France Meat Market Size, Share, Trends and Forecast by Type, Product, Distribution Channel, and Region, 2025-2033

France Meat Market Overview:

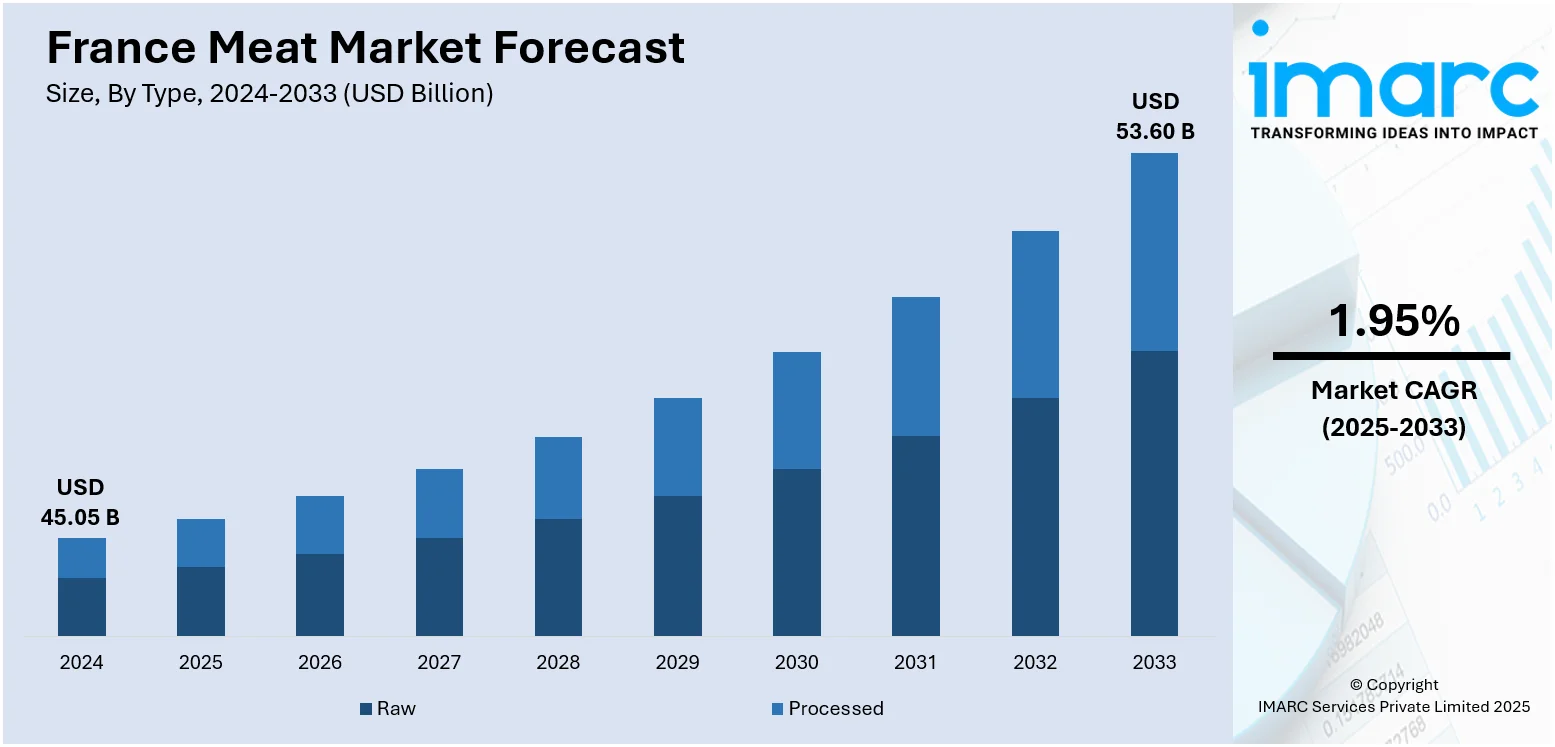

The France meat market size reached USD 45.05 Billion in 2024. The market is projected to reach USD 53.60 Billion by 2033, exhibiting a growth rate (CAGR) of 1.95% during 2025-2033. The market is driven by evolving consumer preferences for healthier, organic, and ethically sourced options, with rising interest in flexitarian diets. Sustainability concerns also play a key role, as environmental impact prompts demand for eco-friendly production and transparency. Together, these factors push the France meat market share toward balancing innovation, environmental responsibility, and cultural preservation in meat consumption and production.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 45.05 Billion |

| Market Forecast in 2033 | USD 53.60 Billion |

| Market Growth Rate 2025-2033 | 1.95% |

France Meat Market Trends:

