France Community Cloud Market Size, Share, Trends and Forecast by Component, Application, Industry Vertical, and Region, 2026-2034

France Community Cloud Market Summary:

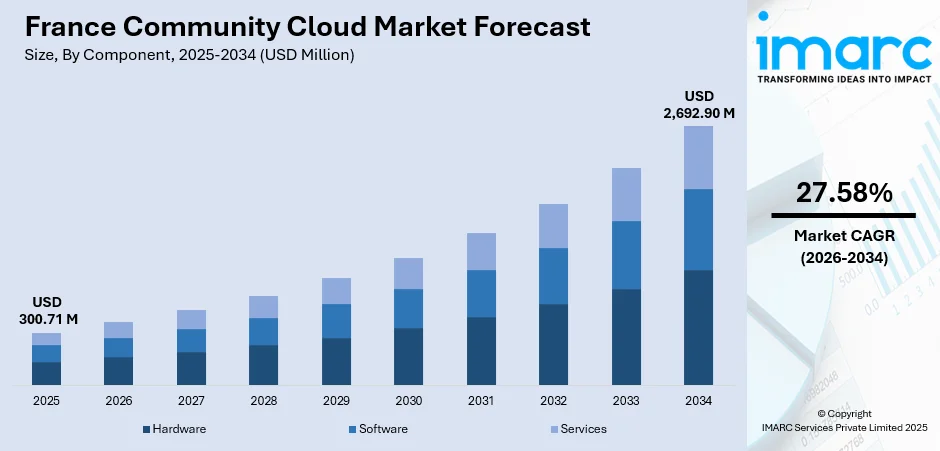

The France community cloud market size was valued at USD 300.71 Million in 2025 and is projected to reach USD 2,692.90 Million by 2034, growing at a compound annual growth rate of 27.58% from 2026-2034.

The market is experiencing significant growth driven by stringent data sovereignty requirements under GDPR, government-backed digital transformation initiatives, and accelerated adoption of artificial intelligence (AI)-driven cloud solutions across banking, financial services, and insurance sectors. French organizations are increasingly shifting from centralized data centers to community cloud models that ensure secure data localization, regulatory compliance, and collaborative infrastructure sharing among entities with common security and operational requirements, thereby expanding to France community cloud market share.

Key Takeaways and Insights:

- By Component: Software dominates the market with a share of 55.04% in 2025, driven by demand for SaaS solutions that enable flexible business process automation and workforce collaboration.

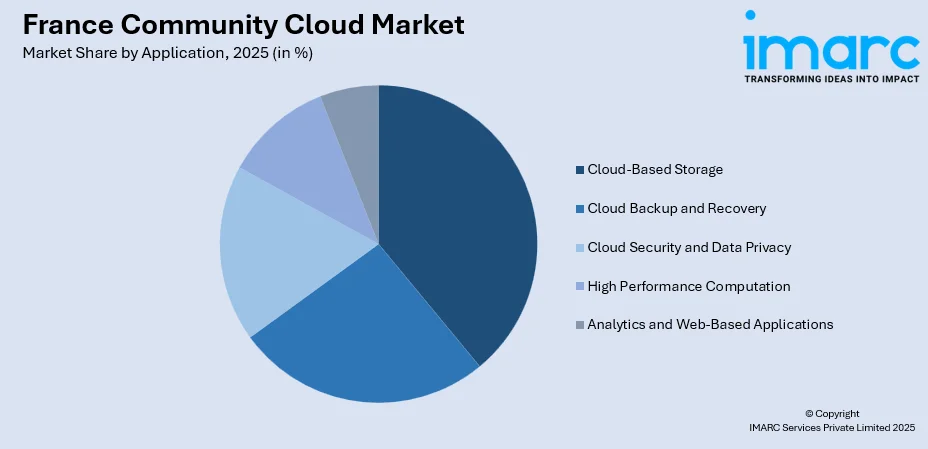

- By Application: Cloud-based storage leads the market with a share of 25.02% in 2025, fueled by increasing need for scalable data management and GDPR-compliant secure storage platforms.

- By Industry Vertical: BFSI represents the largest segment with a market share of 26.05% in 2025, as financial institutions rapidly digitalize payment systems and comply with PSD2 and DORA regulatory frameworks.

