Food Emulsifiers Market Size, Share, Trends and Forecast by Type, Application, Source, and Region, 2025-2033

Food Emulsifiers Market Size and Share:

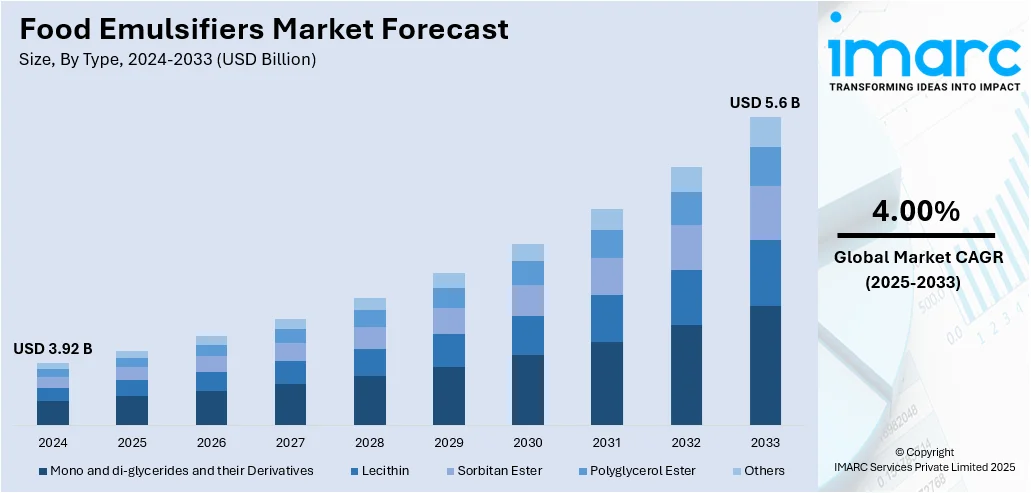

The global food emulsifiers market size was valued at USD 3.92 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.6 Billion by 2033, exhibiting a CAGR of 4.00% from 2025-2033. Europe currently dominates the market, holding a market share of 38% in 2024. At present, there is a high need for processed food as people are looking for convenience in cooking routines. Moreover, as consumers become more health-conscious and discerning about their dietary choices, there is a growing preference for low-fat and reduced-calorie food products. Furthermore, the rising clean label trend is expanding the food emulsifiers market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.92 Billion |

|

Market Forecast in 2033

|

USD 5.6 Billion |

| Market Growth Rate 2025-2033 | 4.00% |

The market for food emulsifiers is witnessing considerable growth as consumers are getting increasingly health-aware and are in need of processed foods. Businesses are concentrating on creating new emulsifiers to enhance the texture, shelf life, and stability of different foodstuffs. Companies are continually conducting research and launching plant-based and natural emulsifiers to support the escalating interest in clean-label ingredients. With increasing uptake of plant-based diets, the demand for emulsifiers sourced from plants, like soy and sunflower, is on an upward trend. These emulsifiers are being applied increasingly in various products like dairy substitutes, spreads, and baked goods. Furthermore, there is an increase in the demand for emulsifiers in low-calorie and low-fat foods due to consumer demand for healthier food products.

To get more information on this market, Request Sample

The United States food emulsifiers sector is growing today as food consumers are increasingly opting for clean and healthier foods. The manufacturers are concentrating on creating new-generation emulsifiers to enhance the texture, stability, and shelf life of food products. Natural and plant-based emulsifiers, like soy-, sunflower-, and palm-derived emulsifiers, are in more demand due to the increased trend of using clean-label ingredients. Firms are constantly launching emulsifiers to address such requirements, primarily in dairy substitutes, bakery foods, and spreads. Consumers looking for healthier eating are dictating the need for emulsifiers in low-calorie, low-fat, and functional food, which is encouraging makers to reformulate their products. Increased veganism and plant-based eating habits are also driving the market, with more applications of emulsifiers being made in plant-based meat and dairy alternatives. Meanwhile, sustainability becomes a central theme in the business. Enterprises are striving to minimize the environmental footprint of emulsifier manufacturing by using raw materials from renewable sources and increasingly adopting more environmentally friendly production techniques. Meanwhile, sustainability becomes a central theme in the business. Enterprises are striving to minimize the environmental footprint of emulsifier manufacturing by using raw materials from renewable sources and more environmentally friendly production techniques. For example, in 2024, Zurich's Cultivated Biosciences changed its name to Cosaic and launched a yeast-derived emulsifier before a $7.5M pre-series A fundraising to aid its entry into the US market. The new name, mosaic with a c, signifies the mixture of fats, proteins, and fibers merging into one emulsion, called Cosaic Neo. The ingredient obtained through fermentation integrates eight essential functions, enabling producers to replace emulsifiers sourced from dairy, eggs, or industrial plant-based alternatives.

