France Automotive Wiring Harness Market Size, Share, Trends and Forecast by Application, Material Type, Transmission Type, Vehicle Type, Category, Component, and Region, 2026-2034

France Automotive Wiring Harness Market Summary:

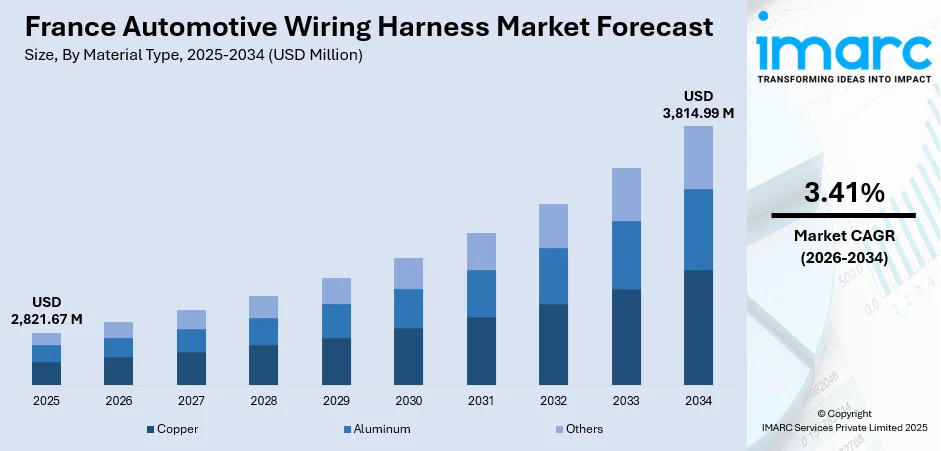

The France automotive wiring harness market size was valued at USD 2,821.67 Million in 2025 and is projected to reach USD 3,814.99 Million by 2034, growing at a compound annual growth rate of 3.41% from 2026-2034.

The market expansion is propelled by accelerating electric vehicle (EV) adoption, stringent environmental regulations mandating emissions reductions, and expanding charging infrastructure across metropolitan and regional areas. Government incentives supporting zero-emission mobility, coupled with investments in domestic battery manufacturing facilities, are catalyzing demand for advanced wiring solutions. The automotive industry's transition toward software-defined vehicles requires increasingly complex harness configurations capable of supporting centralized computing domains, autonomous driving functionalities, and enhanced safety features, positioning the country as a critical hub for next-generation automotive electrical systems, thereby expanding the France automotive wiring harness market share.

Key Takeaways and Insights:

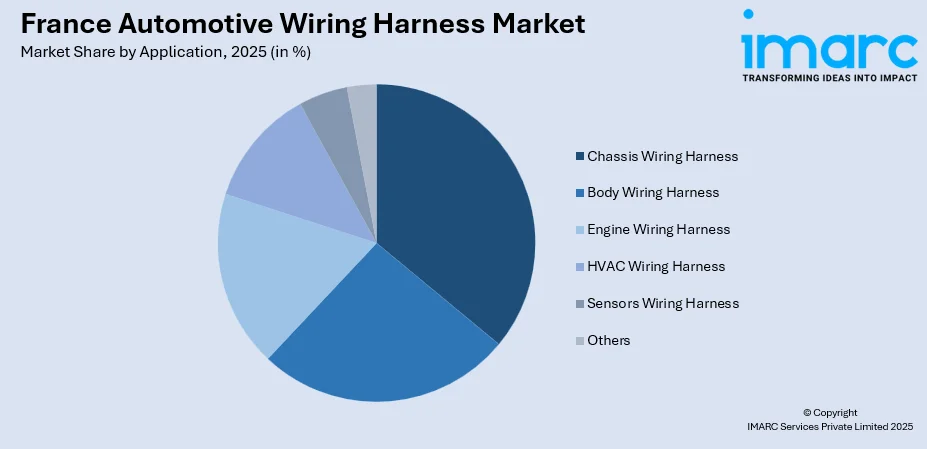

- By Application: Chassis wiring harness dominates the market with a share of 34.94% in 2025, driven by integration of advanced braking systems and electronic stability control.

