France Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End-User, and Region, 2025-2033

France Air Freight Market Overview:

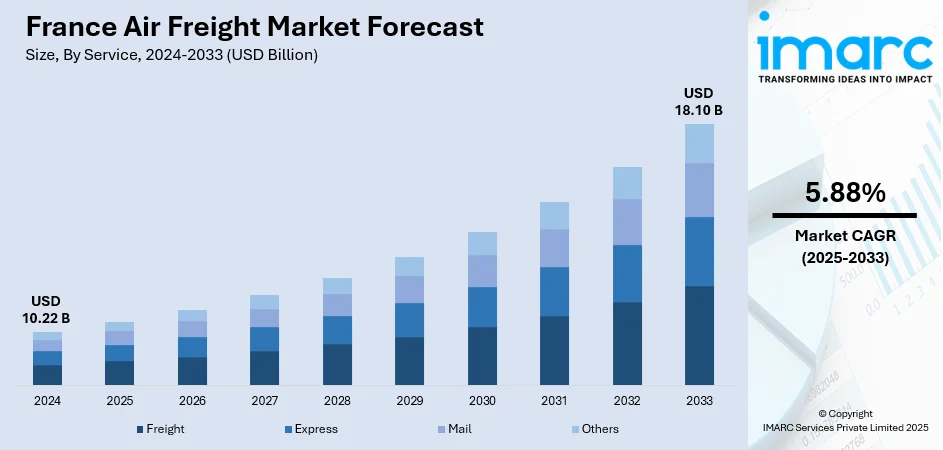

The France air freight market size reached USD 10.22 Billion in 2024. Looking forward, the market is projected to reach USD 18.10 Billion by 2033, exhibiting a growth rate (CAGR) of 5.88% during 2025-2033. The market is driven by France’s strategic role in connecting European and global trade routes, supported by advanced multimodal infrastructure. Rising demand for temperature-controlled pharmaceutical logistics and high-tech exports further elevates the role of air cargo. Additionally, e-commerce expansion and express delivery partnerships are strengthening the sector’s growth outlook, further augmenting the France air freight market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.22 Billion |

| Market Forecast in 2033 | USD 18.10 Billion |

| Market Growth Rate 2025-2033 | 5.88% |

France Air Freight Market Trends:

Strategic Role in European and Global Trade Networks

France’s central position within the European Union and its global trade connections make it a pivotal hub for air freight operations. Major airports such as Charles de Gaulle (Paris) and Lyon-Saint Exupéry serve as critical gateways for cargo moving between Europe, North America, Asia, and Africa. France is a key player in global aerospace, automotive, and luxury goods exports, all of which rely on air freight for time-sensitive shipments. The integration of France’s air cargo infrastructure with Europe’s multimodal transport networks, including road, rail, and sea, strengthens its competitive edge. Air freight and mail transport in France across 23 main provincial airports reached 24,057.155 thousand metric tons in March 2024, marking the year’s peak. September 2024 registered 20,449.573 thousand metric tons, maintaining near parity with September 2023’s 20,448.996 thousand metric tons, reflecting stable annual performance. Additionally, trade agreements between the EU and external partners have facilitated streamlined customs processes, boosting throughput for both imports and exports. The expansion of dedicated cargo terminals and enhanced security measures at major French airports further improve operational efficiency. France’s trade policy emphasizes high-value, technology-intensive goods, ensuring continuous demand for fast and reliable air transport solutions. This interplay between geography, advanced infrastructure, and global trade alignment continues to drive sustained France air freight market growth, ensuring the sector’s centrality in international commerce.