- By Region: Paris region leads the market with a share of 18% in 2025, due to its concentration of corporate headquarters, financial institutions, and hyperscale data center infrastructure.

- Key Players: Key market players in the market are enhancing their offerings by focusing on data sovereignty, improving compliance measures, expanding partnerships, and delivering secure, tailored cloud solutions to meet the growing demand for localized services and regulatory adherence.

To get more information on this market Request Sample

The France community cloud market is undergoing rapid transformation as organizations prioritize digital sovereignty and compliance with European data protection regulations. In 2025, Brookfield announced a Euro 20 billion investment in AI infrastructure across France, significantly expanding data center capacity and positioning the country as a leading European digital infrastructure hub. Government initiatives are accelerating adoption among public sector entities and regulated industries. French enterprises are leveraging community cloud platforms to share infrastructure costs while maintaining control over sensitive data, with particular momentum in BFSI sectors implementing real-time payment systems, healthcare organizations managing electronic health records, and government agencies digitalizing citizen services. The convergence of AI capabilities with sovereign cloud infrastructure, exemplified by Huawei's November 2024 launch of AI-native cloud solutions in Paris, is enabling French businesses to deploy advanced analytics and machine learning applications while ensuring data remains within national jurisdictions compliant with GDPR and local privacy mandates.

France Community Cloud Market Trends:

Decentralized Cloud Computing and Data Sovereignty

The shift towards decentralized cloud computing addresses rising concerns over data sovereignty, privacy, and security, particularly in industries such as healthcare, finance, and public services where sensitive data protection is critical. This trend is driven by France's emphasis on digital sovereignty, ensuring that data storage and processing remain within national borders to comply with European regulations. French organizations are moving beyond conventional centralized data centers due to increased stakes regarding data control and regulatory compliance requirements. The CUPSELI challenge initiative enables French citizens to offer computing capacity securely, demonstrating the broader movement toward autonomous and secure digital infrastructure. The CUPSELI challenge, part of the AI Action Summit, seeks to showcase the practicality of a large-scale distributed computing model that can rival current centralized solutions. It opens doors for innovative uses in crucial fields like healthcare, finance, and public infrastructure, where data sovereignty and security are vital. Through this new challenge, Inria and Hivenet are reiterating their dedication to responsible and sustainable digital technology while significantly supporting the technological autonomy of France and Europe.

AI Integration into Cloud Solutions

AI integration is transforming France's community cloud market by enabling businesses to scale AI and machine learning technologies effectively across diverse industry applications. In 2024, Huawei unveiled its AI-native cloud strategy at the Huawei Cloud Summit in Paris, offering a two-pronged approach of AI for Cloud and Cloud for AI that provides tailored solutions for industries seeking to leverage AI for innovation and productivity gains. This initiative positions France as a frontrunner in AI-led cloud technology within Europe, facilitating seamless AI integration for both small and large French companies while supporting the country's overall digital transformation objectives and enabling rapid deployment of intelligent applications.

Government-Backed Sovereign Cloud Initiatives

France is actively promoting sovereign cloud infrastructure through government programs aimed at strengthening digital independence while protecting sensitive organizational data from foreign jurisdiction access. In April 2025, Clara Chappaz, Minister Delegate for Digital Affairs and Artificial Intelligence, relaunched the sovereign cloud project as part of France 2030, allocating EUR 3 billion through initiatives such as the PEPR Cloud research program. The SecNumCloud certification ensures robust IT security and regulatory compliance, sets interoperability, portability, and functional equivalence obligations for cloud computing service providers, reinforcing France's commitment to technological independence from foreign providers.

Market Outlook 2026-2034:

The France community cloud market is poised for exceptional growth as digital transformation initiatives accelerate across public and private sectors, with market revenue projected to increase. Government investments totaling billions of euros in sovereign cloud infrastructure, combined with mandatory compliance requirements, will drive robust adoption among regulated industries. The market generated a revenue of USD 300.71 Million in 2025 and is projected to reach a revenue of USD 2,692.90 Million by 2034, growing at a compound annual growth rate of 27.58% from 2026-2034. The convergence of AI capabilities with cloud platforms, evidenced by major investments, positions the market for sustained expansion as organizations seek locally-hosted, compliant cloud solutions that support advanced analytics while maintaining data sovereignty.