- By Material Type: Copper leads the market with a share of 86.26% in 2025, owing to superior conductivity and flexibility for modern vehicle electrical systems.

- By Transmission Type: Electrical wiring represents the largest segment with a market share of 81.53% in 2025, owing to its fundamental role in reflecting ubiquitous low-voltage system applications.

- By Vehicle Type: Passenger cars lead the market with a share of 52.27% in 2025, supported by their comprehensive and efficient production volumes and consumer adoption rates.

- By Category: General wires represent the largest segment with a market share of 40.07% in 2025, maintaining dominance across diverse vehicle electrical applications.

- By Component: Wires lead the market with a 42.25% share in 2025, driven by essential role in power transmission throughout vehicle electrical networks.

- By Region: Paris region represents the largest segment with a market share of 17% in 2025, serving as a critical automotive manufacturing and innovation center.

- Key Players: The France automotive wiring harness market exhibits moderate competitive intensity, with multinational electrical systems corporations competing alongside specialized European manufacturers across passenger and commercial vehicle segments, leveraging advanced manufacturing capabilities and regional supply chain integration.

To get more information on this market Request Sample

France's automotive wiring harness sector is experiencing transformative growth driven by the country's ambitious electrification targets and robust domestic vehicle production capabilities. The market benefits from established automotive manufacturing ecosystems concentrated in regions like Paris, northern industrial zones, and southeastern production clusters, where major automakers and tier-one suppliers maintain integrated operations. The French government's commitment to banning internal combustion engine vehicle sales by 2040, combined with immediate incentives supporting battery electric vehicle adoption, creates sustained demand for sophisticated harness systems capable of managing high-voltage electrical architectures and advanced electronic features. The emergence of locally manufactured electric models such as the Renault 5 E-Tech produced in Douai and the Citroën ë-C3 assembled in domestic facilities exemplifies how domestic production capabilities directly translate into expanded wiring harness requirements. Battery gigafactory investments totaling billions of euros in northern France further reinforce the region's position as an integrated electric mobility manufacturing hub, necessitating complex supply chain coordination between cell production, vehicle assembly, and electrical component suppliers throughout the forecast period.

France Automotive Wiring Harness Market Trends:

Accelerating Transition to Electric Powertrains Driving High-Voltage Harness Innovation

The French automotive sector's rapid electrification is fundamentally reshaping wiring harness specifications and manufacturing requirements throughout the value chain. The government is cutting its EV subsidy budget in 2025 from €1.5 billion to €1 billion. Incentives for new BEVs will decrease to a range of €2,000 to €4,000, reduced from the existing €4,000 to €7,000. A new progressive scale will establish the subsidy amount according to household income. Battery electric vehicles demand substantially more sophisticated electrical architectures than conventional internal combustion platforms, incorporating high-voltage distribution systems that operate between four hundred and eight hundred volts to connect traction batteries, inverters, electric motors, and thermal management circuits. These systems require specialized insulation materials, electromagnetic compatibility shielding, and thermal management solutions capable of withstanding elevated operating temperatures while maintaining safety certifications across extended operational lifespans. The integration of bidirectional charging capabilities, which allow vehicles to supply power back to residential systems or grid infrastructure, introduces additional complexity requiring dedicated harness configurations that support both charging and discharging operations.