Changing Consumer Preferences and Health Trends

French consumers are increasingly health-conscious, with 58% of meat-eaters having reduced their meat intake in the past year. Health concerns (38%), animal welfare (30%), and environmental impact (29%) are key motivators behind this shift. As a result, demand is increasing for leaner meats like poultry, organic products, and plant-based alternatives. Flexitarianism is also gaining momentum, prompting many to cut back on red meat without going fully vegetarian. Shoppers are placing greater emphasis on traceability, clean labeling, and ethically sourced products, often willing to pay more for food that aligns with their values. This is compelling producers to offer low-fat, additive-free, and sustainably farmed options. The trend is reshaping the entire supply chain from farming practices to retail strategies and is expected to accelerate as younger, more health- and climate-conscious consumers become the driving force behind food choices thereby contributing to the France meat market growth.

To get more information on this market, Request Sample

Sustainability and Environmental Concerns

Environmental impact is an increasingly significant concern in France’s meat market, with livestock farming contributing around 80% of emissions in the food production sector, according to a February 2024 report. The study indicates that halving meat consumption could significantly help France meet its climate targets while improving public health. Livestock production is a major source of GHGs, deforestation, and water use, prompting growing public pressure for more sustainable practices. Producers are adopting measures to reduce carbon footprints, improve feed efficiency, and enhance waste management. Eco-labels and carbon labeling are increasingly visible in stores, reflecting consumer demand for transparency. The French government is supporting this transition through policy, subsidies, and educational programs. Though still niche, lab-grown meat and plant-based alternatives are gaining traction. Overall, the move toward greener production is evolving from a trend into a long-term structural shift in how meat is produced, marketed, and consumed in France.

Cultural and Culinary Traditions

Despite modern pressures, France’s deep-rooted culinary traditions continue to support strong meat consumption, especially for pork, beef, and poultry an enduring trend within the French meat market. Regional cuisines—from cassoulet in the south to charcuterie in the northeast—rely heavily on specific meat products and recipes passed down through generations. These cultural associations create a resilient baseline demand that adapts slowly to external trends. Additionally, meat plays a central role in national events, holidays, and restaurant menus, reinforcing its social and cultural value. Artisanal and locally sourced meats are especially favored, reflecting France’s emphasis on terroir and gastronomy. While health and sustainability concerns influence purchasing habits, many consumers still prioritize taste, heritage, and quality. This cultural backbone provides stability in the market and shapes how producers and retailers position their products, combining innovation with tradition to meet both nostalgic and modern expectations.

France Meat Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, product, and distribution channel.

Type Insights:

- Raw

- Processed

The report has provided a detailed breakup and analysis of the market based on the type. This includes raw and processed.

Product Insights:

- Chicken

- Beef

- Pork

- Mutton

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes chicken, beef, pork, mutton, and others.

