France Cryptocurrency Market Size, Share, Trends and Forecast by Type, Component, Process, Application, and Region, 2026-2034

France Cryptocurrency Market Summary:

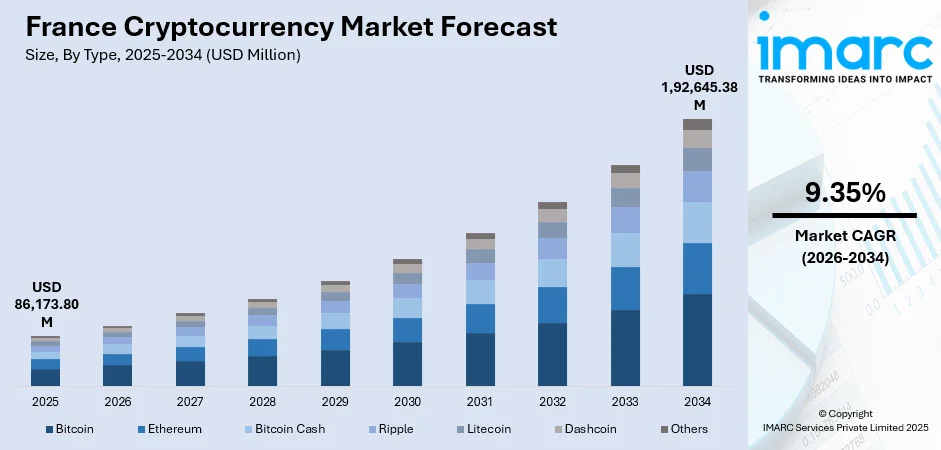

The France cryptocurrency market size was valued at USD 86,173.80 Million in 2025 and is projected to reach USD 1,92,645.38 Million by 2034, growing at a compound annual growth rate of 9.35% from 2026-2034.

France's cryptocurrency ecosystem is experiencing robust expansion, driven by the country's proactive regulatory stance, growing institutional participation from major financial entities, and increasing mainstream adoption among retail investors. Strong government support through dedicated investment initiatives, combined with an expanding network of blockchain startups and established fintech companies, continues to strengthen France's cryptocurrency market share.

Key Takeaways and Insights:

- By Type: Bitcoin dominates the market with a share of 38% in 2025, driven by its established position as the primary cryptocurrency for institutional investment portfolios and its widespread acceptance across French trading platforms and exchanges.

- By Component: Software leads the market with a share of 59% in 2025, owing to the proliferation of cryptocurrency trading platforms, wallet applications, and blockchain infrastructure solutions that enable digital asset management across institutional and retail channels.

- By Process: Transaction represents the largest segment with a market share of 56% in 2025, attributed to the high volume of cryptocurrency trading activities, cross-border payment settlements, and the increasing use of stablecoins for commercial transactions within the French financial ecosystem.

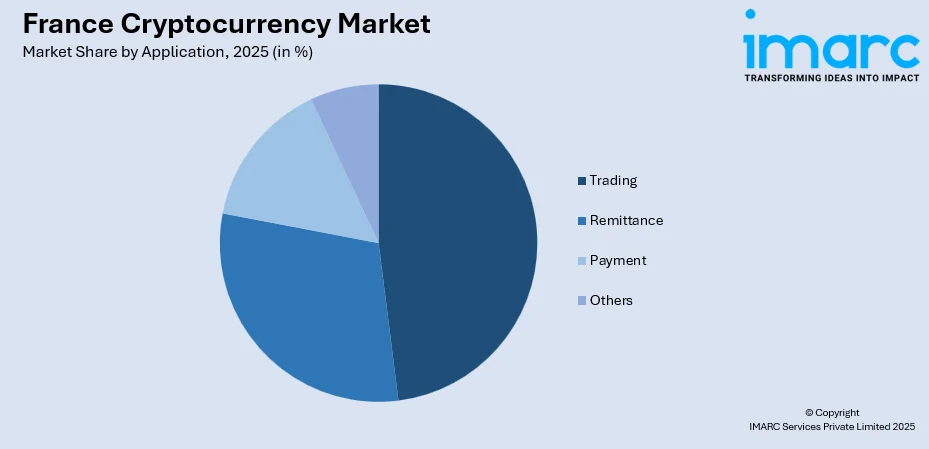

- By Application: Trading prevails the market with a share of 48% in 2025, reflecting the strong speculative and investment demand for digital assets among French investors who view cryptocurrencies as portfolio diversification instruments.