Integration of Advanced Safety and Autonomous Driving Technologies

Modern vehicles incorporate progressively sophisticated sensor arrays and electronic control units that mandate enhanced wiring harness capabilities supporting high-speed data transmission and redundant circuit architectures. Advanced driver assistance systems encompassing adaptive cruise control, lane departure warning, automatic emergency braking, and parking assistance features require dedicated harness connections linking multiple radar sensors, camera modules, ultrasonic transducers, and processing units distributed throughout vehicle structures. The transition toward higher levels of driving automation necessitates redundant electrical pathways ensuring critical safety functions remain operational even during component failures, compelling manufacturers to implement dual-circuit harness designs with independent power sources and communication channels. Connected vehicle technologies enabling over-the-air software updates, remote diagnostics, and vehicle-to-infrastructure communication introduce additional data transmission requirements that traditional copper-based systems increasingly struggle to accommodate, prompting exploration of fiber optic harness solutions capable of supporting gigabit-per-second data rates. In 2025, WeRide, a worldwide frontrunner in autonomous driving technology, collaborated with Renault Group, a premium partner of Roland-Garros for the second year in a row, to offer a Level-4 autonomous minibus shuttle service during the 2025 Grand Slam event on the legendary clay courts. The Robobus service spans 2.8km in 12 minutes, linking Avenue de la Porte d'Auteuil, Place de la Porte d'Auteuil, P1 Parking Carrefour des Anciens Combattants, and Village de Roland Garros. It operates every day from May 25 to June 8, from 10:30 am to 5 pm, and again from 6 pm to 8 pm.

Emphasis on Lightweight Construction and Manufacturing Automation

Weight reduction initiatives aimed at enhancing vehicle efficiency and extending electric vehicle driving ranges are driving innovations in wiring harness materials, configurations, and assembly methodologies throughout the automotive supply chain. Manufacturers are progressively adopting aluminum conductors in selected applications where their lighter weight offsets reduced electrical conductivity compared to traditional copper solutions, particularly in longer cable runs where mass savings prove most significant. Harness routing optimization enabled by advanced computer-aided engineering tools allows designers to minimize cable lengths and eliminate unnecessary redundancy, reducing both material costs and vehicle weight while maintaining functional requirements. The traditional labor-intensive nature of harness assembly, which historically involved extensive manual operations including wire cutting, stripping, crimping, connector insertion, and protective sleeving installation, is undergoing automation through robotic systems capable of executing repetitive tasks with enhanced precision and consistency. In 2025, Renault enhances its industrial robotics expertise through a significant investment in a French start-up specializing in robotics to increase its automated vehicle manufacturing. The car manufacturer is acquiring an undisclosed minority share in Wandercraft, which asserts it is the first firm to create, produce, and sell medical self-balancing exoskeletons.

Market Outlook 2026-2034:

The France automotive wiring harness market is positioned for sustained expansion throughout the forecast period, driven by accelerating electric vehicle penetration, stringent environmental regulations, and advancing vehicle connectivity requirements. Domestic production of battery electric vehicles continues escalating with major automakers localizing manufacturing operations and supply chains, creating proportional demand for sophisticated electrical distribution systems. The market generated a revenue of USD 2,821.67 Million in 2025 and is projected to reach a revenue of USD 3,814.99 Million by 2034, growing at a compound annual growth rate of 3.41% from 2026-2034. Government policies mandating progressive electrification of public and private vehicle fleets, combined with expanding charging infrastructure investments, establish favorable conditions for sustained market growth across passenger and commercial vehicle segments.

France Automotive Wiring Harness Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Application |

Chassis Wiring Harness |

34.94% |

|

Material Type |

Copper |

86.26% |

|

Transmission Type |

Electrical Wiring |

81.53% |

|

Vehicle Type |

Passenger Cars |

52.27% |

|

Category |

General Wires |

40.07% |

|

Component |

Wires |

42.25% |

|

Region |

Paris Region |

17% |

Application Insights:

Access the comprehensive market breakdown Request Sample

- Body Wiring Harness

- Engine Wiring Harness

- Chassis Wiring Harness

- HVAC Wiring Harness

- Sensors Wiring Harness

- Others

Chassis wiring harness dominates with a market share of 34.94% of the total France automotive wiring harness market in 2025.

Chassis wiring harnesses serve as critical nervous systems connecting essential safety and structural components throughout vehicle platforms, managing power distribution and signal transmission for braking systems, suspension controls, fuel delivery mechanisms, and steering assistance modules. The increasing integration of electronic stability control, anti-lock braking systems, and advanced traction management technologies substantially elevates the complexity and sophistication of chassis harness designs, requiring enhanced durability specifications capable of withstanding exposure to road contaminants, temperature extremes, and mechanical vibrations encountered throughout operational lifespans. Modern electric and hybrid vehicles introduce additional chassis harness requirements accommodating battery cooling systems, regenerative braking interfaces, and torque vectoring controls that demand precise electrical specifications ensuring reliable performance across diverse driving conditions and environmental challenges.

