France Confectionery Market Size, Share, Trends and Forecast by Product Type, Age Group, Price Point, Distribution Channel, and Region, 2026-2034

France Confectionery Market Summary:

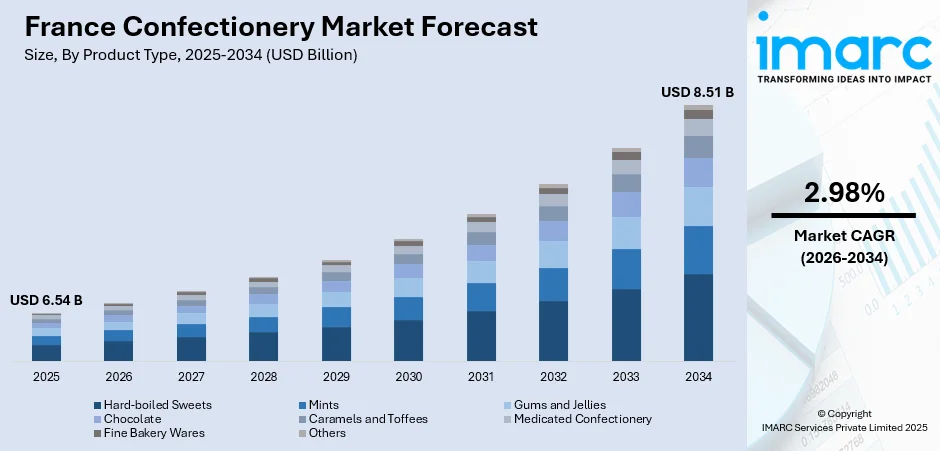

The France confectionery market size was valued at USD 6.54 Billion in 2025 and is projected to reach USD 8.51 Billion by 2034, growing at a compound annual growth rate of 2.98% from 2026-2034.

The confectionery market in France is a vibrant combination of tradition and innovation in the context of the confectionery industry in the European region. The confectionery industry has benefited from the culinary traditions of the country, consumer support for quality confectionery, and the long-established cultural tradition of presenting confectionery products on special occasions. The confectionery market in the country is marked by the presence of a range of products, including chocolate confectionery, sugar confectionery, and other preserved pastries.

Key Takeaways and Insights:

-

By Product Type: Chocolate dominates the market with a share of 58.04% in 2025, driven by its premium appeal, strong cultural ties, and growing demand for artisanal and ethically sourced chocolate products.

-

By Age Group: Adult leads the market with a share of 60.05% in 2025, reflecting mature consumer preferences for premium indulgence, sophisticated flavor profiles, and health-conscious confectionery options.

-

By Price Point: Economy dominates the market with a share of 50.06% in 2025, attributable to widespread consumer demand for affordable everyday treats and value-oriented purchasing patterns.

-

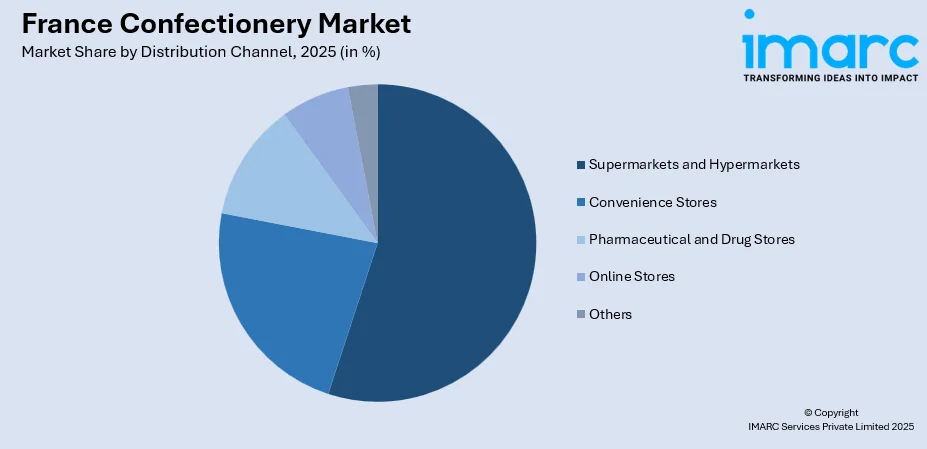

By Distribution Channel: Supermarkets and hypermarkets lead the market with a share of 55.08% in 2025, supported by extensive retail networks offering convenient one-stop shopping experiences.

-

By Region: Paris Region dominates the market with a share of 16% in 2025, reflecting the capital's high population density, tourism-driven consumption, and concentration of premium confectionery outlets.

-

Key Players: The France confectionery market features a competitive landscape with established multinational corporations and renowned French artisanal brands offering diverse product portfolios across chocolate, sugar confectionery, and specialty segments.

