France Animal Health Market Size, Share, Trends and Forecast by Animal Type, Product Type, and Region, 2025-2033

France Animal Health Market Overview:

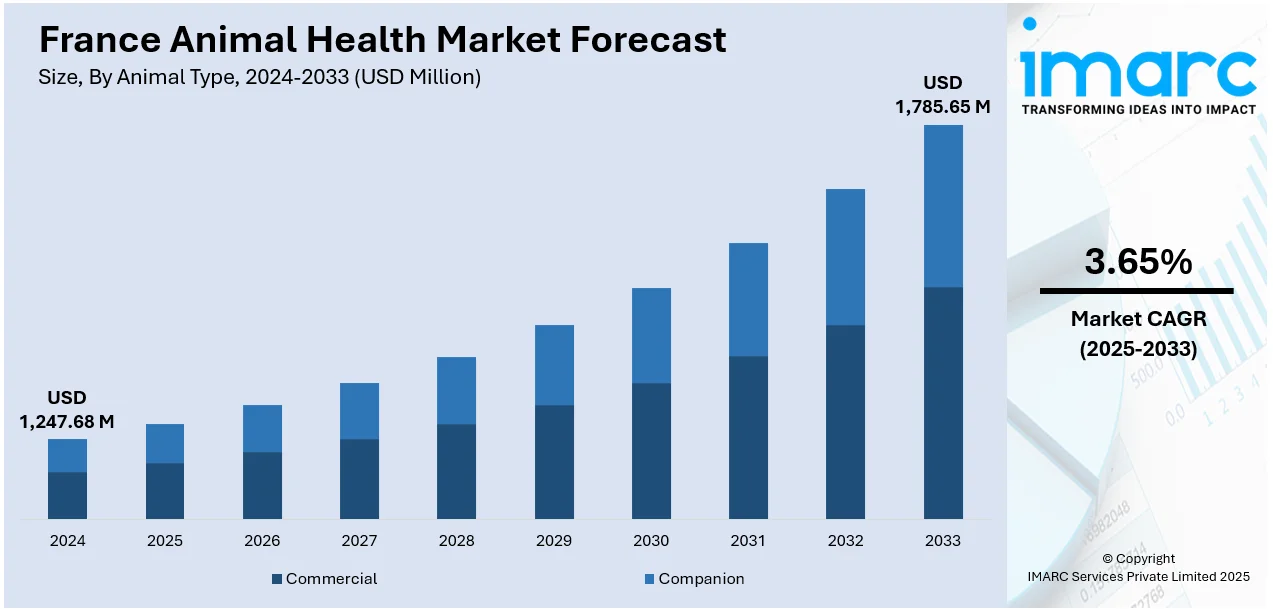

The France animal health market size reached USD 1,247.68 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,785.65 Million by 2033, exhibiting a growth rate (CAGR) of 3.65% during 2025-2033. At present, technological innovations are improving animal health services in France. This, along with the increasing international need for protein derived from animals, is impelling the growth of the market in the country. Apart from this, stringent laws and regulations related to animal welfare are influencing the France animal health market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,247.68 Million |

| Market Forecast in 2033 | USD 1,785.65 Million |

| Market Growth Rate 2025-2033 | 3.65% |

France Animal Health Market Trends:

Growing Demand for Animal Protein

The increasing international need for protein derived from animals is impelling the growth of the market in France. As the population keeps rising and people are becoming more inclined about consuming more protein, there is a greater demand for effective animal rearing. This is leading to a shift towards enhancing animal health in order to increase productivity and minimize losses. Thus, French livestock producers are also spending more on animal health products like vaccines, supplements, and disease control agents for the optimal welfare of animals and for catering to the increasing demand for meat, milk, and eggs. Additionally, the increased demand for sustainable production methods among farmers is encouraging the prevention of outbreaks and use of greener, preventative animal health products. The increased consciousness regarding food safety and the nutritional value of animal products is becoming a contributing factor, with individuals and producers alike focusing on safer and healthier farming practices. Data from Anvol, the French interprofessional organization for poultry, indicated that the French people consumed 31.6 kilograms of poultry meat per person, mainly chicken, while pork and charcuterie accounted for 31 kilograms in 2024.

To get more information on this market, Request Sample

Government Regulations and Animal Welfare Support

France's strict laws and regulations related to animal welfare are positively influencing the market. The animal health and welfare standards are strictly enforced by the government of France to ensure that the animals are treated with respect and their health is ensured, thus catalyzing the demand for veterinary products and services. The establishment of regulatory actions, including a ban on the use of certain antibiotics in animal feed and the encouragement of alternative therapies, is driving innovation in creating alternative health products, including probiotics, vaccines, and other non-antibiotic growth promoters. Subsidies and incentives offered by the French government for animal health and disease prevention programs also support the France animal health market growth. These regulations encourage manufacturers to embrace high-tech health management practices, thereby making the French animal health industry the leader in animal welfare and health developments.

