Food Additives Market Size, Share, Trends and Forecast by Product Type, Source, Application, and Region, 2025-2033

Food Additives Market Size and Share:

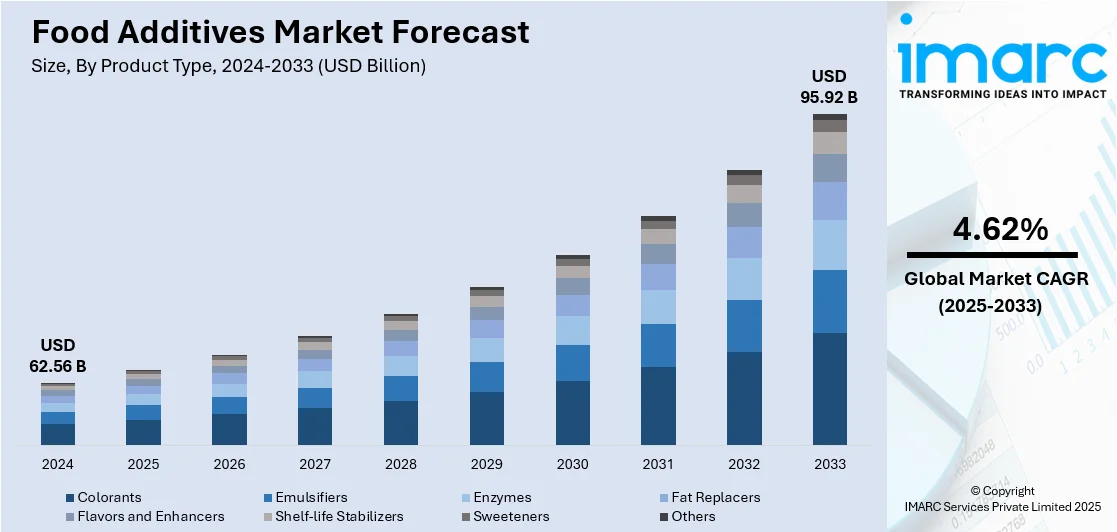

The global food additives market size was valued at USD 62.56 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 95.92 Billion by 2033, exhibiting a CAGR of 4.62% from 2025-2033. Asia-Pacific currently dominates the market, holding a market share of 38.6% in 2024. At present, the increased consciousness regarding diet-related health concerns like cardiovascular diseases (CVDs), diabetes, and obesity is leading consumers to choose food items that are lower in sugar, salt, and fat. Besides this, the growing demand for convenience food products is contributing to the expansion of the food additives market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 62.56 Billion |

| Market Forecast in 2033 | USD 95.92 Billion |

| Market Growth Rate (2025-2033) | 4.62% |

At present, the market is growing due to rising demand for processed and packaged food products. People are seeking convenient and ready-to-eat (RTE) items, which is increasing the use of additives that improve taste, texture, and shelf life. Food manufacturers are employing preservatives, stabilizers, and colorants to maintain product quality. The trend of healthier eating is also driving the demand for natural additives like plant-based sweeteners and colors. Besides this, as urban lifestyles are becoming busier, people continue to rely more on packaged food, supporting the market growth. Increasing worldwide population and disposable incomes are further boosting utilization. Moreover, technological advancements in food processing are encouraging innovations in additive use.

The United States has emerged as a major region in the food additives market owing to many factors. Increasing demand for processed and convenience food items is impelling the food additives market growth. Rising population is catalyzing food demand, creating the need for additives to enhance shelf life. According to the Worldometer, as of Sunday, June 1, 2025, the population of the United States stood at 347,119,300. People prefer RTE meals, snacks, and beverages, promoting the use of preservatives, flavor enhancers, and emulsifiers. The growing health consciousness among Americans is also driving the demand for natural additives, such as plant-based colors, natural sweeteners, and clean-label ingredients. Food manufacturers are investing in innovations to improve taste, texture, and shelf life while meeting regulatory standards. In addition, the popularity of low-fat, low-sugar, and gluten-free products is encouraging the utilization of specialized additives. Apart from this, advancements in food processing technologies and packaging are facilitating wider employment of additives.

