Indian Floriculture Market Size, Share, Trends and Forecast by Flower Type, Retail Vs Institutional, Distribution Channel, and Application, 2026-2034

Indian Floriculture Market Summary:

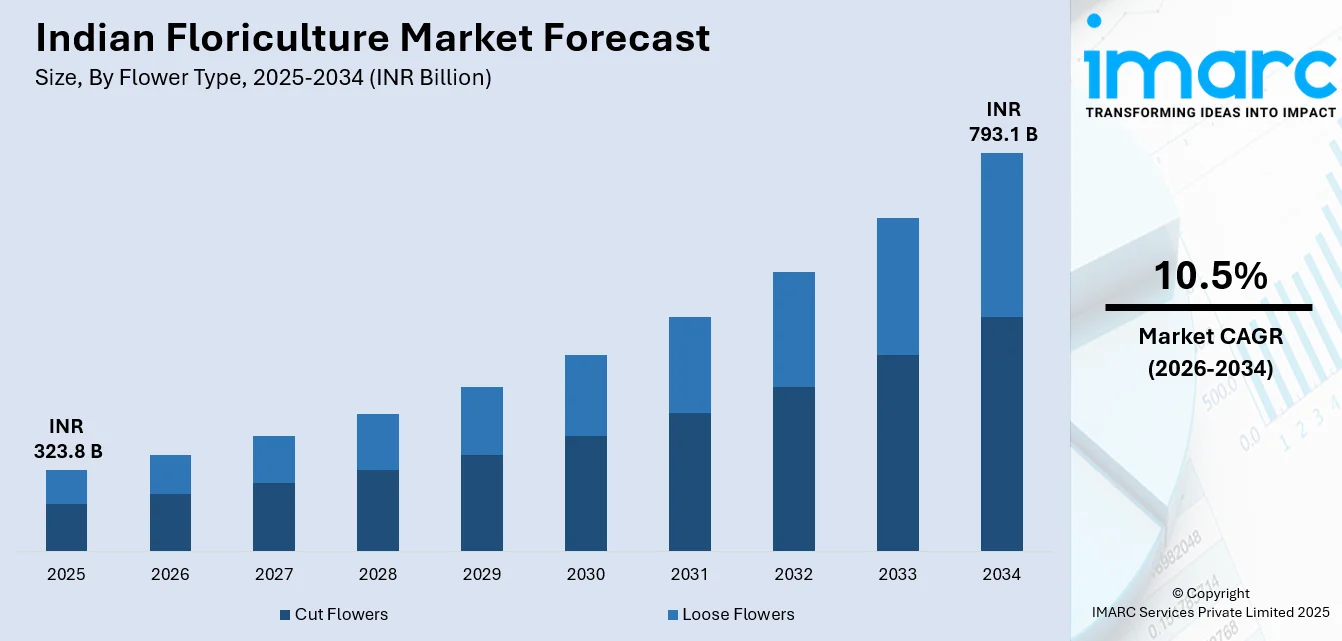

The Indian floriculture market size was valued at INR 323.8 Billion in 2025 and is projected to reach INR 793.1 Billion by 2034, growing at a compound annual growth rate of 10.5% from 2026-2034.

The market is driven by increasing consumer demand for decorative flowers across religious ceremonies, festivals, and social events, coupled with India's favorable agro-climatic diversity enabling year-round cultivation. Growing urbanization, rising disposable incomes, and evolving lifestyle preferences toward gifting flowers are propelling market expansion. Government initiatives supporting horticulture development and the emergence of organized retail channels are further strengthening market infrastructure. Additionally, technological advancements in cultivation practices and expanding export opportunities are contributing to the Indian floriculture market share.

Key Takeaways and Insights:

- By Flower Type: Loose flowers dominate the market with a share of 64% in 2025, driven by their extensive utilization in traditional religious ceremonies, temple offerings, wedding decorations, and festive celebrations deeply embedded in Indian cultural practices.

By Retail Vs Institutional: Retail leads the market with a share of 80% in 2025, owing to widespread consumer purchasing patterns for daily worship, home decoration, and personal gifting occasions supported by accessible local flower vendors.

