Fire Sprinklers Market Size, Share, Trends and Forecast by Product Type, Service, Component, Application, Technology, and Region, 2025-2033

Fire Sprinklers Market Size and Share:

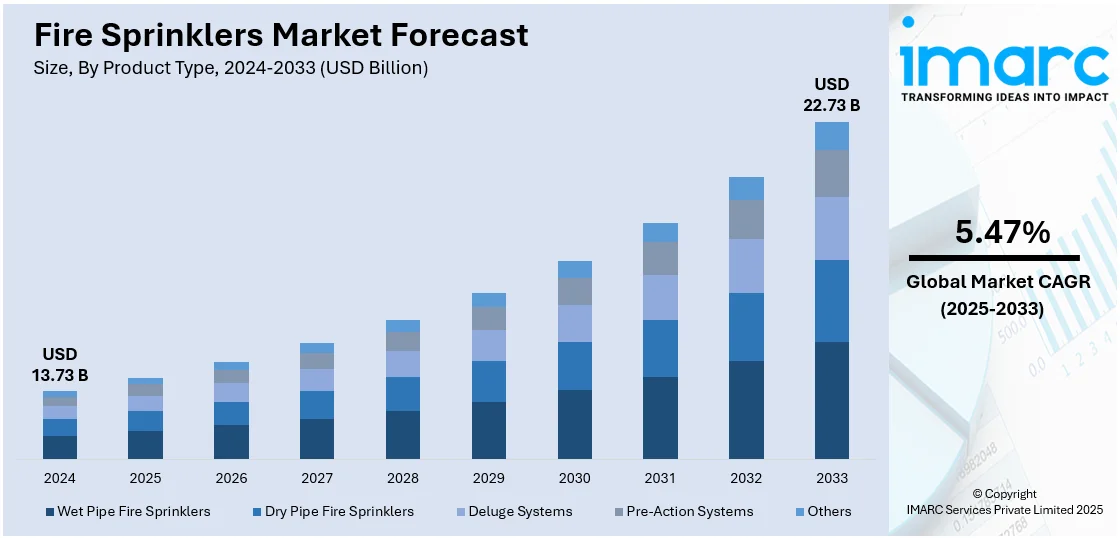

The global fire sprinklers market size was valued at USD 13.73 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 22.73 Billion by 2033, exhibiting a CAGR of 5.47% during 2025-2033. North America currently dominates the market, holding a significant market share of over 31.2% in 2024. Stringent fire safety regulations, increasing urbanization and infrastructure development, heightened awareness about fire safety, significant advancements in fire sprinkler technology, and the growing insurance industry influence are some of the major factors fueling the fire sprinklers market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 13.73 Billion |

|

Market Forecast in 2033

|

USD 22.73 Billion |

| Market Growth Rate 2025-2033 | 5.47% |

The market for fire sprinklers is experiencing significant growth, driven by several key factors. Rapid urbanization and infrastructure development have led to increased construction activities in residential, commercial, and industrial sectors, necessitating robust fire protection systems. The installation of fire sprinklers becomes mandatory under existing government regulations and building codes for enhancing safety protocols. Growing concerns about fire safety among property owners and businesses continue to strengthen the market demand for these systems. Technological advancements, such as smart and automated sprinkler systems, offer improved efficiency and integration with building management systems, making them more appealing. Additionally, the growing emphasis on minimizing property damage and ensuring occupant safety in the event of a fire has underscored the importance of reliable fire suppression solutions, thereby fueling market expansion.

The fire sprinkler market growth in the United States is primarily driven by increasing fire incidents in both residential and non-residential properties, which have heightened awareness about fire safety, prompting investments in fire protection systems. Stringent building codes and regulations mandate the installation of fire sprinklers in various structures, ensuring compliance and safety. Technological advancements have led to the development of smart sprinkler systems equipped with sensors and automated controls, enhancing early detection and response capabilities. Additionally, the growing emphasis on minimizing property damage and ensuring occupant safety has underscored the importance of reliable fire suppression solutions, thereby fueling market expansion. For instance, in September 2024, Plumis, known for its intelligent fire suppression systems, entered a new distribution agreement with Ferguson. This collaboration is set to bring Plumis’ Automist fire suppression system to the US market, as reported by Plumis. Ferguson, a distributor of fire protection products, and Plumis will officially unveil the product at the 43rd Annual American Fire Sprinkler Association (AFSA) Convention and Exhibition, which took place on 18 September 2024.