Technological Developments in Animal Health

At present, technological innovations are improving animal health services in France. The use of digital technologies, diagnostics, and treatment technology has transformed animal health management so that animals can be monitored and treated more accurately and effectively. Technologies like wearable animal health monitoring gadgets, genetic screening, and AI-based diagnostic software are widely being embraced by farmers and veterinarians to identify early warning signs of sickness, monitor animal welfare, and maximize health returns. These technologies not only enhance animal well-being but also increase the efficiency of farming activities, lower costs, and help reduce the amount of antibiotics used. Additionally, progress made in therapeutics and vaccines, such as the creation of disease-resistant livestock breeds, is contributing to the market growth by providing more specific solutions for disease control and prevention outbreaks. With the increased adoption of these advanced technologies, the industry is focusing on innovation. Various animal health companies are also expanding to France to provide top-quality services with advanced technology. For instance, in 2024, Ceva Animal Health (Ceva), the fifth-largest animal health firm globally, formally opened its new global headquarters in Libourne, France. This distinctive circular structure acts as an international platform for the company, reflecting Ceva’s sustainability goals and business aspirations, in addition to its dedication to its workforce.

France Animal Health Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on animal type and product type.

Animal Type Insights:

- Commercial

- Companion

The report has provided a detailed breakup and analysis of the market based on the animal type. This includes commercial and companion.

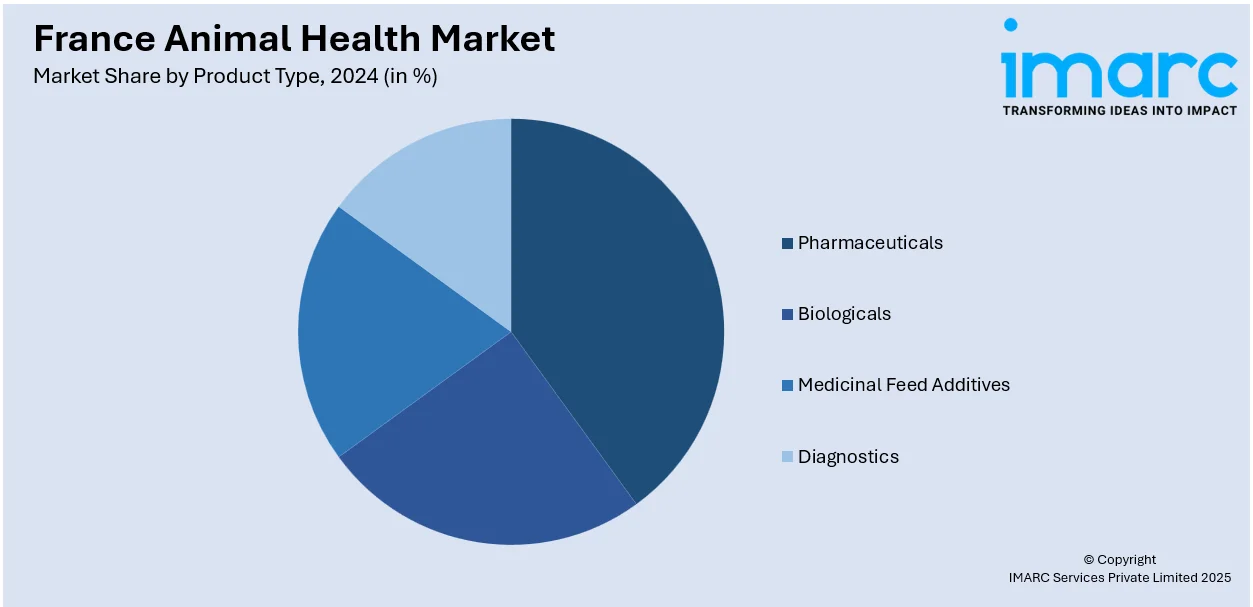

Product Type Insights:

- Pharmaceuticals

- Biologicals

- Medicinal Feed Additives

- Diagnostics

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes pharmaceuticals, biologicals, medicinal feed additives, and diagnostics.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

France Animal Health Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Animal Types Covered | Commercial, Companion |

| Product Types Covered | Pharmaceuticals, Biologicals, Medicinal Feed Additives, Diagnostics |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the France animal health market performed so far and how will it perform in the coming years?

- What is the breakup of the France animal health market on the basis of animal type?

- What is the breakup of the France animal health market on the basis of product type?

- What is the breakup of the France animal health market on the basis of region?

- What are the various stages in the value chain of the France animal health market?

- What are the key driving factors and challenges in the France animal health market?

- What is the structure of the France animal health market and who are the key players?

- What is the degree of competition in the France animal health market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the France animal health market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the France animal health market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the France animal health industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)