Fish Sauce Market Size, Share, Trends and Forecast by Type, Composition, Distribution Channel, Industry Vertical, and Region, 2025-2033

Global Fish Sauce Market 2025-2033

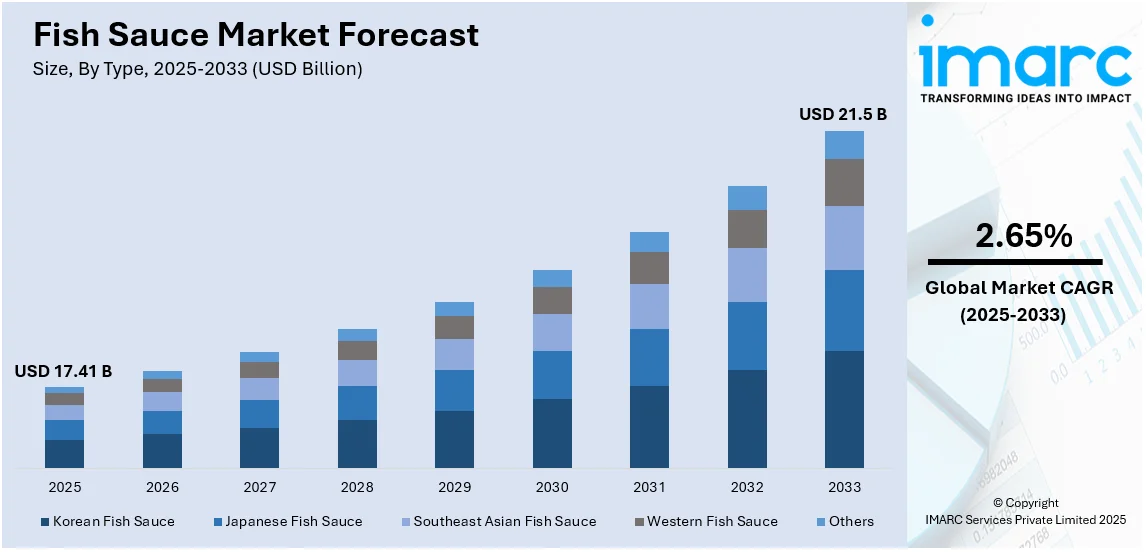

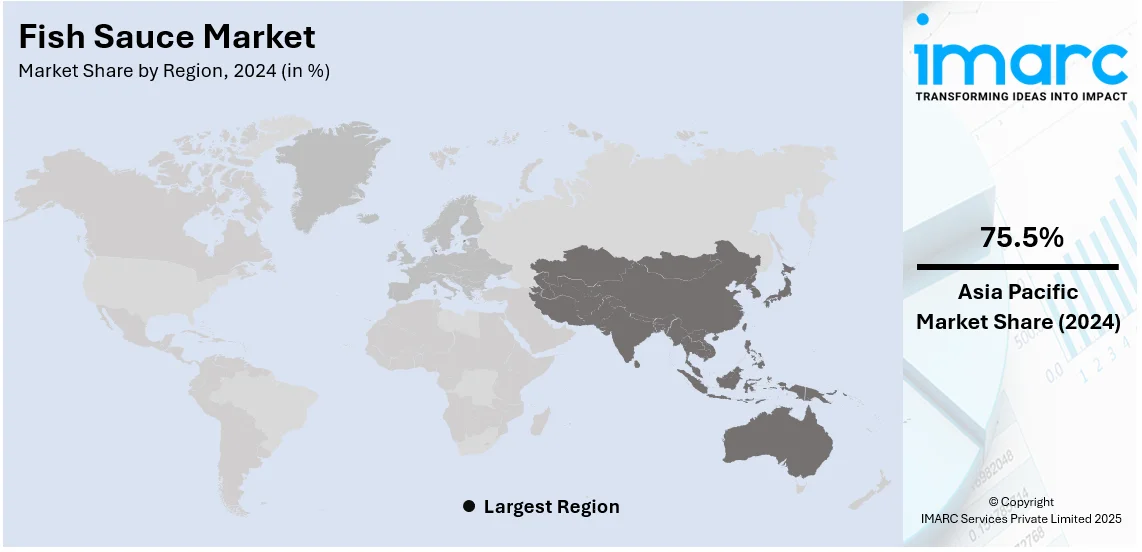

The global fish sauce market size is anticipated to reach USD 17.41 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 21.5 Billion by 2033, exhibiting a CAGR of 2.65% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 75.5% in 2024. The Asia Pacific region is mainly driven by high local production, widespread culinary use, and strong consumer demand for traditional condiments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2025

