France Family Offices Market Size, Share, Trends and Forecast by Type, Office Type, Asset Class, Service Type, and Region, 2026-2034

France Family Offices Market Summary:

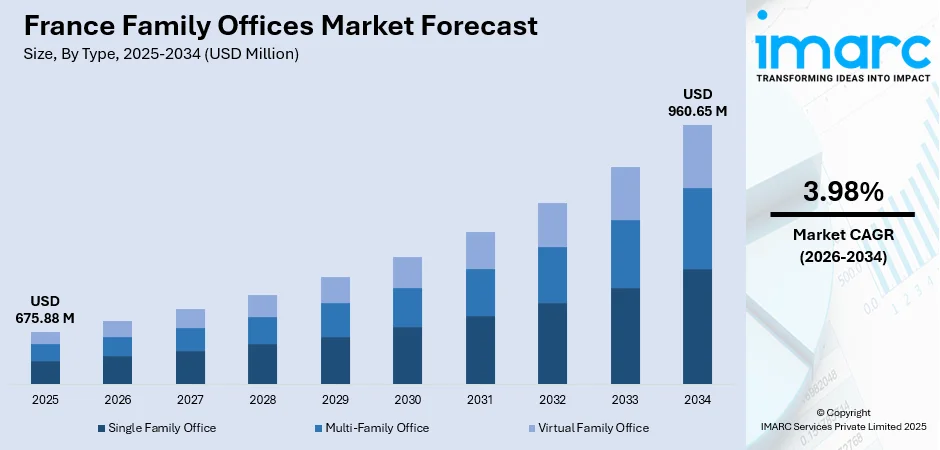

The France family offices market size was valued at USD 675.88 Million in 2025 and is projected to reach USD 960.65 Million by 2034, growing at a compound annual growth rate of 3.98% from 2026-2034.

The France family offices market is experiencing steady expansion driven by the growing concentration of wealth among ultra-high-net-worth individuals seeking comprehensive wealth management solutions. Increasing demand for personalized financial planning, tax optimization strategies, and multigenerational wealth preservation continues to fuel market development. The rising complexity of global investments and regulatory requirements encourages affluent families to establish dedicated structures for managing diverse asset portfolios.

Key Takeaways and Insights:

- By Type: Single family office dominates the market with a share of 48.6% in 2025, driven by wealthy families' preference for personalized investment management and complete control over strategic decisions. Growing emphasis on privacy, customized governance structures, and dedicated advisory services continues strengthening this segment.

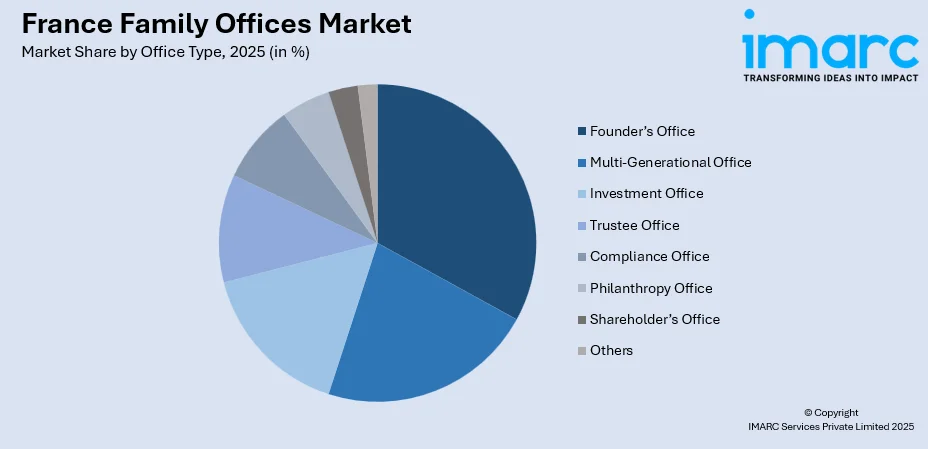

- By Office Type: Founder’s office leads the market with a share of 21% in 2025, reflecting the prominence of first-generation entrepreneurs requiring tailored wealth structuring as they transition from active business operations to comprehensive asset management and legacy planning.

