France Logistics Market Size, Share, Trends and Forecast by Model Type, Transportation Mode, End Use, and Region, 2025-2033

France Logistics Market Overview:

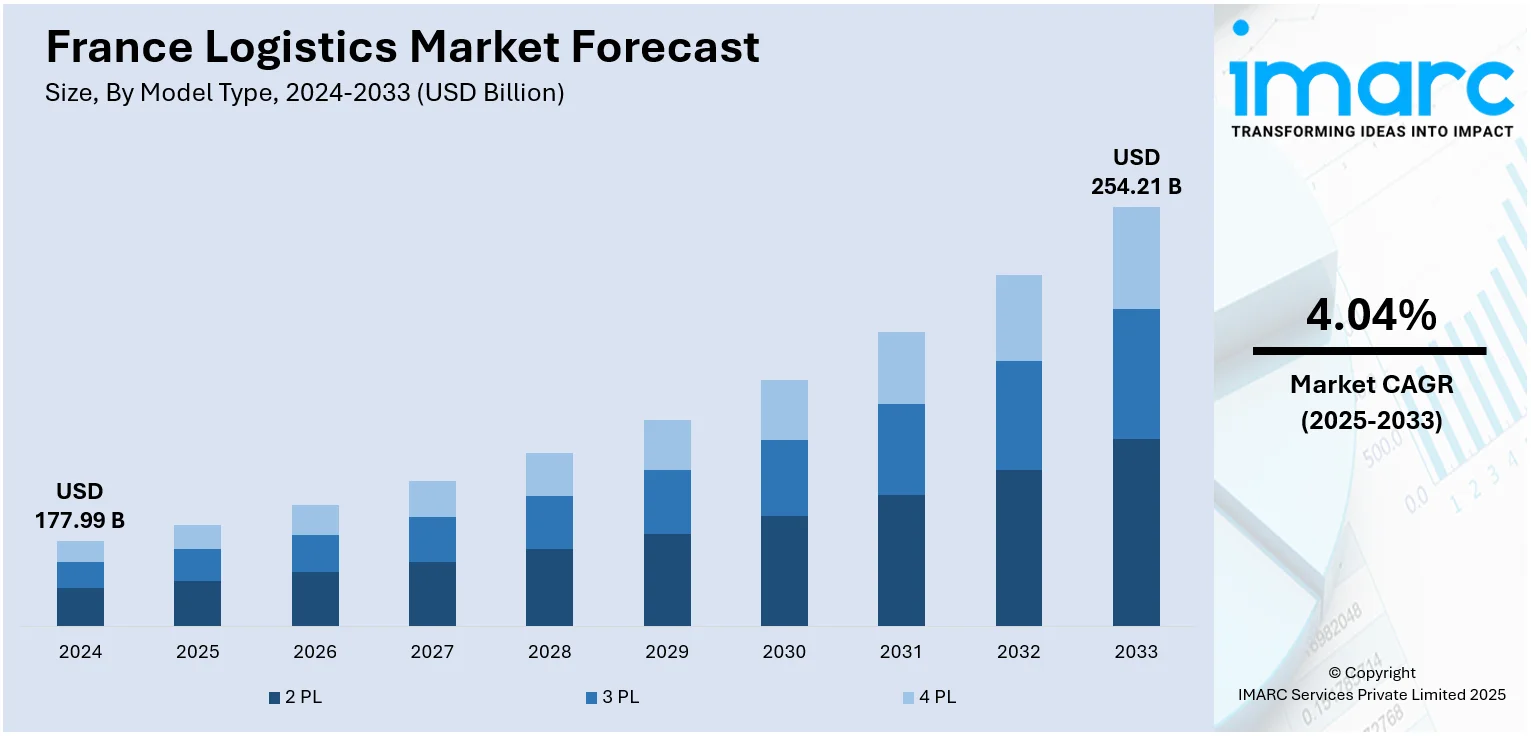

The France logistics market size reached USD 177.99 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 254.21 Billion by 2033, exhibiting a growth rate (CAGR) of 4.04% during 2025-2033. There is a rise in the emphasis placed on sustainability in French freight operations as companies are being pushed to minimize their impact on the environment. Moreover, the expansion of e-commerce sites is propelling the market growth in France. Additionally, the advancements in enhancing supply chain efficiency are expanding the France logistics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 177.99 Billion |

| Market Forecast in 2033 | USD 254.21 Billion |

| Market Growth Rate 2025-2033 | 4.04% |

France Logistics Market Trends:

Emergence of a Growing E-commerce Industry

The expansion of e-commerce sites is propelling the logistics industry in France. People are shopping more online, resulting in a high demand for smooth and timely delivery services. Logistics operators are looking to boost their capabilities to handle increased volumes of orders, particularly with the trend of same-day or next-day delivery expectations. Warehouse automation and the use of sophisticated technologies such as artificial intelligence (AI) and robotics are being introduced to maximize operations and enhance efficiency in delivery. Logistics providers also spend on more localized distribution centers to minimize transit time, addressing the increasing needs of consumers and businesses. As per Ecommerce Europe, in 2024, French online retail maintained its robust growth, achieving a landmark €175.3 billion in digital sales, reflecting a 9.6% rise from the previous year. As e-commerce keeps growing, logistics companies are evolving by streamlining their supply chains, integrating digital tracking technology, and increasing last-mile delivery networks in order to offer smooth services to customers.

To get more information on this market, Request Sample

Supply Chain Technology Advancements

Technological advancements are revolutionizing the French logistics industry by enhancing supply chain efficiency. Businesses are embracing real-time tracking and monitoring systems that give them more visibility into goods movement. Global positioning system (GPS)-based software, big data analytics, and cloud computing are all being used in logistics operations to improve decision-making processes and lower operational costs. Automated warehouses, employing robotics and artificial intelligence (AI)-based sorting mechanisms, are also rising, enhancing productivity and minimizing human error. Internet of Things (IoT) devices are also being used to track the condition of goods, particularly perishables, while in transit, ensuring quality and safety. Logistics providers are also placing emphasis on improving predictive analytics to forecast delays and optimize the routes so deliveries are faster and cheaper. These advancements in technology are constantly remodeling the way logistics companies operate and adapt to changing customer demands.

Sustainability and Green Issues

There is a rise in the emphasis placed on sustainability in the French logistics industry, as companies are being pushed to minimize their impact on the environment. Logistics firms are embracing green technologies like electric vehicles (EVs) for moving goods, decreasing carbon footprints in the process, thereby propelling the France logistics market growth. They are also spending money on energy-efficient warehouses, where they use solar power, and on sustainable packaging materials to reduce waste. As regulatory pressures mount to meet environmental performance and corporate social responsibility (CSR) aspirations, firms are moving swiftly towards greener operations. Several logistics companies are currently in the process of investigating alternative fuels, such as biofuels or hydrogen, to further minimize their carbon footprint. Further, there is an emphatic drive toward streamlining supply chain operations to save energy and lower the environmental footprint of shipping. As sustainability becomes more paramount, logistics providers are constantly innovating to satisfy these needs while remaining competitive in the marketplace. For instance, in 2025, CEVA Logistics announced its plans of broadening its range of eco-friendly transportation options by introducing a low carbon ocean freight service connecting France and Ivory Coast. The innovative service utilizes marine biofuel and offers customers more eco-friendly maritime transport alternatives for shipments to West Africa.

France Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on model type, transportation mode, and end use.

Model Type Insights:

- 2 PL

- 3 PL

- 4 PL

The report has provided a detailed breakup and analysis of the market based on the model type. This includes 2 PL, 3 PL, and 4 PL.

Transportation Mode Insights:

- Roadways

- Seaways

- Railways

- Airways

The report has provided a detailed breakup and analysis of the market based on the transportation mode. This includes roadways, seaways, railways, and airways.