France Community Cloud Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Component |

Software |

55.04% |

|

Application |

Cloud-Based Storage |

25.02% |

|

Industry Vertical |

BFSI |

26.05% |

|

Region |

Paris Region |

18.00% |

Component Insights:

- Hardware

- Server

- Networking

- Storage

- Others

- Software

- Enterprise Application Software

- Collaboration Tools Software

- Dashboards Business Intelligence Software

- Services

- Training Services

- Maintenance and Support

- Regulation and Compliance

- Consulting

Software dominates with a market share of 55.04% of the total France community cloud market in 2025.

The software component dominates the France community cloud market as organizations transition from capital-intensive on-premises software licenses to flexible, subscription-based SaaS models that reduce upfront costs, eliminate infrastructure management burdens, and enable rapid scaling aligned with business growth trajectories. French enterprises across BFSI, healthcare, government, and manufacturing sectors are adopting cloud-native applications for customer relationship management, enterprise resource planning, human capital management, and industry-specific workflows that integrate seamlessly with AI and analytics capabilities.

Software solutions address critical enterprise requirements including real-time collaboration among distributed teams, mobile accessibility for remote workforce productivity, and integration capabilities connecting cloud applications with legacy on-premises systems through API-based architectures. The proliferation of industry-specific SaaS applications tailored to healthcare electronic health records management compliant with French health data regulations, financial services platforms automating regulatory reporting for ACPR and AMF requirements, and manufacturing execution systems optimizing Industry 4.0 production environments reinforces the segment's market leadership.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Cloud-Based Storage

- Cloud Backup and Recovery

- Cloud Security and Data Privacy

- High Performance Computation

- Analytics and Web-Based Applications

Cloud-based storage leads with a share of 25.02% of the total France community cloud market in 2025.

Cloud-based storage leads the application segment as French organizations confront exponential data growth driven by digital transformation initiatives, IoT sensor deployments generating continuous data streams, video surveillance systems producing massive file volumes, and regulatory requirements mandating multi-year retention of business records, customer communications, and transaction logs. Enterprises migrating from costly on-premises storage infrastructure to cloud-based solutions achieve significant capital expenditure reductions by eliminating hardware procurement cycles, data center space requirements, and ongoing maintenance costs while gaining automatic scaling capabilities that adjust storage capacity dynamically based on actual usage patterns.

Industries including healthcare managing patient imaging files and electronic health records, financial services handling years of transaction histories and regulatory filings, manufacturing archiving IoT sensor data for predictive maintenance analytics, and media companies storing high-resolution video assets are driving adoption of cloud storage platforms offering comprehensive security features. These platforms provide encryption at rest using AES-256 standards, encryption in transit through TLS protocols, granular access controls implementing principle of least privilege, immutable storage options preventing ransomware attacks from deleting backup copies, automated lifecycle management policies transitioning infrequently-accessed data to lower-cost storage tiers, and comprehensive audit trails documenting all access events for GDPR compliance reporting.

Industry Vertical Insights:

- BFSI

- Gaming

- Government

- Healthcare

- Education

- Others

BFSI exhibits a clear dominance with a 26.05% share of the total France community cloud market in 2025.

The BFSI sector represents the largest industry vertical driving France's community cloud market growth through accelerated digital transformation initiatives responding to competitive pressures from fintech disruptors, evolving customer expectations for seamless digital banking experiences, and stringent regulatory mandates. French financial institutions including major banks are migrating core banking systems, payment processing platforms, risk management applications, and customer-facing mobile banking solutions to community cloud infrastructure that delivers the security certifications, compliance frameworks, and performance characteristics essential for financial operations handling millions of daily transactions.

