Flat Glass Market Size, Share, Trends and Forecast by Technology, Product Type, Raw Material, End-Use, Type, End Use Industry, and Region, 2025-2033

Flat Glass Market 2024 Size, Share And Trends

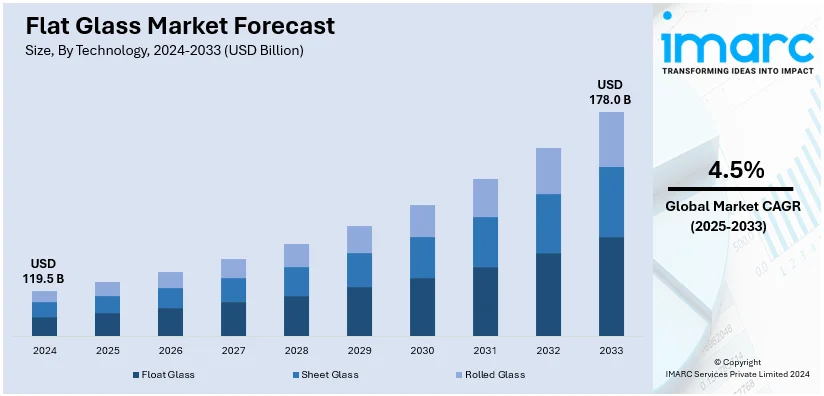

The global flat glass market size was valued at USD 119.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 178.0 Billion by 2033, exhibiting a CAGR of 4.5% from 2025-2033. Asia Pacific currently dominates the flat glass market share by holding over 58.7% in 2024. The market is experiencing steady growth driven by the growing emphasis on sustainable building solutions, the continuous advancements in smart glass technologies, and the expanding use of glass in solar energy applications across the globe.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 119.5 Billion |

|

Market Forecast in 2033

|

USD 178.0 Billion |

| Market Growth Rate (2025-2033) | 4.5% |

The global flat glass market growth is primarily driven by the rising demand for energy-efficient materials in construction, including glass facades and windows. Expanding automotive applications for lightweight, durable glazing and advancements in tempered and laminated glass manufacturing further augmented market growth. Flat glass's crucial role in solar energy projects, like photovoltaic panels, is also a significant market driver. Notably, on September 24, 2024, AGC Glass Europe and ROSI partnered to recycle photovoltaic glass, promoting circularity in the flat glass and solar industries. Supported by Itochu, this collaboration reduces carbon emissions, integrates recycled glass into production, and advances sustainable practices while meeting environmental goals and improving resource efficiency. Urbanization, infrastructure development, and consumer preferences for aesthetic and functional glass solutions are further propelling market expansion.

To get more information on this market, Request Sample

The United States flat glass market demand is majorly growing due to rising demand for energy-efficient materials in construction, driven by the adoption of glass facades and double-glazed windows in commercial and residential buildings. Increased use of flat glass in automotive applications, including advanced windshields and sunroofs, is further fueling growth in the market. Ongoing innovations in smart glass technologies, offering energy savings and enhanced comfort, are expanding applications. Increasing investments in renewable energy projects, particularly solar panels, significantly strengthens the flat glass market share. According to the American Clean Power 2024 report, the U.S. clean energy sector announced USD 500 Billion in investments, with USD 75 Billion realized and 161 new manufacturing facilities creating 20,000 jobs. Over 55 GW of clean power, powering 10+ million homes, supports urbanization, sustainability, and infrastructure development, driving market expansion.

Flat Glass Market Trends:

Rapid Urbanization and Construction Boom

The flat glass market outlook is significantly influenced by the ongoing trend of rapid urbanization and the rising demand for construction activities worldwide. According to World Bank data, more than 55% of people on Earth lived in cities in 2018; by 2050, that number is expected to rise to two-thirds. As urban populations continue to grow, there is an increasing need for infrastructural development, residential housing, and commercial spaces. Flat glass, a crucial component in construction, finds extensive applications in windows, facades, and interior partitions. Additionally, the growing construction industry, particularly in emerging economies, is a major driving force behind the escalating demand. This trend is propelled by factors such as population migration to urban areas, economic development, and governmental initiatives promoting urban infrastructure projects.

