France Greenhouse Horticulture Market Size, Share, Trends and Forecast by Material Type, Crop Type, Technology, and Region, 2026-2034

France Greenhouse Horticulture Market Summary:

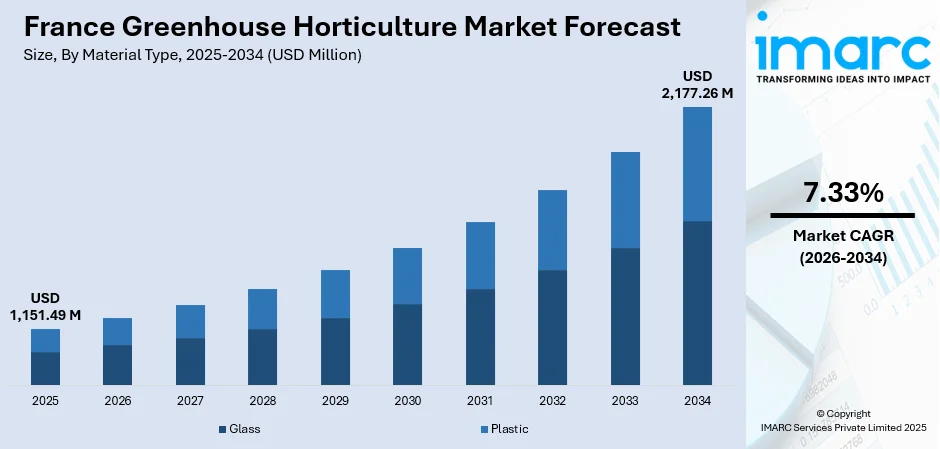

The France greenhouse horticulture market size was valued at USD 1,151.49 Million in 2025 and is projected to reach USD 2,177.26 Million by 2034, growing at a compound annual growth rate of 7.33% from 2026-2034.

The market is driven by growing consumer demand for fresh, high-quality fruits and vegetables throughout the year, coupled with advancements in controlled-environment agriculture. Adoption of energy-efficient, sustainable cultivation practices and innovative greenhouse technologies is enhancing productivity and crop quality. Precision horticulture methods, optimized resource management, and climate-controlled systems enable consistent yields and operational efficiency, supporting the expansion of modern horticultural practices. These developments foster year-round production, reduce environmental impact, and strengthen the overall competitiveness of greenhouse horticulture in France.

Key Takeaways and Insights:

- By Material Type: Glass dominates the market with a share of 55% in 2025, offering superior light transmission, durability, and resistance, which helps maintain optimal growing conditions and enhances overall crop productivity.

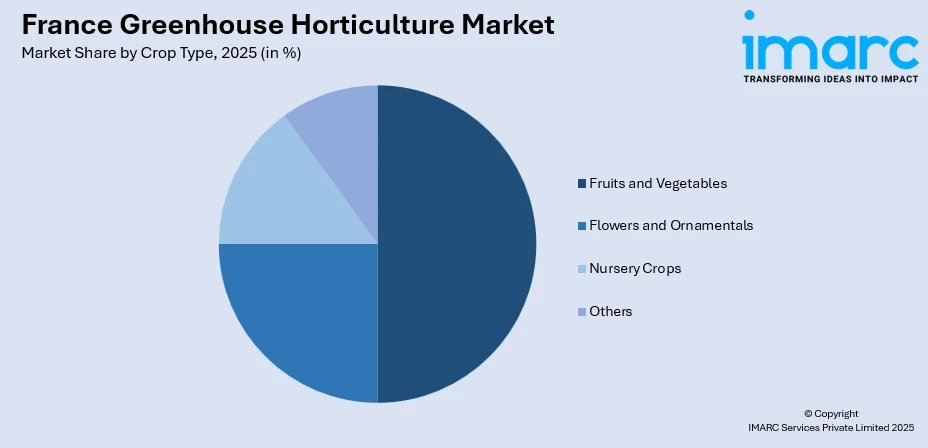

- By Crop Type: Fruits and vegetables leads the market with a share of 50% in 2025, reflecting strong consumer demand for fresh, high-quality produce and encouraging year-round cultivation in controlled greenhouse environments.