- Key Players: The France cryptocurrency market features a diverse competitive landscape with international exchange platforms operating alongside domestically licensed digital asset service providers, hardware wallet manufacturers, and institutional-grade custody solutions.

To get more information on this market Request Sample

The France cryptocurrency market is undergoing a significant transformation, as regulatory frameworks mature and institutional confidence strengthens. Paris has emerged as a strategic hub for global cryptocurrency firms, with Circle establishing its European headquarters in France after receiving Electronic Money Institution (EMI) authorization from the Autorité de Contrôle Prudentiel et de Résolution in July 2024, becoming the first global stablecoin issuer to achieve Markets in Crypto-Assets Regulation (MiCA) compliance. This regulatory milestone has attracted additional institutional players and reinforced France's position as a leading European digital asset jurisdiction. Increasing acceptance of cashless payments is encouraging crypto usage in online transactions and international transfers. In parallel, educational content and online communities are improving awareness and basic understanding among users. Innovations in decentralized finance and token-based projects add new use cases, attracting tech-oriented investors and startups. Overall, improving infrastructure, product diversity, and investor participation are strengthening confidence and positioning the market for sustained long-term growth.

France Cryptocurrency Market Trends:

Accelerated Institutional Adoption and Banking Integration

Traditional financial institutions are increasingly integrating cryptocurrency services into their offerings, marking a significant shift in the French banking landscape. In December 2025, the French banking group BPCE would initiate crypto trading services for 2 Million retail clients via its Banque Populaire and Caisse d’Épargne applications, aiming to broaden to 12 Million customers by 2026. Major banks have established dedicated digital asset subsidiaries to provide custody, trading, and tokenization services to institutional clients. This trend reflects growing acceptance of digital assets within traditional finance and accelerating institutional infrastructure development.

Regulatory-Driven Market Consolidation Under MiCA Framework

Regulatory-driven consolidation under the MiCA framework is strengthening the market in France by removing weak or non-compliant operators and favoring reliable platforms. Clear compliance standards improve investor confidence and reduce fraud risks. Smaller firms either upgrade systems or merge, creating stronger players with better security, transparency, and service quality. This consolidation improves market stability, attracts institutional interest, and supports long-term growth by building trust, professionalism, and operational efficiency across France’s crypto ecosystem.

Emergence of Tokenization and Decentralized Finance (DeFi) Applications

The emergence of DeFi is fueling the growth of the market in France by expanding use cases beyond trading. In July 2024, the Autorité des Marchés Financiers (AMF), the regulator of financial markets in France released a summary report addressing the regulatory challenges related to decentralized finance (DeFi). Regulators needed to evaluate DeFi products, services, activities, and arrangements to grasp the technical expertise, data, and tools required to develop a complete understanding. Tokenization enables fractional ownership of assets, improving accessibility for investors. DeFi platforms offer lending, staking, and yield opportunities without intermediaries, attracting tech-savvy users. These innovations increase transaction activity, boost liquidity, and encourage participation from startups and digital investors. As financial services become more programmable and transparent, interest in crypto assets continues to rise across France.

Market Outlook 2026-2034:

Regulatory clarity provided by the MiCA framework will continue to attract international cryptocurrency firms seeking European market access through France's robust licensing regime. The market generated a revenue of USD 86,173.80 Million in 2025 and is projected to reach a revenue of USD 1,92,645.38 Million by 2034, growing at a compound annual growth rate of 9.35% from 2026-2034. Institutional adoption is expected to accelerate, as traditional financial institutions expand digital asset service offerings, while the French government's continued support through initiatives, including the France 2030 programme, will strengthen domestic blockchain innovation. The growing integration of stablecoins for commercial payments and the broadening of tokenization applications across sectors, including real estate, securities, and carbon credits, will create additional revenue streams.

France Cryptocurrency Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Bitcoin | 38% |

| Component | Software | 59% |

| Process | Transaction | 56% |

| Application | Trading | 48% |

Type Insights:

- Bitcoin

- Ethereum

- Bitcoin Cash

- Ripple

- Litecoin

- Dashcoin

- Others

Bitcoin dominates with a market share of 38% of the total France cryptocurrency market in 2025.