Fire Sprinklers Market Trends:

Stringent Fire Safety Regulations

The global fire sprinklers market is significantly driven by stringent fire safety regulations imposed by governments and authorities worldwide. These regulations mandate the installation of fire sprinkler systems in various types of buildings, including residential, commercial, and industrial. The primary goal is to ensure the safety of occupants and protect property from the devastating effects of fires. In many countries, building codes require fire sprinklers as a fundamental component of fire protection measures. For instance, in the United States, the National Fire Protection Association's (NFPA) standards and codes, such as NFPA 13 for sprinkler systems, have become industry benchmarks. Non-compliance with these regulations can result in hefty fines, legal repercussions, and increased insurance premiums.

Increasing Urbanization and Infrastructure Development

The rapid pace of urbanization and infrastructure development in emerging economies is creating a positive impact on the fire sprinklers market outlook. According to the United Nations, 68% of the world population projected to live in urban areas by 2050. As more individuals move to cities, there is a growing need for residential and commercial buildings, public facilities, and industrial complexes. With this expansion comes an increased risk of fire incidents. Urbanization also means higher population density, which can exacerbate the consequences of fires. Consequently, governments and city planners are emphasizing fire safety measures to protect lives and property. This includes the mandatory installation of fire sprinkler systems in newly constructed buildings and, in some cases, retrofitting existing structures.

Increased Awareness about Fire Safety

Heightened awareness about fire safety among individuals, businesses, and communities is driving the demand for fire sprinkler systems. High-profile fire incidents and disasters have underscored the importance of effective fire protection measures. In residential settings, homeowners are increasingly recognizing the value of fire sprinkler systems in safeguarding their families and property. According to the fire sprinkler market forecast, this awareness has resulted in an increasing movement to retrofit current homes with sprinklers, even in areas where it isn't required. In the same way, organizations and businesses are valuing fire safety highly. It is of utmost importance to safeguard employees, customers, and important assets from fire-related hazards. Companies recognize that the expense of fire sprinkler installation is minimal when weighed against the possible damages a fire could cause.

Advancements in Fire Sprinkler Technology

Technological advancements are a key driver of the fire sprinklers market. Innovations in sprinkler system design, materials, and monitoring capabilities have significantly improved their efficiency and effectiveness in fire prevention and control. One notable advancement is the development of smart fire sprinkler systems. These systems incorporate IoT (Internet of Things) technology and sensors to provide real-time monitoring and control. Property owners and building managers can remotely check the status of their sprinkler systems, receive alerts in case of anomalies, and even control the system through mobile apps. This level of connectivity enhances fire safety and allows for swift response to potential threats. Additionally, eco-friendly and sustainable fire sprinkler systems are gaining traction. These systems use environmentally friendly extinguishing agents, reducing their impact on the environment.

Growing Insurance Industry Influence

The insurance industry plays a significant role in driving the adoption of fire sprinkler systems. Insurance companies often offer reduced premiums to properties equipped with fire sprinklers, as they are seen as a proactive risk mitigation measure. This financial incentive encourages property owners to invest in fire protection. Moreover, some insurance providers may require the installation of fire sprinklers as a condition for coverage, particularly for high-risk properties or businesses. In such cases, property owners have a strong motivation to comply with these requirements to secure insurance. The influence of the insurance industry extends to regulations and building codes. Insurance companies collaborate with regulatory bodies to establish fire safety standards and guidelines. Their expertise in assessing risk and loss prevention helps shape fire safety policies, further emphasizing the importance of fire sprinkler systems.

Fire Sprinklers Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global fire sprinklers market, along with forecasts at the global and regional levels from 2025-2033. The market has been categorized based on product type, service, component, application, and technology.