The segment's market leadership reflects fundamental importance in vehicle safety architecture and regulatory compliance requirements mandating comprehensive electronic monitoring of critical chassis functions. Manufacturers are developing modular chassis harness platforms that accommodate varying wheelbase configurations and suspension geometries across multiple vehicle models, enabling production efficiencies while maintaining customization capabilities addressing specific application requirements. Emerging technologies including by-wire steering and braking systems that eliminate traditional mechanical linkages further expand chassis harness complexity and value content, positioning this application segment for sustained growth throughout the forecast period as vehicles transition toward fully electronic control architectures supporting advanced autonomous driving functionalities and enhanced safety systems.

Material Type Insights:

- Copper

- Aluminum

- Others

Copper leads with a share of 86.26% of the total France automotive wiring harness market in 2025.

Copper maintains overwhelming dominance in automotive wiring harness applications due to its exceptional electrical conductivity, mechanical flexibility, and proven reliability across demanding automotive operating environments spanning extreme temperatures, vibrations, and chemical exposures. The material's superior current-carrying capacity enables smaller wire gauges for equivalent power transmission compared to alternative conductors, reducing overall harness mass and installation complexity while maintaining stringent safety margins required by automotive electrical system standards.

The material's established supply chains, standardized manufacturing processes, and comprehensive material specifications provide manufacturers with confidence in consistent quality and availability essential for high-volume automotive production environments. While aluminum alternatives offer weight advantages in specific applications, copper's superior conductivity and connection reliability make it indispensable for critical electrical systems including powertrain controls, safety circuits, and high-current distribution pathways where failure consequences prove severe. Ongoing developments in copper alloy formulations and advanced insulation materials continue enhancing performance characteristics while addressing sustainability considerations through improved recyclability and reduced environmental impact throughout material lifecycle from extraction through end-of-life vehicle processing.

Transmission Type Insights:

- Data Transmission

- Electrical Wiring

Electrical wiring exhibits a clear dominance with an 81.53% share of the total France automotive wiring harness market in 2025.

Electrical wiring systems encompass fundamental power distribution and signal transmission functions that enable operation of essential vehicle systems including lighting, climate control, power accessories, and basic electronic modules throughout conventional and electrified vehicle platforms. These traditional low-voltage circuits typically operating at twelve or twenty-four volts represent mature technologies with well-established design principles, standardized connector interfaces, and proven manufacturing methodologies that deliver consistent performance at competitive costs.

Despite accelerating electrification trends emphasizing high-voltage power systems and increasing data transmission requirements supporting advanced electronics, traditional electrical wiring maintains essential roles connecting battery management systems, lighting circuits, auxiliary power outlets, and numerous comfort and convenience features demanded by contemporary consumers. The segment benefits from established supply chains, extensive manufacturing expertise, and comprehensive quality standards that enable reliable production at scales matching global automotive volumes.

Vehicle Type Insights:

- Two Wheelers

- Passenger Cars

- Commercial Vehicles

Passenger cars lead with a share of 52.27% of the total France automotive wiring harness market in 2025.

Passenger vehicles represent the dominant application segment for automotive wiring harnesses, driven by substantially higher production volumes compared to commercial vehicle categories and increasing electronic content proliferation across vehicle classes from compact urban models to premium executive sedans. Modern passenger cars incorporate progressively sophisticated electrical architectures supporting advanced infotainment systems, comprehensive climate control, powered seating and access features, ambient lighting packages, and extensive driver assistance technologies that collectively demand complex harness configurations managing hundreds of individual circuits distributed throughout vehicle structures.

French automotive manufacturers' strong positions in passenger car segments, particularly in compact and midsize categories where electric vehicle adoption proves most rapid, directly translate into sustained wiring harness demand throughout the domestic supply chain. Consumer expectations for connected services, over-the-air capability, and advanced safety features continue driving electrical system sophistication across all price segments, with even entry-level models incorporating electronic stability control, multiple airbag circuits, and comprehensive sensor arrays. The passenger vehicle segment's market leadership reflects both production scale advantages and technological content increases that collectively position this category for continued dominance throughout the forecast period as vehicle electrification and autonomy progress toward mainstream adoption.

