France Carbon Black Market Size, Share, Trends and Forecast by Type, Grade Wise Application, and Region, 2026-2034

France Carbon Black Market Summary:

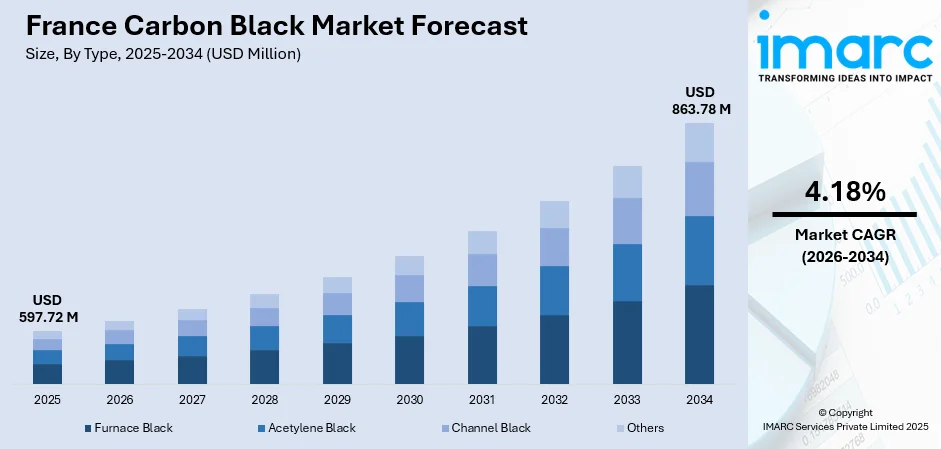

The France carbon black market size was valued at USD 597.72 Million in 2025 and is projected to reach USD 863.78 Million by 2034, growing at a compound annual growth rate of 4.18% from 2026-2034.

The France carbon black market is experiencing steady expansion, driven by robust demand from the tire and rubber manufacturing sectors. Growing automotive production, coupled with rising applications in plastics, coatings, and inks, is bolstering market momentum. Increasing emphasis on sustainable production methods and circular economy initiatives is reshaping industry dynamics, while investments in specialty and eco-friendly carbon black grades are enhancing product value and supporting long-term market growth.

Key Takeaways and Insights:

-

By Type: Furnace black dominates the market with a share of 52% in 2025, owing to its cost-effective production process, high yield capabilities, and extensive applications across tire manufacturing and industrial rubber goods. Increasing demand from the automotive sector continues to strengthen its market leadership.

