France Cheese Market Size, Share, Trends and Forecast by Source, Type, Product, Format, Distribution Channel, and Region, 2026-2034

France Cheese Market Summary:

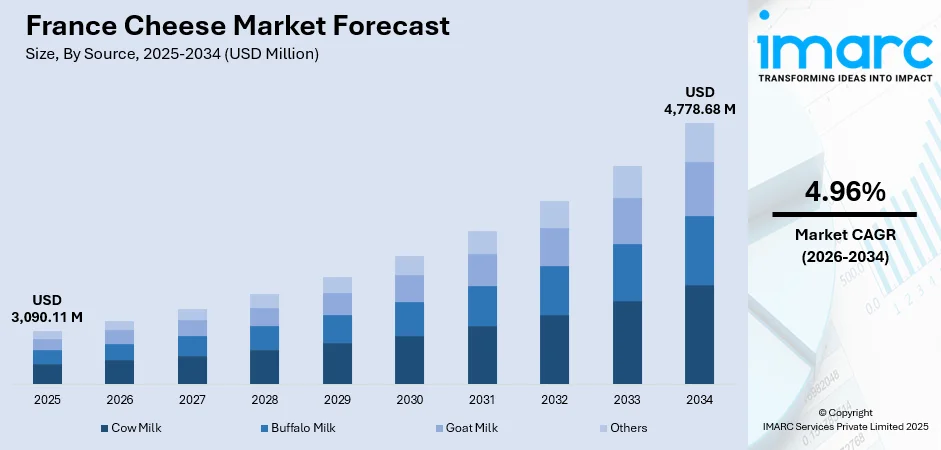

The France cheese market size was valued at USD 3,090.11 Million in 2025 and is projected to reach USD 4,778.68 Million by 2034, growing at a compound annual growth rate of 4.96% from 2026-2034.

The France cheese market is one of the most prestigious and varied in the world, underpinned by centuries of artisanal tradition and culinary excellence. From its many different types of cheese protected designation of origin products to innovative contemporary creations, France remains one of the world's leading countries in terms of both cheese production and consumption. The market continues growing in response to increased demand from consumers for high-end and niche varieties, greater interest in organic and sustainable options, and strong cultural participation in quaffing cheese as part of French cuisine.

Key Takeaways and Insights:

-

By Source: Cow milk dominates the market with a share of 91.45% in 2025, driven by widespread availability, versatile flavor profiles, and established production infrastructure across French dairy regions.

-

By Type: Natural cheese leads the market with a share of 72.95% in 2025, reflecting strong consumer preference for traditional, minimally processed cheese varieties aligned with French gastronomic heritage.

-

By Product: Cheddar dominates the market with a share of 32.44% in 2025, supported by its versatility in culinary applications and growing adoption in quick-service restaurant chains.

-

By Format: Slices lead the market with a share of 31.88% in 2025, driven by convenience-oriented consumption patterns and increasing demand for ready-to-use cheese formats.

-

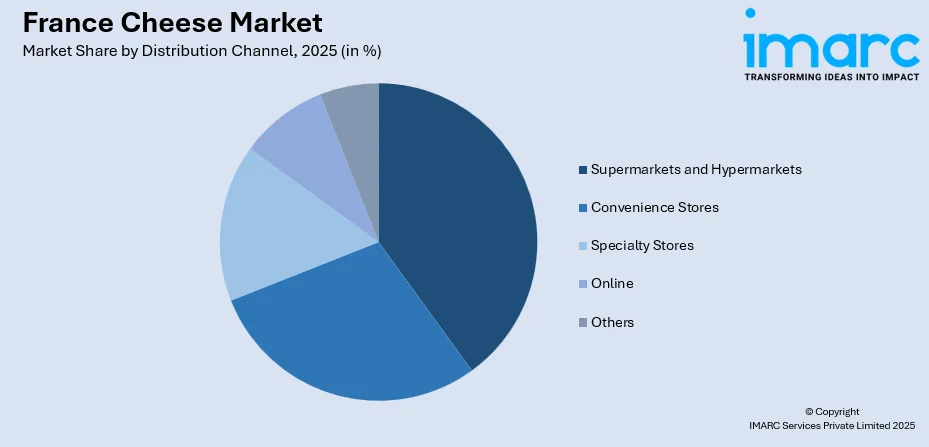

By Distribution Channel: Supermarkets and hypermarkets dominate the market with a share of 35.85% in 2025, benefiting from extensive product assortments, competitive pricing, and nationwide accessibility.

-

By Region: Paris region leads the market with approximately 14% share in 2025, supported by high population density, elevated disposable incomes, and concentrated retail infrastructure.

-

Key Players: The France cheese market exhibits moderate competitive intensity, characterized by established multinational dairy corporations operating alongside regional artisanal producers. Market participants are actively investing in product innovation, sustainability initiatives, and distribution network expansion to strengthen market positioning and capture evolving consumer preferences.