Analysis by Product Type:

- Wet Pipe Fire Sprinklers

- Dry Pipe Fire Sprinklers

- Deluge Systems

- Pre-Action Systems

- Others

Wet pipe fire sprinklers stand as the largest product type in 2024, holding around 52.3% of the market. Wet pipe fire sprinklers are the most common and traditional type of fire sprinkler system. They are designed to have water constantly stored within the pipes and ready for immediate discharge upon activation. This simplicity and readiness make wet pipe systems highly reliable and cost-effective. In a wet pipe system, the sprinkler heads are attached to pipes filled with pressurized water. When the heat from a fire causes a sprinkler head to reach its activation temperature, that specific sprinkler head opens, allowing water to flow and suppress the fire. This targeted response minimizes water damage to unaffected areas of a building.

Analysis by Service:

- Engineering Services

- Installation

- Design Maintenance

- Inspection

- Managed Services

- Others

Engineering services are a fundamental component of the fire sprinkler market. These services encompass the design, planning, and analysis of fire sprinkler systems to ensure they meet regulatory requirements and effectively protect a given space. Fire protection engineers are responsible for designing systems tailored to the specific needs of buildings and facilities. They assess factors such as occupancy type, building layout, and fire risks to determine the optimal sprinkler layout and system capacity. Engineering services also involve hydraulic calculations, pipe sizing, and material selection to guarantee that the fire sprinkler system can deliver the required water flow and coverage. These services are essential in preventing under-designed or over-designed systems, ensuring both safety and cost-effectiveness.

Installation services involve the physical implementation of fire sprinkler systems based on engineering designs. This segment includes the labor, materials, and equipment required to assemble and position sprinkler heads, pipes, valves, and associated components. Professional installation is crucial to ensure that the system functions as intended during a fire event. Skilled technicians must carefully follow design specifications, adhere to local building codes and safety standards, and conduct pressure tests to confirm system integrity. Installation services are highly specialized, as different buildings may require various sprinkler types, such as wet pipe, dry pipe, or pre-action systems. Moreover, the installation must consider factors such as, ceiling type, room layout, and building use.

Design maintenance services involve the creation of detailed plans and drawings for fire sprinkler systems. Fire protection designers collaborate closely with engineers to translate technical specifications into practical, visually comprehensive layouts. The design phase takes into account the architectural features, occupancy, and fire risk factors of the building. It includes selecting the appropriate type of sprinkler heads, pipe routes, and system zoning. Detailed design documents guide installers and help ensure accurate system implementation.

Inspection services are a key element in fire sprinkler system maintenance and safety. These services involve a systematic assessment of the entire fire sprinkler system, including pipes, sprinkler heads, valves, and alarms, to confirm that they meet regulatory requirements and function correctly. Regular inspections aid in identifying potential issues, such as obstructions, leaks, or damaged components, that could impair the effectiveness of the system during a fire event. Inspections also ensure that the system complies with local building codes and standards.

Managed services in the fire sprinklers market are focused on ensuring the ongoing functionality and reliability of fire sprinkler systems. These services are essential for preventing system failures and ensuring that the sprinklers are always ready to respond effectively in case of a fire emergency. Routine maintenance involves inspections, testing, and maintenance of components such as, pipes, valves, and sprinkler heads.

Analysis by Component:

- Stop Valve

- Alarm Valve

- Fire Sprinkler Head

- Alarm Test Valve

- Motorized Alarm Bell

Stop valve leads the market in 2024. The stop valve is a crucial component of a fire sprinkler system, responsible for controlling the flow of water to the system. It is designed to remain in a closed position until activated by the fire detection system. Once triggered, the stop valve opens, allowing water to flow through the system and extinguish the fire. Stop valves are typically made of durable materials to withstand the pressures and conditions they may encounter during operation. The demand for stop valves in the fire sprinkler market is driven by their essential role in fire protection. Property owners and building managers rely on these valves to ensure that water is readily available in case of a fire emergency. The quality and reliability of stop valves are of utmost importance, as any failure in this component can have catastrophic consequences.