Technological Advancements in Energy-Efficient Glass Solutions

Another pivotal factor steering the global market is the ongoing advancements in glass technologies, especially in the realm of energy efficiency. As environmental consciousness rises globally, there is an amplified emphasis on sustainable and energy-efficient construction practices. Therefore, this is positively influencing the market. In confluence with this, its manufacturers are responding to this demand by innovating and producing high-performance glass solutions with enhanced thermal insulation and solar control properties. Moreover, the adoption of these advanced glass technologies is driven by stringent energy efficiency regulations, green building standards, and the increasing preference for environmentally responsible construction materials. In line with this, the European Union claims that buildings account for 36% of all CO2 emissions and 40% of primary energy use, as per an industrial report. Increasing energy efficiency is essential to achieving the 2050 carbon neutrality target, and upgrading to smart buildings is one way to do it. Further, artificial intelligence can be used into smart flat glass technology to assist control the quantity of light and heat entering a structure. The technology can be operated by voice commands, phone applications, or switches.

Automotive Industry Expansion and Rising Demand for Smart Glass

The automotive sector plays a crucial role in propelling the flat glass market trends, driven by the expanding global automotive industry and the growing preference for advanced automotive technologies. The automotive industry is particularly growing well in not-so-saturated markets like India. The Society of Indian Automobile Manufacturers, for example, reported that total passenger vehicle sales rose from 30,69,523 to 38,90,114 units. In FY-2022-23, sales of passenger cars also climbed from 14,67,039 to 17,47,376, utility vehicles from 14,89,219 to 20,03,718, and vans from 1,13,265 to 1,39,020 units. Flat glass is extensively used in automotive applications, including windshields, windows, and sunroofs. Furthermore, the rising trend of smart and connected vehicles has led to increased demand for smart glass, which can dynamically adjust light transmission and provide improved comfort to passengers. As consumer expectations for technologically advanced features in automobiles continue to rise, the demand in the automotive sector is expected to witness sustained growth, contributing significantly to the overall market expansion.

Flat Glass Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global flat glass market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology, product type, raw material, end-use, type, and end use industry.

Analysis by Technology:

- Float Glass

- Sheet Glass

- Rolled Glass

Float glass stands as the largest segment in the market, accounting for a substantial share. This technology involves production by floating molten glass on a bed of molten metal, resulting in a smooth and uniform surface. Widely favored for its optical clarity and versatility, float glass finds extensive applications in architectural glazing, automotive windshields, and electronic displays. The dominance of float glass is attributed to its cost-effectiveness, high-quality finish, and adaptability to various downstream industries.

Analysis by Product Type:

- Basic Float Glass

- Toughened Glass

- Coated Glass

- Laminated Glass

- Insulated

- Extra Clear Glass

- Others

Insulated leads the market with around 21.6% of market share in 2024. The segment holds the largest share of the market, highlighting the growing demand for energy-efficient solutions in construction. Insulated glass, also known as double-glazed or double-pane glass, comprises two or more glass panes separated by a gas-filled space to enhance thermal insulation. Widely adopted for windows and facades, insulated glass reduces heat transfer, enhances soundproofing, and contributes to sustainable building practices.

Analysis by Raw Material:

- Sand

- Soda Ash

- Recycled Glass

- Dolomite

- Limestone

- Others

The sand segment stands as a fundamental cornerstone in the market, serving as a primary raw material for glass production. Silica sand, with its high purity and unique composition, is a key ingredient in the manufacturing of this glass. The sand undergoes a melting process to form molten glass, which is then shaped into various glass products.

Soda ash, also known as sodium carbonate, plays a vital role as a raw material in the glass production. It functions as a flux, aiding in the reduction of the glass melting point and facilitating the overall manufacturing process. Soda ash helps control the viscosity of the molten glass, ensuring proper shaping and forming of the final product.

On the other hand, the use of recycled glass gained prominence as an environmentally conscious approach in the industry. This segment involves the integration of post-consumer or post-industrial glass cullet into the glass production process. Recycling not only conserves natural resources but also reduces energy consumption in glass manufacturing.

