France Foreign Exchange Market Size, Share, Trends and Forecast by Counterparty, Type, and Region, 2025-2033

France Foreign Exchange Market Overview:

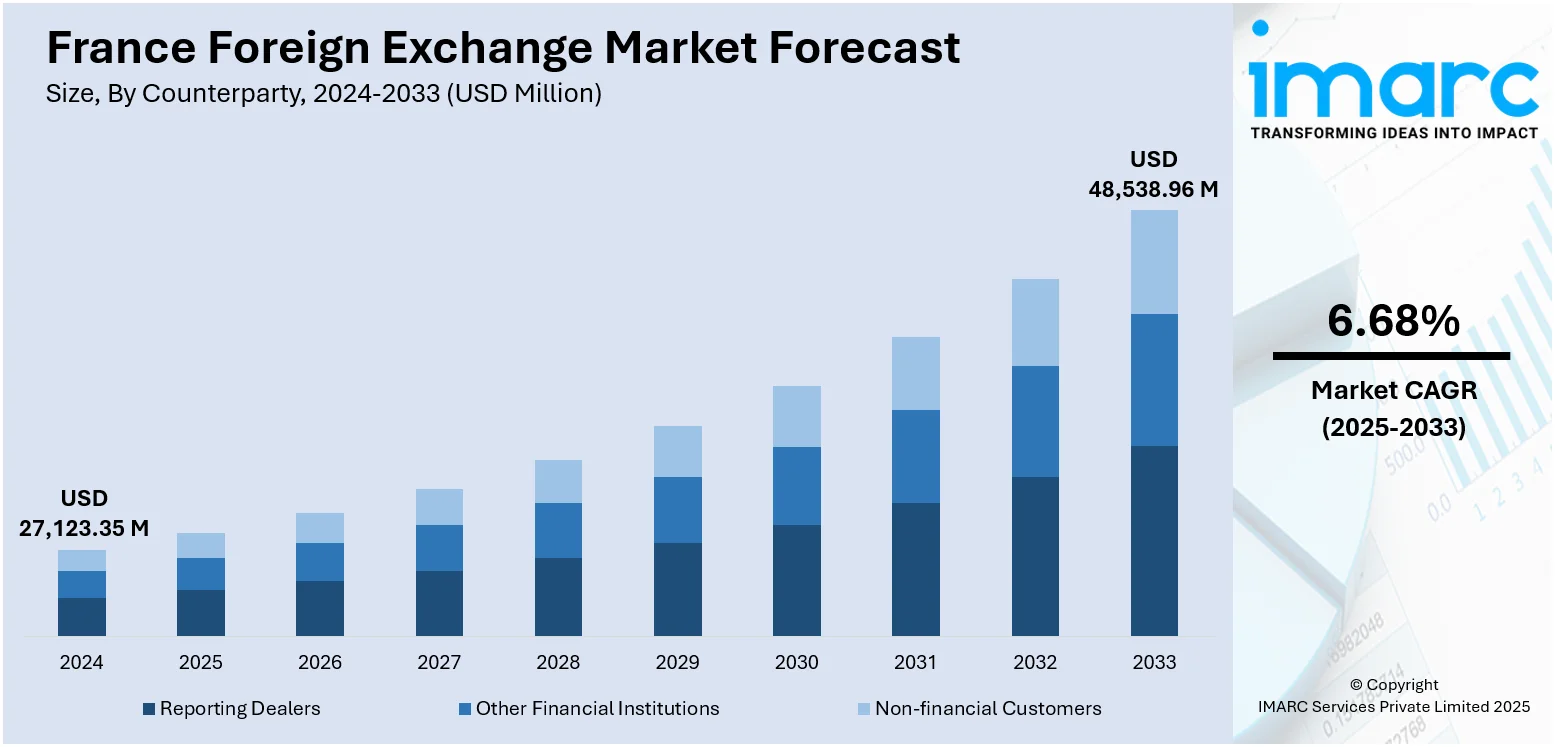

The France foreign exchange market size reached USD 27,123.35 Million in 2024. The market is projected to reach USD 48,538.96 Million by 2033, exhibiting a growth rate (CAGR) of 6.68% during 2025-2033. The market is fueled by the country's strong trade relationships within the Eurozone and globally, particularly its high volume of exports and imports in sectors like aerospace, energy, and luxury goods. Further, capital flows related to foreign direct investment, portfolio management, and sovereign debt are influencing currency demand and euro exchange activity. Apart from that, monetary policy decisions by the European Central Bank and external economic developments are significant factors augmenting the France foreign exchange market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 27,123.35 Million |

| Market Forecast in 2033 | USD 48,538.96 Million |

| Market Growth Rate 2025-2033 | 6.68% |

France Foreign Exchange Market Trends:

Influence of ECB Monetary Policy and Euro Stability

France operates within the Eurozone, making its market highly sensitive to decisions taken by the European Central Bank (ECB). Interest rate changes, asset purchase programs, and inflation targets set by the ECB influence euro liquidity, capital flows, and investor positioning. Moreover, French institutions, including commercial banks and multinational corporations, adjust their FX risk strategies in response to these monetary signals. When the ECB signals policy tightening, the euro often appreciates, leading French exporters to increase hedging to protect revenues in non-euro currencies. Apart from this, France sovereign bond market, being one of the largest in Europe, also reacts strongly to ECB policy stances, affecting FX demand tied to debt issuance and foreign participation. Also, the forward-looking nature of the FX market means that sentiment around ECB decisions, such as forward guidance or inflation forecasts, can move the euro before any policy shift is implemented, impacting day-to-day trading activity and pricing in the market.

To get more information on this market, Request Sample

Trade Exposure and Global Supply Chain Integration

France’s position as a major exporter of aerospace equipment, automobiles, pharmaceuticals, and luxury goods is providing a boost to France foreign exchange market growth. Additionally, the need for currency conversion arises at multiple points, including contract settlement, supplier payments, and revenue repatriation, across both euro and non-euro currencies. With key trading partners including the United States, China, the United Kingdom, and Switzerland, fluctuations in bilateral exchange rates influence both pricing strategies and profitability for French exporters and importers. Moreover, large industrial firms and SMEs rely on forward contracts, swaps, and options to mitigate currency risk, particularly in periods of heightened volatility. In addition to this, trade-related FX flows are also affected by shifts in global commodity prices, especially energy, as France imports significant volumes of oil and natural gas. Seasonal patterns in tourism also contribute to foreign exchange demand, with inflows of currencies like the U.S. dollar, yen, and pound increasing during peak travel periods. As a result, commercial banks and corporates actively manage currency exposure tied to goods, services, and tourism receipts.

Growth of Electronic Trading and FX Market Automation

The market has seen a substantial shift toward electronic trading, driven by advancements in financial technology and regulatory encouragement for greater transparency. Besides this, institutional participants increasingly use algorithmic execution tools and API-based trading platforms to access liquidity, manage orders, and implement hedging strategies with greater efficiency. These systems enable real-time pricing, lower spreads, and faster settlement, contributing to increased trading volumes and a more competitive FX environment. In addition to this, the rise of multi-dealer platforms and single-bank portals has broadened access for corporate treasurers, asset managers, and mid-sized firms. Moreover, French banks have invested heavily in upgrading their FX trading infrastructure, incorporating machine learning models for market prediction and risk assessment. Also, regulatory frameworks under MiFID II have pushed for stricter reporting and best execution standards, fostering accountability in electronic trades. This automation trend has not only changed how market participants operate but has also enhanced overall market resilience and responsiveness to macroeconomic news and geopolitical developments.

France Foreign Exchange Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on counterparty and type.

Counterparty Insights:

- Reporting Dealers

- Other Financial Institutions

- Non-financial Customers

The report has provided a detailed breakup and analysis of the market based on the counterparty. This includes reporting dealers, other financial institutions, and non-financial customers.