-

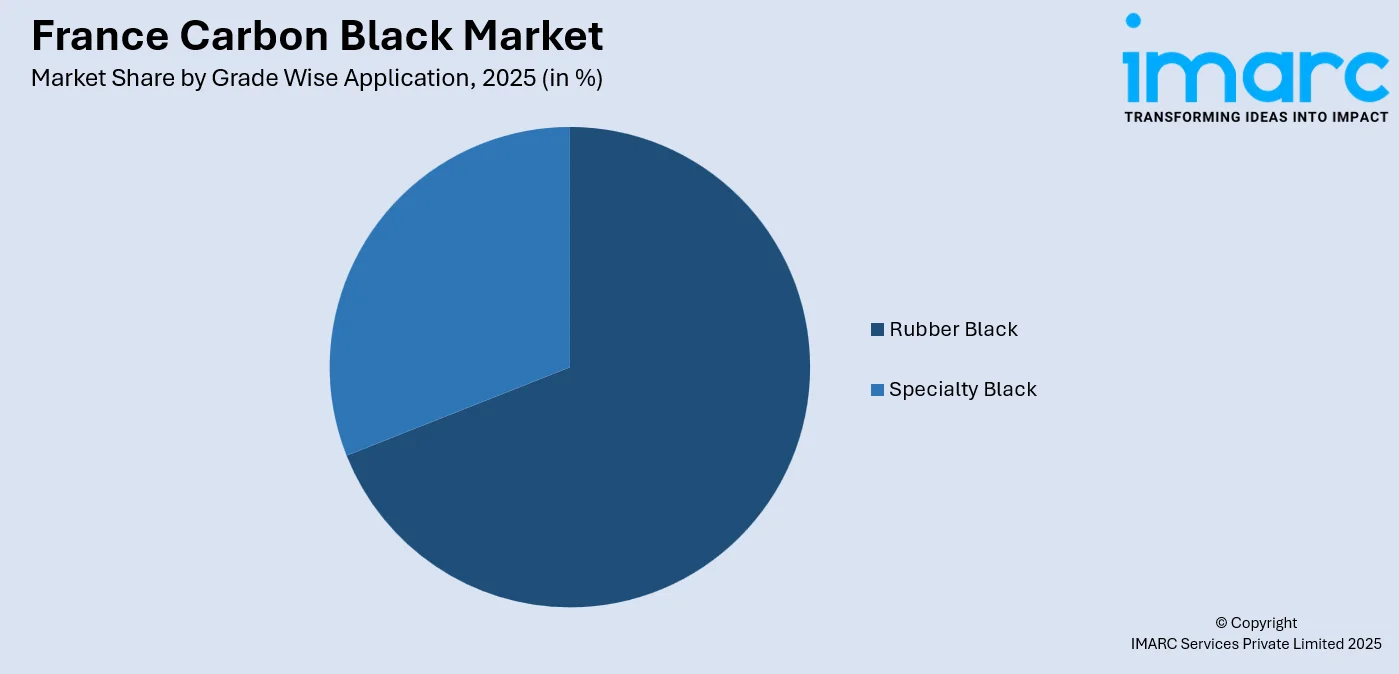

By Grade Wise Application: Rubber black leads the market with a share of 69% in 2025, driven by its critical role in enhancing tire durability, abrasion resistance, and mechanical strength. Growing tire production and expanding automotive manufacturing activities reinforce its dominant position.

-

By Region: Paris Region represents the largest region with 15% share in 2025, supported by the concentration of industrial manufacturing facilities, major automotive component suppliers, and significant rubber and plastics production activities across the metropolitan area.

-

Key Players: Key players drive the France carbon black market by expanding production capacities, investing in sustainable manufacturing technologies, and developing specialized product grades for emerging applications. Their focus on recovered carbon black solutions and partnerships with tire recyclers strengthens market positioning and supports circular economy objectives.

To get more information on this market Request Sample

The France carbon black market is witnessing sustained growth momentum as the country's robust industrial base continues to generate substantial demand for this versatile material. The automotive sector remains the primary consumption driver, with tire manufacturing accounting for a significant portion of overall carbon black utilization. France's position as a major European automotive manufacturing hub creates consistent demand patterns, supported by the presence of global tire manufacturers and automotive component suppliers. The growing emphasis on electric vehicle (EV) adoption is creating new opportunities for specialized carbon black grades in battery applications and lightweight polymer components. In December 2024, 56,901 registrations of EVs were made in France, representing the highest monthly achievement of the year. Additionally, the expanding industrial rubber goods sector, coupled with rising applications in plastics, coatings, and printing inks, is diversifying demand sources and strengthening the overall France carbon black market share.

France Carbon Black Market Trends:

Accelerating Adoption of Recovered Carbon Black

The France carbon black market is experiencing a significant shift towards recovered carbon black derived from end-of-life tires through pyrolysis technology. Major industry players are investing in circular production methods to meet stringent EU environmental regulations and carbon neutrality targets. Michelin, headquartered in Clermont-Ferrand, has been actively incorporating recovered carbon black into its next-generation tires, including a racing tire containing 63% sustainable materials used at the Le Mans 24-hour race in 2023. This transition supports the broader circular economy objectives while maintaining product performance standards.

Rising Demand for Specialty Grades in EV Applications

Increasing demand for specialty carbon black grades in EV applications is driving the market growth in France by supporting advanced battery and lightweight material requirements. Conductive carbon black is increasingly used in lithium-ion batteries to enhance electrical conductivity and energy efficiency. EV manufacturers also rely on specialty grades for high-performance polymers, seals, and insulation components. As EV production expands, demand shifts towards higher-value, customized carbon black solutions. As per IMARC Group, the France electric two-wheeler market size reached USD 1,424.00 Million in 2024. This trend encourages innovations, strengthens supplier partnerships, and boosts market growth through premium product adoption.

Innovations in Low-Emission Production Technologies

Carbon black manufacturers are increasingly adopting energy-efficient production technologies and artificial intelligence (AI)-based process monitoring systems to reduce emissions and optimize operational efficiency. Industry participants are investing in advanced furnace technologies that minimize carbon footprint while maintaining consistent product quality. These innovations align with European sustainability mandates and enable producers to meet growing customer demands for environmentally responsible materials without compromising performance characteristics in tire reinforcement and specialty applications.

Market Outlook 2026-2034:

The France carbon black market outlook remains positive as sustained industrial activity and evolving application requirements continue to drive demand growth across multiple sectors. The automotive industry's ongoing transformation towards electrification is creating substantial opportunities for specialized carbon black formulations in battery materials and lightweight polymer components. The market generated a revenue of USD 597.72 Million in 2025 and is projected to reach a revenue of USD 863.78 Million by 2034, growing at a compound annual growth rate of 4.18% from 2026-2034. The growing emphasis on sustainability and circular economy principles is reshaping production methodologies, with recovered carbon black gaining significant traction among environmentally conscious manufacturers.