Food Additives Market Trends:

Rising demand for convenience food items

The escalating demand for convenience food items is propelling the market growth. According to the IMARC Group, the global convenience food market reached USD 511.1 Billion in 2024 and is set to broaden at a CAGR of 5.25% from 2025-2033. Convenience food products, which include RTE meals, packaged snacks, and microwaveable items, offer consumers an easy and quick way to satiate hunger without the hassle of cooking from scratch. These products often require the incorporation of various additives to maintain their taste, texture, and shelf life. In line with this, preservatives are used to extend the longevity of these items, flavor enhancers heighten the taste, and emulsifiers ensure a consistent texture. Moreover, urban, suburban, and rural areas are witnessing significant growth in on-the-go lifestyles, which in turn is driving the demand for food products that not only save time but also meet quality expectations, thus encouraging manufacturers to utilize a range of food additives.

Rapid globalization of food supply chains

The rapid globalization of food supply chains is positively influencing the market. Food products are sourced and distributed across great distances, often crossing multiple international borders. This global network introduces challenges in maintaining the safety, quality, and longevity of food products. In line with this, food additives, such as preservatives and stabilizers, are becoming crucial. Consequently, the global food preservatives market is growing at a CAGR of 3.57% from 2025-2033 and is anticipated to attain USD 4.51 Billion by 2033, as per the IMARC Group. They act as safeguarding agents that help maintain the food's quality, safety, and appeal during its journey from the farm to the consumer's table. Furthermore, the exponential growth in globally sourced food products owing to the implementation of various international trade agreements is further elevating the need for effective food additives to ensure that they reach people in optimal condition.

Escalating health awareness among consumers

Escalating health awareness among consumers is offering a favorable food additives market outlook. Individuals are reading nutrition labels, researching ingredients, and seeking food items that offer health benefits beyond basic nutrition, which, in turn, is driving the demand for functional food additives, such as vitamins, minerals, and probiotics. Overall, the functional foods market reached USD 233.8 Billion in 2024 and is set to grow at a CAGR of 5.45% during 2025-2033, according to industry reports. These additives not only enhance the food's sensory attributes but also offer additional health benefits. Furthermore, the heightened awareness about diet-oriented health issues, such as cardiovascular diseases (CVDs), diabetes, and obesity, is encouraging consumers to opt for foods with reduced sugar, salt, and fat content. For instance, in 2023, cardiovascular diseases (CVDs) ranked as the top cause of mortality globally, accounting for around 17.9 Million fatalities annually, as reported by the World Health Organization (WHO). This has paved the way for the incorporation of alternative ingredients that serve the function of additives like stevia and plant sterols.

Food Additives Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global food additives market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, source, and application.

Analysis by Product Type:

- Colorants

- Synthetic Food Colorants

- Natural Food Colorants

- Emulsifiers

- Mono, Di-glycerides & Derivatives

- Lecithin

- Sorbate Esters

- Enzymes

- Carbohydrase

- Protease

- Lipase

- Fat Replacers

- Protein

- Starch

- Others

- Flavors and Enhancers

- Natural Flavors

- Artificial Flavors and Enhancers

- Shelf-life Stabilizers

- Sweeteners

- HIS

- HFCS

- Others

- Others

Sweeteners (HFCS) held 55.8% of the market share in 2024. They offer a cost-effective and efficient way to enhance sweetness and flavor in a wide range of food and beverage (F&B) products. HFCS is widely used in soft drinks, processed foods, baked goods, and sauces due to its stability, ease of blending, and long shelf life. Food manufacturers prefer HFCS because it mixes well with other ingredients and maintains sweetness over time. The growing demand for RTE and packaged food products is increasing the utilization of sweeteners in the industry. HFCS also helps improve texture and moisture retention in baked items, making it a valuable additive in bakery applications. In beverages, it delivers consistent taste and sweetness while reducing production costs. Its functional benefits and affordability drive its widespread employment. According to the food additives market forecast, as processed food consumption continues to rise internationally, the demand for sweeteners like HFCS will remain strong, keeping them at the forefront of the market.

Analysis by Source:

- Natural

- Synthetic

Natural represents the largest segment. Natural sources are widely perceived as safer, healthier, and more environment friendly. Consumers increasingly prefer clean-label products that avoid synthetic ingredients, driving the demand for additives derived from plants, fruits, and other natural origins. Food manufacturers are responding to this trend by incorporating natural preservatives, colorants, flavor enhancers, and thickeners to meet both regulatory standards and user expectations. Rising health consciousness and awareness about the harmful effects of artificial additives are also supporting this shift. Natural additives appeal to a broader range of dietary needs, including organic, vegan, and allergen-free categories. As transparency in food labeling is becoming more important, companies are emphasizing natural sourcing to gain consumer trust. Additionally, advancements in food technology help enhance the stability and effectiveness of natural additives, encouraging wider adoption. Retailers are also promoting naturally sourced products to align with wellness trends.

