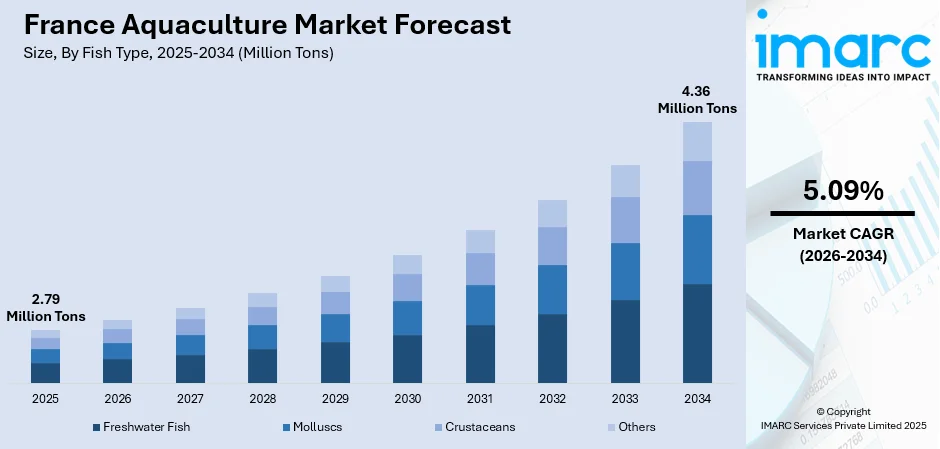

France Aquaculture Market Size, Share, Trends and Forecast by Fish Type, Environment, Distribution Channel, and Region, 2026-2034

France Aquaculture Market Summary:

The France aquaculture market size reached 2.79 Million Tons in 2025 and is projected to reach 4.36 Million Tons by 2034, growing at a compound annual growth rate of 5.09% from 2026-2034.

The market is being propelled by rising consumer health consciousness regarding omega-3 fatty acids and protein-rich diets, government initiatives supporting sustainable seafood production, and technological advancements in recirculating aquaculture systems. Additionally, the emphasis on reducing carbon footprints and strengthening local food sovereignty through domestic production is creating favorable conditions for France aquaculture market share expansion.

Key Takeaways and Insights:

- By Fish Type: Freshwater fish dominates the market with a share of 46.23% in 2025, driven by France's established trout farming infrastructure and consumer preference for locally farmed species.

- By Environment: Fresh water environment leads the market with a share of 46.21% in 2025, supported by traditional pond farming systems and inland aquaculture facilities across French territories.

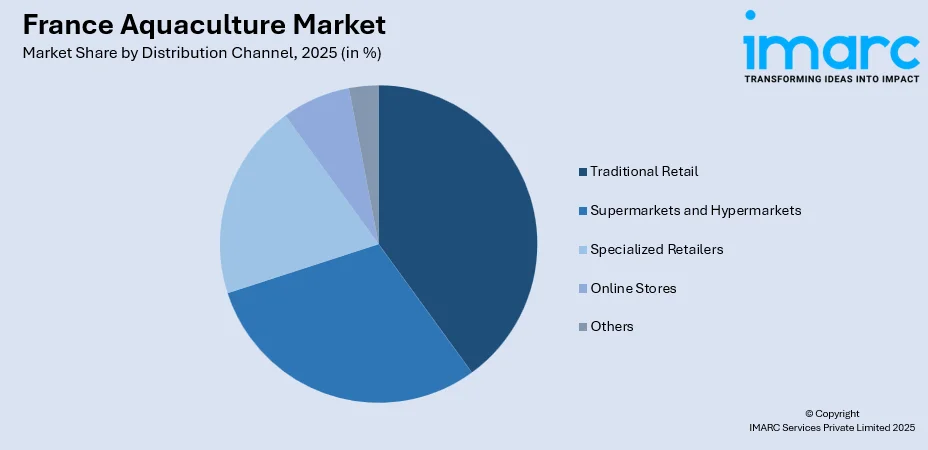

- By Distribution Channel: Traditional retail channels represent the largest segment with a market share of 32.08% in 2025, reflecting strong cultural preference for fishmonger services and market-based seafood purchasing.

- By Region: Paris region leads the market with a share of 18% in 2025, benefiting from high urban population density and concentrated consumer demand in metropolitan areas.

- Key Players: The France aquaculture market features a mix of established marine farming operations, innovative technology startups, and family-owned freshwater fish farms competing across traditional shellfish production, finfish cultivation, and emerging sustainable aquaculture segments.

