India Flavoured Milk Market Size, Share, Trends and Forecast by Sales Channel and Region, 2025-2033

India Flavoured Milk Market Size and Share:

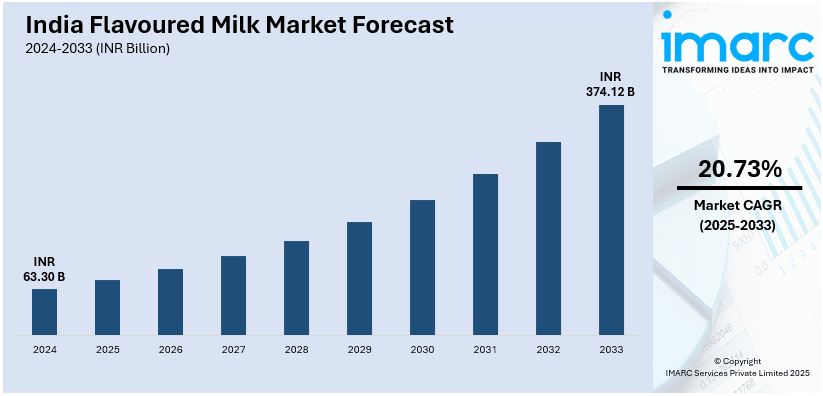

The India flavoured milk market size was valued at INR 63.30 Billion in 2024. Looking forward, IMARC Group estimates the market to reach INR 374.12 Billion by 2033, exhibiting a CAGR of 20.73% from 2025-2033. The market in India is experiencing rapid growth, driven by increasing health consciousness, rising demand for plant-based and lactose-free alternatives, premiumization with innovative flavors, expanding retail and e-commerce penetration, and the growing preference for on-the-go, single-serve packaging solutions catering to evolving consumer lifestyles and convenience needs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | INR 63.30 Billion |

| Market Forecast in 2033 | INR 374.12 Billion |

| Market Growth Rate (2025-2033) | 20.73% |

The India flavoured milk market share is expanding due to greater consumer demand for healthy and ready-to-drink (RTD) beverage products. As lifestyles transform and urbanization increases, more consumers want RTD options that offer the benefit of health along with flavor. Flavoured milk that is fortified with essential nutrients in the form of calcium, protein, and vitamins has become extremely popular as the next best solution after carbonated soft drinks and artificial beverages. Intensified recognition of the significance of balanced diet, particularly by young consumers and working professionals, has further promoted this trend. The growth in organized retailing, supermarkets, and online grocery stores has also improved product accessibility, boosting the availability of flavoured milk as an option in urban and semi-urban areas. For instance, in September 2024, Assam’s Purabi Dairy launched long shelf-life flavored milk in Mango, Strawberry, and Kesar variants. Produced at a modern facility, this innovation expands market reach and boosts farmer opportunities. Furthermore, the impact of western eating trends, as well as a boost in demand for high-end dairy products, has also helped grow the India flavoured milk market companies, prompting to launch new tastes and fortified varieties to meet shifting consumer demands.

To get more information on this market, Request Sample

Another major influencer of India's flavoured milk industry is the growing investment in dairy processing and cold chain facilities. Private and government organizations have been pushing the modernization of the dairy industry through subsidies, technology adoption, and efficient supply chain logistics. This has led to an improved distribution channel, making the flavoured milk available even in rural areas. Additionally, the escalated demand for functional and fortified drinks has led producers to launch value, added versions supplemented with probiotics, omega-3 fatty acids, and botanical extracts, meeting consumers' concerns for health. Altered consumption patterns, as driven by amplified trends towards high-protein diets, have also been instrumental in the raised uptake of flavoured milk. Moreover, the expansion of the quick-service restaurant (QSR) segment, cafes, and food delivery chains has led to an augmented demand for on-the-go dairy-based drinks. The integration of robust marketing activities, celebrity endorsement, and compelling packaging has also enhanced consumer participation, thereby establishing flavoured milk as a dominant segment in India's dairy market.