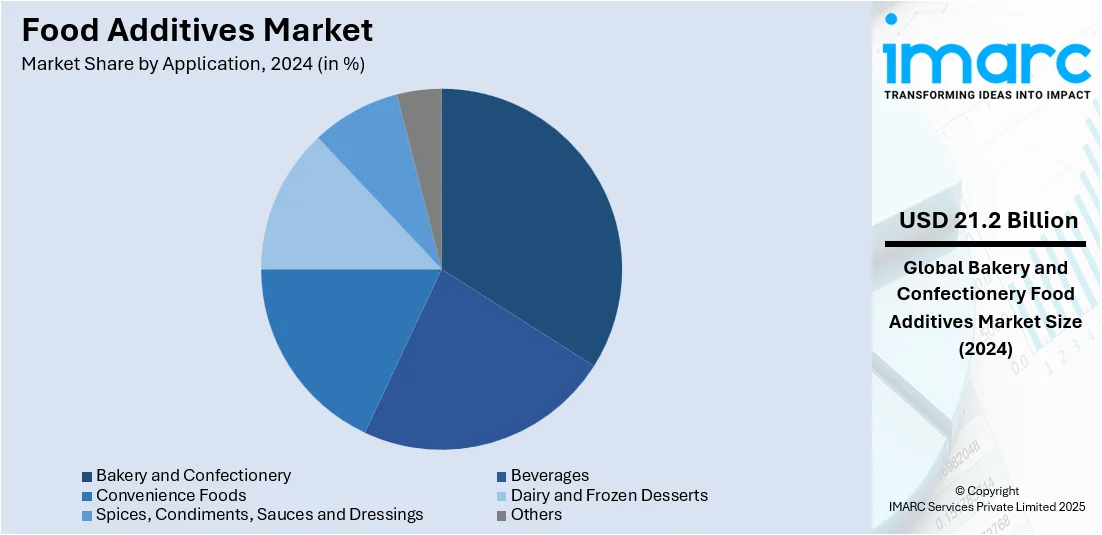

Analysis by Application:

- Bakery and Confectionery

- Beverages

- Convenience Foods

- Dairy and Frozen Desserts

- Spices, Condiments, Sauces and Dressings

- Others

Bakery and confectionery hold 33.8% of the market share. These products heavily rely on additives to enhance taste, texture, color, and shelf life. People expect soft breads, fluffy cakes, and vibrant candies, which require emulsifiers, leavening agents, colorants, and preservatives. The growing demand for packaged bakery items and RTE sweets is encouraging manufacturers to use additives that maintain freshness and appeal during storage and transport. Food additives also help improve dough stability, moisture retention, and product consistency in large-scale production. As new flavors and textures are introduced to attract customers, the role of flavor enhancers, stabilizers, and sweeteners is becoming more important. Seasonal and themed confectionery products further create the need for color and flavor innovation. In addition, the popularity of low-sugar or gluten-free bakery items is promoting the employment of specialty additives to maintain desirable quality.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific, accounting for a share of 38.6%, enjoys the leading position in the market. The market is noted due to its large and growing population, which is driving the demand for processed and packaged food items. Besides this, the thriving food services industry in various countries is encouraging the use of food additives to enhance flavor, The Indian food services sector, estimated at USD 80 Billion in 2024, is projected to expand to USD 144-152 Billion by 2030, as indicated by Redseer Strategy Consultants in their report, ‘The Big Bite: Scaling Success in India’s Food Services’. The predictions indicate a compound annual growth rate (CAGR) of 10-11% until 2030. The region has a strong food manufacturing base, especially in countries like China, India, and Japan, which rely heavily on additives to meet consumer preferences and extend shelf life. Rising disposable incomes allow consumers to spend more on diverse food products, including functional and fortified items that require additives. Local and international companies are investing in scaling their operations in the area owing to lower production costs and high demand.