To get more information on this market Request Sample

France has emerged as a significant European aquaculture producer, ranking among the continent's top three nations for freshwater trout production while maintaining strong shellfish farming traditions along its extensive coastline. The sector encompasses approximately 500 freshwater fish farms producing 34,000 tonnes annually, complemented by robust marine operations cultivating Mediterranean species including sea bass and gilt-head seabream. Government support through the European Maritime and Fisheries Fund has allocated €774 million for sector modernization, while companies like Agriloops secured €13 million in early 2024 to launch France's first industrial-scale saltwater aquaponics system to farm shrimps and vegetables. The industry is experiencing transformation through recirculating aquaculture system adoption, with facilities like Saumon de France investing in post-smolt production to adapt to rising sea temperatures affecting traditional net pen operations.

France Aquaculture Market Trends:

Recirculating Aquaculture System (RAS) Technology Adoption

The France aquaculture sector is witnessing accelerated implementation of recirculating aquaculture systems that enable land-based, controlled environment fish production while minimizing water consumption and environmental impact. In 2025, French aquaculture company Lisaqua has secured €9 million ($10.4 million) to establish its initial large-scale land-based shrimp farm in Monthyon, located in north-central France. These closed-loop systems incorporate advanced filtration, biological treatment, and water quality monitoring technologies that allow year-round production independent of climatic conditions. French operators are investing in RAS infrastructure to address biosecurity challenges, reduce disease transmission risks, and meet stringent EU environmental regulations. The technology enables production proximity to urban consumption centers, reducing transportation emissions and ensuring fresher product delivery.

Integrated Multi-Trophic Aquaculture (IMTA) and Circular Economy Models

French aquaculture producers are increasingly adopting integrated multi-trophic aquaculture approaches that combine fish farming with complementary species cultivation to create closed-loop, resource-efficient production systems. These innovative models utilize nutrient-rich wastewater from fish operations as natural fertilizer for vegetable cultivation or seaweed production, transforming waste streams into valuable co-products while minimizing environmental discharge. The approach aligns with France's commitment to circular economy principles and sustainable food production, attracting significant investment from both private sector and EU funding programs. Companies are developing commercial-scale IMTA facilities that produce both aquatic proteins and agricultural products from single operations. This trend reflects growing recognition that aquaculture can contribute to broader food security objectives while maintaining ecological sustainability through biomimetic production approaches inspired by natural aquatic ecosystems. In 2025, Maïsadour inaugurated a closed-loop fish farm in Langolen, France, establishing it as a benchmark for sustainable aquaculture through the integration of environmental excellence, animal welfare, and local sourcing.

Expansion of Seaweed and Alternative Species Cultivation

France is experiencing diversification beyond traditional finfish and shellfish toward cultivation of seaweed species, spirulina, and emerging aquaculture candidates that address evolving market demands and environmental objectives. The seaweed aquaculture sector is targeting production volumes through cultivation of macroalgae for food applications, microalgae for nutritional supplements, and spirulina for health-conscious consumers. This expansion responds to growing recognition of seaweed's nutritional benefits, minimal environmental footprint, and potential applications in pharmaceutical and cosmetic industries. French producers are developing specialized cultivation techniques adapted to Atlantic and Mediterranean coastal conditions while exploring offshore production methods. In a pivotal action to enhance France's role as a frontrunner in algae production, Agnès Pannier-Runacher, Minister of Ecological Transition, Biodiversity, Forests, Seas, and Fisheries, has presented a fresh roadmap for the nation’s seaweed and algae industry, describing it as a crucial advance in the growth of our algae sectors.

Market Outlook 2026-2034:

The France aquaculture market is positioned for sustained expansion driven by technological innovation, policy support, and evolving consumer preferences favoring sustainably sourced local seafood. The market size was estimated at 2.79 Million Tons in 2025 and is expected to reach 4.36 Million Tons by 2034, reflecting a compound annual growth rate of 5.09% over the forecast period 2026-2034. Government initiatives emphasizing food sovereignty and carbon footprint reduction will accelerate domestic production capacity expansion, while EU sustainability standards create competitive advantages for French producers in premium market segments. The sector will benefit from rising health consciousness driving seafood consumption, though growth will require addressing labor attraction challenges and streamlining regulatory frameworks. Innovation in offshore production, aquaponics integration, and precision aquaculture technologies will enable productivity improvements while maintaining environmental performance standards that distinguish French aquaculture within European and global markets.

France Aquaculture Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Fish Type |

Freshwater Fish |

46.23% |

|

Environment |

Fresh Water |

46.21% |

|

Distribution Channel |

Traditional Retail |

32.08% |

|

Region |

Paris Region |

18% |

Fish Type Insights:

- Freshwater Fish

- Molluscs

- Crustaceans

- Others

Freshwater fish dominates with a market share of 46.23% of the total France aquaculture market in 2025.