India Flavoured Milk Market Trends:

Rising Demand for Plant-Based and Lactose-Free Flavoured Milk

The rising pattern of plant-based and lactose-free variants is strongly impacting India's flavoured milk market. As more and more consumers go dairy-free in response to lactose intolerance, veganism, or food preference, companies are launching plant-based flavoured milk from almonds, soy, oats, and cashews. Such alternatives address the growing health-oriented population in pursuit of healthy but dairy-free offerings. Furthermore, flavoured plant milk is usually enriched with nutrients, such as calcium, vitamin D, and protein to equal the nutritional content of conventional dairy milk. The impact of global dietary trends, accompanied by increasing interest in animal welfare and environmental consciousness, has further stimulated demand. Various startups and traditional dairy companies are broadening their portfolio of products by bringing new flavor varieties like chocolate almond, vanilla oat, and hazelnut soy into the market, which guarantees a large base of consumers. It's changing the flavoured milk industry to cater to more people and making it diverse. For example, in September 2024, Keva Flavours introduced Thandai, Gulkand Paan, and Strawberry flavored milk, blending traditional and modern tastes to offer consumers a unique and indulgent dairy beverage experience.

Premiumization and Innovative Flavor Introductions

The flavoured milk category in India is experiencing a boom in premiumization as more consumers look for high-end, indulgent products. Premium flavoured milk is distinguished by unorthodox ingredients, organic farming, and innovative flavour pairings such as saffron-pistachio, Belgian chocolate, and honey-vanilla. The premium offerings appeal to upscale consumers in pursuit of a richer taste experience and a sense of luxury in their everyday diets. Also, vendors are trying innovative regional and local Indian flavors such as elaichi (cardamom), kesar badam (saffron almond), and rose to create cultural appeal coupled with a new-age appeal. Seasonal-only flavors, limited-edition festivity-inspired ones, and functionality boosts like incorporating protein, fiber, or probiotics are fast picking up popularity. The call for preservative-free, natural, and organic-flavored milk varieties has further fuelled this trend, compelling companies to create cleaner-label products with open ingredient labeling to satisfy changing consumer needs in the premium dairy market.

Expansion of On-the-Go and Single-Serve Packaging

The growing convenience demand has been responsible for the swift growth in on-the-go and single-serve flavoured milk packaging options. Busy lives and evolving eating habits have prompted consumers to want easily portable, ready-to-drink (RTD) foods that provide both nutrition and thirst quenching without needing to be prepared. This has prompted an increase in tetra packs, PET bottles, and lightweight pouches suited for instant use. The trend towards reduced preservative use also comes because of portion size reduction driven by consumers who are health-conscious and want portion control without affecting taste. Progress in aseptic packaging technology to offer longer shelf life without the need for preservatives also makes flavoured milk easier to be available in many retail formats, including vending machines, supermarkets, and online. Brands are emphasizing appealing, sustainable packaging options, including exploring recyclable and biodegradable materials, to support sustainability objectives. As demand for convenience keeps growing, new packaging formats will further fuel market growth in India's flavoured milk sector.

India Flavoured Milk in India Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India flavoured milk market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on sales channel.

Analysis by Sales Channel:

.webp)

- Retail

- Institutional

Retail industry is a key driver in India flavored milk market, with supermarket chains, hypermarkets, and convenience stores increasing reach. Organized retail players like Reliance Fresh, Big Bazaar, and D-Mart provide a separate section for dairy-based drinks, raising consumers' awareness levels and availability. The longer shelf life of flavored milk in contrast to fresh milk makes the product appealing to contemporary retail stores, providing steady supply and less wastage. The emergence of instant-commerce platforms, such as Swiggy Instamart, Zepto, and Blinkit has further amplified sales by facilitating on-demand home delivery of flavored milk. Furthermore, aggressive promotional strategies, such as appealing packaging, offers, and in-store promotions, lead to boosted sales. Urbanization and shifting lifestyles of consumers, with convenience and health advantages being given importance, render flavored milk a sought-after substitute for carbonated beverages. With retail penetration accelerating deeper into Tier 2 and Tier 3 cities, India's flavored milk market continues to grow fast.