|

USD 17.41 Billion |

|

Market Forecast in 2033

|

USD 21.5 Billion |

| Market Growth Rate 2025-2033 | 2.65% |

Rising preferences for authentic and traditional flavors in cooking is driving the demand for fish sauce as a key seasoning ingredient. People are also becoming more aware about the nutritional advantages of fish sauce, including its natural source of amino acids and minerals, which appeal to health-conscious buyers. Moreover, the versatility of fish sauce as a flavor enhancer in various recipes, marinades, and seasonings is solidifying its position as an essential ingredient in various cuisines. In addition, the growing number of retail channels, including supermarkets, hypermarkets, and e-commerce platforms, is increasing the accessibility and convenience for buyers. Besides this, manufacturers are meeting evolving consumer demands by introducing premium, low-sodium, and organic fish sauce variants, broadening its appeal across different market segments.

To get more information on this market, Request Sample

The United States is a crucial segment in the fish sauce market, driven by the rising interest in diverse culinary experiences. The growing appreciation for umami-rich foods is making fish sauce a preferred choice for enhancing flavor profiles in a variety of recipes. Consumers are also seeking natural flavoring agents with nutritional benefits, such as amino acids, which is encouraging the adoption of fish sauce as a healthier alternative to synthetic condiments. The rising number of e-commerce platforms is making fish sauce widely accessible to consumers, offering convenience, a diverse range of brands, and competitive pricing through online marketplaces. IMARC Group anticipates that the e-commerce market in the United States will reach US$ 2,083.97 Billion by 2032, showing a compound annual growth rate (CAGR) of 6.80% from 2024 to 2032.

Fish Sauce Market Trends:

Growing Preference for Nutrient-Rich Foods

Fish sauce is a potential source of vital nutrients and minerals derived from fish and fish organs and enhanced by fermentation during its production. These nutrients are associated with health benefits, such as supporting sleep, boosting the digestive system and metabolism, reducing blood cholesterol, and improving brain and heart function. The rising demand for fish sauce on account of the increasing prevalence of dietary nutrient deficiency among a large section of the population globally is positively influencing the market growth. For instance, the World Health Organization (WHO) estimates that over two billion people, representing 30% of the global population, suffer from micronutrient deficiency. Besides this, the growing demand for gluten-free fish sauces due to the rising cases of gluten intolerance among individuals is offering a favorable market outlook. Brands are capitalizing on the needs of users to keep up with the evolving trends and uphold their market position. For instance, in 2023, Thai fish sauce firm Squid Brand launched two new products, Mala Spicy Fish Sauce and Truffle Fish Sauce. These products are free from gluten, artificial colors, and preservatives.

Increasing Product Offerings

Various manufacturers are expanding their product portfolios to offer a wider range of flavors and variants to cater to diverse consumer tastes and preferences. These include premium products made with high-quality ingredients, organic options targeting environmentally conscious buyers, and artisanal versions that emphasize traditional fermentation methods. These innovations not only appeal to niche markets but also elevate the perception of fish sauce as a gourmet ingredient. Companies are also experimenting with unique flavor infusions, such as herbs and spices, to broaden its culinary appeal. These efforts ensure that fish sauce remains relevant across diverse consumer demographics. For instance, in April 2024, responsibly sourced chilled fish brand Fish Said Fred launched two new SKUs to its oven-ready range, Thai Green Cod Curry and Tuna Katsu Curry.

