France Running Gear Market Size, Share, Trends and Forecast by Product, Gender, Distribution Channel, and Region, 2026-2034

France Running Gear Market Summary:

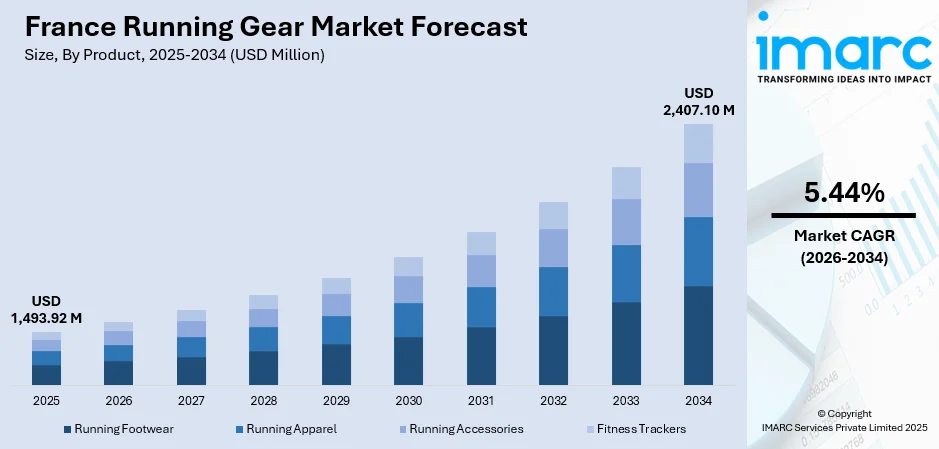

The France running gear market size was valued at USD 1,493.92 Million in 2025 and is projected to reach USD 2,407.10 Million by 2034, growing at a compound annual growth rate of 5.44% from 2026-2034.

The France running gear market is experiencing robust expansion driven by increasing health consciousness among consumers and growing participation in recreational and competitive running events. The convergence of athleisure fashion trends with high-performance technical requirements has elevated demand for premium running products. Innovations in sustainable materials, advanced cushioning technologies, and smart wearable integration are reshaping consumer preferences. The prominence of internationally recognized events such as the Paris Marathon and Ultra-Trail du Mont-Blanc continues to drive tourism-linked gear purchases and seasonal product turnover, further strengthening the France running gear market share.

Key Takeaways and Insights:

- By Product: Running footwear dominates the market with a share of 50.33% in 2025, driven by continuous technological advancements in cushioning systems, carbon fiber plates, and sustainable manufacturing processes that enhance performance and athlete comfort.

- By Gender: Male leads the market with a share of 54.12% in 2025, reflecting higher participation rates in competitive running events and greater adoption of premium performance-oriented gear among male consumers.

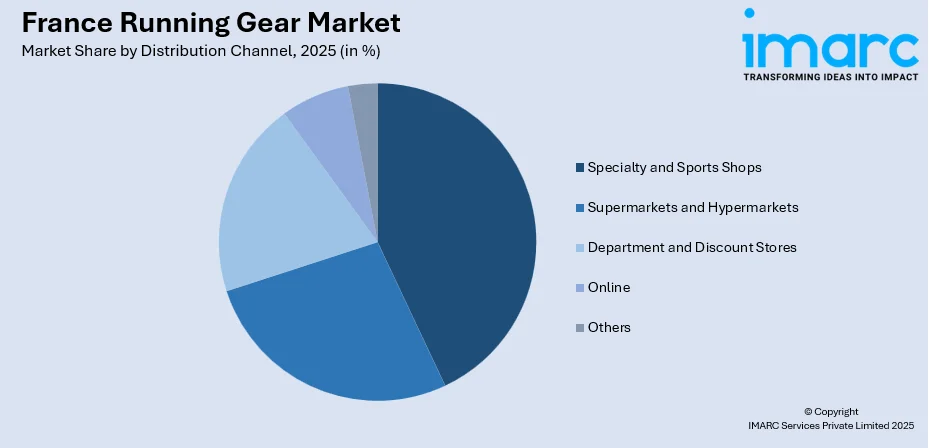

- By Distribution Channel: Specialty and sports shops represent the largest segment with a market share of 43.84% in 2025, offering expert guidance, gait analysis services, and curated product assortments that enhance consumer confidence in purchase decisions.