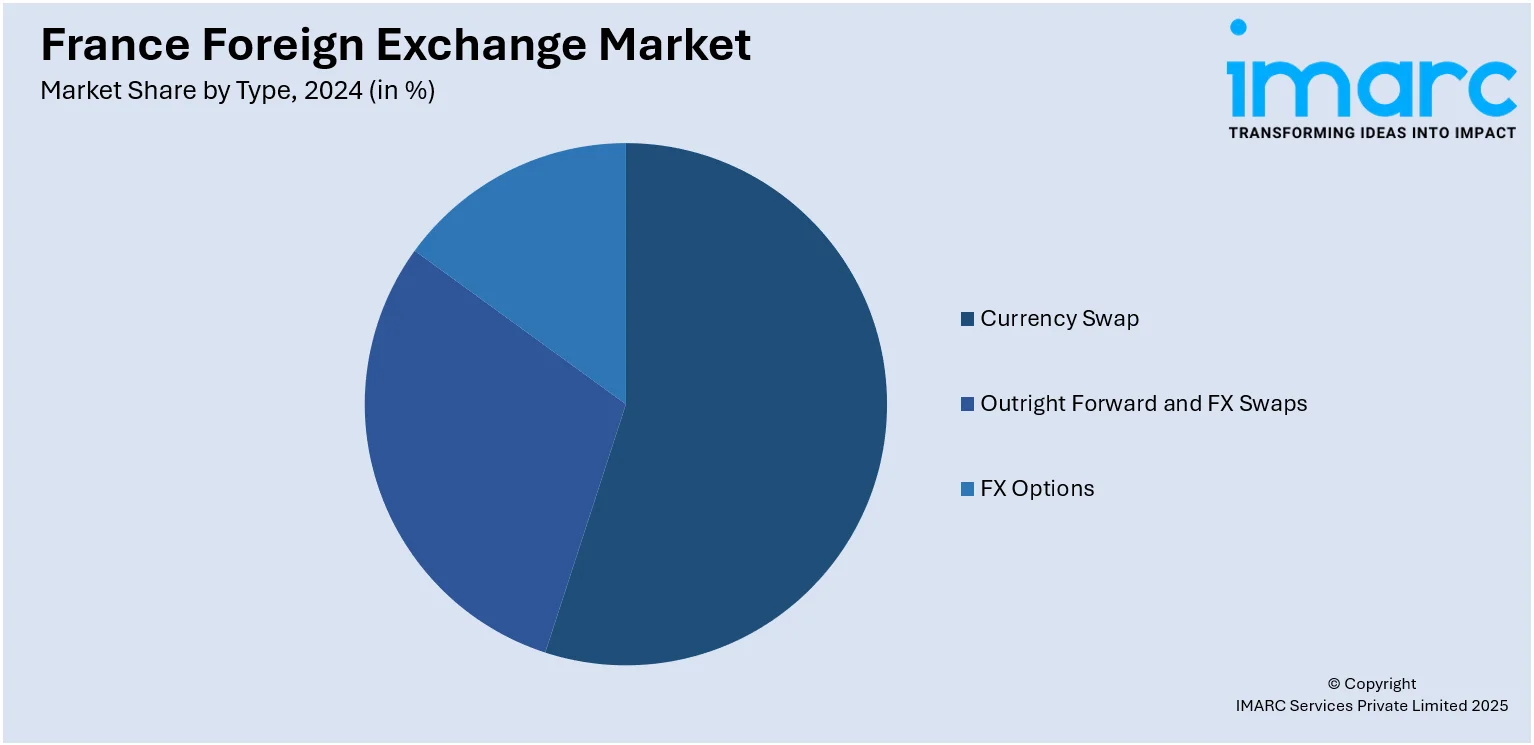

Type Insights:

- Currency Swap

- Outright Forward and FX Swaps

- FX Options

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes currency swap, outright forward and FX swaps, and FX options.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

France Foreign Exchange Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Counterparties Covered | Reporting Dealers, Other Financial Institutions, Non-Financial Customers |

| Types Covered | Currency Swap, Outright Forward and FX Swaps, FX Options |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the France foreign exchange market performed so far and how will it perform in the coming years?

- What is the breakup of the France foreign exchange market on the basis of counterparty?

- What is the breakup of the France foreign exchange market on the basis of type?

- What is the breakup of the France foreign exchange market on the basis of region?

- What are the various stages in the value chain of the France foreign exchange market?

- What are the key driving factors and challenges in the France foreign exchange market?

- What is the structure of the France foreign exchange market and who are the key players?

- What is the degree of competition in the France foreign exchange market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the France foreign exchange market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the France foreign exchange market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the France foreign exchange industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)