Freshwater fish cultivation represents the cornerstone of France's aquaculture industry, with rainbow trout production serving as the primary driver accounting for substantial volumes distributed across approximately 500 specialized farms throughout French territories. France ranks as Europe's third-largest producer of freshwater rainbow trout with annual production reaching 34,000 tonnes. The segment benefits from decades of accumulated expertise in earthen pond farming, raceway cultivation systems, and increasingly, recirculating aquaculture installations that enable controlled environment production.

French freshwater operations emphasize product quality through careful water management, optimized feeding protocols, and processing capabilities including smoked trout production that supplies growing domestic demand. Geographic distribution spans both inland regions utilizing spring-fed systems and coastal areas employing marine-adapted production methods. The segment faces moderate competitive pressure from international producers in Iran and Turkey that have rapidly scaled production volumes, necessitating French operators to differentiate through quality positioning, organic certification, and value-added processing approaches. Government support through the progress plan for fish farm development provides technical assistance and regulatory guidance to sustain competitiveness while maintaining environmental performance standards that characterize European freshwater aquaculture.

Environment Insights:

- Fresh Water

- Marine Water

- Brackish Water

Fresh water leads with a share of 46.21% of the total France aquaculture market in 2025.

Freshwater aquaculture operations represent the predominant environment category within France's production landscape, encompassing traditional earthen pond systems, concrete raceway facilities, and modern recirculating installations distributed across inland regions. Rainbow trout cultivation dominates freshwater production, benefiting from species adaptability to French climatic conditions, favorable growth characteristics, and strong domestic market acceptance. French freshwater farms typically operate as small to medium-scale family businesses with annual production capacities below 200 tonnes per facility, though consolidation trends and technology adoption are gradually increasing average operation sizes.

The environment provides advantages including controlled water quality management, reduced disease transmission risks compared to open water systems, and independence from marine environmental fluctuations. Freshwater operations face challenges including water rights allocation, discharge regulation compliance, energy costs for pumping and oxygenation, and competition for water resources with agricultural and municipal uses. The segment is experiencing technological transformation through recirculating aquaculture system adoption that dramatically reduces water consumption while enabling production in locations previously unsuitable for conventional flow-through farming. Government policy supporting freshwater pond fish farming recognizes these operations' contributions to biodiversity conservation, rural employment, and local protein supply, providing technical and financial assistance to sustain competitiveness within evolving European aquaculture landscape.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Traditional Retail

- Supermarkets and Hypermarkets

- Specialized Retailers

- Online Stores

- Others

Traditional retail exhibits a clear dominance with a 32.08% share of the total France aquaculture market in 2025.

Traditional retail channels encompassing independent fishmongers, municipal markets, and specialized seafood retailers maintain significant market presence within France's aquaculture distribution landscape, reflecting deep-rooted cultural preferences for personalized service, product expertise, and fresh daily offerings that characterize French food purchasing behaviors. The segment benefits from consumer perceptions associating traditional retail with superior product quality, appropriate handling practices, and knowledgeable staff capable of providing preparation guidance and species information. Geographic distribution demonstrates concentration in coastal regions and densely populated urban areas, particularly in Île-de-France where market density supports specialized retail operations.

Traditional channels serve as important outlets for premium aquaculture products including locally farmed oysters, mussels, and whole fish that require careful handling and immediate consumption. French traditional retailers are adapting through offering added services with local pickup, expanded value-added services including cleaning and preparation, and emphasis on sustainability credentials including organic certification and responsible sourcing claims. Regional differences exist with coastal areas maintaining stronger traditional retail presence supported by tourism demand and proximity to production sources, while inland urban markets demonstrate greater reliance on conventional supermarket channels for convenience and variety.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

Paris region leads with a share of 18% of the total France aquaculture market in 2025.

The Paris region represents the single largest aquaculture consumption market within France, driven by metropolitan population concentration exceeding 12 million residents and elevated per capita seafood consumption levels characteristic of urban demographics. The region contains the highest density of retail fishmonger businesses in France, supported by consumer demand for premium products, diverse species availability, and frequent purchasing patterns enabled by walkable neighborhoods and established market traditions. While aquaculture production within Île-de-France remains limited due to land constraints and urban development pressures, the region serves as the primary destination for products originating from coastal production areas and inland farming regions throughout France. Distribution infrastructure includes wholesale markets, particularly Rungis International Market serving as Europe's largest fresh product market and central node in French seafood distribution networks.