Analysis by Application:

- Commercial Applications

- Residential Applications

- Industrial Applications

Commercial application leads the market with around 58.7% of market share in 2024. The commercial application segment of the fire sprinklers market encompasses a wide range of businesses, including offices, retail stores, hotels, restaurants, and entertainment venues. Fire safety is of paramount importance in these settings to protect occupants and also to safeguard valuable assets and maintain business continuity. Commercial properties often feature large open spaces, complex layouts, and a high volume of foot traffic, which can increase the risk of fire incidents. As a result, many countries and regions have stringent fire safety regulations that mandate the installation of fire sprinkler systems in commercial buildings.

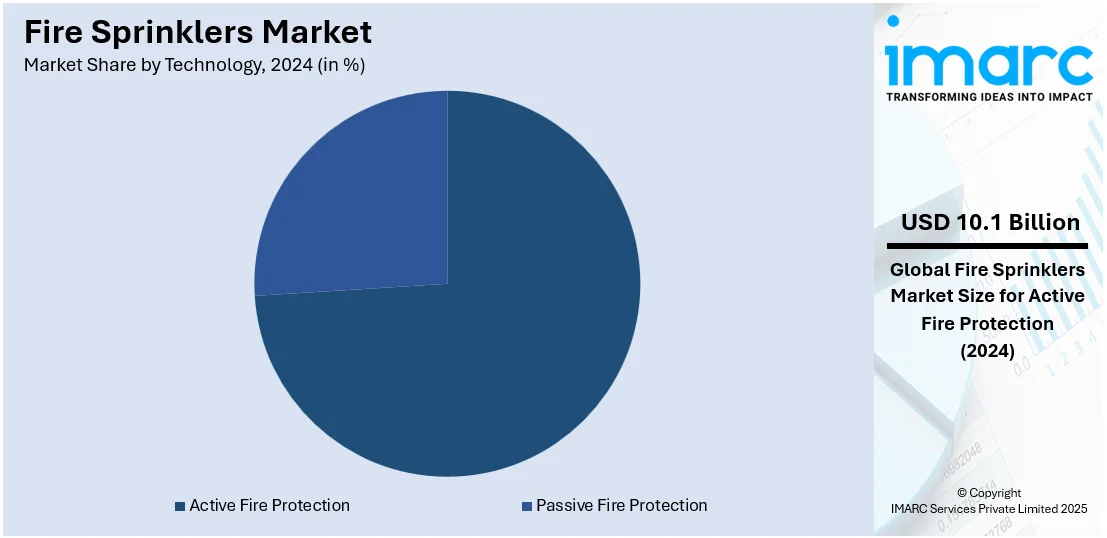

Analysis by Technology:

- Active Fire Protection

- Passive Fire Protection

Active fire protection leads the market with around 73.6% of market share in 2024. Active fire protection technology encompasses systems and devices that actively detect and suppress fires when they occur. This segment includes fire alarms, fire sprinkler systems, fire extinguishers, and fire suppression systems. One of the prominent components within active fire protection is the fire sprinkler system. These systems are equipped with heat or smoke detectors that trigger the release of water or other extinguishing agents when a fire is detected. They work very well to put a stop to fires when they are still in their early stages, preventing them from spreading and resulting in widespread destruction. Due to stringent fire safety regulations and increased awareness, the demand for fire sprinkler systems has been steadily growing, particularly in residential, commercial, and industrial sectors.

Regional Analysis:

- North America

- Asia Pacific

- Europe

- Middle East and Africa

- Latin America

In 2024, North America accounted for the largest market share of over 31.2%. North America is a mature and prominent market for fire sprinkler systems. The region has stringent fire safety regulations, notably in the United States and Canada, which drive the demand for fire sprinkler installations in various building types. Residential, commercial, and industrial sectors in North America are aware of the life-saving benefits of fire sprinklers, contributing to sustained market growth. In recent years, the adoption of advanced technologies in fire sprinkler systems, such as smart sprinkler technology, has gained momentum in North America. The fire sprinkler market demand here is characterized by the presence of established manufacturers and service providers who continually innovate to meet evolving regulatory standards.