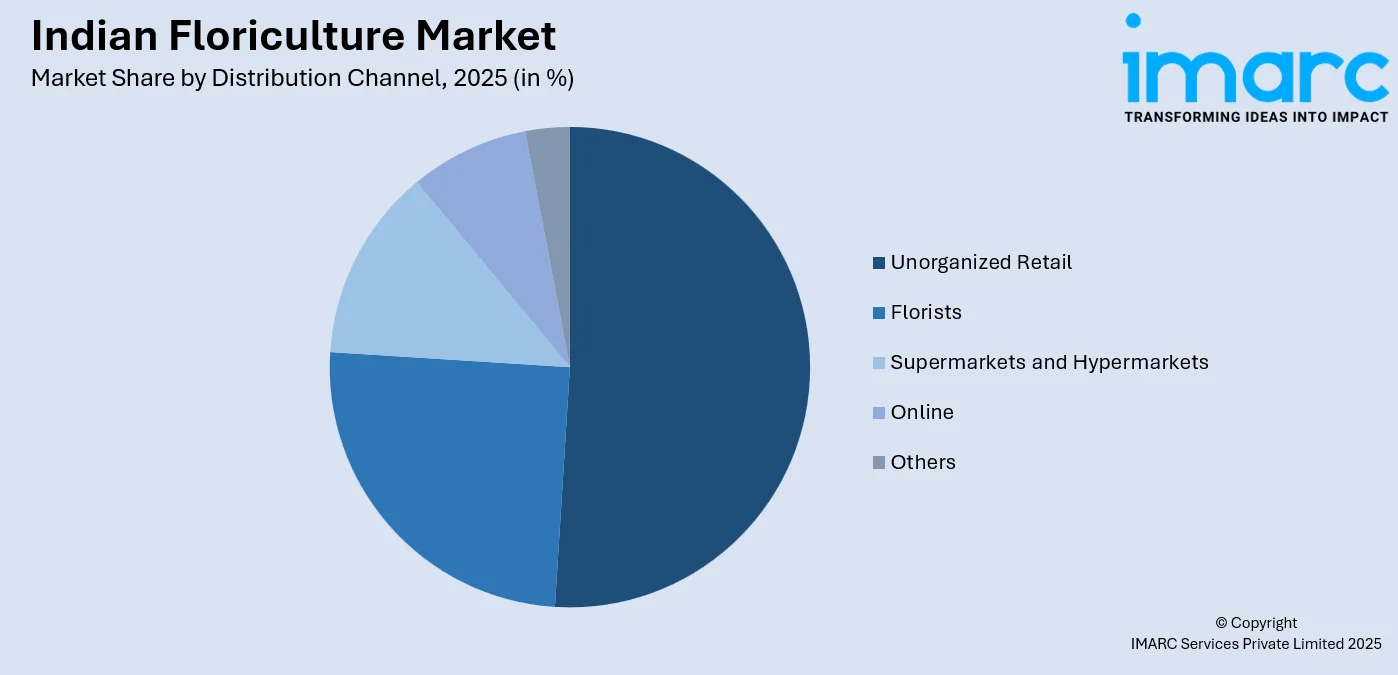

- By Distribution Channel: Unorganized retail represents the largest segment with a market share of 51% in 2025, driven by extensive networks of local street vendors and traditional flower markets offering fresh blooms at competitive prices.

- By Application: Aesthetic and decorative applications dominate the market with a share of 59% in 2025, owing to strong cultural traditions of using flowers for venue embellishment, wedding ornamentation, and religious altar arrangements.

- Key Players: The Indian floriculture market exhibits a fragmented competitive landscape, with numerous regional growers and local traders competing alongside established exporters and organized retail players across different market segments and geographical regions.

To get more information on this market Request Sample

The Indian floriculture market is experiencing robust expansion driven by the nation's deep-rooted cultural traditions that mandate flower usage across religious ceremonies, wedding celebrations, and festivals throughout the year. As per sources, in 2025, Mizoram exported its first Anthurium flower consignment to Singapore, comprising 1,024 cut flowers via APEDA-backed collaboration, strengthening northeastern participation in India’s floriculture exports and global market access. Moreover, growing urbanization and rising disposable incomes among the middle-class population have enhanced consumer spending on decorative flowers and ornamental plants for home beautification and gifting purposes. The government's recognition of floriculture as a sunrise industry with export potential has attracted significant investments in greenhouse cultivation and cold chain infrastructure. Favorable agro-climatic conditions across multiple states enable year-round flower production, while technological advancements in protected cultivation and post-harvest management have improved flower quality and shelf life.