Analysis by End Use:

- Safety and Security

- Solar Control

- Others

The safety and security segment in the market is pivotal, encompassing applications that prioritize protection against impact, breakage, and forced entry. Flat glass products designed for safety and security purposes often incorporate features such as laminated glass, which holds together upon impact due to an interlayer, minimizing the risk of shattering. This segment is integral in sectors such as automotive, construction, and public infrastructure where safety standards are paramount.

On the other hand, solar control represents a significant segment in the market, addressing the need to manage sunlight and heat entering a building or vehicle. Products within this segment often feature coatings or tints that reduce glare, UV radiation, and heat absorption. Solar control glass finds extensive use in architectural applications, automotive windows, and electronic displays.

Analysis by Type:

- Fabricated

- Non-Fabricated

Fabricated glass segment holds a dominant position in the market, representing products that undergo additional processing beyond basic manufacturing. In addition to this, fabricated glass includes value-added processes such as cutting, edging, drilling, and coating, resulting in customized solutions tailored to specific applications. This segment caters to the diverse needs of industries such as construction, automotive, and electronics, offering glass products with precise dimensions, specialized features, and enhanced functionalities.

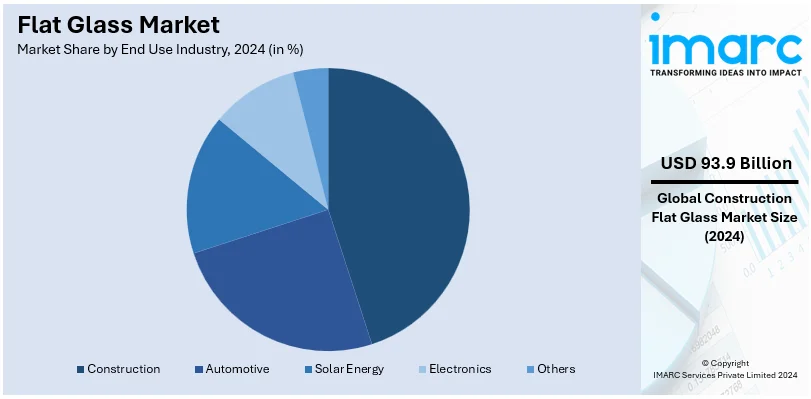

Analysis by End Use Industry:

- Construction

- Automotive

- Solar Energy

- Electronics

- Others

Construction leads the market with around 78.6% of market share in 2024. The sector stands as the largest segment in the market, driving substantial demand for glass products in applications ranging from windows and facades to interior design. The use of this glass in construction is integral for creating transparent and aesthetically pleasing structures, promoting natural light penetration while ensuring energy efficiency. The demand is further propelled by global urbanization trends, infrastructural development, and a growing emphasis on sustainable building practices.

Regional Analysis:

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

In 2024, Asia Pacific accounted for the largest market share of over 58.7%. The region stands as the largest and most dynamic segment in the flat glass market, majorly fueled by rapid urbanization, infrastructural development, and robust economic growth in countries such as China and India. In addition to this, the construction boom in the region, coupled with a thriving automotive industry and increasing adoption of advanced glass technologies, contributes significantly to the demand for these products in the market.

Key Regional Takeaways:

United States Flat Glass Market Analysis

The United States holds a key region in the North American market, with a total share of over 87.80%. Rapid expansion in the solar energy, automotive, and construction industries is propelling the flat glass market in the US. Energy-efficient glass, such as insulated and low-emissivity (Low-E) glass, is being used by the residential and commercial building sectors to satisfy the strict requirements for LEED certification. Construction spending in October 2024 was estimated at a seasonally adjusted annual rate of USD 2,174.0 Billion, which was 0.4 percent higher than the revised September estimate is of USD 2,164.7 Billion, according to US government data. Increasing energy-efficient buildings popularity is driving up demand for solar control glass. Lightweight and sturdy flat glass is becoming increasingly necessary in the automotive sector, which sold over 15.6 million vehicles in 2023, to achieve higher fuel efficiency and accommodate smart features like heads-up displays, as per an industry report. Another primary driver is the growing usage of solar energy systems; by 2023, the United States had 142 GW of cumulative solar capacity. Further motivation of the market for solar-integrated glass comes from federal incentives in the form of the Investment Tax Credit (ITC).