- By Asset Class: Equities represent the biggest segment with a market share of 34% in 2025, underscoring French family offices' commitment to capital appreciation through diversified stock portfolios and direct investments in established corporations alongside emerging growth companies.

- By Service Type: Financial planning exhibits a clear dominance in the market with 29.2% share in 2025, reflecting family offices' prioritization of comprehensive wealth strategies encompassing investment allocation, tax efficiency, retirement preparation, and intergenerational transfer planning.

- By Region: Paris Region is the largest region with 40% share in 2025, driven by the capital's concentration of financial expertise, proximity to private equity networks, established banking infrastructure, and access to premier wealth advisory services serving affluent families.

- Key Players: Key players drive the France family offices market by expanding service portfolios, enhancing digital capabilities, and strengthening advisory expertise. Their investments in technology integration, succession planning solutions, and sustainable investment frameworks support growing client demands while ensuring comprehensive wealth management.

To get more information on this market Request Sample

The France family offices market demonstrates robust fundamentals as wealthy families increasingly prioritize sophisticated wealth management structures to navigate complex financial landscapes. The market benefits from France's position as a leading European financial center, with Paris hosting an extensive network of wealth advisors, private bankers, and investment specialists serving ultra-high-net-worth clients. The market witnesses accelerating demand for comprehensive services spanning investment management, tax planning, estate structuring, and philanthropic advisory. Family offices are increasingly engaging with environmental, social, and governance principles, integrating sustainable investment criteria into portfolio decisions. The ongoing intergenerational wealth transfer creates substantial opportunities for service providers offering tailored succession planning and next-generation engagement programs. Aging principals within established families are proactively formalizing governance frameworks to ensure smooth transitions of both assets and decision-making authority. Digital transformation initiatives continue reshaping operational frameworks as family offices adopt advanced analytics, portfolio management platforms, and consolidated reporting technologies to enhance efficiency and client service delivery.

France Family Offices Market Trends:

Rising Allocation to Private Equity Investments

French family offices are significantly expanding their private equity allocations as they seek enhanced returns beyond traditional asset classes. Wealthy families increasingly favor direct investments and co-investment opportunities that provide greater control over portfolio companies. This trend reflects a broader preference for long-term value creation strategies that align with patient capital philosophies. Family offices are actively targeting technology, healthcare, and sustainable enterprise sectors to capture growth opportunities while diversifying risk across multiple investment vintages.

Growing Integration of Sustainable Investment Practices

Environmental, social, and governance considerations are becoming integral to French family office investment frameworks as next-generation principals assume leadership roles. Wealthy families increasingly view responsible investing as essential for preserving long-term portfolio value while aligning with personal values. Climate-focused strategies, impact investing initiatives, and ESG screening protocols are gaining prominence across investment decision processes. This shift reflects broader societal expectations and evolving regulatory requirements surrounding sustainable finance disclosure and reporting standards.

Accelerating Digital Transformation and Technology Adoption

French family offices are embracing technological innovation to enhance operational efficiency, investment analytics, and client reporting capabilities. Advanced portfolio management platforms, data aggregation tools, and artificial intelligence applications are transforming traditional wealth management practices. Family offices increasingly recognize technology as critical for maintaining competitive advantage and meeting sophisticated client expectations. Digital solutions support improved risk monitoring, performance attribution, and consolidated reporting across diverse and complex asset portfolios.

Market Outlook 2026-2034:

The France family offices market outlook remains positive as structural drivers continue supporting long-term expansion. Growing wealth concentration among affluent families, increasing regulatory complexity, and evolving investment opportunities create sustained demand for comprehensive family office services. The market generated a revenue of USD 675.88 Million in 2025 and is projected to reach a revenue of USD 960.65 Million by 2034, growing at a compound annual growth rate of 3.98% from 2026-2034. The ongoing intergenerational wealth transfer presents significant growth opportunities as established families formalize governance structures and professionalize investment management. Paris's strengthening position as a European financial hub following Brexit continues attracting international wealth management expertise and enhancing service capabilities available to French families. Expanding alternative investment allocations, deepening ESG integration, and advancing technology adoption will define competitive differentiation throughout the forecast period.