Indian Floriculture Market Trends:

Rising Adoption of Protected Cultivation Technologies

The Indian floriculture market is witnessing substantial adoption of advanced protected cultivation methods including polyhouse farming, greenhouse structures, and shade net facilities. According to reports, in September 2025, Prayagraj installed six polyhouses and two net houses under the Horticulture Development Mission, enabling farmers to grow export-quality roses and daisies shipped to Russia and the Middle East. Furthermore, these technologies enable cultivators to maintain optimal growing conditions irrespective of external weather variations, ensuring consistent production quality throughout the year. Protected cultivation allows farmers to cultivate high-value exotic flower varieties previously difficult to grow under open field conditions.

Expanding E-commerce and Online Flower Delivery Platforms

The digital transformation of India's flower retail landscape is reshaping consumer purchasing behavior and market dynamics significantly. According to sources, Ferns N Petals joined the government‑backed Open Network for Digital Commerce (ONDC) to make its floral and gifting catalogue accessible across multiple digital marketplaces, expanding its reach nationwide. Moreover, online flower delivery platforms have emerged as convenient alternatives for urban consumers seeking hassle-free gifting solutions for birthdays, anniversaries, and festive occasions. These platforms offer curated floral arrangements, same-day delivery options, and subscription services catering to evolving consumer preferences.

Growing Demand for Exotic and Specialty Flower Varieties

Indian consumers are demonstrating increasing preference for exotic and specialty flower varieties beyond traditional marigolds and jasmine offerings. As per sources, in May 2025, Mumbai florists reported surging demand for exotic flowers like Proteas, Tulips, and Cymbidium Orchids, driven by high-net-worth consumers and celebrity clientele seeking premium home décor and gifting. Furthermore, orchids, lilies, gerberas, carnations, and hybrid roses are gaining popularity among urban consumers for premium decorations, corporate gifting, and high-end event arrangements. This preference shift is encouraging cultivators to diversify their production portfolios and invest in specialized growing infrastructure.

Market Outlook 2026-2034:

The Indian floriculture market is poised for substantial revenue growth during the forecast period, supported by strengthening domestic consumption and expanding export opportunities. Government initiatives including subsidies under horticulture development missions are expected to boost production capabilities significantly. The integration of advanced cultivation technologies and improved cold chain logistics will enhance product quality and reduce post-harvest losses. Growing consumer awareness regarding gifting culture combined with increasing penetration of organized retail and e-commerce platforms will drive revenue expansion across urban markets. The market generated a revenue of INR 323.8 Billion in 2025 and is projected to reach a revenue of INR 793.1 Billion by 2034, growing at a compound annual growth rate of 10.5% from 2026-2034.

Indian Floriculture Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Flower Type |

Loose Flowers |

64% |

|

Retail Vs Institutional |

Retail |

80% |

|

Distribution Channel |

Unorganized Retail |

51% |

|

Application |

Aesthetic and Decorative Applications |

59% |

Flower Type Insights:

- Cut Flowers

- Loose Flowers

Loose flowers dominate with a market share of 64% of the total Indian floriculture market in 2025.

Loose flowers represent the dominant segment within the Indian floriculture market, commanding the leading revenue share attributed to their indispensable role in religious and cultural traditions across the country. According to reports, in July 2025, the Uttar Pradesh government waived all mandi fees for flower farmers selling outside market premises, reclassifying flowers as non-specified agricultural products, providing crucial support to small and marginal cultivators. These flowers are extensively utilized in daily worship rituals, temple offerings, religious festivals, wedding ceremonies, and social gatherings, reflecting deeply embedded cultural practices.

The accessibility of loose flowers through extensive unorganized retail networks including local mandis, street vendors, and traditional flower markets ensures widespread consumer reach across urban and rural areas. Their relatively affordable pricing compared to cut flower arrangements makes them accessible to consumers across different income segments. The segment continues benefiting from consistent demand throughout the year driven by religious calendars, festival seasons, and wedding periods that sustain strong consumption patterns.

Retail Vs Institutional Insights:

- Retail

- Institutional

Retail leads with a share of 80% of the total Indian floriculture market in 2025.

The retail dominates the Indian floriculture market with the largest revenue share, driven by extensive individual consumer purchases for personal consumption purposes. In February 2024, quick-commerce platforms like Swiggy Instamart reported peak Valentine’s week demand, selling over 108 bouquets per minute across India, highlighting the rising urban preference for convenient online floral purchases. Moreover, retail consumers primarily purchase flowers for daily worship activities, home decoration, personal gifting occasions, and ceremonial requirements directly from local vendors, florists, and online platforms.

