Fire Safety Equipment Market Size, Share, Trends and Forecast by Solution, Application, and Region, 2025-2033

Fire Safety Equipment Market Size and Share:

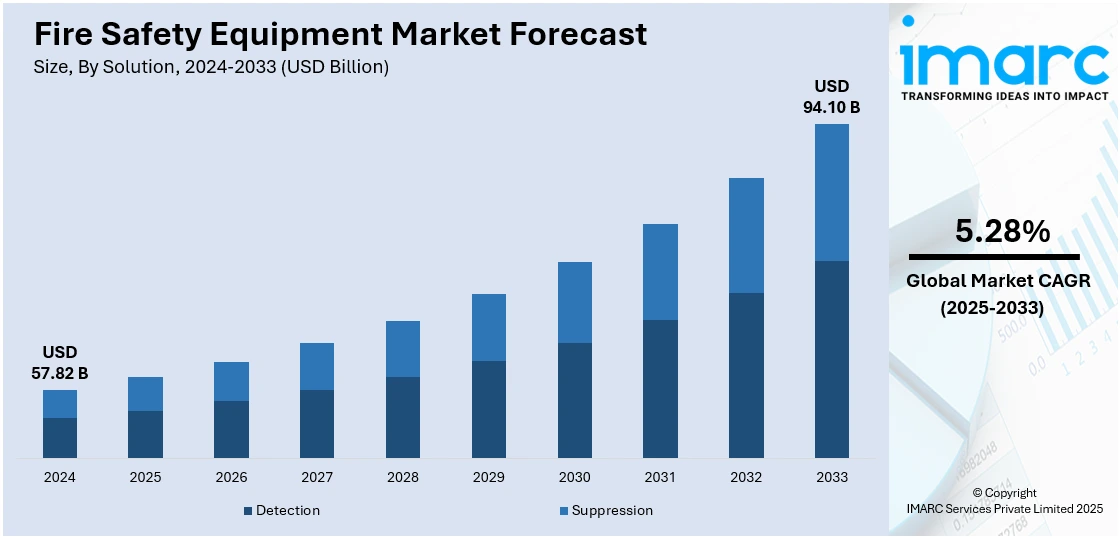

The global fire safety equipment market size was valued at USD 57.82 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 94.10 Billion by 2033, exhibiting a CAGR of 5.28% during 2025-2033. North America currently dominates the market, holding a significant market share of 38.9% in 2024. The rising fire risks, stringent regulations, and growing safety awareness drive demand for advanced fire detection and suppression solutions across sectors. Continuous technological innovations and infrastructure expansion further boost growth, influencing the dynamics of the fire safety equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 57.82 Billion |

|

Market Forecast in 2033

|

USD 94.10 Billion |

| Market Growth Rate (2025-2033) | 5.28% |

The increasing fire hazards in residential, commercial, and industrial settings have heightened the need for effective fire detection and suppression systems. Stringent government regulations and safety standards mandate the installation of advanced fire safety solutions, boosting market demand. Growing urbanization and rapid infrastructure development lead to higher installation of fire safety equipment in new buildings. Additionally, rising awareness about fire prevention and safety among businesses and homeowners encourages proactive adoption. Technological advancements, like smart fire alarms and automated suppression systems, enhance safety and efficiency, attracting more users. Moreover, increased investments in public safety and emergency preparedness further support the expansion of the fire safety equipment market globally.

To get more information on this market, Request Sample

The fire safety equipment market growth is also driven by stringent fire safety regulations from agencies like NFPA and OSHA enforce the installation of advanced detection and suppression systems across sectors. Rapid urbanization and infrastructure growth increase demand for comprehensive fire safety solutions in commercial and industrial buildings. Technological advancements, including IoT-enabled smart detectors and automated suppression systems, improve early fire detection and response. Rising awareness of environmental and health impacts prompts the adoption of eco-friendly, non-toxic firefighting equipment. Additionally, increasing investments in public safety and emergency preparedness strengthen market growth. For instance, in April 2025, 3A Composites USA and TENMAT announced a major advancement in exterior wall assemblies' fire safety. ALUCOBOND PLUS has passed several stringent tests and follows the 2022 NYC Building Code when used in rainscreen applications in conjunction with the TENMAT FF102/50 Rainscreen Fireblock.

