France Commercial Insurance Market Size, Share, Trends and Forecast by Type, Enterprise Size, Distribution Channel, Industry Vertical, and Region, 2025-2033

France Commercial Insurance Market Overview:

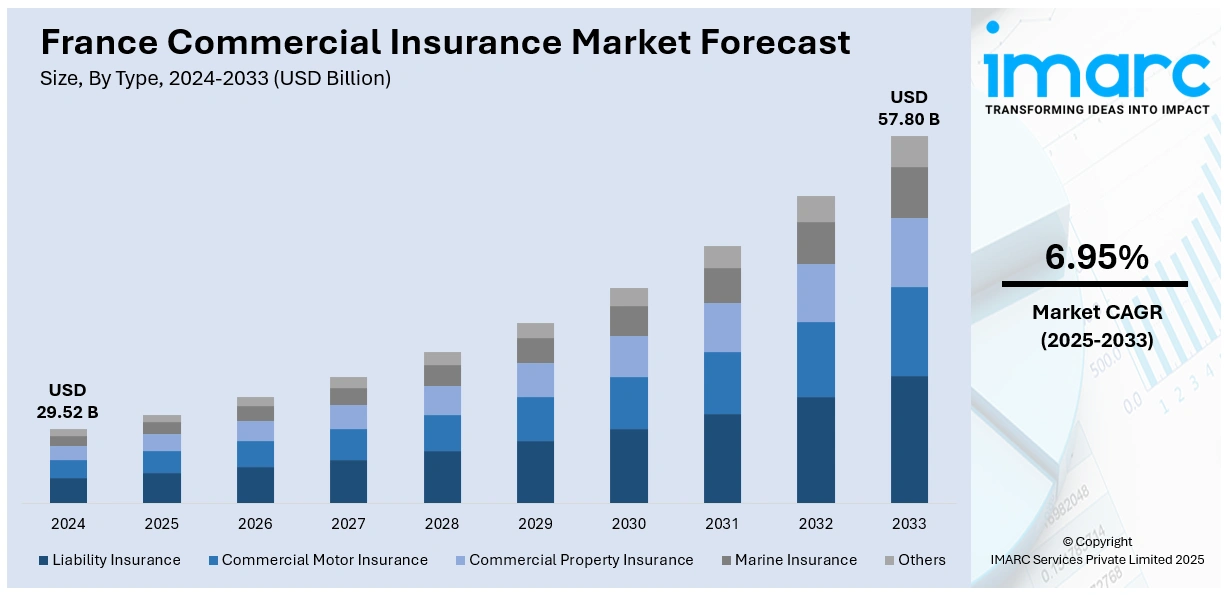

The France commercial insurance market size reached USD 29.52 Billion in 2024. The market is projected to reach USD 57.80 Billion by 2033, exhibiting a growth rate (CAGR) of 6.95% during 2025-2033. The market is expanding with rising demand for tailored coverage against cyber risks and climate-related losses. In addition, regulatory reforms and adoption of digital platforms continue to support France commercial insurance market share across diverse business sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 29.52 Billion |

| Market Forecast in 2033 | USD 57.80 Billion |

| Market Growth Rate 2025-2033 | 6.95% |

France Commercial Insurance Market Trends:

Rising Demand for Tailored Coverage

The France commercial insurance market growth is gaining momentum as companies across industries seek solutions that reflect the changing risk environment. Traditional coverage models that once focused mainly on property damage and liability are no longer sufficient for firms dealing with digital exposure, cross-border trade, and environmental volatility. In recent years, cyber insurance has become a major driver, as data breaches, ransomware attacks, and system outages affect businesses of every size. Alongside this, supply chain breakdowns triggered by global events have highlighted the importance of protection that extends beyond domestic operations. This shift has encouraged insurers to design policies that bundle multiple risk categories, giving clients flexibility while reducing administrative costs. Another important factor has been the use of advanced analytics and digital platforms to improve underwriting, pricing, and claims handling. Insurers are deploying predictive tools that assess sector-specific vulnerabilities, which helps them craft policies tailored to industries like manufacturing, logistics, or financial services. These developments have created a more competitive landscape where providers differentiate themselves through innovation and customer-centric services. Over the last few years, this trend has fueled deeper penetration of insurance products among small and medium enterprises, strengthening the overall market outlook.

To get more information on this market, Request Sample

Growing Influence of Regulatory Changes

The regulatory environment is playing an increasingly important role in shaping the direction of the France commercial insurance market. Authorities have introduced stricter compliance standards to ensure stability, transparency, and protection for policyholders. One major development has been the requirement for insurers to maintain stronger capital reserves, which has improved the industry’s resilience against financial shocks. Alongside this, there is growing emphasis on sustainable finance, pushing insurance companies to integrate environmental and social governance criteria into their offerings. Climate-related risk modeling is now becoming part of portfolio strategies, particularly as extreme weather events create higher claims exposure. These adjustments are not only aligning the market with European Union directives but also building confidence among corporate clients who expect insurers to meet global standards. The regulatory focus on digitalization is also driving changes, with guidance encouraging the adoption of secure online platforms for claims processing and customer communication. Industry players are responding by investing in technology that meets compliance benchmarks while improving efficiency. In the past two years, collaborative initiatives between regulators and insurance associations have further supported transparency and trust. Collectively, these regulatory drivers are fostering innovation, risk discipline, and long-term market growth in France.