Category Insights:

- General Wires

- Heat Resistant Wires

- Shielded Wires

- Tubed Wires

General wires exhibit a clear dominance with a 40.07% share of the total France automotive wiring harness market in 2025.

General wires constitute the fundamental building blocks of automotive electrical systems, providing essential connectivity between power sources, control modules, sensors, actuators, and end devices distributed throughout vehicle architectures. These standardized conductors encompass diverse gauge specifications, insulation types, and construction methodologies optimized for specific application requirements ranging from low-current signal transmission to substantial power distribution circuits supporting major electrical loads. The category's market dominance reflects universal requirements spanning all vehicle types, powertrain configurations, and technology levels, establishing general wires as indispensable components whose demand scales proportionally with overall vehicle production volumes and electrical system complexity.

Manufacturing advancements including improved conductor materials, enhanced insulation formulations, and optimized production processes continue delivering incremental performance improvements while maintaining cost effectiveness essential for price-sensitive automotive applications. The transition toward electric vehicles amplifies general wire requirements through additional circuits supporting battery management, thermal systems, and power electronics while traditional applications including lighting, climate control, and accessory power remain essential across all powertrain types. Ongoing developments in wire marking technologies, environmental resistance, and manufacturing automation position this category for sustained growth throughout the forecast period as vehicle electrical systems continue expanding in scope and sophistication.

Component Insights:

- Connectors

- Wires

- Terminals

- Others

Wires lead with a share of 42.25% of the total France automotive wiring harness market in 2025.

Wires represent the most fundamental component category within automotive electrical systems, providing the physical pathways through which electrical current and data signals traverse throughout vehicle structures connecting diverse subsystems and enabling coordinated operation of modern automotive technologies. The component's market-leading position reflects both the sheer quantity of wire required in contemporary vehicles, which may contain several kilometers of conductors distributed across body, chassis, and powertrain installations, and the critical importance of wire specifications in determining overall electrical system performance, reliability, and safety characteristics. Modern vehicle designs incorporate progressively diverse wire types optimized for specific applications, including twisted pair configurations for high-speed data transmission, shielded constructions for electromagnetic interference mitigation, and specialized high-voltage cables managing substantial power flows in electric vehicle architectures.

Technological evolution toward higher operating voltages, increased data transmission rates, and more demanding environmental conditions continues driving wire specification advancements incorporating novel insulation materials, improved conductor geometries, and enhanced shielding methodologies. The transition toward lighter vehicle constructions motivates adoption of aluminum conductors in selected applications where their weight advantages offset reduced conductivity compared to traditional copper solutions, particularly in longer cable runs where mass savings prove most significant. Wire manufacturing innovations including automated production processes, inline quality inspection systems, and advanced material formulations position this component category for sustained growth throughout the forecast period as vehicle electrical architectures continue expanding in complexity and capability requirements.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

Paris region exhibits a clear dominance with a 17% share of the total France automotive wiring harness market in 2025.

The Paris region represents a critical automotive manufacturing and innovation center, hosting major automaker headquarters, research and development facilities, and specialized component suppliers within integrated industrial ecosystems supporting advanced vehicle production. The region’s concentration of engineering expertise established supply chain networks, and proximity to key European markets positions it as a strategic hub for automotive wiring harness development and production activities serving both domestic assembly plants and international export markets. Advanced manufacturing facilities in the Paris vicinity incorporate state-of-the-art production technologies including robotic assembly systems, comprehensive quality inspection capabilities, and flexible manufacturing configurations accommodating diverse harness specifications across multiple vehicle platforms, enabling responsive production capabilities aligned with rapidly evolving automotive technology requirements.