Food Emulsifiers Market Trends:

Escalating demand for processed foods

In today's fast-paced lifestyle, consumers are increasingly seeking convenient food choices, contributing to the popularity of processed foods such as baked goods, confectionery items, and ready-to-eat (RTE) meals. For instance, by 2025, Gen Z is expected to make up 27% of the workforce in India, making them a significant demographic in the job market. Food emulsifiers play a pivotal role in enhancing the quality of these products by addressing key attributes such as texture, stability, and shelf-life. Emulsifiers enable the creation of appealing textures in baked goods, ensuring softness in bread, fluffiness in cakes, and creaminess in fillings. In confectionery, they aid in achieving the desired consistency and mouthfeel of chocolates, candies, and creamy centers. Additionally, in ready-to-eat (RTE) meals, emulsifiers help maintain product stability during storage and reheating, ensuring a consistent and pleasant eating experience. As consumer preferences continue to evolve, leading food manufacturers are relying on emulsifiers to meet these demands, making them an integral part of the processed food industry. The enhanced convenience and extended shelf-life provided by food emulsifiers contribute to their enduring appeal, making them essential for a wider audience of consumers seeking both taste and convenience in their food choices.

Rising health consciousness

One of the major food emulsifiers market trends is the growing preferences for low-fat and reduced-calorie food products. According to reports, low-calorie food market size is valued at USD 13.19 Billion in 2024 and it is predicted to reach USD 26.37 Billion by the year 2034 at a 7.3% CAGR during the forecast period for 2025-2034. Food emulsifiers play a crucial role in the development of such healthier options while preserving the taste and texture that consumers enjoy. Emulsifiers are invaluable in low-fat and reduced-calorie food formulations, where they aid in creating products that are better for overall health as well as satisfy sensory expectations. These additives help distribute fat substitutes evenly, resulting in a smoother texture and improved mouthfeel, contributing to the food emulsifiers market growth. In salad dressings, spreads, and other reduced-fat products, emulsifiers ensure that the oil and water components remain stably mixed, preventing separation and maintaining product quality. The alignment of emulsifiers with the augmenting demand for better nutrition and healthier choices reinforces their significance in the food industry. As health-conscious consumers continue to seek foods that offer both taste and nutritional benefits, the role of emulsifiers in enabling such products become increasingly vital, accelerating their adoption and application across a wide range of low-fat and reduced-calorie food items.

Emerging clean label trends

The rising clean label trend is a pivotal driver in the food emulsifiers market as consumers increasingly prioritize natural and transparent ingredients in their food choices, offering a favorable food emulsifiers market outlook. The trend is visible in Europe, being the third leading region in clean label claims penetration, after Australasia and North America. In response to this demand, food manufacturers are shifting their focus toward providing clean label products, and food emulsifiers play a crucial role in this transformation. Emulsifiers derived from natural sources, such as lecithin sourced from soy or sunflower, are gaining immense popularity owing to their clean label appeal. These naturally derived emulsifiers align with consumers' desires for more transparent ingredient lists and products that are free from synthetic additives. To cater to this growing trend, manufacturers are actively developing and promoting natural emulsifier options, expanding their product portfolios to include clean label alternatives. The availability of these natural emulsifiers is supporting the market growth as more food producers embrace clean label practices to meet consumer expectations for healthier, more authentic, and less processed food products. This alignment with clean label trends underscores the importance of natural emulsifiers in shaping the future of the food industry.

Food Emulsifiers Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global food emulsifiers market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, application, and source.