Key Regional Takeaways:

United States Food Additives Market Analysis

The United States holds 87.50% of the market share in North America. The market is primarily driven by shifting consumer preferences, regulatory influences, and industry requirements. Increasing awareness about food quality, safety, and nutrition has heightened the demand for natural and clean-label additives, such as plant-based preservatives and colorants. Simultaneously, rising preferences for processed and convenience food products are creating the need for additives that enhance shelf life, flavor, and texture. According to a report by the IMARC Group, the convenience foods market in the United States is growing at a CAGR of 3.33% during 2025-2033. Furthermore, innovations in food technology have led to the development of multifunctional additives, improving efficiency and reducing production costs for manufacturers. The rise of health-conscious consumerism has also increased the use of fortifying agents like vitamins and minerals in functional food products and beverages. Additionally, the food service and packaged food sectors continue to expand, particularly with the proliferation of online food delivery platforms, further catalyzing the demand. According to the US Department of Agriculture (USDA), in 2023, the food retail and food service sectors provided USD 2.6 Trillion in food, with food service establishments contributing USD 1.5 Trillion. Besides this, regulatory oversight from agencies, such as the FDA, is ensuring safety and compliance, encouraging transparency, fostering consumer trust, and supporting the market growth.

Europe Food Additives Market Analysis

The Europe market is experiencing robust growth, fueled by regulatory, consumer, and industry trends. A key factor is the increasing demand for processed and convenience food items, which require preservatives, flavor enhancers, emulsifiers, and colorants to maintain taste, appearance, and shelf life. Changing lifestyles and the growing preference for RTE meals and snacks among busy urban populations are driving this demand. The market is also being propelled by the rising trend of sustainable and plant-based food production as manufacturers continue to seek additives that align with environmental and ethical concerns. The increasing adoption of vegan and vegetarian diets across Europe has created the need for plant-derived additives like natural colorants, thickeners, and flavor enhancers. According to a 2021 industry report, 38% of citizens in Europe were discovered to be adhering to a vegan, vegetarian, flexitarian, or pescatarian diet. Among these, Austria had the highest percentage of vegans at 5% of its total population, while the UK had the greatest number of vegetarians, making up 7% of its total population. Additionally, the popularity of ethnic cuisines and gourmet products is encouraging the employment of specialty additives that enhance taste and authenticity.

Asia-Pacific Food Additives Market Analysis

In the Asia-Pacific region, the market is expanding due to rapid urbanization and shifting dietary patterns. This is creating the need for convenience and processed food items, which often require additives for preservation and enhancement. For instance, in India, the food processing sector is projected to more than double from USD 307 Billion in 2023 to USD 700 Billion by 2030, as per the India Brand Equity Foundation (IBEF). The burgeoning food processing sector is expected to subsequently catalyze the demand for adequate food additives. Moreover, economic growth in countries, such as China, India, and Southeast Asia, has led to higher disposable incomes, allowing people to spend more on premium food products that incorporate additives for improved quality and taste. The expanding middle-class population is also driving the demand for premium food products, which often incorporate specialty additives to meet quality and taste expectations.

Latin America Food Additives Market Analysis

The Latin America market is significantly influenced by the region’s thriving F&B manufacturing sector, supported by foreign investments and government initiatives to modernize food production infrastructure. Growth in export-oriented food industries, particularly in Brazil, Argentina, and Chile, is driving the demand for additives that ensure product stability during transportation and long shelf life. For instance, Argentina ranked as the third largest food exporter globally, with an average food export value of USD 34,836 Million from 2019 to 2021, according to the World Bank Group. During the same timeframe, Brazil exported an average of USD 84,531 Million in food products. Increased consumer interest in fortified food items aimed at addressing nutrient deficiencies, particularly in rural and underserved populations, is further boosting the use of vitamin and mineral additives, making the market both economically and socially relevant across Latin America.

Middle East and Africa Food Additives Market Analysis

In the Middle East and Africa region, the market is being increasingly propelled by the growing influence of Western dietary patterns and globalization of food supply chains, which are introducing a variety of international food products requiring specific additives. The rise in health-conscious consumerism is catalyzing the demand for natural and clean-label additives, encouraging innovations in plant-based and organic ingredient solutions for individuals following organic and plant-based diets. For instance, the plant-based food market in Saudi Arabia reached USD 0.11 Billion in 2024 and is set to grow at a CAGR of 11.28% during 2025-2033, according to the IMARC Group. Other than this, broadening halal food production, which requires compliant additive utilization, is further strengthening the market. Increasing investments from multinational food companies are also fueling regional market expansion.

