France Electric Two-Wheeler Market Size, Share, Trends and Forecast by Vehicle Type, Battery Type, Voltage Type, Peak Power, Battery Technology, Motor Placement, and Region, 2025-2033

France Electric Two-Wheeler Market Overview:

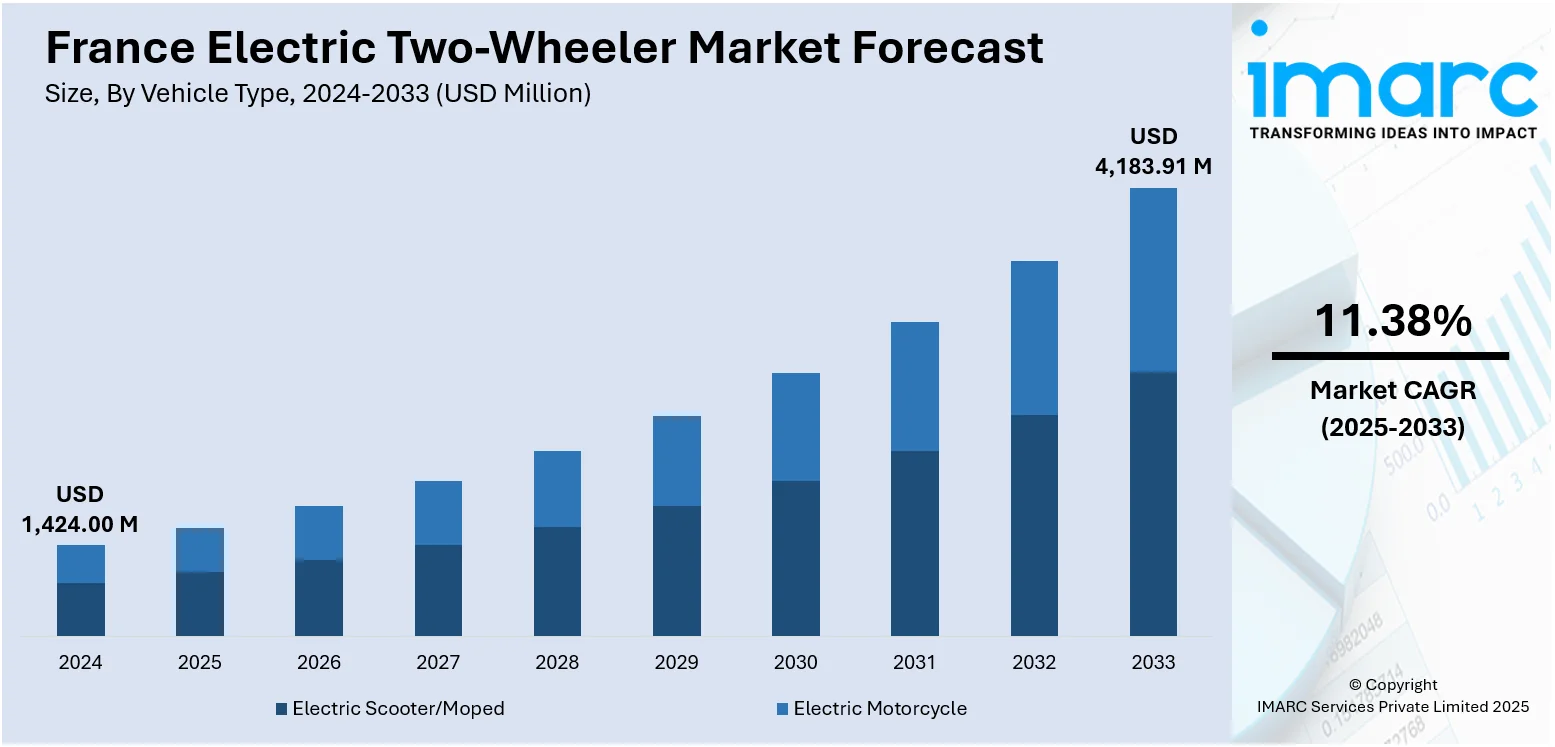

The France electric two-wheeler market size reached USD 1,424.00 Million in 2024. The market is projected to reach USD 4,183.91 Million by 2033, exhibiting a growth rate (CAGR) of 11.38% during 2025-2033. The market in France is driven by growing environmental concerns, stringent government emissions regulations, and attractive subsidies for electric vehicle adoption. Urban congestion and rising fuel costs are pushing consumers toward cost-effective, eco-friendly mobility solutions. Additionally, expanding charging infrastructure and technological advancements in battery performance enhance user convenience and vehicle efficiency. The increasing popularity of shared mobility services and strong support for sustainable transportation initiatives further accelerate the France electric two-wheeler market share for electric scooters and motorcycles across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,424.00 Million |

| Market Forecast in 2033 | USD 4,183.91 Million |

| Market Growth Rate 2025-2033 | 11.38% |

France Electric Two-Wheeler Market Trends:

Urbanization and Traffic Congestion

One of the key France electric two-wheeler market trends is the increasing urbanization and traffic congestion within cities are strong reasons behind the growth in the adoption of electric two-wheelers. As city centers get congested, conventional vehicles are plagued by parking, maneuvering, and traffic holdup issues. Electric two-wheelers provide a sensible urban mobility solution with compact and lightweight designs that offer perfect short-distance transportation. In Paris, Lyon, and Marseille cities, electric scooters and mopeds are being widely adopted by commuters to save time and escape waiting times for public transport. Also, numerous municipalities are investing in micro-mobility-friendly infrastructure, including two-wheeler lanes and parking spots. With growing city sizes, space-efficient and effective transport is becoming ever more important, and electric two-wheelers are an extremely appealing choice in such a scenario. Their silent mode of operation and lack of tailpipe emissions also fit nicely with urban environmental objectives and noise reduction initiatives.

To get more information on this market, Request Sample

Government Incentives and Regulations

One of the most significant drivers in the French electric two-wheeler market is strong government support through incentives and regulatory policies. France has implemented subsidies like the “Bonus écologique” and local grants from cities such as Paris, making electric scooters more affordable and accessible. This financial encouragement, combined with stringent emissions regulations and a national goal to phase out internal combustion engine vehicles by 2040, creates strong motivation for consumers to adopt electric alternatives. Low Emission Zones (ZFE) in major urban areas further discourage petrol-powered vehicle use, reinforcing the shift toward cleaner mobility. These efforts are proving effective—by May 2024, France saw a 29.8% year-to-date increase in electric two-wheeler sales, outpacing other Western European countries. This growth highlights how favorable policy frameworks and urban environmental goals are directly impacting the France electric two-wheeler market growth.

Technological Advancements and Product Innovation

Advances in battery technology, motor efficiency, and vehicle design technology are contributing significantly to speeding up the development of electric two-wheelers in France. New lithium-ion batteries provide longer ranges, quick charging times, and better durability, making electric scooters and motorcycles more usable and desirable for daily use. French and global makers are innovating continuously to enhance performance, decrease weight, and advance features such as regenerative braking, connectivity (through smartphone sapps), and smart diagnostics. These advancements enhance user experience, reliability, and overall cost of ownership, persuading more customers to switch from gasoline-powered models. In addition, modular battery systems and battery swaps are picking up steam, particularly for shared mobility services. With continuing developments in technology and economies of scale reducing the cost of manufacturing, electric two-wheelers are increasingly competitive with conventional vehicles, and their market share in both personal and commercial user segments is increasing.

France Electric Two-Wheeler Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on vehicle type, battery type, voltage type, peak power, battery technology, and motor placement.

Vehicle Type Insights:

- Electric Scooter/Moped

- Electric Motorcycle

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes electric scooter/moped, and electric motorcycle.

