France e-KYC Market Size, Share, Trends and Forecast by Product, Deployment Mode, End User, and Region, 2025-2033

France e-KYC Market Overview:

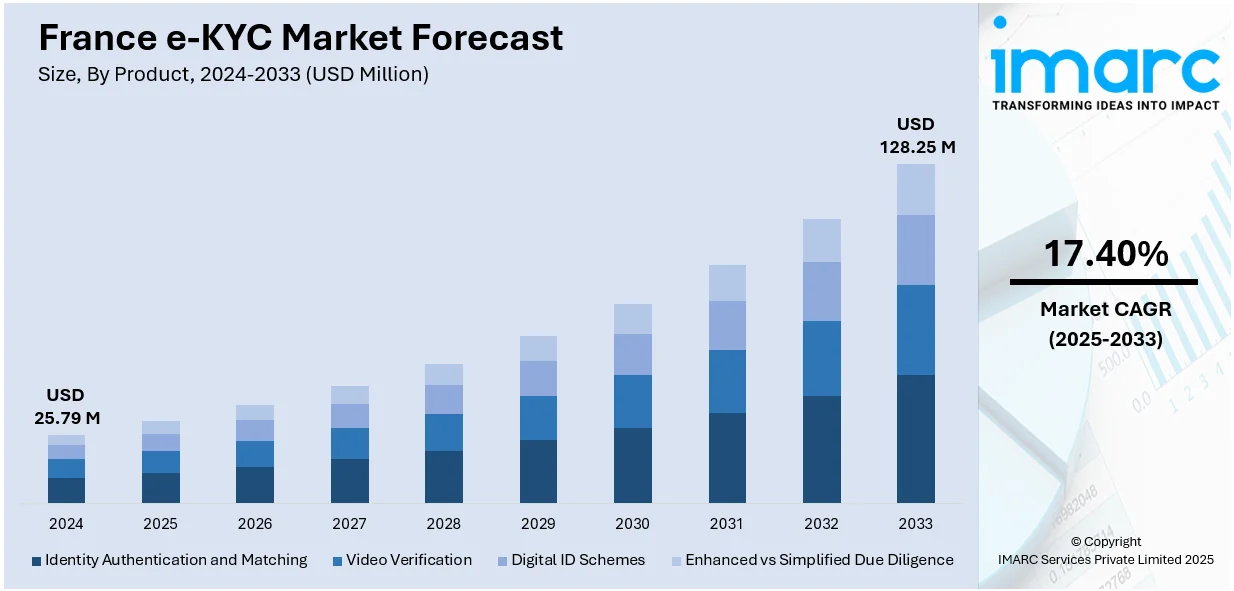

The France e-KYC market size reached USD 25.79 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 128.25 Million by 2033, exhibiting a growth rate (CAGR) of 17.40% during 2025-2033. The increase in online financial services and digital banking in France contributes to the growth of the market. Moreover, the presence of a stringent regulatory environment in the country is positively influencing the market. Additionally, the advancements in emerging technologies in artificial intelligence (AI) and biometrics are expanding the France e-KYC market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 25.79 Million |

| Market Forecast in 2033 | USD 128.25 Million |

| Market Growth Rate 2025-2033 | 17.40% |

France e-KYC Market Trends:

Growing Demand for Mobile Financial Services

The increase in online financial services and digital banking in France contributes to the growth of the market. With the rise in the adoption of digital platforms by more financial companies and fintech organizations, there is a greater demand to automate customer verification processes. Electronic-know your customer (e-KYC) technology provides quicker, more efficient ways of verifying identities, enabling businesses to comply with regulatory obligations without the time loss associated with manual in-person verification. The movement towards online channels is particularly strong in the banking, insurance, and payment industries, where people expect instant account opening and transactions. Therefore, e-KYC solutions play a key role in the enforcement of anti-money laundering (AML) and combating the financing of terrorism (CFT) laws, enabling smooth onboarding while preventing fraud and identity theft risks. The deepening penetration of the internet and smartphones further drives e-KYC technologies' adoption at a faster rate, making them a central part of the French modern financial services infrastructure. Beginning April 29, 2025, some French banks planned to halt transfers over €1,000 for as long as 72 hours if any irregularities are identified. This is a component of a larger plan to identify questionable transactions and stop money from moving through the unmonitored system. These AML initiatives are also responsible for the adoption of advanced e-KYC solutions in the country.

To get more information on this market, Request Sample

Stringent Regulatory Environment

The French regulatory environment is offering a favorable market outlook. France follows the European Union's anti-money laundering (AML) directives and the General Data Protection Regulation (GDPR), both of which require stringent identity verification processes. Banks are under growing pressure to deploy sophisticated e-KYC solutions to ensure compliance with these regulations, as they provide safe, compliant, and streamlined ways of authenticating customers' identities in real-time. The French regulatory authorities are strong on the need for sound customer due diligence (CDD) procedures, encouraging companies to spend on digital solutions that facilitate efficient compliance. In addition, with the French government persistently tightening data privacy and protection regulations, businesses are motivated to adopt secure digital means of identification verification to avoid fraud and maintain privacy protection.