Fire Safety Equipment Market Trends

Increasing Fire Hazards and Risk Awareness

The rising frequency of fire incidents across residential, commercial, and industrial sectors is a significant driver of the fire safety equipment market. For instance, in India, approximately 7,566 fire-related accidents were reported in 2022, with 7,435 fatalities, as per recent industry reports. Similarly, in the United States, local fire departments responded to approximately 1,504,500 fires in 2022. There were a reported 3,790 civilian deaths and 13,250 civilian injuries due to fires. Rapid urbanization and industrial growth increase fire risks, particularly in densely populated and high-risk areas. High-profile fire disasters have raised public and corporate awareness regarding fire prevention, prompting investments in advanced fire detection and suppression systems. This growing risk consciousness encourages both individuals and organizations to adopt proactive safety measures. Industries dealing with flammable materials especially prioritize fire safety to safeguard assets, infrastructure, and lives. Consequently, the demand for reliable, efficient fire safety equipment is expanding, driving innovation and market growth worldwide.

Stringent Government Regulations and Safety Standards

Government regulations and safety codes play a crucial role in shaping the fire safety equipment market. Agencies like the Occupational Safety and Health Administration (OSHA) and National Fire Protection Association (NFPA) enforce strict standards requiring the installation of fire detection and suppression systems in residential, commercial, and industrial buildings. According to the fire safety equipment market forecast, these laws ensure public safety by mandating compliance with updated fire codes, including requirements for fire alarms, sprinklers, and emergency exits. The evolving regulatory landscape compels businesses and property owners to upgrade or install new fire safety solutions, fueling market demand. Moreover, penalties for non-compliance further motivate adherence, making government regulations a major catalyst for market growth and innovation. For instance, in December 2023, the Government of Gujarat in India introduced the ‘Ease of Living’ Initiative to provide citizens with information on fire safety features in a variety of buildings, such as multi-story complexes, high-risk buildings, hospitals, hotels, shopping centers, schools, and colleges. The primary aim of the portal is to make sure that the public is aware of the fire safety regulations and provisions in such establishments.

Technological Advancements and Innovation

Technological progress significantly propels the fire safety equipment market by enhancing detection, response, and prevention capabilities. Innovations such as IoT-enabled smart fire detectors, AI-powered alarm systems, and automated suppression technologies enable quicker and more accurate fire identification, reducing false alarms and enabling remote monitoring. Advances in eco-friendly fire retardants and sustainable materials address environmental and health concerns, expanding market appeal. These technologies improve safety efficiency, user convenience, and system integration with broader building management systems, creating a positive impact on the fire safety equipment market outlook. The continuous push for smarter, reliable, and energy-efficient fire safety solutions encourages manufacturers to invest heavily in research and development, driving market expansion across residential, commercial, and industrial sectors worldwide. For instance, in August 2024, Bull Products expanded its line of fire safety products to include the new LFX lithium-ion fire extinguishers, which are a temporary fire protection option. These extinguishers were created especially to combat the rising dangers of lithium-ion battery fires.

Fire Safety Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global fire safety equipment market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on solution and application.

Analysis by Solution:

- Detection

- Detectors

- Alarms

- Suppression

- Extinguishers

- Sprinklers

Detection stands as the largest component in 2024, holding 64.0% of the market. Detection holds the largest share in the market because it serves as the first critical step in preventing fire-related damage and casualties. Early detection systems, including smoke detectors, heat sensors, and flame detectors, enable rapid identification of fires, allowing for timely alerts and prompt emergency responses. This early warning helps minimize property loss and protects lives by giving occupants and fire services more time to act. Regulatory mandates across residential, commercial, and industrial sectors require the installation of reliable detection devices, boosting market demand. Moreover, advancements in smart detection technology, such as IoT integration, real-time monitoring, and automated alerts, have enhanced system effectiveness, making detection equipment indispensable and driving its dominant market share globally.