- By Technology: Heating system represents the largest segment with a market share of 60% in 2025, providing consistent temperature regulation, improving plant growth cycles, and supporting higher yields while optimizing energy use within greenhouse operations.

- Key Players: The market is highly competitive, with leading companies emphasizing innovative greenhouse technologies, energy-efficient systems, sustainable cultivation practices, and advanced operational strategies to meet rising demand, enhance market share, and consistently deliver high-quality, year-round horticultural produce.

To get more information on this market, Request Sample

Rising demand for fresh, high-quality produce is a primary driver of the France greenhouse horticulture market. Consumers increasingly prefer locally grown fruits and vegetables available year-round, encouraging modern cultivation practices. As per sources, in October 2024, a French initiative in Pau’s “Green Belt” fosters high-tech greenhouse growers, offering affordable farmland, mentorship, market access, and €200,000 per-farm investment to promote sustainable, low-carbon agriculture. Moreover, advanced greenhouse technologies, including climate control, automation, and precision horticulture, enhance efficiency, productivity, and crop quality. Sustainable approaches, such as energy-efficient systems, optimized water management, and integrated pest control, support environmentally responsible production. Controlled-environment agriculture allows growers to maintain consistent yields and superior product standards, reducing resource wastage. These developments, combined with growing awareness of healthy eating and innovative cultivation techniques, are propelling the expansion and modernization of greenhouse horticulture operations across France.

France Greenhouse Horticulture Market Trends:

Integration of Smart Technologies

Greenhouse horticulture is increasingly adopting smart technologies, including sensors, IoT devices, and automated monitoring systems. These innovations enable precise control over temperature, humidity, and light, optimizing plant growth and reducing manual intervention. In November 2023, Lyon-based RED Horticulture raised €17M to advance AI-driven dynamic LED lighting for greenhouses, supporting energy-efficient cultivation, higher yields, and expanded adoption across France’s horticulture sector. Moreover, growers can analyze real-time data to make informed decisions, improving operational efficiency and crop quality. The integration of artificial intelligence and predictive analytics allows for early detection of plant stress or nutrient deficiencies, supporting proactive management and enhancing overall sustainability within modern horticultural practices.

Sustainable Resource Management

Sustainability is becoming a key focus in greenhouse operations, with emphasis on efficient water usage, renewable energy sources, and waste reduction. Techniques such as hydroponics, rainwater harvesting, and energy-efficient heating systems help minimize environmental impact while maintaining productivity. For example, in April 2025, France-based Volta Group and Richel Group commissioned a photovoltaic greenhouse in Drôme for kiwi cultivation, generating 7.3 GWh annually while supporting controlled-environment crop protection and improved yields. Additionally, nutrient recycling and soil-less cultivation practices further support resource conservation. These sustainable approaches allow growers to produce high-quality crops responsibly, meeting consumer expectations for eco-friendly produce while reducing operational costs and promoting long-term viability of greenhouse horticulture.

Diversification of Crop Varieties

Growers are expanding the range of crops cultivated in greenhouses beyond traditional fruits and vegetables. This includes specialty herbs, exotic produce, and high-value crops that require controlled environments for optimal growth. As per sources, in January 2023, CleanGreens Solutions and Midiflore signed a contract to install a 3,500 m² aeroponic greenhouse in France, enabling local aromatic herb production, reducing imports, and improving sustainability. Further, diversification helps meet evolving consumer preferences and opens new market opportunities. Advanced cultivation methods and tailored climate management enable the successful growth of sensitive or high-demand crops. By broadening crop portfolios, greenhouse operators can enhance profitability, optimize space utilization, and adapt to changing dietary trends and market demands effectively.

Market Outlook 2026-2034:

The market is expected to grow steadily, driven by increasing adoption of precision horticulture, automation, and sustainable cultivation practices. Advances in controlled-environment systems, resource optimization, and climate management are enhancing productivity, crop quality, and operational efficiency. The market outlook reflects a continued shift toward modern, efficient, and environmentally responsible greenhouse operations, enabling consistent year-round production while supporting the evolving demands of consumers and promoting long-term sustainability in the horticulture sector. The market generated a revenue of USD 1,151.49 Million in 2025 and is projected to reach a revenue of USD 2,177.26 Million by 2034, growing at a compound annual growth rate of 7.33% from 2026-2034.