Analysis by Type:

- Mono and di-glycerides and their Derivatives

- Lecithin

- Sorbitan Ester

- Polyglycerol Ester

- Others

Mono and di-glycerides and their derivatives stand as the largest component in 2024, holding around 46.9% of the market. They provide a number of important advantages in food processing. These emulsifiers are utilized extensively to enhance the texture, stability, and shelf life of foodstuffs. They facilitate mixing of ingredients that normally don't commingle like oil and water, to provide a smooth and consistent texture. In baked foods, mono and di-glycerides improve dough handling, volume, and freshness life by maintaining moisture. They also lower the requirement for excessive fats and oils, making food items of lower fat content without affecting texture. In dairy products and ice cream, these emulsifiers create a creamy texture and inhibit the growth of ice crystals, resulting in a smoother product. In addition, mono and di-glycerides are stabilizers in drinks and sauces, enhancing overall stability in products and avoiding separation. Because of their multipurpose uses, they are utilized in a broad variety of applications, ranging from baked goods to processed foods and drinks.

Analysis by Application:

- Confectionery Products

- Bakery Products

- Dairy and Frozen Desserts

- Meat Products

- Others

Dairy and frozen desserts lead the market in 2024. Emulsifiers in food are important in dairy and ice cream manufacturing to improve texture, stability, and total quality. In milk, yogurt, and cream-based dairy products, emulsifiers of the mono and di-glycerides type prevent water and fat separation, maintaining a smooth texture. This creates an even texture and improved mouthfeel, enhancing the quality of eating. In frozen foods such as ice cream and sorbet, emulsifiers play a critical role in managing ice crystal growth, avoiding large crystals that form an unacceptable texture. They allow for a smooth, creamy consistency to be achieved by encouraging even fat, air, and water distribution, resulting in a lighter product. Emulsifiers also contribute to extending the product's shelf life through the stabilization of ingredients, hindering separation, and ensuring quality when in storage. Moreover, emulsifiers play a crucial role in enhancing both the visual appeal and sensory attributes of dairy and frozen desserts.

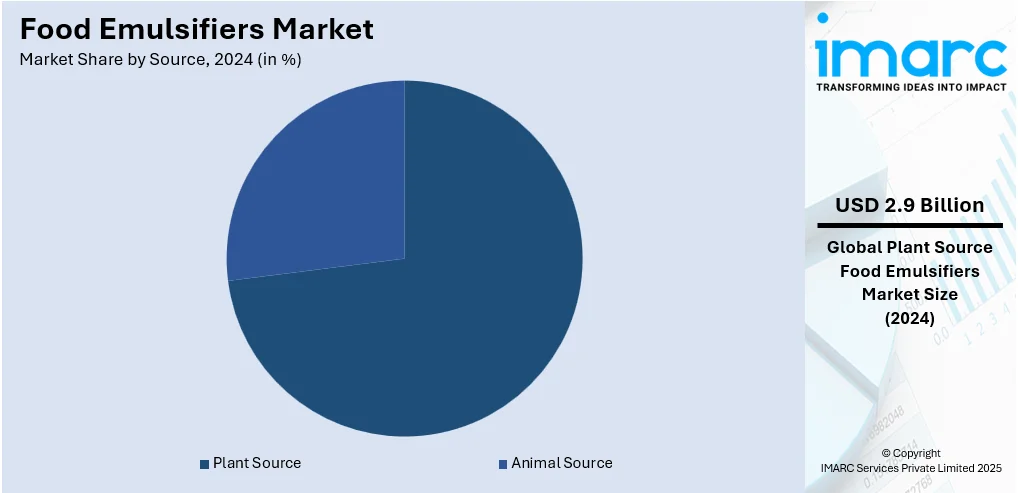

Analysis by Source:

- Plant Source

- Animal Source

Plant source leads the market with around 73.0% of market share in 2024. Food emulsifiers made from plant sources have a number of advantages, especially against the backdrop of increasing consumer interest in natural and clean-label products. Formed from plant sources such as soy, sunflower, and rapeseed, these emulsifiers are a sustainable, environmentally friendly alternative to animal-derived or man-made emulsifiers. They enhance the texture, stability, and shelf life of foods while preserving a natural profile. In products like dairy alternatives, spreads, and baked goods, plant-based emulsifiers enhance product consistency by ensuring uniform mixing of oil and water. They also contribute to moisture retention, improving freshness and preventing dryness. These emulsifiers are often considered healthier, as they are free from artificial additives and preservatives, aligning with the rising demand for clean-label foods.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 38%. The food emulsifiers market in the region is currently experiencing significant growth, driven by changing consumer preferences and an escalating demand for clean-label and plant-based products. Manufacturers are continuously developing innovative emulsifiers derived from natural sources, such as plants, to meet the rising demand for healthier, more sustainable food ingredients. This shift towards natural and plant-based emulsifiers is particularly evident in dairy alternatives, vegan products, and bakery items, where these emulsifiers are used to enhance texture, stability, and shelf life. Consumers are also focusing on healthier options, leading to a growing preference for low-fat, low-calorie, and functional foods, which are incorporating emulsifiers to improve product quality. Additionally, as the popularity of plant-based diets continues to rise, food companies are increasingly using emulsifiers from sources like soy, sunflower, and canola to cater to these dietary trends.