To get more information on this market Request Sample

The France cheese market is renowned for its remarkable diversity and strong cultural significance within French cuisine. The country features a wide spectrum of producers, from large industrial operations to small artisanal farms, offering an extensive range of cheeses defined by regional terroir, production techniques, and aging methods. In 2025, French dairy giant Bel announced a €60 million investment to modernize and expand its Sablé‑sur‑Sarthe facility, home to iconic brands like Babybel, underscoring ongoing efforts to drive innovation and support local employment. The Appellation d'Origine Protégée (AOP) designation safeguards many traditional cheeses, ensuring authenticity and high standards. French consumers consistently favor quality, local sourcing, and genuine craftsmanship, with cheese playing a central role in everyday meals as well as festive and ceremonial occasions.

France Cheese Market Trends:

Rising Demand for Organic and Artisanal Cheese Varieties

French consumers are increasingly favoring organic and artisanal cheeses, emphasizing authenticity, traceability, and sustainable production. In 2025, overall dairy purchases are rebounding, with organic segments showing notable growth, reflecting renewed interest in bio products. Small-scale producers using traditional methods are benefiting from rising demand in specialty stores and farmers’ markets. Health-conscious buyers are driving the expansion of the organic cheese segment, seeking additive-free, environmentally responsible products, further supporting the France cheese market’s growth.

Expansion of Convenient Ready-to-Eat Cheese Formats

Convenience-driven consumption is shaping cheese product development and packaging. Sliced, shredded, and pre-portioned formats are increasingly popular among busy consumers. In 2025, Mini Babybel drives Bel Group growth, with one-third of global sales (20,000 tonnes), US volumes up 12%, prompting €60 million investment in Sablé-sur-Sarthe production expansion. Ready-to-eat (RTE) snacks and single-serve options are growing rapidly, with manufacturers adopting advanced packaging technologies to extend shelf life and maintain freshness, enabling wider distribution across retail and foodservice channels.

Growing Integration of Cheese in Foodservice Applications

The growing foodservice sector is boosting demand for versatile cheeses suitable for diverse culinary uses. Quick-service restaurants, cafes, and gourmet outlets are adding premium cheeses to enhance menus. In 2025, Lactalis announced a €1 billion ($1.18 billion) investment to modernize French facilities and expand production, supporting new formats and foodservice supply. Hot eating, melting, and specialty cheeses for pizza, sandwiches, and salads are key growth areas, reflecting consumers’ focus on quality ingredients and authentic flavors in dining experiences.

Market Outlook 2026-2034:

The France cheese market outlook remains positive, supported by sustained domestic consumption, expanding export opportunities, and ongoing product innovation. Industry participants are expected to prioritize sustainability initiatives, technological modernization, and premium product development to address evolving consumer expectations. Rising health consciousness will drive demand for functional cheese varieties featuring enhanced nutritional profiles, while continued urbanization supports convenience-oriented product formats. The market generated a revenue of USD 3,090.11 Million in 2025 and is projected to reach a revenue of USD 4,778.68 Million by 2034, growing at a compound annual growth rate of 4.96% from 2026-2034.

France Cheese Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Source |

Cow Milk |

91.45% |

|

Type |

Natural |

72.95% |

|

Product |

Cheddar |

32.44% |

|

Format |

Slices |

31.88% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

35.85% |

|

Region |

Paris Region |

14% |

Source Insights:

- Cow Milk

- Buffalo Milk

- Goat Milk

- Others

The cow milk dominates with a market share of 91.45% of the total France cheese market in 2025.

Cow milk forms the backbone of France’s dairy industry, supported by extensive pastoral farming and strong supply chains. Consumers favor its familiar flavors and consistent quality. Producers use advanced pasteurization and aging techniques to offer soft, creamy, and hard varieties. In 2025, Savencia Fromage & Dairy saw revenue growth from favorable milk prices, underscoring cow milk cheese’s commercial strength. Widespread availability ensures a stable supply for industrial and artisanal producers.

Growing consumer interest in nutritional benefits associated with cow milk cheese, including protein content and calcium availability, continues supporting segment growth. Manufacturers are investing in quality enhancement initiatives and sustainable farming partnerships to strengthen supply chain resilience. The segment benefits from strong brand recognition among traditional French cheese varieties such as Brie and Camembert, which utilize cow milk as their primary ingredient, reinforcing consumer loyalty and repeat purchase behavior.

Type Insights:

- Natural

- Processed

The natural leads with a share of 72.95% of the total France cheese market in 2025.

Natural varieties hold a strong market position, reflecting French preferences for traditional, minimally processed products. Consumers increasingly value authenticity and heritage, driving demand for cheeses made with time-honored techniques and natural ingredients. At the 2025 Cheese Awards, several artisanal producers were recognized for preserving traditional methods. The segment spans soft‑ripened, semi-hard, and hard cheeses, with protected designations ensuring quality, authenticity, and distinct culinary appeal.