- Key Players: The France running gear market exhibits competitive intensity with global athletic brands competing alongside heritage mountain sports manufacturers. Companies are differentiating through technological innovation, sustainability initiatives, localized manufacturing, and strategic partnerships with major sporting events.

To get more information on this market Request Sample

The France running gear market benefits from a strong running culture supported by diverse geographic terrains spanning Mediterranean coastlines, Alpine mountain ranges, and urban metropolitan centers. Regional climate variations drive demand for specialized seasonal products, from lightweight breathable apparel for summer coastal runs to thermal insulated gear for winter mountain trails. In January 2024, French outdoor brand Salomon launched the INDEX.03 recyclable running shoe featuring a lightweight midsole material, recycled polyester tongue, and improved cutting methods, demonstrating the industry's commitment to sustainable innovation. The growing prominence of trail running, particularly around iconic destinations like Chamonix and the Mont Blanc massif, has positioned France as a global hub for outdoor running enthusiasts seeking technical footwear and apparel solutions.

France Running Gear Market Trends:

Sustainability-Driven Product Innovation

Environmental consciousness is reshaping running gear manufacturing in France, with brands prioritizing recyclable materials, reduced carbon emissions, and circular design principles. In July 2024, Swiss brand On unveiled its innovative LightSpray marathon shoe at a Paris pop-up ahead of the Paris Olympics, featuring a robotic arm manufacturing process that sprays thermoplastic material onto a mold, eliminating laces and reducing carbon emissions by 75% compared to traditional production methods. This shift toward eco-friendly manufacturing is driving France running gear market growth as consumers increasingly demand sustainable performance products.

Specialty Retail Experience Evolution

Running-focused retail concepts are gaining prominence as brands seek to deliver expert-led shopping experiences. In May 2025, Decathlon established its first operating specialty store in central Bordeaux in May 2025, showcasing its exclusive Kiprun and Kalenji brands in addition to high-end third-party products like Hoka, Brooks, Asics, Saucony, Mizuno, and Salomon. The store incorporates gait analysis technology, nutritional supplements, and connected fitness devices, representing a shift from generalist sporting goods retail toward specialized multi-brand running destinations that enhance consumer engagement and product discovery.

Event-Driven Gear Demand Acceleration

Major running events are catalyzing unprecedented gear purchases as participation reaches historic levels. The 2025 Paris Marathon welcomed 56,950 runners, setting a world participation record with 51% first-time marathoners and 33% international participants. This surge of newcomers generates significant demand for complete gear packages spanning footwear, apparel, and accessories. Event-driven demand extends to trail running, with prestigious alpine races attracting enthusiasts seeking specialized technical equipment. Such events generate sustained seasonal purchasing patterns for products tailored to specific race conditions and terrain requirements.

Market Outlook 2026-2034:

The France running gear market outlook remains positive as health awareness campaigns, corporate wellness initiatives, and urban fitness trends continue driving consumer adoption. Technological advancements in performance footwear, including carbon fiber plate integration and super foam midsoles, are attracting both competitive athletes and recreational runners seeking enhanced efficiency. The expansion of e-commerce platforms and direct-to-consumer channels is broadening market accessibility, while localized manufacturing investments are strengthening regional supply chains. The market generated a revenue of USD 1,493.92 Million in 2025 and is projected to reach a revenue of USD 2,407.10 Million by 2034, growing at a compound annual growth rate of 5.44% from 2026-2034.

France Running Gear Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Running Footwear | 50.33% |

| Gender | Male | 54.12% |

| Distribution Channel | Specialty and Sports Shops | 43.84% |

Product Insights:

- Running Footwear

- Running Apparel

- Running Accessories

- Fitness Trackers

Running footwear dominates the France running gear market with a 50.33% share in 2025.

Running footwear maintains market leadership through continuous technological advancement and premiumization trends. French consumers increasingly prioritize performance-engineered shoes featuring carbon fiber plates, nitrogen-infused foams, and advanced traction systems designed for varied terrain conditions. The emphasis on localized manufacturing has strengthened France's position in premium footwear production. Brands are investing in sustainable materials, recyclable components, and circular design principles to meet evolving environmental expectations. Trail running footwear demonstrates particular strength, supported by France's reputation as a global destination for mountain running enthusiasts seeking technical solutions for challenging alpine conditions.

