France Business Process Management Market Size, Share, Trends and Forecast by Deployment Type, Component, Business Function, Organization Size, Vertical, and Region, 2025-2033

France Business Process Management Market Overview:

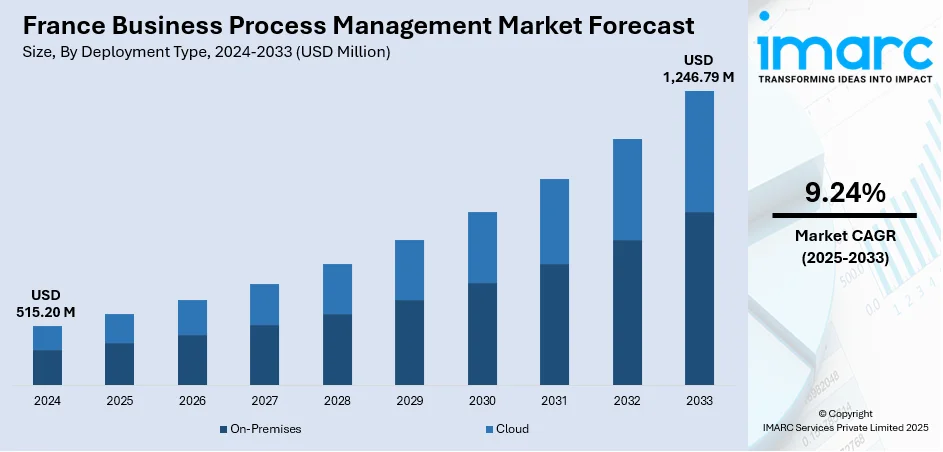

The France business process management market size reached USD 515.20 Million in 2024. The market is projected to reach USD 1,246.79 Million by 2033, exhibiting a growth rate (CAGR) of 9.24% during 2025-2033. The market is evolving rapidly due to growing enterprise focus on automation, digital workflows, and customer-centric operations. Increased adoption of cloud platforms and integration of AI-driven tools are enhancing process optimization across industries. Organizations are prioritizing agility, regulatory compliance, and cost-efficiency through BPM solutions. The demand spans sectors such as finance, healthcare, and manufacturing. Ongoing digital innovation and supportive policy frameworks are expected to significantly contribute to the France business process management market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 515.20 Million |

| Market Forecast in 2033 | USD 1,246.79 Million |

| Market Growth Rate 2025-2033 | 9.24% |

France Business Process Management Market Trends:

BPM Adoption Strengthens Amid Services Sector Momentum

In August 2024, France’s services sector experienced a strong uptick, with the S&P Global flash Services PMI climbing to a 27‑month high of 55.0 during the Olympic Games period up from 50.1 in July, indicating a pronounced expansion in business services activity. This buoyed momentum prompted organizations across finance, logistics, and public administration to modernize by implementing BPM solutions. Cloud-based BPM platforms saw increased uptake, offering scalable process models and real-time workflows tailored to hybrid working conditions. The rising adoption of intuitive, low-code BPM environments facilitated rapid deployment and operational transparency. Firms leveraged these platforms to automate transactional processes, enhance collaboration, and enforce regulatory compliance. This growing reliance on BPM frameworks demonstrates France business process management market growth, as organizations pivot from legacy systems toward agile, digitally enabled operations. The sustained services sector activity in late 2024 establishes a solid foundation for companies to explore broader BPM integration in 2025 and beyond.

To get more information on this market, Request Sample

AI & Analytics Propel BPM Innovation

By early 2025, France experienced a noticeable acceleration in the integration of artificial intelligence (AI) and advanced analytics within business process management (BPM) systems. The AI Action Summit held in Paris in February 2025 reinforced the government’s push to position France as a leader in ethical AI development and enterprise adoption. Encouraged by these initiatives, organizations across healthcare, logistics, and financial services began incorporating AI-powered automation into BPM platforms. These capabilities include process mining, real-time performance dashboards, anomaly detection, and smart alerts allowing for dynamic workflow adjustments and predictive decision-making. Cloud-based BPM platforms are being deployed with embedded machine learning models to forecast process inefficiencies, reduce operational delays, and support compliance requirements. These solutions also help organizations adapt to increasingly complex regulatory frameworks by automating audit trails and reporting mechanisms. These developments reflect broader France business process management market trends, where data-driven execution and intelligent automation are becoming critical to achieving operational agility, process transparency, and sustained efficiency in a competitive landscape.

