France Private Equity Market Size, Share, Trends and Forecast by Fund Type and Region, 2025-2033

France Private Equity Market Overview:

The France private equity market size reached USD 24,792.19 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 53,007.13 Million by 2033, exhibiting a growth rate (CAGR) of 8.81% during 2025-2033. The market is driven by innovation funding, EU integration, and favorable monetary policy. Government incentives, robust infrastructure, and a vibrant startup environment attract global investors. Strong corporate governance standards and increasing cross-border deals also support expansion within the France private equity market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 24,792.19 Million |

| Market Forecast in 2033 | USD 53,007.13 Million |

| Market Growth Rate 2025-2033 | 8.81% |

France Private Equity Market Trends:

Expansion of Tech and AI Investments

France is experiencing a surge in private equity investments focused on artificial intelligence, deep tech, and enterprise SaaS sectors. The country’s mature R&D ecosystem, supported by government initiatives such as France 2030, encourages innovation in cutting-edge technologies. Private equity firms are aligning with these efforts by backing high-growth ventures in autonomous systems, machine learning platforms, and cybersecurity solutions. This surge is further catalyzed by France’s integration into the European Digital Strategy, which provides additional funding channels. Investors are particularly interested in scalable ventures with strong intellectual property portfolios. As digital transformation intensifies across industries, this strategic orientation is significantly driving France private equity market growth by channeling capital into the future-ready sectors. For instance, in June 2025, Tikehau Capital launched a €150 million private equity fund, “Tikehau Défense et Sécurité,” focusing on aeronautics and cybersecurity to boost innovation and job creation in French and European defence. Partnering with insurers Société Générale, CNP Assurances, and CARAC, the fund will initially be available within their insurance policies from September 2025 and later to other investors. The French Defence Ministry supports the initiative to strengthen Europe’s strategic autonomy and involve individual savers in defence investments.

To get more information on this market, Request Sample

Increased Secondary Buyouts

Secondary buyouts are becoming a major trend in France's private equity scene. These transactions involve one private equity firm selling a portfolio company to another, allowing for continued operational improvement and capital infusion. This trend is gaining momentum due to the availability of dry powder and the need for longer holding periods to maximize value. Secondary buyouts offer flexibility for both sellers and buyers while maintaining company momentum. Additionally, France’s legal and financial infrastructure supports these transactions through efficient exit mechanisms. Such buyouts are increasingly seen as a viable alternative to IPOs or strategic sales, especially in uncertain market conditions. Their prevalence is a strong indicator of France private equity market growth through enhanced deal liquidity. For instance, in May 2024, Crystal, a leading independent wealth management firm in France, announced that Goldman Sachs Alternatives' Private Equity division will become its majority shareholder. This partnership, alongside Crystal’s management team and existing investor Seven2, aims to accelerate Crystal’s growth both domestically and internationally.

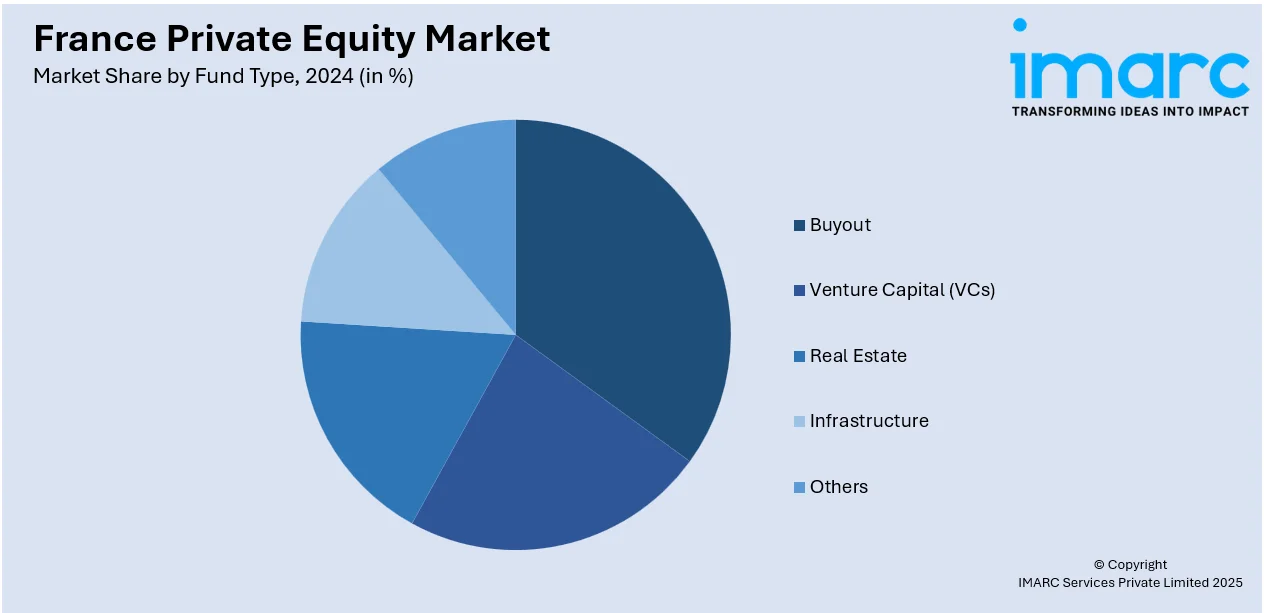

France Private Equity Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional level for 2025-2033. Our report has categorized the market based on fund type.

Fund Type Insights:

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

The report has provided a detailed breakup and analysis of the market based on the fund type. This includes buyout, venture capital (VCs), real estate, infrastructure, and others.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

France Private Equity Market News:

- In July 2025, France’s public pension reserve fund (FRR) launched private equity fund‑of‑fund mandates, seeking to appoint one or two asset managers to invest €400‑500 million. Each mandate will deploy at least 80% into French-based companies, and up to 20% in the EEA, UK or Switzerland. The portfolios will focus on primary buyout and growth capital funds targeting small-to-mid‑sized firms, with ESG and social impact considerations embedded. Mandates run for 15 years with optional one-year extensions.

- In July 2025, AMG announced a minority equity investment in Montefiore Investment, a leading European private equity firm managing €5 billion focused on small- and mid-cap service sector companies. Montefiore’s management retains majority control, continuing to lead independently. The partnership diversifies AMG’s business and expands its global private market presence. Montefiore will use AMG’s capital to enhance capabilities and team growth while preserving its entrepreneurial culture. The deal, expected to close in late 2025, reflects AMG’s strategy of supporting independent firms through long-term partnerships.

France Private Equity Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fund Types Covered | Buyout, Venture Capital (VCs), Real Estate, Infrastructure, Others |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the France private equity market performed so far and how will it perform in the coming years?

- What is the breakup of the France private equity market on the basis of fund type?

- What is the breakup of the France private equity market on the basis of region?

- What are the various stages in the value chain of the France private equity market?

- What are the key driving factors and challenges in the France private equity market?

- What is the structure of the France private equity market and who are the key players?

- What is the degree of competition in the France private equity market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the France private equity market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the France private equity market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the France private equity industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)