France Drones Market Size, Share, Trends and Forecast by Type, Component, Payload, Point of Sale, End-Use Industry, and Region, 2025-2033

France Drones Market Overview:

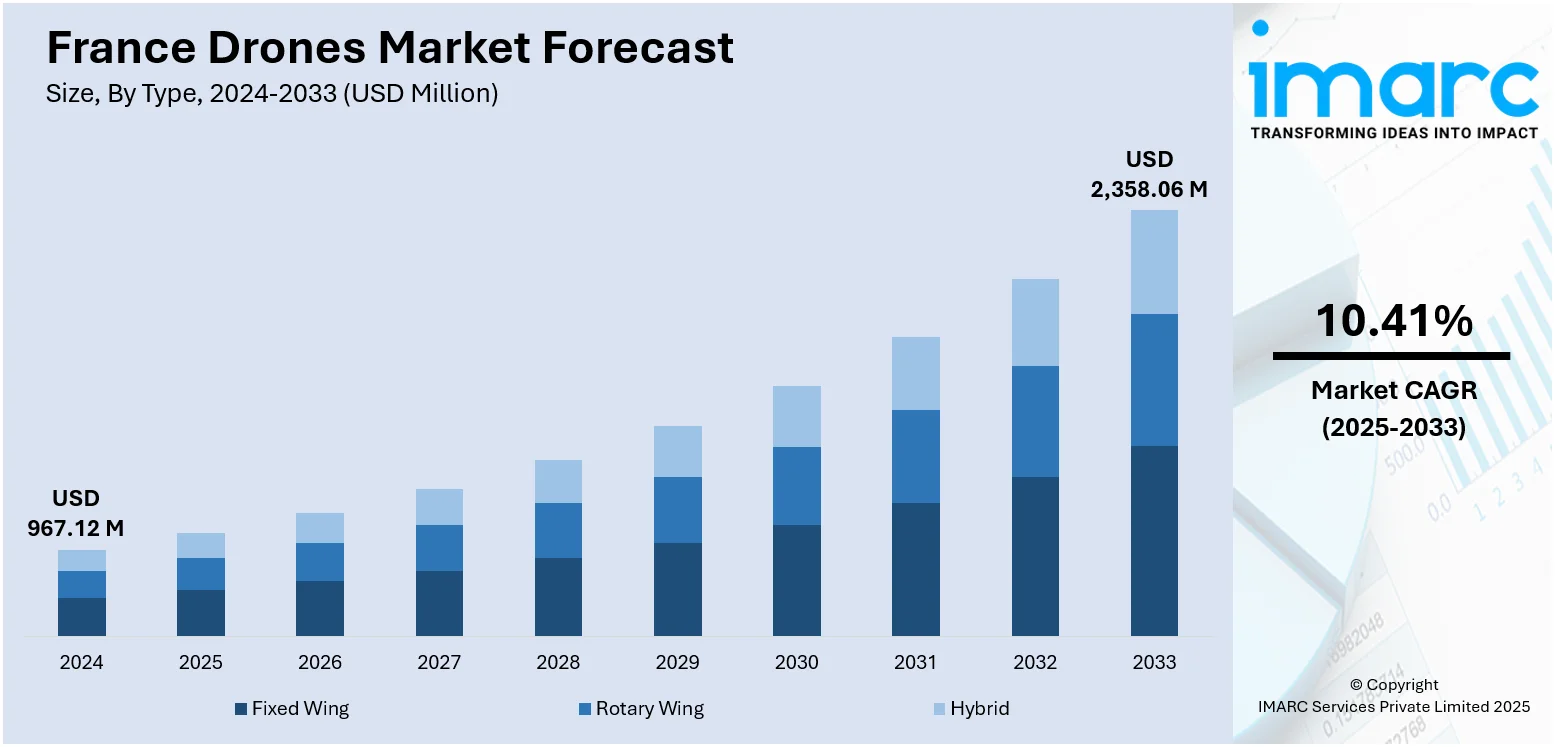

The France drones market size reached USD 967.12 Million in 2024. Looking forward, the market is expected to reach USD 2,358.06 Million by 2033, exhibiting a growth rate (CAGR) of 10.41% during 2025-2033. The market is stimulated by increasing need across agriculture, defense, infrastructure, and environmental monitoring. Vineyard precision farming, military surveillance needs, and urban planning initiatives increasingly depend on drones for efficiency and accuracy of data. Government stimulus in the form of innovation clusters, such as Aerospace Valley and changing drone regulation, also drive market growth. Application in public security, event security, and maritime use also underpins ongoing investment and development within the industry, further contributing to increased France drones market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 967.12 Million |

| Market Forecast in 2033 | USD 2,358.06 Million |

| Market Growth Rate 2025-2033 | 10.41% |

France Drones Market Trends:

Commercial and Industrial Drone Growth in Various French Industries

The French unmanned aerial vehicle market is also experiencing significant trend changes fueled by its adoption in a wide array of industrial sectors specific to the nation's geography and economy. In France's iconic wine country such as Bordeaux and Burgundy, agricultural drones are widely utilized for precision viticulture like vein health monitoring, fungal growth detection, and spraying routine optimization, merging France's legacy farming culture with advanced aerial technology. Other sectors are following suit with drone implementation: urban and rural infrastructure inspections utilize drone-mounted LiDAR and high-definition cameras to analyze bridges, railroads, and utilities with efficiency. Heritage conservation companies in the Paris area and throughout historic areas such as Versailles use drones for 3D mapping, allowing cultural preservation previously unimaginable on a large scale. Maritime officials in the English Channel collaborate with drones to monitor ship emissions and observe shipping traffic off Calais. Simultaneously, power operators in Occitanie and Provence test drones to survey renewable energy infrastructure like solar farms and offshore wind farms. This broad implementation illustrates the French trend toward industrial drone deployment adapted to local specialisms, which also contributes to the France drones market growth.

To get more information on this market, Request Sample

Regulatory Innovation and Government-Backed Ecosystem Development

France's regulatory landscape positively fosters drone development while guaranteeing security, so regulatory change itself becomes a core trend in the market. The DGAC (Direction Générale de l'Aviation Civile) has developed specific drone flight zones and a pilot registration scheme, further promoting legal adherence and organized growth. Initiatives such as Drone Zones in rural and suburban areas create testbeds for delivery drones, urban air mobility ideas, and last-mile logistics—symbolic of France's leadership in cargo drone innovation. Aerospace Valley, a competitive cluster in southwestern France, drives ecosystem development by underwriting drone swarm intelligence pilots and AI-driven mapping initiatives, combining regional R&D competencies with commercial scale‑ups. French university‑industry partnerships increasingly prioritize additive manufacturing for drones, allowing for customized 3D‑printed UAVs built closer to Toulouse to speed prototyping and local manufacture. Such regulatory and innovation developments portend a shift from casual experimentation toward professionally governed drone infrastructure within the fabric of French industrial policy.

Defense and Counter‑Drone Technology Shaping Market Dynamics

National defense imperatives and counter‑drone innovation also fuel France's trends in the drone market. French firms like Parrot and Delair have converted combat‑proven drone technology, for civilian use, increasing market acceptability for drones with resistance to electronic jamming and reliable operation in unfavorable environments. Indigenous development of the AAROK MALE drone demonstrates France's focus on sovereign unmanned platforms, balancing long endurance flight with high payload sensors capable of surveillance and strategic operations. At the same time, big‑ticket events like the Paris Olympics have spurred investment in anti-drone technology: sophisticated laser‑based neutralization systems and next‑generation radar detection are being used to secure critical infrastructure and public safety. Drone technology with a defense focus like detection, jam avoidance, and kinetic neutralization, is being cross‑leveraged into civilian markets like airport security and industrial perimeter security. This synergistic trend between defense R&D and commercial drone capabilities is dictating a unique path for the French drone ecosystem.

France Drones Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, component, payload, point of sale, and end-use industry.

Type Insights:

- Fixed Wing

- Rotary Wing

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the type. This includes fixed wing, rotary wing, and hybrid.

Component Insights:

- Hardware

- Software

- Accessories

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and accessories.

Payload Insights:

- <25 Kilograms

- 25-170 Kilograms

- >170 Kilograms

A detailed breakup and analysis of the market based on the payload have also been provided in the report. This includes <25 Kilograms, 25-170 Kilograms, and >170 Kilograms.

Point of Sale Insights:

- Original Equipment Manufacturers (OEM)

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the point of sale. This includes original equipment manufacturers (OEM) and aftermarket.