The region exhibits sophisticated consumer preferences including strong demand for organic certified products, traceable sourcing, and value-added preparations reflecting time-constrained urban lifestyles. Restaurant and foodservice sectors represent substantial consumption channels, with Parisian establishments showcasing French aquaculture products in traditional and innovative preparations that influence broader culinary trends. The region's aquaculture market demonstrates resilience through economic cycles supported by diverse income levels, tourism-driven demand from international visitors seeking authentic French seafood experiences, and cultural importance of seafood within Parisian gastronomy.

Market Dynamics:

Growth Drivers:

Why is the France Aquaculture Market Growing?

Government Support and Strategic Policy Framework for Sustainable Aquaculture Development

The France aquaculture market is experiencing robust growth propelled by comprehensive government support manifested through strategic funding allocations, regulatory framework development, and long-term sector planning that positions aquaculture as essential component of national food security and environmental sustainability objectives. This financial support enables operators to invest in advanced technologies including recirculating aquaculture systems, implement biosecurity improvements, and adopt sustainable practices without bearing full capital burden independently. Government initiatives specifically target production capacity expansion while maintaining high environmental performance standards through the progress plan facilitating fish farm development, administrative procedure simplification to reduce regulatory burden, and spatial planning coordination resolving conflicts among maritime space users. In 2025, s worldwide conference on the alarming condition of the oceans took place in France, featuring appeals to prohibit bottom trawling and enhance protections for the planet's overused marine regions. World leaders at the UN Ocean Conference in Nice have been urged to propose tangible solutions as well as funding to address what organisers describe as a worldwide "crisis" confronting the overlooked oceans. A surge of new pledges was anticipated in Nice, where approximately 60 heads of state and government gathered with thousands of business executives, scientists, and civil society advocates.

Rising Health Consciousness and Nutritional Awareness Driving Seafood Demand

Consumer health consciousness represents a fundamental market driver as growing awareness regarding nutritional benefits of seafood consumption, particularly omega-3 fatty acid content, high-quality protein provision, and favorable fat composition, elevates aquaculture products within dietary preferences and purchasing decisions. French per capita seafood consumption maintains relatively high levels annually, reflecting established cultural appreciation for aquatic foods complemented by mounting scientific evidence supporting cardiovascular health benefits, cognitive function support, and chronic disease risk reduction associated with regular seafood consumption. Health-conscious consumers actively seek protein sources offering superior nutritional profiles compared to terrestrial meats, with aquaculture products providing essential nutrients including long-chain polyunsaturated fatty acids, vitamins, minerals, and bioactive compounds supporting optimal health outcomes. In 2025, the Global Shrimp Council (GSC) extended its its “Happy Protein” marketing campaign to France and Spain in June. The Global Shrimp Council was established to bring together the worldwide shrimp industry under a single brand, irrespective of origin, species, or production technique, to promote global awareness and consumption.

Technological Innovation Enabling Production Intensification and Environmental Performance Optimization

Technological advancement represents crucial growth enabler through innovations improving production efficiency, reducing environmental footprints, and enabling viable aquaculture operations in locations and contexts previously unsuitable for conventional farming approaches. Recirculating aquaculture system technology has matured into commercially viable production method enabling land-based operations with dramatically reduced water consumption, enhanced biosecurity controlling disease risks, and operational independence from natural water body characteristics or climatic variations. These closed-loop systems incorporate sophisticated water treatment components including mechanical filtration, biological nitrification, denitrification units, and disinfection technologies maintaining optimal water quality parameters supporting intensive stocking densities and rapid growth rates. In 2025, French researchers carried out the 'Lunar Hatch' initiative to find out if they can securely transport bass eggs to the lunar station and if the hatched fry can develop in the lunar aquaculture facility.

Market Restraints:

What Challenges the France Aquaculture Market is Facing?

Complex Regulatory Framework and Administrative Burden Constraining Sector Development

The France aquaculture industry confronts significant development constraints arising from complex, overlapping regulatory frameworks spanning environmental protection, animal welfare, food safety, spatial planning, and sectoral governance that create administrative burden, lengthy authorization processes, and operational uncertainty discouraging investment and expansion. French and European Union regulations establish stringent environmental discharge standards, water quality requirements, and impact assessment obligations intended to protect aquatic ecosystems but imposing compliance costs and technical challenges particularly affecting smaller operators with limited administrative capacity. Spatial planning complexity involving coordination among multiple government agencies with potentially conflicting mandates, competing maritime space users including fishing, shipping, renewable energy, and conservation interests creates authorization difficulties and site access constraints limiting production expansion.