Key Regional Takeaways:

United States Fire Sprinklers Market Analysis

In 2024, the United States accounted for over 83.50% of the fire sprinklers market in North America. The United States is witnessing rising fire sprinkler adoption driven by the growing demand for fire safety systems across commercial and residential sectors. For instance, as of 2025, the fire protection and security system installation contractors industry in the United States comprises 19,845 businesses. Increased investments in infrastructure modernization, stringent fire safety regulations, and awareness regarding property protection have significantly contributed to this trend. Insurance benefits and government-backed incentives are also encouraging the installation of fire sprinklers. Integration with building management systems has made fire safety systems more efficient and reliable, supporting the deployment of advanced fire sprinklers. Public and private sector collaboration to enhance fire preparedness and mitigate risks is further accelerating fire sprinklers adoption. The demand for smart fire safety systems, combined with consistent updates in fire codes and standards, is ensuring continuous growth. Adoption is notably strong across high-occupancy structures and critical facilities in urban areas.

Asia Pacific Fire Sprinklers Market Analysis

Asia-Pacific is experiencing increased fire sprinklers adoption due to the growing fire accidents across densely populated urban centers and industrial zones. For instance, in India, the share of fire incidents attributed to electrical problems/short circuits increased from 3% in 1996 to 21% by 2022. Rising fatalities and economic losses from fire incidents are pushing authorities to enhance building safety measures. Regulatory pressure and mandatory fire compliance protocols in new and existing buildings are stimulating fire sprinklers integration. Accelerated industrial expansion and high-rise construction further necessitate efficient fire suppression solutions. Technological advancements and cost-effective system availability are enabling broader access to fire sprinklers. Rising safety awareness among businesses and consumers alike, particularly in educational, healthcare, and commercial infrastructures, is supporting this adoption trend. Moreover, media coverage of fire tragedies and resulting public concern are acting as social drivers for fire sprinklers adoption.

Europe Fire Sprinklers Market Analysis

Europe is seeing accelerated fire sprinklers adoption supported by growing government initiatives that focus on enhancing fire safety regulations and building codes. According to Eurostat, in 2021, the total expenditure of general government in EU countries on fire protection services reached €34.1 billion, which reflects a 2.5% increase from 2020. National and regional authorities are introducing mandates and funding programs that promote the use of fire suppression systems across new and existing structures. Emphasis on sustainable construction and energy-efficient buildings includes integrated safety mechanisms like fire sprinklers. Public infrastructure investments and renovation of aging buildings further support the trend. Enhanced regulatory compliance requirements for public and private establishments ensure that fire sprinklers are prioritized. Collaborative efforts between regulatory bodies, fire safety organizations, and construction stakeholders are advancing awareness and the execution of safety measures. This policy-driven environment is encouraging extensive deployment of fire sprinklers throughout Europe’s real estate landscape.

Latin America Fire Sprinklers Market Analysis

Latin America is witnessing higher fire sprinklers adoption due to growing rapid urbanization and infrastructure development. For instance, Brazil has 27 federal states and each of them has its own fire safety legislation. As cities expand and high-rise buildings, commercial centers, and residential complexes multiply, the demand for effective fire protection grows. Fire sprinklers are being increasingly installed to align with evolving safety codes and to reduce the risks associated with dense urban settings. Construction firms and developers are incorporating these systems to ensure compliance and enhance occupant safety amid ongoing urban growth across Latin America.

Middle East and Africa Fire Sprinklers Market Analysis

The Middle East and Africa is experiencing increased fire sprinklers adoption fueled by growing smart building and smart home constructions. For instance, the Middle East expects to invest nearly U.S. USD 50 Billion in smart city projects by 2025. Integration of intelligent systems with automated fire suppression technologies is becoming standard in modern construction projects. As developers focus on safety and operational efficiency in high-tech infrastructure, fire sprinklers are gaining traction. This technological shift toward smart environments is reinforcing the relevance of fire suppression systems in the Middle East and Africa.