Gender Insights:

- Male

- Female

- Unisex

Male leads the France running gear market with a 54.12% share in 2025.

Male runners tend to show higher participation in organized events and a stronger inclination toward premium performance gear. They often stick with favored technical footwear brands and readily invest in advanced technologies like carbon-plate super shoes and specialized trail equipment. Their strong presence in competitive road marathons and trail ultramarathons keeps demand high for top-tier products and consistent upgrades, pushing brands to release newer models with improved stability, cushioning, and energy return. This pattern also shapes marketing strategies, with brands targeting men through performance-focused messaging and event sponsorships.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Specialty and Sports Shops

- Supermarkets and Hypermarkets

- Department and Discount Stores

- Online

- Others

Specialty and sports shops hold the largest share at 43.84% of the France running gear market in 2025.

Specialty and sports shops maintain market leadership through expert-guided shopping experiences, professional gait analysis services, and comprehensive product assortments spanning entry-level to elite performance categories. These stores employ knowledgeable staff capable of recommending appropriate footwear based on running style, terrain preferences, and performance objectives. The strategic evolution toward multi-specialist concepts includes dedicated running stores offering both proprietary brands and premium third-party products, enhancing consumer access to expert guidance and technical fitting services that build purchasing confidence for high-value performance gear investments.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d'Azur

- Grand Est

- Others

Paris Region is driven by high population density, strong urban fitness culture, and hosting of the internationally renowned Paris Marathon. The concentration of specialty retail stores, flagship brand outlets, and fitness communities generates consistent demand for premium running gear across all product categories.

Auvergne-Rhône-Alpes serves as France's trail running capital, hosting the prestigious UTMB Mont-Blanc events in Chamonix and housing major brand headquarters. The region's mountainous terrain drives strong demand for technical trail footwear, alpine apparel, and specialized accessories suited to challenging elevation conditions.

Nouvelle-Aquitaine benefits from coastal running routes and wine-region event tourism through popular marathons in Bordeaux and surrounding areas. The region's temperate Atlantic climate supports year-round outdoor running activities, generating consistent demand for versatile footwear and weather-adaptive apparel suited to varied coastal conditions.

Hauts-de-France features a growing running community supported by regional marathons and urban running clubs across major cities including Lille. The region's flat terrain attracts road running enthusiasts, driving demand for cushioned footwear and lightweight apparel optimized for speed-focused training and competitive racing.

Occitanie combines Mediterranean coastal routes with Pyrenees mountain trails, creating diverse terrain demands across the region. This geographic variety supports demand for both road running footwear and technical trail equipment, while the warm southern climate drives seasonal purchases of breathable, lightweight performance apparel.

Provence Alpes Côte d'Azur benefits from Mediterranean climate conditions driving demand for lightweight summer running gear and UV-protective apparel. The region attracts running tourism through scenic coastal routes and trail networks, generating seasonal gear purchases from both domestic runners and international visitors.

Grand Est features a developing running culture supported by regional events and cross-border running communities near Germany and Switzerland. The region's continental climate with distinct seasons drives demand for versatile gear collections spanning thermal winter apparel through breathable summer options for year-round training.

Market Dynamics:

Growth Drivers:

Why is the France Running Gear Market Growing?

Rising Health Consciousness and Fitness Culture Expansion

France is experiencing a fundamental shift toward preventive healthcare and active lifestyles, driving sustained demand for running gear across all consumer demographics. The French fitness market is growing, propelled by corporate wellness initiatives, urban fitness trends, and growing awareness of lifestyle-related health benefits. The expanding runner population creates consistent baseline demand for replacement footwear, seasonal apparel updates, and upgraded performance accessories. Corporate wellness programs increasingly incorporate running incentives, while schools and universities integrate physical activity curricula, establishing running habits across generational cohorts and sustaining long-term market growth.

