France Lithium-ion Battery Market Size, Share, Trends and Forecast by Product Type, Power Capacity, Application, and Region, 2025-2033

France Lithium-ion Battery Market Overview:

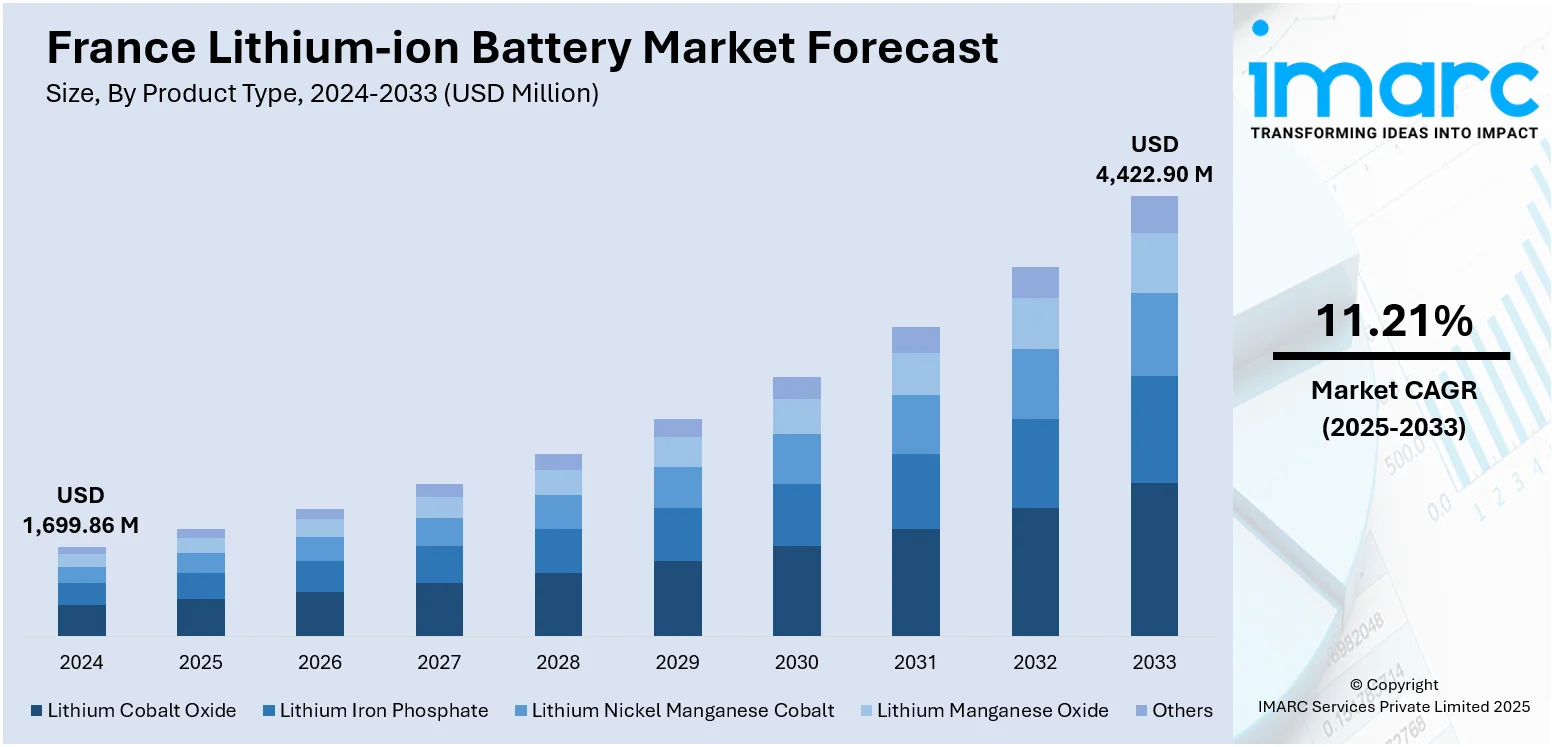

The France lithium-ion battery market size reached USD 1,699.86 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,422.90 Million by 2033, exhibiting a growth rate (CAGR) of 11.21% during 2025-2033. Rising EV adoption, strong government incentives, and stringent carbon reduction targets are some of the factors contributing to the France lithium-ion battery market share. Expansion of renewable energy storage, advancements in battery technology, and growth in domestic manufacturing capacity are further fueling demand from automotive, grid, and industrial sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,699.86 Million |

| Market Forecast in 2033 | USD 4,422.90 Million |

| Market Growth Rate 2025-2033 | 11.21% |

France Lithium-ion Battery Market Trends:

New Battery Facility Strengthening EV Ambitions

A large-scale battery production factory in Douai has begun operations, with the goal of generating improved lithium-ion batteries for electric vehicles. The facility is a key component of France's campaign for greener mobility, with the goal of supporting home manufacturing while reducing reliance on foreign supplies. By collaborating with a major automaker, the facility will assist in fulfilling increased demand for electric vehicles and foster widespread adoption across the country. It is also projected to generate major employment possibilities, thus benefiting the local economy. With an emphasis on innovation and sustainable energy solutions, the factory is a step toward creating a more reliable battery supply network and strengthening France's position in the rapidly expanding European electric car industry. These factors are intensifying the France lithium-ion battery market growth. For example, in June 2025, AESC began production at its new 10 GWh gigafactory in Douai, France, supplying advanced lithium-ion batteries to Renault for electric vehicles. The plant, part of France’s electric mobility strategy, will employ up to 1,000 people and can power about 200,000 EVs annually at full capacity.

To get more information on this market, Request Sample

Rising Demand and Domestic Production

France’s lithium-ion battery market is showing strong growth, driven by the country’s push for clean energy and sustainable transport. Government incentives for electric vehicles (EVs) and renewable energy storage solutions have accelerated demand. Automakers are expanding EV production in France, which is increasing the need for high-capacity, efficient batteries. Additionally, large-scale investments in gigafactories, such as the projects in Hauts-de-France, are aimed at strengthening domestic battery manufacturing capabilities and reducing reliance on imports. The market is also benefiting from advancements in battery technology, including higher energy density and faster charging times, which improve performance and broaden applications beyond EVs, into sectors like stationary energy storage for grids. Environmental regulations and EU-wide climate targets are pushing manufacturers to focus on recycling and developing batteries with reduced carbon footprints. Supply chain localization efforts and partnerships between battery makers, car manufacturers, and energy companies are shaping the competitive landscape. With rising raw material demand, companies are also exploring sustainable sourcing and alternatives to critical minerals, positioning France as an important hub in Europe’s lithium-ion battery value chain.

France Lithium-ion Battery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, power capacity, and application.

Product Type Insights:

- Lithium Cobalt Oxide

- Lithium Iron Phosphate

- Lithium Nickel Manganese Cobalt

- Lithium Manganese Oxide

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes lithium cobalt oxide, lithium iron phosphate, lithium nickel manganese cobalt, lithium manganese oxide, and others.

Power Capacity Insights:

- 0 to 3000mAh

- 3000mAh to 10000mAh

- 10000mAh to 60000mAh

- More than 60000mAh

The report has provided a detailed breakup and analysis of the market based on the power capacity. This includes 0 to 3000mAh, 3000mAh to 10000mAh, 10000mAh to 60000mAh, and more than 60000mAh.