The region's robust transportation infrastructure, skilled workforce availability, and established automotive industry clusters facilitate efficient logistics operations and collaborative relationships between harness manufacturers, automakers, and complementary component suppliers throughout integrated supply chains. Regional policies supporting electric vehicle adoption, charging infrastructure deployment, and sustainable manufacturing practices create favorable business environments encouraging continued investment in advanced harness production capabilities aligned with France's broader automotive electrification objectives. The concentration of automotive research institutions, technical universities, and innovation centers within the Paris metropolitan area further enhances regional competitiveness through continuous technology development, workforce training programs, and collaborative research initiatives advancing next-generation wiring harness solutions supporting evolving vehicle architectures throughout the forecast period.

Market Dynamics:

Growth Drivers:

Why is the France Automotive Wiring Harness Market Growing?

Accelerating EV Production and Government Incentive Programs

France's aggressive electrification strategy, anchored by the government's commitment to ban internal combustion engine vehicle sales by 2040 and supported by substantial consumer incentives, drives exponential growth in battery electric vehicle adoption throughout passenger and commercial vehicle segments. In January 2025, there were 27,131 registered electrified vehicles, accounting for 19.4% of the market share, yet this marked a 15.4% decrease from January 2024. The 2025 social leasing program allowing low-income households to access electric vehicles for approximately two hundred euros monthly has enabled over forty-one thousand households to acquire battery electric cars, substantially expanding the addressable market beyond traditional early adopters. Major automotive manufacturers including Renault and Stellantis are investing billions of euros in domestic electric vehicle production capacity, establishing integrated supply chains linking cell production, vehicle assembly, and component manufacturing throughout northern France.

Stringent Emission Regulations and Environmental Compliance Requirements

The European Union's comprehensive regulatory framework targeting carbon neutrality by 2050, encompassing the European Green Deal and Fit for 55 regulations, mandates progressive reductions in automotive emissions that effectively compel manufacturers to electrify vehicle portfolios across all segments. France's national climate objectives align with these broader European initiatives, establishing ambitious targets including the complete phase-out of gasoline and diesel vehicle sales by 2040 and intermediate milestones requiring substantial EV penetration throughout passenger and commercial fleets. Manufacturers are developing specialized harness platforms optimized for electric vehicle applications, incorporating enhanced insulation specifications, electromagnetic compatibility shielding, and thermal management capabilities addressing elevated operating temperatures and electrical stresses characteristic of high-voltage traction systems, positioning the industry to capture substantial value from the electrification transition throughout the forecast period.

Expanding Charging Infrastructure and Technological Advancements

France's comprehensive charging infrastructure deployment establishes essential enabling conditions for mass-market electric vehicle adoption throughout metropolitan and regional areas. Technological advancements in battery chemistries promising extensive driving range, coupled with ultra-fast charging capabilities achieving eighty percent charge in under ten minutes, necessitate progressively sophisticated thermal management and power distribution systems requiring specialized harness configurations. Innovations including solid-state batteries, on-board artificial intelligence, and over-the-air software update capabilities continue expanding vehicle electronic content and electrical system sophistication, driving sustained wiring harness demand throughout the forecast period as automotive technologies advance toward full autonomy and comprehensive connectivity. In 2024, the Banque des Territoires, an essential contributor to ecological change and social unity throughout regions, TIIC, an expert in mobility infrastructure investments within Europe, and Equans, a worldwide leader in the energy and services arena, have united to establish Elinvest. Armed with €40 million, this fresh investment framework seeks to expedite the rollout of publicly accessible electric vehicle charging infrastructure (IRVE) across France.

Market Restraints:

What Challenges the France Automotive Wiring Harness Market is Facing?

Fluctuating Raw Material Costs and Copper Price Volatility

Copper, accounting for well over half of total bill-of-materials costs in conventional wiring harnesses, experiences substantial price fluctuations driven by global supply-demand dynamics, geopolitical tensions, and macroeconomic conditions that create significant cost uncertainties throughout automotive supply chains. Recent copper price increases exceeding fifteen percent compound manufacturing expense challenges for harness suppliers operating on thin margins within highly competitive automotive component markets. While most line-fit supply contracts include pass-through clauses allowing material cost adjustments, automakers increasingly resist mid-cycle price increases, compressing supplier profitability and constraining investment capacity for advanced manufacturing technologies and product development initiatives.