Rising Popularity of Cross-Continental Cuisines

The emerging preferences for cross-continental cuisines, like Thai, Korean, Chinese, etc., are supporting the growth of the market. Fish sauce is widely consumed in Southeast Asian countries and is currently enjoyed by individuals of numerous cultures across the globe. Additionally, fish sauce market statistics indicate that the growing number of Thai, Chinese, Japanese, and Korean restaurants across the world is also contributing to the consumption of fish sauce. Moreover, according to the Ministry of Agriculture, Food and Rural Affairs, Korea, the government will expand Korean food's global appeal by nurturing 100 Michelin-starred Korean restaurants worldwide by 2027 and increasing the global market value of Korean food to 300 Trillion won (USD 227 Billion). Besides this, collaborations between fish sauce manufacturers and hospitality establishments to develop signature dishes or exclusive blends are positively influencing the market.

Global Fish Sauce Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global fish sauce market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, composition, distribution channel, industry vertical, and region.

Analysis by Type:

- Korean Fish Sauce

- Japanese Fish Sauce

- Southeast Asian Fish Sauce

- Western Fish Sauce

- Others

Southeast Asian fish sauce holds the biggest market share, accounting for 52.1% in 2024. The dominance of the segment is owing to its rich umami flavor, traditional fermentation methods, and widespread usage in diverse culinary applications. It is known for its distinct taste and quality and has become a staple in cooking, adding depth and complexity to various dishes. The segment benefits from established production expertise, ensuring consistency and authenticity, which appeals to both individuals and the foodservice industry. Furthermore, manufacturers are leveraging advanced packaging and marketing strategies to enhance product appeal and accessibility in international markets. This category also sees innovation, such as low-sodium and premium variants, catering to health-conscious and niche consumer groups. The strong export potential and growing recognition of its versatility reinforce Southeast Asian fish sauce as the market leader in this category.

Analysis by Composition:

- Basic

- Premium

Basic segment caters to the mass market, offering an affordable and versatile option for daily culinary use. This segment is primarily composed of products with traditional ingredients and standard fermentation processes, ensuring consistent flavor profiles. Widely available in retail and wholesale channels, basic fish sauces are popular among budget-conscious consumers and commercial food service providers. Their affordability and ease of use make them a staple in households and an essential ingredient in pre-packaged or ready-to-cook meals.

Premium targets consumers seeking high-quality, artisanal products with enhanced taste and nutritional benefits. These products often use superior ingredients, such as wild-caught fish, and are produced using extended fermentation techniques to achieve a richer, more complex flavor profile. Premium offerings frequently include organic, low-sodium, and additive-free options, appealing to health-conscious and environmentally aware consumers.