Regional Analysis:

- Maharashtra

- Uttar Pradesh

- Andhra Pradesh and Telangana

- Tamil Nadu

- Gujarat

- Rajasthan

- Karnataka

- Madhya Pradesh

- West Bengal

- Bihar

- Delhi

- Kerala

- Punjab

- Orissa

- Haryana

Maharashtra is the dominant state in India's flavored milk market, propelled by its large dairy industry, high urbanization, and health-conscious consumer population. Major dairy companies such as Amul, Gokul, Warana, and Chitale are present in the state, complemented by strong cold chain infrastructure, facilitating the growth of the market. Metro cities in the state, such as Mumbai and Pune, experience escalating demand for on-the-go healthy drinks, further fueling flavored milk consumption. Further, Maharashtra's mixed demographic, comprising an emerging middle class with rising disposable income, suits premium dairy. Support for dairy farming from the government and publicity campaigns for increased milk consumption has bolstered the market. Emerging product forms like protein-enhanced and probiotic-enhanced flavor milk are attracting health-conscious customers. A mature retail and online shopping environment in Maharashtra also promote easy product penetration, and the state thus finds itself as an important driver for India's flavor milk market.

Competitive Landscape:

India's market for flavoured milk is fiercely competitive with multiple players vying to tap more consumers with product diversification, innovation, and strategic promotion. Players are developing distinctive flavours incorporating traditional Indian flavors and premium quality exotic flavors to be distinct in the highly congested market. Brands have introduced sugar-free and fortified variants to gain traction with healthy-conscious consumers based on growing preferences for healthy offerings. Innovations in packaging are essential, with ease of use, single-serve, and sustainable packaging becoming more popular to promote consumer attractiveness. Boosting e-commerce and modern trade outlet penetration further sharpened the competitive landscape as companies amplify the size of the distribution base for larger outreach. Spending on ruthless advertising campaigns, celebrity endorsements, and online media initiatives is driving consumers' images as well. With changing consumer tastes and rising disposable incomes, competition will further intensify, compelling brands to innovate and enhance product quality continuously.

The report provides a comprehensive analysis of the competitive landscape in the India flavoured milk market with detailed profiles of all major companies, including:

- GCMMF

- Mother Dairy

- KMF

- CavinKare

- TN Cooperative

Latest News and Developments:

- In October 2024, Karnataka Milk Federation (KMF) launched its milk and curd sales in Delhi, targeting daily sales of 2 lakh litres of milk and 25,000 litres of curd. With rising demand for cow milk, KMF expanded through online platforms, retailers, and traders, marking its first direct entry into North India.

- In August 2024, Tamil Nadu Cooperative Milk Producers' Federation (Aavin) launched three new flavored milk varieties—herbal, ashwagandha, and sukku malli coffee—to strengthen its market presence. After reaching a 15-lakh liters per day supply milestone, Aavin aims to boost sales by 20% through expanded retail distribution and marketing strategies.

- In June 2024, Ball Corporation, a global leader in sustainable packaging, partnered with CavinKare to introduce retort two-piece aluminum cans for its popular milkshake flavors—Badam, Gulkhand, Rajbog, and Rabri. This innovation enhances product freshness, shelf life, and sustainability, aligning with the rising demand for convenient, ready-to-drink dairy products in India.

India Flavoured Milk Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion INR, Million Litres |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sales Channels Covered | Retail, Institutional |

| Regions Covered | Maharashtra, Uttar Pradesh, Andhra Pradesh and Telangana, Tamil Nadu, Gujarat, Rajasthan, Karnataka, Madhya Pradesh, West Bengal, Bihar, Delhi, Kerala, Punjab, Orissa, Haryana |

| Companies Covered | GCMMF, Mother Dairy, KMF, CavinKare and TN Cooperative |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India flavoured milk market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India flavoured milk market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India flavoured milk industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The flavoured milk market in the India was valued at INR 63.30 Billion in 2024.

The growth of India's flavoured milk market is driven by increasing health consciousness, rising disposable incomes, urbanization, and demand for convenient, nutritious beverages. Innovations in flavors, packaging, and dairy-based functional drinks also boost consumption. Additionally, government initiatives promoting dairy, expanding retail networks, and the popularity of ready-to-drink products fuel market expansion.

The India flavoured milk market is projected to exhibit a CAGR of 20.73% during 2025-2033, reaching a value of INR 374.12 Billion by 2033.

The retail segment holds the largest market share in India’s flavoured milk sector, driven by increased consumer demand in supermarkets, convenience stores, and e-commerce platforms, offering convenient access to flavoured milk products.

Some of the major players in the flavoured milk market include GCMMF, Mother Dairy, KMF, CavinKare and TN Cooperative, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)