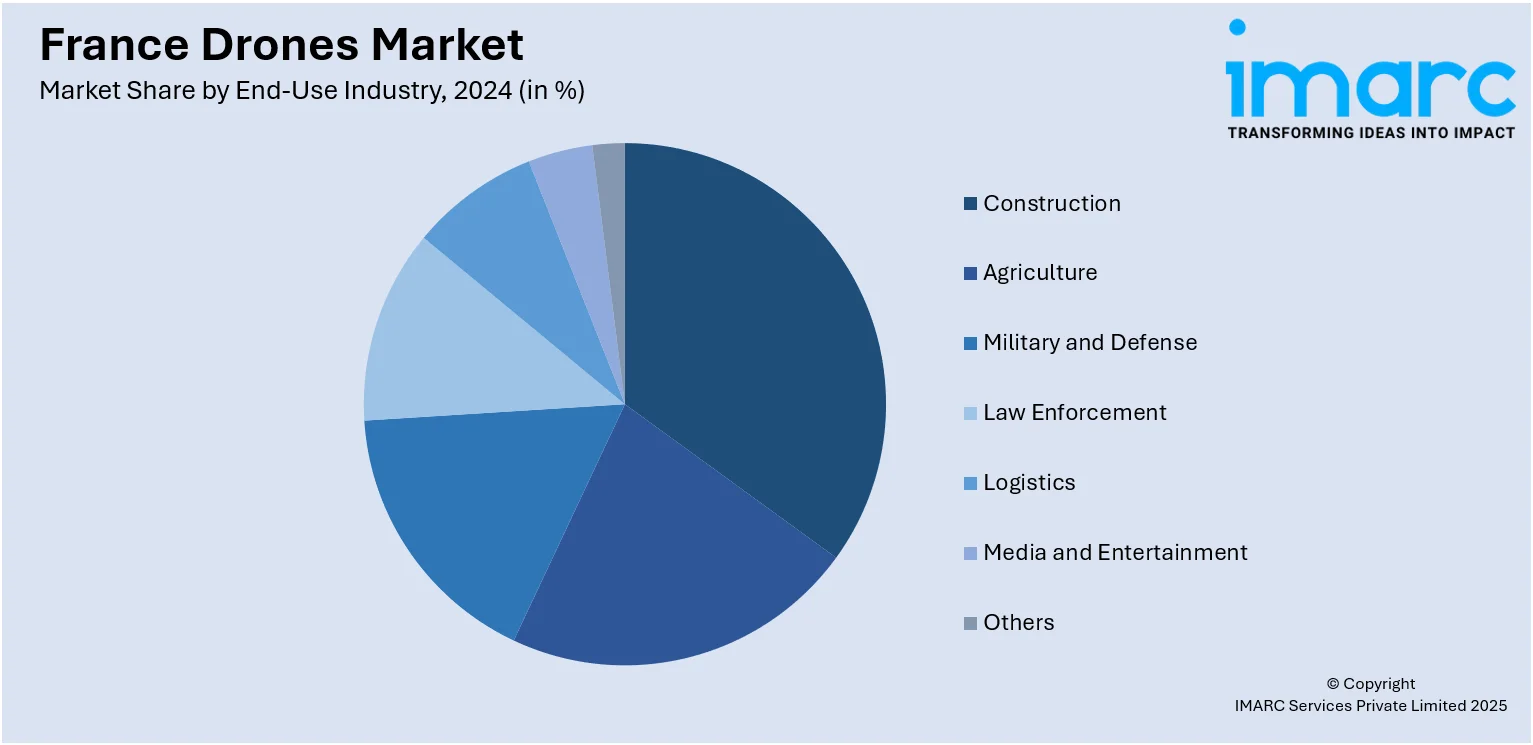

End-Use Industry Insights:

- Construction

- Agriculture

- Military and Defense

- Law Enforcement

- Logistics

- Media and Entertainment

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes construction, agriculture, military and defense, law enforcement, logistics, media and entertainment, and others.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which includes Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

France Drones Market News:

- In June 2025, France requested five domestic firms to create prototypes for a medium-altitude, long-endurance drone, finalizing contracts at the Paris Air Show this week as the nation aims for an affordable option to address a shortfall in unmanned aerial surveillance and light attack capabilities. France's Directorate General for Armament will financially support the efforts of aircraft manufacturers Aura Aero, Daher, and SE Aviation, along with drone producer Fly-R and aerospace firm Turgis Gaillard, to create rival MALE drone prototypes by 2026.

- In June 2025, Renault was contacted by France's defense ministry to assist in manufacturing drones, following the ministry's suggestion that French firms could aid in production in Ukraine.

France Drones Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fixed Wing, Rotary Wing, Hybrid |

| Components Covered | Hardware, Software, Accessories |

| Payloads Covered | <25 Kilograms, 25-170 Kilograms, >170 Kilograms |

| Points of Sales Covered | Original Equipment Manufacturers (OEM), Aftermarket |

| End-Use Industries Covered | Construction, Agriculture, Military and Defense, Law Enforcement, Logistics, Media and Entertainment, Others |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the France drones market performed so far and how will it perform in the coming years?

- What is the breakup of the France drones market on the basis of type?

- What is the breakup of the France drones market on the basis of component?

- What is the breakup of the France drones market on the basis of payload?

- What is the breakup of the France drones market on the basis of point of sale?

- What is the breakup of the France drones market on the basis of end-use industry?

- What is the breakup of the France drones market on the basis of region?

- What are the various stages in the value chain of the France drones market?

- What are the key driving factors and challenges in the France drones market?

- What is the structure of the France drones market and who are the key players?

- What is the degree of competition in the France drones market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the France drones market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the France drones market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the France drones industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)