France Greenhouse Horticulture Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Material Type | Glass | 55% |

| Crop Type | Fruits and Vegetables | 50% |

| Technology | Heating System | 60% |

Material Type Insights:

- Glass

- Plastic

The glass dominates with a market share of 55% of the total France greenhouse horticulture market in 2025.

Glass remains the dominant material in France greenhouse horticulture due to its exceptional light transmission, allowing maximum sunlight to reach crops and support optimal photosynthesis. Its durability and resistance to weather conditions ensure long-lasting performance, making it ideal for large-scale and commercial greenhouse operations. Glass structures also provide superior insulation, maintaining stable internal temperatures and protecting plants from external fluctuations, which enhances overall productivity and crop quality across various horticultural applications. In November 2025, REDEN commissioned a 3-hectare agrivoltaic glass greenhouse in Montaut, Ariège, combining specialised crop production and renewable electricity generation, enhancing efficiency and sustainability on a family-run site.

The versatility of glass in design and construction further strengthens its preference among growers. It allows for customized greenhouse structures that accommodate diverse crop types and modern cultivation techniques. Glass surfaces are easier to clean and maintain, reducing the risk of pests and diseases. Additionally, its aesthetic appeal and transparency create favorable growing conditions while supporting efficient resource use, reinforcing its position as the preferred choice in France’s greenhouse horticulture market.

Crop Type Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Fruits and Vegetables

- Flowers and Ornamentals

- Nursery Crops

- Others

The fruits and vegetables leads with a share of 50% of the total France greenhouse horticulture market in 2025.

Fruits and vegetables constitute the largest segment in France greenhouse horticulture, driven by strong consumer demand for fresh, high-quality produce throughout the year. Controlled greenhouse environments enable consistent cultivation, protecting crops from seasonal fluctuations and adverse weather conditions. Growers can optimize nutrient supply, light exposure, and humidity to enhance growth and flavor, ensuring premium-quality output. This segment benefits from advanced horticultural techniques that support productivity, yield consistency, and sustainable farming practices. In July 2025, French greenhouse grower Jean-Paul Fargier in Arles adopted AMALGEROL, boosting pepper and eggplant yields by up to 1 kg/m² while improving fruit quality and reducing second-grade produce.

The popularity of fruits and vegetables in greenhouses is also fueled by evolving dietary preferences and increased focus on healthy eating. Growers can cultivate a wide variety of produce, from common staples to specialty items, meeting diverse consumer needs. Efficient space utilization, precise environmental control, and reduced crop loss contribute to profitability and operational efficiency. As a result, fruits and vegetables remain the cornerstone of France’s greenhouse horticulture, driving innovation and market expansion.

Technology Insights:

- Heating System

- Cooling System

- Others

The heating system exhibits a clear dominance with a 60% share of the total France greenhouse horticulture market in 2025.

Heating systems dominate the France greenhouse horticulture market, providing essential climate control to ensure optimal plant growth throughout the year. These systems maintain consistent temperatures, protecting crops from cold weather and seasonal fluctuations, which is crucial for sensitive fruits, vegetables, and high-value horticultural products. By creating stable internal conditions, heating technologies enhance crop quality, support faster growth cycles, and reduce the risk of plant stress, making them a critical component of modern greenhouse operations.

The widespread adoption of heating systems also enables growers to extend growing seasons and increase yield reliability. Advanced systems allow precise temperature regulation, energy efficiency, and integration with other environmental controls such as ventilation and humidity management. This not only improves operational efficiency but also contributes to sustainable cultivation practices. As a result, heating systems are a cornerstone of greenhouse technology, ensuring productivity, profitability, and consistent year-round horticultural output in France.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

The Paris Region is a key greenhouse horticulture hub, benefiting from proximity to urban centers and strong consumer demand. Modern facilities employ advanced climate control and automation, enabling consistent, high-quality production of fruits, vegetables, and specialty crops to efficiently supply local and regional markets throughout the year.