Bitcoin's commanding position reflects its established status as the primary digital asset for both institutional portfolios and retail investment strategies. The cryptocurrency benefits from extensive liquidity across all major French-registered exchanges and trading platforms, enabling seamless on-ramping and off-ramping capabilities for investors. Institutional adoption has accelerated as asset managers increasingly incorporate Bitcoin exposure into diversified portfolio strategies, viewing it as both a store of value and inflation hedge.

The Bitcoin ecosystem in France continues to expand through infrastructure development across mining, custody, and trading services. French investors demonstrate preference for Bitcoin as an entry point into cryptocurrency markets, with the cryptocurrency serving as a gateway asset before portfolio diversification into alternative tokens. The robust secondary market for Bitcoin-denominated financial products, including exchange-traded products listed on European exchanges accessible to French investors, has further strengthened the cryptocurrency's market position. Professional investment advisory services increasingly recommend Bitcoin allocations, reflecting its integration into mainstream financial planning frameworks.

Component Insights:

- Hardware

- Software

Software leads with a share of 59% of the total France cryptocurrency market in 2025.

Software solutions encompass the comprehensive technological infrastructure enabling cryptocurrency transactions, storage, and management across the French market ecosystem. Trading platforms, wallet applications, and blockchain analytics tools represent the foundational software layer supporting all cryptocurrency activities. The segment's dominance reflects the capital-light nature of software adoption compared to hardware requirements, enabling broader market participation across investor demographics. French cryptocurrency users predominantly access digital assets through mobile applications and web-based platforms offered by licensed exchanges, contributing to software segment revenue generation through transaction fees and subscription services.

The software component continues to expand, as innovative applications address emerging market needs, including portfolio management, tax calculation, and regulatory compliance tools. Institutional-grade software solutions for custody, settlement, and reporting have attracted significant development investments, as financial institutions require enterprise-quality infrastructure for digital asset operations. The integration of generative artificial intelligence (AI) and machine learning (ML) capabilities into cryptocurrency software platforms represents an emerging trend enhancing trading strategies and risk management functionality. As per IMARC Group, the France generative AI market is set to attain USD 2,548.30 Million by 2033, exhibiting a growth rate (CAGR) of 18.48% during 2025-2033.

Process Insights:

- Mining

- Transaction

Transaction exhibits a clear dominance with a 56% share of the total France cryptocurrency market in 2025.

Transaction processing encompasses all cryptocurrency transfer activities, including trading, payments, remittances, and settlement operations, conducted across French platforms and exchanges. The segment's leadership position reflects France's role as a significant trading hub within the European cryptocurrency ecosystem, with high-frequency trading activities generating substantial transaction volume. Cross-border payment applications utilizing stablecoins have contributed meaningfully to transaction volumes. The segment benefits from France's well-developed financial infrastructure, enabling efficient integration between cryptocurrency networks and traditional banking systems.

Transaction activity continues to expand, as cryptocurrency applications diversify beyond speculative trading towards practical commercial use cases. European cryptocurrency market demonstrated resilience throughout 2024-2025, with transaction volumes reaching peak levels in December 2024 amid MiCA implementation and subsequent regulatory clarity. French enterprises exploring blockchain-based settlement solutions for international trade represent an emerging transaction volume driver, leveraging the efficiency and cost advantages of cryptocurrency infrastructure for commercial payments.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Trading

- Remittance

- Payment

- Others

Trading represents the leading segment with a 48% share of the total France cryptocurrency market in 2025.

Trading applications encompass all speculative and investment activities conducted through cryptocurrency exchanges, brokerages, and decentralized platforms by French investors. The segment's leadership reflects the predominant perception of cryptocurrencies as investment vehicles rather than transactional currencies among French market participants. Regulated trading platforms operating under Autorité des marchés financiers (AMF) registration or MiCA authorization provide French investors access to diverse cryptocurrency assets through spot, margin, and derivatives trading products. The proliferation of user-friendly mobile trading applications has democratized market access, enabling retail participation alongside institutional trading activities.