To get more information on this market Request Sample

The confectionery industry in France is undergoing significant transformation driven by evolving consumer preferences, heightened health consciousness, and growing demand for sustainable and ethically sourced products. In October 2024, Nestlé France launched a pilot scheme packaging KitKat and Lion chocolates in reusable steel tins under a French deposit‑return system to reduce single‑use plastics, aiming to reach 100% recyclable or reusable packaging by the end of 2025. French consumers increasingly prioritize authenticity, transparency, and natural ingredients in their confectionery purchases. The market benefits from a strong tradition of chocolate-making excellence, with French chocolatiers renowned globally for their craftsmanship and innovation. The rising popularity of organic confectionery, sugar-free alternatives, and premium artisanal offerings reflects broader shifts in consumer expectations toward indulgence balanced with wellness considerations.

France Confectionery Market Trends:

Premiumization and Artisanal Product Demand

The market is witnessing accelerated consumer preference for premium and artisanal confectionery products that emphasize craftsmanship, quality ingredients, and unique flavor experiences. In 2025, French artisanal maker Des Lis Chocolat was awarded the Prix Épicure d’Or for its innovative sablés au coquelicot, underlining the rising recognition of locally crafted premium confectionery in France’s food scene. French consumers are showing a growing preference for premium chocolates, artisanal confections, and products that highlight unique origins. This premiumization trend is particularly pronounced during festive seasons and gift-giving occasions when consumers seek luxury presentations and exclusive offerings.

Health-Conscious Consumption and Clean Label Movement

Growing consumer awareness of health implications is driving demand for low-sugar, sugar-free, and vegan confectionery options across the French market. Manufacturers are addressing this trend by creating products that incorporate natural sweeteners, lower sugar levels, and plant-based ingredients. For example, in 2025 Ferrero Group introduced a new sugar‑free variant of its iconic Tic Tac mints as part of its broader strategy to appeal to health‑conscious consumers seeking indulgence without added sugar. Traditional French ingredients including nougat and natural fruit extracts are being reimagined in healthier formulations that maintain indulgent appeal while addressing wellness concerns.

Sustainability and Ethical Sourcing Emphasis

French consumers increasingly prioritize confectionery brands committed to sustainable sourcing, ethical production, and environmental responsibility. Demand for organic, fair‑trade, and traceable-ingredient products continues to grow. In July 2024, Ferrero launched its first global sustainability campaign at Nice Côte d’Azur Airport, highlighting that over 90 % of its hazelnuts are traceable to individual farms and more than 21,000 farmers have been trained in sustainable practices, emphasizing ethical sourcing and transparency. Sustainable packaging, including recyclable and biodegradable materials, is also gaining consumer preference.

Market Outlook 2026-2034:

The France confectionery market is expected to grow steadily, supported by the country’s strong culture of sweet consumption and the tradition of gifting sweets during celebrations. Growth is fueled by ongoing product innovation and a balanced demand for both traditional favorites and healthier, innovative alternatives. Consumers’ evolving preferences for novel flavors and better-for-you options, alongside enduring appreciation for classic confections, underpin the market’s resilience and long-term expansion. The market generated a revenue of USD 6.54 Billion in 2025 and is projected to reach a revenue of USD 8.51 Billion by 2034, growing at a compound annual growth rate of 2.98% from 2026-2034.

France Confectionery Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Chocolate |

58.04% |

|

Age Group |

Adult |

60.05% |

|

Price Point |

Economy |

50.06% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

55.08% |

|

Region |

Paris Region |

16% |

Product Type Insights:

- Hard-boiled Sweets

- Mints

- Gums and Jellies

- Chocolate

- Caramels and Toffees

- Medicated Confectionery

- Fine Bakery Wares

- Others

The chocolate dominates with a market share of 58.04% of the total France confectionery market in 2025.

Chocolate’s dominance reflects France’s strong cultural affinity for chocolate confectionery and its celebrated chocolate-making heritage. Consumers show equal preference for artisanal and mass-market offerings, with per capita consumption averaging around seven kilograms annually. In 2025, the Salon du Chocolat et de la Pâtisserie in Paris attracted more than 96,000 visitors and nearly 250 exhibitors worldwide, underscoring France’s global influence in chocolate innovation, craftsmanship, and trade. Segment growth is further driven by ethical and organic chocolate innovations aligned with sustainability expectations.

The segment is supported by strong seasonal demand during holidays such as Christmas, Easter, and Valentine’s Day, when chocolate gifting significantly boosts sales. Premium dark chocolate is gaining popularity among health-conscious consumers due to its perceived antioxidant benefits. In addition, the rise of single-origin and bean-to-bar chocolates is broadening product offerings, appealing to discerning consumers seeking distinctive flavors, higher quality, and authentic craft-driven chocolate experiences.