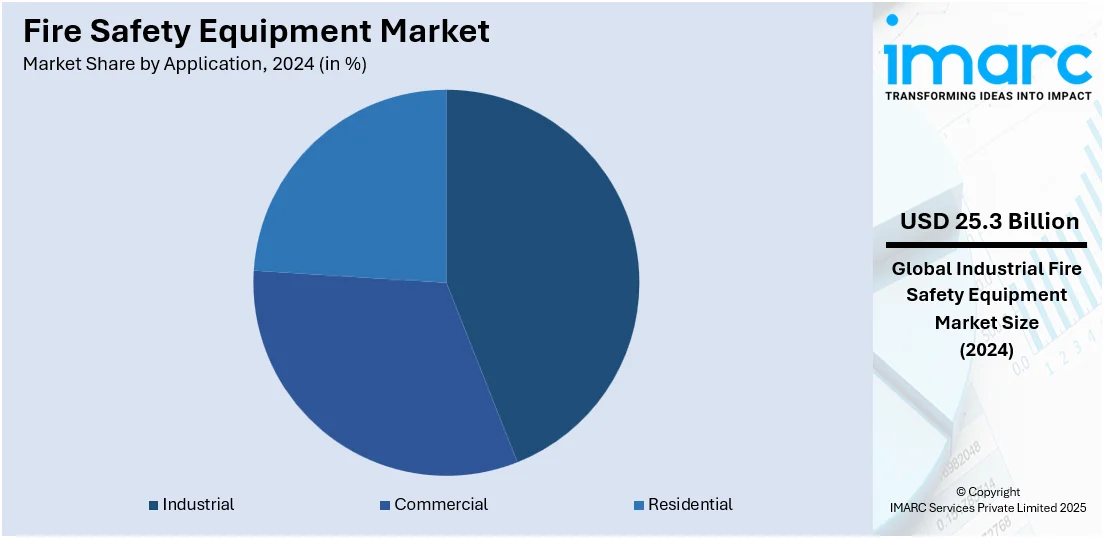

Analysis by Application:

- Commercial

- Industrial

- Residential

Industrial leads the market with 43.7% of market share in 2024. The industrial sector holds the largest share in the market due to the high risk of fire hazards inherent in manufacturing plants, chemical factories, oil and gas facilities, and warehouses. These environments often involve flammable materials, heavy machinery, and complex electrical systems, increasing the likelihood and potential severity of fires. To protect valuable assets, ensure worker safety, and comply with stringent government regulations, industries invest heavily in comprehensive fire safety systems, including detection, suppression, and extinguishing equipment. Additionally, regulatory bodies impose strict fire safety standards in industrial settings, driving continuous demand for advanced and reliable fire protection solutions. The critical need to minimize operational downtime and avoid catastrophic losses further reinforces the dominant market share held by the industrial segment.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 38.9%. The North America fire safety equipment market demand is driven by stringent government regulations and building codes that mandate advanced fire detection and suppression systems across residential, commercial, and industrial sectors. Increasing fire incidents and heightened safety awareness push demand for reliable, innovative fire safety solutions. Technological advancements such as smart detectors, IoT integration, and automated suppression systems enhance fire prevention and response capabilities. Additionally, growing urbanization and infrastructure development create a need for comprehensive fire safety in new constructions and retrofits.

Key Regional Takeaways:

United States Fire Safety Equipment Market Analysis

In 2024, the United States accounted for 82.90% of the fire safety equipment market in North America. The United States fire safety equipment market is primarily driven by a combination of regulatory enforcement, technological advancements, and rising awareness about fire hazards across commercial, residential, and industrial sectors. Strict building codes and safety standards set by bodies like the Occupational Safety and Health Administration (OSHA) and National Fire Protection Association (NFPA) mandate the installation of fire alarms, extinguishers, sprinklers, and suppression systems in both existing and new structures. The growing incidence of fire-related incidents, specifically in densely populated urban areas and industrial zones, is further propelling the demand for reliable fire safety infrastructure. According to the National Fire Protection Association (NFPA), approximately 1.39 million fires were responded to by municipal fire departments in the U.S. in 2023. As per estimates, 13,350 civilians were injured, and 3,670 civilians lost their lives as a result of these fires. Moreover, these incidents cost nearly USD 23 Billion in property damage. Additionally, increased insurance requirements and liability concerns are also prompting businesses to invest in advanced fire detection and mitigation solutions. Meanwhile, technological innovation is enhancing product effectiveness and integration, with smart alarms, wireless detectors, and connected fire safety systems witnessing increased adoption, particularly in commercial real estate and smart buildings. The demand for environmentally friendly and low-maintenance fire suppression systems is also gaining popularity, further facilitating industry expansion.