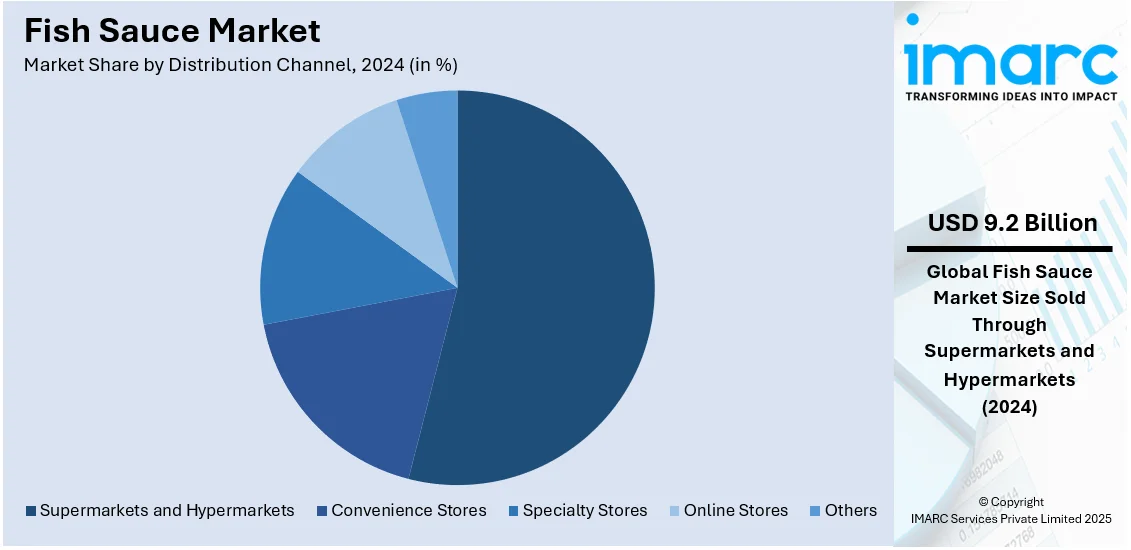

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

In 2024, supermarkets and hypermarkets lead the market with 54.2% share of the market. This growth is attributed to their extensive reach, product variety, and convenience for consumers. These outlets provide a centralized shopping experience, enabling buyers to access a wide range of fish sauce brands and variants under one roof. Their ability to stock large quantities and promote products through in-store marketing campaigns ensures strong visibility and accessibility. Discount schemes, loyalty programs, and organized product displays further enhance shopping appeal. Supermarkets and hypermarkets cater to diverse user needs by offering both basic and premium options, making them the go-to choice for households and professional buyers alike. In addition, their robust supply chains and strategic partnerships with manufacturers support consistent product availability.

Analysis by Industry Vertical:

- Food and Beverages

- Household

- Hotels and Restaurants

- Others

Food and beverages stand as the largest industry vertical in 2024, holding 34.9% of the market share. The dominance of the segment is driven by its essential role as a flavor enhancer in culinary applications. This segment encompasses a wide array of uses, ranging from packaged food products to RTE meals, benefiting from the growing demand for authentic and savory flavors. Fish sauce is a key ingredient in sauces, marinades, and seasonings, enhancing its versatility and appeal across global cuisines. The segment is also supported by the increasing production of processed foods and the rising popularity of gourmet and specialty products. Food manufacturers prioritize fish sauce for its natural flavor profile, aligning with consumer preferences for clean-label and traditional ingredients.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific holds the largest market share of 75.5%. Asia Pacific holds the largest market share in the fish sauce industry, driven by well-established production practices, including artisanal and large-scale manufacturing, ensuring a steady supply of high-quality products. Additionally, the growing export of fish sauce to international markets underscores the region's influence in setting quality and flavor standards. Expanding retail channels, including supermarkets, specialty stores, and e-commerce platforms, enhance accessibility for consumers. The region also benefits from its historical and cultural significance in the region's cuisine. The widespread use of fish sauce as a staple seasoning in traditional dishes supports its dominance. In 2024, Haidilao launched its first regional-themed menu featuring fermented fish sauce with pickled chilies, a delicacy from Guizhou's Xijiang Qianhu Miao Village. The menu includes sour broth hot pot and other local specialties, celebrated with a short film highlighting the sauce's cultural heritage.

Key Regional Takeaways:

United States Fish Sauce Market Analysis

In 2024, US accounted for around 76.5% of the total North America Fish Sauce market. The adoption of fish sauce in the United States highlights its growing popularity as a versatile ingredient in culinary innovation. This trend stems from its rich umami flavor, which enhances a variety of dishes, bridging the gap between traditional Asian cuisine and modern fusion creations. Advancements in production techniques are ensuring high-quality, sustainably sourced fish sauce, meeting consumer demands for both taste and environmental responsibility. The United States, particularly in states like California and New York, are emerging as a key market, with diverse populations embracing the ingredient for its health benefits, such as low-fat content and rich amino acids. For instance, United States is the largest importer of fish sauce globally, with 41,413 shipments, primarily sourced from Vietnam, Thailand, and Hong Kong. This significant demand supports the fish sauce industry by providing a substantial market for exporters. Renowned chefs in cities like Los Angeles and Seattle are integrating fish sauce into Western recipes, elevating its status beyond niche markets. This positioning strengthens the United States as a leader in global food innovation, catering to evolving culinary preferences and fostering cross-cultural appreciation through gastronomy.