Age Group Insights:

- Children

- Adult

- Geriatric

The adult leads with a share of 60.05% of the total France confectionery market in 2025.

Strong purchasing power, refined taste, and cultural acceptance of confectionery as an everyday indulgence in France have contributed to the dominance of adult consumers. Increasingly, adults drive demand for premium and artisanal products, opting for refined flavor profiles, high-quality ingredients, and distinct brand identities. This demographic increasingly seeks chocolates and confectionery positioned around health benefits, reduced sugar content, or balanced indulgence, aligning enjoyment with wellness awareness while maintaining expectations for craftsmanship and sensory appeal.

The segment also benefits from confectionery's role in social occasions, workplace snacking, and personal reward moments that shape the adult consumption habit. Marketing strategies toward adult’s underscore craftsmanship, ingredient origin, and rich sensory experiences to connect with adult appreciation for quality and authenticity. Moreover, a rising interest in functional confectionery infused with wellness ingredients reflects these adult consumers striving to find their balance of indulgence with health-conscious choices, all while driving enjoyment and a premium appeal.

Price Point Insights:

- Economy

- Mid-range

- Luxury

The economy dominates with a market share of 50.06% of the total France confectionery market in 2025.

The leading position of economy products reflects strong demand for affordable everyday treats and the importance of value-driven purchasing in the French confectionery market. Budget-friendly chocolates, candies, and snacks feature mass-market consumption and impulse buying occasions. Private label offerings account for a significant share of this segment, competing effectively with branded products by offering comparable quality, wide availability, and attractive pricing that appeals to cost-conscious consumers.

It forms a very critical entry point for daily confectionery consumption, particularly for all those price-sensitive consumers and families who would want to indulge in more confectioneries at affordable costs. Competition is intense on cost optimization, leveraging an efficient distribution network, and adding more value for money by introducing value-added formulations, all within strict price ceilings. All in all, this segment demonstrates the stubborn resistance of accessible indulgence within French consumer culture, with low-cost confectionery demand being flat even during periods of economic uncertainty and fluctuating household spending.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmaceutical and Drug Stores

- Online Stores

- Others

The supermarkets and hypermarkets lead with a share of 55.08% of the total France confectionery market in 2025.

The commanding share of supermarkets and hypermarkets reflects the convenience of one-stop shopping and extensive assortments that allow consumers to compare multiple confectionery brands and variants. Major retail chains such as Carrefour, Leclerc, and Auchan maintain broad offerings across economy and premium segments. According to reports, in 2025, Carrefour Group increased its market share in France following the integration of Cora hypermarkets and stronger loyalty programs, reinforcing retailer influence on confectionery sales through promotions, seasonal displays, and strategic shelf placement.

The segment benefits from France’s well-developed retail infrastructure, where hypermarkets feature dedicated confectionery aisles with wide and diverse product assortments. The integration of online ordering with in-store pickup is enhancing modern retail appeal by improving shopping convenience. This omnichannel approach allows hypermarkets to strengthen customer engagement, increase purchase frequency, and compete more effectively with emerging digital platforms and specialized e-commerce channels in the evolving confectionery retail landscape.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

Paris Region exhibits a clear dominance with a 16% share of the total France confectionery market in 2025.

The dominant role for the Paris Region arises out of the population, business, and tourism concentrations of the Île-de-France, because the Paris Region contains many upscale confectionery boutiques and flagships of global brands and chocolatiers targeting the discerning urban consumer and international visitors, where the high disposable incomes and worldly outlook promote the demand for premium and novel confectionery products.

The area has a strong retail infrastructure that includes hypermarkets, specialized retail stores, and a rapidly developing online marketplace that caters to all segments of consumers. Tourist-driven consumption patterns are prominent in this region too, as tourists buy French confectionery specialties as souvenirs or gifts in this region. Furthermore, the fact that major confectionery producers and distributors are based in or around Paris ensures favorable supply chain functions and quick distribution channels in response to changing consumption patterns.

Market Dynamics:

Growth Drivers:

Why is the France Confectionery Market Growing?

Strong Cultural Heritage and Gifting Traditions

France's deeply rooted cultural traditions surrounding confectionery consumption and gifting continue driving market demand across seasonal occasions and everyday indulgence moments. In October 2025, Ferrara Candy Company’s European holding arm completed the acquisition of France’s CPK Group, owner of beloved local brands such as Carambar, Lutti, Krema, Poulain and Vichy, reinforcing the enduring appeal and strategic value of French confectionery heritage for global players. The tradition of gifting chocolates and specialty sweets during holidays, celebrations, and personal occasions sustains robust sales volumes throughout the year. French consumers' appreciation for culinary excellence extends to confectionery, maintaining strong brand loyalty and willingness to invest in quality products.