Key Regional Takeaways:

United States Food Emulsifiers Market Analysis

The United States holds 87.60% share in North America. The country has witnessed increased food emulsifiers adoption driven by a shift toward healthier eating habits. A survey of consumers and nutrition professionals published by healthy snack food brand That’s It. found that 23% of consumers and 46% of nutritionists plan to reduce their consumption of ultra-processed snacks in 2025. Consumers are actively choosing products with reduced fat, low calories, and improved nutritional profiles, leading to the integration of food emulsifiers in reformulated recipes. Manufacturers are using emulsifiers to enhance texture and shelf-life without compromising health benefits. Health-conscious trends have elevated demand for plant-based, gluten-free, and reduced-sugar products, where food emulsifiers play a vital role. This has further pushed food producers to incorporate cleaner ingredient solutions that align with dietary expectations. The push toward transparency in labelling and dietary awareness continues to fuel innovation and reformulation strategies.

Asia Pacific Food Emulsifiers Market Analysis

The Asia Pacific food emulsifiers market is experiencing robust growth, fueled by urbanization, rising disposable incomes, and changing consumer preferences for processed and convenience foods. Key drivers include the increasing demand for ready-to-eat foods, health-conscious consumer trends favoring natural and clean-label emulsifiers, technological advancements in food processing, and the rise of women in the workforce. As reported, the Worker Population Ratio (WPR) for women aged 15 years and above has significantly increased from 22.0% in 2017-18 to 40.3% in 2023-24, reflecting a notable rise in women's participation in the workforce. Similarly, the Labour Force Participation Rate (LFPR) for women has grown from 23.3% to 41.7% during the same period, indicating a higher proportion of women actively engaged in economic activities. With more women joining the workforce, there is a higher demand for convenient food options that fit into busy lifestyles.

Europe Food Emulsifiers Market Analysis

Europe has seen heightened use of food emulsifiers owing to the expansion of the processed foods sector. For instance, in 2025, there are 3,731 food processing startups in Europe which include Novozymes, Butternut Box, Bella and Duke, Lesaffre, Greencore. Out of these, 998 startups are funded, with 645 having secured Series A+ funding. Convenience-focused lifestyles have driven consumers toward packaged meals, snacks, sauces, and ready-to-eat options, all of which require stable formulations. Food emulsifiers are being extensively used to maintain product integrity during shelf-life, prevent separation, and enhance sensory appeal. The growing demand for consistent texture and improved mouthfeel in processed foods has led manufacturers to integrate advanced emulsification techniques. In response to evolving regulatory standards and consumer scrutiny, companies are reformulating products with multifunctional emulsifiers that comply with clean label demands.

Latin America Food Emulsifiers Market Analysis

Latin America is experiencing increased food emulsifiers adoption as urbanization and growing disposable income fuels growth in confectionery products, bakery products, and meat products. For instance, Brazil Households disposable income accumulated in 12 Months data was reported at USD 1.71 Trillion in February 2025. Rapid city expansion has led to a shift in dietary patterns favouring packaged and prepared foods. Emulsifiers help enhance texture, extend shelf-life, and improve product stability across these categories.

Middle East and Africa Food Emulsifiers Market Analysis

Middle East and Africa have witnessed growth in food emulsifiers adoption due to increasing demand for ready-to-eat (RTE) meals, spurred by a thriving tourism sector. For instance, Dubai welcomed 1.94 Million overnight visitors in Jan 2025, with an increase of +9% compared to Jan 2024. As hospitality and travel industries expand, the need for stable, visually appealing, and long-lasting meals has grown. Food emulsifiers contribute to product stability, moisture retention, and uniformity, making them essential in RTE offerings catered to diverse consumer segments.