France Family Offices Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Single Family Office |

48.6% |

|

Office Type |

Founder’s Office |

21% |

|

Asset Class |

Equities |

34% |

|

Service Type |

Financial Planning |

29.2% |

|

Region |

Paris Region |

40% |

Type Insights:

- Single Family Office

- Multi-Family Office

- Virtual Family Office

Single family office dominates with a market share of 48.6% of the total France family offices market in 2025.

The single family office segment maintains commanding market leadership as wealthy French families prioritize dedicated structures delivering exclusive attention to their comprehensive wealth management requirements. These entities provide complete control over investment decisions, personalized governance frameworks, and confidential advisory services tailored specifically to individual family circumstances. Single family offices accommodate unique investment philosophies, risk tolerances, and legacy objectives that standardized wealth management solutions cannot adequately address.

Single family offices in France serve as comprehensive platforms managing diverse responsibilities including investment portfolio oversight, tax planning coordination, estate administration, and family governance facilitation. These structures enable wealthy families to consolidate professional expertise under unified management while maintaining strict confidentiality standards essential for high-profile households. Paris hosts the majority of French single family offices, benefiting from proximity to established financial markets, experienced advisory professionals, and extensive private equity networks. The segment continues strengthening as first-generation entrepreneurs formalize wealth structures following successful business exits and inheritance events. Growing regulatory complexity and expanding alternative investment allocations further encourage families to establish dedicated offices rather than relying on fragmented external advisory relationships.

Office Type Insights:

Access the comprehensive market breakdown Request Sample

- Founder’s Office

- Multi-Generational Office

- Investment Office

- Trustee Office

- Compliance Office

- Philanthropy Office

- Shareholder’s Office

- Others

Founder’s office leads with a share of 21% of the total France family offices market in 2025.

The Founder’s office segment captures significant market share as first-generation entrepreneurs establish dedicated wealth management structures following successful business ventures and liquidity events. These offices focus on transitioning entrepreneurs from active operational roles to strategic asset oversight while preserving the concentrated positions that generated initial wealth. The 2024 Julius Baer Family Barometer revealed that 37% of wealth transfer discussions still occur informally without structured planning, highlighting substantial opportunity for founder-focused advisory services. Founder's offices address the unique challenges of newly liquid entrepreneurs including concentrated stock positions, emotional attachments to operating businesses, and unfamiliarity with diversified portfolio management.

French founder's offices provide specialized expertise addressing the particular requirements of first-generation wealth creators navigating complex financial transitions. These structures assist entrepreneurs with business succession planning, liquidity management strategies, and the establishment of governance frameworks appropriate for newly formed family wealth. Professional staff guide founders through investment diversification decisions, charitable giving structures, and estate planning considerations that may be unfamiliar following decades of business-focused attention. The segment benefits from France's vibrant entrepreneurial ecosystem generating continuous supply of newly affluent families requiring sophisticated wealth structuring solutions.

Asset Class Insights:

- Bonds

- Equities

- Alternative Investments

- Commodities

- Cash or Cash Equivalents

Equities exhibit a clear dominance with a 34% share of the total France family offices market in 2025.

The equities segment commands substantial market share as French family offices maintain significant allocations to publicly traded securities for capital appreciation and liquidity purposes. Family offices strategically balance holdings across domestic French companies, European markets, and global opportunities to optimize risk-adjusted returns. Recent trends indicate growing equity allocations among French family offices, reflecting renewed confidence in stock market fundamentals despite economic uncertainties. This momentum demonstrates family offices' commitment to building diversified portfolios combining established blue-chip positions with selective growth opportunities across technology, healthcare, and consumer sectors.

French family offices utilize sophisticated equity strategies spanning direct stock ownership, managed portfolios, and exchange-traded instruments to access global market opportunities efficiently. These investors increasingly engage with small and medium enterprises through direct investments that leverage operational expertise accumulated through family business backgrounds. Equity allocations provide essential liquidity supporting other portfolio initiatives including private equity commitments and real estate acquisitions. Family offices actively manage concentration risks arising from legacy holdings while seeking opportunities in emerging sectors aligned with long-term thematic convictions surrounding technological transformation, demographic shifts, and sustainability transitions.