Trading activities in France demonstrate sophisticated market characteristics, including significant derivatives volume and growing copy trading adoption. Major international exchanges maintain strong market positions through localized services, while domestic platforms differentiate through regulatory compliance and French-language customer support. According to recent surveys, approximately 33% of French consumers express intention to acquire cryptocurrency assets in 2025, representing a significant potential trading participant pool. The segment benefits from evolving investor demographics, with younger age cohorts showing particular affinity for cryptocurrency trading.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d'Azur

- Grand Est

- Others

Paris Region holds prominence due to its strong fintech ecosystem, presence of major banks, venture capital firms, and blockchain startups. High institutional interest, crypto exchanges, and Web3 projects are concentrated here. Wealth concentration, tech talent, and corporate adoption support advanced use cases like tokenization, crypto trading platforms, and blockchain-based financial services.

Auvergne-Rhône-Alpes represents a growing secondary hub for cryptocurrency activities, with emerging fintech clusters and academic blockchain research initiatives. Technology incubators support early-stage cryptocurrency startups, while the region's industrial base explores blockchain applications for supply chain optimization.

Nouvelle-Aquitaine demonstrates increasing cryptocurrency adoption, driven by tech-savvy demographics in Bordeaux and surrounding urban centers. Local financial advisory services have expanded cryptocurrency offerings, while regional economic development agencies promote blockchain innovation opportunities.

Hauts-de-France represents an emerging market for cryptocurrency adoption with particular interest in mining operations leveraging competitive energy pricing. The region's proximity to Belgium and industrial infrastructure supports blockchain-related technology development.

Occitanie benefits from Toulouse's aerospace technology ecosystem that has fostered blockchain innovation applications. The region demonstrates strong startup activity and houses notable blockchain research institutions.

Provence Alpes Côte d'Azur has emerged as a technology hub focusing on blockchain and cryptocurrency innovation, attracting international entrepreneurs and investors. The region's lifestyle appeal combined with growing tech infrastructure supports cryptocurrency company establishment.

Grand Est’s cryptocurrency market is shaped by manufacturing, logistics hubs, and trade with Germany, Switzerland, and Luxembourg. Firms assess blockchain for process automation and regulatory reporting. Cross-border workers use crypto for faster remittances. Universities and research centers support blockchain training and innovation-based adoption among young professionals.

Market Dynamics:

Growth Drivers:

Why is the France Cryptocurrency Market Growing?

Implementation of Comprehensive Regulatory Framework

France's proactive adoption of cryptocurrency regulation has established the country as a secure and predictable environment for digital asset activities. The successful implementation of the MiCA regulation, with France among the first European nations to operationalize the framework, has attracted international cryptocurrency firms seeking regulatory clarity. The dual authorization path through the AMF and ACPR provides clear guidelines for digital asset service providers across custody, trading, and issuance activities. Licensing requirements improve transparency and limit fraudulent activities, which strengthens user confidence and supports wider adoption. For startups, predictable policies reduce operational risk and attract venture funding, leading to faster innovations in DeFi, blockchain infrastructure, and fintech services. For users, compliance-focused platforms offer safer environments for trading and asset storage, increasing participation across demographics.

Government-Backed Investments and Institutional Support

Government-backed investments and growing institutional support are playing a major role in driving the market expansion by strengthening infrastructure, innovation, and credibility. Public funding programs and innovation grants encourage blockchain research, fintech experimentation, and startup acceleration across France. Support from universities, research labs, and state-backed incubators helps develop skilled talent and practical blockchain applications. Institutional interest from banks, asset managers, and corporate groups further boosts market maturity by expanding crypto custody, trading, and tokenization services. Large organizations bring operational discipline, compliance systems, and capital strength, reducing market volatility and increasing user confidence. Partnerships between public institutions and private companies accelerate pilot projects in digital identity, supply chain transparency, and smart contracts. Together, these efforts create a stable foundation for long-term growth, transforming cryptocurrency from a niche concept into a strategic digital finance sector within France’s broader technology and financial ecosystem.

Growth of Crypto Payments and Real-World Use Cases

Real-world usage is steadily pushing cryptocurrencies from an investment tool to a practical financial utility. Businesses in e-commerce, tourism, freelancing, and digital services increasingly accept crypto payments for faster and cheaper transactions. Cross-border workers and international clients benefit from reduced fees and instant settlements. Blockchain also enables secure smart contracts, supply-chain monitoring, and data authentication across industries. Merchants see crypto as a way to attract tech-savvy customers and international buyers. Payment gateways, crypto debit cards, and mobile wallets simplify everyday use. As transaction speed and usability improve, more consumers experiment with crypto for daily spending. Adoption in gaming and digital content monetization expands usage among younger users. In October 2023, France approved an innovative law that had the potential to transform the nation's entire digital framework. The Sorare Law aimed to create a regulatory framework for games incorporating crypto and non-fungible token (NFT) elements, intending to differentiate them from France’s ‘gambling’ laws because of the unpredictable characteristics of these digital assets. The shift from speculation to applied utility strengthens the crypto ecosystem and ensures sustainable growth in France.