Community cloud platforms enable BFSI organizations to share infrastructure costs while maintaining security isolation through private network segments, dedicated compute resources for sensitive workloads, and customer-controlled encryption keys ensuring cryptographic protection throughout data lifecycle stages. Insurance companies leverage cloud analytics platforms processing vast datasets from connected vehicle telematics, smart home sensors, and wearable health devices to optimize underwriting accuracy, detect fraudulent claims, and personalize policy offerings, while wealth management firms deploy cloud-based portfolio management systems delivering real-time market data and advanced risk modeling capabilities to investment advisors serving high-net-worth clients.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

Paris region leads with a share of 18% of the total France community cloud market in 2025.

The Paris region dominates France's community cloud market as the nation's economic and political capital hosting corporate headquarters of major French enterprises of multinational technology companies, and the highest concentration of BFSI institutions requiring secure, low-latency cloud connectivity for trading systems, payment processing, and customer-facing digital banking platforms. The region benefits from extensive fiber optic networks delivering multi-terabit connectivity, submarine cable landing stations at Marseille providing international connectivity to Middle East and Asian markets, and proximity to France-IX internet exchange points enabling high-performance cloud services with minimal network latency for latency-sensitive applications including financial trading, real-time analytics, and interactive customer experiences.

Government ministries and agencies concentrated in Paris including the Ministry of Economy and Finance, Ministry of Interior, and regulatory bodies drive substantial demand for SecNumCloud-certified sovereign cloud platforms meeting stringent security requirements for handling classified information, citizen personal data, and sensitive government operations. The capital's vibrant technology ecosystem encompasses.

Market Dynamics:

Growth Drivers:

Why is the France Community Cloud Market Growing?

Stringent GDPR and Data Sovereignty Requirements

The General Data Protection Regulation and evolving data sovereignty mandates are compelling French organizations to adopt community cloud solutions that guarantee local data residency and compliance with European privacy standards while preventing unauthorized cross-border data transfers. These regulatory pressures create strong demand for community cloud platforms operated by European providers or certified through SecNumCloud standards that ensure data remains within French territorial jurisdiction and subject to French legal protections. In 2024, CNIL published its priority investigation topics for. The topics include data about minors, files associated with the Olympic and Paralympic Games, electronic sales receipts and loyalty schemes, and the right of access. In light of the Olympic and Paralympic Games, the CNIL also said that it would examine the data collection that occurred through ticketing and security systems, which included the use of QR codes and augmented cameras. Since the matter involves many individuals and data exchange with event sponsors, the CNIL seeks to ensure that data collection is in accordance with the law.

Government Digital Transformation Programs and Infrastructure Investment

The French government is accelerating cloud adoption through substantial investments and supportive policies aimed at strengthening the nation's digital economy, reducing dependence on foreign technology providers, and positioning France as a European leader in sovereign digital infrastructure. In 2025, Cisco announced its plans to open a new Global AI Hub in Paris which aims to create secure, energy-efficient infrastructure, educate 230,000 in AI skills, and enhance France’s AI startup ecosystem, providing assistance to local startup and Cisco partner Mistral AI. The upcoming center will emphasize building secure and energy-efficient infrastructure suitable for AI. It will also feature a worldwide hub of proficiency for advanced cooling technologies in data centers.

BFSI Sector Digital Modernization and Cloud Migration

The Banking, Financial Services, and Insurance sector is driving substantial community cloud adoption as financial institutions modernize legacy mainframe systems to meet PSD2 open banking requirements, implement DORA operational resilience mandates, and enable real-time payment processing capabilities demanded by increasingly digital-savvy customers expecting seamless omnichannel banking experiences. The sector's stringent compliance needs for audit trails, encrypted data storage, sovereign-cloud zones preventing foreign government access, and managed encryption services with customer-held keys accelerate demand for specialized community cloud platforms that shared infrastructure costs among financial institutions while maintaining the security isolation and regulatory compliance frameworks required for banking operations. The French financial organization Paris Europlace united important stakeholders in France's financial ecosystem to uphold Paris' attractiveness in the digital finance sector. On 7 November 2024, Caisse des Dépôts et Consignations (CDC) successfully issued the first Digitally Native Note in bearer form under French law, with support from Euroclear and settled via the Banque de France’s DL3S digital currency platform.

Market Restraints:

What Challenges the France Community Cloud Market is Facing?