Advancements in Artificial Intelligence (AI) and Biometrics Technologies

Emerging technologies in artificial intelligence (AI) and biometrics are contributing to the France e-KYC market growth. The combination of AI-based facial recognition, document verification, and machine learning algorithms for e-KYC solutions highly improves the accuracy and reliability of identity verification processes. These technologies help businesses to authenticate customer identities with higher accuracy, limiting the possibilities of fraud and identity manipulation. In addition, biometric solutions like fingerprint and facial recognition add layers of security, which secure the verification process and make it more convenient for users. As people increasingly look for convenience and security, such advanced technology delivers a simplified, frictionless experience for digital onboarding. AI and biometrics also help automate KYC procedures, minimizing manual interventions and accelerating the verification timeline. In 2024, IDEMIA Public Security, the top provider of reliable and secure biometric solutions, and SECURE Systems, a subsidiary of VINCI Energies, declared the release of their collaboratively created solution that allows the innovative MorphoWave biometric terminal to function in transparent card reading mode. In reaction to increasing demand for security and European technological independence, this solution, driven by the Smart Secure Common Protocol (SSCP) from SPAC Alliance, ensures top-tier security while adhering to the highest standards for Operators of Vital Importance (OIV) and critical infrastructures in France and internationally.

France e-KYC Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, deployment mode, and end user.

Product Insights:

- Identity Authentication and Matching

- Video Verification

- Digital ID Schemes

- Enhanced vs Simplified Due Diligence

The report has provided a detailed breakup and analysis of the market based on the product. This includes identity authentication and matching, video verification, digital id schemes, and enhanced vs simplified due diligence.

Deployment Mode Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes cloud-based and on-premises.

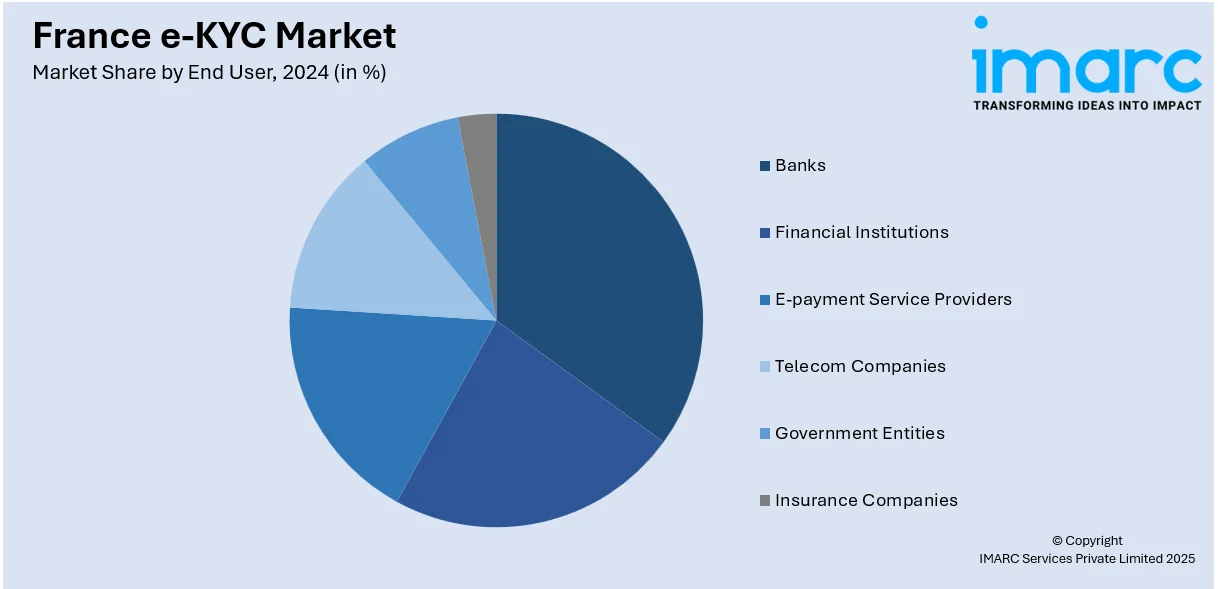

End User Insights:

- Banks

- Financial Institutions

- E-payment Service Providers

- Telecom Companies

- Government Entities

- Insurance Companies

The report has provided a detailed breakup and analysis of the market based on the end user. This includes banks, financial institutions, e-payment service providers, telecom companies, government entities, and insurance companies.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

France e-KYC Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Identity Authentication and Matching, Video Verification, Digital ID Schemes, Enhanced vs Simplified Due Diligence |

| Deployment Modes Covered | Cloud-based, On-Premises |

| End Users Covered | Banks, Financial Institutions, E-Payment Service Providers, Telecom Companies, Government Entities, Insurance Companies |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the France e-KYC market performed so far and how will it perform in the coming years?

- What is the breakup of the France e-KYC market on the basis of product?

- What is the breakup of the France e-KYC market on the basis of deployment mode?

- What is the breakup of the France e-KYC market on the basis of end user?

- What is the breakup of the France e-KYC market on the basis of region?

- What are the various stages in the value chain of the France e-KYC market?

- What are the key driving factors and challenges in the France e-KYC market?

- What is the structure of the France e-KYC market and who are the key players?

- What is the degree of competition in the France e-KYC market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the France e-KYC market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the France e-KYC market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the France e-KYC industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)