Auvergne-Rhône-Alpes combines traditional cultivation with modern greenhouse technologies. Growers leverage climate-controlled systems and sustainable practices to optimize productivity and crop quality. This region supports reliable, year-round production of fruits, vegetables, and specialty crops, ensuring a consistent supply chain that serves both local consumers and broader regional markets efficiently.

Nouvelle-Aquitaine focuses on efficient greenhouse production of fruits, vegetables, and high-value crops. Controlled-environment methods, precision horticulture, and resource optimization allow growers to maintain consistent quality and yield. These practices enable the region to meet local demand while supporting opportunities for wider distribution and market expansion.

Hauts-de-France integrates modern heating, lighting, and irrigation systems in its greenhouse operations. Controlled-environment technology ensures reliable year-round cultivation of fruits and vegetables, enhancing productivity, maintaining high-quality output, and efficiently meeting regional consumption needs with minimal resource waste.

Occitanie benefits from favorable climate conditions and advanced greenhouse infrastructure. Controlled-environment systems and sustainable cultivation techniques enable growers to produce high-quality fruits, vegetables, and specialty crops consistently, supporting local consumption and contributing to broader regional distribution networks.

Provence Alpes Côte d’Azur emphasizes innovative greenhouse practices, combining climate control with precision horticulture techniques. These methods allow consistent production of fruits, vegetables, and specialty crops, supporting high-quality output while addressing increasing consumer demand and improving operational efficiency across the region.

Grand Est features advanced greenhouse facilities equipped with heating, lighting, and irrigation technologies. These systems ensure year-round production of fruits and vegetables, maintaining crop quality and supporting both local consumption and distribution to wider regional markets with consistent efficiency.

Other regions contribute through smaller-scale greenhouse operations that utilize efficient cultivation methods and controlled environments. These areas complement major production hubs by providing diverse fruits, vegetables, and specialty crops, enhancing national supply chains and supporting consistent availability of horticultural produce.

Market Dynamics:

Growth Drivers:

Why is the France Greenhouse Horticulture Market Growing?

Expansion of Controlled-Environment Agriculture

The growth of controlled-environment agriculture is a major factor driving France’s greenhouse horticulture market. Advanced climate control, automated irrigation, and smart lighting systems allow growers to maintain optimal conditions regardless of external weather. These technologies enable precise regulation of temperature, humidity, and CO₂ levels, improving plant health, accelerating growth cycles, and enhancing yields. Controlled environments also reduce the risk of crop loss from pests and diseases, supporting consistent production. As growers adopt these techniques, greenhouse operations become more efficient, predictable, and capable of producing high-quality fruits, vegetables, and specialty crops throughout the year. In February 2024, Agriloops, a French company, raised €13M to build its first commercial-scale Mangrove #1 farm, combining shrimp aquaculture and greenhouse vegetable production, enhancing sustainability, water efficiency, and local premium yields.

Adoption of Precision Horticulture Practices

Precision horticulture is increasingly contributing to the expansion of France’s greenhouse horticulture sector. Techniques such as automated nutrient delivery, sensor-based monitoring, and data-driven growth management allow growers to optimize inputs, reduce waste, and improve crop quality. By closely tracking plant health and environmental parameters, growers can make informed adjustments that enhance productivity and sustainability. Precision practices also support diversified crop cultivation, allowing sensitive or high-value crops to thrive in controlled conditions. This approach enhances operational efficiency, maximizes yield potential, and ensures consistent output, reinforcing the long-term growth and competitiveness of greenhouse horticulture in France.

Integration of Sustainable Energy Solutions

Sustainable energy solutions are accelerating growth in France’s greenhouse horticulture market. Many greenhouse operations are implementing renewable energy sources, such as solar panels, biomass heating, and energy-efficient ventilation systems to reduce operational costs and environmental impact. In November 2025, Newheat inaugurated France’s largest agricultural solar thermal plant at Les Tomates d’Auïtou greenhouse, installing 7,000 m² of solar collectors and supplying 5,400 MWh annually. Additionally, these solutions enable stable and reliable production throughout the year while promoting eco-friendly cultivation practices. Integration of energy-efficient technologies also supports climate control systems, reducing energy consumption while maintaining optimal conditions for plant growth. As sustainability becomes a priority for both growers and consumers, adoption of these solutions enhances operational efficiency and strengthens the overall growth trajectory of greenhouse horticulture in the country.