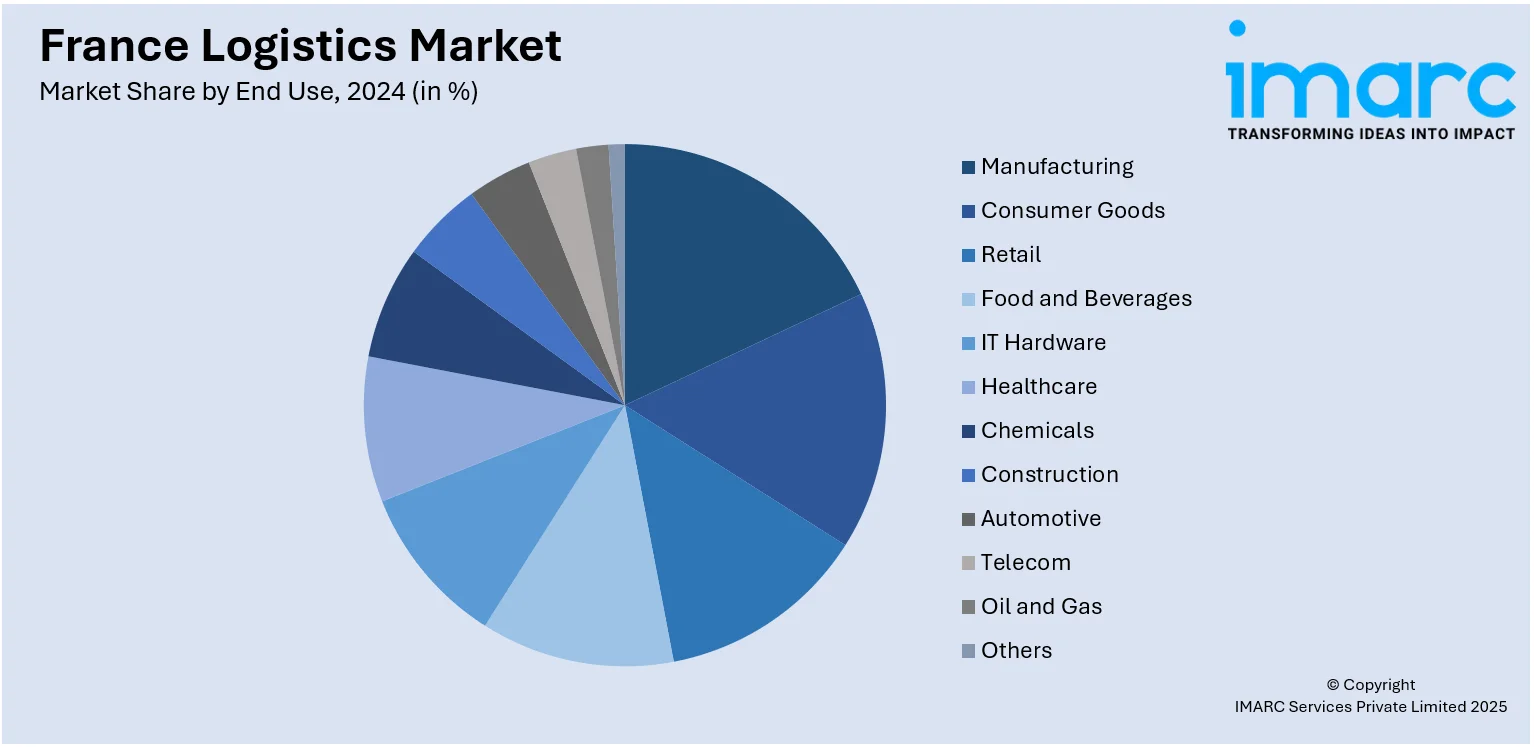

End Use Insights:

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes manufacturing, consumer goods, retail, food and beverages, IT hardware, healthcare, chemicals, construction, automotive, telecom, oil and gas, and others.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

France Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Model Types Covered | 2 PL, 3 PL, 4 PL |

| Transportation Modes Covered | Roadways, Seaways, Railways, Airways |

| End Uses Covered | Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, Others |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the France logistics market performed so far and how will it perform in the coming years?

- What is the breakup of the France logistics market on the basis of model type?

- What is the breakup of the France logistics market on the basis of transportation mode?

- What is the breakup of the France logistics market on the basis of end use?

- What is the breakup of the France logistics market on the basis of region?

- What are the various stages in the value chain of the France logistics market?

- What are the key driving factors and challenges in the France logistics market?

- What is the structure of the France logistics market and who are the key players?

- What is the degree of competition in the France logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the France logistics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the France logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the France logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)