Health-conscious consumers are increasingly opting for natural cheeses, perceived as lower in additives and preservatives. Demand is rising for artisanal varieties, especially among premium segments seeking unique flavors. The natural cheese market is closely linked to French culinary traditions, where cheese courses remain a staple of dining. This cultural integration reinforces consumer preference for authentic, high-quality products, supporting steady growth and expanding the appeal of natural cheeses across diverse French consumer groups.

Product Insights:

- Mozzarella

- Cheddar

- Feta

- Parmesan

- Roquefort

- Others

The cheddar dominates with a market share of 32.44% of the total France cheese market in

Cheddar has been able to make its mark within the French market due to its versatility, being adapted for various cooking processes, and its increasing usage within quick-service restaurants. Cheddar cheese has a dense consistency, and its strong flavor makes it suitable for consumption in the form of sandwiches, burgers, salads, and cooking. Cheddar cheese is experiencing the effects of the globalization of food habits, as the influence of international food trends has increased its usage within the French market.

There is an expansion of cheddar offerings by manufacturers, including aged, smoked, and flavored varieties, to appeal to different consumer preferences. This market is already established and popular in both retail and foodservice sectors, and products like sliced and shredded cheddars are in high demand. Rise in snacking and shift towards convenient eating patterns is driving the overall consumption of cheddar in different consuming sectors of French consumers.

Format Insights:

- Slices

- Diced/Cubes

- Shredded

- Blocks

- Spreads

- Liquid

- Others

The slices lead with a share of 31.88% of the total France cheese market in 2025.

Sliced formats are seeing strong market growth, fueled by convenience-driven consumption and demand for ready-to-use products. Perfect for sandwiches, burgers, and quick meals, they cater to modern lifestyles prioritizing time efficiency. In 2025, French brand Fol Épi introduced a high-protein, reduced-fat sliced cheese range with 29 g of protein per 100 g, targeting health-conscious, on-the-go consumers. Producers are also adopting advanced slicing technologies and resealable packaging to enhance freshness and convenience.

Retail distribution networks have expanded sliced cheese offerings across diverse price points and cheese varieties, improving accessibility for broader consumer segments. The format benefits from strong adoption in both household and foodservice applications, supporting consistent demand growth. Enhanced packaging solutions featuring portion control and extended shelf life are driving premiumization within the sliced cheese category.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

The supermarkets and hypermarkets dominate with a market share of 35.85% of the total France cheese market in 2025.

Supermarkets and hypermarkets are major players in the cheese distribution business and have a prominent share due to the extensive ranges of cheeses, including both mass-market and premium ranges. Retailing is about exploiting consumer shopping habits, and these channels take advantage of these habits along with pricing and accessibility. Point-of-purchase cheese displays and specialists improve consumer shopping by adding expertise and recommendations, thus fueling consumer confidence and subsequent purchases, which raise awareness of a variety of cheeses.

Contemporary retail brands are betting on local and artisanal cheeses to differentiate themselves. This is because partnerships between retail brands and local manufacturers enable the development of unique offerings which are not available in competing brands. The distribution channel uses promotions, loyalty cards, and private labels to offer enhanced customer engagement and loyalty to differentiate themselves in the market. This attracts customers who are searching for unique cheese experiences.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

Paris region exhibits a clear dominance with a 14% share of the total France cheese market in 2025.

Paris region is the largest cheese consumption market in France, supported by high population density, elevated disposable incomes, and advanced retail infrastructure. Its cosmopolitan consumers favor both premium and imported cheeses, alongside traditional French varieties. A robust foodservice sector, including restaurants, hotels, and catering, drives significant commercial demand, making the region a key hub for cheese consumption and a strategic focus for producers and retailers targeting diverse consumer preferences.

Specialty cheese retailers and gourmet food establishments are prominent across the Paris Region, catering to consumers seeking artisanal and rare cheese varieties. The region’s thriving tourism sector further boosts demand, as visitors pursue authentic French culinary experiences. Efficient logistics networks support the timely distribution of fresh and perishable cheeses throughout the metropolitan area, enabling retailers to maintain product quality, meet consumer demand, and reinforce the reputation of Paris as a key hub for premium and specialty cheese offerings.

Market Dynamics:

Growth Drivers:

Why is the France Cheese Market Growing?

Deep Cultural Significance and Culinary Heritage

The France cheese market is deeply rooted in cultural traditions, where cheese is central to daily meals, festive occasions, and culinary heritage. French consumers’ strong emotional connections reflect regional identities, family customs, and national pride. In 2025, the 38th International Cheese and Wine Fair in Antony drew producers and food lovers nationwide to celebrate regional cheeses and promote cultural appreciation (Sortiraparis). This enduring cultural significance underpins stable demand and premiumization, with traditional cheese courses, entertaining, and diverse culinary uses maintaining consistent consumption across all age groups and regions.