To get more information on this market, Request Sample

Expanding Pharmaceutical and High-Tech Logistics Demand

France’s strong position in pharmaceutical production and the broader life sciences industry is significantly shaping its air freight requirements. Pharmaceutical companies demand strict temperature controls and fast transit times to maintain the integrity of sensitive medical products, making air freight the preferred logistics option. Major logistics providers have expanded dedicated pharmaceutical hubs at French airports, offering advanced cold chain solutions, temperature monitoring, and compliance with international safety standards. Additionally, France’s high-tech manufacturing sectors—particularly semiconductors, electronics, and precision machinery—also require rapid global distribution via air cargo. On March 7, 2025, Air France KLM Martinair Cargo (AFKLMP) reported a 4.1% rise in full-year cargo volumes, reaching 911,000 tons, alongside a 4.2% increase in cargo traffic to 6.8 Billion revenue ton kilometers in 2024. The cargo load factor improved by 1.1 percentage points to 47.7%, with a capacity increase of 1.8% during the year. Collaboration between pharmaceutical companies, government agencies, and logistics providers ensures alignment on regulatory standards and customs protocols, particularly critical for cross-border medical shipments. France’s leadership role in European pharmaceutical exports, supported by initiatives under the EU’s health policy framework, highlights its growing specialization in healthcare logistics. Furthermore, research and development in biotechnology and medical devices continue to drive demand for agile, temperature-controlled cargo services. The combination of high-tech and healthcare sectors strengthens the critical role of air freight within France’s export strategy.

France Air Freight Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service, destination, and end-user.

Service Insights:

- Freight

- Express

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes freight, express, mail, and others.

Destination Insights:

- Domestic

- International

The report has provided a detailed breakup and analysis of the market based on the destination. This includes domestic and international.

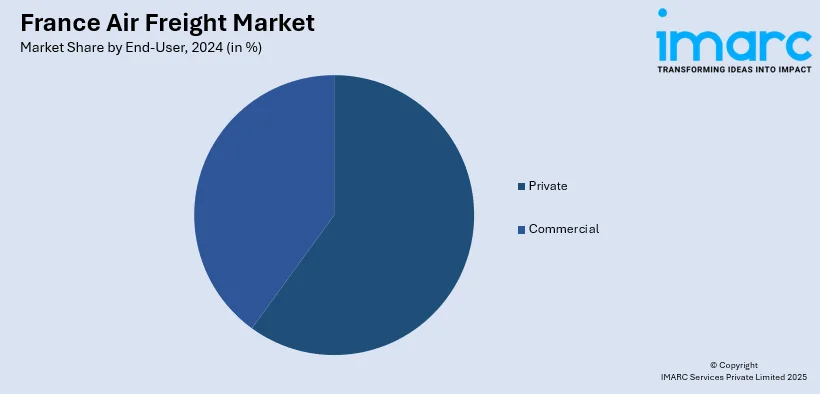

End-User Insights:

- Private

- Commercial

The report has provided a detailed breakup and analysis of the market based on the end- user. This includes private and commercial.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

France Air Freight Market News:

- On May 22, 2025, Air France KLM Martinair Cargo introduced enhanced allotment customization on its myCargo platform to offer customers full control over their contracted allotment bookings. The upgrade includes features such as AWB number selection, shipment routing specification, detailed cargo handling input, and shipper designation, aiming to improve operational efficiency and booking flexibility.

- On May 28, 2025, IBS Software announced its partnership with Air France-KLM Group to implement the iFlight digital platform across the Group’s fleet of over 500 aircraft. This initiative aims to reduce operational costs, eliminate inefficiencies, and minimize delays through centralized decision-making and enhanced resource allocation. The strategic move aligns with digital transformation efforts in the France air cargo market, supporting improved operational resilience and efficiency.

France Air Freight Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Freight, Express, Mail, Others |

| Destinations Covered | Domestic, International |

| End-Users Covered | Private, Commercial |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the France air freight market performed so far and how will it perform in the coming years?

- What is the breakup of the France air freight market on the basis of service?

- What is the breakup of the France air freight market on the basis of destination?

- What is the breakup of the France air freight market on the basis of end user?

- What is the breakup of the France air freight market on the basis of region?

- What are the various stages in the value chain of the France air freight market?

- What are the key driving factors and challenges in the France air freight market?

- What is the structure of the France air freight market and who are the key players?

- What is the degree of competition in the France air freight market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the France air freight market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the France air freight market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the France air freight industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)