Strategic Governance & Regulatory Integration through BPM

In the first quarter of 2025, the Bank of France revised its GDP growth forecast up to 0.2%, following a 0.1% contraction at the end of 2024, a sign of cautiously improving macroeconomic stability. This modest rebound gave French enterprises greater confidence to invest in digital governance and risk management through BPM solutions. In regulated sectors such as public services, financial administration, and healthcare, BPM platforms are being implemented to enhance transparency, compliance, and performance metric tracking. These systems enable structured process standardization, audit trails, and regulatory reporting aligned with evolving EU frameworks. Furthermore, integration with enterprise resource planning (ERP) and customer relationship management (CRM) systems facilitate end-to-end visibility and decision traceability. This evolution underscores the transforming role of BPM into a governance core a reflection of long-term France business process management market. In an environment marked by economic steadiness and heightened regulatory scrutiny, BPM adoption is increasingly strategic, supporting compliance, resilience, and operational excellence.

France Business Process Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on deployment type, component, business function, organization size, and vertical.

Deployment Type Insights:

- On-Premises

- Cloud

The report has provided a detailed breakup and analysis of the market based on the deployment type. This includes on-premises and cloud.

Component Insights:

- IT Solution

- Process Improvement

- Automation

- Content and Document Management

- Integration

- Monitoring and Optimization

- IT Service

- System Integration

- Consulting

- Training and Education

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes IT solutions (process improvement, automation, content and document management, integration, monitoring and optimization) and IT services (system integration, consulting, and training and education).

Business Function Insights:

- Human Resource

- Accounting and Finance

- Sales and Marketing

- Manufacturing

- Supply Chain Management

- Operation and Support

- Others

The report has provided a detailed breakup and analysis of the market based on the business function. This includes human resources, accounting and finance, sales and marketing, manufacturing, supply chain management, operation and support, and others.

Organization Size Insights:

- SMEs

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes SMEs and large enterprises.

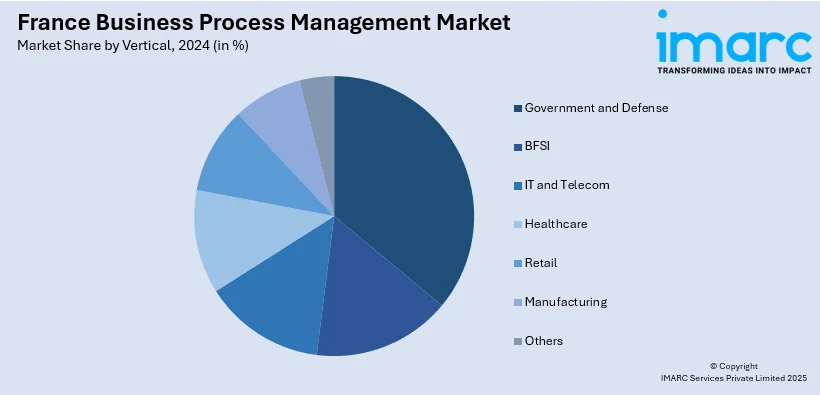

Vertical Insights:

- Government and Defense

- BFSI

- IT and Telecom

- Healthcare

- Retail

- Manufacturing

- Others

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes government and defense, BFSI, IT and telecom, healthcare, retail, manufacturing, and others.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include the Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

France Business Process Management Market News:

- May 2024: Teleperformance, a French BPM major, plans to hire 15,000 additional employees in India, expanding its workforce to over 100,000. With operations in 15 cities, the company is also set to grow into five more locations, including Lucknow, Raipur, Jaipur, and Noida. This move supports its expanding U.S. operations while leveraging India’s large and skilled talent base. The hiring initiative highlights Teleperformance’s continued investment and confidence in India’s business process management sector.

France Business Process Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Types Covered | On-Premises, Cloud |

| Components Covered |

|

| Business Functions Covered | Human Resource, Accounting and Finance, Sales and Marketing, Manufacturing, Supply Chain Management, Operation and Support, Others |

| Organization Sizes Covered | SMEs, Large Enterprises |

| Verticals Covered | Government and Defense, BFSI, IT and Telecom, Healthcare, Retail, Manufacturing, Others |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the France business process management market performed so far and how will it perform in the coming years?

- What is the breakup of the France business process management market on the basis of deployment type?

- What is the breakup of the France business process management market on the basis of component?

- What is the breakup of the France business process management market on the basis of business function?

- What is the breakup of the France business process management market on the basis of organization size?

- What is the breakup of the France business process management market on the basis of vertical?

- What is the breakup of the France business process management market on the basis of region?

- What are the various stages in the value chain of the France business process management market?

- What are the key driving factors and challenges in the France business process management?

- What is the structure of the France business process management market and who are the key players?

- What is the degree of competition in the France business process management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the France business process management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the France business process management market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the France business process management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)