Growing urbanization has expanded the retail base as city dwellers increasingly embrace decorative flower usage for enhancing living spaces and celebrating special occasions. The emergence of organized retail outlets, boutique florists, and e-commerce delivery platforms has improved accessibility and convenience for retail customers seeking quality floral products. Rising disposable incomes among urban middle-class households are enabling premium flower purchases and curated arrangements, thereby contributing to sustained retail segment expansion and overall value growth.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Unorganized Retail

- Florists

- Supermarkets and Hypermarkets

- Online

- Others

Unorganized retail exhibits a clear dominance with a 51% share of the total Indian floriculture market in 2025.

Unorganized retail dominates the Indian floriculture distribution landscape, accounting for the largest market share through extensive networks of traditional vendors and informal marketplaces. In October 2025, Gurugram’s Old Delhi Road flower market witnessed hundreds of shoppers purchasing marigolds, roses, and lotuses, with marigold prices rising from ₹100 a kilogram to ₹300 a kilogram, reflecting the Diwali demand surge. Moreover, this channel encompasses street flower sellers, pushcart vendors, weekly haats, wholesale mandis, and local neighbourhood shops that have historically served Indian consumers' flower purchasing needs.

The dominance of unorganized retail reflects prevailing consumer shopping behaviors and preferences for direct procurement from familiar local sources offering personalized services. These traditional channels maintain strong relationships with regional flower growers, enabling efficient supply chain operations and fresh product availability daily. Despite increasing organized retail presence, unorganized channels continue thriving by serving price-sensitive consumers and offering flexibility in purchase quantities suited to individual customer requirements across diverse urban and rural geographical regions.

Application Insights:

- Aesthetic and Decorative Applications

- Flavours and Fragrances

- Natural Colours

- Medicines

- Others

Aesthetic and decorative applications lead with a market share of 59% of the total Indian floriculture market in 2025.

Aesthetic and decorative applications constitute the leading segment within the Indian floriculture market, commanding the dominant revenue share driven by extensive flower usage across ceremonies, events, and interior decoration purposes. As per sources, in 2025, Krishnagiri farmers planned to send 2 Lakh flowers daily, including white roses from 500 acres to Kerala for Christmas and the wedding season, reflecting peak decorative flower demand. Furthermore, this segment encompasses wedding venue decoration, festival arrangements, religious altar embellishments, corporate event styling, hospitality sector requirements, and residential interior beautification that collectively generate substantial demand.

Religious festivals including diwali, durga puja, onam, and ganesh chaturthi drive seasonal demand surges for decorative flower arrangements across the country. The growing hospitality industry requires consistent floral supplies for hotel lobbies, restaurants, and event venues, while corporate demand for office decoration and event management further supports segment expansion. Rising consumer interest in home aesthetics is encouraging decorative flower purchases for personal living spaces, with urban consumers increasingly adopting flower arrangements as essential lifestyle elements.

Market Dynamics:

Growth Drivers:

Why is the Indian Floriculture Market Growing?

Deep-Rooted Cultural and Religious Traditions

India's rich cultural heritage and religious diversity serve as fundamental drivers propelling floriculture market expansion, creating sustained demand throughout the year. In June 2025, Jagannath Temple gates were adorned with nearly 3,000 kg of flowers for the annual Ratha Yatra festival, underscoring the high religious floral demand in India. Moreover, flowers hold sacred significance across major religions practiced in India, with daily worship rituals, temple ceremonies, and religious festivals necessitating regular flower consumption by millions of households. Hindu temples across the country require enormous flower quantities for deity decoration, while auspicious occasions mandate flower usage following traditional customs.

Government Support and Policy Initiatives

The Indian government's recognition of floriculture as a sunrise industry with substantial export potential has catalyzed supportive policy frameworks and developmental initiatives. The Mission for Integrated Development of Horticulture provides financial assistance for establishing polyhouses, shade nets, and cold storage facilities essential for modern floriculture operations. State horticulture departments offer subsidies, training programs, and technical guidance to encourage farmers' transition toward commercial flower cultivation. These comprehensive government interventions are reducing entry barriers, improving production capabilities, and strengthening the overall floriculture ecosystem significantly.