Service Type Insights:

- Financial Planning

- Strategy

- Governance

- Advisory

- Others

Financial planning represents the leading segment with a 29.2% share of the total France family offices market in 2025.

The financial planning segment captures the largest service share as French family offices prioritize comprehensive wealth strategies addressing complex multigenerational requirements. Services encompass investment policy development, asset allocation optimization, tax efficiency planning, retirement preparation, and intergenerational transfer structuring. Financial and non-financial value-added services represent significant growth opportunities as families prepare for substantial wealth transfers to subsequent generations. Financial planning professionals guide families through increasingly complex regulatory environments while coordinating diverse advisors including tax specialists, estate attorneys, and investment managers.

French family offices engage comprehensive financial planning services to navigate evolving tax landscapes, optimize portfolio structures, and prepare effective succession frameworks. These services integrate investment management decisions with broader family objectives spanning education funding, charitable giving, and lifestyle maintenance across generations. Professional financial planners coordinate multiple family stakeholders to establish shared goals, clarify expectations, and document governance protocols preventing future disputes. The segment benefits from increasing regulatory complexity requiring specialized expertise in cross-border taxation, European investment regulations, and sustainable finance disclosure requirements affecting sophisticated portfolios.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

Paris Region holds the largest share with 40% of the total France family offices market in 2025.

The Paris Region dominates the French family offices market benefiting from its established position as Europe's leading financial center and hub for private capital. The region hosts more than 364 private equity funds alongside an extensive network of wealth management professionals, private banks, and specialized advisory firms serving ultra-high-net-worth families. The capital's comprehensive financial ecosystem provides families access to diverse investment opportunities, experienced professionals, and sophisticated infrastructure supporting complex wealth structures. Paris attracts premier talent across investment management, tax advisory, legal services, and family governance disciplines, creating unmatched service depth for affluent clients.

The region's prominence strengthened following Brexit as international financial institutions expanded their European operations within the French capital, enhancing available expertise and market connectivity. Family offices benefit from proximity to major corporate headquarters, venture capital networks, and real estate investment platforms concentrated within the metropolitan area. The presence of leading business schools and financial training institutions ensures continuous pipeline of qualified professionals supporting family office operational requirements and succession needs.

Market Dynamics:

Growth Drivers:

Why is the France Family Offices Market Growing?

Expanding Wealth Concentration and UHNWI Population

France continues experiencing significant wealth concentration among ultra-high-net-worth individuals driving demand for sophisticated family office services. The expanding population of wealthy families requires comprehensive wealth management solutions addressing complex investment portfolios, tax optimization strategies, and intergenerational transfer planning. Growing entrepreneurial success across technology, luxury goods, healthcare, and professional services sectors generates continuous pipeline of newly affluent families establishing dedicated wealth structures. France's favorable positioning as a major European economy attracts international wealth alongside domestic wealth creation, further expanding the addressable market for family office services. The increasing complexity of managing diverse global investments, regulatory compliance requirements, and family governance considerations encourages affluent families to professionalize their wealth management through dedicated office structures rather than relying on fragmented advisory relationships.

Accelerating Intergenerational Wealth Transfer Dynamics

The ongoing intergenerational wealth transfer represents a fundamental growth catalyst as established families formalize governance structures and professionalize investment management. Aging principals within wealthy families are proactively establishing succession frameworks to ensure smooth transitions of both assets and decision-making authority to subsequent generations. This transition period creates substantial demand for family office services encompassing succession planning, next-generation education, family constitution development, and governance protocol establishment. The complexity of transferring diverse portfolios spanning operating businesses, real estate holdings, private investments, and liquid securities requires coordinated professional expertise unavailable through traditional advisory relationships. Family offices provide integrated platforms managing these multifaceted transitions while maintaining family cohesion and shared purpose across generational boundaries.