Competitive Landscape:

Top companies are developing new types of food additives that are more efficient, cost-effective, and aligned with consumer needs. Furthermore, they are proactively working to comply with international food safety regulations to not only ensure the safety and quality of their products but also better position themselves in the global distribution chain. Besides this, leading market players are forming alliances and partnerships with other companies, research institutions, and government agencies to pool resources and expertise for more effective and rapid development of new products and technologies. In addition, companies are expanding their market presence through mergers, acquisitions, and entering new geographical territories. Moreover, several key players are focusing on sustainability by sourcing raw materials responsibly, reducing waste, and decreasing the environmental impact of their operations and products. For instance, in June 2024, the Food Safety and Standards Authority of India (FSSAI) declared changes to the Food Safety and Standards (Food Products Standards and Food Additives) Regulations, 2011. Key changes involved removing the minimum requirement for total soluble solids and replacing ‘nutritive sweeteners’ with ‘sweeteners’ in synthetic syrups for carbonated beverages. Additionally, acidity restrictions were no longer applicable for retort or aseptically processed sauces and culinary pastes.

The report provides a comprehensive analysis of the competitive landscape in the food additives market with detailed profiles of all major companies, including:

- Ajinomoto Co. Inc.

- Archer Daniels Midland

- BASF SE

- Cargill Incorporated

- Chr. Hansen A/S

- Corbion N.V.

- Dow Chemical Company

- Eastman Chemical Company

- Givaudan

- Ingredion Incorporated

- Kerry Group

- Koninklijke DSM N.V.

- Novozymes A/S

- Tate & Lyle

Latest News and Developments:

- May 2025: The US Food and Drug Administration (FDA) authorized three new natural food color additives, butterfly pea flower extract, calcium phosphate, and Galdieria extract blue, as part of an effort to eliminate petroleum-derived synthetic dyes. These natural food additives, sourced from algae, flowers, and minerals, were permitted for use in a range of products, such as drinks, sweets, yogurts, snacks, and chicken products.

- April 2025: Godrej Industries (Chemicals) finalized its purchase of Savannah Surfactants' food additives division, incorporating it into its specialty chemicals segment. This action strengthened Godrej's presence in the F&B industry, complementing its strategy for long-term growth.

- February 2025: China's National Health Commission (NHC) authorized eight new food additives, such as curdlan and enzyme-modified steviol glycosides, for broader applications in items like flavored fermented milk and microbial formulations. This action demonstrated China's dedication to improving food safety and innovation via the controlled integration of new food additives.

Food Additives Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered |

|

| Sources Covered | Natural, Synthetic |

| Applications Covered | Bakery and Confectionery, Beverages, Convenience Foods, Dairy and Frozen Desserts, Spices, Condiments, Sauces and Dressings, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ajinomoto Co. Inc., Archer Daniels Midland, BASF SE, Cargill Incorporated, Chr. Hansen A/S, Corbion N.V., Dow Chemical Company, Eastman Chemical Company, Givaudan, Ingredion Incorporated, Kerry Group, Koninklijke DSM N.V., Novozymes A/S, Tate & Lyle, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the food additives market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global food additives market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the food additives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The food additives market was valued at USD 62.56 Billion in 2024.

The food additives market is projected to exhibit a CAGR of 4.62% during 2025-2033, reaching a value of USD 95.92 Billion by 2033.

Health-conscious trends are influencing the market positively, as manufacturers continue to seek natural additives like plant-based colors and sweeteners to replace synthetic ones. The food industry’s focus on improving product quality and safety is further boosting the use of emulsifiers, thickeners, and antioxidants. In addition, advancements in food processing technologies and growing investments in food innovation are creating favorable opportunities for additive development.

Asia-Pacific currently dominates the food additives market, accounting for a share of 38.6% in 2024, driven by a large population, rapid urbanization, and increasing demand for processed and packaged food items. Rising disposable incomes and evolving dietary habits are further supporting the employment of food additives in the region.

Some of the major players in the food additives market include Ajinomoto Co. Inc., Archer Daniels Midland, BASF SE, Cargill Incorporated, Chr. Hansen A/S, Corbion N.V., Dow Chemical Company, Eastman Chemical Company, Givaudan, Ingredion Incorporated, Kerry Group, Koninklijke DSM N.V., Novozymes A/S, Tate & Lyle, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)