Europe Fish Sauce Market Analysis

The Asia-Pacific region is emerging as a leading market for fish sauce, driven by its rich culinary heritage and growing adoption in both traditional and modern cuisines. Countries like Thailand, Vietnam, and the Philippines hold a dominant position due to their long-standing expertise in producing high-quality fish sauce. Advancements in fermentation techniques and packaging innovations are enhancing the product's appeal, ensuring better quality and extended shelf life. For instance, China leads the global fish sauce export market with a 13.3% share in 2023, exporting 619.60 million kilograms (+3.21% YoY), while imports rose 3.98% to 68.55 million kilograms, driven by increasing domestic production and robust international demand. The region benefits from its strategic location, enabling robust export networks to North America and Europe. Fish sauce's versatility as a flavor enhancer is fostering its integration into global fusion cuisines, further boosting its demand. States within India and China are increasingly embracing fish sauce, reflecting its growing penetration in non-traditional markets, underlining Asia-Pacific's leadership in this evolving segment.

Asia Pacific Fish Sauce Market Analysis

Fish sauce is gaining prominence across Europe as a versatile ingredient in culinary practices, blending traditional European cuisines with Southeast Asian flavors. Its growing use reflects advancements in the global food industry, driven by innovation in flavor profiles and sustainable production techniques. Countries like France and Italy are incorporating fish sauce into gourmet recipes, enhancing dishes such as pasta, soups, and marinades. Germany and the UK are witnessing a rise in demand due to its appeal among health-conscious consumers, valuing its rich umami flavor and nutritional benefits. For instance, Germany's fish sauce exports comprise 212 shipments, contributing to the global trade of 74,987 shipments. This participation aids in diversifying the international fish sauce market. European manufacturers are embracing eco-friendly production methods to cater to the environmentally aware market, positioning Europe as a leader in sustainable culinary trends. Additionally, urban areas in Spain and the Netherlands are popularizing fish sauce through fusion restaurants and food festivals, creating new culinary experiences. This transformation underscores Europe’s adaptability and its diverse gastronomic landscape, where global influences are harmonized with local tastes.

Latin America Fish Sauce Market Analysis

Fish sauce is gaining prominence in Latin America as culinary trends diversify and global flavors integrate into local cuisines. Its versatile use in enhancing traditional dishes is driving the demand in countries like Mexico and Brazil, where fusion cuisine is flourishing. The region benefits from advancements in production techniques, ensuring high-quality sauces that cater to international standards. For instance, Mexico plays a key role in the fish sauce market, with 2023 export volumes reaching 211.20MKG (+5.51% YoY) and imports at 110.96MKG (+25.28% YoY), driving significant growth in trade and production value. Local producers are innovating with sustainably sourced ingredients, positioning Latin America as a key player in the global fish sauce market. States such as São Paulo and Yucatán are emerging as hubs for experimentation, blending fish sauce with native ingredients to create unique flavor profiles.

Middle East and Africa Fish Sauce Market Analysis

Middle East and Africa are embracing diverse culinary practices, with fish sauce becoming integral to local and fusion cuisines. Countries like South Africa and Nigeria are incorporating it into marinades and stews, enhancing umami flavors in traditional dishes. For instance, The UAE, importing 90% of its food consumption and valuing fish and seafood imports at USD 637 Million in 2020, is a key market for fish-related products. Its demand for diverse seafood creates growth opportunities for fish sauce, aligning with evolving culinary and trade trends. In the Gulf states, including the UAE and Saudi Arabia, fish sauce is being used in gourmet dining to craft innovative Asian-inspired delicacies. Its long shelf life and compatibility with various spices make it ideal for regions with hot climates. Coastal nations like Kenya and Tanzania leverage fish sauce in seafood preparations, reflecting its versatility and aligning with growing international food trends.