Asia Pacific Fire Safety Equipment Market Analysis

The Asia Pacific fire safety equipment market is expanding due to rapid urbanization, growing industrial activity, and stricter fire safety regulations. As per estimates by industry reports, in 2025, 53.6% of the population of Asia lives in urban areas, equating to 2,589,655,469 individuals. As cities expand and high-rise construction increases in countries such as China, India, and Southeast Asian nations, the need for robust fire protection systems in residential and commercial buildings is becoming more critical. Governments are tightening fire codes and enforcement, particularly following major fire incidents that have raised public concern and highlighted safety gaps. In India, the fire sprinklers market is expected to reach USD 1,277.6 Million by 2033, exhibiting a growth rate (CAGR) of 8.79% during 2025-2033. Additionally, the growth of manufacturing hubs and warehousing facilities has led to increased demand for specialized fire detection and suppression systems to protect valuable assets and ensure business continuity. Besides this, rising insurance standards and corporate risk management practices are also propelling companies to invest in modern fire safety solutions.

Europe Fire Safety Equipment Market Analysis

The Europe fire safety equipment market is experiencing robust growth, fueled by a robust regulatory framework, modernization of infrastructure, and rising awareness about workplace and residential safety. For instance, in November 2023, around 18 organizations in the EU established a partnership to improve fire safety across the European Union and launch the EU Manifesto for 2024-2029 #KEEPEUFIRESAFE, according to the European Fire Safety Alliance. As part of this initiative, EU authorities will be expected to develop and implement a fire safety strategy to support Member States in maintaining fire safety for EU citizens in all buildings, as well as coordinating and enhancing Member State efforts as necessary. The European Union directives and national regulations require strict adherence to fire protection standards, particularly in commercial buildings, industrial facilities, and public infrastructure. Regular safety audits and mandatory fire risk assessments under policies such as the EU Construction Products Regulation (CPR) are also prompting organizations to upgrade or install advanced fire detection and suppression systems. Additionally, the rise in electric vehicle (EV) charging infrastructure and battery storage installations has also introduced new fire safety requirements, driving adoption of thermal detection and gas suppression technologies. For instance, as per a 2023 study by the European Commission, there are approximately 244 EV fires for every million registered EVs. Other than this, increasing investment in the industrial and energy sectors is also contributing to demand for specialized fire protection equipment tailored for hazardous environments.

Latin America Fire Safety Equipment Market Analysis

The Latin America fire safety equipment market is significantly influenced by the increasing digitization of building management systems and the gradual adoption of IoT-enabled fire detection solutions. As property owners and facility managers seek to streamline operations, integrated safety systems that allow for remote monitoring and real-time alerts are gaining popularity. Additionally, the rise in renewable energy installations, such as solar farms and battery storage units, is prompting the need for specialized fire suppression equipment to address electrical fire risks. Besides this, training programs and certification standards for fire safety personnel are also expanding across the region, creating a more informed user base and reinforcing long-term market growth for fire safety equipment. For instance, in May 2025, the State Government of Rio de Janeiro, Brazil, launched a new, state-of-the-art urban firefighting training facility. With a R$5 million investment from the State Government, the facility features cutting-edge equipment developed to provide a broad range of exercises and activities to educate military personnel about how fires develop so that they can better utilize firefighting resources in real time.

Middle East and Africa Fire Safety Equipment Market Analysis

The Middle East and Africa fire safety equipment market is being increasingly propelled by growing infrastructure development, strict enforcement of building safety codes, and the expansion of smart city initiatives. According to a report published by the IMARC Group, the smart cities market in the Middle East reached USD 62,965.8 Million in 2024 and is expected to grow at a CAGR of 21.89% during 2025-2033. As countries such as the UAE, Saudi Arabia, and South Africa invest in large-scale urban projects, there is a rising demand for integrated fire detection and suppression systems that can be embedded into smart building frameworks. Smart cities such as NEOM in Saudi Arabia are also incorporating real-time fire monitoring and automated response technologies, setting new benchmarks for fire safety standards in the region.

