France Agribusiness Market Size, Share, Trends and Forecast by Product and Region, 2025-2033

France Agribusiness Market Overview:

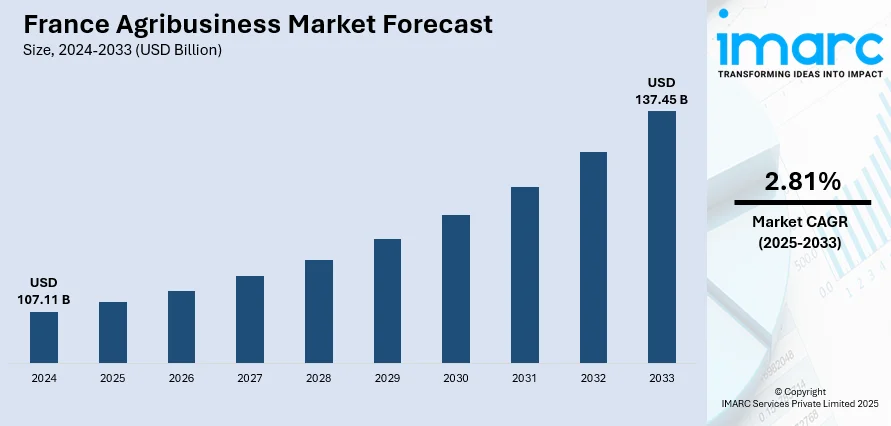

The France agribusiness market size reached USD 107.11 Billion in 2024. The market is projected to reach USD 137.45 Billion by 2033, exhibiting a growth rate (CAGR) of 2.81% during 2025-2033. Dairy cooperatives and processing companies are expanding product ranges to include lactose-free, organic, and fortified dairy options, catering to diverse consumer needs. Besides this, the growing adoption of organic farming practices is contributing to soil health, biodiversity preservation, and reduced carbon footprint, thus fueling the France agribusiness market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 107.11 Billion |

| Market Forecast in 2033 | USD 137.45 Billion |

| Market Growth Rate 2025-2033 | 2.81% |

France Agribusiness Market Trends:

Growing demand for dairy products

Rising demand for dairy products is offering a favorable market outlook in France. France is one of Europe’s largest dairy producers, renowned for its high-quality milk, cheese, butter, and yogurt, which are in demand both domestically and globally. Increasing urbanization, changing dietary preferences, and the popularity of protein-rich foods are fueling higher consumption of dairy products within the country. On the export side, French dairy continues to enjoy strong demand in international markets, enhancing revenue opportunities for producers. As per the French economic institute for the dairy industry, CNIEL, in 2024, French dairy product exports rose by 2.5% to reach a value of €3.2 Billion. The sector benefits from advanced dairy farming techniques, high-yield cattle breeds, and efficient cold chain infrastructure, ensuring quality and supply reliability. Furthermore, dairy cooperatives and processing companies are expanding product ranges to include lactose-free, organic, and fortified dairy options, catering to diverse consumer needs. Strong branding, geographic indications, such as for specific cheese varieties, and government-backed quality certification programs are further strengthening France’s dairy export competitiveness. With the growing investments in modern processing facilities, automation, and sustainable farming practices, the dairy segment is becoming a central pillar of the agribusiness industry.

To get more information on this market, Request Sample

Increasing adoption of organic farming practices

Rising adoption of organic farming practices is impelling the France agribusiness market growth by meeting the increasing consumer preference for healthy, chemical-free, and environmentally sustainable food products. France, being one of Europe’s leaders in organic agriculture, is witnessing expanding farmland dedicated to organic crops, fruits, vegetables, and livestock. Farmers are shifting towards organic methods to capture premium pricing in both domestic and export markets, as people are willing to pay more for certified organic goods. This trend is also attracting government incentives, subsidies, and certification support, further encouraging producers to transition from conventional to organic farming. Additionally, organic farming practices contribute to soil health, biodiversity preservation, and reduced carbon footprint, aligning with France’s sustainability goals and EU environmental regulations. The growth of organic-focused distribution channels, such as specialized retail stores, farmers’ markets, and e-commerce platforms, is further expanding the market reach. As per the IMACR Group, the France e-commerce market size reached USD 857.60 Billion in 2024. This transition to organic agriculture is not only enhancing profitability for farmers but also strengthening France’s position as a global leader in sustainable agribusiness.

France Agribusiness Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product.

Product Insights:

- Grains

- Wheat

- Rice

- Coarse Grains – Ragi

- Sorghum

- Millets

- Oilseeds

- Rapeseed

- Sunflower

- Soybean

- Sesamum

- Others

- Dairy

- Liquid Milk

- Milk Powder

- Ghee

- Butter

- Ice-cream

- Cheese

- Others

- Livestock

- Pork

- Poultry

- Beef

- Sheep Meat

- Others

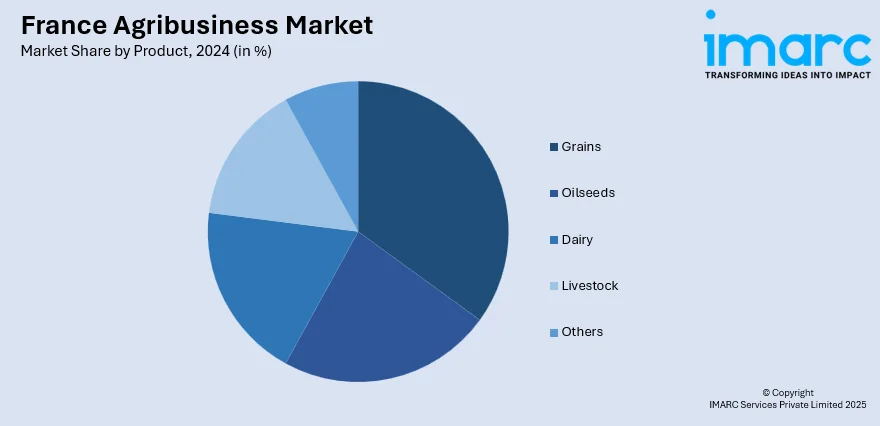

The report has provided a detailed breakup and analysis of the market based on the product. This includes grains (wheat, rice, coarse grains – ragi, sorghum, and millets), oilseeds (rapeseed, sunflower, soybean, sesamum, and others), dairy (liquid milk, milk powder, ghee, butter, ice-cream, cheese, and others), livestock (pork, poultry, beef, and sheep meat), and others.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

France Agribusiness Market News:

- In March 2025, the 10th edition of the Agro Export Days, scheduled to take place online from March 31 to April 4, 2025, represented a significant achievement in promoting the growth of French companies in agriculture, agri-food, and agricultural machinery sectors. Focused mainly on SMEs and mid-sized enterprises, the Agro Export Days sought to equip businesses with resources to enhance their comprehension of market demands, forecast industry trends, and capitalize on specific opportunities.

France Agribusiness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the France agribusiness market performed so far and how will it perform in the coming years?

- What is the breakup of the France agribusiness market on the basis of product?

- What is the breakup of the France agribusiness market on the basis of region?

- What are the various stages in the value chain of the France agribusiness market?

- What are the key driving factors and challenges in the France agribusiness market?

- What is the structure of the France agribusiness market and who are the key players?

- What is the degree of competition in the France agribusiness market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the France agribusiness market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the France agribusiness market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the France agribusiness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)