Competitive Landscape:

Major players in the industry are prioritizing product innovation by creating low-sodium and preservative-free choices to cater to the needs of health-conscious consumers. They are broadening their range of products to offer high-quality and natural options, meeting different taste preferences. Efforts are made to improve market visibility and expand distribution networks through strategic partnerships and acquisitions. Investments in marketing efforts are intended to increase brand recognition and attract user attention. Additionally, these companies are expanding their offerings with locally inspired recipes, blending tradition with modern culinary trends to create a stronger emotional connection with consumers. In 2024, Anan Saigon, a Michelin-starred restaurant in Ho Chi Minh City, launched a $100 version of the Vietnamese broken rice dish, featuring Angus beef ribs marinated with fish sauce, lemongrass, and garlic. The dish represents a premium take on traditional Vietnamese cuisine, combining local flavors with modern techniques. It is served alongside a fish sauce-based garlic chili dressing and bone broth.

The report provides a comprehensive analysis of the competitive landscape in the fish sauce market with detailed profiles of all major companies, including:

- Halcyon Proteins Pty Ltd

- Masan Consumer Goods Joint Stock Company

- Pairoj (Tang Sang Ha) Company Limited

- Phetdamfoods Co., Ltd

- Pichai Fish-Sauce Co., Ltd.

- Rayong Fish Sauce Industry Co., Ltd

- Red Boat Fish Sauce

- Rungroj Fish Sauce Co., Ltd.

- Teo Tak Seng Fish Sauce Factory Co. Ltd.

- Thai Fishsauce Factory (Squid Brand) Co. Ltd

- Thaipreeda Industry Co., Ltd.

Latest News and Developments:

- August 2024: Vietnamese startup Seagull Co. Ltd. has successfully introduced its traditional fish sauce, branded as "Old Fishing Village," to the US market after two years of preparation. Produced in Binh Thuan province using a 300-year-old recipe, the sauce is available in US stores, with 500 ml bottles priced between USD 6.49 and USD 13.59.

- June 2024: Noumami AS, a Norwegian manufacturer, ventured into fish sauce production using locally sourced Norwegian salmon, cod, and herring. This innovation highlights a unique approach to incorporating Nordic ingredients into a traditionally Southeast Asian product. This initiative also promotes sustainability by utilizing abundant local fish stocks.

Fish Sauce Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Korean Fish Sauce, Japanese Fish Sauce, Southeast Asian Fish Sauce, Western Fish Sauce, Others |

| Compositions Covered | Basic, Premium |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Industry Verticals Covered | Food and Beverages, Household, Hotels and Restaurants, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Halcyon Proteins Pty Ltd, Masan Consumer Goods Joint Stock Company, Pairoj (Tang Sang Ha) Company Limited, Phetdamfoods Co., Ltd, Pichai Fish-Sauce Co., Ltd., Rayong Fish Sauce Industry Co., Ltd, Red Boat Fish Sauce, Rungroj Fish Sauce Co., Ltd., Teo Tak Seng Fish Sauce Factory Co. Ltd., Thai Fishsauce Factory (Squid Brand) Co. Ltd, Thaipreeda Industry Co., Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the fish sauce market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global fish sauce market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the fish sauce industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fish sauce market was valued at USD 17.41 Billion in 2024.

The fish sauce market is projected to exhibit a CAGR of 2.65% during 2025-2033, reaching a value of USD 21.5 Billion by 2033.

The market is driven by increasing demand for savory condiments, growing awareness regarding traditional culinary ingredients, and rising applications in processed foods. The market benefits from expanding global food trade, the popularity of fermented products, and evolving consumer preferences for natural flavor enhancers. Enhanced production techniques and innovative product variations are further supporting market growth.

Asia Pacific currently dominates the fish sauce market, accounting for a share of 75.5% in 2024. The dominance is fueled by the region's rich culinary heritage, high fish sauce consumption, and growing demand for traditional flavors.

Some of the major players in the fish sauce market include Halcyon Proteins Pty Ltd, Masan Consumer Goods Joint Stock Company, Pairoj (Tang Sang Ha) Company Limited, Phetdamfoods Co., Ltd, Pichai Fish-Sauce Co., Ltd., Rayong Fish Sauce Industry Co., Ltd, Red Boat Fish Sauce, Rungroj Fish Sauce Co., Ltd., Teo Tak Seng Fish Sauce Factory Co. Ltd., Thai Fishsauce Factory (Squid Brand) Co. Ltd, and Thaipreeda Industry Co., Ltd., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)