France Commercial Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type, enterprise size, distribution channel, and industry vertical.

Type Insights:

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes liability insurance, commercial motor insurance, commercial property insurance, marine insurance, and others.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

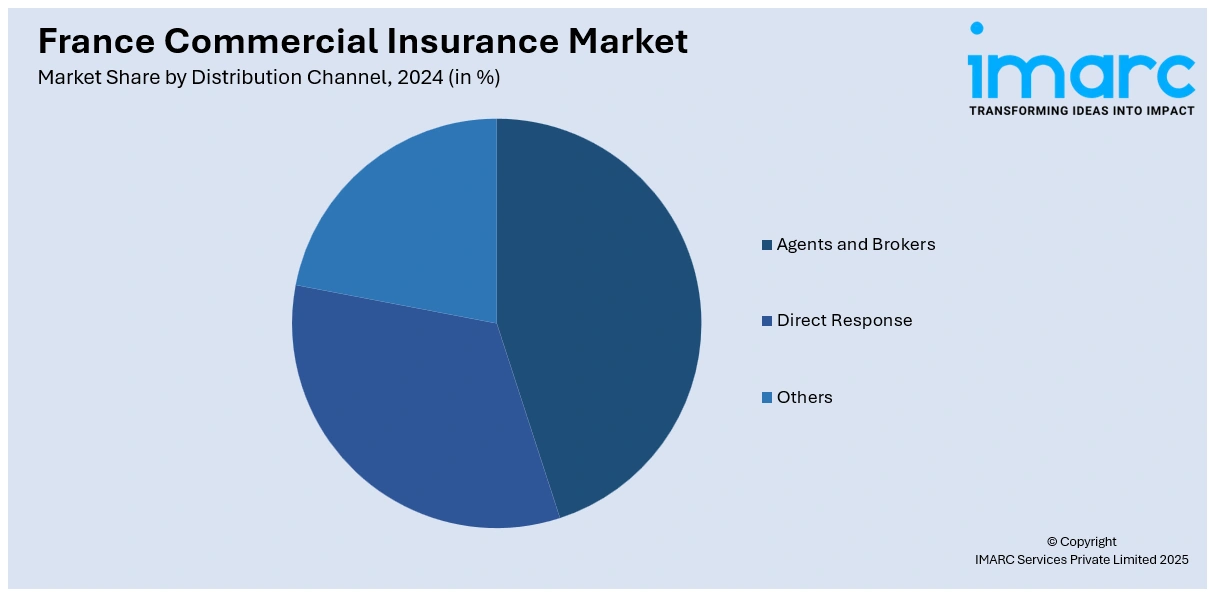

Distribution Channel Insights:

- Agents and Brokers

- Direct Response

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes agents and brokers, direct response, and others.

Industry Vertical Insights:

- Transportation and Logistics

- Manufacturing

- Construction

- IT and Telecom

- Healthcare

- Energy and Utilities

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes transportation and logistics, manufacturing, construction, it and telecom, healthcare, energy and utilities, and others.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

France Commercial Insurance Market News:

- July 2025: Descartes Insurance expanded its portfolio in France by launching Credit and Political Risk Insurance, appointing experienced leaders to manage the class. This development strengthened France’s commercial insurance market by diversifying coverage, supporting corporate clients, and enhancing resilience against global investment and counterparty risks.

- June 2025: French startup Orus raised €25 Million in Series B funding to expand internationally and launched a digital broker platform for SMB insurance. This development strengthened France’s commercial insurance market by modernizing distribution, enhancing accessibility, and offering tailored, technology-driven solutions for small businesses.

France Commercial Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liability Insurance, Commercial Motor Insurance, Commercial Property Insurance, Marine Insurance, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-Sized Enterprises |

| Distribution Channels Covered | Agents and Brokers, Direct Response, Others |

| Industry Verticals Covered | Transportation and Logistics, Manufacturing, Construction, IT and Telecom, Healthcare, Energy and Utilities, Others |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the France commercial insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the France commercial insurance market on the basis of type?

- What is the breakup of the France commercial insurance market on the basis of enterprise size?

- What is the breakup of the France commercial insurance market on the basis of distribution channel?

- What is the breakup of the France commercial insurance market on the basis of industry vertical?

- What is the breakup of the France commercial insurance market on the basis of region?

- What are the various stages in the value chain of the France commercial insurance market?

- What are the key driving factors and challenges in the France commercial insurance market?

- What is the structure of the France commercial insurance market and who are the key players?

- What is the degree of competition in the France commercial insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the France commercial insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the France commercial insurance market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the France commercial insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)