Competitive Landscape:

Market players in the food emulsifiers sector are continuously investing in research and development (R&D) to introduce innovative, sustainable, and health-conscious solutions. They are focusing on developing plant-based and natural emulsifiers to meet the growing demand for clean-label ingredients. Companies are also expanding their product portfolios to include emulsifiers that cater to specific dietary trends, such as vegan, gluten-free, and low-fat foods. Manufacturers are increasingly collaborating with suppliers to ensure the use of renewable resources and environment friendly production processes. As per the food emulsifier market forecasts, manufacturers are expected to strengthen their distribution networks, particularly through e-commerce platforms, to reach global markets more effectively. Overall, as per the food emulsifiers market forecasts, industry players are expected to plan to adapt to consumer demands for healthier, cleaner, and more sustainable food options.

The report provides a comprehensive analysis of the competitive landscape in the food emulsifiers market with detailed profiles of all major companies, including:

- Archer-Daniels-Midland Company

- BASF SE

- Cargill, Incorporated

- Corbion N.V.

- Croda International Plc

- Ingredion Incorporated

- Kerry Group plc

- Lasenor Group

- Palsgaard A/S

- Vantage Specialty Chemicals, Inc.

Latest News and Developments:

- July 2025: FrieslandCampina extended its distribution partnership with IMCD to cover key European and Middle Eastern markets, including the exclusive distribution of its Kievit portfolio. The expanded deal included food emulsifiers among other ingredients, enhancing FrieslandCampina's market presence through IMCD's technical and formulation expertise.

- June 2025: MaGie Creations introduced what it claimed was the world’s first emulsifier made from upcycled brewer’s grain, named PowerBond, to offer a clean-label alternative to synthetic emulsifiers. The emulsifier worked across diverse food applications and addressed sustainability by transforming beer industry byproducts into functional food ingredients.

- May 2025: Indorama Ventures launched food-grade emulsifiers under its Indovinya division, introducing Kosher and Halal-certified Sorbitan Esters to enhance texture, stability, and shelf life in bread, confectionery, dairy, and beverages. The ALKEST SP 80 K® and ALKEST SP 60 K® emulsifiers, including a Non-GMO option, were designed to meet rising food industry demands for quality and compliant ingredients.

- February 2025: LBB Specialties partnered with Kerry Group to introduce innovative ingredients, including food emulsifiers, into the North American personal care market. The collaboration brought emulsifiers and fermentation-derived actives to enhance texture, stability, and anti-aging properties in skin care and cosmetics.

- January 2025: Louis Dreyfus acquired BASF’s Food and Health Performance Ingredients Business, which produced plant-based ingredients and food emulsifiers. The deal included a German production site, three labs, and the transfer of 300 BASF employees.

Food Emulsifiers Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Mono and di-glycerides and their Derivatives, Lecithin, Sorbitan Ester, Polyglycerol Ester, Others |

| Applications Covered | Confectionery Products, Bakery Products, Dairy and Frozen Desserts, Meat Products, Others |

| Sources Covered | Plant Source, Animal Source |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Archer-Daniels-Midland Company, BASF SE, Cargill, Incorporated, Corbion N.V., Croda International Plc, Ingredion Incorporated, Kerry Group plc, Lasenor Group, Palsgaard A/S, Vantage Specialty Chemicals, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the food emulsifiers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global food emulsifiers market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the food emulsifiers industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The food emulsifiers market was valued at USD 3.92 Billion in 2024.

The food emulsifiers market is projected to exhibit a CAGR of 4.00% during 2025-2033, reaching a value of USD 5.6 Billion by 2033.

Key factors driving the food emulsifiers market include increasing consumer demand for processed foods, rising health awareness, preference for low-fat and reduced-calorie products, the clean label trend, and growing adoption of plant-based diets. Additionally, emulsifiers are crucial in improving texture, stability, and shelf life in various food products.

Europe currently dominates the food emulsifiers market with a market share of 38%, accounting for a significant share due to growing demand for clean-label and plant-based products.

Some of the major players in the food emulsifiers market include Archer-Daniels-Midland Company, BASF SE, Cargill, Incorporated, Corbion N.V., Croda International Plc, Ingredion Incorporated, Kerry Group plc, Lasenor Group, Palsgaard A/S, Vantage Specialty Chemicals, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)