Market Restraints:

What Challenges the France Cryptocurrency Market is Facing?

Market Volatility and Investment Risks

Cryptocurrencies are highly volatile, exposing French investors to sudden price swings. Sharp fluctuations can lead to financial losses, undermining confidence in digital assets. Retail investors without experience may hesitate to enter the market. Institutional investors also weigh volatility against risk management strategies, which can limit large-scale adoption. High-risk perception affects long-term investment planning and can reduce trading volumes. This instability challenges market maturity and may slow mainstream acceptance of cryptocurrency as a reliable financial instrument in France.

Cybersecurity Threats and Fraud Risks

The France cryptocurrency market faces challenges from hacking, phishing, and fraudulent schemes targeting exchanges and wallets. Security breaches can result in significant financial losses for investors and damage trust in digital asset platforms. Weak security measures by smaller operators increase vulnerability. Investors may be reluctant to use unregulated platforms due to fear of theft or scams. Regulatory authorities emphasize protection standards, but ongoing cyber threats continue to pose operational risks. Security concerns remain a critical barrier to mass adoption.

Limited Public Understanding and Knowledge Gaps

Despite growing awareness, many French consumers still lack in-depth understanding of cryptocurrencies and blockchain technology. Misconceptions about complexity, legality, and risks reduce confidence. This knowledge gap limits adoption to a smaller, tech-savvy audience. Educational initiatives are increasing but remain insufficient to reach wider demographics. Retail investors may make uninformed decisions, resulting in negative experiences. Low literacy also hinders adoption of advanced products like staking. Improving public understanding is essential for sustainable market growth.

Competitive Landscape:

The France cryptocurrency market demonstrates a dynamic competitive environment, featuring international exchange platforms, domestic licensed service providers, and specialized technology companies. Market participants range from global cryptocurrency exchanges maintaining French registrations to domestically headquartered firms providing localized services. The regulatory transition toward MiCA authorization is reshaping competitive dynamics, favoring entities with robust compliance capabilities and established regulatory relationships. Hardware wallet manufacturers, trading platform operators, and institutional custody providers represent distinct competitive segments within the broader market. Strategic partnerships between traditional financial institutions and cryptocurrency-native companies are emerging as competitive differentiation strategies, combining regulatory credibility with technological innovations.

Recent Developments:

- In March 2025, Bpifrance revealed a €25 Million cryptocurrency investment fund aimed at directly purchasing tokens from French blockchain initiatives, representing a groundbreaking move among sovereign wealth funds worldwide and indicating governmental dedication to fostering the local cryptocurrency ecosystem.

- In February 2025, Societe Generale-FORGE (SG-FORGE) announced the introduction of its EUR-pegged stablecoin (EURCV) on the Stellar platform. This growth would create new prospects for individuals and companies to utilize a secure, transparent, and scalable digital euro stablecoin, driven by the cutting-edge Stellar blockchain system

France Cryptocurrency Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Dashcoin, Others |

| Components Covered | Hardware, Software |

| Processes Covered | Mining, Transaction |

| Applications Covered | Trading, Remittance, Payment, Others |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The France cryptocurrency market size was valued at USD 86,173.80 Million in 2025.

The France cryptocurrency market is expected to grow at a compound annual growth rate of 9.35% from 2026-2034 to reach USD 1,92,645.38 Million by 2034.

Bitcoin dominates the market with a 38% share, driven by its established position as the primary cryptocurrency for institutional and retail investment portfolios.

Key factors driving the France cryptocurrency market include comprehensive regulatory framework implementation, government-backed investment initiatives through France 2030, growing institutional adoption by major French banks, and the establishment of France as a European hub for global cryptocurrency firms.

Major challenges include banking access difficulties for cryptocurrency companies, taxation complexity creating reporting burdens for investors, market volatility affecting mainstream adoption, and ongoing consumer protection concerns regarding unauthorized platforms.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)