Growing Demand for Alternative Investment Access

French family offices increasingly prioritize alternative investments including private equity, venture capital, real estate, and infrastructure as they seek enhanced returns beyond traditional public market allocations. This shift toward alternatives requires sophisticated due diligence capabilities, ongoing portfolio monitoring, and specialized expertise that family offices are uniquely positioned to provide. Wealthy families leverage their patient capital advantages and long-term investment horizons to access opportunities unavailable to institutional investors facing shorter-term performance pressures. The growing sophistication of alternative investment strategies, including direct co-investments alongside established private equity sponsors, creates demand for dedicated professional teams managing these complex relationships. Family offices enable families to participate meaningfully in alternative asset classes while maintaining appropriate diversification and risk management across comprehensive portfolios.

Market Restraints:

What Challenges the France Family Offices Market is Facing?

Talent Acquisition and Retention Difficulties

Family offices face significant challenges attracting and retaining qualified professionals capable of managing sophisticated investment strategies and complex family dynamics. Competition from established financial institutions offering structured career paths, comprehensive benefits, and competitive compensation packages creates persistent recruitment difficulties. The specialized skill set combining investment expertise, interpersonal capabilities, and discretion required for family office roles limits the available talent pool, constraining operational capacity and service quality.

Increasing Regulatory Complexity and Compliance Burden

Evolving regulatory requirements across tax, investment, and reporting domains create substantial compliance burdens for family offices operating in France. European Union directives surrounding sustainable finance disclosure, cross-border taxation, and anti-money laundering protocols demand continuous adaptation and specialized expertise. These regulatory pressures increase operational costs while diverting professional resources from core wealth management activities, potentially constraining service delivery and investment performance outcomes.

Succession Planning Implementation Challenges

Many family offices struggle implementing effective succession frameworks despite recognizing their critical importance for long-term sustainability. Emotional complexities surrounding wealth transfer discussions, divergent family member expectations, and inadequate preparation of next-generation principals create implementation barriers. These succession challenges risk disruption to investment strategies, professional team stability, and family cohesion during critical transition periods, potentially undermining long-term wealth preservation objectives.

Competitive Landscape:

The France family offices market demonstrates a fragmented competitive landscape comprising single family offices, multi-family office platforms, private banks, and specialized wealth advisors competing for affluent clientele. Competition centers on service comprehensiveness, investment performance, professional expertise, and relationship quality rather than pricing considerations. Market participants differentiate through specialized capabilities including alternative investment access, succession planning expertise, and technology-enabled reporting solutions. Leading platforms continue expanding service portfolios through strategic partnerships, talent acquisitions, and technology investments to address evolving client requirements. Consolidation trends among smaller operators create opportunities for established players to capture market share while maintaining personalized service delivery essential for ultra-high-net-worth relationships.

Recent Developments:

- In June 2025, Indosuez Wealth Management, a subsidiary of Crédit Agricole Group, announced plans to acquire the wealth management clients of BNP Paribas Group in Monaco through its CFM Indosuez entity. This acquisition would strengthen Indosuez's leading position in the Monegasque market, where it has operated since 1922, while providing BNP Paribas clients continued access to comprehensive international wealth services.

France Family Offices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Single Family Office, Multi-Family Office, Virtual Family Office |

| Office Types Covered | Founder’s Office, Multi-Generational Office, Investment Office, Trustee Office, Compliance Office, Philanthropy Office, Shareholder’s Office, Others |

| Asset Classes Covered | Bonds, Equalities, Alternatives Investments, Commodities, Cash or Cash Equivalents |

| Service Types Covered | Financial Planning, Strategy, Governance, Advisory, Others |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The France family offices market size was valued at USD 675.88 Million in 2025.

The France family offices market is expected to grow at a compound annual growth rate of 3.98% from 2026-2034 to reach USD 960.65 Million by 2034.

Single family office dominated the market with a share of 48.6%, reflecting wealthy families' preference for dedicated structures providing complete control over investment decisions, personalized governance frameworks, and confidential advisory services.

Key factors driving the France family offices market include expanding wealth concentration, accelerating intergenerational transfers, growing demand for alternative investments, increasing regulatory complexity, and Paris's strengthening position as a European financial hub.

Major challenges include talent acquisition difficulties, increasing regulatory compliance burden, succession planning implementation complexities, economic uncertainty impacts, and technology integration requirements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)