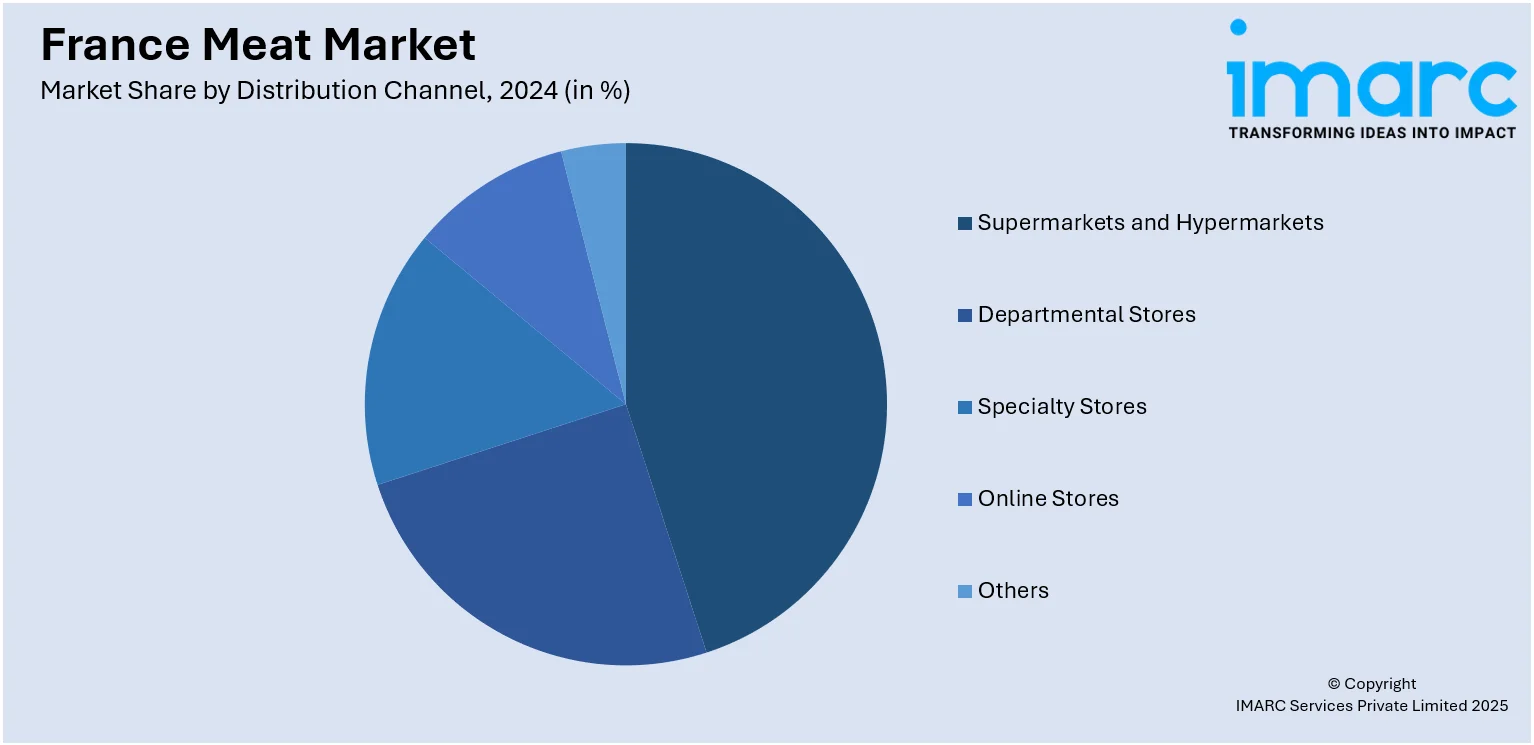

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, departmental stores, specialty stores, online stores, and others.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and Others,

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

France Meat Market News:

- In July 2024, French start-up Gourmey become the first company to apply for EU approval to sell cultivated meat, submitting its application to EFSA for lab-grown foie gras. The process could take at least 18 months. Also filed in the U.S., U.K., Switzerland, and Singapore, the application reflects growing global interest. Gourmey emphasizes no GMOs are used, aligning with EU novel food regulations. Experts say food innovation can complement traditional cuisine sustainably.

France Meat Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Raw, Processed |

| Products Covered | Chicken, Beef, Pork, Mutton, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the France meat market performed so far and how will it perform in the coming years?

- What is the breakup of the France meat market on the basis of type?

- What is the breakup of the France meat market on the basis of product?

- What is the breakup of the France meat market on the basis of distribution channel?

- What is the breakup of the France meat market on the basis of region?

- What are the various stages in the value chain of the France meat market?

- What are the key driving factors and challenges in the France meat market?

- What is the structure of the France meat market and who are the key players?

- What is the degree of competition in the France meat market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the France meat market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the France meat market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the France meat industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)