France Carbon Black Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Furnace Black | 52% |

| Grade Wise Application | Rubber Black | 69% |

| Region | Paris Region | 15% |

Type Insights:

- Furnace Black

- Acetylene Black

- Channel Black

- Others

Furnace black dominates with a market share of 52% of the total France carbon black market in 2025.

Furnace black maintains its dominant position in the France carbon black market due to its cost-effective production methodology, superior scalability, and versatile performance characteristics across multiple applications. The production process enables precise control over particle size distribution and surface area properties, allowing manufacturers to develop customized grades tailored to specific end use requirements. Growing tire production activities and expanding industrial rubber goods manufacturing continue to reinforce demand for furnace black grades, particularly high-reinforcing variants that enhance mechanical strength and durability in demanding applications.

The segmental growth of furnace black is further supported by its suitability for modern applications, including EV tires and advanced rubber formulations. French manufacturers are increasingly utilizing furnace black in sustainable tire production initiatives, leveraging its compatibility with recovered carbon black blends to meet environmental objectives while maintaining product performance standards. Additionally, continuous process optimization and emission reduction initiatives are improving the sustainability profile of furnace black, further strengthening its long-term market leadership in France.

Grade Wise Application Insights:

Access the comprehensive market breakdown Request Sample

- Rubber Black

- Tire Treads

- Inner Liner and Tubes

- Conveyor Belts

- Hoses

- Others

- Specialty Black

- Plastics

- Ink and Toners

- Paint and Coatings

- Wires and Cables

- Others

Rubber black leads with a share of 69% of the total France carbon black market in 2025.

Rubber black maintains overwhelming dominance in the France carbon black market owing to its critical role in tire manufacturing and mechanical rubber goods production. The material provides essential reinforcement properties that enhance tire durability, abrasion resistance, and rolling performance characteristics. France's well-established automotive manufacturing ecosystem generates consistent demand for rubber black grades utilized in tire treads, sidewalls, and inner components. The presence of major tire manufacturers reinforces the country's position as a significant consumer of rubber-grade carbon black.

The rubber black segment continues to benefit from growing automotive production activities and expanding industrial applications. In the first eleven months of 2025, there were 1,662,399 registrations of new battery-electric vehicles (BEVs), representing 16.9% of the market share in the EU. The four biggest markets in the EU, responsible for 62% of BEV registrations, were Germany (+41.3%), Belgium (+10.2%), the Netherlands (+8.8%), and France (+9.1%). Additionally, the mechanical rubber goods sector, encompassing conveyor belts, hoses, and industrial seals, provides diversified demand sources that contribute to stable rubber black consumption patterns across the France carbon black market.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

The Paris Region exhibits a clear dominance with a 15% share of the total France carbon black market in 2025.

The Paris Region leads the France carbon black market due to its concentration of automotive, tire manufacturing, and advanced materials industries that generate consistent demand for reinforcing and specialty carbon black grades. Proximity to major original equipment manufacturers (OEMs), research institutions, and downstream rubber processors supports integrated supply chains and efficient distribution. The region’s strong logistics infrastructure, including highways, rail networks, and access to export routes, enables timely raw material sourcing and finished product movement, reinforcing its role as a key industrial and commercial hub.

The region’s leadership is further strengthened by its focus on innovations and sustainability-driven manufacturing. Companies located in and around the Paris Region invest in research and development (R&D) activities of high-performance and eco-friendly carbon black grades for EVs, batteries, and specialty plastics. Collaboration between manufacturers, universities, and technology centers accelerates product innovations. Additionally, stringent environmental standards encourage adoption of advanced production technologies, supporting long-term market growth and reinforcing the Paris Region’s dominant position.

Market Dynamics:

Growth Drivers:

Why is the France Carbon Black Market Growing?

Expanding Automotive and Tire Manufacturing Sector

The France carbon black market is primarily driven by the thriving automobile and tire manufacturing industries, which are bolstered by steady vehicle production and robust demand for replacement tires. In France, automakers manufactured 1,026,690 passenger vehicles in 2023. In tire treads, sidewalls, and inner liners, carbon black is an essential reinforcing filler that enhances abrasion resistance, durability, and overall performance. Consistent consumption volumes are maintained by France's developed automotive ecosystem, which includes passenger cars, commercial vehicles, and niche mobility segments. Replacement tire cycles guarantee consistent baseline demand even in times of varying new car sales. Carbon black is frequently utilized in automobile rubber parts, such as hoses, belts, gaskets, seals, and vibration damping systems. The need for high-reinforcing carbon black grades is further increased by growing demands for longevity, safety, and fuel efficiency. The heightened focus on advanced tire formulations, including low rolling resistance, noise reduction, and improved grip, drives innovations and higher-value usage. As automotive manufacturers prioritize performance optimization and regulatory compliance, carbon black remains indispensable, reinforcing its dominant contribution to market growth across France.