Competitive Landscape:

The fire safety equipment market is highly competitive, dominated by global and regional players focusing on innovation, product quality, and compliance with stringent safety standards. Major players invest heavily in research and development (R&D) to introduce advanced technologies like IoT-enabled detectors, AI-powered alarms, and eco-friendly suppression systems. Mergers, strategic partnerships, and acquisitions are common to expand market reach and product portfolios. Manufacturers also emphasize certification and adherence to international fire safety codes to gain customer trust. Competitive pricing, after-sales service, and customization options further differentiate players. Emerging companies leverage niche innovations, while established firms capitalize on strong distribution networks and brand recognition. This dynamic landscape drives continuous advancements, meeting growing demand across residential, commercial, and industrial sectors globally.

The report provides a comprehensive analysis of the competitive landscape in the fire safety equipment market with detailed profiles of all major companies, including:

- Bosch Sicherheitssysteme GmbH

- Carrier Global Corporation

- Eaton Corporation plc

- Gentex Corporation

- Halma plc

- Hochiki America Corporation

- Honeywell HBT

- Johnson Controls International PLC

- Napco Security Technologies, Inc

- Nittan Co., Ltd

- Siemens AG

- Space Age Electronics, Inc.

Latest News and Developments:

- April 2025: LifeSafe established a partnership with Trinity Fire & Security in order to launch its novel 6-litre Multi-Purpose Fluid (MPF) fire extinguisher in the United Kingdom. The new fire extinguisher is certified according to the BSI Kitemark and CE regulations and approved for Class A, B, and F fires.

- February 2025: Pye-Barker Fire & Safety completed the acquisition of Nebraska Safety and Fire Equipment. With this acquisition, Pye-Barker aims to expand its Midwest footprint in the United States by adding three new facilities in Nebraska, allowing the company to reach more towns across the country with full fire code compliance.

- February 2025: UL Solutions Inc. declared the establishment of a new Global Fire Science Center of Excellence in Northbrook, Illinois. The Global Fire Science Center of Excellence will evaluate and certify various fire safety equipment, such as sprinkler systems, pipes, fire extinguishers, and perimeter fire barrier structures for both residential and commercial use.

- December 2024: Siemens Smart Infrastructure acquired Danfoss Fire Safety, a provider of fire suppression technologies based in Denmark. This acquisition will drive the steady expansion of the low-pressure CO₂ and high-pressure water mist sustainable fire safety offerings by Siemens.

Fire Safety Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Applications Covered | Commercial, Industrial, Residential |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bosch Sicherheitssysteme GmbH, Carrier Global Corporation, Eaton Corporation plc, Gentex Corporation, Halma plc, Hochiki America Corporation, Honeywell HBT, Johnson Controls International PLC, Napco Security Technologies, Inc, Nittan Co., Ltd, Siemens AG, Space Age Electronics, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the fire safety equipment market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global fire safety equipment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the fire safety equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fire safety equipment market was valued at USD 57.82 Billion in 2024.

The fire safety equipment market is projected to exhibit a CAGR of 5.28% during 2025-2033, reaching a value of USD 94.10 Billion by 2033.

Key factors driving the fire safety equipment market include rising fire incidents, stringent government regulations, increasing safety awareness, technological advancements like smart detectors and automated systems, urbanization, and infrastructure growth. These elements collectively boost demand for reliable, efficient fire detection and suppression solutions across residential, commercial, and industrial sectors.

North America currently dominates the fire safety equipment market due to strict regulations, rising fire incidents, technological innovations, urbanization, and increased safety awareness.

Some of the major players in the fire safety equipment market include Bosch Sicherheitssysteme GmbH, Carrier Global Corporation, Eaton Corporation plc, Gentex Corporation, Halma plc, Hochiki America Corporation, Honeywell HBT, Johnson Controls International PLC, Napco Security Technologies, Inc, Nittan Co., Ltd, Siemens AG, Space Age Electronics, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)