Competitive Landscape:

The key players in the market are actively pursuing several strategies to maintain their competitive edge and adapt to evolving market demands. They are heavily investing in research and development to innovate and create advanced fire sprinkler systems that offer enhanced safety, efficiency, and environmental sustainability. Additionally, these industry leaders are focusing on expanding their global footprint through strategic partnerships, collaborations, and acquisitions, allowing them to tap into emerging markets and offer comprehensive fire protection solutions. Furthermore, they are actively engaging in educational outreach programs and awareness campaigns to promote the benefits of fire sprinklers, contributing to increased market adoption. Overall, these players are committed to ensuring the growth of the industryand meeting the evolving needs of customers worldwide.

The report provides a comprehensive analysis of the competitive landscape in the fire sprinklers market with detailed profiles of all major companies, including:

- Honeywell International

- Johnson Controls

- Minimax GmbH & Co. KG

- API Group Inc.

- United Technologies Corporation

- Robert Bosch GmbH

- Hochiki Corporation

- VT MAK

- Siemens AG

Latest News and Developments:

- April 2025: The British Automatic Fire Sprinkler Association (BAFSA) has introduced a new online CPD program that provides comprehensive training on automatic fire sprinkler systems. The course, named Principles & Practices of Automatic Fire Sprinkler Systems, was aimed at industry professionals and related stakeholders. It covered system design, components, and certification, and awarded a CPD-endorsed certificate upon completion.

- April 2025: The PURGENVENT™ Model 7940 BLE, an automatic air vent assembly for wet fire sprinkler systems that complies with BABAA standards, has been launched by AGF Manufacturing. The new model enhanced air management and system reliability while aligning with NFPA 13 standards.

- March 2025: MiTek launched an integrated fire protection service in partnership with WCS Interiors Ltd., enhancing mezzanine floor systems across UK projects. The service incorporated fire sprinklers as part of broader suppression measures to meet safety and insurance standards.

- February 2025: UL Solutions unveiled the new Global Fire Science Center of Excellence. The facility offered advanced testing and certification services for fire sprinklers, pipes, valves, and related systems. It supported manufacturers in meeting evolving safety and sustainability standards.

- January 2025: Forede® introduced the ESFR Fire Sprinkler for Dry Sprinkler Systems, enhancing fire protection for high-piled storage areas. Designed for rapid response, the ESFR system released a concentrated water stream directly onto fires, minimizing spread and water damage. It was particularly suited for warehouses storing flammable materials, ensuring early detection and swift suppression.

Fire Sprinklers Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Wet Pipe Fire Sprinklers, Dry Pipe Fire Sprinklers, Deluge Systems, Pre-Action Systems, Others |

| Services Covered | Engineering Services, Installation, Design Maintenance, Inspection, Managed Services, Others |

| Components Covered | Stop Valve, Alarm Valve, Fire Sprinkler Head, Alarm Test Valve, Motorized Alarm Bell |

| Applications Covered | Commercial Applications, Residential Applications, Industrial Applications |

| Technologies Covered | Active Fire Protection, Passive Fire Protection |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Honeywell International, Johnson Controls, Minimax GmbH & Co. KG, API Group Inc., United Technologies Corporation, Robert Bosch GmbH, Hochiki Corporation, VT MAK, Siemens AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the fire sprinklers market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global fire sprinklers market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the fire sprinklers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fire sprinklers market was valued at USD 13.73 Billion in 2024.

The fire sprinklers market is projected to exhibit a CAGR of 5.47% during 2025-2033, reaching a value of USD 22.73 Billion by 2033.

The fire sprinklers market is driven by rising fire safety awareness, strict government regulations, rapid urbanization, and increasing construction activities. Technological advancements in smart sprinkler systems and growing demand for property protection also contribute to market growth, as businesses and homeowners prioritize safety and damage prevention.

North America currently dominates the fire sprinklers market due to strict fire safety regulations, rising construction activities, technological advancements, and growing awareness of property and occupant protection.

Some of the major players in the fire sprinklers market include Honeywell International, Johnson Controls, Minimax GmbH & Co. KG, API Group Inc., United Technologies Corporation, Robert Bosch GmbH, Hochiki Corporation, VT MAK, Siemens AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)