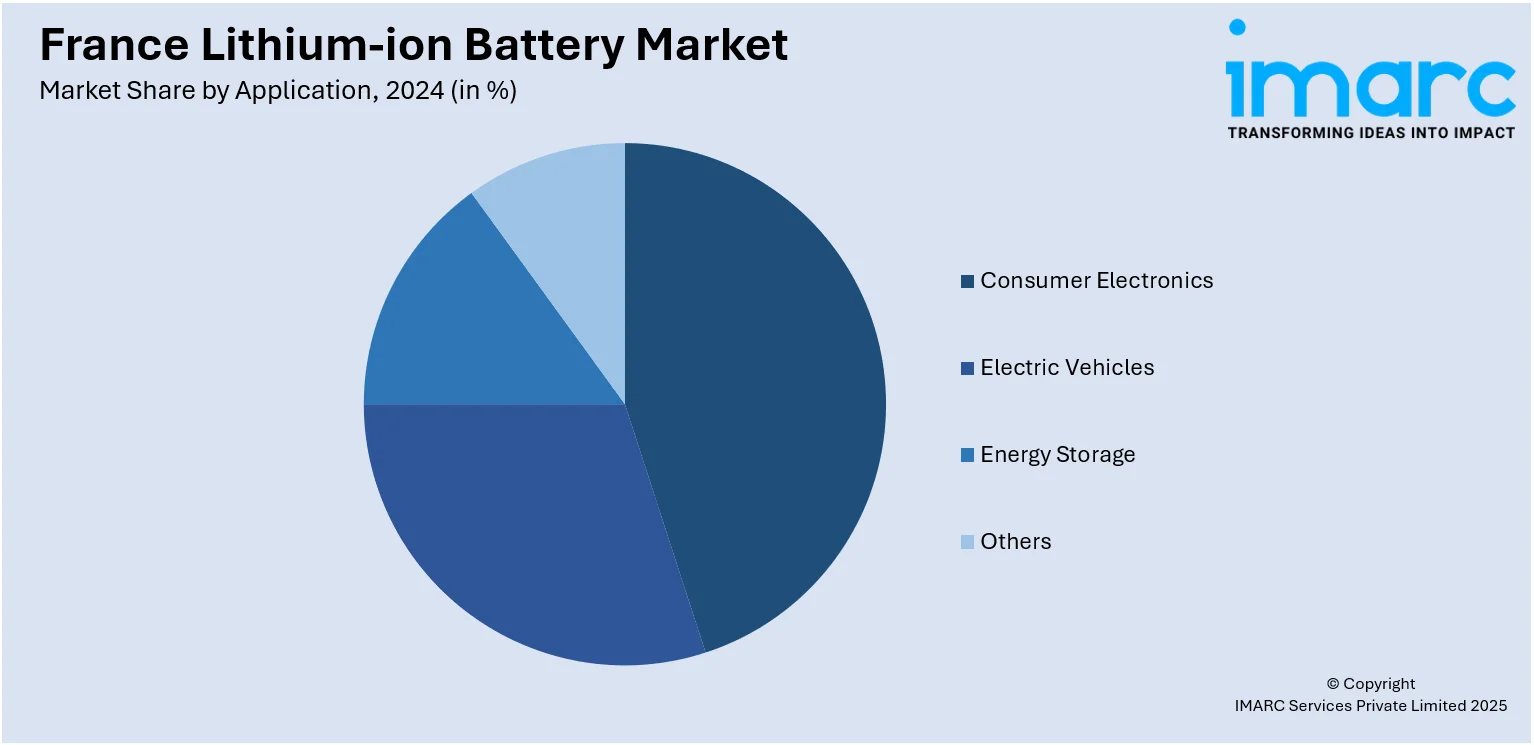

Application Insights:

- Consumer Electronics

- Electric Vehicles

- Energy Storage

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes consumer electronics, electric vehicles, energy storage, and others.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

France Lithium-ion Battery Market News:

- In July 2025, Manitou Group and Hangcha Group planned a joint venture in Le Mans, France, to produce and distribute lithium-ion batteries, pending European competition approval. The venture targets replacing lead-acid batteries in industrial vehicles, boosting efficiency, lifespan, and supporting the electrification of new product lines, including the Manitou ME LIFT forklift range.

France Lithium-ion Battery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Lithium Cobalt Oxide, Lithium Iron Phosphate, Lithium Nickel Manganese Cobalt, Lithium Manganese Oxide, Others |

| Power Capacities Covered | 0 to 3000mAh, 3000mAh to 10000mAh, 10000mAh to 60000mAh, More than 60000mAh |

| Applications Covered | Consumer Electronics, Electric Vehicles, Energy Storage, Others |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the France lithium-ion battery market performed so far and how will it perform in the coming years?

- What is the breakup of the France lithium-ion battery market on the basis of product type?

- What is the breakup of the France lithium-ion battery market on the basis of power capacity?

- What is the breakup of the France lithium-ion battery market on the basis of application?

- What is the breakup of the France lithium-ion battery market on the basis of region?

- What are the various stages in the value chain of the France lithium-ion battery market?

- What are the key driving factors and challenges in the France lithium-ion battery market?

- What is the structure of the France lithium-ion battery market and who are the key players?

- What is the degree of competition in the France lithium-ion battery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the France lithium-ion battery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the France lithium-ion battery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the France lithium-ion battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)