Supply Chain Complexity and Semiconductor Shortages

The automotive industry's transition toward increasingly sophisticated electronic architectures relying on numerous semiconductor components creates vulnerabilities to supply disruptions affecting global electronics manufacturing sectors. Recent semiconductor shortages caused by pandemic-related production interruptions, logistics bottlenecks, and surging consumer electronics demand resulted in substantial automotive production curtailments throughout major manufacturing regions, with some vehicle assembly plants suspending operations due to component unavailability. These disruptions cascade throughout automotive supply chains, affecting wiring harness manufacturers dependent on electronic control units, connector assemblies, and specialized components incorporating semiconductor devices. The geographically dispersed nature of automotive supply chains, with critical components sourced from multiple continents, exposes manufacturers to logistics challenges, border delays, and transportation cost increases that collectively impact profitability and delivery reliability.

High Manufacturing and Labor Costs in Developed Markets

Wiring harness production remains predominantly labor-intensive despite ongoing automation initiatives, requiring skilled workers for assembly operations including wire cutting, stripping, crimping, connector insertion, and protective sleeving installation that collectively account for substantial manufacturing costs. European labor rates substantially exceed those in emerging manufacturing regions including Eastern Europe, North Africa, and Southeast Asia, creating competitive disadvantages for French-based production facilities serving price-sensitive automotive markets. The complexity of modern wiring harnesses, particularly those supporting electric vehicle applications with high-voltage requirements and extensive electronic integration, demands specialized technical expertise and comprehensive quality assurance processes that further elevate manufacturing costs compared to conventional harness configurations.

Competitive Landscape:

The France automotive wiring harness market demonstrates moderate competitive intensity characterized by presence of established multinational corporations maintaining significant market positions through comprehensive product portfolios, extensive manufacturing capabilities, and long-standing relationships with major automotive manufacturers. These global leaders leverage economies of scale, advanced engineering capabilities, and international production networks to serve diverse customer requirements across passenger vehicles, commercial trucks, and specialty applications. European regional specialists compete effectively through focused expertise in specific market segments, premium quality positioning, and responsive customer service aligned with European automotive manufacturers' requirements for technical collaboration and supply chain integration. The competitive landscape reflects industry consolidation trends as larger suppliers acquire smaller specialists to expand technological capabilities, geographic coverage, and customer portfolios, while maintaining operational efficiency through standardized manufacturing processes and shared engineering resources across multiple production facilities.

France Automotive Wiring Harness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Body Wiring Harness, Engine Wiring Harness, Chassis Wiring Harness, HVAC Wiring Harness, Sensors Wiring Harness, Others |

| Material Types Covered | Copper, Aluminum, Others |

| Transmission Types Covered | Data Transmission, Electrical Wiring |

| Vehicle Types Covered | Two Wheelers, Passenger Cars, Commercial Vehicles |

| Categories Covered | General Wires, Heat Resistant Wires, Shielded Wires, Tubed Wires |

| Components Covered | Connectors, Wires, Terminals, Others |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The France automotive wiring harness market size was valued at USD 2,821.67 Million in 2025.

The France automotive wiring harness market is expected to grow at a compound annual growth rate of 3.41% from 2026-2034 to reach USD 3,814.99 Million by 2034.

Chassis wiring harness segment dominates the market with a 34.94% share in 2025, driven by integration of advanced braking systems, electronic stability control, and sophisticated chassis management technologies across modern vehicle platforms.

Key factors driving the France automotive wiring harness market include accelerating EV production supported by substantial government incentives and domestic manufacturing investments, stringent emission regulations compelling automotive electrification across all segments, and expanding charging infrastructure deployment enabling mass-market battery electric vehicle adoption throughout metropolitan and regional areas.

Major challenges include fluctuating raw material costs particularly copper price volatility affecting manufacturing expenses, supply chain disruptions encompassing semiconductor shortages and logistics bottlenecks creating production delays, and high manufacturing costs in developed European markets compared to lower-cost production regions creating competitive pressures on profit margins.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)