Europe Flat Glass Market Analysis

Advanced glazing systems are in high demand on account of energy-efficient building regulations such as the EU Energy Performance of Buildings Directive. According to data from the IFO Institute for Economic Research, over 1.5 million housing units will have been completed in Europe by 2026. Another driving force is the automobile sector. This is as in 2023, the automobile industry will have constituted 20% of Europe's global EV production and still needs lightweight glass for efficiency in energy consumption. In Europe, new passenger car registrations, including the EU, the UK, and EFTA countries, increased by almost 14% to over 12.8 million automobile sales in 2023, according to reports from the industry. The demand for solar control and photovoltaic glass is increasing due to investments in solar energy projects by countries such as France and Germany. Moreover, the emerging trend of smart homes makes more people use high-performance glass. Double-glazed windows are very common in colder climates since they can cut energy loss by up to 50%. European manufacturers, which include AGC and Saint-Gobain, lead the competition in flat glass products that focus on sustainability and recycling.

Asia Pacific Flat Glass Market Analysis

The market is being driven immensely by construction boom within China and India, while urbanization and industrialization both support these. Investment Information and Credit Rating Agency of India Limited expects the government's infrastructure development focus to push the construction industry's revenue growth by 12–15% in FY25. The growth is expected to be driven by important programs like the Smart Cities Mission, train network expansions, and road building under the Bharatmala scheme. In 2023, China alone produced more than 50% of the world's flat glass, driven by government-supported infrastructure projects. With over 50 million vehicles produced each year in the Asia-Pacific region, the automotive industry also contributes, as complex flat glass is required for conventional and electric vehicles. Investments in solar power, especially in China, which is the world's largest producer of solar panels, increase the demand for solar glass. Meanwhile, residential, and commercial projects all over the region are now integrating energy-efficient glass innovations like thermal insulation and smart glass.

Latin America Flat Glass Market Analysis

Residential and commercial building demand in Brazil and Mexico is mainly attributed to the urbanization happening in both countries. Flat glass is increasingly being used in infrastructure projects and upscale homes in Brazil. Large investments in energy, infrastructure, and urban growth are also driving the fast growth of Brazil's construction sector. A new Growth Acceleration Program was announced by President Luiz Inácio Lula da Silva in August 2023, committing over BRL 1.7 Trillion (about USD 350 Billion) over four years, according to an industry report. Mexico is the seventh-largest car-producing country globally with an annual output of more than 3.5 million vehicles, which will add up to the demand for the robust, lightweight glass. Another aspect is that the potential for solar energy is expanding in the region.

Middle East and Africa Flat Glass Market Analysis

One of the major drivers is the rapid infrastructure growth, especially in Saudi Arabia and the United Arab Emirates. Mega-projects such as Expo City Dubai and NEOM City (investments of USD 1.5 Trillion) increase demand for high-end flat glass solutions. Solar energy initiatives, such as Saudi Arabia's Vision 2030, are promoting the use of photovoltaic glass. In addition, the car industry, especially in South Africa, influences demand for safety glass and other specialty types. Sustainable construction methods and the rising urbanization drive energy-efficient and solar-controlled glass adoption throughout the region in residential and commercial buildings.

Competitive Landscape:

Key players in the market are actively engaged in strategies to maintain their competitive edge and respond to changing industry trends. Numerous companies are investing significantly in research and development to innovate and introduce advanced glass technologies, such as smart glass with dynamic functionalities. Sustainability is a central focus, with initiatives to reduce environmental impact and enhance energy efficiency in glass production. Strategic collaborations and partnerships are prevalent, facilitating technology exchange and market expansion. Geographic diversification is also a common strategy, with expansions into emerging markets to capitalize on growing opportunities. Additionally, key players are continually refining their product portfolios to meet the diverse demands of end-use industries.

The report provides a comprehensive analysis of the competitive landscape in the flat glass market with detailed profiles of all major companies, including:

- AGC Inc.

- Cardinal Glass Industries Inc

- Central Glass Co., Ltd

- CSG Holding Co. Ltd.

- Euroglas

- Fuyao Glass America

- Guardian Industries Holdings

- Nippon Sheet Glass Co. Ltd

- Saint-Gobain Glass

- Şişecam

- Taiwan Glass Ind. Corp.