Urbanization and Evolving Lifestyle Preferences

Rapid urbanization across India is transforming consumer behaviors and creating new demand avenues for the floriculture market beyond traditional consumption patterns. In October 2024, Delhi‑NCR flower subscription services reported rising popularity among young professionals, offering weekly deliveries of lilies, roses, carnations, daisies, and hydrangeas, ensuring convenience, freshness, and aesthetic home décor. Urban populations demonstrate heightened interest in home decoration, aesthetic living environments, and lifestyle products including fresh flowers and ornamental plants. Metropolitan cities are witnessing emergence of premium florist boutiques, flower subscription services, and specialized event decoration companies catering to sophisticated urban consumers.

Market Restraints:

What Challenges the Indian Floriculture Market is Facing?

Perishable Nature and Post-Harvest Losses

The inherently perishable nature of flowers poses significant operational challenges impacting market efficiency and profitability. Cut flowers and loose blooms have extremely limited shelf life, requiring rapid movement from farms to end consumers within narrow time windows. Inadequate cold chain infrastructure accelerates flower deterioration during transit and storage, substantially reducing marketable yields and farmer incomes.

Fragmented Supply Chain and Market Access

The Indian floriculture supply chain remains highly fragmented with multiple intermediary layers separating growers from end consumers. Small and marginal farmers dominating production lack direct market access, depending heavily on aggregators and commission agents who capture significant value margins. Infrastructure deficiencies including poor road connectivity and insufficient cold storage facilities hamper efficient product movement.

Climate Vulnerability and Production Uncertainties

Floriculture production remains susceptible to climatic variations and weather uncertainties that impact crop yields and quality outcomes. Extreme temperature fluctuations, unseasonal rainfall, drought conditions, and pest outbreaks can devastate flower crops, causing significant economic losses for cultivators. Open-field cultivation exposes crops to environmental risks without adequate protective measures against weather-related production failures.

Competitive Landscape:

The Indian floriculture market exhibits a fragmented competitive structure characterized by numerous regional growers, local traders, and established commercial enterprises operating across different segments and geographical areas. The competitive landscape encompasses small-scale cultivators serving local mandis alongside medium-scale commercial farms supplying urban markets and export-oriented integrated operations targeting international buyers. Market participants differentiate through product quality, variety offerings, supply reliability, and value-added services including floral arrangements and event decoration. The organized sector is gradually expanding market presence through improved cultivation infrastructure, quality certification, and professional marketing approaches. Regional variations in competitive intensity reflect local demand patterns, cultivation traditions, and infrastructure development levels.

Recent Developments:

- In September 2025, Soex Flora launched disease-free, high-yielding gerbera tissue culture plants at India Horti Connect, Bangalore. Partnering with global breeder Selecta, the initiative offers Indian growers reliable, uniform, and profitable planting material, expanding the company’s portfolio beyond roses and supporting year-round floriculture productivity.

Indian Floriculture Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Tons, INR Billion |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Flowers Types Covered | Cut Flowers, Loose Flowers |

| Retails Vs Institutionals Covered | Retail, Institutional |

| Distribution Channels Covered | Unorganised Retail, Supermarkets and Hypermarkets, Florists, Online, Others |

| Applications Covered | Aesthetic and Decorative Applications, Flavours and Fragrances, Natural Colours, Medicines, Others |

| States Covered | State-wise Breakup on the Basis of Production and Consumption |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Indian floriculture market size was valued at INR 323.8 Billion in 2025.

The Indian floriculture market is expected to grow at a compound annual growth rate of 10.5% from 2026-2034 to reach INR 793.1 Billion by 2034.

Loose flowers held the largest Indian floriculture market share, driven by their extensive utilization in traditional religious ceremonies, temple offerings, wedding decorations, and festive celebrations that are deeply embedded in Indian cultural traditions and consumer daily worship practices across the entire country.

Key factors driving the Indian floriculture market include deep-rooted cultural and religious traditions mandating flower usage, supportive government policies and horticulture development initiatives, rising urbanization with evolving lifestyle preferences, and expanding organized retail and e-commerce platforms.

Major challenges include the highly perishable nature of flowers causing significant post-harvest losses, fragmented supply chain with multiple intermediary layers, inadequate cold storage and logistics infrastructure, climate vulnerability impacting production, and limited market access for small-scale growers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)