Market Restraints:

What Challenges the France Greenhouse Horticulture Market is Facing?

High Initial Investment Requirements

Greenhouse horticulture often demands substantial initial investment for construction, climate control systems, lighting, and advanced cultivation equipment. These costs can limit participation for smaller growers and slow expansion plans for existing operators. The need for specialized materials, skilled labor, and ongoing maintenance further increases financial pressure. As a result, some producers hesitate to adopt fully controlled environments, restraining the overall pace of greenhouse development across France.

Complexity of Managing Controlled Environments

Operating a greenhouse requires precise coordination of temperature, humidity, ventilation, irrigation, and nutrient supply. Maintaining these conditions consistently can be technically demanding, especially for growers without specialized expertise. Minor mismanagement may affect crop quality or growth cycles, creating operational uncertainty. The need for continuous monitoring, adjustments, and technical understanding can deter potential adopters, limiting the broader expansion of technologically advanced greenhouse horticulture in France.

Limited Availability of Skilled Workforce

Greenhouse horticulture increasingly depends on workers skilled in climate management, advanced cultivation practices, and automated systems. However, the availability of such expertise remains limited, making it challenging for growers to operate modern facilities effectively. Training requirements, knowledge gaps, and competition for specialized labor add operational strain. This shortage of skilled personnel can slow technological adoption, reduce efficiency, and hinder the ability of growers to fully optimize greenhouse production.

Competitive Landscape:

The competitive landscape of the France greenhouse horticulture market is shaped by a diverse mix of growers, technology providers, and integrated horticultural operations. Participants focus on improving production efficiency through advanced climate control systems, precision cultivation methods, and sustainable resource management. Innovation plays a central role, with operators adopting automated monitoring tools, enhanced heating solutions, and optimized irrigation techniques to support high-quality output. Market players emphasize consistent year-round production, diversification of crop varieties, and improved operational reliability to strengthen their position. Collaboration between growers, research institutions, and technology suppliers further drives advancements, enabling continuous improvements in productivity, sustainability, and overall competitiveness across the greenhouse horticulture sector.

Recent Developments:

- In November 2025, Certhon initiated construction of a two-hectare SuprimAir greenhouse for the French tomato producer Poumo D’amour near Avignon. Certhon is fully responsible for design, construction, and integration of advanced heating and climate-control systems, enabling year-round tomato production with precise environmental management and insect exclusion.

- In March 2025, the association Ami.es de la Serre du Ruisseau initiated construction of Paris’s first vertical, rotating greenhouse in the 18th arrondissement. The 125 m² facility will cultivate 17,000 seedlings annually using mobile shelves to optimize natural light, supporting urban agriculture, environmental education, and community engagement, with completion expected in 2026.

- In January 2025, Aisprid secured €10 million in funding to accelerate research and development, expand production, and enhance its autonomous de-leafing robots, advancing greenhouse automation and addressing labor shortages, thereby supporting increased efficiency and modernization within France’s greenhouse horticulture sector.

France Greenhouse Horticulture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Glass, Plastic |

| Crop Types Covered | Fruits and Vegetables, Flowers and Ornamentals, Nursery Crops, Others |

| Technologies Covered | Heating System, Cooling System, Others |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The France greenhouse horticulture market size was valued at USD 1,151.49 Million in 2025.

The France Greenhouse Horticulture market is expected to grow at a compound annual growth rate of 7.33% from 2026-2034 to reach USD 2,177.26 Million by 2034.

Glass held the largest share due to its superior light transmission, durability, and ability to maintain stable growing conditions. Its long lifespan and suitability for controlled-environment cultivation make it the preferred choice for greenhouse structures.

Key factors driving the France greenhouse horticulture market include rising demand for high-quality local produce, increasing adoption of controlled-environment cultivation, advancements in climate management technologies, and the shift toward resource-efficient horticultural practices that support consistent, year-round production.

Major challenges include high initial investment requirements, the technical complexity of managing controlled environments, and limited availability of skilled labor. These factors can hinder adoption of advanced systems and slow expansion of modern greenhouse operations across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)