- Vitro Architectural Glass

- Xinyi Glass Holdings Limited

Latest News and Developments:

- December 2024: Leading flat glass manufacturer AGC Inc. joins Glass Futures to work together on creative solutions and environmentally friendly glass industry practices. This collaboration demonstrates AGC's dedication to combating climate change by developing low-carbon glass production techniques. A non-profit group called Glass Futures works to lessen environmental effects by encouraging innovation and decarbonizing the glass industry.

- January 2024: A partnership from Qatar agreed to invest USD 240 Million to build a cutting-edge float glass production plant in India. The increasing need for float glass in the region's automotive, construction, and other industries is reflected in this investment. The facility strives to use cutting-edge technology to create premium glass while upholding efficiency and ecological standards.

- August 2023: AGC Inc. announced a new contract with Asahi Kasei Pharma Corporation to manufacture clinical medicinal material at AGC Biologics' Seattle manufacturing facility for Asahi Kasei antibody-based therapeutics.

- April 2023: Cardinal Glass Industries Inc. announced a USD 40 Million expansion that would create around 30 new jobs, increasing employment in the park by 10%.

- February 2023: Greek industrial group Mytilineos SA signed a contract to supply energy from a 4.9-MW solar park in Italy to run a nearby Compagnie de Saint-Gobain SA facility that produces construction materials in France.

Flat Glass Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Float Glass, Sheet Glass, Rolled Glass |

| Product Types Covered | Basic Float Glass, Toughened Glass, Coated Glass, Laminated Glass, Insulated, Extra Clear Glass, Others |

| Raw Materials Covered | Sand, Soda Ash, Recycled Glass, Dolomite, Limestone, Others |

| End-Uses Covered | Safety and Security, Solar Control, Others |

| Types Covered | Fabricated, Non-Fabricated |

| End Use Industries Covered | Construction, Automotive, Solar Energy, Electronics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | AGC Inc., Cardinal Glass Industries Inc, Central Glass Co., Ltd, CSG Holding Co. Ltd., Euroglas, Fuyao Glass America, Guardian Industries Holdings, Nippon Sheet Glass Co. Ltd, Saint-Gobain Glass, Şişecam, Taiwan Glass Ind. Corp., Vitro Architectural Glass, Xinyi Glass Holdings Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the flat glass market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global flat glass market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the flat glass industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Flat glass refers to a type of glass manufactured in thin, flat sheets, commonly used in applications such as windows, doors, automotive glass, and architectural designs. It is produced through processes like the float glass method, ensuring uniform thickness and clarity, and is often customized for strength, energy efficiency, or decorative purposes.

The flat glass market was valued at USD 119.5 Billion in 2024.

IMARC estimates the global flat glass market to exhibit a CAGR of 4.5% during 2025-2033.

The global flat glass market is primarily driven by rapid urbanization and construction boom, ongoing technological advancements in energy-efficient glass solutions, and the expansion of the automotive industry and rising demand for smart glass.

float glass holds the largest segment in the flat glass market based on technology, driven by advancements in manufacturing processes, energy efficiency, and innovation in products like low-emissivity glass, tempered glad, and solar applications.

Insulated leads the market by product type attributed to its superior thermal insulation, soundproofing capabilities, and alignment with sustainable building practices.

The fabricated glass is the leading segment by type, driven by its additional processing for customized solutions and enhanced functionalities across diverse applications.

In 2024, construction represented the largest segment by end use industry, driven by demand for energy-efficient and aesthetic glass in urbanization and infrastructure projects.

Asia Pacific currently dominates the flat glass market, accounting for a share exceeding 58.7% in 2024. This dominance is fueled by the rising demand in construction, and automotive sectors, and the growing need for energy-efficient glass solutions.

Some of the major players in the global flat glass market include AGC Inc., Cardinal Glass Industries Inc, Central Glass Co., Ltd, CSG Holding Co. Ltd., Euroglas, Fuyao Glass America, Guardian Industries Holdings, Nippon Sheet Glass Co. Ltd, Saint-Gobain Glass, Sisecam, Taiwan Glass Ind. Corp., Vitro Architectural Glass, and Xinyi Glass Holdings Limited, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)