Legacy System Integration Complexities

Migrating from traditional on-premises infrastructure to community cloud platforms presents significant technical challenges as French organizations must integrate cloud services with existing legacy systems including decades-old mainframe applications, proprietary database platforms, and custom-developed software applications that were not designed for cloud-native architectures or API-based integration patterns. This transition requires extensive system compatibility assessments, complex data migration planning, application refactoring to eliminate dependencies on legacy infrastructure components, and careful orchestration to ensure business continuity throughout multi-year transformation programs. Organizations face risks including data loss during migration, performance degradation due to network latency when accessing cloud-based services from on-premises applications, and compatibility issues with legacy software dependencies that may not have cloud-compatible versions available.

High Implementation Costs for Small and Medium Enterprises

Although community cloud computing offers long-term cost savings through reduced hardware capital expenditures and optimized operational efficiency, the short-term financial barriers including migration costs, integration expenses, employee training programs, and ongoing vendor management create substantial obstacles particularly for resource-constrained small and medium enterprises with limited access to capital financing. These upfront investments encompass expenses for comprehensive system assessments, professional services for cloud architecture design and migration execution, potential application re-platforming or redevelopment to achieve cloud compatibility, employee training programs to build internal cloud management capabilities, and temporary productivity losses during transition periods when staff are learning new systems and processes while maintaining existing operational responsibilities.

Shortage of Skilled Cloud Professionals

France faces a critical shortage of qualified cloud computing professionals with the technical expertise, certifications, and practical experience required to design secure cloud architectures, implement complex migrations, optimize cloud resource utilization, and manage multi-cloud environments effectively while maintaining compliance with GDPR and SecNumCloud requirements. A lack of AI expertise is cited as a major blocker to innovation, with large enterprises identifying skills shortages as a key barrier to cloud and AI adoption programs that are essential for maintaining competitive positioning in increasingly digital markets. This talent gap creates direct financial consequences and organizations paying premium salaries to attract scarce cloud architects, DevOps engineers, and cloud security specialists with expertise in technologies.

Competitive Landscape:

In the France Market, key players are focusing on a range of strategies to enhance their business operations and better serve the growing demand for cloud services. One of the primary areas of emphasis is data sovereignty, as companies work to ensure compliance with strict European data protection regulations such as the GDPR. This focus on local data storage and control is particularly important to businesses concerned with privacy and legal obligations. Additionally, these players are investing in advanced security measures, ensuring that their cloud platforms offer secure and reliable solutions for businesses in various sectors, from finance to healthcare. To further improve their market position, companies are expanding their partnerships with local enterprises, strengthening the ecosystem around their cloud offerings. Another key strategy is the development of tailored solutions that meet specific industry needs, providing greater flexibility and specialized features for customers across different sectors.

France Community Cloud Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Applications Covered | Cloud-Based Storage, Cloud Backup and Recovery, Cloud Security and Data Privacy, High Performance Computation, Analytics and Web-Based Applications |

| Industry Verticals Covered | BFSI, Gaming, Government, Healthcare, Education, Others |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The France community cloud market size was valued at USD 300.71 Million in 2025.

The France community cloud market is expected to grow at a compound annual growth rate of 27.58% from 2026-2034 to reach USD 2,692.90 Million by 2034.

Software leads the component segment with 55.04% market share, driven by enterprise demand for flexible SaaS solutions enabling business process automation, workforce collaboration tools, customer relationship management platforms, and industry-specific applications that eliminate on-premises infrastructure management requirements while providing scalable, subscription-based access to cloud applications integrated with AI and analytics capabilities for data-driven decision making.

Key growth drivers include stringent GDPR and data sovereignty requirements compelling organizations to adopt locally-hosted cloud solutions, substantial government investments through France 2030 programs and initiatives promoting digital independence, and accelerated BFSI sector digital modernization efforts to comply with PSD2 and DORA regulations while implementing real-time payment systems and AI-powered financial services applications requiring secure, high-performance cloud infrastructure.

Major challenges include legacy system integration complexities requiring extensive technical expertise and multi-year migration timelines to transition decades-old mainframe applications to cloud-native architectures, and high implementation costs creating financial barriers particularly for small and medium enterprises (SMEs) with limited capital budgets for migration projects and employee training programs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)