 tonnes. Rail offers cost-effective solutions for long-distance hauls, especially across large countries or between regions. Sea transport is crucial for intercontinental shipments, whereas air freight, though less common due to higher costs, is used for the rapid delivery of high-value vehicles.

Breakup by Vehicle Type:

- Passenger Vehicle

- Commercial Vehicle

- Hybrid Electric Vehicle

- Battery Electric Vehicle

Commercial Vehicle holds the largest share of the industry

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes Passenger Vehicle, Commercial Vehicle, Hybrid Electric Vehicle, and Battery Electric Vehicle. According to the report, commercial vehicle accounted for the finished vehicles logistics market share.

The finished vehicles logistics market is dominated by commercial vehicles due to the rising demand for transportation and delivery services worldwide. E-commerce and construction activities are driving this demand, which, in turn, necessitates robust fleets of trucks, vans, and other commercial transport solutions. The growth of logistics and supply chain networks further propels this segment, while technological advancements and the development of fuel-efficient and eco-friendly commercial vehicles encourage fleet renewals and expansions. As a result, logistics services tailored to commercial vehicles are in constant demand, solidifying their dominant position in the market.

Breakup by Distribution Channel:

- OEMs (Original Equipment Manufacturers)

- Aftermarket

OEMs (Original Equipment Manufacturers) represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes OEMs (Original Equipment Manufacturers), and Aftermarket. According to the report, OEMs (Original Equipment Manufacturers) represented the largest segment.

Original Equipment Manufacturers (OEMs) represent the leading market segment in the finished vehicles logistics market, playing a pivotal role as the primary source of demand for logistics services. OEMs are crucial because they manage the output of new vehicles that require transportation from manufacturing sites to dealerships and customers globally. The collaboration between OEMs and logistics providers is essential to ensure efficient distribution channels that maintain vehicle quality and timely delivery. OEMs often work closely with logistics companies to develop customized solutions that address specific logistical challenges, such as route optimization, inventory management, and adapting to regional regulatory requirements. This partnership is vital for maintaining the seamless flow of newly manufactured vehicles into the market.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific leads the market, accounting for the largest finished vehicles logistics market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia-pacific represents the largest regional market for finished vehicles logistics.

Asia-Pacific holds the dominant position in the finished vehicles logistics market, primarily due to the rapid expansion of automotive manufacturing and sales in the region. Countries like China, India, and Japan are significant contributors, driven by their large population bases, increasing middle-class incomes, and growing preferences for vehicle ownership. In line with this, governmental initiatives promoting automotive sector growth and improvements in regional infrastructure, such as ports and road networks, further bolster the market. For instance, The Government of India (GoI) has provided subsidies amounting to 5,228 INR crore for the sale of 11,53,079 electric vehicles under the FAME India Phase II scheme as of December 1, 2023. This leadership in the market showcases Asia-Pacific’s critical role in shaping global automotive distribution trends.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the finished vehicles logistics industry include CargoTel Inc., CEVA Logistics (CMA CGM), DHL (Deutsche Post AG), DSV A/S, Hellmann Worldwide Logistics SE & Co. KG, Kuehne + Nagel International AG, Omsan Logistics, Pound Gates, among many others.

(Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.)

- Key players in the Finished Vehicles Logistics Market are diversifying their service portfolios to address the evolving needs of the automotive industry, including tailored solutions for electric vehicle logistics and enhanced vehicle tracking capabilities. For instance, logistics company Hellmann partnered with Capgemini to drive innovation through a workshop in their Applied Innovation Exchange. The workshop focused on exploring new technologies and solutions to help Hellmann stay competitive and meet the evolving needs of their clients. Companies are distinguishing themselves by offering value-added services such as pre-delivery inspections, vehicle customization, and real-time delivery updates. Additionally, the integration of digital tools is revolutionizing customer interactions, enabling seamless access to shipment tracking, scheduling, and management, thereby improving overall service delivery and customer satisfaction in this competitive sector.

Finished Vehicles Logistics Market News:

- In June 2025, Volkswagen Group Logistics announced the launch of a new automotive terminal at the Port of Venice, Italy, set to begin operations in autumn 2025. The facility will support exports from plants in southern Germany and central Europe, reducing lead times, increasing rail use, and lowering emissions. The terminal will offer storage for up to 12,000 vehicles.

- In March 2025, Geely Auto announced its partnership with CEVA Logistics to transport its electric EX5 SUVs to Australia for its official market launch. The vehicles became available for test drives starting March 11, marking Geely’s expansion into the Australian EV market. The collaboration ensures efficient nationwide delivery and support for Australian dealerships.

- In September 2024, Stanley Robotics announced a landmark agreement with a Canadian finished vehicle logistics company to launch North America’s first robotic automotive logistics compound management system in Toronto. This partnership marked the first use of outdoor robotics in finished vehicle logistics on the continent.

- In 2024, The Bolloré Group and the CMA CGM Group announced the completion of the sale of 100% of Bolloré Logistics to CMA CGM for 4.850 billion euros. This acquisition is CMA CGM's largest since its creation in 1978 and a major step in the group's logistics development strategy.

- In 2023, Hellmann Worldwide Logistics has opened its first Irish branch at Dublin Airport, offering airfreight, sea-freight, overland transportation, and customs clearance services. The move is part of Hellmann's growth strategy and follows the establishment of additional national companies in Switzerland, Slovakia, and Italy.

Finished Vehicles Logistics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Activities Covered | Transport (Rail, Road, Air, Sea), Warehouse, Value-added Services |

| Vehicle Types Covered | Passenger Vehicle, Commercial Vehicle, Hybrid Electric Vehicle, Battery Electric Vehicle |

| Distribution Channels Covered | OEMS (Original Equipment Manufacturers), Aftermarket |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | CargoTel Inc., CEVA Logistics (CMA CGM), DHL (Deutsche Post AG), DSV A/S, Hellmann Worldwide Logistics SE & Co. KG, Kuehne + Nagel International AG, Omsan Logistics, Pound Gates, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the finished vehicles logistics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global finished vehicles logistics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the finished vehicles logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The finished vehicles logistics market was valued at USD 150.1 Billion in 2024.

The finished vehicles logistics market is projected to exhibit a CAGR of 4.26% during 2025-2033, reaching a value of USD 218.8 Billion by 2033.

The market is primarily driven by the rising global demand for efficient vehicle distribution, growing awareness of carbon footprint reduction, stringent regulations on carbon emissions, and the rising adoption of electric vehicles (EVs).

Asia-Pacific holds the largest share in the finished vehicles logistics market, driven by the rapid expansion of automotive manufacturing and sales, especially in countries like China, India, and Japan.

Some of the major players in the finished vehicles logistics market include CargoTel Inc., CEVA Logistics (CMA CGM), DHL (Deutsche Post AG), DSV A/S, Hellmann Worldwide Logistics SE & Co. KG, Kuehne + Nagel International AG, Omsan Logistics, Pound Gates, among many others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)