Growing Interest in Premium and Artisanal Products

The France cheese market is experiencing strong growth driven by rising consumer demand for premium, artisanal, and specialty cheeses. French buyers are increasingly willing to pay for exceptional quality, unique flavors, and authentic production methods. Small-scale producers employing traditional techniques, raw milk, and extended aging attract discerning consumers seeking genuine and high-value products. Specialty retailers and farmers’ markets enhance accessibility and engagement, allowing a wider audience to experience artisanal offerings. This trend highlights the growing preference for culturally rooted, premium cheese varieties, supporting overall market expansion and diversification.

Expansion of Distribution Channels and Consumption Occasions

Market growth is supported by expanding distribution channels and diversified consumption occasions, boosting cheese accessibility and usage. Online grocery platforms and specialty e‑commerce provide convenient access to regional and artisanal varieties, with French e‑commerce sales projected to exceed €200 billion by 2026, enhancing exposure for niche producers. Simultaneously, foodservice expansion, including restaurants, cafeterias, and catering, drives out-of-home consumption and product trials. Cheese is increasingly featured in snacking occasions, particularly among younger consumers, complementing traditional meals and creating additional demand opportunities.

Market Restraints:

What Challenges the France Cheese Market is Facing?

Competition from Plant-Based Alternatives and Dietary Shifts

The France cheese market faces emerging competition from plant-based cheese alternatives gaining traction among health-conscious, environmentally motivated, and flexitarian consumers. While traditional cheese maintains dominant positioning, dairy-free options are capturing incremental market share particularly among younger demographics reducing animal product consumption. Broader dietary shifts including reduced dairy intake recommendations for certain health conditions and growing awareness of dairy industry environmental impacts influence consumption decisions among specific consumer segments.

Price Sensitivity and Economic Pressures

Economic pressures including inflation affecting food budgets and household purchasing power create challenges for premium cheese segments as consumers prioritize essential purchases. Price sensitivity drives some consumers toward lower-cost alternatives including private label products and imports competing on value positioning. Artisanal producers face margin pressures from rising input costs including milk prices, energy expenses, and labor costs that are challenging to fully pass through to price-sensitive consumers.

Import Competition and Market Fragmentation

French cheese producers face increasing competition from imported cheeses offering comparable quality at competitive prices, particularly from other European Union member states benefiting from free trade access. Italian, Dutch, and German cheeses compete effectively in specific product categories, capturing market share from French domestic producers. Market fragmentation across numerous small producers limits economies of scale and marketing investment capacity, creating competitive disadvantages relative to consolidated international dairy groups.

Competitive Landscape:

The France cheese market demonstrates moderate competitive intensity, characterized by multinational dairy corporations competing alongside regional producers and artisanal cheese makers. Leading market participants are focusing on product portfolio diversification, premium segment expansion, and operational efficiency improvements to strengthen competitive positioning. Strategic acquisitions and partnerships enable companies to access new distribution channels, production capabilities, and consumer segments. Innovation in product development, packaging technologies, and sustainability practices represents key competitive differentiators. Manufacturers are investing in brand building initiatives and consumer engagement strategies to enhance market share and customer loyalty across traditional and emerging retail channels.

Recent Developments:

-

In July 2025, Soignon has launched its Triple Cream Goat Brie for the U.S. market, blending traditional French craftsmanship with a rich, indulgent profile. The cheese promises a velvety texture and delicate tang, aiming to appeal to premium consumers. It will be available in leading U.S. retailers from September 2025.

France Cheese Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Cow Milk, Buffalo Milk, Goat Milk, Others |

| Types Covered | Natural, Processed |

| Products Covered | Mozzarella, Cheddar, Feta, Parmesan, Roquefort, Others |

| Formats Covered | Slices, Diced/Cubes, Shredded, Blocks, Spreads, Liquid, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online, Others |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The France cheese market size was valued at USD 3,090.11 Million in 2025.

The France cheese market is expected to grow at a compound annual growth rate of 4.96% from 2026-2034 to reach USD 4,778.68 Million by 2034.

Cow milk held the largest France cheese market, dominating France's cheese production due to widespread availability, versatile flavor profiles, established dairy infrastructure, and strong consumer preference for traditional cow milk cheese varieties.

Key factors driving the France cheese market include strong cultural heritage, rising demand for premium and organic products, expanding foodservice applications, convenience-oriented product innovation, and sustained domestic consumption patterns.

Major challenges include rising production costs, supply chain pressures, competition from plant-based alternatives, stringent regulatory compliance requirements, and maintaining competitiveness while preserving traditional artisanal production methods.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)