France Pro AV Market Size, Share, Trends and Forecast by Solution, Distribution Channel, Application, and Region, 2025-2033

France Pro AV Market Overview:

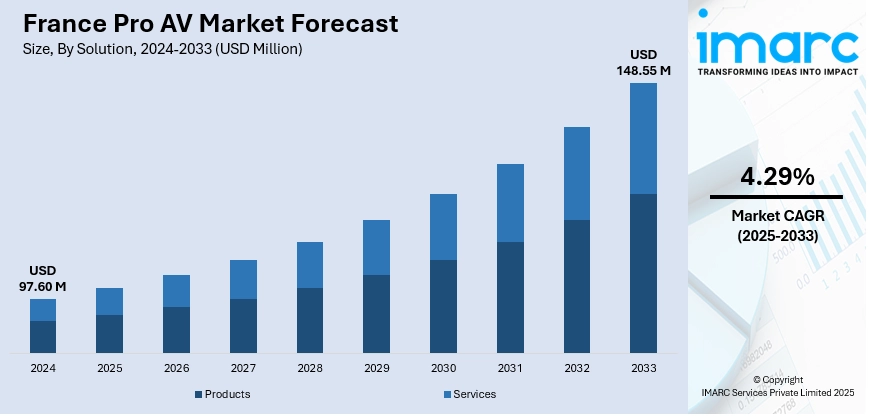

The France Pro AV market size reached USD 97.60 Million in 2024. The market is projected to reach USD 148.55 Million by 2033, exhibiting a growth rate (CAGR) of 4.29% during 2025-2033. The market is expanding due to increasing adoption of advanced audio-visual solutions in hybrid workplaces and public infrastructure. Growing investment in digital displays, conferencing tools, and AV integration continues to support France Pro AV market share across corporate, education, and government sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 97.60 Million |

| Market Forecast in 2033 | USD 148.55 Million |

| Market Growth Rate 2025-2033 | 4.29% |

France Pro AV Market Trends:

Rise in AV Integration Demand

The France Pro AV market growth is steadily driven by rising demand for integrated audio-visual systems across education, hospitality, and corporate sectors. Businesses are investing more in interactive displays, smart conferencing tools, and digital signage to improve communication and customer engagement. Schools and universities are shifting to hybrid learning environments, requiring upgraded projectors, collaboration tools, and centralized control systems. This shift supports long-term adoption of Pro AV solutions across institutions. French hospitality chains are also revamping guest experiences with in-room entertainment systems and advanced display solutions in lobbies and conference areas. Event venues, particularly in major cities, are installing large-format displays, automated lighting, and remote-control features to attract more bookings from organizers and agencies. In the second half of 2024, several local integrators reported an uptick in installation contracts from mid-sized enterprises seeking to modernize office infrastructure. Regional partnerships between French AV integrators and global display manufacturers also increased. This includes more localized support and faster deployment, helping ease supply chain bottlenecks. Compact, energy-efficient AV devices are gaining popularity among urban clients, especially in densely populated regions. Demand for AV-as-a-Service (AVaaS) subscription models has grown quietly, particularly among tech startups in Paris and Lyon, due to flexible financing options and easier upgrades. These developments reflect a growing preference for long-term, service-based AV investments over one-time purchases, especially among cost-conscious clients with evolving workplace needs.

To get more information on this market, Request Sample

Increased Focus on Remote Collaboration

Remote collaboration continues to be a major driver in France’s Pro AV market. Many companies are permanently shifting toward hybrid work models, fueling steady demand for conferencing displays, wireless sharing tools, and sound management systems. Even small firms are investing in professional-grade AV setups to reduce communication gaps and streamline internal workflows. Enterprises in finance, tech, and consulting are particularly active in modernizing meeting rooms with multi-camera support and AI-based tracking systems. Organizations also require better noise suppression, voice clarity, and stable video output, pushing the demand for more advanced hardware. By early 2025, hardware shipments of video bars and digital whiteboards grew faster than anticipated, based on reports from select distributors. French system integrators also began bundling collaboration hardware with cloud services tailored for remote work, seeing better conversion rates. Mid-level municipalities started upgrading public-sector facilities with AV setups that support online town halls and digital community engagement. Trade shows in Paris and Marseille featured more AV brands launching mid-range collaboration products targeting SMBs. The increase in 4K display adoption and interest in real-time translation tools also reflects the market's gradual shift toward higher quality and broader accessibility in AV-enabled communication. These trends are also being reinforced by IT managers prioritizing long-term compatibility, remote support, and seamless software-hardware integration.

France Pro AV Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on solution, distribution channel, and application.

Solution Insights:

- Products

- Display

- AV Acquisition and Delivery Products

- Projectors

- Sound Reinforcement Products

- Conferencing Products

- Others

- Services

- Installation Services

- Maintenance Services

- IT Networking Services

- System Designing Services

- Others

The report has provided a detailed breakup and analysis of the market based on the solution. This includes products (display, AV acquisition and delivery products, projectors, sound reinforcement products, conferencing products, and others) and services (installation services, maintenance services, IT networking services, system designing services, and others).

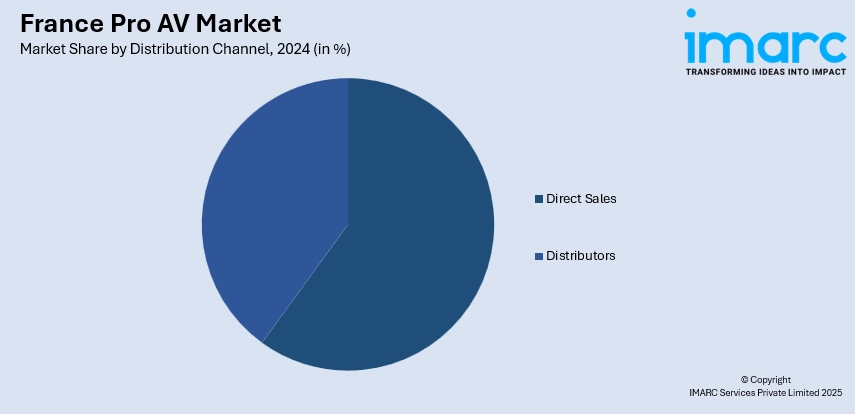

Distribution Channel Insights:

- Direct Sales

- Distributors

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes direct sales and distributors.

Application Insights:

- Home Use

- Commercial

- Education

- Government

- Hospitality

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes home use, commercial, education, government, hospitality, and others.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Paris Region, Auvergne-Rhône-Alpes, Nouvelle, Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

France Pro AV Market News:

- April 2025: Atlona partnered with France-based distributor EAVS Groupe to strengthen its presence in the French Pro AV market. The move expanded access to education and corporate sectors, improved local support, and enhanced Atlona’s brand visibility, boosting integrator engagement and competitive positioning in France.

France Pro AV Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Distribution Channels Covered | Direct Sales, Distributors |

| Applications Covered | Home Use, Commercial, Education, Government, Hospitality, Others |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle, Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the France pro AV market performed so far and how will it perform in the coming years?

- What is the breakup of the France Pro AV market on the basis of solution?

- What is the breakup of the France Pro AV market on the basis of distribution channel?

- What is the breakup of the France Pro AV market on the basis of application?

- What is the breakup of the France Pro AV market on the basis of region?

- What are the various stages in the value chain of the France Pro AV market?

- What are the key driving factors and challenges in the France Pro AV market?

- What is the structure of the France Pro AV market and who are the key players?

- What is the degree of competition in the France Pro AV market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the France Pro AV market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the France Pro AV market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the France Pro AV industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)