France Cyber Insurance Market Size, Share, Trends and Forecast by Component, Insurance Type, Organization Size, End-Use Industry, and Region, 2025-2033

France Cyber Insurance Market Overview:

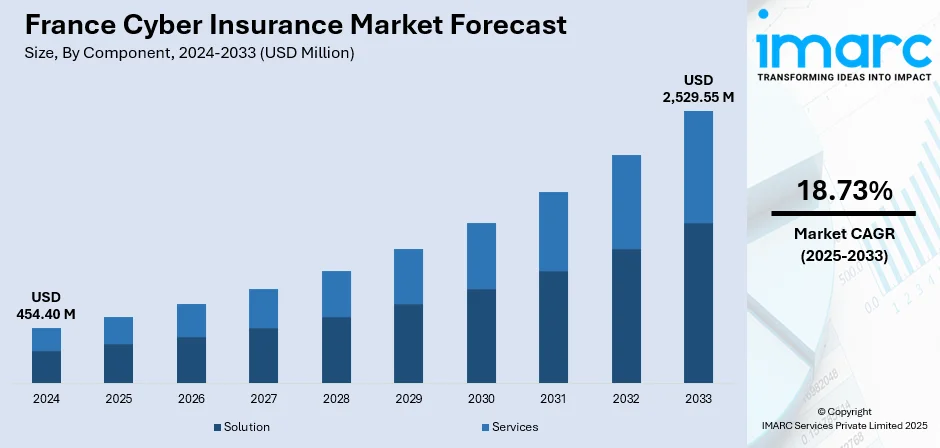

The France cyber insurance market size reached USD 454.40 Million in 2024. The market is projected to reach USD 2,529.55 Million by 2033, exhibiting a growth rate (CAGR) of 18.73% during 2025-2033. The market is expanding due to increasing cases of cyberattacks and rising awareness of digital risk protection. In addition, growing use of advanced security tools and regulatory compliance support France cyber insurance market share across various industry sectors, especially finance and healthcare.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 454.40 Million |

| Market Forecast in 2033 | USD 2,529.55 Million |

| Market Growth Rate 2025-2033 | 18.73% |

France Cyber Insurance Market Trends:

Rising Demand Due to Cyber Threats

The France cyber insurance market growth is being shaped by a noticeable increase in ransomware attacks, phishing scams, and data breaches across public and private sectors. Organizations of all sizes are seeking better financial protection against these risks, leading to a steady rise in policy purchases. Small and medium enterprises, once hesitant, are now prioritizing cyber coverage as digital exposure grows. Regulatory requirements, such as GDPR compliance, are also playing a part in driving this trend. As the volume of cyber incidents increases, insurance providers are tailoring more specialized products to cover losses from business interruptions, data restoration, and legal fees. The growing reliance on digital infrastructure across sectors like finance, healthcare, and manufacturing further supports the demand for cyber insurance. This has created a competitive environment where insurers are expanding coverage options and improving risk assessment tools to meet client needs. As awareness improves, more firms are treating cyber coverage as essential rather than optional.

To get more information on this market, Request Sample

Adoption of Advanced Risk Solutions

Technology integration is influencing how cyber insurance operates in France. Insurers are now using AI-based threat detection, real-time risk monitoring, and security audits to better assess exposure and manage claims. This shift is encouraging companies to improve their own cybersecurity posture to qualify for better premium terms. Partnerships between cybersecurity firms and insurers are also growing, helping policyholders reduce potential losses through preventive support. Another driver is the use of digital platforms for policy management and claims processing, which makes cyber insurance more accessible and responsive. Risk quantification tools are becoming more refined, allowing underwriters to better price policies and set limits that reflect actual threat levels. These advancements are not only making policies more relevant but also boosting trust in the insurance process. This move toward smarter underwriting and active risk management is expected to play a key role in how the France cyber insurance market continues to evolve over the next few years.

France Cyber Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on component, insurance type, organization size, and end-use industry.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services.

Insurance Type Insights:

- Packaged

- Stand-alone

The report has provided a detailed breakup and analysis of the market based on the insurance type. This includes packaged and stand-alone.

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes small and medium enterprises and large enterprises.

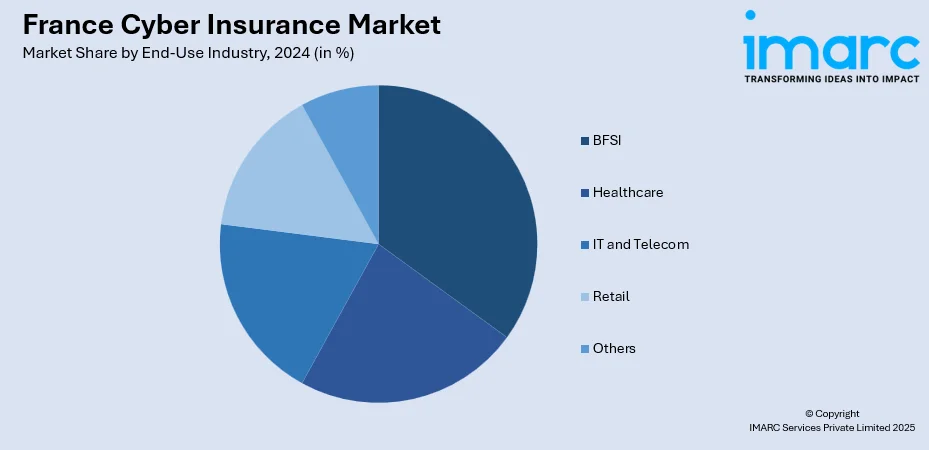

End-Use Industry Insights:

- BFSI

- Healthcare

- IT and Telecom

- Retail

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use industry. This includes BFSI, healthcare, IT and telecom, retail, and others.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

France Cyber Insurance Market News:

- April 2025: Resilience launched Tech E&O coverage in the UK and EU for enterprises with €25M+ revenue, supported by Accredited Insurances. With limits up to €10M, this offering addressed rising business interruption risks, strengthening cyber insurance options for large firms across European technology sectors.

- October 2024: Stoïk, a French cyber insurance provider, raised €25M in Series B funding, backed by Alven, a16z, and others. With 1,000+ brokers and expansion into Germany and Austria, this strengthened cyber coverage for European SMEs, boosting market competitiveness and digital risk preparedness.

France Cyber Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Insurance Types Covered | Packaged, Stand-alone |

| Organization Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| End-Use Industries Covered | BFSI, Healthcare, IT and Telecom, Retail, Others |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle- Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the France cyber insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the France cyber insurance market on the basis of component?

- What is the breakup of the France cyber insurance market on the basis of insurance type?

- What is the breakup of the France cyber insurance market on the basis of organization size?

- What is the breakup of the France cyber insurance market on the basis of end-use industry?

- What is the breakup of the France cyber insurance market on the basis of region?

- What are the various stages in the value chain of the France cyber insurance market?

- What are the key driving factors and challenges in the France cyber insurance market?

- What is the structure of the France cyber insurance market and who are the key players?

- What is the degree of competition in the France cyber insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the France cyber insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the France cyber insurance market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the France cyber insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)