Labor Shortage and Sector Attractiveness Challenges Affecting Operational Capacity

The France aquaculture market experiences persistent labor availability challenges stemming from difficult working conditions, limited social recognition, sector image deficits, and competition for workforce from alternative employment opportunities offering better compensation, working conditions, and career prospects. Aquaculture operations require year-round commitment including weekend and holiday work, physical labor in challenging outdoor conditions exposed to weather extremes, and technical skills spanning biological understanding, mechanical maintenance, and record-keeping capabilities that exceed simple manual labor requirements. The sector struggles to attract young professionals despite offering entrepreneurial opportunities and connection to food production, partly due to low public awareness regarding aquaculture career pathways, limited educational programs providing specialized training, and absence of clear professional advancement structures.

Capital Intensity and Financial Barriers Limiting Technology Adoption and Scale Expansion

French aquaculture sector development faces substantial financial constraints arising from high initial capital requirements for facility establishment, advanced technology acquisition, and scale expansion, coupled with limited access to favorable financing terms and challenging return-on-investment profiles discouraging potential entrants and constraining existing operator growth trajectories. Recirculating aquaculture system installations require significant upfront investment spanning land acquisition, building construction, sophisticated water treatment equipment, monitoring systems, and backup power infrastructure, with total costs potentially exceeding several million euros before first harvest revenues materialize. Marine net pen operations necessitate substantial capital for mooring systems, cage structures, feeding installations, and vessel acquisition for daily operations and harvest logistics, while facing asset depreciation from harsh marine conditions and biological fouling requiring regular maintenance and replacement cycles.

Competitive Landscape:

The France aquaculture market exhibits moderate competitive intensity characterized by fragmented industry structure with numerous small-to-medium enterprises, limited large-scale corporate operations, and emerging technology-focused startups pursuing innovative production models. The competitive landscape encompasses traditional family-owned operations maintaining multi-generational expertise in specific species or production methods, particularly prevalent in shellfish farming and freshwater trout cultivation sectors. Marine finfish operations demonstrate somewhat greater consolidation with specialized companies operating multiple production sites and achieving economies of scale in procurement, processing, and marketing functions. Recent years have witnessed entry of venture-backed startups developing novel approaches including recirculating aquaculture systems, integrated multi-trophic aquaculture models, and alternative species cultivation targeting premium market positioning through sustainability credentials and innovation narratives. Competition occurs across multiple dimensions including production efficiency determining cost structures, product quality affecting price premiums and brand loyalty, sustainability certifications enabling market access particularly in institutional and export channels, and innovation capacity driving operational improvement and market differentiation. Geographic specialization creates natural competitive segmentation with coastal regions focusing on marine and shellfish species while inland areas concentrate on freshwater fish production, limiting direct competition between operators serving distinct market segments. Overall, the competitive landscape reflects mature industry structure balancing traditional production approaches with gradual innovation adoption, regional specialization patterns, and quality-focused differentiation strategies characteristic of developed aquaculture markets within regulatory frameworks emphasizing environmental sustainability and food safety standards.

France Aquaculture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fish Types Covered | Freshwater Fish, Molluscs, Crustaceans, Others |

| Environments Covered | Fresh Water, Marine Water, Brackish Water |

| Distribution Channels Covered | Traditional Retail, Supermarkets and Hypermarkets, Specialized Retailers, Online Stores, Others |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The France aquaculture market size reached 2.79 Million Tons in 2025.

The France aquaculture market is expected to grow at a compound annual growth rate of 5.09% from 2026-2034 to reach 4.36 Million Tons by 2034.

Freshwater fish held the largest market share, accounting for 46.23% of the market share. This dominance is driven by France's established trout farming infrastructure and strong consumer preference for locally farmed freshwater species that offer quality assurance and minimal carbon footprint compared to imported alternatives.

Key factors driving the market include government support through substantial EU funding for sector modernization and innovation, rising health consciousness among consumers seeking omega-3 rich and protein-dense seafood, technological advancements in recirculating aquaculture systems enabling sustainable land-based production, emphasis on local food sovereignty reducing import dependency, and growing demand for sustainably sourced seafood with verified environmental credentials meeting premium market requirements.

Major challenges include complex overlapping regulatory frameworks creating administrative burden and lengthy authorization processes, labor shortage resulting from difficult working conditions and limited social recognition of aquaculture careers, high capital requirements for advanced technology adoption particularly for recirculating systems and offshore installations, biological vulnerabilities to disease outbreaks and environmental stressors including rising sea temperatures, and intense competition for coastal space with other maritime activities creating spatial planning constraints limiting production expansion opportunities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)