Major Running Event Participation Surge

Internationally recognized running events are driving unprecedented gear purchases as participation reaches historic levels across France. The UTMB Mont-Blanc attracts over 10,000 runners annually across eight races, with elite athletes and amateur enthusiasts requiring specialized trail footwear, technical apparel, and hydration equipment. Regional events including the La Rochelle Marathon, Nice-Cannes trail races, and Mediterranean ultramarathons extend event-driven purchasing throughout the calendar year. This robust events ecosystem generates recurring gear turnover as participants upgrade equipment for successive race challenges and varying terrain conditions.

Technological Innovation and Performance Enhancement

Continuous advancement in running footwear and apparel technology is attracting premium purchases from both competitive athletes and recreational runners seeking enhanced performance outcomes. Carbon fiber plate integration, nitrogen-infused foam midsoles, and energy-return cushioning systems have transformed running shoe engineering, enabling faster times and improved running economy. Moreover, manufacturers are increasingly focused on sustainability, exploring new ways to reduce environmental impact while advancing performance features. This has led to the development of new production techniques, such as robotic manufacturing processes that streamline production and eliminate waste. The industry is also seeing a rise in seamless designs and lace-free uppers, which not only improve comfort and fit but also contribute to a cleaner, more sustainable product lifecycle.

Market Restraints:

What Challenges the France Running Gear Market is Facing?

Premium Product Pricing Barriers

High-performance running footwear increasingly commands premium pricing, with super shoes featuring carbon fiber plates and advanced foam technologies, limiting accessibility for price-sensitive consumers. Inflationary pressures on manufacturing costs, raw materials, and supply chain logistics have elevated retail prices across product categories, potentially constraining purchase frequency and trading down to lower-specification alternatives among budget-conscious buyers.

Rural and Semi-Urban Retail Accessibility

Specialty running retail remains concentrated in metropolitan areas, limiting product discovery and expert fitting services for consumers in rural and semi-urban regions. While e-commerce partially addresses geographic accessibility gaps, the inability to physically try products, access gait analysis, or receive personalized recommendations disadvantages consumers outside major urban centers. This retail distribution imbalance constrains market penetration across France's diverse geographic landscape.

Counterfeit Product Proliferation

The growing prevalence of counterfeit running gear through unauthorized online marketplaces undermines brand integrity, consumer safety, and legitimate retail channels. Replica products lacking genuine performance technologies and quality materials may deliver substandard running experiences or contribute to injury risks, while simultaneously diverting revenue from authentic manufacturers investing in research, development, and sustainable production practices.

Competitive Landscape:

The France running gear market exhibits competitive intensity with global athletic footwear giants competing alongside heritage European mountain sports brands and emerging performance specialists. Competition is primarily driven by technological innovation, sustainable manufacturing credentials, professional athlete endorsements, and strategic partnerships with major running events. Companies are differentiating through localized production investments, recyclable product development, and omnichannel retail strategies combining specialty store experiences with direct-to-consumer digital platforms. Collaborations with prestigious events such as the Paris Marathon, UTMB Mont-Blanc, and the Paris 2024 Olympics provide visibility platforms for product launches and brand positioning, while athlete sponsorship programs validate performance credentials across competitive running disciplines.

France Running Gear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Running Footwear, Running Apparel, Running Accessories, Fitness Trackers |

| Genders Covered | Male, Female, Unisex |

| Distribution Channels Covered | Specialty and Sports Shops, Supermarkets and Hypermarkets, Department and Discount Stores, Online, Others |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The France running gear market size was valued at USD 1,493.92 Million in 2025.

The France running gear market is expected to grow at a compound annual growth rate of 5.44% from 2026-2034 to reach USD 2,407.10 Million by 2034.

Running footwear, holding the largest revenue share of 50.33%, remains pivotal for the France running gear market, driven by continuous technological advancement in cushioning systems, carbon fiber integration, and sustainable manufacturing processes that enhance athletic performance.

Key factors driving the France running gear market include rising health consciousness, growing participation in major running events such as the Paris Marathon and UTMB, technological innovation in performance footwear, expanding e-commerce distribution, and increasing demand for sustainable products.

Major challenges include premium product pricing limiting accessibility, concentrated specialty retail in metropolitan areas disadvantaging rural consumers, counterfeit product proliferation undermining brand integrity, and inflationary pressures on manufacturing and supply chain costs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)