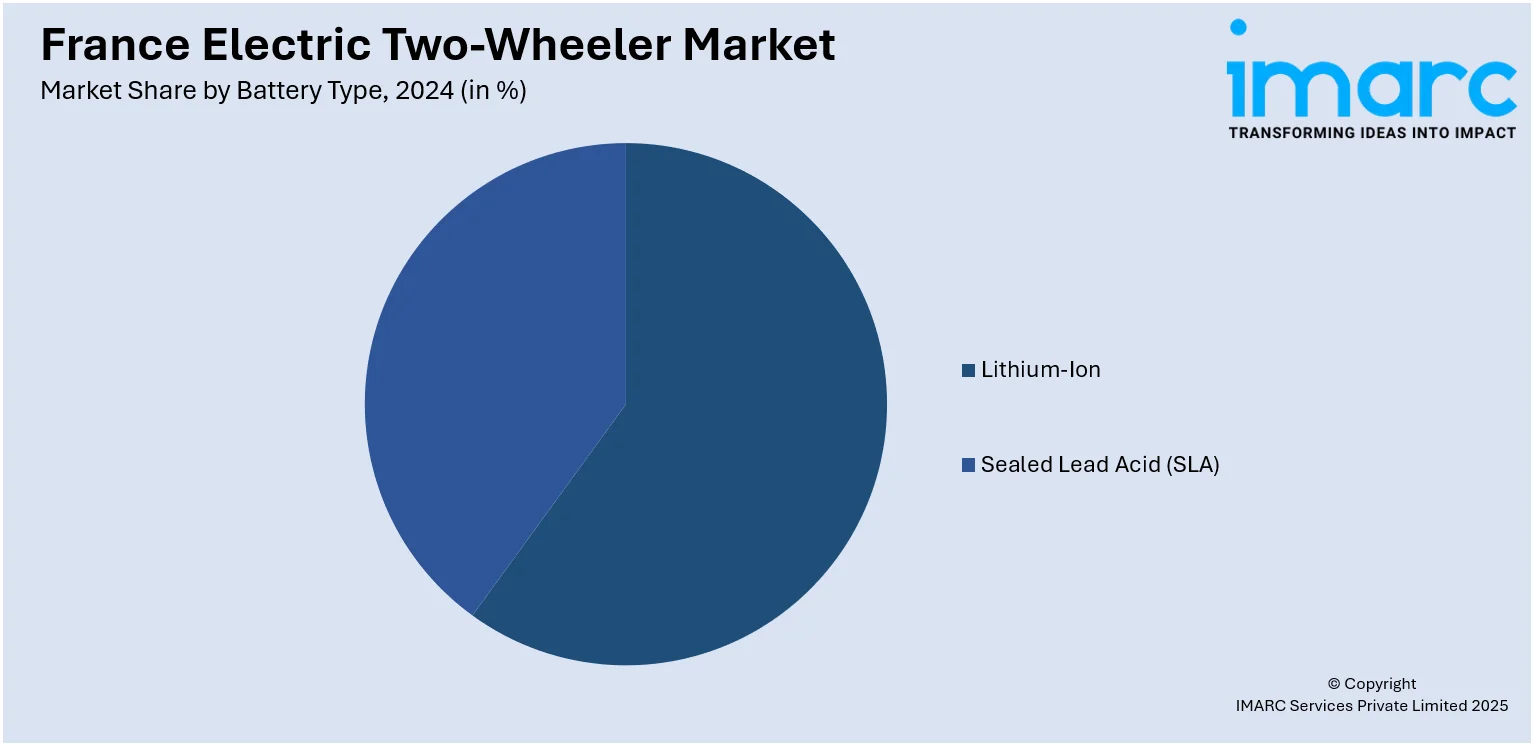

Battery Type Insights:

- Lithium-Ion

- Sealed Lead Acid (SLA)

A detailed breakup and analysis of the market based on the battery type have also been provided in the report. This includes lithium-ion, and sealed lead acid (SLA).

Voltage Type Insights:

- <48V

- 48-60V

- 61-72V

- 73-96V

- >96V

A detailed breakup and analysis of the market based on the voltage type have also been provided in the report. This includes <48V, 48-60V, 61-72V, 73-96V, and >96V.

Peak Power Insights:

- <3 kW

- 3-6 kW

- 7-10 kW

- >10 kW

A detailed breakup and analysis of the market based on the peak power have also been provided in the report. This includes <3 kW, 3-6 kW, 7-10 kW, and >10 kW.

Battery Technology Insights:

- Removable

- Non-Removable

A detailed breakup and analysis of the market based on the battery technology have also been provided in the report. This includes removable, and non-removable.

Motor Placement Insights:

- Hub Type

- Chassis Mounted

A detailed breakup and analysis of the market based on the motor placement have also been provided in the report. This includes hub type, and chassis mounted.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

France Electric Two-Wheeler Market News:

- In July 2025, Hero MotoCorp is set to launch its all-electric Vida sub-brand in the UK, Germany, France, and Spain this September, starting with the Vida Z electric scooter. Following this, high-end ICE models like the Xtreme 250R and XPulse 421 will enter the European market. With strong growth across 48 global markets, Hero’s European push marks a major step in its global expansion and commitment to sustainable mobility.

- In June 2025, Bengaluru-based Ultraviolette launched its F77 electric motorcycles in ten European countries, including France, Germany, and the UK. The F77 MACH 2 and SuperStreet models offer up to 30 kW power, 100 Nm torque, and a top speed of 155 km/h. Key features include Violette A.I., Bosch ABS, and multiple traction and braking modes. Introductory prices start at €8,990 for pre-bookings before July 31, 2025.

- In July 2025, TVS Motor Company is launching its premium EV and ICE two-wheelers, including the iQube S, TVS X, and Apache series, in France and Italy as part of its European expansion. Partnering with Emil Frey for distribution, the move marks TVS’s entry into key EU markets. The company also plans new premium products under its UK-based Norton brand by 2025-26, aiming to strengthen its global presence amid recovering export markets.

France Electric Two-Wheeler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Electric Scooter/Moped, Electric Motorcycle |

| Battery Types Covered | Lithium-Ion, Sealed Lead Acid (SLA) |

| Voltage Types Covered | <48V, 48-60V, 61-72V, 73-96V, >96V |

| Peak Powers Covered | <3 kW, 3-6 kW, 7-10 kW, >10 kW |

| Battery Technologies Covered | Removable, Non-Removable |

| Motor Placements Covered | Hub Type, Chassis Mounted |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the France electric two-wheeler market performed so far and how will it perform in the coming years?

- What is the breakup of the France electric two-wheeler market on the basis of vehicle type?

- What is the breakup of the France electric two-wheeler market on the basis of battery type?

- What is the breakup of the France electric two-wheeler market on the basis of voltage type?

- What is the breakup of the France electric two-wheeler market on the basis of peak power?

- What is the breakup of the France electric two-wheeler market on the basis of battery technology?

- What is the breakup of the France electric two-wheeler market on the basis of motor placement?

- What is the breakup of the France electric two-wheeler market on the basis of region?

- What are the various stages in the value chain of the France electric two-wheeler market?

- What are the key driving factors and challenges in the France electric two-wheeler market?

- What is the structure of the France electric two-wheeler market and who are the key players?

- What is the degree of competition in the France electric two-wheeler market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the France electric two-wheeler market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the France electric two-wheeler market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the France electric two-wheeler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)