Growing Applications in Plastics, Coatings, and Inks

Carbon black is frequently used in plastics to add color, electrical conductivity, and ultraviolet (UV) protection to items like pipes, packaging, vehicle parts, and building supplies. For deep coloring, opacity, weather resistance, and durability, the coating and paint industry depends on carbon black. Carbon black guarantees constant color strength, dispersion quality, and print clarity for packaging and publishing applications, making printing inks a steady market segment. These non-rubber applications are nevertheless supported by the expansion of consumer goods production, infrastructural construction, and industrial packaging. Additionally, there is a growing need for conductive plastics for utilization in industrial equipment, electronics, and antistatic packaging. These applications require specialty carbon black grades with precise structural properties. Expanding use across multiple industries reduces dependency on tire manufacturing alone, creating a more balanced demand profile and strengthening the overall resilience of the France carbon black market.

Technological Advancements and Product Customization

Technological innovations and product customization are central drivers of the market expansion in France. Advancements in furnace black production allow precise control over particle size, structure, and surface area, enabling manufacturers to tailor carbon black grades to specific application requirements. This capability is critical for high-performance tires, battery materials, conductive plastics, and advanced rubber goods. Investments in automation, digital process monitoring, and quality control systems enhance consistency, efficiency, and scalability of production. Collaborations between carbon black producers, automotive manufacturers, and research institutions accelerate the development of application-specific solutions. End users increasingly demand materials that deliver improved durability, conductivity, processability, and sustainability. Customized carbon black formulations help meet these evolving performance expectations. As industries adopt more complex materials and higher technical standards, demand shifts towards premium, value-added carbon black products. Continuous innovations strengthen supplier differentiation, support pricing stability, and reinforce the strategic importance of carbon black across France’s automotive, industrial, and advanced materials sectors.

Market Restraints:

What Challenges the France Carbon Black Market is Facing?

Stringent Environmental Regulations and Compliance Costs

Strict EU environmental rules that impose high compliance costs on industry pose serious difficulties to the France carbon black market. Emissions from carbon black production processes necessitate sophisticated pollution control tools and monitoring systems. Significant investments in cleaner industrial technology are required due to the EU's emission restrictions and carbon border adjustment systems. These regulatory demands raise operating expenses and put obstacles in the way of smaller enterprises trying to stay competitive while adhering to changing environmental regulations.

Raw Material Price Volatility and Supply Chain Disruptions

Carbon black producers and downstream consumers face cost uncertainty due to fluctuations in the price of petroleum-based feedstocks. The market is vulnerable to disruptions in the global supply chain and geopolitical issues that impact the availability of hydrocarbons due to its reliance on imported raw materials. The effects of increased purchasing costs on profit margins have been exacerbated by persistent supply chain interruptions that have raised rubber prices. These erratic input costs affect profitability throughout the value chain and make it difficult for manufacturers to maintain consistent pricing strategies.

Competition from Asian Imports and Market Share Pressure

The France carbon black market faces increasing competition from lower-cost imports, particularly from Asian manufacturers offering competitive pricing. This import pressure has contributed to market share losses for domestic producers and regional tire manufacturers. While EU anti-dumping investigations and tariff measures may provide some relief, the uncertain timing of market recovery creates challenges for capacity planning and investment decisions among established producers.

Competitive Landscape:

The France carbon black market exhibits a moderately consolidated competitive structure, characterized by the presence of established global manufacturers alongside specialized regional suppliers. Market participants compete on product quality, technical expertise, and sustainability credentials while expanding their portfolios to address emerging application requirements. Strategic investments in recovered carbon black technologies and circular production methods are becoming key differentiators, as companies seek to align with environmental objectives and customer sustainability mandates. Leading players are focusing on capacity optimization, product innovations, and strategic partnerships with tire manufacturers and recyclers to strengthen market positioning. The competitive landscape is evolving, as manufacturers balance cost competitiveness with sustainability investments to capture opportunities in both traditional rubber applications and emerging specialty segments.

France Carbon Black Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Furnace Black, Acetylene Black, Channel Black, Others |

| Grade Wise Applications Covered |

|

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The France carbon black market size was valued at USD 597.72 Million in 2025.

The France carbon black market is expected to grow at a compound annual growth rate of 4.18% from 2026-2034 to reach USD 863.78 Million by 2034.

Furnace black dominated the market with a share of 52%, owing to its cost-effective production process, high yield capabilities, and extensive applications across tire manufacturing and industrial rubber goods.

Key factors driving the France carbon black market include expanding automotive and tire manufacturing activities, rising EV adoption driving demand for specialty grades, growing industrial applications in plastics and coatings, and increasing emphasis on sustainable production methods.

Major challenges include stringent environmental regulations and compliance costs, raw material price volatility and supply chain disruptions, competition from Asian imports, and pressure to transition towards sustainable production methods while maintaining cost competitiveness.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)