Innovation in Product Development and Formulations

Continuous innovation in flavors, formats, and formulations is expanding market appeal and attracting new consumer segments. In 2025, Mondelēz International announced the launch of new high‑protein and reduced‑sugar confectionery bars under its Clif Builders brand, featuring indulgent flavours like Almond Salted Caramel and Peanut Butter Chocolate while delivering 16 g of protein and only five grams of sugar per bar, reflecting manufacturers’ push toward better‑for‑you formulations that still feel like treats. Manufacturers are introducing products featuring unique flavor combinations, functional ingredients, and health-conscious formulations that address evolving preferences. The development of sugar-reduced, organic, and vegan confectionery options is opening new market opportunities while retaining indulgent appeal.

Premiumization and Artisanal Movement

The growing consumer appetite for premium and artisanal confectionery products is elevating market value despite moderate volume growth. French chocolatiers and confectioners are capitalizing on craftsmanship, quality ingredients, and distinctive brand positioning to command premium prices. For example, Swiss chocolatier Lindt & Sprüngli raised its 2025 organic sales growth forecast to 9 %–11 %, citing strong consumer loyalty and increasing demand for premium chocolates such as Lindor and Excellence in European markets, underscoring the resilience and appeal of upscale chocolate offerings. The luxury confectionery segment benefits from strong demand during gift-giving occasions and increasing consumer willingness to pay for exceptional quality experiences.

Market Restraints:

What Challenges the France Confectionery Market is Facing?

Raw Material Price Volatility

Fluctuating prices of key ingredients including cocoa and sugar significantly impact production costs and manufacturer margins. Rising cocoa prices driven by supply chain disruptions and climate-related challenges are forcing manufacturers to adjust pricing strategies or reformulate products. Economic uncertainties and commodity market volatility create planning challenges for producers seeking to maintain consistent pricing.

Health and Regulatory Concerns

Rising consumer health awareness and stricter sugar regulations are pressuring traditional confectionery recipes. European rules on child-directed advertising and nutritional labeling are shaping product development and marketing. Manufacturers must reformulate products to lower sugar content while preserving taste and consumer appeal, balancing compliance with continued market competitiveness and maintaining brand loyalty.

Competitive Pressure from Private Labels

Private label confectionery is capturing market share through competitive pricing and enhanced quality perceptions. Retailer brands gain from prime shelf placement and in-store promotions in major chains. Mid-priced branded products are under pressure, as consumers increasingly view private labels as acceptable everyday alternatives, shifting purchasing habits toward more cost-effective options without compromising perceived value.

Competitive Landscape:

The France confectionery market features a competitive landscape characterized by established multinational corporations, renowned French confectioners, and emerging artisanal brands serving diverse consumer segments. Leading players leverage brand heritage, extensive distribution networks, and continuous innovation to maintain market positions. The market structure encompasses global giants commanding significant shares alongside cherished French brands with strong domestic loyalty. Competition intensifies around product innovation, sustainability credentials, and digital engagement strategies. Strategic acquisitions and partnerships are enabling companies to expand product portfolios and capture emerging consumer preferences across health-conscious and premium segments.

Recent Developments:

-

In 2025, French caramels specialist Nigay has announced a €30 million investment to construct a new production facility in Saint‑Quentin, aiming to boost capacity and drive product innovation in caramel confectionery. The expansion reflects growing demand for premium and innovative confections in both domestic and international markets.

France Confectionery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Hard-Boiled Sweets, Mints, Gums and Jellies, Chocolate, Caramels and Toffees, Medicated Confectionery, Fine Bakery Wares, Others |

| Age Groups Covered | Children, Adult, Geriatric |

| Price Points Covered | Economy, Mid-Range, Luxury |

| Distribution Channels Covered | Supermarkets And Hypermarkets, Convenience Stores, Pharmaceutical and Drug Stores, Online Stores, Others |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The France confectionery market size was valued at USD 6.54 Billion in 2025.

The France confectionery market is expected to grow at a compound annual growth rate of 2.98% from 2026-2034 to reach USD 8.51 Billion by 2034.

Chocolate dominated the market with a 58.04% share, driven by France's strong cultural connection with chocolate confectionery, premium product appeal, and growing demand for artisanal and ethically sourced chocolate offerings.

Key factors driving the France confectionery market include strong cultural heritage and gifting traditions, innovation in product development and formulations, premiumization trends, growing demand for health-conscious options, and sustainability-focused product offerings.

Major challenges include raw material price volatility affecting cocoa and sugar costs, health and regulatory concerns regarding sugar content, competitive pressure from private label products, and the need to balance traditional formulations with evolving consumer health preferences.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)